If you’re the disciplined and organized trader I think you are or at least aspire to be, then you may be getting excited for the ultimate goals planning event celebrated around the world. While the New Year is a time for parties, celebration, and reflection, we, as traders, are eager to do better or maintain our profitability from last year by sitting down and making some serious trading goals for the year ahead.

If you like to read personal development books as much as I do, you’ll notice a trend among authors like Brendon Burchard, Marie Forleo, Brian Tracey, and Napoleon Hill, that they all encourage you to make serious goals.

Why?

Because when we put a goal down on paper, our brain gets to work on making a vision happen.

By setting an intention, we have an idea of what we want and give ourselves the time frame, that is, the year ahead, to make it happen.

However, not all goals are created equal.

The method with which you use to form your goal can increase or decrease your likelihood of achieving it.

A Research Study on New Year’s Resolutions and Goal Setting

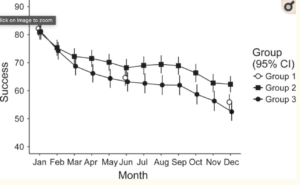

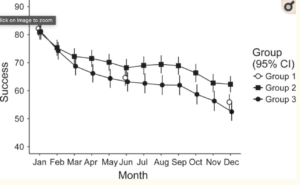

A group of researchers in Sweden did a study on new year’s resolutions by taking three groups of people and giving them various levels of support, instructions, and extra guidance on goal creation to see which one would be most likely to not only achieve their goals but also sustain commitment over the long term.

The first group was given no instruction or support apart from being asked to write down their new year’s resolution. The second group was given a bit more support and was told how to find an accountability buddy. They also received check in’s from the research group and were given a little bit of written advice on how to maintain goal commitment. The third group was given the same support as group two but was also taught how to create SMART goals, as well as what they called interim goals, which were smaller goals that could be completed immediately in order to make early progress towards longer-term goals. They also received a couple more reminders and check-ins with the research team, scheduled once per quarter.

Now, be prepared to be surprised, because this study’s outcome is not what you think. So it turned out, by the end of the year, when asked if the participants felt like they had achieved their goals, Group 2 was the most likely to report feeling successful, while Group 1 came next and Group 3 had the lowest success rate of them all.

Having clear goals and a regular support system didn’t necessarily make the third group more likely to achieve their goals over the others.

Now, let’s deconstruct this a bit.

First of all, the researchers noted that the individuals in group 3 had to create very clear goals with specific measurements, while group 1 could write whatever they want.

So someone from group 3 could say they want to lose 25lbs by the end of the year while someone from group 1 could have made a vague resolution to lose weight.

For all we know, that group 1 person didn’t even step on a scale all year, they could have gone with just a felt sense that wasn’t accurate. Group 3 was better able to say whether a specific goal was achieved or not, while group 1 and 2 could give an answer to make themselves look better even if they had no evidence to support the claim.

Another thing to keep in mind is that the main difference between Group 2 and Group 3 was the additional instructions for making smart goals.

Group 2 could make the same vague goals as group 1, but they were given check-ins and added instructions for maintenance along the way. There was a lot more wiggle room for reflection and course correction.

Ultimately, like many research studies, another study and further research are needed to work out some of the underlying variables at play.

However, the reason why this study is still interesting for us as traders is that when we sit down to create our goals, we shouldn’t think of goal setting as a one-and-done event, but instead as the beginning of a new routine.

The most important aspect of goal setting isn’t necessarily the goal itself, but the routine act of checking in with your goals and needing to course correct in the face of unexpected setbacks.

What you do with them over the long run is more important than how you start.

So I’m going to share with you all 5 steps you can take to make an effective plan for goal-setting this new year.

We’ll talk about the kinds of goals you should set as a day trader and the system you’ll need to create in order to make continuous progress over the year.

5 Steps to Creating Day Trading Goals for 2022

Step 1) Make Clear General Goals

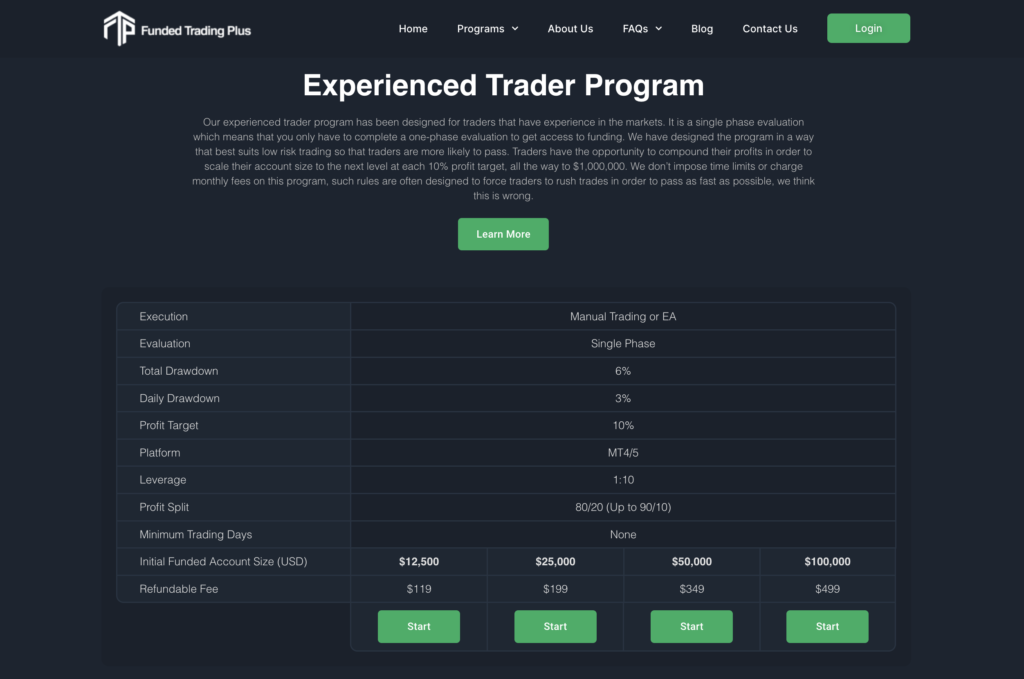

For the first step, you’re going to make some clear yet general goals, such as wanting to learn how to day trade Forex, passing a prop trading challenge, or finally achieving consistent profit over a series of months.

List no more than 5.

It can also be useful to include goals that tell you how much you want to make per month to hit a budget or lifestyle target, but I recommend giving yourself a range, such as returning 4-6% of your account per month, because markets and the best of strategies can change with more profitable and less profitable months. I don’t want you to be tempted to trash a decent strategy if it’s not hitting your exact target every month.

I also recommend including at least 1 goal that isn’t based on money.

This could be making a goal to commit to the same exact strategy for 60 days, or reading three books from my recommended disciplined trading reading syllabus.

Here’s an example of a list of goals you could have for 2022:

1) Get consistently profitable on a quarter-to-quarter basis

2) Learn and trade only the Disciplined FX Scalping strategy for at least three months

3) Read “Trading in the Zone”, “High Probability Trading”, and “High-Performance Habits”

4) Pass the FTMO challenge

5) Grow personal account to $25k

Step 2) Know Your Why

Step 2) Know Your Why

For the second step, I want you to think deeply about why you chose each goal.

For example, getting consistently profitable on a quarter-to-quarter basis could mean that you’ve proven to yourself that you’re a disciplined trader and that you’re ready to go for a prop trading challenge.

Growing a $25k account could mean that you may be able to start returning enough money to start growing a hefty emergency fund for yourself.

By understanding why you are doing this thing, you will feel more committed to the challenge. And bringing that emotion to your goals is a big catalyst in helping you stay on track over the long run.

By understanding why you are doing this thing, you will feel more committed to the challenge. And bringing that emotion to your goals is a big catalyst in helping you stay on track over the long run.

If you find yourself attached to your why you can more easily get back up after being knocked down.

It’s easy to change your mind about trading a certain strategy, but it’s not as easy to change your desperate desire for financial freedom.

Knowing why we are choosing a goal will help us stay committed.

Step 3) Make a Plan and Schedule the Months You’ll Achieve Your Goal

For the third step, you’re going to start to make a plan and give yourself an idea of when things should happen.

In the same study on new years resolutions that I mentioned earlier, the researchers also found that a common trait of participants who failed to achieve their goal often assumed that they would work on the goal later in the year and ended up procrastinating their way to failure.

It’s important to break down big goals into smaller parts that we can get started on now, so that we can begin to build momentum for the long-run.

If you’re familiar with any of my other content on discipline, you’ll know that I believe discipline has nothing to do with willpower and everything to do with building smart habits.

If you can break your goals down into habits that you perform regularly, such as reading one of those trading books for ten minutes a day or following the same ruleset of a strategy each trading session, then you will be more likely to achieve your long term goal than if you aimed for some big, vague event.

So take your goals, break them down into smaller parts, and decide when you want to hit those smaller goals.

Don’t worry about when you’ll achieve the big year goals unless there is a specific date that the goals need to be completed by.

I often find that things don’t always go according to plan, and when I try to rush things with day trading, I could make costly mistakes.

So don’t worry about when you think you should pass your FTMO challenge. Instead, focus on when you want to perform a backtest for the strategy you’ll use and plan when you’d like to start your first challenge.

You can break the goal of passing the FTMO challenge down into five parts, such as researching both the challenge and tips for risk management and psychology for prop trading, deciding what strategy you’ll use, deciding what risk management strategy you’ll perform, signing up for the challenge, and completing a checklist of your rules for each trading challenge session. Then decide on what you can start on this month and write down what month you’ll work on the other steps.

Step 4) Understand What Will Change and What Is At Risk if You Fail

The fourth step in this goal-setting process is to look at each of your goals and write down what would be different in your life if you achieve them.

So if you pass a prop trading challenge you could have extra income to fund your hobbies or you could even consider leaving the job you hate.

If you read three good books on day trading then you can learn what to do to behave like a professional trader and make some solid money.

If you have more money you could finally take that international trip, go back to school, or move somewhere that feels safe and beautiful. You could afford a gym membership, organic food, and take care of yourself at an optimal level. Money tends to have a way of making other goals easier to achieve.

Similarly, after you finish this list of the ways your life could be made better by achieving the goal, I want you to write a list of what would happen if nothing changes.

Would your situation remain the same? Would it be worse?

Day trading is inherently risky, if you don’t commit to improving your trading discipline and skills, then you could end up losing hundreds or thousands of dollars by the end of the year.

There are always repercussions for not completing your goal, so you need to keep these in the back of your mind as motivation alongside the positive outcomes, too.

Step 5) Schedule Time to Review Your Goals

For the last step you need to schedule time to review your goals. This is the part of the process that will turn your goals into a system.

Napoleon Hill and other success writers like him recommend reviewing your goals every single day.

Researchers Locke and Latham (2006) from the University of Maryland and the University of Toronto found that goals are often only effective when they are used in combination with feedback.

You need to find a way to be able to tell whether you’re on target with your goal or not and check in on that progress regularly.

At the very least, I think you need to review your goals every week and make a check-in every month to see if you need to adjust any of the goals to meet new expectations, situations, or methods.

For myself, I have a list of annual goals that are broken down into quarterly goals, those quarterly goals are broken down into monthly goals. Each week I review my monthly and quarterly goals to make my weekly goals. Every day I review my weekly goals in the morning and plan my daily tasks so that I’m always doing something to get closer to accomplishment each day.

The theme of this tutorial is that clarity of your vision alone won’t ensure success.

You need to actively and regularly work your goals and your goal-setting system in order to stay focused, on track, and agile in the face of unexpected changes.

I hope you found these five steps useful, be sure to take notes if you want to implement this process for yourself this new year and let me know in the comments section below what you’re eager to achieve in the next 12 months.

I wish you all the best of strength and luck, and I’ll see you in the markets, take care.

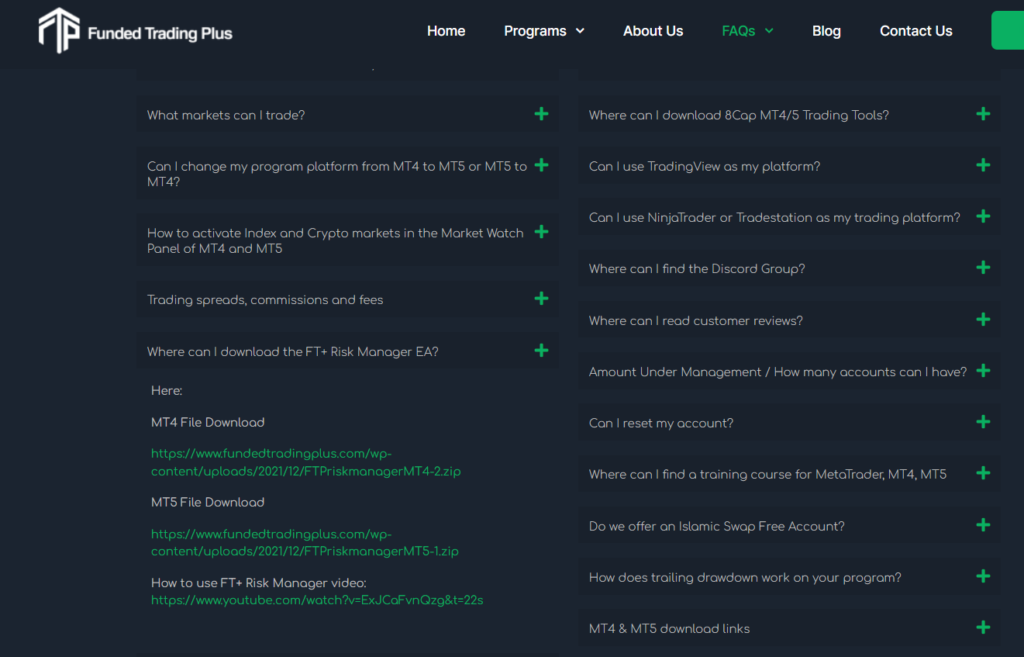

This business is also dedicated to better understanding trading strategy data that it collects to differentiate strategies that are effective and exhibit a high probability of success over the long run.

This business is also dedicated to better understanding trading strategy data that it collects to differentiate strategies that are effective and exhibit a high probability of success over the long run.

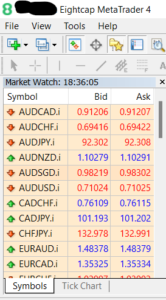

A position size calculator is a magnificent tool for minimizing the number of inputs you need to type before submitting an order.

A position size calculator is a magnificent tool for minimizing the number of inputs you need to type before submitting an order. BONUS: Use strategies that let you maximize your profit return.

BONUS: Use strategies that let you maximize your profit return.

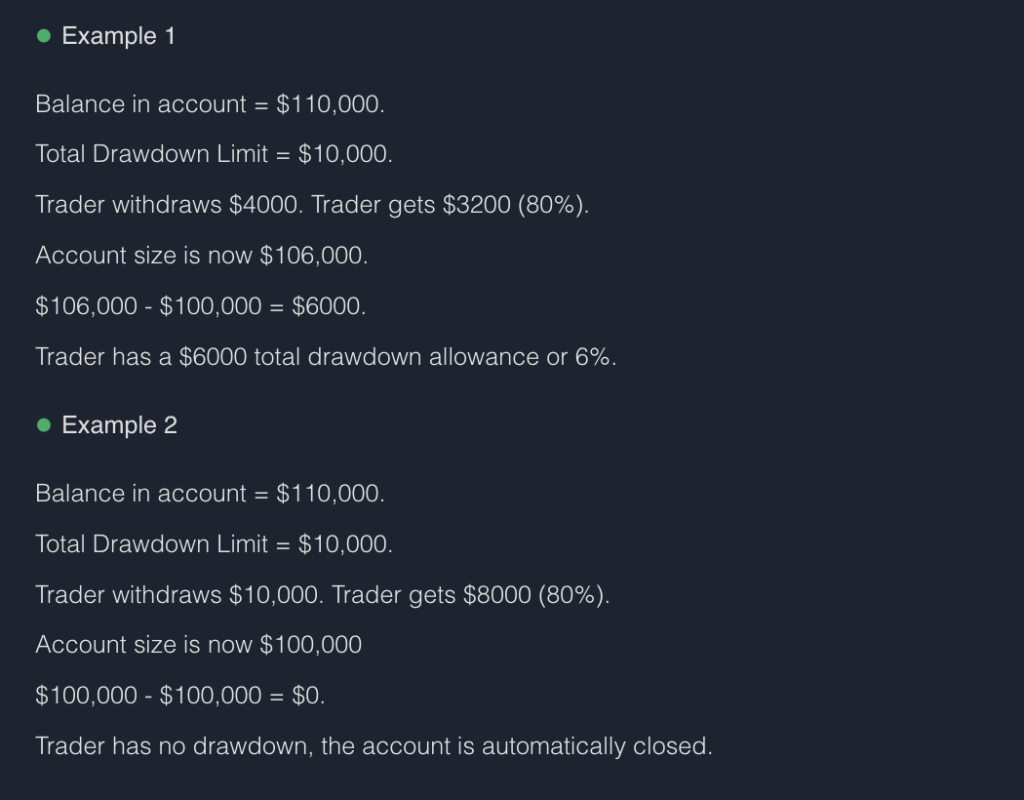

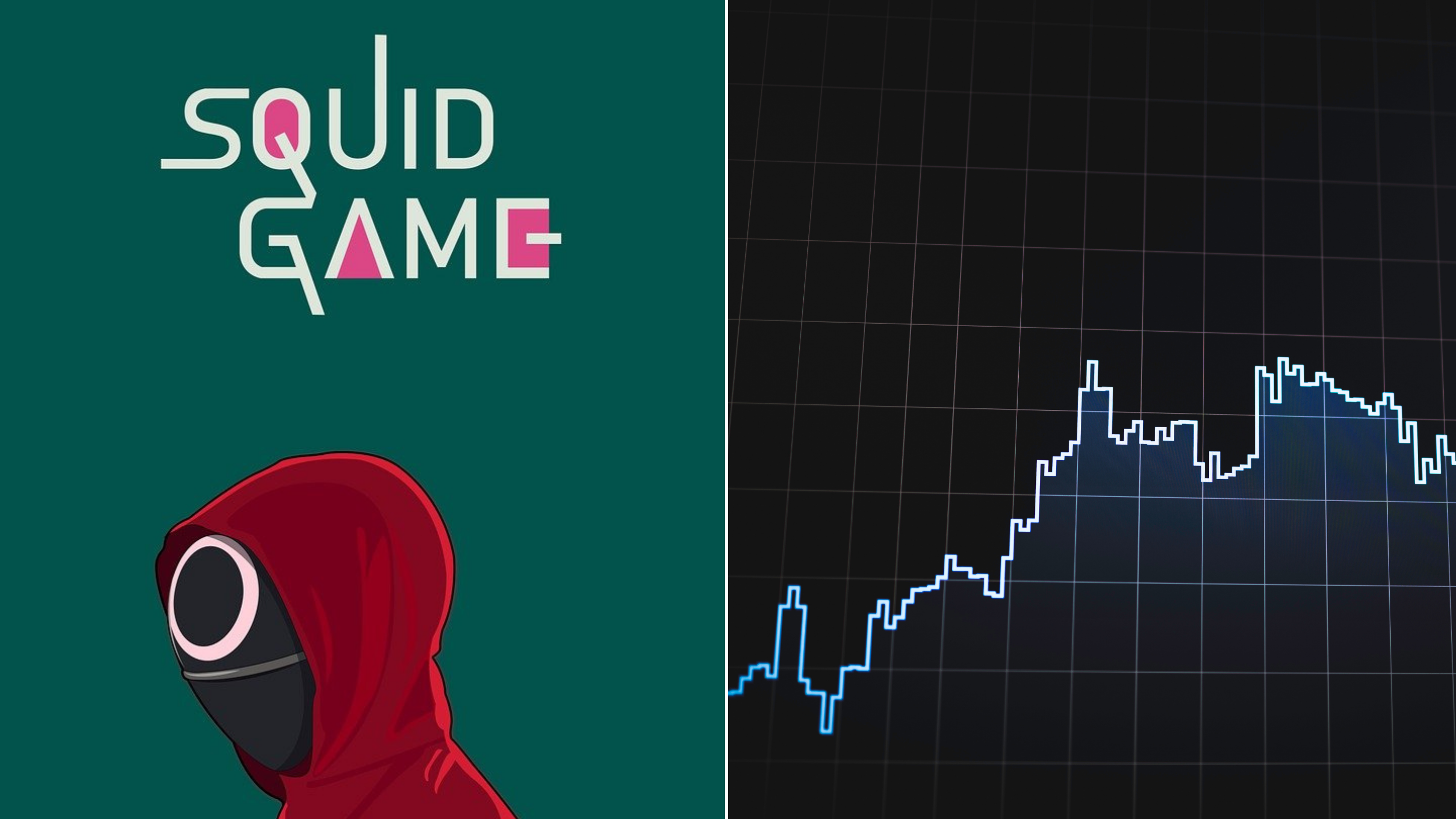

Day trading can be similar.

Day trading can be similar.  As retail day traders, we should never forget that we are merely Remora fish swinging alongside great big sharks who control where we are heading.

As retail day traders, we should never forget that we are merely Remora fish swinging alongside great big sharks who control where we are heading.  (I mean, we should have seen this coming, he did a pretty good job position sizing his way through the marble game, that sly ol’ fox. )

(I mean, we should have seen this coming, he did a pretty good job position sizing his way through the marble game, that sly ol’ fox. )

Step 2) Know Your Why

Step 2) Know Your Why By understanding why you are doing this thing, you will feel more committed to the challenge. And bringing that emotion to your goals is a big catalyst in helping you stay on track over the long run.

By understanding why you are doing this thing, you will feel more committed to the challenge. And bringing that emotion to your goals is a big catalyst in helping you stay on track over the long run.

Almost all of these activities can be performed even if you’re not at home for the holidays. If you need to, make a hard boundary with family and friends for at least ONE HOUR of time for yourself! (#1 and #5 are particularly good for “getting away”)

Almost all of these activities can be performed even if you’re not at home for the holidays. If you need to, make a hard boundary with family and friends for at least ONE HOUR of time for yourself! (#1 and #5 are particularly good for “getting away”)

Once I became profitable, I decided to start a business that could help teach tra

Once I became profitable, I decided to start a business that could help teach tra Within a few weeks, I failed that account as well.

Within a few weeks, I failed that account as well.

Latest posts