Hey there traders, Andrew Bloom of Disciplined FX here.

August 2022 Update

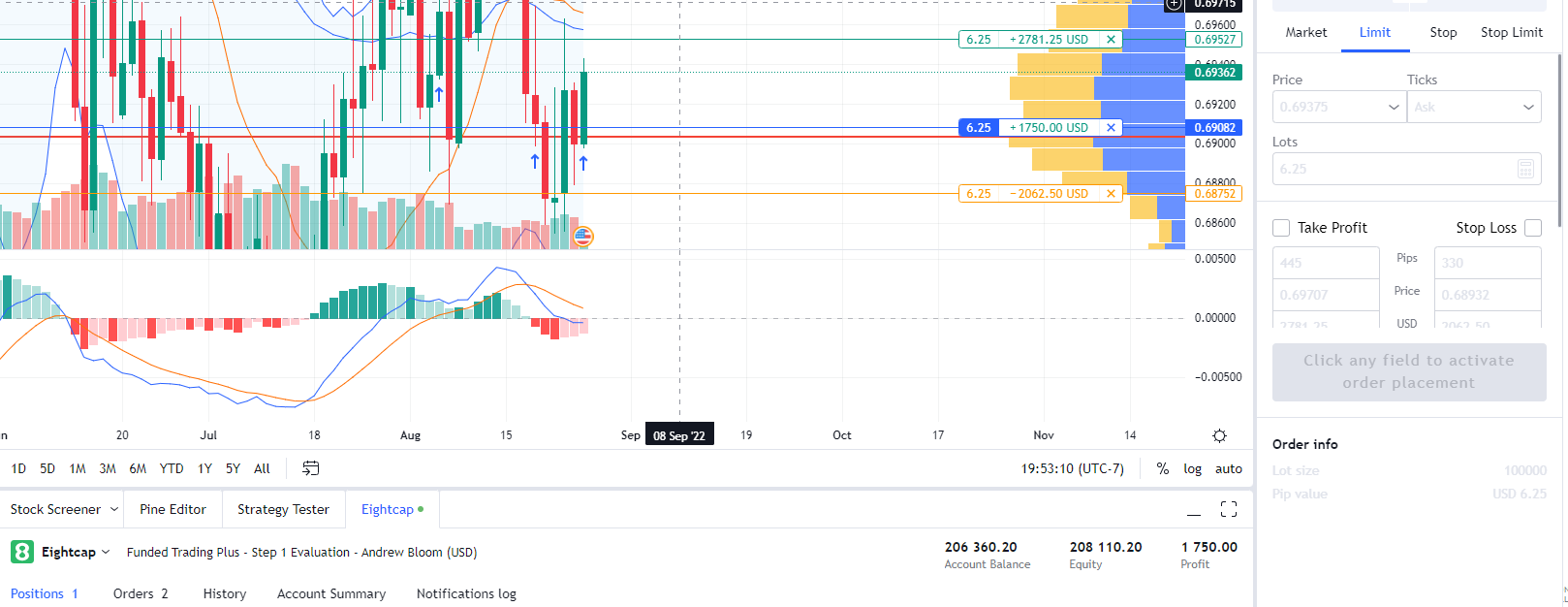

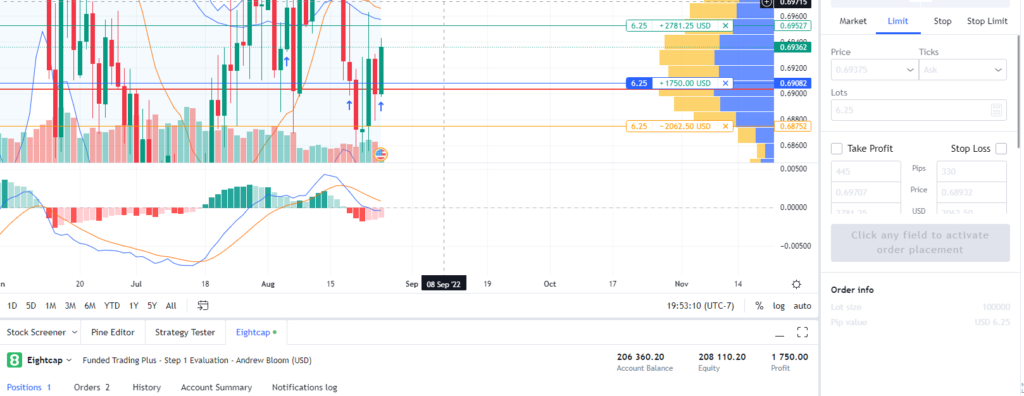

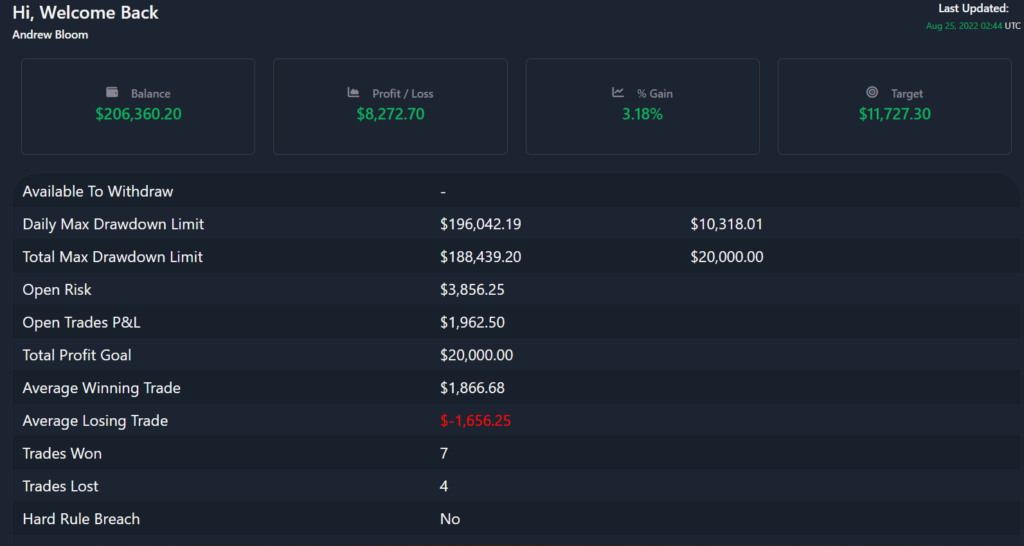

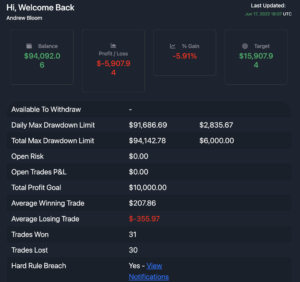

July and August have been fantastic months for trading with the daily chart strategy that I am using, as I was able to pass and profit (+$5k!) from a 200k MyForexFunds account. I am currently awaiting payout and will make a comprehensive post with all the details next week. So be sure to subscribe to get notified when that content is released.

Taking Care of Your Trading Psychology

For today, I want to talk a bit about some of the less common trading discipline and psychology tools that are 100% available to you but you may be afraid to give a try.

If you’ve been in the day trading world for a hot second, you’ve probably come to the conclusion that your strategy isn’t necessarily the reason you’ve lost money or failed challenges.

How you manage your risk is another important factor that can lead to ultimate success or failure in these endeavors, but there’s another aspect of trading that dominates nearly all of your trading outcomes.

And that factor is your trading psychology.

By psychology we mean the way you feel about your trading experience, the way those feelings turn into actions, and most importantly whether you are able to experience non-attachment from your feelings while still being able to follow your rules and make logical decisions.

I believe your trading psychology is the #1 reason you are either doing very well and staying profitable or staying stuck in a series of weekly and monthly losses.

Some examples of psychology getting in the way of your trading include:

- Getting anxious about a trade and closing it too early before it hits your profit target or stop loss

- Feeling uncomfortable about losses and therefore giving up a solid strategy in search of one that you believe will help you avoid losses

- Feeling greedy and breaking your rules in order to chase every setup

- Holding out for more profit past your take profit target.

When these feelings go unexamined and therefore unmanaged, your trading can feel like a rollercoaster and while you may behave according to your rules one day, on the days you’re out of control you can completely destroy your account.

The purpose of this lesson is to share with you a few solutions to help better understand what you’re feeling, be able to see your emotions in the moment and act on them with logic instead of impulsivity, and literally change the way your neurochemistry works so that you are more stable and grounded as you trade.

The five tactics that I’m going to share with you may seem completely unrelated to trading and may not even change your outcomes significantly at first, but there are long-term solutions that will help you grow exponentially over weeks and months rather than hours or days.

This is partly why they may seem scary – because they require a desire to want to change the way you think and feel over the long run.

Each will require further research and a daily or weekly commitment, so if all are new to you, just pick one or two to start with and focus on slowly building long-term habits.

There are no quick fixes here.

Furthermore, they may feel scary because a lot of people, especially men, may have been raised with stigmas against these acts of self-nurturing and care, but I promise you that they all work very well and have the power to change not only your trading but also your own happiness and ability to stay resilient in life.

So without further delay, let’s go over five seemingly scary tools you can use to improve your trading psychology!

5 Seemingly Scary Discipline Hacks to Save Your Trading

#1: Keep a Daily Meditation Practice.

The art of meditation is literally the practice of observing what you’re thinking without getting caught up in your feelings.

The aim of meditation is to be able to create some space between a typical flurry of thoughts and the part of your mind that is capable of observing and making logical choices. Meditation won’t stop you from feeling your feelings, you don’t want to be a complete robot – instead, it serves as a tool that helps you see yourself clearly and be able to stop a spiral of thoughts before they take over your mind.

This is useful for trading because there are so many moments that require snap judgment and an unaware mind can easily let fear or greed make a decision.

When I was in college I became deeply interested in Buddhism and have kept a meditation practice ever since – I believe this practice alone has made the learning curve of trading bearable. Meditation helps us create space in our minds because we’re able to notice when there is anxiety, fear, greed, and excitement.

In that pause, we can go against an impulsive thought and stick to the trading plan.

Since the early 20th century, after many leaders of eastern religions such as Buddhism, Hinduism, and Taoism started migrating and teaching in European and North American locations, eastern philosophy and various styles of meditation have become more commonplace and better understood, particularly for therapeutic and spiritual benefit. In the 1960’s an American would have had to find a local ashram or sangha in order to learn to meditate, but nowadays the number of resources available for learning is so widespread.

A quick youtube search can provide guided meditations and there are lots of apps, like Calm and Mindspace which can help you not only start your meditation practice but stay accountable over the long run.

If you’re interested in starting a practice, I recommend using one of these apps or finding an audio or video course so that you are taught what to do while you meditate and can be held accountable for a longer period of time.

#2 Work with a Therapist

Next, the second tactic is to work with a therapist.

Of everything I list here, this may be the one that most people will feel the strongest resistance. And I completely understand why – therapy can be expensive, especially if you seek to go regularly.

It can also take a while to find a therapist you like.

You may need to have a couple of introductory sessions with different practitioners in order to find someone who has a style you like and you find trustworthy.

Some folks are afraid of therapy because they don’t want to unearth painful memories or past experiences. Others may be afraid of having to change who they are.

Like meditation, a lot of stigma around therapy is finally falling by the wayside. Since the beginning of quarantine, many individuals are seeking out mental health help from a practitioner for the first time in their lives. This isn’t a shock – we live in a pretty stressful global situaiton right now!

I speak from experience. I’ve worked with different therapists throughout my life, usually for only a few months at a time due to cost and moving. However, I always feel better for processing my inner fears and concerns with someone who is trained to guide and help teach coping mechanisms.

Yes, it can feel difficult to start, but it is a service that is completely life-changing. A good contemporary therapist is able to teach you coping mechanisms and emotional skills to help you better navigate your life.

Talk therapy, which is what most people think of when considering therapy, is kind of old hat, and honestly, unearthing one’s past over and over again may not even be very beneficial if there’s no real action or change in thought that comes from it.

Rather, Finding the right therapist is key – there are other forms of therapeutic practice that may be more beneficial to changing trading behaviors – for example, I recommend checking out cognitive-behavioral therapy, which emphasizes focusing more on what you think than what you’re doing since all action begins with a thought.

Humanistic therapy is another solid approach, which focuses on helping the individual grow into a higher self with the client acting as an authority on their own experiences, rather than a therapist trying to tell them what they should or shouldn’t be doing.

But nowadays you’ll likely find most practitioners to be integrative therapists – that is, they use a blend of therapeutic styles to help serve the needs of the patient.

If you’re looking for an easy and convenient way to get started with therapy, I highly recommend checking out the app and service BetterHelp, which allows you to have weekly video or audio sessions with your therapist, who you can select based on your interests and needs, and is available for texting throughout the week.

This is the cheapest way to get the most intensive and frequent therapy. They also offer financial aid, depending on your income level. My partner and I just signed up with BetterHelp a few weeks ago and we love the service. I particularly like that my therapist will send homework, which are just worksheets that either help me write out some thoughts or teach me exercises to help cope with anxiety and depression.

The last thing ill say about this is to do your research and go slow if you need to, this is meant to be a long-term, ideally lifetime, commitment, and it should be treated with the same level of care as finding a spouse.

#3 Study Psychology and Consume Self-Improvement Content

Third, especially if you aren’t able to afford therapy or make the time for it, I highly encourage you to self-study psychology and make a habit of reading self-improvement or personal development books.

If you don’t like to read, then find audiobooks or podcasts that serve a similar purpose.

Like everything I’m going to mention in this list, the goal of this activity is to help you better understand your feelings.

However, when choosing your content, leave psychology textbooks to future therapists, there are far better options for individuals who want to learn personal coping skills.

There are also plenty of therapist-written workbooks that can help you focus on and develop skills around an area of your choosing, such as with anxiety, addiction, PTSD, and self-actualization.

Two resources I recommend for reading or listening as an audiobook are Feeling Good: The New Mood Therapy by Dr. David Burns and 13 Things Mentally Strong People Don’t Do by Amy Morin.

It’s worthwhile to make a habit of reading a bit of a self-help book each day, and it can even be a great way to spend time in front of the charts while you’re waiting for a setup.

I imagine you’re already a committed learner, seei

ng how you’ve independently sought ways to learn how to trade. Psychology and personal development are a subject you can learn on your own, too.

#4 Eat Healthy and Exercise

Fourth, take care of your nutrition and exercise daily.

We currently live in a world where humans like to cleanly organize different subjects as separate containers. When you go to a doctor, if you have a stomach ache, they’ll send you to a gastroenterologist. If you feel depressed, they’ll send you to a psychiatrist. The body is treated as a bunch of separate systems that seem to connect together like lego blocks of different colors.

However, this is a limited and outdated way of perceiving health. You cannot separate bodily systems – just think about how when you find out about the death of a loved one or an accident, your stomach may drop, your palms can turn sweaty, or perhaps the muscles in your shoulder tense up.

When you take a moment to feel your own body, you know that it is one solid entity, its individual parts work together to protect you and attempt to survive. Thus, how you take care of your body also affects your mind.

If you eat unhealthy, processed foods and lots of sugar, you’ll notice that your brain feels foggier, your moods may swing as your blood sugar spikes and drop, and you lack energy – this is a disadvantage when you’re demanding your body to act in the moment during a trade!

But it’s more than just being overweight or eating too much sugar. On a biochemical level, your body needs nutrients to be able to perform essential tasks.

For example, your body creates enzymes to break down food, to break down pathogens in the blood, and to create neurotransmitters. Many of these enzymes rely on vitamins and minerals like vitamin C, E, magnesium, B6, and folate to complete the process.

On a neurobiochemical level, each neurotransmitter depends on vitamins and minerals as cofactors for their creation. Dopamine, the reward-seeking and attention-focusing neurotransmitter require the amino acid tyrosine, which you get from eating protein, as well as vitamins B6 and folate, which are found in meats, vegetables, and fruits, as well as the mineral zinc among others.

The best way to get these nutrients so that you can create these neurotransmitters that help you focus, stay calm, and remain alert, is through eating a healthy diet that is based on consuming whole food items, so anything that is a single ingredient, like an apple, a chicken breast, almonds, etc.

When you combine a healthy diet with exercise, the effects skyrocket – you feel more energized, you get more oxygen in your body, and not to mention you feel better about yourself when you like the way you look.

Some commonly enjoyed forms of exercise include weight lifting, jogging, biking, playing a sport like tennis or basketball, and yoga.

However, I’m not a doctor or professional in this area, and I highly recommend seeking out the help of nutritionists, functional doctors, and fitness trainers in order to learn more. I recommend looking up the work of Dr. Mark Hyman and Dr. Susan Blum. Mark’s book the Ultramind solution was the first resource that got me deep into functional medicine and nutrition a few years ago.

#5 Consider Medication or Nootropics

Lastly, our final mental health tactic is to consider medication and/or nootropics when necessary.

Many people believe that taking medication to help depression or anxiety makes you somehow a broken person or a failure. There has been a stigma against medication for a long time.

However, I believe this stigma is changing. More individuals are willing to work with a doctor to determine if such a resource is appropriate when facing chronic depression or overwhelm.

I will be candid with you and say that I’ve been using the antidepressant Zoloft for a few years now and it’s been a key medication for helping with some of my chronic health issues, particularly insomnia. A nice side-effect is that it also helps me stay calm while trading.

While this is by no means a solution, it is a support while I seek to heal my body so that it can sleep on its own.

There are always side effects when taking medication, such as some weight gain, slower digestion, and inhibited libido, but for me the mood stabilization and added sleep are worth the trade-off.

Most medications are bandaids and will not solve the underlying issue, but they can also be lifesavers when you have to select and prioritize how to work on your health and circumstances.

If you feel like you are struggling with depression or a mood disorder, especially when you’re already committed to multiple other mental healthcare habits like a healthy diet and meditation, then it may be worthwhile to seek the advice of a psychiatrist or general practitioner to continue to address the issue.

There is nothing wrong with you for wanting to have this support.

Taking medication can be a profound act of self-care!

Another area worth exploring, especially if medication doesn’t feel like a viable option, is to use nootropics or supplements to help balance your mood or even increase your concentration and focus.

As with our earlier discussion on nutrients, you may have nutritional deficiencies that are preventing your nervous system and body from operating optimally.

Working with a functional doctor or nutritionist who specializes in mental health nutrition is the best way to test for and accurately identify what supplements to take.

There are also cool at-home tests available, like this one from 5 Strands, which can tell you if you’re deficient in certain nutrients or have sensitivities to certain foods.

Many supplements are available for purchase on Amazon or in local stores, so once you know what you need, you can seek out trusted, safe, and ideally organic supplements to address any deficiencies or areas to optimize.

Again, I am not a medical doctor or licensed therapist, so as with any of these suggestions, I highly recommend doing further research and working with professionals who can provide individualized suggestions.

Conclusion

Today I’ve listed just five ways you can prioritize your mental health in order to improve your trading psychology and discipline.

Any of these habits and actions can give you an edge in your trading over the long run.

Whether starting a meditation practice, signing up for therapy, purchasing a good self-help book, looking up a whole food diet you can commit to, or signing up for a consultation with a nutritionist, I encourage you to take action today.

Hopefully, you’ve already thought of one that you’re going to start researching after this video, but do come back and watch again when you feel like you’re out of ideas for ways to improve.

I genuinely wish you the best of strength and luck on your trading journey. Let me know your thoughts on what you decide to do, and I’ll see you all in the markets. Take care!

However, funded trading plus uses 8-cap as its broker, so you need to be sure to select 8-cap’s chart before setting an order on it.

However, funded trading plus uses 8-cap as its broker, so you need to be sure to select 8-cap’s chart before setting an order on it.

How to Improve Your Physical Energy

How to Improve Your Physical Energy

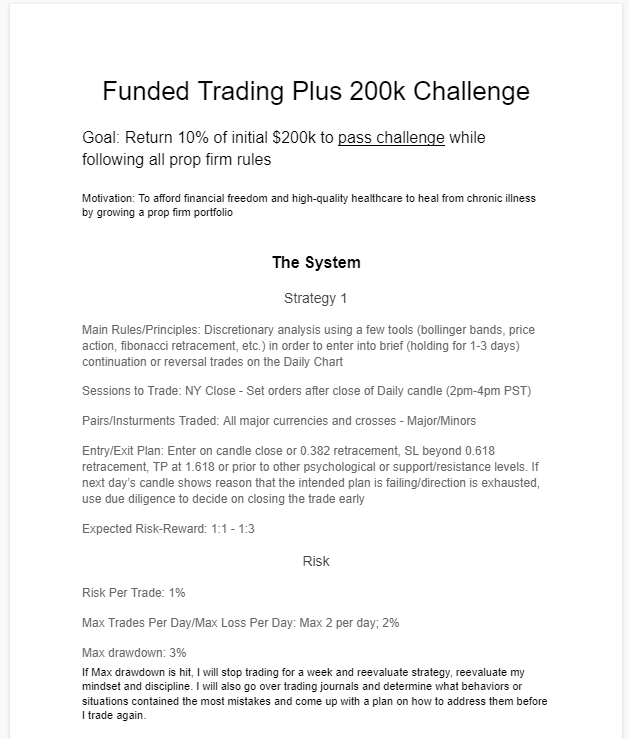

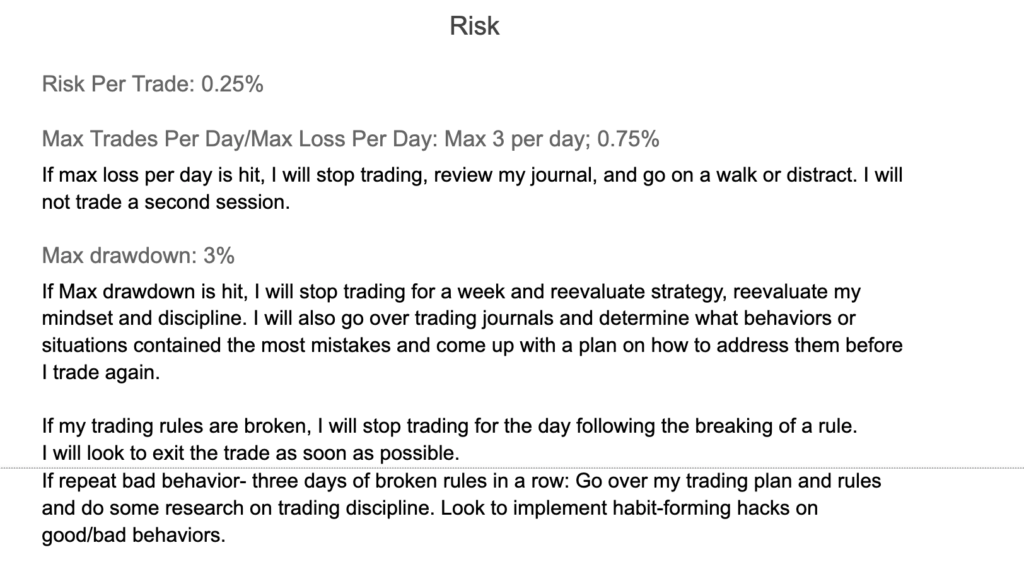

Whether you write a plan for each of your strategies you perform or a plan for each phase of a prop trading challenge, the beginning of every trading pursuit or goal you aim for needs to have a trading plan.

Whether you write a plan for each of your strategies you perform or a plan for each phase of a prop trading challenge, the beginning of every trading pursuit or goal you aim for needs to have a trading plan.  2. Goal

2. Goal

Latest posts