Funded Trading Plus Is No Longer a Prop Firm

In this article I’m going to be talking about Funded Trading Plus and why it’s no longer a prop firm. Hereafter, I will be alluding to the firm’s updated name as FT+

For those of you who don’t know, a prop firm is a company that provides funding to traders in exchange for a fractional share of their profits. This can be a great way for traders to get started in the financial markets, as it allows them to trade with real money without having to put up any of their own capital.

However, in recent years, there have been a number of prop firms that have been shut down by regulatory bodies. This is because many of these firms were not properly regulated, and they were taking on too much risk while also misleading their clients regarding what was going on in the background of the firm’s platform.

One of the most high-profile examples of this industry infracture was MyForexFunds, which was shut down by the CFTC in September of 2023. The CFTC found that MyForexFunds had been making false and misleading claims about its services. While the majority of the issues relevant to the MyForexFunds case involve irresponsible business practices, another major reason for its closure is due to its failure to uphold the legal responsibilities of maintaining a proprietary fund.

As a result of these events, a number of online prop firms that are still in the industry have been forced to change their business models as they relate to the legal responsibilities of running a prop firm. FT+ is one of these firms that is making a massive shift in how it legally organizes and presents itself.

FT+s used to offer prop trading account challenges, but it has since discontinued this sort of service. Instead, it now proclaims to offer simulated trading accounts with payouts for achieved simulated profit. This means that traders can still use the FT+ platform to trade, but they will only be trading simulated funds and receive a performance-based commission representative of simulated earnings.

< GET 10% OFF OF YOUR SIMULATED FT+ CHALLENGE WITH CODE “DFX10” >

Funded Trading Plus says that this change was made in order to comply with regulatory requirements. However, it is also likely that the company was concerned about the reputational damage that was caused by the closure of other prop firms.

So, what does this mean for us traders who have depended on prop trading to access greater leverage in the markets?

If you were hoping to get funded by a prop firm with actual live funds, your chances at finding firms who still offer this option are exponentially dwindling as the industry shifts. Furthermore, it may be beneficial to avoid utilizing firms that claim to offer real proprietary funding, as regulation continues to disrupt the standard practices in this industry.

However, it’s still possible to make money using trading strategies on simulated accounts.

In fact, it’s likely that many of us who have traded with “funded accounts” over the last few years have already been trading on simulated funds up to this point. I don’t have a way to back this statement with evidence, but I can make a fair guess after spending the last 3 years researching prop firms and watching a handful of firms get taken down by regulatory bodies.

The MyForexFunds debacle also highlights another important aspect regarding retail trading with online funds – now more than ever, it’s important to seek to maintain a portfolio of real or simulated trading accounts from various firms. It’s no longer safe to put all of your eggs in one basket. I go over a list of reliable firms in this article about the best prop trading firms for the remainder of 2023.

The best way to manage multiple accounts is to utilize a trade copier. This allows you to link all of your accounts to one main account, from which you place your trade, and thus copy that order onto all other accounts.

< My best recommendation for a trade copier: Traders Connect >

So apart from diversifying your accounts, it’s also important to stick with firms that are responsible, agile, and professional.

I can’t begin to tell you how many of these prop firms are run by 20-something-year-olds with no education and no experience running a business. FT+ is not one of those companies. It is managed by a highly professional team who have the experience and responsibility to oversee the support and service of trading education and opportunities for millions of people.

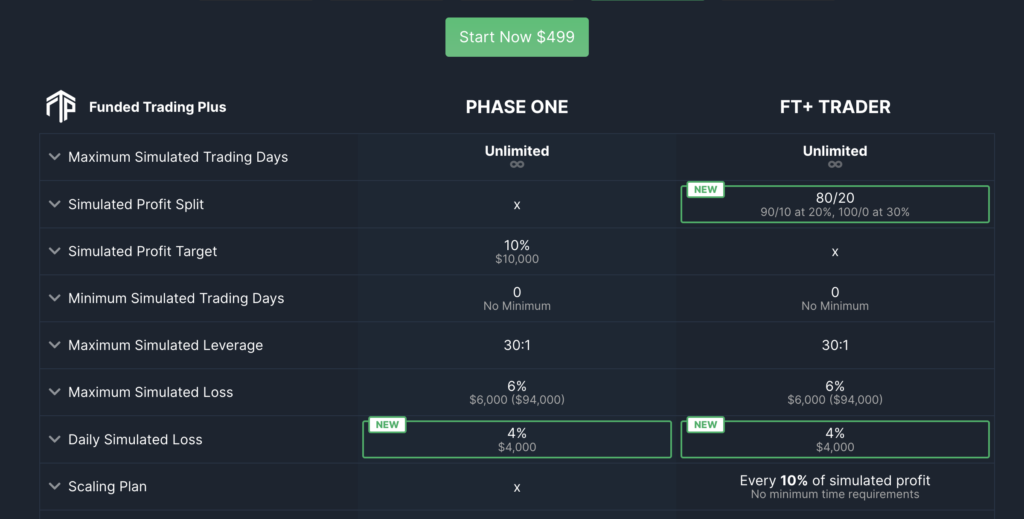

Here is an example of one of FT+’s updated programs:

This is known as their one-phase, “Experienced” simulated program. Some of its main features are that it’s a no-time-limit, one phase simulated challenge with a profit target of 10%, a maximum simulated loss of 6%, a daily simulated loss of 4%, and a scaling plan that lets you bump up the simulated account size with every 10% increase on the account. Furthermore, you’re able to hold open positions through the weekend and for a $100k simulated account, the fee is only $499 compared to FTMO’s equivalent account program with a fee of $575.

This is one of the best and most reliable account options available in the online trading industry right now. This is an educational experience that you can profit from by displaying your well-honed trading skills on a simulated challenge. Funded Trading Plus is being highly proactive and will continue to thrive and survive as the entire prop firm industry goes through a major squeeze.

I am an affiliate of this firm because it is one of the last few that I trust and have been thoroughly impressed by through all of these years of navigating the prop firm industry.

Be sure to use my affiliate coupon code, “DFX10”, for 10% off of your simulated challenge!

Pingback: This is the Only Safe "Prop Firm" for US Traders - Disciplined FX