FTMO Verification: PASSED!

Hey there, folks! My name is Andrew Blom, founder and CEO of Disciplined Fx. If you’re new here, welcome! I first started teaching myself how to day trade after developing a chronic illness and needing to find a way to make money from home with a minimal amount of time and energy. Ever since then, I’ve developed so much confidence and hope because of how much day trading has left me feeling successful and empowered to actually make money from home on my own time. I’m also a Ph.D. student pursuing a doctorate in business with a concentration in entrepreneurship. The intention of Disciplined FX is to provide a safe space that supports diverse traders from all walks of life as we learn how to hone discipline and a trading mindset to succeed in forex markets

Update!

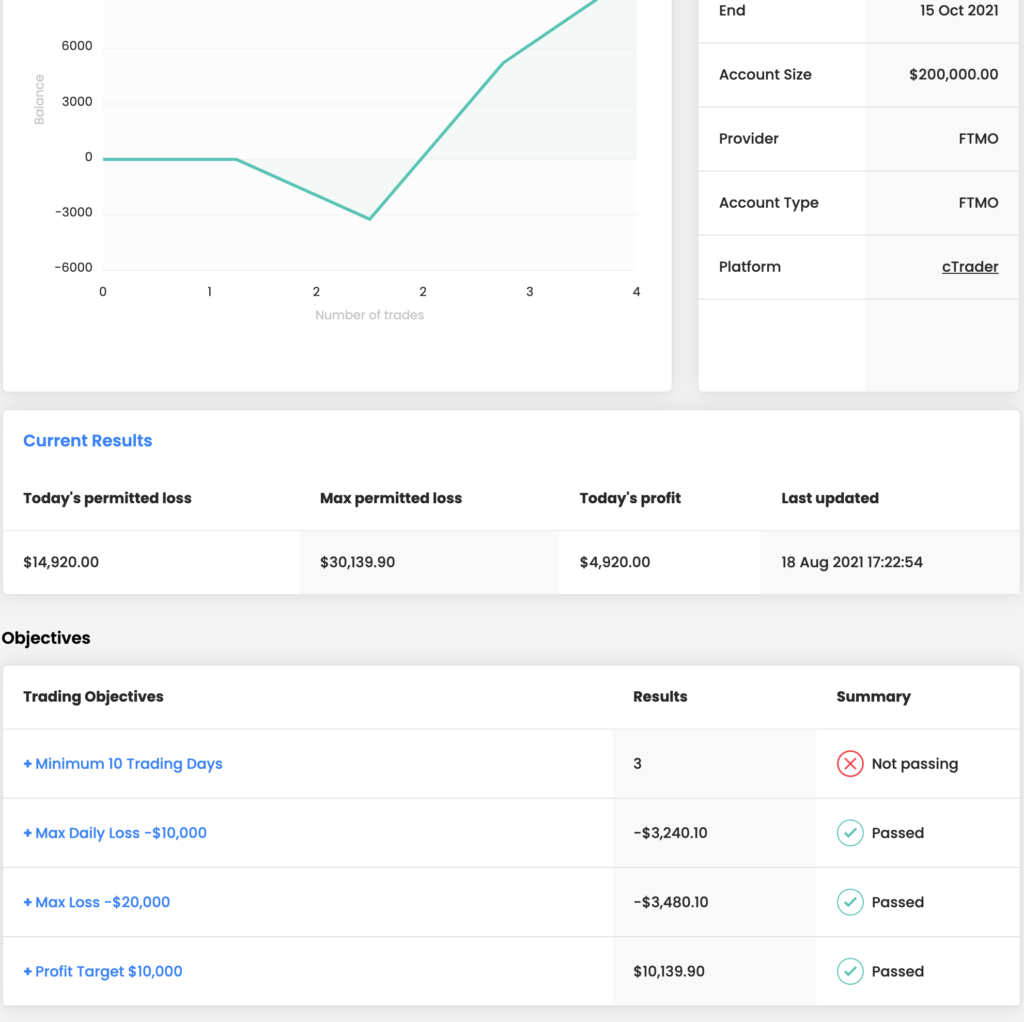

I didn’t think I’d make another post so soon, but I just wanted to jump on here real quick to let you know that after just three days of trading the verification for an FTMO funded $200k account, I’ve passed the verification profit target!

All of my verification targets have been met except for the minimum number of days traded.

This means that I will spend the next seven days taking microtrades each day to meet the 10 trading day minimum, and from there, assuming everything checks out okay on FTMO’s end, I’ll be qualified to begin trading as a FTMO funded trader.

If you aren’t familiar with FTMO:

In a nutshell, FTMO funds traders who pass their 2-step trading challenge with a $10,000 to $200,000 account to start, and disperses 70% of monthly profits to the trader.

I can’t express just how excited I am to begin working with FTMO and to put my trading discipline and strategies to work!

If you want to learn a little bit more about my trading style and experience with passing the FTMO challenge, as well as tips for starting your own FTMO challenge, be sure to check out this first post I made.

The Breakdown of My Verification Experience:

I used the same strategy as I did for the end of the challenge and took three trades, with only one trade per day I sat in front of the charts.

My first trade was a loss but the next two were winners.

My first trade was a loss but the next two were winners.

Each had a risk-reward ratio of 2.5 and I risked about 1.5% of my account for each trade.

I trade only once a day because I like to use a “set and forget” strategy that minimizes the amount of time I send in front of the charts, and therefore, also minimizes the opportunities for my emotions to get in the way.

This has worked well for me but I’m also at a point in my trading where I can watch my trades without experiencing much of any emotional reaction.

I will say, though, that trading for a funding challenge does come with more pressure, and therefore I felt like this “set and forget strategy” was particularly useful for the kind of higher stakes trading that comes with attempting to hit a profit goal despite what’s going on in the markets.

Overall, I am so relieved and excited to have the privilege to be able to trade for a prop firm.

If you have any questions about the FTMO challenge, their FAQ section is a good place to start.

I wish you the best of strength and luck, and I’ll see you all in the markets!

Pingback: 5 Steps to FTMO Challenge Success - Disciplined FX

Pingback: How to Make Your Own Mechanical Strategy - Disciplined FX

Pingback: What To Do When You Fail Your Prop Trading Challenge - Disciplined FX

Pingback: Don't Take a Prop Firm Challenge Until You Do This - Disciplined FX

Super awesome. Congratulations! I’m also currently doing the FTMO challenge. It was a bit bumpy because I started without being fully prepared. So I got into drawdown, but worked hard on improving my trading and started to climb out from the drawdown. I only have 2 trading days left in the challenge, but I need just 1 or 2 profitable trades to get back above the breakeven point to get a free retry of the challenge. If not I’ll just pay again. I love how impersonal and rules-based this game is. There’s no one to blame. I know I’m responsible for my results and I get what I deserve. But I also know that if I persist and continuously improve my trading, I’ll reach my goals. What is your goal by the way? Know you can take another 200K challenge and ask FTMO to merge your accounts once you pass the challenge. And then go for the scaling plan. Are you going to do it? I’m also doing the challenge on City Traders Imperium. They have great conditions too. They give 1 year for evaluation, 7% profit target, 100:1 leverage, but there is max position sizing limit and also max 1.5% risk per trade. Max drawdown is relative for evaluation and it’s 5%. So in general you only need to reduce your risk and expect the progress to be slower. But their scaling plan is faster than FTMO’s.

Thanks for your comment here, Tomas! It’s fascinating to hear your story and I love that you can so clearly see the role of your own responsibility with trading. My goal is to build a portfolio of prop trading accounts and then aim for a return of 2-4% from each and try to achieve this with only 3 trades or less. While FTMO is the Gold Standard for prop trading, their day trading rules are really limiting for the funded accounts. You can’t trade during news and you must close a day trade by their own market close in Prague. I’m looking at Traders Central and MyForexFunds for future accounts, but will also go for additional FTMO accounts as long as I can keep scalping!

Thanks for your comment here, Tomas! It’s fascinating to hear your story and I love that you can so clearly see the role of your own responsibility with trading. My goal is to build a portfolio of prop trading accounts and then aim for a return of 2-4% from each and try to achieve this with only 3 trades or less. While FTMO is the Gold Standard for prop trading, their day trading rules are really limiting for the funded accounts. You can’t trade during news and you must close a day trade by their own market close in Prague. I’m looking at Traders Central and MyForexFunds for future accounts, but will also go for additional FTMO accounts as long as I can keep scalping!

It’s in point of fact a great and helpful piece of info. I’m happy that you just shared this useful information with us. Please keep us up to date like this. Thank you for sharing.

You made some decent points there. I appeared on the web for the difficulty and located most people will go along with along with your website.

This web site is really a walk-through for all of the info you wanted about this and didn’t know who to ask. Glimpse here, and you’ll definitely discover it.

I have been exploring for a little bit for any high-quality articles or blog posts on this kind of area . Exploring in Yahoo I finally stumbled upon this website. Studying this info So i’m happy to exhibit that I have a very excellent uncanny feeling I came upon exactly what I needed. I most no doubt will make certain to don’t fail to remember this site and give it a glance regularly.

I’ve been browsing online more than three hours today, yet I never found any interesting article like yours. It’s pretty worth enough for me. In my opinion, if all website owners and bloggers made good content as you did, the web will be a lot more useful than ever before.

Great ?V I should certainly pronounce, impressed with your web site. I had no trouble navigating through all tabs and related info ended up being truly easy to do to access. I recently found what I hoped for before you know it in the least. Reasonably unusual. Is likely to appreciate it for those who add forums or anything, site theme . a tones way for your client to communicate. Nice task..

Generally I do not read post on blogs, however I would like to say that this write-up very compelled me to try and do so! Your writing style has been amazed me. Thanks, quite nice article.

I’ve recently started a blog, the info you provide on this site has helped me tremendously. Thank you for all of your time & work.

Definitely, what a fantastic site and revealing posts, I will bookmark your site.Have an awsome day!

Perfect piece of work you have done, this website is really cool with great info .

I’m usually to running a blog and i really admire your content. The article has really peaks my interest. I’m going to bookmark your web site and keep checking for brand spanking new information.

I’m extremely inspired along with your writing talents and also with the format for your weblog. Is that this a paid theme or did you customize it your self? Anyway stay up the excellent high quality writing, it’s rare to look a nice blog like this one these days..

I do agree with all the ideas you’ve offered in your post. They’re very convincing and will certainly work. Nonetheless, the posts are too quick for starters. Could you please extend them a bit from next time? Thank you for the post.

I’m curious to find out what blog system you are using? I’m experiencing some small security issues with my latest site and I’d like to find something more risk-free. Do you have any solutions?

I like this website because so much utile stuff on here : D.

This is a topic close to my heart cheers, where are your contact details though?

Milf with a need for fresh ! come in and enjoy!

What¦s Taking place i’m new to this, I stumbled upon this I’ve discovered It absolutely useful and it has aided me out loads. I hope to give a contribution & help other users like its helped me. Great job.

Good web site! I truly love how it is simple on my eyes and the data are well written. I am wondering how I might be notified whenever a new post has been made. I have subscribed to your feed which must do the trick! Have a nice day!

As I website owner I think the content material here is very wonderful, thanks for your efforts.

Of course, what a fantastic site and informative posts, I will bookmark your site.All the Best!

What Is Puravive? The Puravive weight loss aid is formulated using eight clinically proven natural ingredients.

Fantastic website. Lots of useful information here. I am sending it to several friends ans additionally sharing in delicious. And naturally, thank you for your effort!

I enjoy the efforts you have put in this, regards for all the great content.

Greetings from California! I’m bored to death at work so I decided to check out your site on my iphone during lunch break. I love the knowledge you present here and can’t wait to take a look when I get home. I’m surprised at how quick your blog loaded on my mobile .. I’m not even using WIFI, just 3G .. Anyhow, good site!

Hi! I just wanted to ask if you ever have any trouble with hackers? My last blog (wordpress) was hacked and I ended up losing months of hard work due to no back up. Do you have any solutions to protect against hackers?

of course like your website however you need to check the spelling on several of your posts. A number of them are rife with spelling problems and I in finding it very troublesome to inform the reality nevertheless I will surely come again again.

Howdy! I’m at work browsing your blog from my new iphone!

Just wanted to say I love reading your blog and look forward to all your posts!

Carry on the great work!

Thanks , I’ve recently been searching for info about this topic for ages and yours is the best I have discovered till now. But, what about the conclusion? Are you sure about the source?

Its like you read my mind! You seem to know so much about this, like you wrote the book in it or something. I think that you can do with some pics to drive the message home a bit, but other than that, this is magnificent blog. A great read. I’ll definitely be back.

Wow, marvelous blog layout! How lengthy have you

ever been running a blog for? you made blogging glance easy.

The overall look of your website is fantastic, as smartly as the content!

You can see similar here e-commerce

Some really choice blog posts on this website , saved to my bookmarks.

Valuable info. Lucky me I found your site by accident, and I’m shocked why this accident didn’t happened earlier! I bookmarked it.

Spot on with this write-up, I truly think this website needs much more consideration. I’ll in all probability be once more to learn rather more, thanks for that info.

hello there and thank you for your information – I’ve certainly picked up anything new from right here. I did however expertise several technical points using this site, as I experienced to reload the website lots of times previous to I could get it to load correctly. I had been wondering if your web hosting is OK? Not that I’m complaining, but sluggish loading instances times will often affect your placement in google and could damage your high quality score if ads and marketing with Adwords. Well I am adding this RSS to my email and can look out for much more of your respective intriguing content. Make sure you update this again very soon..

Usually I don’t read post on blogs, but I would like to say that this write-up very forced me to try and do so! Your writing style has been surprised me. Thanks, very nice article.

I have been exploring for a little for any high-quality articles or blog posts on this sort of area . Exploring in Yahoo I ultimately stumbled upon this website. Reading this info So i am glad to express that I have an incredibly just right uncanny feeling I came upon just what I needed. I most without a doubt will make sure to do not disregard this website and give it a look regularly.

I was just looking for this information for some time. After six hours of continuous Googleing, at last I got it in your site. I wonder what’s the lack of Google strategy that don’t rank this type of informative websites in top of the list. Normally the top sites are full of garbage.

Thank you for the good writeup. It in fact was a amusement account it. Look advanced to far added agreeable from you! By the way, how could we communicate?

This web site is really a walk-through for all of the info you wanted about this and didn’t know who to ask. Glimpse here, and you’ll definitely discover it.

Please let me know if you’re looking for a article writer for your site. You have some really great posts and I feel I would be a good asset. If you ever want to take some of the load off, I’d really like to write some content for your blog in exchange for a link back to mine. Please shoot me an email if interested. Kudos!

What i do not understood is if truth be told how you are now not really much more well-appreciated than you might be now. You are so intelligent. You realize therefore considerably in relation to this matter, produced me in my opinion believe it from numerous numerous angles. Its like men and women don’t seem to be involved until it is something to accomplish with Woman gaga! Your own stuffs excellent. Always handle it up!

you are in point of fact a good webmaster. The web site loading speed is incredible. It seems that you are doing any unique trick. Also, The contents are masterwork. you’ve performed a great process on this subject!

When I originally commented I clicked the -Notify me when new feedback are added- checkbox and now each time a comment is added I get 4 emails with the identical comment. Is there any way you’ll be able to take away me from that service? Thanks!

An impressive share, I simply given this onto a colleague who was doing a bit analysis on this. And he in actual fact purchased me breakfast as a result of I discovered it for him.. smile. So let me reword that: Thnx for the deal with! However yeah Thnkx for spending the time to discuss this, I feel strongly about it and love studying more on this topic. If attainable, as you change into experience, would you mind updating your weblog with more particulars? It’s highly helpful for me. Massive thumb up for this weblog put up!

I got what you intend, thankyou for putting up.Woh I am pleased to find this website through google.

Sumatra Slim Belly Tonic primarily focuses on burning and eliminating belly fat.

Renew is a nutritional supplement that activates your metabolism and promotes healthy sleep.

I really like assembling useful info, this post has got me even more info! .

You made some decent factors there. I regarded on the web for the difficulty and located most people will go together with together with your website.

Very great visual appeal on this web site, I’d rate it 10 10.

I love it when people come together and share opinions, great blog, keep it up.

A lot of of whatever you articulate happens to be astonishingly accurate and it makes me wonder the reason why I had not looked at this with this light before. This particular article really did switch the light on for me as far as this particular issue goes. Nonetheless at this time there is one position I am not necessarily too cozy with and while I make an effort to reconcile that with the actual main idea of your position, let me observe what the rest of the visitors have to point out.Well done.

Hi just wanted to give you a brief heads up and let you know a few of the images aren’t loading correctly. I’m not sure why but I think its a linking issue. I’ve tried it in two different web browsers and both show the same outcome.

Everything is very open and very clear explanation of issues. was truly information. Your website is very useful. Thanks for sharing.

Pretty section of content. I simply stumbled upon your blog and in accession capital to say that I get actually loved account your weblog posts. Anyway I will be subscribing to your augment and even I success you get entry to persistently fast.

Hi there, just became alert to your blog through Google, and found that it is truly informative. I’m gonna watch out for brussels. I will be grateful if you continue this in future. A lot of people will be benefited from your writing. Cheers!

Good – I should certainly pronounce, impressed with your site. I had no trouble navigating through all tabs and related info ended up being truly easy to do to access. I recently found what I hoped for before you know it in the least. Reasonably unusual. Is likely to appreciate it for those who add forums or something, website theme . a tones way for your customer to communicate. Excellent task.

I really appreciate this post. I have been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thanks again

Good info. Lucky me I reach on your website by accident, I bookmarked it.

Lottery Defeater is an automated, plug-and-plug lottery-winning software.

Hey, you used to write great, but the last few posts have been kinda boringK I miss your great writings. Past several posts are just a little out of track! come on!

I¦ve been exploring for a little bit for any high quality articles or weblog posts in this kind of house . Exploring in Yahoo I at last stumbled upon this site. Reading this information So i¦m glad to convey that I have an incredibly good uncanny feeling I found out just what I needed. I such a lot without a doubt will make sure to don¦t put out of your mind this website and give it a glance on a continuing basis.

We’re a bunch of volunteers and starting a brand new scheme in our community. Your site provided us with useful information to work on. You’ve done a formidable task and our entire community will probably be thankful to you.

I went over this internet site and I believe you have a lot of superb information, bookmarked (:.