As 2024 rolls along, the number of resilient prop firms seems to continue to dwindle as more regulatory fears are changing the online prop trading industry as we know it.

One of the most professional and respectable firms I’ve ever traded with is Funded Trading Plus (FT+) and I am seeking to test a simple and objective higher time frame strategy to see if it’s able to withstand the trading conditions of the Experienced Trader challenge.

Full disclosure: I am an affiliate with FT+ and have voluntarily chosen to be so after I thoroughly vetted the firm for its trustworthiness and reliability. I cannot emphasize enough just how much I believe this is one of the very few professional firms that I have ever traded with.

If you’d like to receive 10% off of your FT+ challenge, use “DFX10” at checkout.

In this article, I want to share with you:

- Why I chose this particular firm to test this swing strategy

- The conditions of the Experienced Trader challenge

- Some of the fundamental aspects of the swing strategy I will be using

- My risk management plan for this experiment

- Some final notes on trading psychology while trading a challenge

Why Funded Trading Plus?

As I mentioned earlier, I believe Funded Trading Plus is one of the most reliable and sophisticated firms available. They are based in the UK, and the founders have a handful of years of experience trading and running a business in the Forex industry.

They were the first prop firm to offer a “no-time-limit” challenge and have always done so since they were established. Their motto is that they wanted to “create a challenge that, as Forex traders themselves, would want to trade.” Their trading rules are realistic, they offer news and weekend trading, and there are no hidden rules around lot sizes or the use of stop losses.

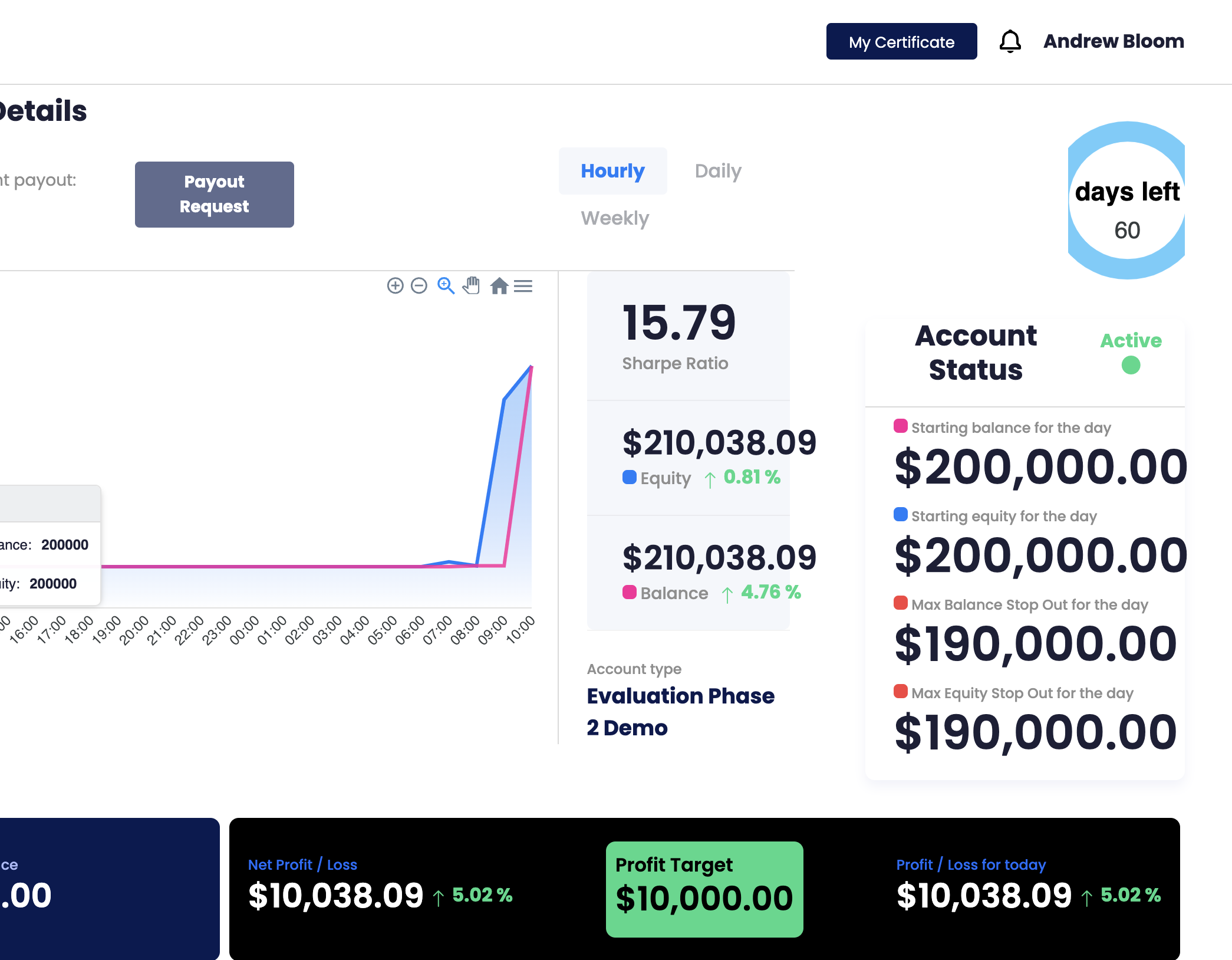

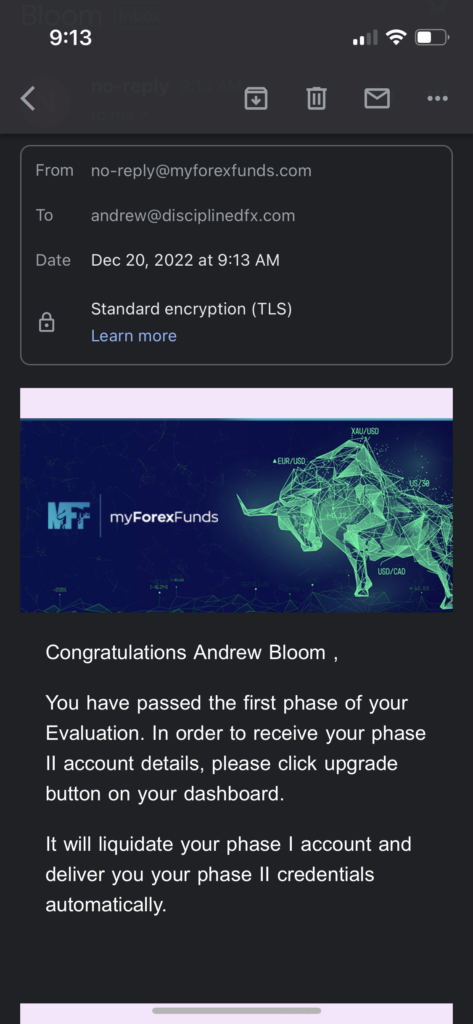

So too, they are transparent about utilizing demo accounts as part of the simulated trading experience – this is particularly important for the current challenges that are arising in the prop trading industry. Many government regulatory bodies are looking to crack down on the availability of online live prop firm accounts and the trading of Forex CFDs to retail traders. It’s no secret that many prop firms use simulated accounts as part of their challenge experience – however, when firms like MyForexFunds failed to disclose this information, they were sued and shut down.By offering a simulated challenge, FT+ is protecting them (and us traders) from losing accounts over regulatory changes.

What is the Experienced Trader Challenge?

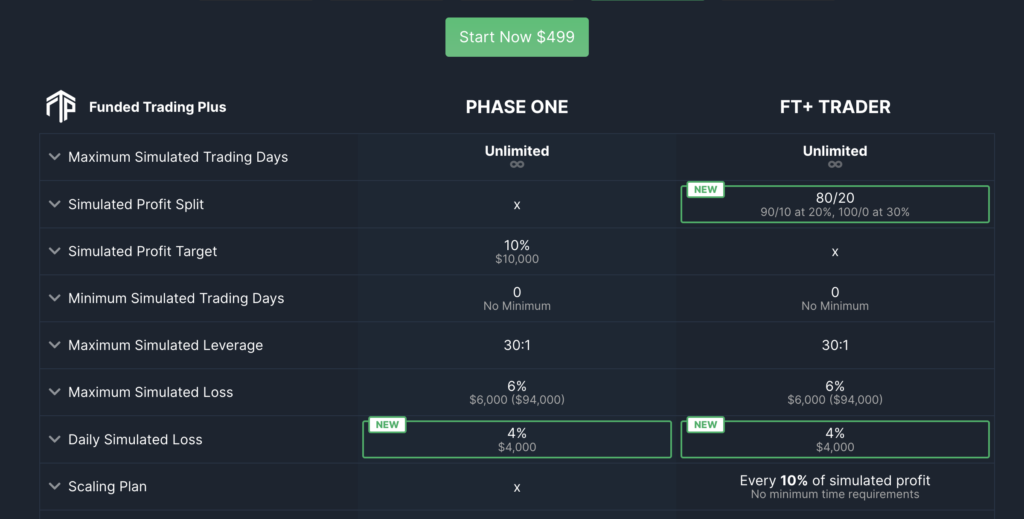

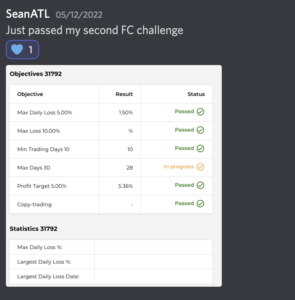

The Experienced Trader Challenge is Funded Trading Plus’ 1-phase challenge. This means that traders only have to hit one simulated profit target of 10% in order to qualify for a funded account.

It’s important to note that the max relative simulated loss is 6%, their daily max loss is 4%. If you want a quick explanation of what is meant by relative drawdown, click here. EA’s, weekend trading, and news trading are all allowed.

After receiving funding, FT+ also has a generous scaling program with an increase in funding granted at 10% profit.

My Higher Time Frame Swing Trading Strategy

Timeframe: D chart

Assets: Majors & a couple of popular minors

Time of day for order placement: 5pm EST (New York Close)

Order types: Market and limit order (retracement)

Time spent trading each day: 15 minutes

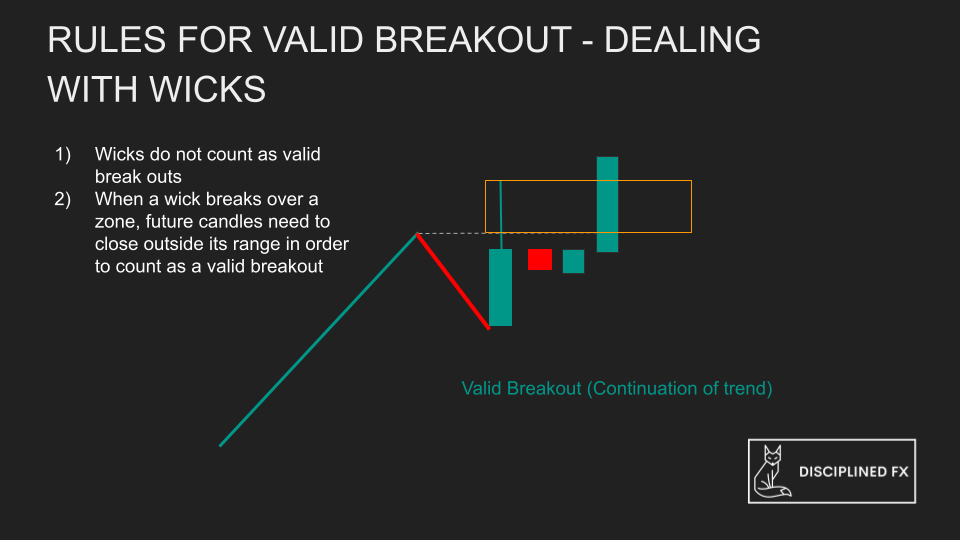

Main entry criteria: engulfing candle at key levels

While I won’t be sharing all of the indicators and rules involved in my strategy, I’ll list for you some of the main features that give this strategy an edge and why I’ve chosen to apply this style of trading.

For over two years, I’ve been working on formulating a strategy that could be easily utilized by people who have a full-time job and very little time to trade. I find that the daily chart offers great opportunities for getting a good vantage point of what the market is up to.

Trades taken on the daily chart also allow for large enough stop losses so that the trader doesn’t have to waste a lot of money on commissions or be at risk of getting taken out due to market noise seen on lower time frames.

Price action trading is a fairly popular style as it helps paint a picture of how market players respond to certain price levels. Engulfing candles, on the daily time frame in particular, tend to show how both the high and low of the previous day were tested and the direction of the close engulfing candle won out in favor (Bullish when closing near the high and bearish when closing near the low). The daily open, high, low, and close holds a lot of weight in the eyes of bankers.

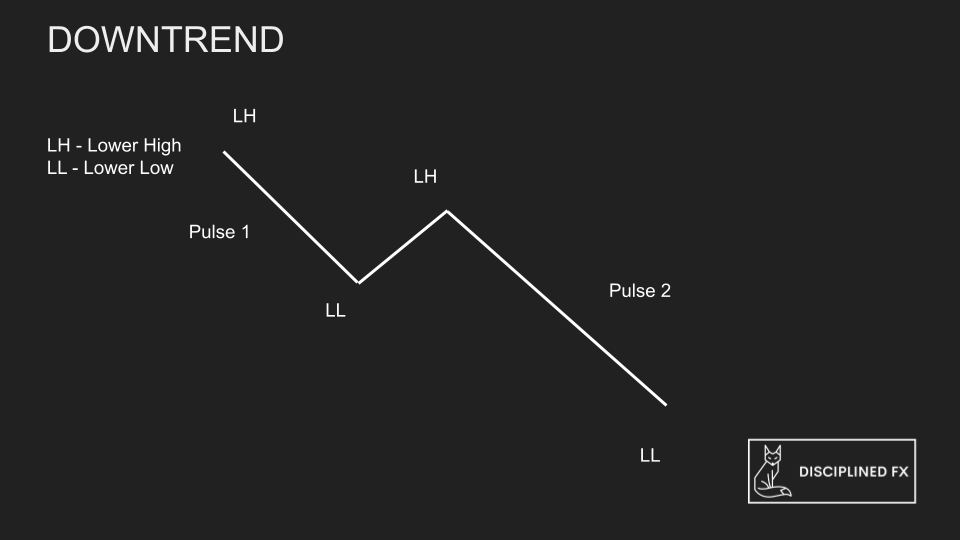

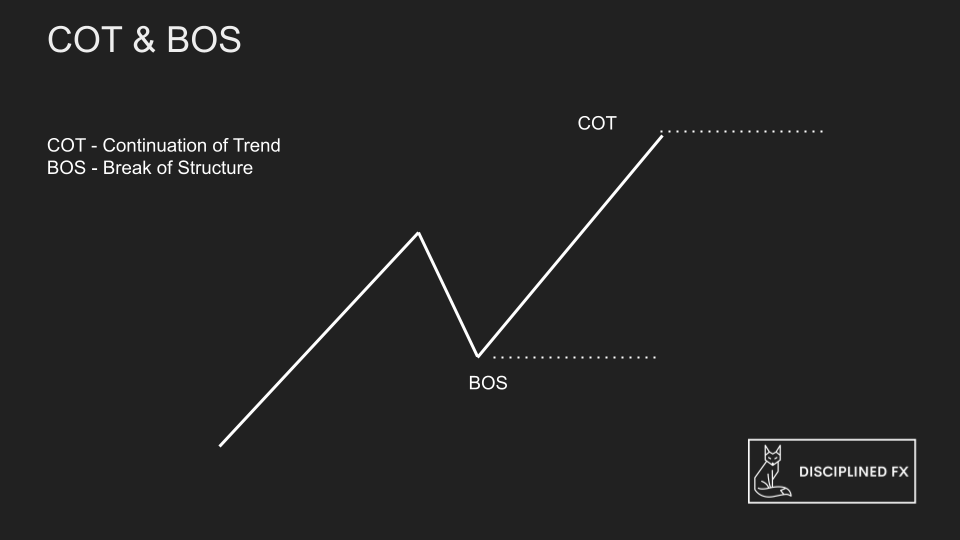

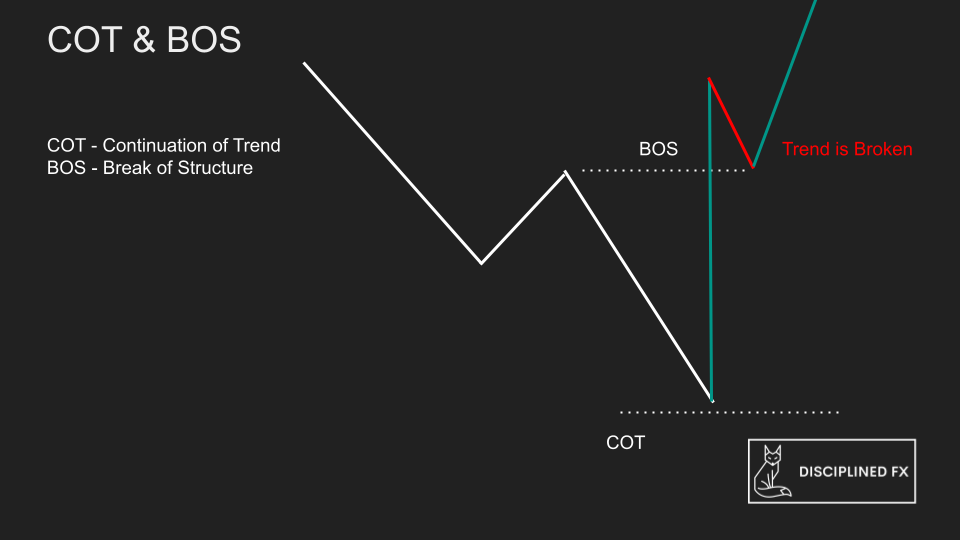

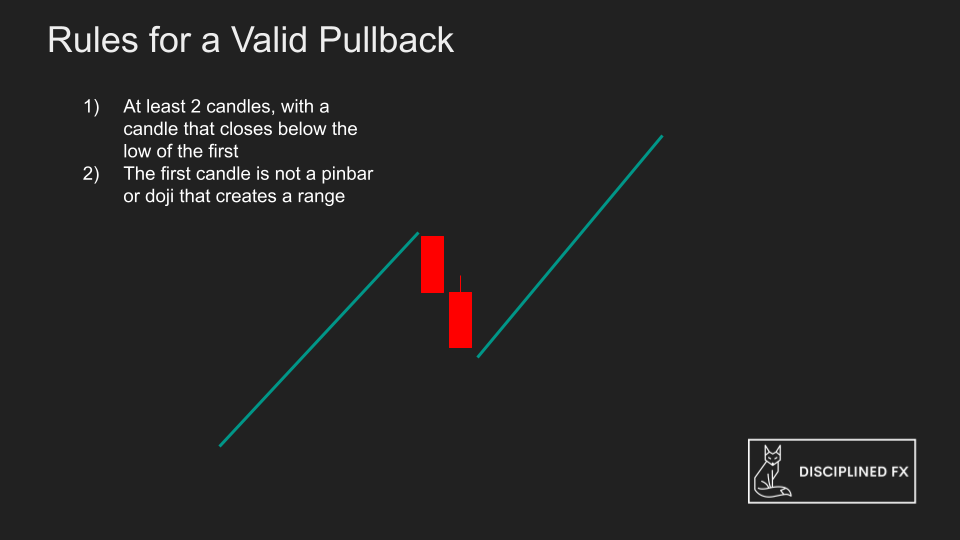

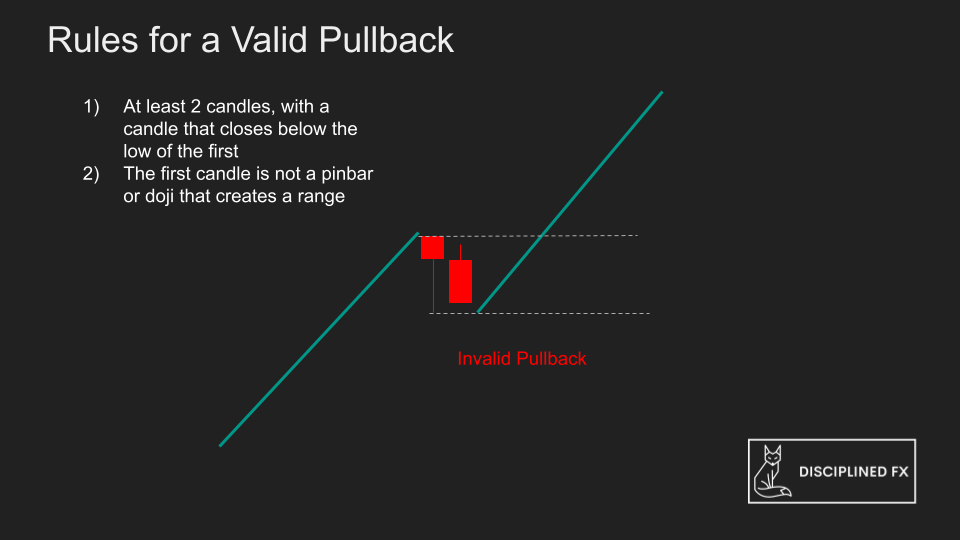

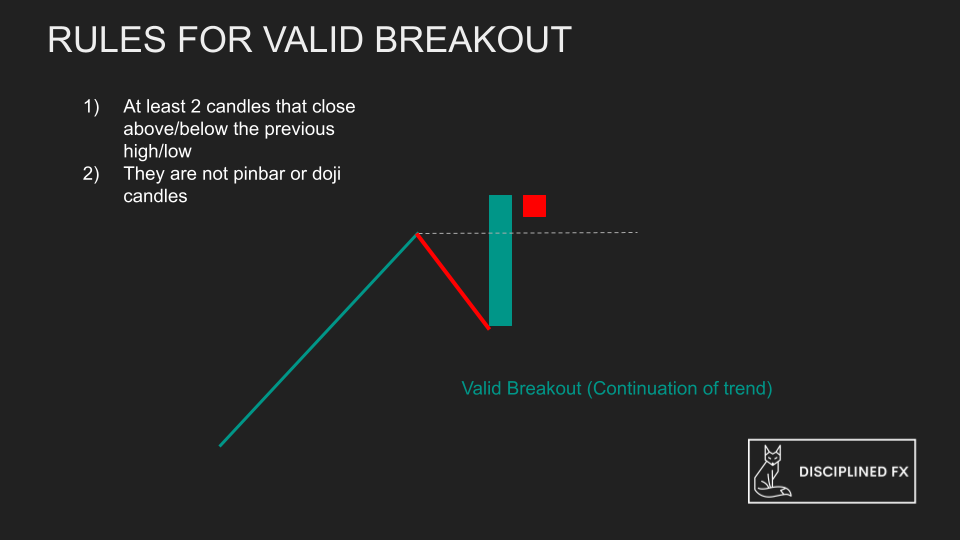

The market rarely moves in a straightforward line. Instead, price tends to pulse and retreat in waves. When engulfing patterns occur at certain levels, such as just past a whole number, among other areas, this gives emphasis that price reached a certain limit and is ready to retrace back to a previous price.

Taking a market order and then leaving a limit order at some part of the retracement of the engulfing daily candle gives two possible opportunities to get in on the trade with the market having a slightly lower risk-to-reward than the retracement order.

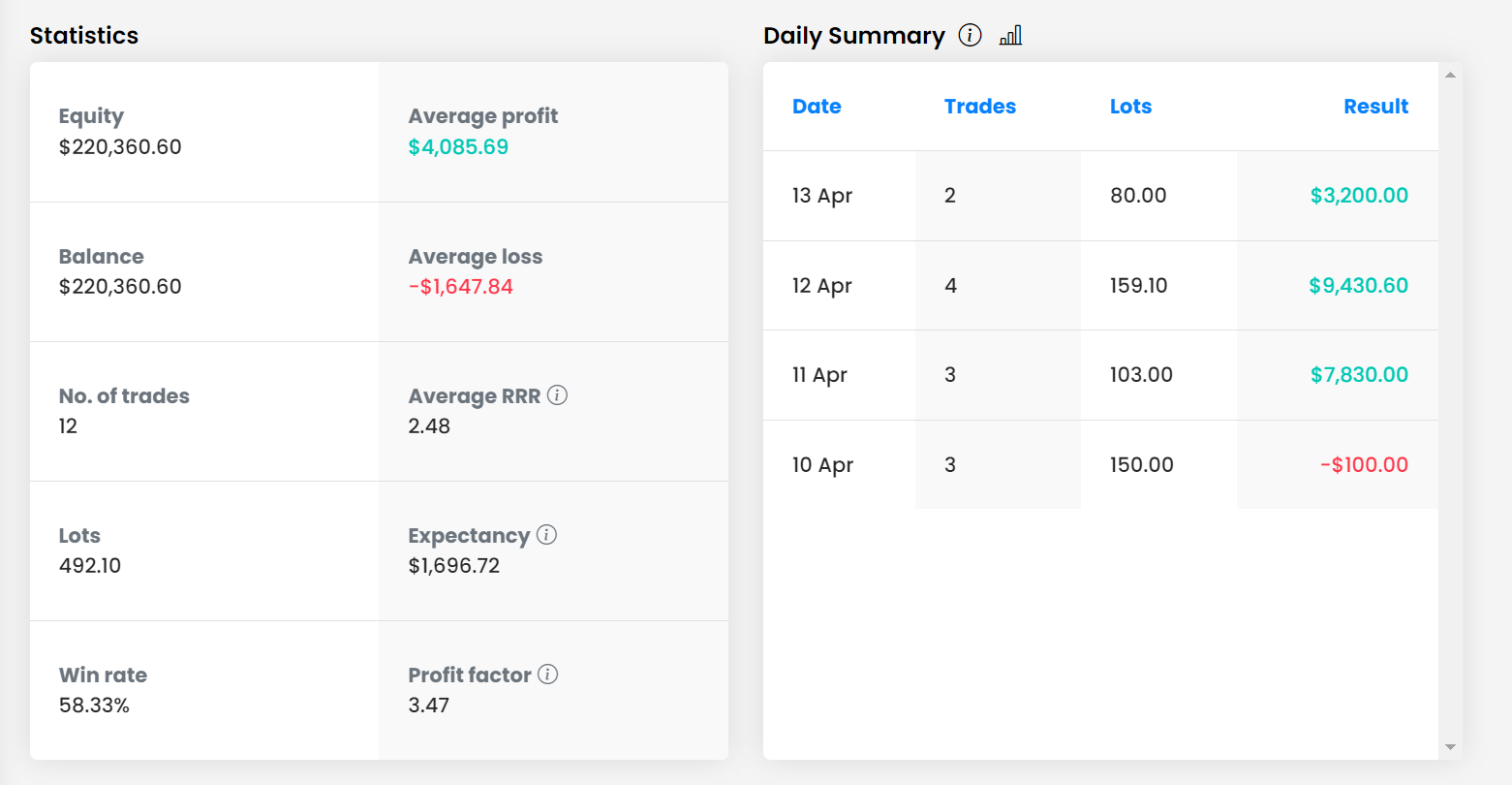

By checking the daily charts once a day, Monday through Thursday, there are often opportunities to get in on a trade with my particular setup at least twice a week. Often these trades return between 1.4 and 3 R with a profitable outcome.

My Risk Management Plan for Funded Trading Plus

For this particular challenge combined with this particular strategy, I am looking to risk no more than 0.5% of the initial account balance per trade idea (0.25% for the market order, 0.25% for the retracement order – sometimes only one order of the two is hit).

I intend to use this precise risk amount for the entirety of the challenge, except when the account falls into drawdown.

When the balance falls below 2% of the initial balance, so in this case, to $49,0000, I will cut my risk in half to 0.25% of the initial balance (0.125% for market order, 0.125% for retracement order).

When the strategy can recover half of the drawdown (so when the balance is back to $49,500 or higher), I will return to 0.5% risked per trade idea.

However, should a losing streak continue to unfold, I will reduce my risk by half again. Thus, when price reaches $48,000, I will risk 0.125% of the initial account balance per trade idea. I will return to 0.25% risked per trade when the balance is $48,500.

While this can make for an extended challenge, such a risk management approach helps me stay level-headed during a time when the trader feels the most fearful. Reducing risk can significantly reduce the pressure placed on oneself during a drawdown.

I have yet to meet a trader who wins 100% of the time. More often than not, even the best strategies can undergo a losing streak for a few weeks, a month, or longer. Thus, this risk management approach prepares for the losing streak in advance.

Due to the nature of the trailing drawdown, I will not increase my risk beyond 0.5% per trade should the account reach higher in profit.

A Final Note on Psychology

There is something about prop challenges that can make a trader more emotional than just trading one’s own funds.

Perhaps it’s the mix of more restrictions plus the hopes of a greater account size than anything that could personally be saved for in cash.

It’s important to remember that it’s okay to lose a prop challenge, oftentimes that’s part of the process of learning how to manage this style of trading. Thus, be sure to buy a challenge that doesn’t break your break – risk only the funds you are comfortable losing. For many, that could be the cost of a $50k challenge.

I want to also note that I have addressed psychology through choosing a higher time frame to trade and using a very algorithmic approach to limiting losses in drawdowns through my risk management strategy.

When trading the daily time frame, I am merely setting an order. During the New York close, the market is barely moving. There is nothing to chase. I merely follow my rules and if all the box marks are checked, then I take a trade. If not, then I patiently wait for another day to offer a setup.

It is all very rudimentary and securely…boring.

Higher Time Frame or Swing Trading can be quite methodical and relieving especially after many long mornings of scalping. It’s also nice that I have the option to continue to scalp (with other accounts) while letting this account do its thing in its own time.

More importantly, I’m going into this challenge with no expectations for how long it will take. I’m not in a rush, and it’s likely that it could take multiple months to reach 10% in profit. I’m okay with that.

I think between taking less than 15 minutes to trade each day and risking very small amounts of funds helps make this a calm experience. With a calm mindset, I trust that I will continue to show up, follow the rules, and let the process take care of itself.

Conclusion

Overall, this is my plan for taking this FT+ $50k challenge while using a swing style strategy. I recommend checking out the complimentary video for more information and to subscribe to the DisciplinedFX channel or the newsletter to receive updates as this experiment unfolds. Again, if you’d like to take a Funded Trading Plus challenge with me, be sure to use “DFX10” at checkout to get 10% off of your challenge.

As always, I wish you all nothing but the best of strength and luck!

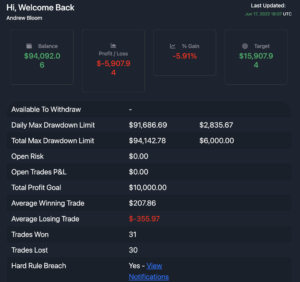

Well, don’t worry, I’m here to catch those tears when they fall.

Well, don’t worry, I’m here to catch those tears when they fall.

And when you DO get funded…

And when you DO get funded…

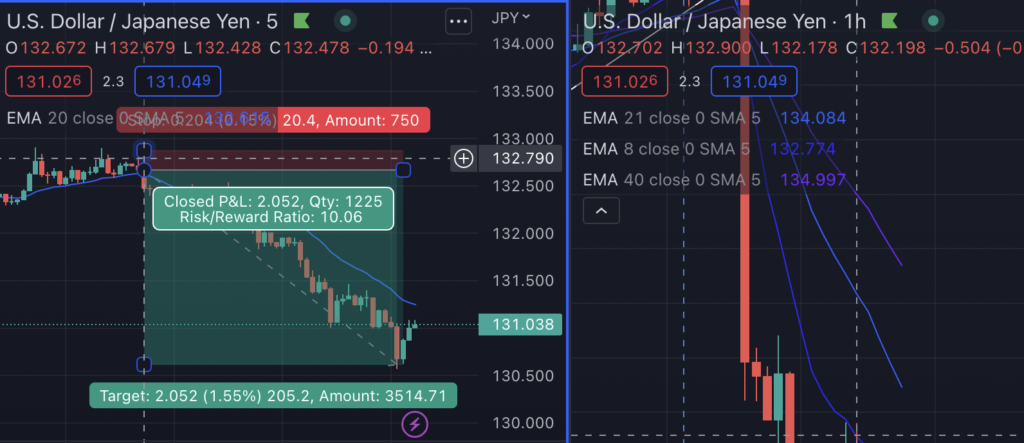

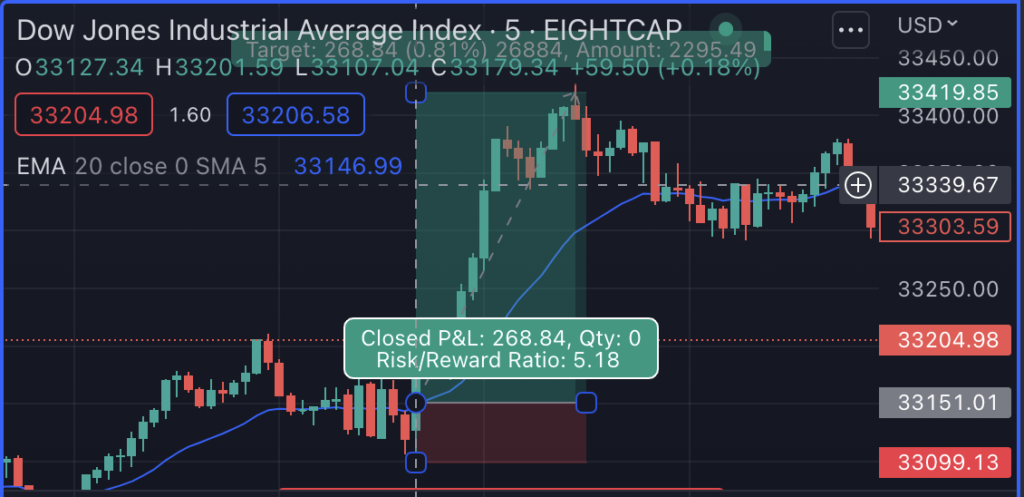

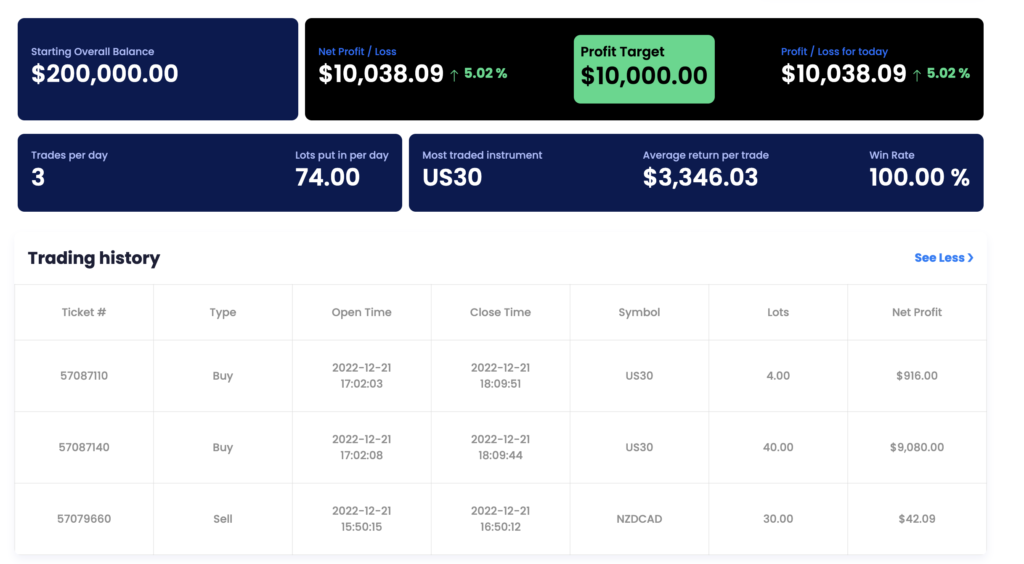

Let’s talk about those two trades that returned 9% and 5%, respectively, while only risking 1% per trade.

Let’s talk about those two trades that returned 9% and 5%, respectively, while only risking 1% per trade.

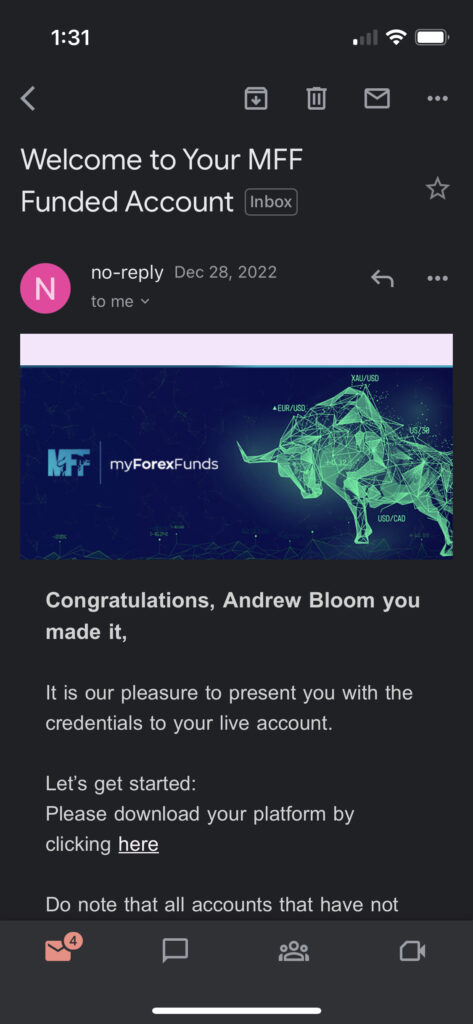

Since I had already hit the 5 minimum trading days for this account, I was immediately granted a verification account and login details. I set this up and the following morning, December 21st, during the New York session. I continued with my 1% risk per trade and focused on the CAD inflation and CPI news that came out at 530PST. The reports showed that the actuals were about the same as expected, so the news was already priced in for this announcement. I initially got in on a NZDCAD trade but I pulled it out at break-even, as per my trading rules.

Since I had already hit the 5 minimum trading days for this account, I was immediately granted a verification account and login details. I set this up and the following morning, December 21st, during the New York session. I continued with my 1% risk per trade and focused on the CAD inflation and CPI news that came out at 530PST. The reports showed that the actuals were about the same as expected, so the news was already priced in for this announcement. I initially got in on a NZDCAD trade but I pulled it out at break-even, as per my trading rules.

Latest posts