Okay traders, shotgun question.

Do you or do you not believe you understand all of the rules and stipulations involved with your next prop trading challenge?

Just reading the sign-up page isn’t good enough. While it would be ideal to have all of the rules regarding a prop firm challenge clearly written with language that’s simple enough for someone without a college education to understand, found all in one web page, such is not the reality.

I’ll begin this tutorial by saying that it’s important that you do not select a prop firm based on an advertisement or product page alone! You must read all of the FAQ sections first and then reach out to customer support to clarify anything that doesn’t seem 100% certain.

Assumptions alone can fail your challenge, even if you have a profitable strategy and exhibit good risk management. I’m going to repeat myself because it’s so important: If you want to find out every detail about what you can and cannot do in a challenge, you have to ask customer support.

Don’t be shy, just get on the prop firm’s home page and use the chatbox to connect with a representative.

Questions to Ask the Firm Before You Take a Prop Firm Challenge

So today I’m going to help you make sure you have correct and complete information before you even begin to choose the appropriate firm.

While standard information like expected take profit targets and daily drawdown limits are easily figured out by looking at most FAQ pages, You’re going to need to ask questions that might not even occur to you unless you’ve already traded a challenge. Furthermore, there are other types of questions you should ask that won’t even cross your mind until you’ve had a funded account.

So let me give you these questions now so you can prepare yourself ahead of time even if you’ve never traded with a prop firm before.

To help organize these different questions, we’re going to cover what you should ask about the trading challenge, the funded account, and regulations around failure and retry.

To help organize these different questions, we’re going to cover what you should ask about the trading challenge, the funded account, and regulations around failure and retry.

Questions About the Challenge

To properly analyze and select your challenge, your first step is to read the faq pages and product descriptions of any challenge you want to take. Once you’re clear on the basic information of the challenge, your next step is to contact customer support to clarify all the details that are and are not written publicly. Be sure to reword the answer through your own understanding and repeat it back to them for validation. If you don’t get a straight answer about something, don’t be afraid to push and ask again. Now here’s what you need to ask that person.

First, let’s go over a few questions you should ask about the prop trading challenge. I’m going to list them here one by one

- Are there any consistency rules for lot sizes or amount risked?

- Are stop loss and take profit orders required when setting a trade?

- Once you hit the take profit amount are you allowed to take small micro trades to complete the rest of the trading days?

- Are holidays included in the maximum number of days?

- Do traders need to stay in trades for a certain amount of time?

Your questions should also include clarifying anything that’s oddly worded on a FAQ page (show example of Lux)

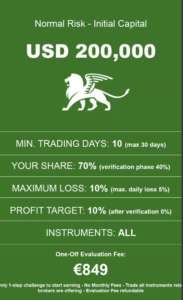

For example, I had to clarify with Lux Trading as to what they meant by saying 29 traded days for both the evaluation and advanced stage. Does that mean 29 for the total of the two stages or 29 for each one? It turns out they have a minimum trading day of 29 for each phase. So it could take at least two months longer to trade with a full account when using Lux as compared to say, FTMO. Lux also fails to explicitly describe their consistency rules for their challenges.

I had to find out in a chat that a trader has to more or less trade the exact position size with stop loss and take profit targets for pretty much every single trade. Even going from say 0.75% risked per trade to 0.5% risked per trade could discount some of those trading days.

Traders Central is a good example of firms that require consistency rules – they’ve changed what this implies over the last few months, but as of right now, it’s possible to decrease your position size by up to 75% once you hit the profit target. Luckily, they share this in the FAQ, so I didn’t need to hound them as hard about it.

Questions About Funded Accounts

Next, you’ll want to know about the rules regarding funded accounts as well. Just because your strategy and trading style works for a challenge doesn’t mean you can trade the same way with a funded account. For example, FTMO requires funded day trading accounts to close trades by the end of their business day in Prague and doesn’t allow trading 2 minutes before and after news releases. So your questions about the funded account should include:

- Are there any additional rules for funded accounts? If so, what are they?

- Do funded accounts require a minimum number of days traded each month?

- If a trader ends the month with less than the initial balance but doesn’t break drawdown and maximum loss rules, does the account balance reset or do they need to continue to trade the same amount?

- Can I get paid in my own country’s currency? If so, are there fees?

- Can I ever freeze the account in order to take a break from trading?

Questions About Failure/Retry

Lastly, you’ll want to be sure about what happens should you fail your account. Some firms are willing to offer a discount for a second attempt even though it’s not listed on their page. Others are firm on their prices. Consider asking

- Do you offer discounts on challenge retries?

- If I pass the challenge but fail verification, can I get a free retry or discounted retry?

These questions merely touch the surface. If you can think of others that I haven’t listed here, please be sure to share below.

Again, assume nothing about your challenge and prop firm.

You need to gather as much information first before signing up because there may be rules that will prevent you from passing or staying with the prop firm over the long run.

There are also prop firms that are designed to fail even the best of traders, since there’s so much money to be made in selling challenges with the promise of making bank.

Above all keep your wits about you, be responsible, disciplined, and patient about the process.

wish you all the best of strength and luck, and I’ll see you in the markets. Take care.

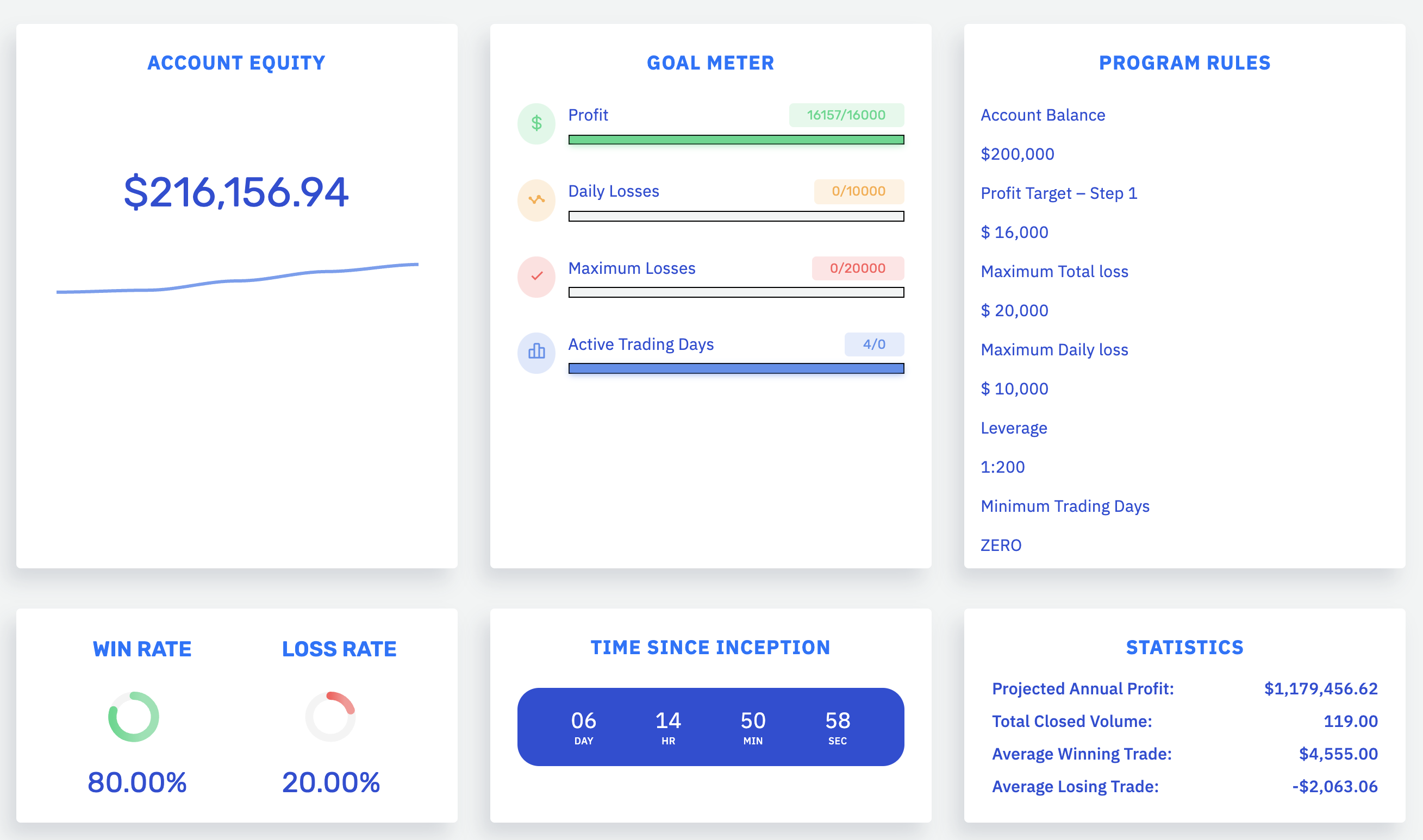

The interface for their account dashboard is very simple to use.

The interface for their account dashboard is very simple to use.

Latest posts