Fidelcrest – Prop Trading Firm Review

Hey there folks, Andrew Bloom of Disciplined FX here! Heads up, this post contains affiliate links to products and companies I’ve personally evaluated and selected in order to provide you with useful resources for your own trading journey!

A Portfolio of Prop Trading Firms

Last month, I had the honor of passing a $200k FTMO challenge.

It was quite a rewarding feeling to be able to achieve this level of trading after years of study, practice, trial and error, and not to mention, a number of serious losses and mistakes made with trading Forex markets.

As I started to do some research on how to manage a prop trading account, I also received good advice from commenters on the DFX YouTube channel as to how to best approach acquiring and managing a portfolio of prop trading accounts.

It seems that one of the best courses of action is to trade with two to four accounts, so as to create a payout calendar that keeps money coming to you more regularly than once a month, and to also minimize the amount you need to risk in each account so as to protect against losing any one of them.

Thus, I sought out another firm besides FTMO.

If we think of prop trading as similar to investing, then it makes sense to diversify our prop trading resources to avoid any single firm from causing us problems, so long as we can stay organized and on top of managing different platforms and rules.

So I didn’t want to just run another FTMO account.

I also wanted to take advantage of the unique promotions and offerings from other firms, that can complement some of the more rigorous aspects of the FTMO challenge.

For example, there are firms that offer fewer required days traded or a profit target of 8% instead of 10%.

Recently, I came across Fidelcrest again, which was originally part of my research when I was first selecting a prop trading firm for my first challenge.

Last week I signed up to trade their 200k “normal” risk challenge. I want to share my reasons why I selected Fidelcress, over say, Funding Talent, as well as a little review of my impressions of this firm, so far.

[Before we dive in though if you want to learn more about the scalping approach and strategies I use to succeed with Forex markets, check out the Disciplined FX Scalping Strategy Course! Students have access to the resources and strategy I used to pass the FTMO and The Prop Trading challenges and will continue to receive updates and new videos of any new strategies I implement in my trading.]

My ultimate goal is to not only help you profit but also empower you with frameworks and tools to begin to craft your own strategies that fit your trading style, as well.

So Without further ado, let’s dive into why Fidelcrest was my selection for my next prop trading experience.

Fidelcrest’s Prop Trading Challenge: Pro’s and Con’s

First off, let’s talk about the rules and parameters of the challenges this firm offers.

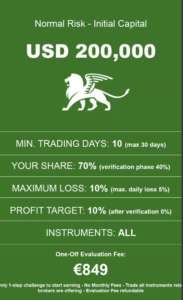

For the purpose of this post, I’m going to focus on the $200k account, which is an option from their Pro FX+ program.

I prefer a slightly larger account so as to squeeze a bit more profit from my strategies without needing to risk more of the account than necessary.

I prefer a slightly larger account so as to squeeze a bit more profit from my strategies without needing to risk more of the account than necessary.

So with a $200k challenge as our example, it appears that the challenge costs significantly less than FTMO’s $200k challenge and Fidelcrest requires a minimum of ten trading days each for step 1 and step 2 of their challenge.

This is similar to FTMO’s trading requirements, and Fidelcrest also requires a profit target of 10% for “normal” risk, while losing no more than 5% on the day or 10% of the account overall.

This is similar to FTMO’s trading requirements, and Fidelcrest also requires a profit target of 10% for “normal” risk, while losing no more than 5% on the day or 10% of the account overall.

The verification stage also requires a 10% target, which is comparatively a disadvantage when you consider that most prop trading challenges only require a 5% profit target during verification.

However, before you decide against Fidelcrest, it’s beneficial to consider the fact that they’re one of the few prop trading challenges that payout for their verification stage with a 40% profit split returned to you.

So if your profit target is $20,000, then your verification payout could be at least $8,000.

Theoretically, you can get paid this amount in as little as twenty days, which is much quicker than waiting as short as a month and twenty days for a FTMO payout.

This verification payout is much better than nothing or the couple of hundred bucks returned to you with your challenge purchase refund.

Speaking of, Fidelcrest does not refund the prop challenge fee but again, you earn significantly more with a verification payout than a refund.

If you don’t meet the 10% target but end the first phase in profit, you can try again with a new challenge at no extra cost to you.

They also have scaling plans up to $800,000 and you can have multiple trading accounts with Fidelcrest. You can use any trading style you like and you can trade with news.

They also have scaling plans up to $800,000 and you can have multiple trading accounts with Fidelcrest. You can use any trading style you like and you can trade with news.

However, you are only allowed to trade one challenge phase one at a time.

What I like about Fidelcret, or rather, what I don’t really like about Funding Talent, is that while Funding Talent has complicated rules despite seemingly quicker payouts and fewer challenge requirements, Fidelcrest keeps its rules simple, it pays out earlier than other large account challenges, and also provides more freedom to its traders to take risks as appropriate to their strategies.

Their format is to link you with a brokerage firm of your choice, which you decide on when you apply, and currently the firm only offers MT4 and MT5 platforms to trade from.

Now, as I’ll recommend with any prop challenge, please don’t rely on Youtube alone to find answers to your questions – reviews are just secondary sources, you need to be sure to get the most accurate information from the primary source itself, and the best place to do that is with the prop firm’s FAQ page.

You can access Fidelcrest’s FAQ page HERE

My Fidelcrest Application

So for my challenge with Fidelcrest, I decided to use a MT4 account through IC Markets with a raw spread, as I like to use scalping strategies.

The interface for their account dashboard is very simple to use.

The interface for their account dashboard is very simple to use.

Their response time for e-mails, questions, and setting up your account is quick, usually within 24 hours, although I ran into an issue with their e-mails being sent to my spam folder, so it took me a few days to access my account even though I had already received the information.

So be sure to check your spam folder when it comes to signing up for trading challenges, especially with firms that operate outside of your country.

Overall, I’m excited to trade this challenge and honestly, I think I like Fidelcrest a lot more than FTMO because the challenge rules are simpler, you receive your first payout more quickly, and you’re given more freedom with trading during news and holding overnight trades.

So if you’re looking for your first or next trading challenge, I highly recommend checking out Fidelcrest.

Be sure to sign-up for the newsletters for more posts on trading discipline, prop trading, and Forex strategies.

I wish you all the best of strength and luck, and I’ll see you in the markets! Take care.

I found a lot of useful information on your site. Thank you for the valuable information. Author of the blog: https://www.proptradefirm.com/

Thanks for the feedback!

Oh my goodness! a tremendous article dude. Thank you Nonetheless I am experiencing concern with ur rss . Don’t know why Unable to subscribe to it. Is there anyone getting an identical rss downside? Anyone who is aware of kindly respond. Thnkx

The crux of your writing whilst sounding agreeable initially, did not sit well with me personally after some time. Somewhere within the paragraphs you actually were able to make me a believer unfortunately just for a while. I however have got a problem with your jumps in assumptions and you might do well to fill in all those breaks. In the event you actually can accomplish that, I would undoubtedly end up being fascinated.

I cling on to listening to the news update speak about getting boundless online grant applications so I have been looking around for the top site to get one. Could you advise me please, where could i find some?

It is truly a nice and helpful piece of info. I’m happy that you simply shared this useful info with us. Please keep us informed like this. Thank you for sharing.

Wow, incredible blog format! How lengthy have you ever

been running a blog for? you make blogging glance easy.

The total look of your site is great, as smartly as the content material!

You can see similar: e-commerce and here dobry sklep

Wow, fantastic blog layout! How long have you ever been blogging for?

you make blogging glance easy. The full glance of your site is great, as neatly as the content!

You can see similar: ecommerce and here e-commerce

It is really a great and helpful piece of info. I’m satisfied that you shared this useful information with us. Please keep us informed like this. Thank you for sharing.

Hello there I am so grateful I found your blog, I really

found you by accident, while I was searching on Yahoo for

something else, Anyhow I am here now and would just like to say cheers for a remarkable

post and a all round enjoyable blog (I also love the theme/design),

I don’t have time to look over it all at the moment but I have book-marked it and

also added your RSS feeds, so when I have time I will be back to read a great deal

more, Please do keep up the awesome work. I saw similar here: e-commerce

and also here: sklep internetowy

Absolutely indited written content, appreciate it for information. “The bravest thing you can do when you are not brave is to profess courage and act accordingly.” by Corra Harris.

Heya i am for the primary time here. I found this board and I

to find It truly useful & it helped me out much. I hope to offer something

back and aid others such as you helped me.

I saw similar here: E-commerce

Thank you for the good writeup. It in fact was a amusement account it.

Look advanced to far added agreeable from you! However, how could we communicate?

I saw similar here: Najlepszy sklep

Good day! Do you know if they make any plugins to assist with Search Engine Optimization?

I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very

good success. If you know of any please share. Cheers!

You can read similar article here: Ecommerce

It’s very interesting! If you need help, look here: ARA Agency

It’s very interesting! If you need help, look here: ARA Agency

Hey there! Do you know if they make any plugins to assist

with Search Engine Optimization? I’m trying to get my

blog to rank for some targeted keywords but I’m not seeing very good

gains. If you know of any please share. Many

thanks! You can read similar article here: Sklep internetowy

Howdy! Do you know if they make any plugins to help with Search Engine

Optimization? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good success.

If you know of any please share. Thanks! You can read similar art here:

Ecommerce

I have not checked in here for some time since I thought it was getting boring, but the last several posts are good quality so I guess I will add you back to my daily bloglist. You deserve it my friend 🙂

Hey! Do you know if they make any plugins to assist with Search Engine Optimization? I’m trying to get my site to rank for some targeted keywords but I’m not seeing very good success.

If you know of any please share. Kudos! You can read similar art here:

Auto Approve List

Hello there! Do you know if they make any plugins to help with Search Engine Optimization? I’m trying to get my website to

rank for some targeted keywords but I’m not seeing very good gains.

If you know of any please share. Cheers! You can read similar art

here: List of Backlinks

Hey There. I discovered your blog the use of msn. That is

a really well written article. I’ll be sure to bookmark it

and return to learn more of your useful

info. Thank you for the post. I’ll certainly comeback.

Hello! I know this is kinda off topic nevertheless I’d figured

I’d ask. Would you be interested in trading links

or maybe guest authoring a blog post or vice-versa?

My website addresses a lot of the same topics as yours and I feel we could

greatly benefit from each other. If you are interested feel free

to send me an e-mail. I look forward to hearing from you!

Great blog by the way!

What Is FitSpresso? As you may know, FitSpresso is a natural weight loss supplement that comes in capsule form.

Hello, Neat post. There is a problem together with your website in internet explorer, would test thisK IE still is the marketplace chief and a large part of other folks will pass over your excellent writing due to this problem.

Your mode of explaining the whole thing in this article is really fastidious, every one can without difficulty be aware of it, Thanks a lot.

I would like to thnkx for the efforts you’ve put in writing this site. I’m hoping the same high-grade web site post from you in the upcoming also. In fact your creative writing abilities has encouraged me to get my own site now. Really the blogging is spreading its wings quickly. Your write up is a great example of it.

Very interesting info !Perfect just what I was searching for!

I have recently started a blog, the information you provide on this site has helped me tremendously. Thanks for all of your time & work.

Wow, marvelous blog format! How long have you been blogging for?

you make blogging glance easy. The overall glance of your web site

is magnificent, let alone the content material! You can see similar here dobry sklep

I went over this internet site and I believe you have a lot of wonderful info, saved to fav (:.

Real instructive and wonderful complex body part of content material, now that’s user genial (:.

Wow, awesome blog layout! How long have you ever been running a blog for?

you made running a blog look easy. The total look of your web site is fantastic, let alone the content!

You can see similar here prev next and that was wrote by

Willard72.

Wow, awesome blog format! How lengthy have you ever been running a blog

for? you make blogging look easy. The full look of your web site is fantastic, as

neatly as the content! You can read similar

here prev next and that was wrote by Shanda67.

I believe this website has got some rattling fantastic information for everyone :D. “We rarely think people have good sense unless they agree with us.” by Francois de La Rochefoucauld.

Wow, superb blog structure! How lengthy have you been running a blog for?

you make running a blog look easy. The full look of your site

is excellent, as well as the content! I saw similar here prev next and those was wrote by Robbyn02.

Wow, marvelous blog format! How long have you been running a blog for?

you make running a blog look easy. The full glance of your website

is wonderful, as smartly as the content material!

You can read similar here prev next and those

was wrote by Israel67.

Wow, fantastic weblog layout! How long have you been running a blog for?

you made blogging look easy. The full glance of your site is excellent, let alone

the content material! You can read similar here prev

next and it’s was wrote by Dovie64.

You have remarked very interesting points! ps nice web site.

Wow, superb blog format! How lengthy have you

been running a blog for? you made running a blog glance

easy. The entire look of your web site is fantastic, let

alone the content material! You can see similar here Lena Non7.

2024/04/23

so much great info on here, : D.

I am usually to running a blog and i really admire your content. The article has really peaks my interest. I’m going to bookmark your web site and hold checking for brand spanking new information.

Hey, you used to write fantastic, but the last several posts have been kinda boring?K I miss your super writings. Past several posts are just a bit out of track! come on!

I believe what you said made a lot of sense.

But, what about this? what if you typed a catchier post title?

I ain’t saying your information is not good, however

suppose you added a title that makes people want more?

I mean Fidelcrest – Prop Trading Firm Review – Disciplined FX is

a little plain. You might peek at Yahoo’s home

page and note how they create news headlines to get people to click.

You might add a related video or a related pic or two to

get people interested about everything’ve written. Just my

opinion, it could bring your blog a little livelier.

This paragraph is actually a nice one it helps new

web users, who are wishing for blogging.

I do accept as true with all of the ideas you’ve introduced to your post.

They are very convincing and can definitely

work. Still, the posts are too brief for starters. Could

you please prolong them a little from subsequent time? Thanks for the

post.

I relish, cause I found exactly what I used to be having a look for.

You’ve ended my 4 day lengthy hunt! God Bless you man. Have

a nice day. Bye

Your style is very unique compared to other folks I have read stuff from.

I appreciate you for posting when you’ve got the opportunity, Guess I will just bookmark

this web site.

I have been exploring for a little bit for any high

quality articles or weblog posts on this kind of house .

Exploring in Yahoo I ultimately stumbled upon this web site.

Reading this info So i am satisfied to convey that I have

a very excellent uncanny feeling I found out exactly what I needed.

I most unquestionably will make certain to do not fail

to remember this website and provides it a glance on a relentless

basis.

Excellent post. Keep writing such kind of info

on your site. Im really impressed by your site.

Hello there, You have done a great job. I’ll certainly digg it and in my

opinion recommend to my friends. I am sure they will be benefited from this

web site.

Great remarkable things here. I am very happy to peer your article. Thanks a lot and i am having a look forward to touch you. Will you kindly drop me a e-mail?

Yes! Finally someone writes about website.

Quality articles or reviews is the main to

attract the people to go to see the site, that’s what this web page is

providing.

I blog frequently and I seriously thank you for your information. Your article has truly peaked my interest.

I will book mark your site and keep checking for new

information about once a week. I subscribed to your RSS feed

too.

I like the helpful information you provide in your articles.

I’ll bookmark your blog and check again here regularly.

I’m quite certain I will learn many new stuff right here!

Good luck for the next!

Good day! Do you know if they make any plugins to assist with

Search Engine Optimization? I’m trying to get my blog to rank for some targeted

keywords but I’m not seeing very good results. If you

know of any please share. Cheers!

This post will assist the internet visitors for setting up new blog or even a blog from start to end.

I am not sure where you’re getting your information, but great topic.

I needs to spend some time learning more or understanding more.

Thanks for fantastic information I was looking for this info

for my mission.

WOW just what I was looking for. Came here by searching for

slot gacor

Wow, this article is good, my younger sister is analyzing such things, thus I am going to inform her.

My spouse and I absolutely love your blog and find

a lot of your post’s to be exactly what I’m looking for. Does one offer guest writers to

write content for yourself? I wouldn’t mind writing a post or elaborating on a lot of the subjects you write

concerning here. Again, awesome web log!

This is a topic that is close to my heart… Take care! Where are your contact details though?

Hola! I’ve been following your blog for some time now and

finally got the courage to go ahead and give you a shout

out from Dallas Texas! Just wanted to mention keep up the excellent job!

Howdy! I know this is somewhat off topic but I was wondering which blog platform are you using

for this site? I’m getting sick and tired of WordPress because I’ve had issues with hackers and I’m looking at options for another platform.

I would be great if you could point me in the direction of a good platform.

I do not even know how I ended up here, but

I thought this post was great. I do not know who you

are but definitely you’re going to a famous blogger if you aren’t already 😉 Cheers!

Hello There. I found your blog using msn. This is an extremely well written article.

I’ll make sure to bookmark it and return to read more of your useful info.

Thanks for the post. I’ll certainly return.

It’s an awesome article for all the web users; they will get

advantage from it I am sure.

We are a group of volunteers and opening a new scheme in our

community. Your site provided us with valuable info to work on.

You have done a formidable job and our entire community

will be grateful to you.

Discovering your website has been a pleasure. Brimming with

informative content and thought-provoking commentary,

which is hard to find these days. appreciate the time you’ve put into your work.

Your article is refreshingly unique. You present a new perspective that is ignited my

interest. Looking forward to reading what you write next.

I just had to leave a comment. Your posts resonate with me on a personal level.

If you’re considering offering a newsletter, sign me up!

It would be a pleasure to have your insights sent right to my inbox.

Your writing resonated with me. It’s not every day you stumble upon a website

that prompts you to ponder. I’m excited to read more of

your work and encourage you to keep writing.

Your article was an eye-opener. With so much noise online, it’s wonderful to read content that’s as

engaging and educational as yours. Please keep writing

This syntax provides a variety of options for creating a positive and encouraging blog comment

that compliments the author’s work and expresses a desire to continue engaging with their content.

Every once in a while, I discover a blog that captures

my attention with its depth of insight. Yours is undoubtedly one

of those rare gems. The way you weave your words is not just educational

but also remarkably entertaining. I commend the dedication you show towards

your craft and eagerly look forward to your future posts.

In the plethora of the online space, it’s refreshing to find a creator who puts considerable effort into their work.

Your posts not only offer knowledgeable takeaways but also stimulate meaningful dialogue.

You’ve gained a faithful follower from this

point forward.

Your blog has quickly risen to the top of my list for me, and I find myself check it regularly for updates.

Each post is like a tutorial in the subject matter,

presented with crispness and humor. Might you starting a

subscription service or a monthly newsletter?

I would be delighted to get more of your knowledge directly to my inbox

The unique angle you bring to issues is truly refreshing, it’s deeply needed in the modern digital landscape.

Your ability to dissect complex concepts and offer them in an easily digestible way is an ability that

should never be underestimated. I look forward to your future publications and the conversations

they’ll inspire.

Finding a blog that serves both a brain gym and a

warm discussion. Your posts accomplish that, offering

a rich blend of intellectual stimulation and emotional resonance.

The audience you’re building here is evidence to your

impact and authority. I’m curious to see where you’ll take us

next and I’m strapped in for the journey.

After investing several hours diving into the depths

of the internet today, I must say that your blog is like an oasis of insight.

Not once have I encountered such an amalgamation of captivating thoughts that resonate on a profound level.

Your ability for elucidating complex subjects with grace

and keen insight is admirable. I’m eagerly waiting for your next article,

believing it will deepen my understanding even further.

In today’s digital age, where information overload is common, your blog

shines as a cornerstone of originality. It’s a rarity to

discover a platform of the web that adheres to fostering intellectual growth.

Your eloquently written posts spark an appetite

for knowledge that many of us long for. Please let me know if

there’s a way to sign up for direct notifications, as

I would hate to miss any enlightening post.

Your blog is a true reflection of what engaged storytelling should be.

Each article you compose is filled with valuable takeaways and rich narratives

that make me reflect long after I’ve left the page. Your perspective is a refreshing

voice to the frequently crowded online world.

Should you decide to an exclusive membership, count me as a committed member to join. Your work is meriting following.

I find myself returning to your blog frequently,

drawn by the standard of discourse you provoke. It’s clear that

your blog is not merely a platform for sharing thoughts; it’s a hub for like-minded individuals who desire substantive engagement.

Your investment inOf course!

When I began reading your blog, I realized it was something unique.

Your ability to delve into challenging topics and clarify

them for your readers is truly impressive. Each article

you release is a repository of knowledge, and I always find myself eager

to discover what you’ll uncover next. Your dedication to high-quality content is evident, and I

anticipate that you’ll continue sharing such

invaluable insights.

Your blog is a lighthouse in the often turbulent seas of

online content. Your deep dives into a multitude of subjects are

not only educational but also incredibly captivating.

I appreciate the way you meld meticulous investigation with relatable examples, producing

posts that are both informative and enjoyable. If there’s a way to follow your blog or join a newsletter subscription, I would be grateful to be kept in the loop of your latest musings.

As a blogger, I’m motivated by the enthusiasm you put into each article.

You have a knack for making even the most esoteric topics

approachable and intriguing. The way you present ideas and connect them

to larger contexts is nothing short of artful. Kindly let me know if

you have any workshops or e-books in the works, as I would be eager to be guided by your

expertise.

It’s rare to come across a blog that hits the mark

with both intellect and emotion. Your pieces

are crafted with a degree of thoughtfulness that speaks to the core

of the human experience. Every time I check your blog, I come away more informed and

inspired. I’m eager to know whether you intend to

As soon as I began perusing your blog, I could tell it was something

extraordinary. Your skill to dive into complex topics and unravel them for your readers is truly noteworthy.

Each entry you release is a repository of insights, and I always find

myself eager to read what you’ll delve into next.

Your dedication to quality is clear, and I hope that you’ll continue sharing such invaluable insights.

Finding your website was a delight. Brimming with knowledgeable content and witty

commentary, which isn’t easy to come by these days.

value the effort you’ve put into your posts.

Your writing style is refreshingly unique. You present a

new perspective that has sparked my interest. I’m eager to

reading what you post next.

I just had to leave a comment. Your posts speak with me on a deeper level.

If you’re planning on offering a newsletter, sign me up!

It would be a joy to have your insights sent right to my inbox.

Your post struck a chord with me. Rarely do you find a website that encourages you to think deeply.

Keen to see more of your ideas and encourage you to

continue sharing.

Your blog post felt like a breath of fresh air.

With a sea of content online, it’s wonderful to find content that’s as engaging and educational as yours.

Keep it up

This syntax provides a variety of options for creating a positive and encouraging blog comment that compliments the author’s work

and expresses a desire to continue engaging with their content.

Occasionally, I come across a blog that captures my attention due to its compelling content.

Yours is undoubtedly one of those rare gems.

The way you weave your words is not just educational but also remarkably entertaining.

I applaud the dedication you show towards your craft and eagerly anticipate your future posts.

In the vast expanse of the online space, it feels rewarding to encounter a writer who invests

genuine passion into their work. Your posts don’t just offer knowledgeable takeaways but also provoke meaningful dialogue.

Please consider me a lifelong fan from this point forward.

Your blog has become a go-to resource for me, and I can’t help but peruse it frequently for updates.

Each post is like a tutorial in your niche, presented with crispness and humor.

Might you creating a subscription service or a periodic newsletter?

I am keen to get more of your knowledge directly to my inbox

The unique angle you bring to issues is not only refreshing, it’s highly sought

after in today’s internet landscape. Your ability to analyze complex concepts and present

them in an understandable way is a skill that should

be celebrated. I eagerly await your next article and the dialogues they’ll foster.

It’s rare to find a blog that serves both a cognitive challenge and a heartfelt conversation. Your posts accomplish that,

providing a perfect mix of intellectual stimulation and empathy.

The readership you’re building here is evidence to your influence and proficiency.

I’m eager to see where you’ll take us next

and I’ll be following along closely.

Having dedicated several hours navigating the expanse of

the internet today, I must say that your blog is like a lighthouse in a sea of

information. Not once have I encountered such a trove of compelling

ideas that resonate on a deep level. Your ability for shedding light on complex

subjects with simplicity and sharpness is admirable. I’m enthusiastically waiting for your

next article, anticipating it will enhance my understanding even further.

In today’s digital age, where content is plentiful, your blog emerges as a bastion of authenticity.

It’s a joy to find a space of the web that commits to developing knowledge expansion. Your well-crafted posts ignite an appetite for knowledge that

many of us crave. Kindly inform me if there’s a possibility to sign up for

direct notifications, as I would hate to miss a single thought-provoking article.

Your online presence is the epitome of what dedicated blogging should be.

Each entry you create is laden with valuable takeaways and meaningful stories

that leave me pondering long after I’ve finished reading.

Your voice is an invaluable contribution to the sometimes chaotic

internet space. If you have an exclusive community, count me

among the first to join. Your work is deserving of following.

I find myself returning to your blog frequently, drawn by the quality of

discourse you initiate. It’s obvious that your blog isn’t just a place

for sharing concepts; it’s a community for

like-minded individuals who seek substantive engagement.

Your investment inOf course!

From the moment I began perusing your blog, I could tell

it was something extraordinary. Your skill to dive into complex topics and unravel them for your readers is truly noteworthy.

Each article you publish is a wealth of insights, and I constantly find myself anxious to see what you’ll explore next.

Your commitment to excellence is clear, and I trust that you’ll persist sharing such precious

insights.

Your posts serves as a beacon in the often turbulent waters of

online content. Your deep dives into a multitude of subjects are not only educational but also incredibly engaging.

I respect the way you meld thorough research with relatable examples,

crafting posts that are both enlightening and enjoyable.

If there’s an opportunity to sign up for updates your blog or enter

a mailing list, I would be grateful to be informed of your latest musings.

As a fellow writer, I’m spurred by the passion you pour into each blog entry.

You have a knack for making even the most obscure topics accessible and fascinating.

The way you break down concepts and link them to broader themes is incredibly artful.

Kindly let me know if you have any workshops or digital

resources in the works, as I would jump at the chance to learn from your expertise.

It’s rare to come across a blog that strikes

the perfect chord with both the intellectual and the personal.

Your articles are crafted with a depth of understanding that speaks to the core of the human experience.

Each time I check your blog, I leave with new knowledge and inspired.

I’m keen to know whether you plan to

When I commenced exploring your blog, I could tell it was

something extraordinary. Your ability to dive into complex topics and clarify

them for your audience is truly noteworthy. Each entry you share is a

wealth of information, and I constantly find myself anxious

to discover what you’ll uncover next. Your commitment to quality is evident, and I

trust that you’ll continue providing such valuable

perspectives.

A fascinating discussion is definitely worth comment.

I believe that you ought to publish more about this subject matter,

it might not be a taboo subject but typically people don’t talk about such issues.

To the next! Kind regards!!

Nice response in return of this question with firm arguments and explaining everything about that.

Lottery Defeater Software is a digital tool designed to assist individuals in improving their chances of winning in various lotteries.

Hi there just wanted to give you a quick heads up.

The text in your post seem to be running off the screen in Safari.

I’m not sure if this is a formatting issue or something to

do with internet browser compatibility but I thought I’d post to let you know.

The style and design look great though! Hope you get the problem fixed soon. Many thanks

Way cool! Some very valid points! I appreciate

you penning this post and the rest of the site is also really good.

A person essentially help to make significantly articles I’d state.

This is the first time I frequented your web page and up to now?

I amazed with the research you made to make this actual publish amazing.

Excellent process!

I got this site from my buddy who told me on the topic of this website and

now this time I am browsing this web site and reading very informative

content here.

whoah this weblog is magnificent i really like reading your posts.

Keep up the good work! You already know, many people are searching round for this

information, you can aid them greatly.

Generally I do not learn article on blogs, but I wish to say that this write-up very pressured me to try and do so!

Your writing style has been surprised me. Thank you, very great article.

My brother recommended I might like this web site.

He was totally right. This post actually made my day.

You cann’t imagine simply how much time I had spent for this info!

Thanks!

Superb blog! Do you have any hints for aspiring writers?

I’m hoping to start my own blog soon but I’m a little lost on everything.

Would you advise starting with a free platform like WordPress or go for a paid

option? There are so many options out there that I’m totally confused ..

Any recommendations? Kudos!

DentiCore is a dental and gum health formula, made with premium natural ingredients.

When someone writes an article he/she keeps the image of a user in his/her mind that how a

user can be aware of it. Thus that’s why this article is great.

Thanks!

I think this is among the most vital info for me.

And i am glad reading your article. But should remark

on few general things, The site style is ideal, the articles is really nice :

D. Good job, cheers

whoah this blog is magnificent i really like studying your articles.

Keep up the great work! You understand, lots of individuals are looking around for this info,

you could help them greatly.

Heya i’m for the first time here. I came across this board and

I find It really useful & it helped me out much. I hope to give something back and help

others like you aided me.

Good day! I could have sworn I’ve been to this website before but after browsing through some of the

post I realized it’s new to me. Anyways, I’m definitely happy I found

it and I’ll be book-marking and checking back frequently!

It’s really a cool and helpful piece of info.

I am satisfied that you simply shared this useful information with us.

Please stay us up to date like this. Thanks for sharing.

Howdy! I know this is kinda off topic but I was wondering if you knew where I could

locate a captcha plugin for my comment form? I’m using

the same blog platform as yours and I’m having trouble finding one?

Thanks a lot!

Hmm is anyone else encountering problems with the pictures on this blog loading?

I’m trying to find out if its a problem on my end or if it’s the blog.

Any feedback would be greatly appreciated.

Nice respond in return of this difficulty with genuine arguments and telling all regarding that.

Hi, I think your website might be having browser compatibility issues.

When I look at your website in Chrome, it looks fine but when opening in Internet Explorer, it has

some overlapping. I just wanted to give you a quick heads

up! Other then that, awesome blog!

If some one wants expert view about blogging then i suggest him/her to visit this weblog,

Keep up the nice job.

We’re a bunch of volunteers and opening a new scheme in our

community. Your website offered us with valuable info to work on. You’ve performed an impressive activity and our whole group can be grateful to you.

SightCare is a vision enhancement aid made of eleven carefully curated science-backed supplements to provide overall vision wellness.

Hello there, I discovered your website by the use of Google while searching for a related subject, your website came

up, it seems great. I’ve bookmarked it in my google bookmarks.

Hello there, simply changed into alert to your weblog thru Google, and

found that it’s truly informative. I’m going to be careful for brussels.

I will be grateful if you happen to proceed this in future.

Numerous other folks will likely be benefited from your writing.

Cheers!

Quality articles or reviews is the secret to attract the users

to go to see the web site, that’s what this web page is providing.

Balmorex Pro is a natural and amazing pain relief formula that decreases joint pain and provides nerve compression relief.

What is Lottery Defeater Software? Lottery software is a specialized software designed to predict and facilitate individuals in winning lotteries.

Greetings! Very helpful advice within this post! It’s the little changes which will make the greatest

changes. Many thanks for sharing!

Do you have a spam issue on this website;

I also am a blogger, and I was curious about your situation;

we have developed some nice procedures and we

are looking to swap methods with others, please shoot me an e-mail if interested.

Puravive is a weight management supplement formulated with a blend of eight exotic nutrients and plant-based ingredients aimed at promoting fat burning.

What Is Potent Stream? Potent Stream is a male health formula that helps to maintain healthy urinary and prostate health by killing off all the toxins in the body

hello!,I like your writing very so much! percentage we be in contact more about your article on AOL?

I need a specialist on this space to resolve

my problem. May be that’s you! Looking ahead

to see you.

I believe this is among the such a lot vital

information for me. And i am satisfied studying your article.

However wanna remark on few basic issues, The website taste is perfect, the articles

is really nice : D. Excellent activity, cheers

Hey! I just wanted to ask if you ever have any problems with hackers?

My last blog (wordpress) was hacked and I ended up losing many months

of hard work due to no back up. Do you have any methods to protect against hackers?

Perfectly indited written content, Really enjoyed reading through.

Hi there! This is my first visit to your blog!

We are a team of volunteers and starting a new project in a community in the

same niche. Your blog provided us useful information to work on. You have done

a outstanding job!

What’s up to all, it’s actually a fastidious for me to go to see this website,

it includes priceless Information.

I believe this is among the most significant information for me.

And i’m glad studying your article. However wanna observation on few general things, The web site style is wonderful, the articles is

truly excellent : D. Good activity, cheers

Stunning quest there. What occurred after? Good luck!

You really make it appear so easy together with your presentation but I

find this matter to be actually something that I feel

I would by no means understand. It kind of feels

too complex and very wide for me. I am taking a look ahead in your subsequent put up, I will attempt to get the

cling of it!

It’s an amazing paragraph in favor of all the internet visitors; they will take benefit from it I am sure.

Good way of describing, and good article to take information regarding my presentation subject matter, which i am going to present in school.

Thanks in support of sharing such a fastidious thinking, piece

of writing is pleasant, thats why i have read it completely

An outstanding share! I have just forwarded this onto a coworker who has been conducting a little homework on this.

And he actually ordered me lunch because I found it for him…

lol. So let me reword this…. Thank YOU for the meal!!

But yeah, thanks for spending some time to discuss this matter here on your internet site.

I’ve read a few just right stuff here. Definitely

worth bookmarking for revisiting. I surprise how much effort

you place to make such a fantastic informative website.

Howdy just wanted to give you a quick heads up. The words in your post seem to be running off

the screen in Ie. I’m not sure if this is a formatting issue or something to do with web browser compatibility but I thought I’d post to let you know.

The design look great though! Hope you get the problem solved soon. Kudos

Incredible points. Sound arguments. Keep up the amazing spirit.

Hey there! This is my first visit to your blog! We are a collection of volunteers and starting a

new initiative in a community in the same niche.

Your blog provided us valuable information to work on. You

have done a extraordinary job!

Thanks for your personal marvelous posting! I seriously enjoyed reading it,

you happen to be a great author. I will always bookmark your blog and will

eventually come back very soon. I want to encourage continue

your great posts, have a nice weekend!

When some one searches for his required thing, so he/she wishes to be available that in detail, so that thing is maintained over here.

Hey I know this is off topic but I was wondering if you knew of any widgets I could

add to my blog that automatically tweet my newest twitter updates.

I’ve been looking for a plug-in like this for quite some

time and was hoping maybe you would have some experience with something like this.

Please let me know if you run into anything.

I truly enjoy reading your blog and I look forward to your new updates.

It’s an remarkable paragraph designed for all the

online visitors; they will get benefit from it I am

sure.

If you are going for finest contents like myself, only

visit this site daily since it presents quality contents,

thanks

It’s actually a nice and helpful piece of information. I am glad

that you just shared this useful info with us.

Please keep us informed like this. Thank you for sharing.

I enjoy reading and I believe this website got some truly useful stuff on it! .

DentiCore is a gum health support formula designed to help users remove dental health problems like bad breath, cavities, tooth decay, etc.

If you desire to get a great deal from this piece of writing then you have to apply such techniques to your won website.

WOW just what I was searching for. Came here by searching for naga169

We’re a group of volunteers and starting a new scheme in our community. Your website provided us with valuable information to work on. You have done a formidable job and our whole community will be thankful to you.

In fact no matter if someone doesn’t be aware of then its up

to other visitors that they will assist, so here it occurs.