Andrew, from Disciplined FX, here! If you’re interested in learning how to day trade as your profitable skill, I recommend reading the book I wrote on how you can leverage the most important habits of professional day traders to set yourself up for long-term success in the markets!

I’ve Been Thinking…

I want to share with you something that I’ve been reflecting on for some time now.

Most of you reading, like me, probably grew up with parents or society pressuring you to get an education in order to create financial security in life.

You might have been encouraged to hustle for scholarships or take out enough student loan money that could have covered the cost of a house in order to gain a university-level education and therefore qualify for a steady paycheck and benefits.

This formula of “initial education investment + diploma + time and energy in someone else’s business, nonprofit, or government entity = financial stability and maaaaaybe satisfaction is starting to become more anachronistic and perhaps even mythical.

Steady is no longer stable.

A lot of my friends and family have what are considered “stable jobs” – sure, they receive a paycheck every two weeks, but their time to take care of themselves is limited, the amount they make barely scratches the surface of the student loan debt or living expenses they incur, and lurking in the shadows of this seemingly stable job is the threat of being laid off or fired at any given moment.

Some of them like their work but others trudge along because there is no financial safety net to allow them the choice to leave.

Thus, paying Fedloan Servicing or private student loan companies a ¼ of your budget each month and giving away ⅓ of your entire life, while failing to get enough sleep, have time to be with your family or friends, or just play, all for the sake of acquiring this illusion of a secure job is no longer a reliable formula for financial security, let alone a well-lived life.

Now, This isn’t particularly enlightening of me to name this issue, as I believe most people are aware of this discrepancy.

Some of you reading this may be feeling this pain right now.

(I will say that there’s also a special kind of motivation that comes with knowing you have debt, though. That’s a hidden ability we can use to our advantage. But that thought is best left for another post.)

While I think many folks have a hunch as to what a solution to this problem looks like, they may not have a clear formula for what to do to reclaim their time, energy, creativity, purpose, and financial well-being.

So that’s what I want to share with you, today.

A simple formula that I’ve seen others perform, time and again, to spend less time working, make enough money to assuage financial woes, and focus on the activities that create a better world and a more meaningful life.

We know that relying on a sole paycheck won’t necessarily give you the safety it once promised.

We also know that trying to drive for a ride-share company on the side or selling your used things on an app each month won’t necessarily grant you financial freedom either.

So, what to do instead?

Here’s my formula: We need to combine our favorite skills with income-generating activities OR develop skills that have a high return on investment and take those skills to market.

Lucrative Skill + Skill Development (Time + Effort + Knowledge + Experience) + Marketability = Financial FREEDOM.

This approach may require a lot of time and effort up front, but in the future it lets you acquire the resources to invest less time for the same return.

Let me show you how to do this through 4 simple steps.

4 Steps to Making +$10k Per Month

Step 1) Research and Select Your Marketable Skill

As mentioned, there are two paths you can take with this.

One is to select a skill that you’ve already developed and turn that skill into a business.

The other approach is to learn a new skill that is inherently lucrative. These skills often involve the exchange of value for large sums of money and therefore have a large return on investment.

Some skills that fall under this category include selling real estate, learning a high-demand tech skill like coding, developing marketing or sales skills like copywriting and social media marketing, or, my personal favorite and the primary subject of this blog – day trading.

Start by doing a little research on either starting a business or developing your preferred skill and based on what you discover from this research, write down your top five goals surrounding your project of developing that skill.

This should include a financial goal, such as making $7,000 in sales or $10,000 in trading profit each month.

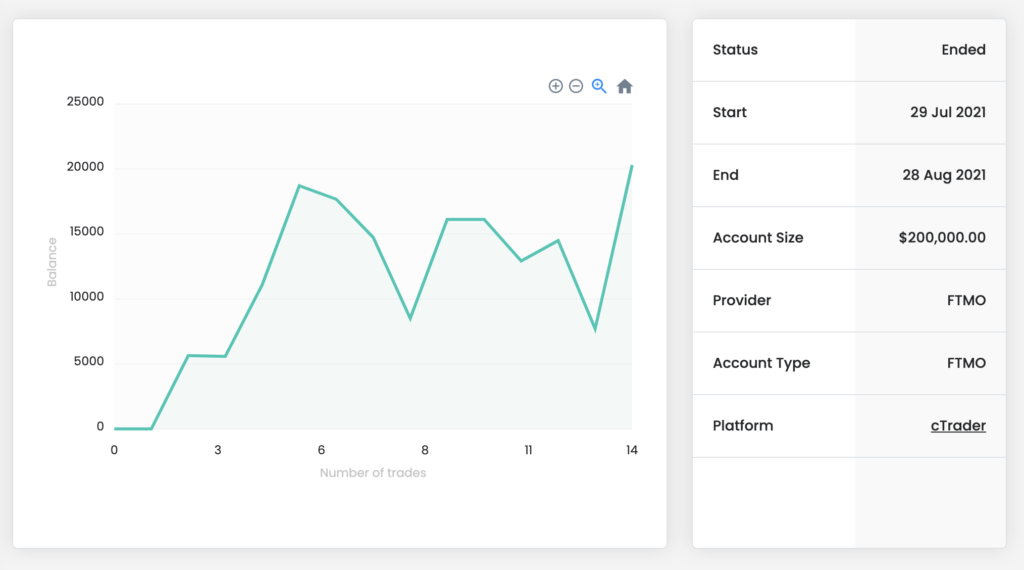

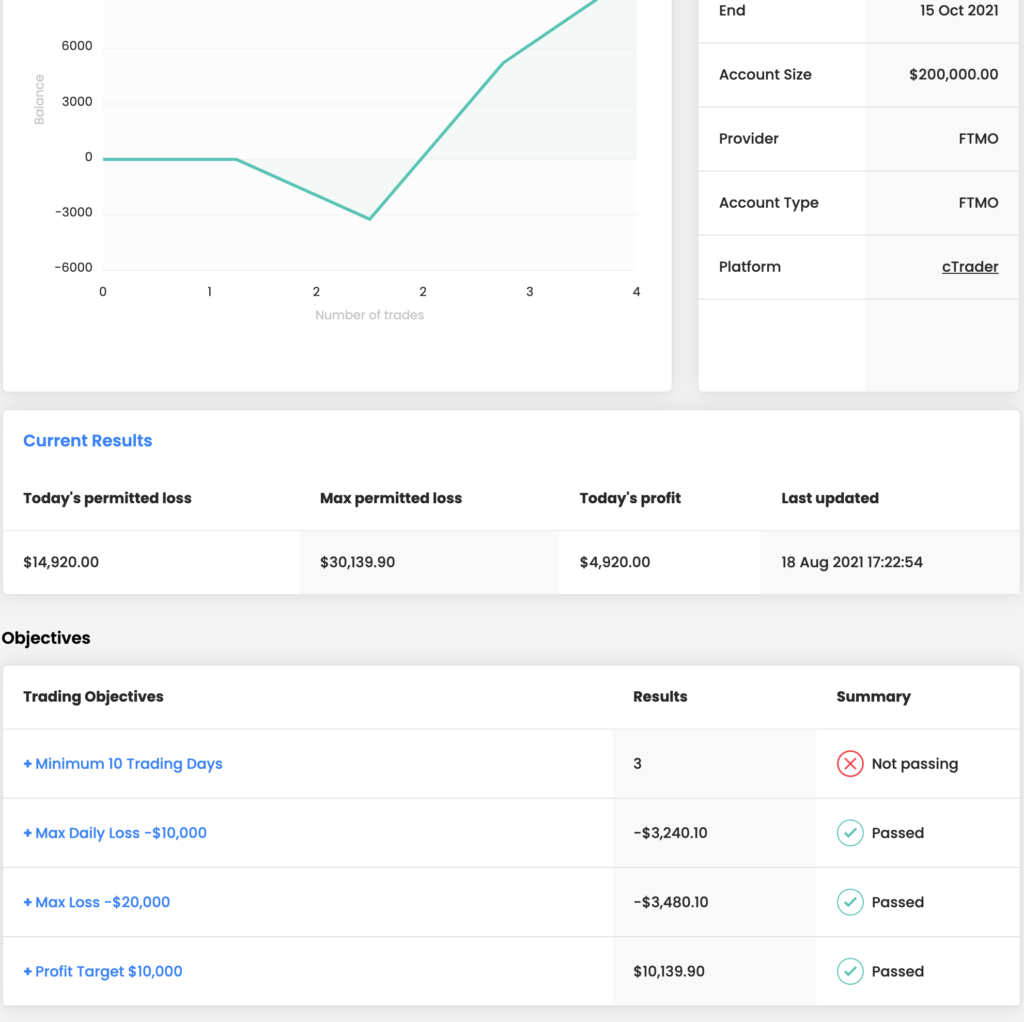

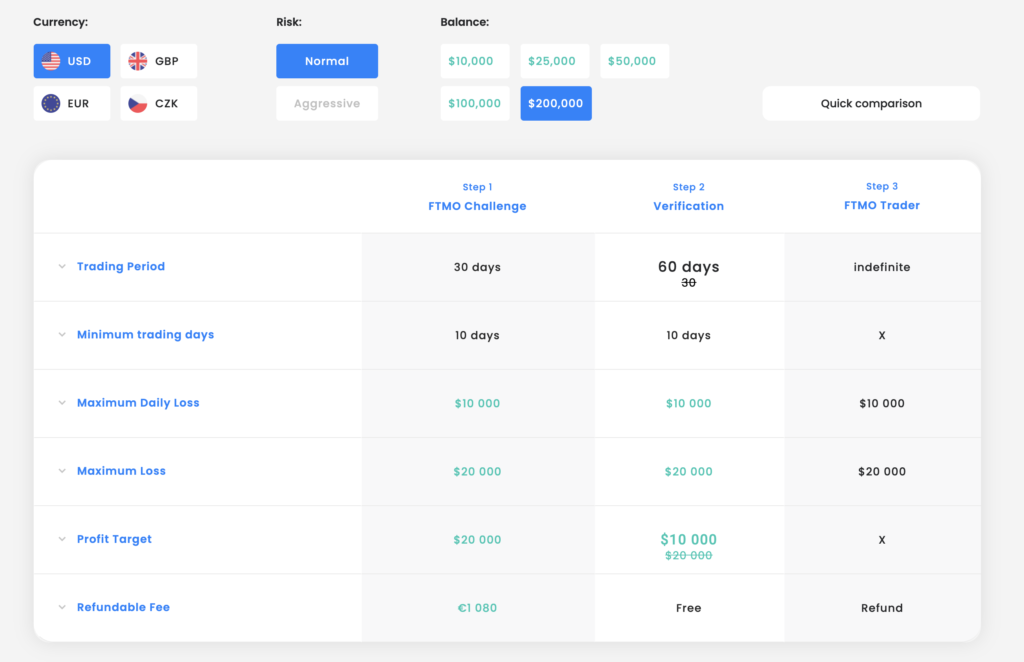

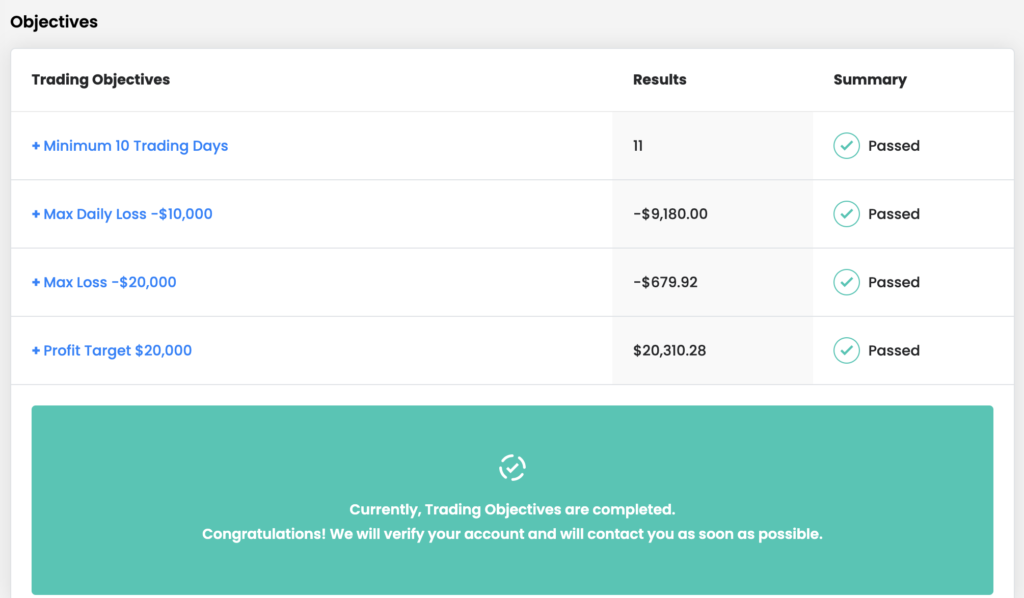

The other goals should include important milestones on this journey that help you reach your financial goal, such as creating and launching your first online course, or passing a prop trading challenge, like the FTMO challenge.

Step 2) Develop Your Skill

This is where we get to work. Your next step is to develop your skill.

If you are taking a skill you already have and turning it into a business, then during this stage, your focus is to develop the skill of running a business.

You’ll want to learn as much as you can about marketing and sales strategies, how to turn knowledge into a product, like a course or a book, as well as how to create a system that runs the business itself.

So During this stage, you will put a great amount of time, effort, and probably money into learning this skill.

Some ways you can go about this include finding information on youtube, blogs, reading books, paying for courses, and even finding a mentor to guide you in developing this skill.

The secret to becoming great in anything is to find people who already do or have what you want and learning from them so as to avoid unnecessary mistakes and take a faster journey by learning your skill in an organized and systematic way.

Let me reiterate that last part – this path of developing your skill should feel organized and systematized.

Take notes and review what you learn regularly.

Track your stats in order to figure out what to improve.

Also, make sure you’re putting time into practicing your skill almost every day.

There are certain things that can only be learned by doing them yourself.

It can also be useful to find groups of people who are learning this skill and build relationships that help you reflect and grow.

Before moving on to the next step, I want to note that this stage of developing the skill will probably take more time than you think.

Based on my own experience with day trading and learning about how to grow a business, as well as what I’ve observed in other people’s stories of capitalizing on a skill, I’m going to suggest that you can expect to stay in the development stage for at least 1 to 2 years.

This doesn’t mean that you can’t earn money right away, but to get to that special level you outlined in your goals from step one, be ready to play the long game.

Impatience will likely come with some costly mistakes that you might not be able to absorb without burning out.

Think maybe half-marathon, not sprint and pace yourself.

{If you’re interested in learning how to day trade as your profitable skill, I recommend reading the book I wrote on how you can leverage the most important habits of professional day traders to set yourself up for long-term success in the markets!}

Step 3) Take Your Skill to the Marketplace

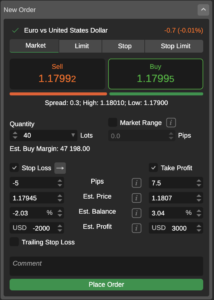

This is the time when you take your business live, you land your first deal, or you trade your first prop trading challenge.

If you’ve been working on a skill like coding or SEO optimization, this may be the point at which you start applying to and interviewing for roles that demand this skill.

Make sure the numbers add up – if your goal is to earn $7k/ month then be firm on that amount when you get to the negotiating table.

If you have other requirements you want to see in a job, like the ability to work from home or bring a dog to work, then keep searching for that optimal package.

You should feel confident in your skill at this point and know that you are valuable.

Step 4) Grow, Reap, and Repeat

At this point, you should feel highly knowledgeable and effective in your skill, and some, if not all of your goals from step one should be accomplished.

At this point, you can decide if you want to create new goals for yourself to take your skill to an even higher level, whether that means writing a book, turning your lucrative skill into a business, launching a social media platform around your skill, or if you’re a prop trader, then perhaps growing funds for your own account instead of only depending on prop trading firms.

Also, it’s okay to be content with this new level that you’ve achieved and maybe use it to give yourself more comfort or rest in your life.

Not everything we do has to be about endless improvement.

You can come back to step four at any time.

The one thing to watch out for, though, is to not become so complacent in our knowledge and expertise that we start backpedaling.

This world is continually changing and often our skills need to adapt to new environments and circumstances.

So make sure to keep a habit of regular personal development and skill improvement.

Now that we’ve reached the end of this lesson, I hope you can step away from this video feeling like you have more clarity around what your process to success could look like.

Now that we’ve reached the end of this lesson, I hope you can step away from this video feeling like you have more clarity around what your process to success could look like.

I believe this is an organic formula that most high performers use to achieve greatness in what they do.

{If you’re interested in learning how to day trade as your profitable skill, I recommend reading the book I wrote on how you can leverage the most important habits of professional day traders to set yourself up for long-term success in the markets!}

It’s also not to say that you need to quit your salaried or hourly position in order to have a better life – as there are plenty of meaningful and necessary jobs that serve a great purpose that requires working for someone else.

You can use this formula to become more valuable and effective in your field or even develop a business or skill on the side.

Remember that success is not reserved for the talented, the privileged, or intellectuals.

Anyone can get started on learning a skill.

Patience, Perseverance, and Proactive reflection can see you through.

If you have a skill you think you’d like to learn or grow a business out of, or have already achieved these four steps, please share your aspirations, wisdom, and stories with us in the comments section below.

I want to participate in helping more people feel empowered to achieve a level of success and meaningfulness in life than ever imagined before.

I wish you all the best of strength and luck, take care!

Mechanical strategies are like machines that run a protocol of actions, such as with a pinball machine that uses levers to flick the ball back up towards the holes on the board, where you can trust that when you press the buttons on the side of the machine, those levels that they’re attached to will always flick the ball up without fail, so long as you time it right.

Mechanical strategies are like machines that run a protocol of actions, such as with a pinball machine that uses levers to flick the ball back up towards the holes on the board, where you can trust that when you press the buttons on the side of the machine, those levels that they’re attached to will always flick the ball up without fail, so long as you time it right.

That summarizes my approach to crafting mechanical day trading strategies. I hope you’ve been able to discover just how organized and useful a mechanical strategy can be, especially when you want to achieve clarity and minimize confusion while trading.

That summarizes my approach to crafting mechanical day trading strategies. I hope you’ve been able to discover just how organized and useful a mechanical strategy can be, especially when you want to achieve clarity and minimize confusion while trading.

My first trade was a loss but the next two were winners.

My first trade was a loss but the next two were winners.

Remember that money is a placeholder for value and value is relative to the environment it exists in. Think about how you can earn 500 to 1000 points per hole when playing something like Skeeball, but only win one to three points when shooting arcade hoops. The winning skeeball player may need to gain seemingly more points than the winning basketball player, but either way, they both won.

Remember that money is a placeholder for value and value is relative to the environment it exists in. Think about how you can earn 500 to 1000 points per hole when playing something like Skeeball, but only win one to three points when shooting arcade hoops. The winning skeeball player may need to gain seemingly more points than the winning basketball player, but either way, they both won.

Rocketbook has an app that lets you take a screenshot of your page and send it to one of the destinations you link to the symbols on the pages.

Rocketbook has an app that lets you take a screenshot of your page and send it to one of the destinations you link to the symbols on the pages.

hose programs for more than a few days, and my opinion of them would likely be different if I was forced to learn that platform because of a lack of options.

hose programs for more than a few days, and my opinion of them would likely be different if I was forced to learn that platform because of a lack of options.

#3) The FX market can be a bit more stable than the kinds of stocks most beginners can afford to trade.

#3) The FX market can be a bit more stable than the kinds of stocks most beginners can afford to trade.

Latest posts