Note: This post contains MyForexFunds affiliate links. I’ve voluntarily chosen to become an affiliate of MFF because I believe they are a valid and trustworthy prop firm with some of the most reasonable challenge rules you will find in the prop trading industry!

——

Over a month ago, I made an important update to the mechanical strategy I’ve used to take a couple of trades a day in the Forex markets. For a long time, I generated backtested strategies based on fixed exit points. I like using mechanical rules in my strategies, it helps me stay grounded no matter what’s going on in the market. Sometimes this approach would lead to profit, but other times it meant undergoing periods of drawdown. I constantly look for ways to learn more about Forex markets and trading, and thus decided to apply one foundational principle that I’ve always heard mentioned in the day trading community but have yet to really hone for my own use: “Let profits run”.

I came up with a mechanical, indicator-based strategy to identify opportune setups with the potential for ongoing momentum and multiple-R wins. The strategy depends on other foundational principles, such as trading with trends, sticking to simple rules and setups, and keeping losses small. After a solid backtest and a few weeks of taking the strategy live, I knew it was the best update I’ve ever made to my trading system.

In the business environment of selling trading information, there are a lot of folks who create courses and provide information freely on social media platforms, but often times there is no real proof of concept. Some folks will share singular trading day Profit/Loss amounts but fail to provide a brokerage statement for the year. Others will tout prior experience in finance roles at banks or investment firms, but again, fail to divest ongoing performance records with potential customers.

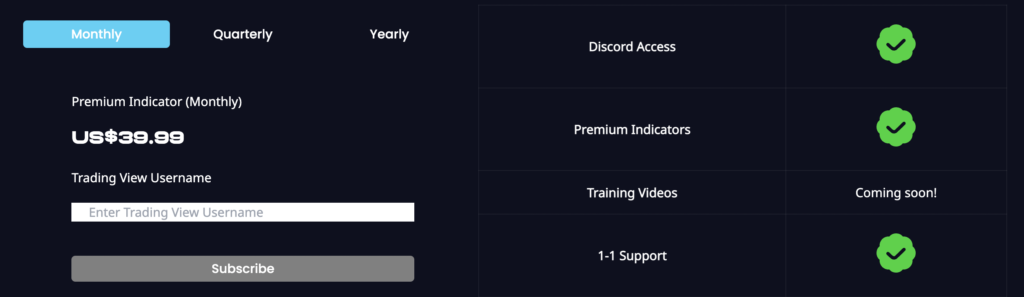

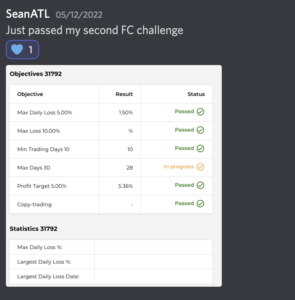

However, there are a few who can provide proof to backup their claims – you’ll see this with traders who can provide brokerage statements, third-party trade copier records, or regular screenshot updates of account balances. Another way to provide proof of concept is through prop trading challenges or trading tournaments. This latter approach has been my preferred way of showing the power behind what I teach in the Disciplined FX Scalping Course, as I only trade prop firm funds and not my own cash.

So to show you the efficacy of this incredible strategy update, I decided to take on another prop firm challenge using only this strategy.

Why I Chose MyForexFunds

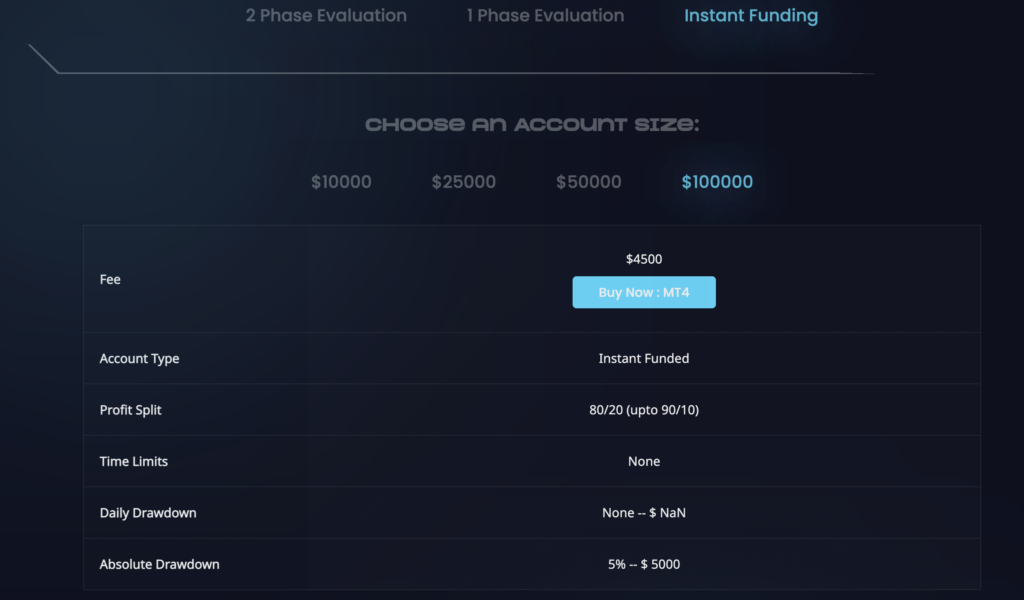

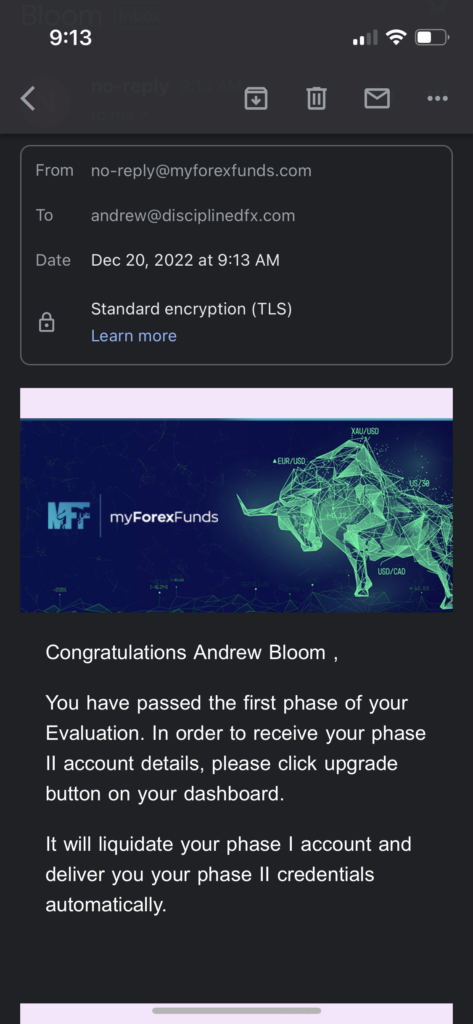

I decided to take the challenge with MyForexFunds, as I believe this is one of the best 30-day-limit challenges out there – they have a slightly easier profit target than FTMO, which is one of the prop trading world’s more popular firms, and also allow for a little more wiggle room with their drawdown limits. They also pay a small bonus for challenge phase profits. So many successful traders who have passed their challenges are providing proof of payout, putting the rest of us at ease knowing that this is a legit firm and we’ll actually get paid for our trading.

As I climb closer to my goal of acquiring $1 Million in prop firm funding (an arbitrary target based more on status of achievement rather than financial goals. It’s something I want to know I’m capable of, not necessarily something that I need), I decided to select a $200k challenge. I prefer taking challenges to acquire more funding than trying to scale an account – I rather let scaling come naturally, if at all, as it’s a slow process and sometimes more difficult to obtain than you’d think.

So I signed up for my challenge, input my login credentials to MT4’s webplatform, and prepared to take the updated strategy for a ride. I’ve been through my share of challenges and funded accounts, and was ready to put everything I’ve learned (from both the losses and the wins) into practice.

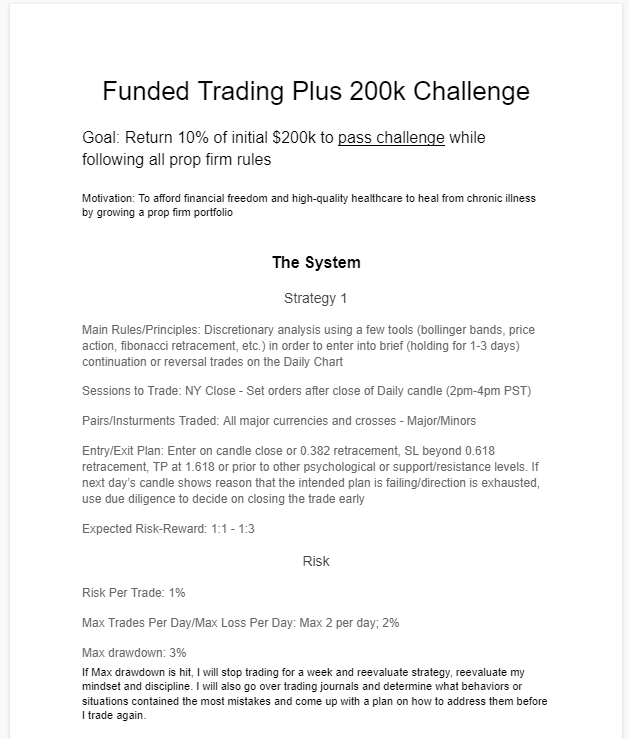

My Trading Plan and Strategy

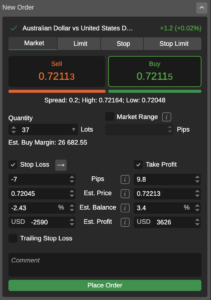

To pass this challenge, I decided that 1% risked per trade would be a great way to maximize profit potential without risking a quick drift to daily or maximum drawdown limits. Normally, I stick to 0.5% – 1% risked per trade on my other accounts, but for a challenge with a time limit, I believe a slightly higher risk per trade is important for making the target within 30-days (a good number of which are weekends with no trading or low liquidity). However, every strategy is different with more or less losses or opportunities to trade, so setting a fixed risk rate is highly personal and needs to be decided per case and strategy.

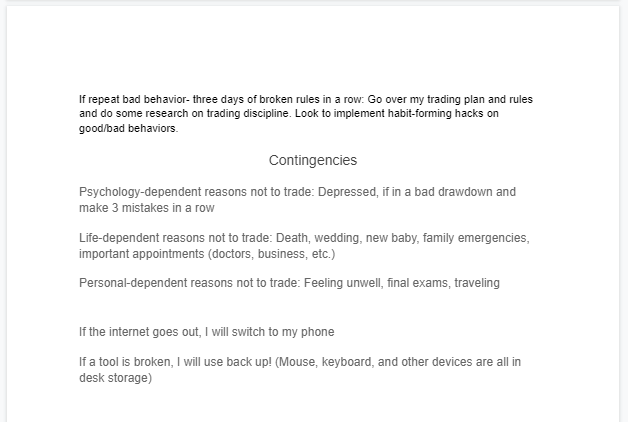

I make a rule of aiming for a retry if at any point during the challenge I undergo too many losses in a row. If I’m not at least halfway to profit target by 2-3 weeks into the challenge, then I’ll aim to stop once I’m above balance and begin again with the next month. This wasn’t applicable to this challenge, but I mention it as an often ignored option for those of you who are struggling to hit your profit target. This is always an option for prop trading risk management.

As per the rules of the strategy, I focused on trading trending pairs (which I would identify on one hour charts) and waiting for signals for continuation after a pullback on the 5m chart. Being on the West Coast, in Southern California, the New York session is my preferred time for short-term trades. This strategy provides clear signals for entry and exit, assuming a trend is in play. I tend to use a manual exit strategy that can let a trade run for a few hours, but there are options for fixed 2-3R or support/resistance, set-and-forget points as well. Utilizing the concept to “Let Profits Run,” I tend to see winning trades return 2-5x what’s risked. Every now and then there are rare 10-22R return trades. All I needed to do was show up, pick my pairs, and follow the rules. I figured I would take a few weeks to make strides towards the profit target amidst a few losses. What happened during this challenge was beyond anything that I ever expected.

One Other Crucial Tool: Learning How to Utilize Fundamental Analysis

Right before taking this challenge, there was one other important task I took upon myself. There is a piece of advice, often taught by personal development coaches and business leaders, that the best way to achieve any goal is to find out who are the best in the field and do exactly what they do to achieve phenomenal results. For us traders, this can mean following the methods of the pro’s, that is, professional-level traders who successfully manage multi-million dollar accounts or more. When you look up what an institutional trader learns and applies to trading markets, at the heart of their trading plan lies fundamental analysis. Us retail traders can argue that following is the news is unnecessary, that all information is already priced in the charts, or that there’s too much information shared only at institutions and banks that we can’t possibly be in the know – but when you ask any professional trading account manager with a track record in the industry, they will all attest to a ratio akin to this proportion: 80% Fundamentals, 20% Technicals.

For a long time I made those same retail trader assumptions: that I don’t need fundamental analysis or that I can’t possibly stay on top of all the different news and economic reports to know how to strategize fundamentals. I also convinced myself that if I want to emulate traders who have exactly what I want (funded traders managing a lot of prop firm capital and making consistent monthly returns) then I should seek to learn from these individuals and take their courses or trade in their same style. This led to spending the last few months taking different classes on supply-and-demand trading.

But a couple of concerned thoughts were leading me to believe that even a prop-firm-trader-focus for my selection in trading education wasn’t enough. Some can get funded from a challenge but many more struggle to stay funded or still experience periods of drawdowns. Awhile back, I did an interview with an employee of The 5%ers prop firm, who told me that the only person who ever scaled up to a $1 million account through their program was an individual with a Ph.D. in Economics – utilizing fundamental analysis in his approach. Surely this fellow was able to understand market movements and forecast better than those with only technical analysis as their edge. Second, even as I attempted to learn more advanced-level approaches to trading, such as smart money concepts, or supply and demand trading, even these high return strategies couldn’t help shake an underlying anxiety of not ever really kowing why the market is moving or where it might go next. These styles of trading don’t necessarily identify what pairs to focus on and they fail to acknowledge momentous changes in direction when volatility and average daily ranges significantly change.

Last semester, for my Ph.D. program in Business and Entrepreneurship, I took a course on global management that included foreign exchange markets as a subtopic in the study material. I chose the functions of foreign exchange markets as my research topic for my final and this was the first time I ever conducted a deep dive into academic-level research of Forex markets. Remember, the Forex market doesn’t exist just so we can play it – international businesses and monetary institutions depend on this market for changing currency when making major purchases or sales in different countries and central banks depend on it for manipulating currency value and economic health. Their participation in the market is intentional and involves objectives that extend far beyond making a profit off of swapping positions. This activity helped me develop a general sense of the various players and underlying economic reports and news that are crucial to affecting rate changes. It gave me the confidence to further learn about fundamental analysis now that I had some references to build my learning upon.

So I started to do some research on using fundamental analysis in order to profit from trading. Just as with technical analysis, there are a diverse array of systems and strategies for identifying market trends and sentiment through monitoring central bank positions, economic reports, and news. There are some professional traders who rely heavily on an Excel spreadsheet approach to tracking data across all currencies for long-term positions (this is what’s mostly taught by individuals ike notable traders, Lex van Damn and Anton Kriel) and others who take positions based upon recent news releases. Someone who does a good job explaining both the importance of fundamental analysis and how one can mentally model priority of economic levers and players, is Jarratt Davis. I highly recommend checking out his interviews and publications. His teachings helped me generate a solid understanding of the fundamentals of fundamentals.

What I got out of the information I’ve gathered thus far is that fundamental analysis can tell you what to trade and in which direction, while technical analysis is an assist to determining when to take a trade and when to exit. I’m still merely at the beginning of adding this understanding and process in my own system, but for this challenge, I decided to use economic news and central bank bias to help determine which currencies I would focus on for my daily trades. Technical analysis alone can generate a number of opportunities each day, but fundamental analysis helps focus in on the few pairs that are top priority for the big players.

In all honesty, given the number of retail traders who DON’T use fundamental analysis – I’m starting to believe that including fundamental analysis in one’s trading is a profound edge over everyone else who is trying to figure this trading thing out at home with a personal computer. Even if you use technical analysis to call the shots, doing research on the fundamentals behind currency rate trends and changes can help separate the wheat from the chaff (of which currency pairs are a priority for the banks) and nourish a sense of confidence and clarity before entering the market.

An Important Epiphany..

Before and during this challenge, I experienced an important epiphany that has occurred on every other occasion I’ve passed a prop trading challenge. I went into the challenge not hoping, but knowing I was going to pass. This wasn’t an affirmation, but perhaps an intuitive observation after having already seen the high return potential of this strategy and the added clarity of doing a little research on current market sentiment. Nonetheless, this confidence helped me stay patient, take losses without falter, and let my winning trades run even if it meant risking a large potential turn-around.

I’m curious if others who have passed their challenges have experienced this kind of resolute confidence prior to hitting the profit target, as well. If so, then this internal sensor can be an indicator of one’s preparedness for a challenge.

There’s another saying: Scared money don’t make money.

Entering a challenge with anxiety or concern may be a sign to take a pause and do more work to show yourself your profitability prior to starting. Remember, trading is as much a mental game with oneself as it is a technical game with the markets.

How I Passed My $200k MyForexFunds Challenge and Verification in 2 Days.

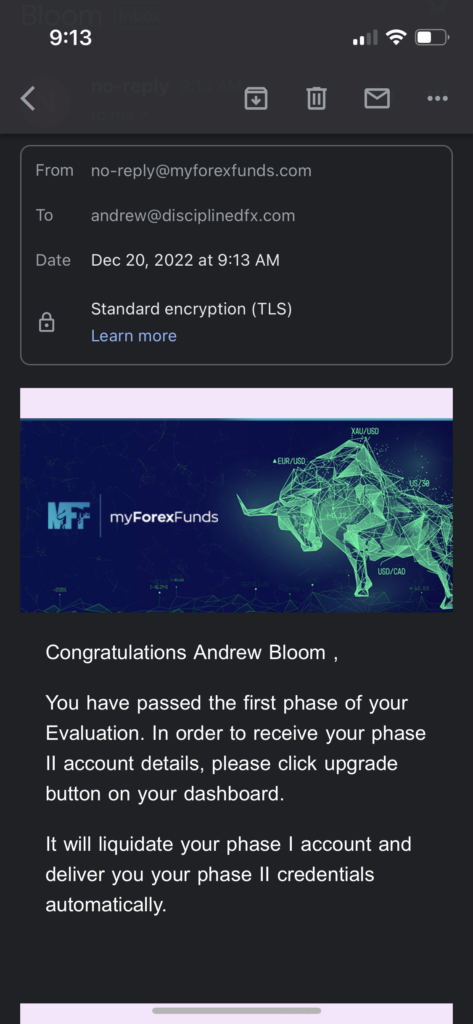

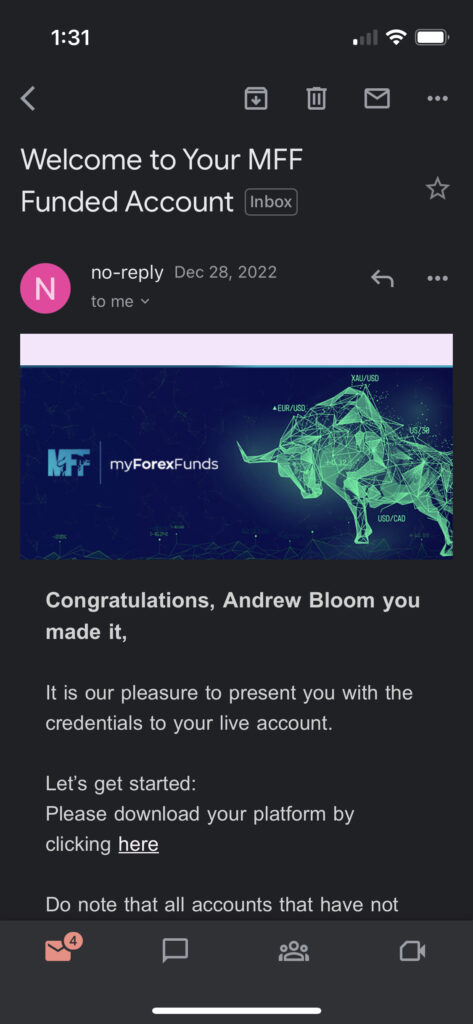

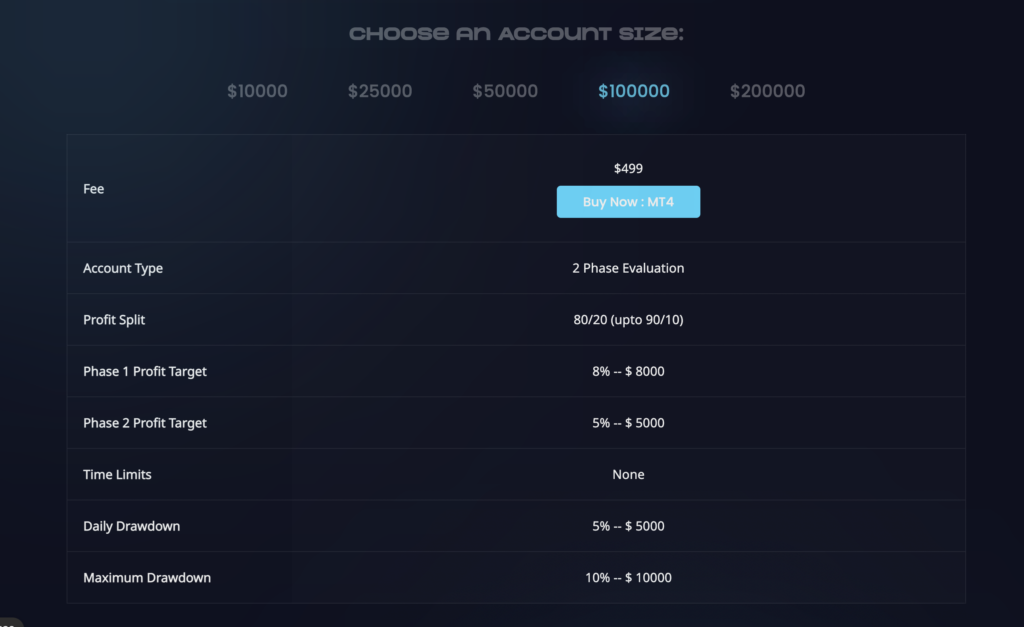

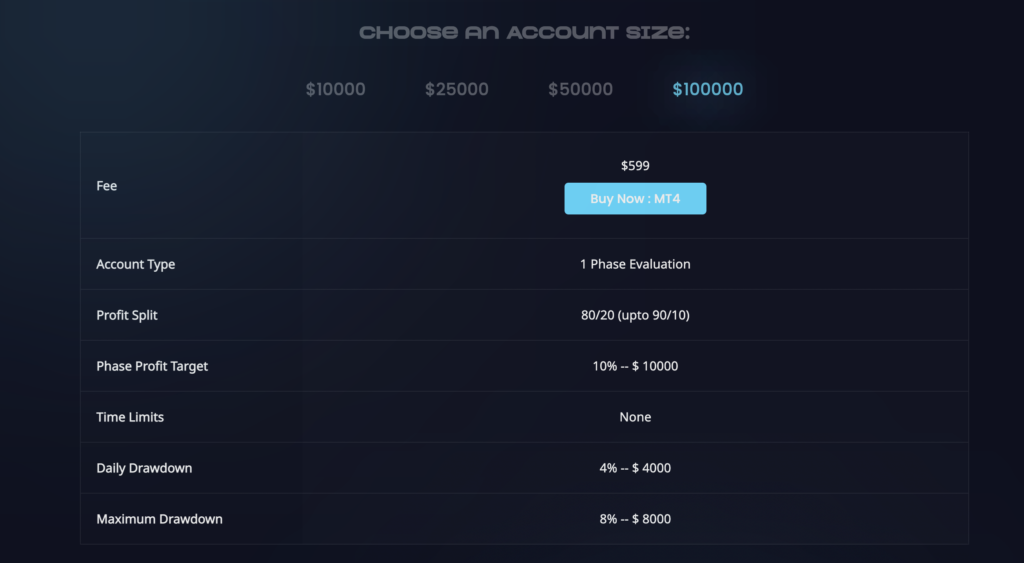

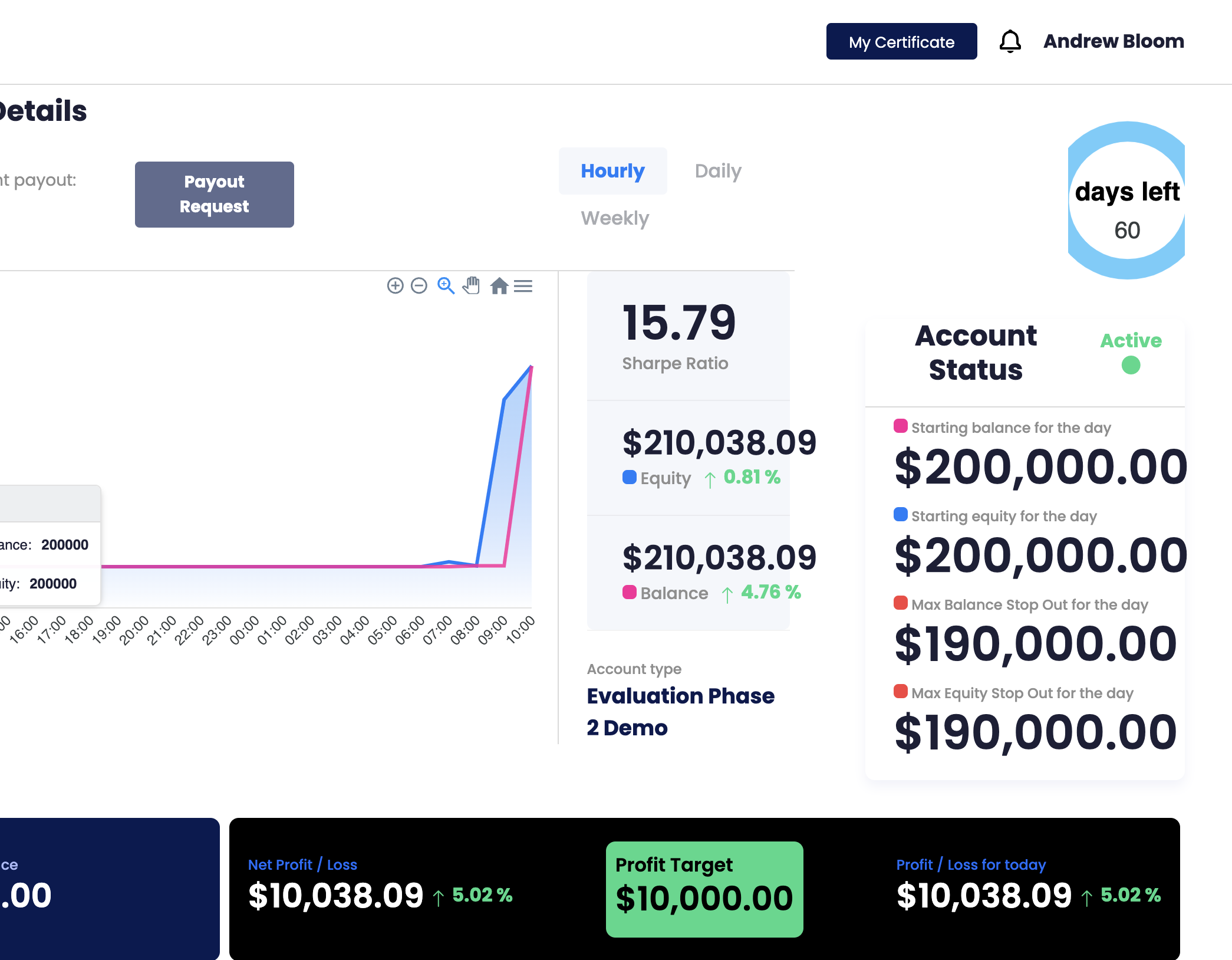

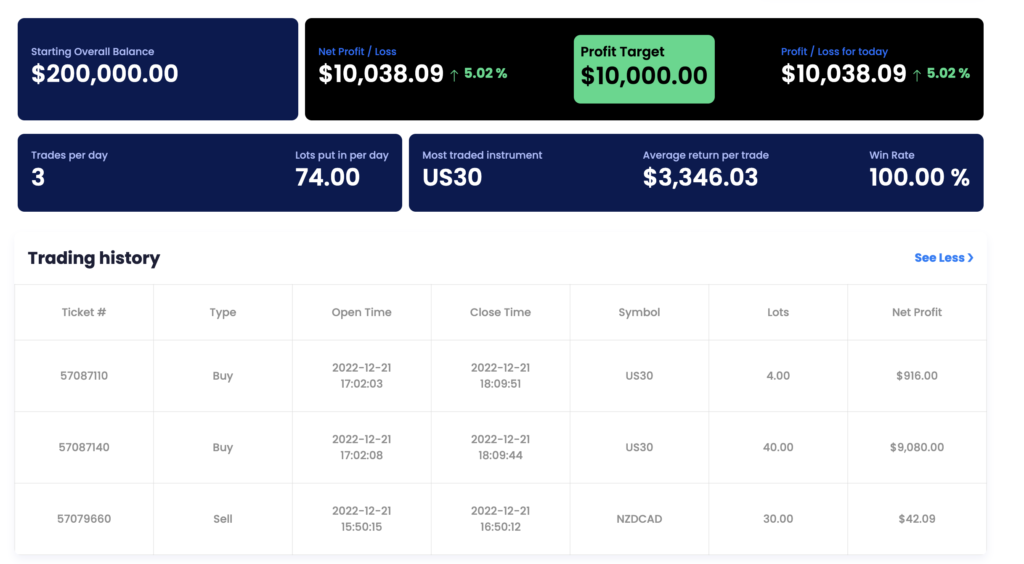

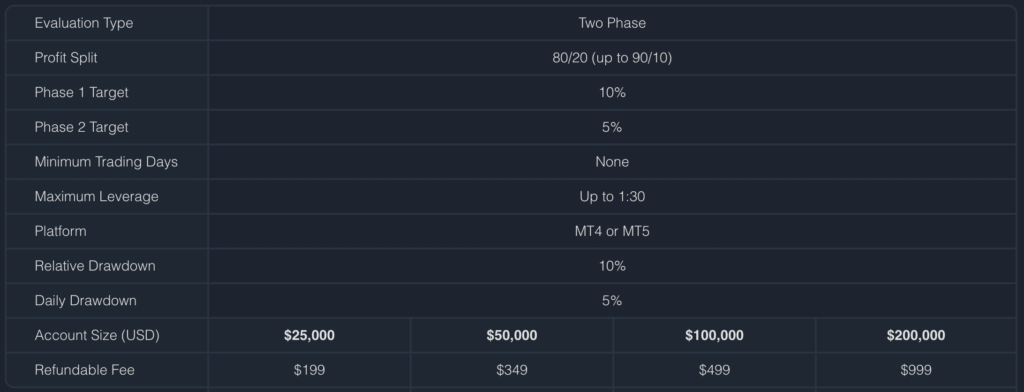

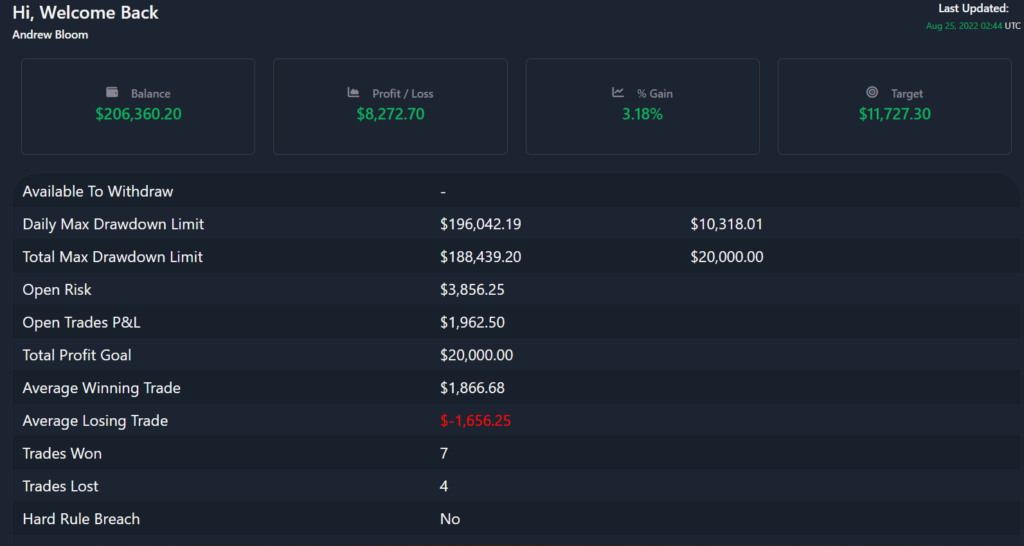

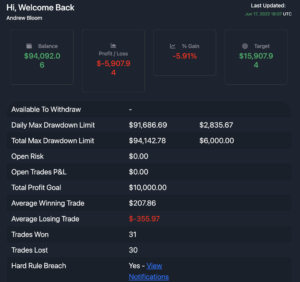

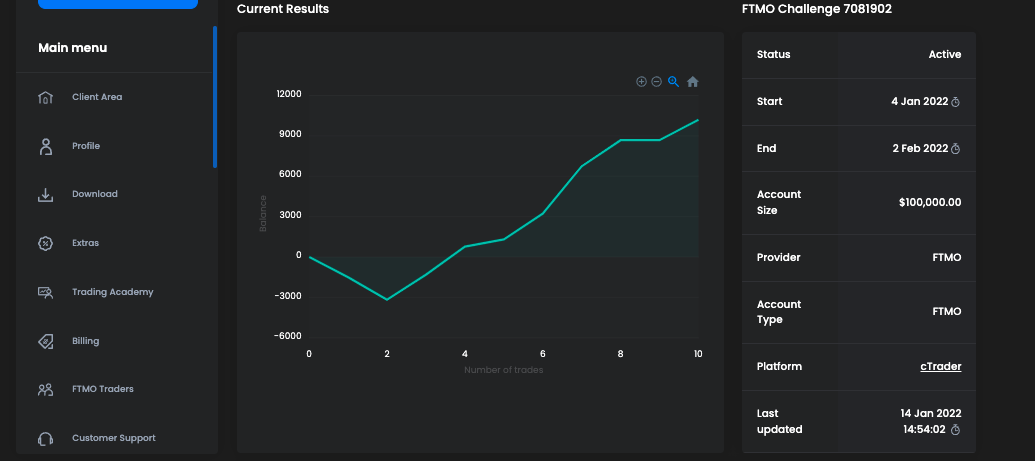

As a recap, the objectives of the MyForexFunds funding challenges require a trader to undergo two phases. The first is a 30-day challenge requiring an 8% profit target, at least 5 days of trades, and avoidance of a daily 5% drawdown and overall 12% max drawdown. The second phase is a verification round that requires a 5% profit target, 5% daily drawdown and 12% overall drawdown avoidance, as well as up to 60 days to complete the phase with a minimum of 5 trading days.

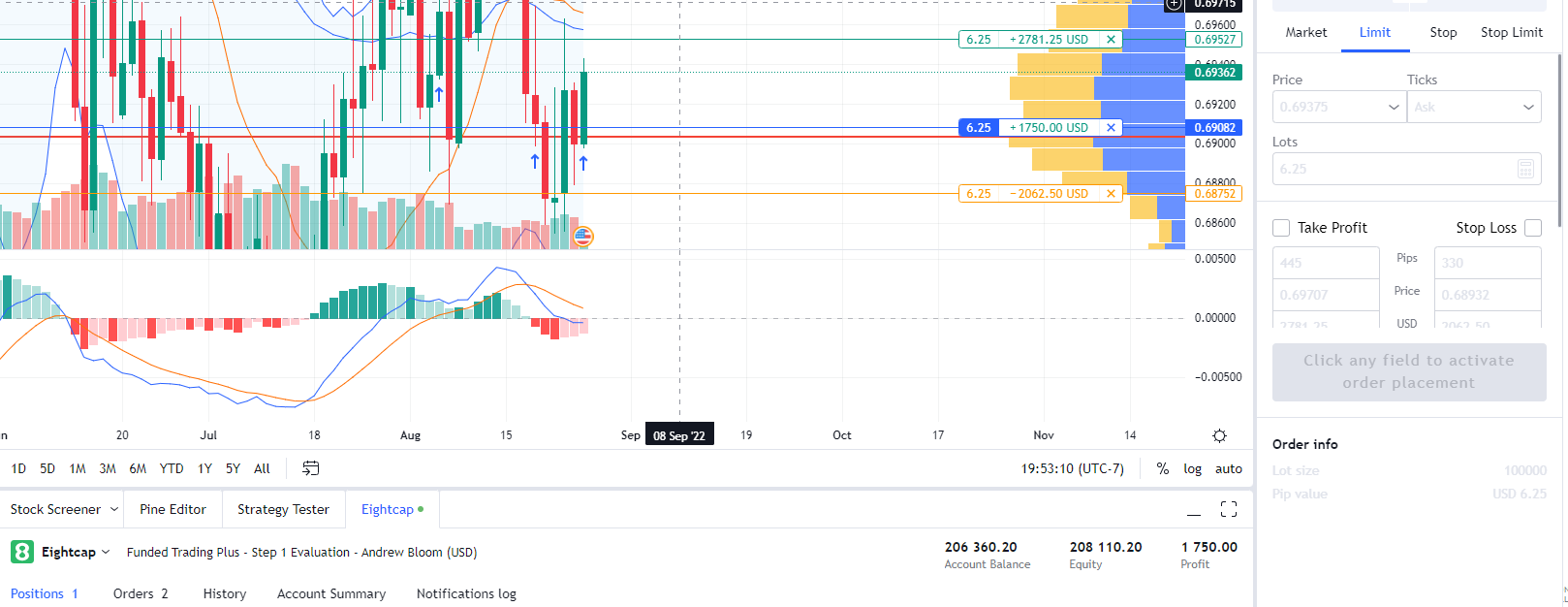

Thus, when I exclaim that I passed the challenge and verification in 2 days, I am implying that I hit the first challenge target in one day and then proceeded to hit the verification phase target in one day. However, I also had to set some microtrades to meet the 5 trading day objective. For the first phase, I started the account with a slight drawdown but my trade that hit the profit target compensated for the amount in drawdown in addition to the 8% target.

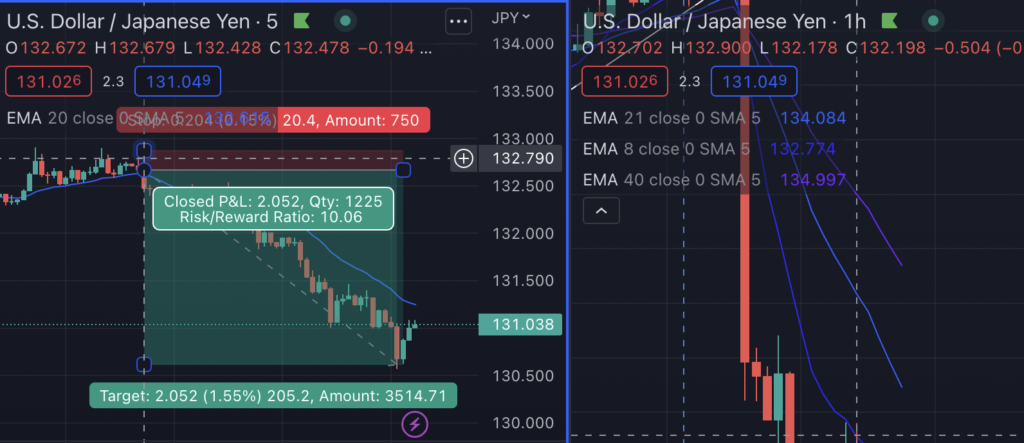

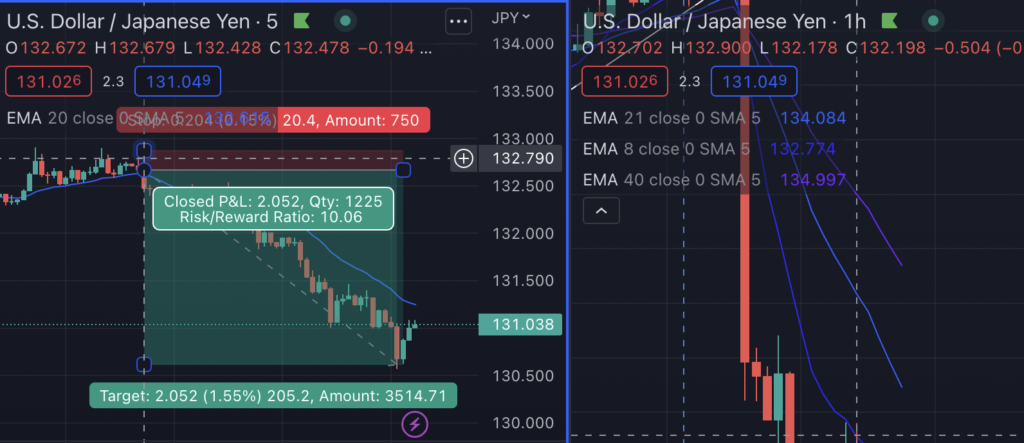

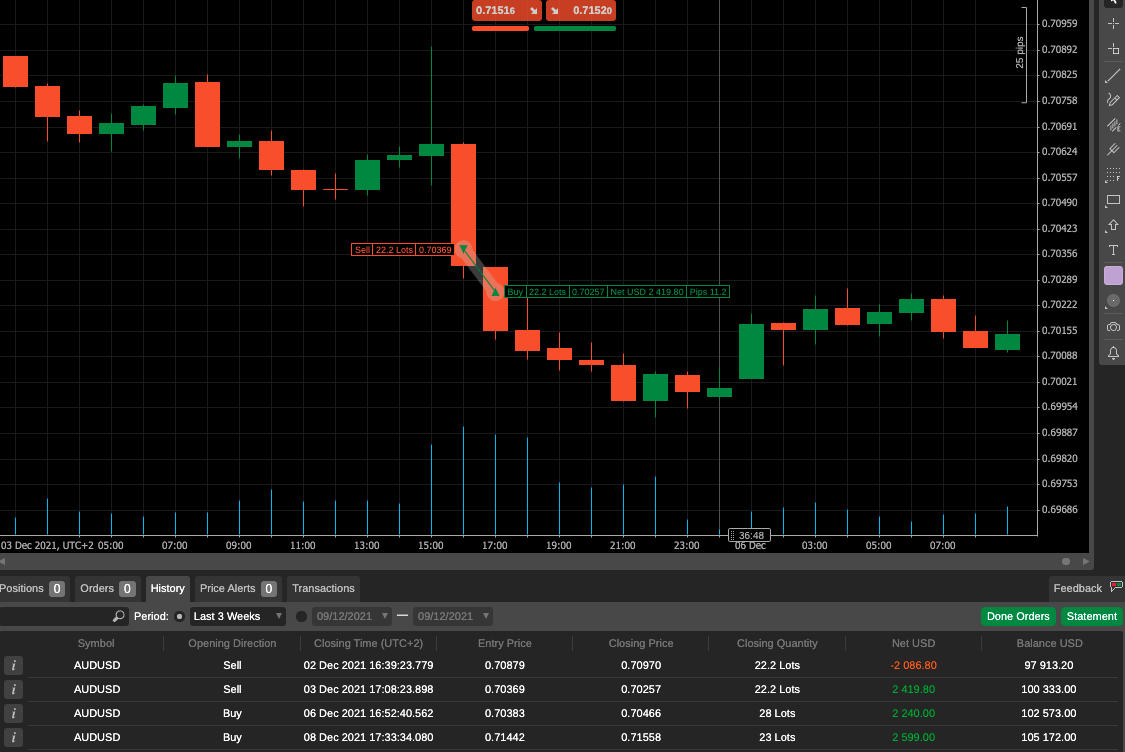

Let’s talk about those two trades that returned 9% and 5%, respectively, while only risking 1% per trade.

Let’s talk about those two trades that returned 9% and 5%, respectively, while only risking 1% per trade.

The evening before I passed the challenge, the Bank of Japan announced that it would be raising its interest rates on its 10-year bonds. For the last handful of years, the Bank of Japan’s M.O. has been to keep interest rates negative so that the country can easily prop up its exports, which are a major economic boost for this South Asian country. Earlier in the month, the BOJ was giving hints that it would continue to stick to this policy of keeping interest rates low. However, on December 19th, the BOJ came out of left field and shocked the Forex markets with news that they were finally increasing bond rates.

From a greater economic perspective, when interest rates for a country are high, this tends to increase the value of the currency, as many investors will seek to put their money in banks where they can earn a return on their investments. A higher interest rate means that the money stored in bonds, savings accounts, or certificates will all yield a higher return. As long as the underlying economy is relatively stable and safe, higher interest rates attract investors.

For the last couple of decades, the bank of Japan has manufactured a weak yen so that other countries stay interested in purchasing inexepsive imports from Japan. That is, until the end of 2022, with the looming global inflation affecting its underlying economy, as well.

This is major Forex news. It’s the kind of rare economic event that can halt or even turn around long-term trends. With rising inflation and rising interest rates in the United States, as well as a strong reputation for the reliability of the United States economy, the USD/JPY spent most of 2021-2022 rising. However, now that the BOJ is changing its Dovish mentality to a more Hawkish one, many JPY quoted pairs are falling.

The news came out the evening of the 19th for me, and it was definitely large enough news to keep riding on the 20th, when I woke up for the New York session. Since many other crosscurrencies are weighted on USD anyhow, I decided to stick with USD/JPY as my pair. I waited for an appropriate signal of pullback and continuation into the trend on the 5m chart and held out for a 10R trade.

While utilizing this strategy with fundamental analysis can frequently bring strong returns, I didn’t expect a home run. It was a bit of luck and prepared opportunity to be able to ride this trade during the month I happened to take this challenge, but I am pleased with the results, all the same.

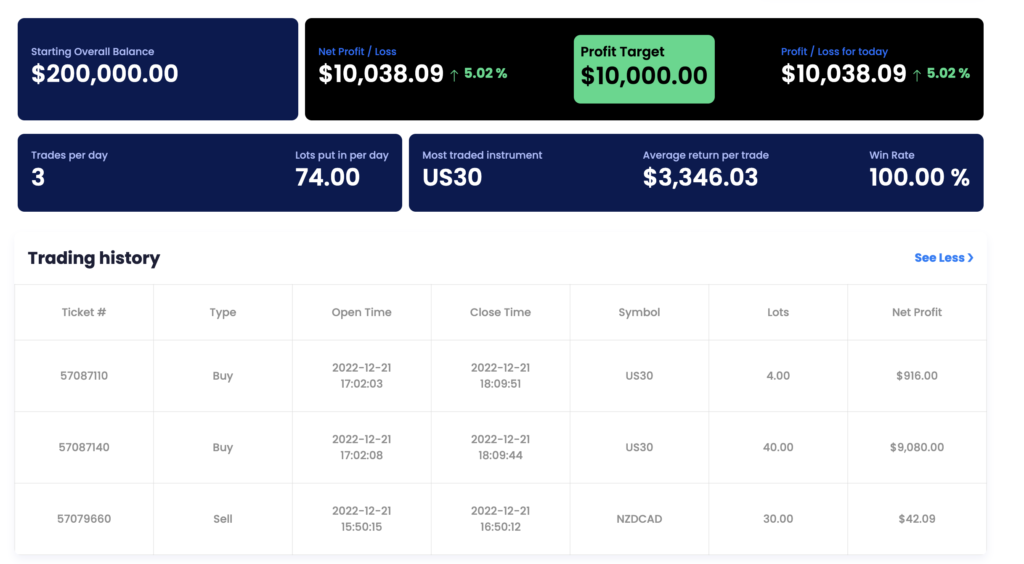

Since I had already hit the 5 minimum trading days for this account, I was immediately granted a verification account and login details. I set this up and the following morning, December 21st, during the New York session. I continued with my 1% risk per trade and focused on the CAD inflation and CPI news that came out at 530PST. The reports showed that the actuals were about the same as expected, so the news was already priced in for this announcement. I initially got in on a NZDCAD trade but I pulled it out at break-even, as per my trading rules.

Since I had already hit the 5 minimum trading days for this account, I was immediately granted a verification account and login details. I set this up and the following morning, December 21st, during the New York session. I continued with my 1% risk per trade and focused on the CAD inflation and CPI news that came out at 530PST. The reports showed that the actuals were about the same as expected, so the news was already priced in for this announcement. I initially got in on a NZDCAD trade but I pulled it out at break-even, as per my trading rules.

However, at 700AM PST, a consumer sentiment report for the US came out and I kept my US30 chart open in anticipation of its release, as its hourly chart matched my technical analysis criteria. When the report came out better than expected, with additional news of a strong earnings season for Nike, I felt like there were enough catalysts to enter on this trade. Sure enough, it was a 5R win (with potential for a greater return, as per rules, but my focus was on hitting MFF’s target). Again, it was mostly luck that there happened to be two big news events leading to two highly profitable trades, but just having the insight to know what news was moving which pairs and having an exit strategy that maximized potential profit return was the perfect combo for hitting large profit targets.

Final Thoughts and Reflections

Overall, I am excited to share this news with you. I firmly believe there are multiple paths to achieving prop firm funding and staying consistently profitable – some people are excellent with supply-and-demand or SMC styles, others swear by price action and candlestick formations, and then there are folks, like me, who will stubbornly cling to indicators and other simple methods of analysis (emphasizing process and systems over a holy grail strategy) until something works well.

The more I learn about the purpose of the Forex market from the perspectives of government, banks, and businesses, the more I believe that we’re missing the forest for the trees when we hyper-focus only on technical analysis alone. If anything, having solid confidence in the direction of a trade due to fundamentals allows us to profit even if the technicals aren’t accurate or precise. Combine this with solid money management and trade management rules and then you have a worthwhile trading system that can pass prop firm challenges and grow accounts!

Let’s talk about those two trades that returned 9% and 5%, respectively, while only risking 1% per trade.

Let’s talk about those two trades that returned 9% and 5%, respectively, while only risking 1% per trade.

Since I had already hit the 5 minimum trading days for this account, I was immediately granted a verification account and login details. I set this up and the following morning, December 21st, during the New York session. I continued with my 1% risk per trade and focused on the CAD inflation and CPI news that came out at 530PST. The reports showed that the actuals were about the same as expected, so the news was already priced in for this announcement. I initially got in on a NZDCAD trade but I pulled it out at break-even, as per my trading rules.

Since I had already hit the 5 minimum trading days for this account, I was immediately granted a verification account and login details. I set this up and the following morning, December 21st, during the New York session. I continued with my 1% risk per trade and focused on the CAD inflation and CPI news that came out at 530PST. The reports showed that the actuals were about the same as expected, so the news was already priced in for this announcement. I initially got in on a NZDCAD trade but I pulled it out at break-even, as per my trading rules.

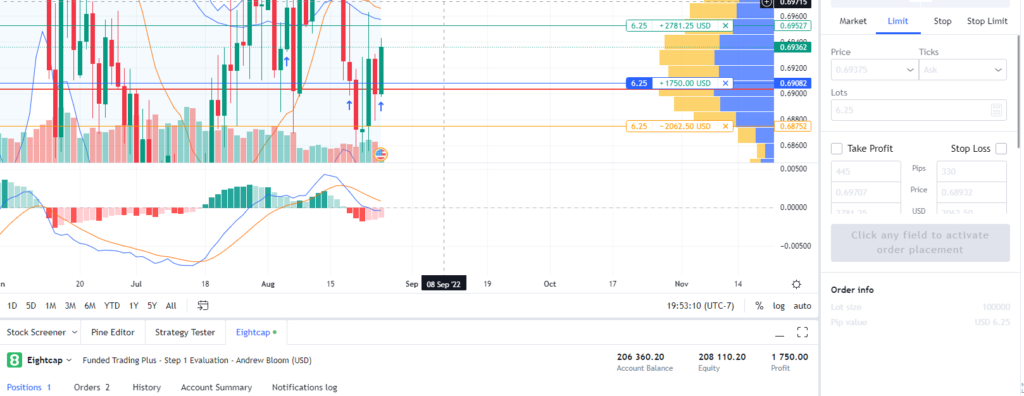

However, funded trading plus uses 8-cap as its broker, so you need to be sure to select 8-cap’s chart before setting an order on it.

However, funded trading plus uses 8-cap as its broker, so you need to be sure to select 8-cap’s chart before setting an order on it.

Latest posts