Read “How I Became a Day Trader: Part 1” first

One summer night, while I was overheating and having a particularly severe case of insomnia, I was reading a book of interviews from different millionaires as to what skills and habits make money.

Reading self-help books has been a hobby of mine since my college days, so it wasn’t unusual for me to pick this book as a way to pass the witching hour.

However, I just so happen to come across a chapter by a famous Forex trader, Rob Booker.

However, I just so happen to come across a chapter by a famous Forex trader, Rob Booker.

I couldn’t have stumbled upon a more inspiring trader than Rob Booker – he’s entertainingly sarcastic, can dish out a little tough love, but his actions are tremendously humble in the ways he runs his trading business and donates his time and money to charities. Something about the way he described dropping his legal career so he could trade currencies resonated with my own drastic turn in life and career circumstances.

The following morning, I started researching and using free educational resources to learn as much as I could about Forex.

When I started trading, I felt then as you do now: excited, eager to find a quick and be-your-own-boss way to make money, yet also overwhelmed by the variety of advice and information available.

My first actions included picking a YouTuber whose track record and style seemed reliable, watching as many videos as I could while gathering notes, and taking immediate action on anything important he said.

I also bought a few books that were more structured than a mishmash of videos.

In the beginning, I couldn’t quite wrap my head around Forex.

I found a free course that was highly comprehensive but very dense. I took notes and made my way through the curriculum, only to find myself overwhelmed by all the different indicators, price patterns, and lingo. I ended up moving back and forth between stocks and Forex since I had more familiarity with the former.

“Okay,” I thought to myself, “I got this – it’ll just be a few months until I work out the kinks, get a feel for the process, and then make at least 40% a month as I build up my account to that $25,000 goal for ultimate day-trading status. I probably have an advantage because I know I’m decent at keeping a routine and doing as much research as possible to figure out DIY projects. This should be a piece of cake, right?”

So young, so naive.

During my first year of trading, yes, I collected a lot of research and information about what top day traders do to maintain a consistent profit.

But I also held onto losses with such pugnacity that I kept losing money week after week.

I watched in horror as potential profits turned into losses when I held past a take profit target, thinking I could squeeze a little bit more out of the trade.

I tried out other people’s pre-made trading strategies, followed the rules for a week or two, but then gave up during the first string of losses, arrogantly telling myself, “They don’t know what they’re doing. This strategy is a dud.”

Name a trading mistake, and chances are that I’ve committed it.

I couldn’t see how much I was causing problems for myself by acting on fear, greed, and impatience.

With time and further education, I stopped holding onto losses.

I stopped trading with impulsive, made-on-the-spot plans.

A big game-changer for me was actually paying for courses instead of trying to gather an education piece-meal from free videos.

The information offered was often more organized, detailed, and reliable.

Despite how much my life became disheveled and upended by my invisible chronic and undiagnosed illness, there were some important changes in my personality that I could consider a silver lining and were of great use to my trading beliefs.

For one, this is the most focused I’ve ever felt – even before the pandemic, I was stuck at home and had to make do with what I had in my bedroom to find meaning and joy in life – I felt a strong intrinsic motivation to learn and create out of pure enjoyment and need for purpose. Second, as many of you who have suffered greatly in life know, sometimes hardships give you thicker skin and help you learn to recognize the difference between a real issue from an inconvenience.

My ability to put up with problems and seek to solve them skyrocketed. I felt more sure of myself, more confident, and less inclined to let others make decisions or think for me. Being dismissed with “I don’t know” by many doctors made me realize the limits of human thinking, no matter how well-educated a person is.

I also became obsessed with reading biographies and memoirs by those who suffered atrocities and somehow managed to find meaning and joy in life. Viktor Frankl (a psychotherapist who survived multiple of Hitler’s concentration camps, including Auschwitz), Eugenia Ginsberg (who survived multiple camps and prisons of Stalin’s Gulag), and Chris Gardner (who, with his son, went from homelessness to wealth by finding work on Wall Street during a time when black men and women weren’t very welcome in the industry) are a few that come to mind. Their stories taught me just how much maintaining a commitment to personal values, as well as sheer perseverance, can see a person through horrific experiences.

If you want to follow what I’m reading on a weekly basis and also receive tips and updates on responsible and reflective day trading, You can also subscribe to the Disciplined FX weekly newsletter by entering your e-mail in the sign-up box at the end of this post.

Ultimately, I realized that suffering an illness is something that connects me to the plight of humanity, instead of depriving me from participating in it.

And most important of all – listen carefully, as this is key to good trading and perhaps any great accomplishment in life – I stopped believing something or someone was going to come to save me. Not a doctor, not the government, not a charity, not a family member.

I took more responsibility in seeking solutions rather than dwelling on the problem.

As it turns out, there are many more options when taking the road of responsibility.

Changing external factors is a much more difficult (albeit often still necessary) step that should be taken after first creating a foundation within yourself.

Perhaps the most life-altering realization I had when my illness first spun out of control was this: There are some things that you and only you, alone, will have to face.

Even if someone was there to lie in bed and hold me while I lay perpetually awake and burning, they couldn’t get inside my brain and feel this with me.

At best, they could express empathy and try to understand, but if I was going to tackle and overcome this thing, I needed to be okay with being misunderstood, willing to do the work to carve out my own path back to health and be able to allow myself to feel a grab bag of emotions while being my own primary source of comfort.

When your life falls apart, you will fall back on your habits, however helpful or hurtful they may be, as well as whatever emotional management skills you’ve developed up until that point.

It was already in my habit to keep a calendar and planner, to journal, and to meditate. Commonplace as they seem, they’re a big part of what helped me stay organized as my life, my thoughts, and my body became disorganized and uncontrollable.

Organizational skills also make trading far less complicated than it needs to be.

It’s crucial to work on building beneficial habits long before you fall back on them during times of unusual stress.

This applies to trading habits, as well. To accomplish what I wanted to accomplish, I needed to become even more disciplined.

Combined with persistence, this is a key characteristic for surviving the learning curve of any endeavor, and all the more so with the Big Boss Dungeon of trading for profit – let alone the problems that come with human existence.

Disciplined FX, the business I’ve created to help others on this rewarding and challenging path, is so aptly named for this skill that leads all other skills.

Successful trading has far more to do with a strong mindset than a perfect combination of indicators and technical analysis tactics.

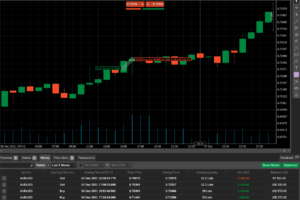

Sure enough, as I became more organized and ritualistic in my trading preparations, reviews, and tactics, I started to actually make money after being in Forex for a little more than a year.

I had posted some trading tips on Reddit forums and was personally asked by users to be their mentor. Creating a resource to help beginner and novice traders find a way to earn an income through day trading became my next logical step.

This year, I also started experimenting with prop trading and passed two challenges with the anticipation of managing a portfolio of two to four prop trading accounts.

I had to tweak some of the strategies and risk management I used prior to prop trading in order to meet the requirements of these challenges and funded accounts, but it’s been an alluring and fascinating process.

I wish I could give a better happy ending in regards to my health issues, but I’m still wrestling with what appears to be a hyperactive immune system and autonomic dysfunction. I will eagerly report, however, that I’m doing far better now than when I first started trading. Most of that progress came from keeping a whole-food, plant-based diet, and supplementing with vitamins and minerals for which I have a deficiency. I believe there is still a deeper root to these problems and my hunt is not over.

Just to get to this point took years of research, reviewing and contemplating on my medical test results, learning about functional medicine, experimenting with diets and supplements, and not giving up every time a doctor told me that I would probably never get better.

I hope to take some of the profits I’ve made from trading to afford intensive functional healthcare in order to make a lasting recovery. In this way, failing at trading is not an option – it is an important tool on my path to finally reclaim freedom, and now that I’ve come this far, I don’t want to give it up.

I don’t doubt that some of you have a similar drive for earning enough money to solve the biggest problems in your life.

I made Disciplined FX specifically with you in mind. I’m okay with letting go of the rabbi path – in some ways, I believe my proactive personality is a bit better suited to the grittier, high-risk problem-solving that comes with trading and running a business. There is something about independently trading and being an entrepreneur that feels like a true calling, in contrast to the ways in which I often felt like an imposter when I was called “Rabbi”.

These days, I’m not really sure I believe much in religion anymore, but I do like to keep a Zen meditation practice and continue to study Buddhist texts.

I think I avoided for-profit endeavors for a long time because I had a limited belief that only nonprofit and counseling-based work could meaningfully contribute to the world.

When I first started trading, I felt guilty for making money without giving much in return. I now realize that there are many ways people completely change their own lives with paid-for resources and services. “Doing good” isn’t restricted to the world of philanthropy. Incredible technology, services, and resources have increased the quality of life for so many people in this world.

Teaching people how to trade with success, especially anyone who wasn’t born into wealth, can tremendously help a life, too.

Successful traders also have the power to donate and further invest their earnings into organizations, businesses, and people who are better equipped to change the world for the better.

During my undergraduate orientation, I was required to read a wonderful collection of essays on social justice and change that’s titled The Impossible Will Take Awhile. I love that statement. Because often, the most life-altering changes can occur with time and persistence, even if they seem unattainable.

This is true for trading and achieving financial freedom, as well. If I could learn to make money trading Forex while sleep-deprived, with a head full of fog, and limited vision, then you can trust that you can make it, too, regardless (or with motivation from) the dire circumstances you’re in.

No matter where you are on your forex journey, I hope you can walk away from this story with a sense of determination and hope.

It’s possible to turn terrible situations into a springboard for transformation, achievement, and success.

Again, if you find yourself resonating with my story, be sure to subscribe so we can stay connected!

Also, if you are finding yourself struggling with challenges in life while you’re also learning to day trade, please let me know about your own stories by commenting below or sending an e-mail to [email protected]. I don’t doubt I’m alone in this. I’d love to help gather a community of traders who seek to profit from a responsible, honest, and compassionate sense of self.

I wish you all the best of strength and luck, and I’ll see you in the markets. Take care!

— Andrew Bloom

How to Improve Your Physical Energy

How to Improve Your Physical Energy

Step 2) Know Your Why

Step 2) Know Your Why By understanding why you are doing this thing, you will feel more committed to the challenge. And bringing that emotion to your goals is a big catalyst in helping you stay on track over the long run.

By understanding why you are doing this thing, you will feel more committed to the challenge. And bringing that emotion to your goals is a big catalyst in helping you stay on track over the long run.

Latest posts