Hey there, folks! My name is Andrew Blom, founder and CEO of Disciplined Fx. If you’re new here, welcome! I first started teaching myself how to day trade after developing a chronic illness and needing to find a way to make money from home with a minimal amount of time and energy. Ever since then, I’ve developed so much confidence and hope because of how much day trading has left me feeling successful and empowered to actually make money from home on my own time. I’m also a Ph.D. student pursuing a doctorate in business with a concentration in entrepreneurship. The intention of Disciplined FX is to provide a safe space that supports diverse traders from all walks of life as we learn how to hone discipline and a trading mindset to succeed in forex markets

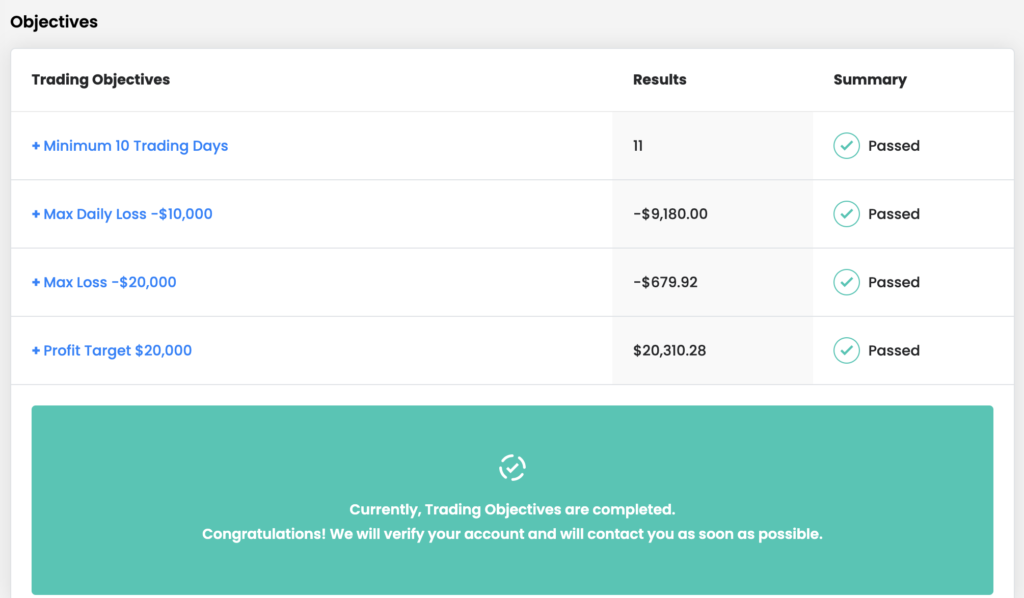

Today, I’m excited to share with you all, that I’ve passed the FTMO challenge for a $200k account and am starting the verification round as of 8/16/21.

By the way, I want to acknowledge that I’ve registered with FTMO to be an affiliate for the program because I truly do believe this is a solid way for responsible and experienced traders to make a living from their trading skills without needing to wait to amass a large account.

What is FTMO?

If you’re not already familiar with FTMO, it’s one of a handful of professional prop trading firms available, which provide six-figure funding to traders who exhibit discipline and use profitable strategies and strategic trading skills.

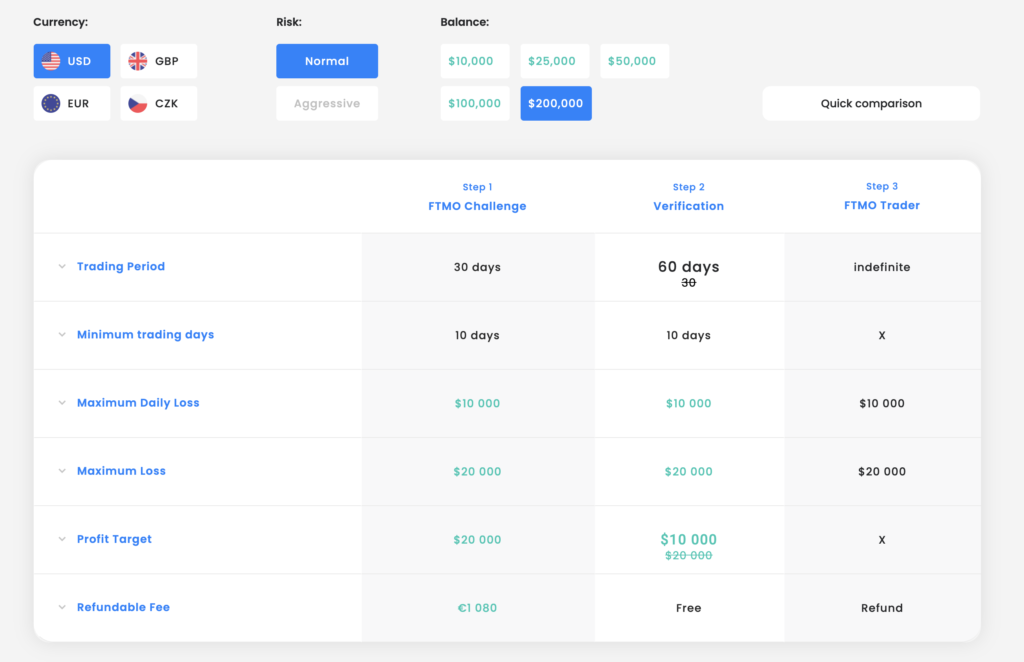

As with other prop trading firms, FTMO requires participants to first pass a trading challenge that has strict rules for a target profit you need to meet, how many days you can trade, how much you can lose on any day, and how much you can lose at any point during the overall challenge.

There is a fee to participate in the challenge, depending on how large of an account you’d like to manage, as well as the exchange rate between your currency and the Euro*.

Once you pass the challenge, you trade with FTMO provided funds, and every month you split your profit with the company. This works by sending FTMO an invoice in the amount you’d like to withdraw from your account. You get to walk away with 70% of the profit and FTMO takes 30%.

If you’re able to make 10% on a $200,000, you can end up with $14,000 paid out to you.

There are restrictions, of course, for how much you can lose on the account, and if you’re not responsible with your trading, you can lose your status as a funded trader.

While there’s quite a bit of healthy and reasonable skepticism about the reliability and trustworthiness of prop trading firms, I really do believe FTMO is one of the most well-documented firms to provide an honest and fair prop trading experience.

Before I decided to go for a prop trading challenge, I did quite a bit of research to determine which firm I’d like to trade with, and I felt FTMO was the best fit.

I will share what has worked for me and leave it to you, dear viewer, to come to your own conclusions as to whether you’d like to take a FTMO challenge or not.

My Trading Style

So Before I dive into what my FTMO challenge was like, I want to give you a little context regarding my trading style.

Here are three important aspects about the way I trade:

#1: My strategy is about 90% mechanical and 10% discretionary decision-making.

That means I keep very clear-cut rules for each step of the trade: the signal, the entry, the stop loss, and the take profit target.

My trading rules can be written down as a checklist which I can cross off one by one for every trade I take.

The only bit of discretionary decision-making I allow is for visually determining the direction that price is moving towards.

Otherwise, every other element has set rules.

Theoretically, I can put my strategy down on paper as one of those Yes or No flow charts if I needed to.

This leaves very little room for my own opinion and I like to keep it that way.

#2: I keep my trading very, very simple.

I only take one trade a day tops, and that’s if there’s a proper signal on the chart.

I also only allow an entry between 630am and 930 am PST, to trade during the crossover of the London and New York sessions.

Lastly, I only trade the EUR/USD.

So to summarize, that’s one trade, at one time of the day, with one currency pair.

#3 Once my trade order is submitted with a stop loss and take profit orders attached, I’ll either close my screen or read a book and only glance at the progress from time to time.

I don’t currently use complicated exit strategies, although I’ve found trailing stops to be helpful in the past.

I try to keep my time watching the charts to an absolute minimum.

By turning the screen off, I don’t tempt my creative brain to make spur-of-the-moment trading decisions.

However, doing a lot of backtesting on my strategy gives me more than enough confidence so that I can now watch my trade if I want to, without having any hard feelings if it goes sour.

***If you want to learn more about some of the best practices you can keep to develop your trading discipline and to avoid making costly mistakes as you learn, download your free excerpt to the book I wrote called The Seven Habits of Successful Day Traders, which is available in ebook format on Amazon***

My Experience with the FTMO $200k Challenge

Okay, so this $200k account is actually my third attempt at getting funded after starting my first challenge about two months ago.

My first attempt was for a $100k account and while my demo account was in profit, I lost 5.5% on a given day due to some position sizing mismanagement.

Feeling like I still had the potential to hit the target with my strategy, I ended up jumping back into another attempt two days after losing my first one.

Unfortunately, I found out too late that the tempo of my strategy depended on early wins from the beginning of the month that I had lost with the last attempt.

So I realized that while my strategy worked well for me when I was casually trading with my own small account without any profit targets, I needed something far more durable for a trading challenge that involves stopping and starting with different times in the economic calendar, and requires a larger profit target than the 4-8% per month that I was used to.

And perhaps that’s one of the important things to realize before jumping into the FTMO challenge.

While you’ll want to carry over your trading skills around risk management and discipline, even a profitable, homespun strategy may need some tweaking to meet the time-bound requirements of the challenge, as well as the profit targets.

My second challenge failed.

So before starting this third challenge, I got down to work and had a few ten hour days of focusing solely on crafting and backtesting a strategy that would both hit the profit target and stay profitable at any time of the month, not to mention, in any kind of market environment as well.

If I want to stay optimistic and focus on the benefits that come from frustrating experiences, I could say that the fees I spent on the first two FTMO challenges were the price of admission I needed to pay to get so worked up and determined to craft a far more profitable strategy than anything I’ve ever traded before, which I probably wouldn’t have bothered doing if I hadn’t made an attempt at prop trading.

I’m sure some of you reading this who have done this challenge, too, may also feel like doing a funded account challenge forced you to become a better trader than you were before.

I know for myself that I often have to put skin in the game to really learn from an experience, which is sometimes a very costly way to live my life, but I also implant lessons in my memory much better when emotion is involved.

Actually, I think this is true for most learners, as well.

So by actually paying for a challenge, I was more willing to find a solution than, say, give up, which is more of a reasonable choice when trading a free demo challenge.

I decided to go for a $200k account instead of a $100k account on my third challenge because after doing copious sessions of backtesting, I determined that trading a $200k account on my worst trading month would still result in enough profit to cover my monthly budget.

Third times the charm, right?

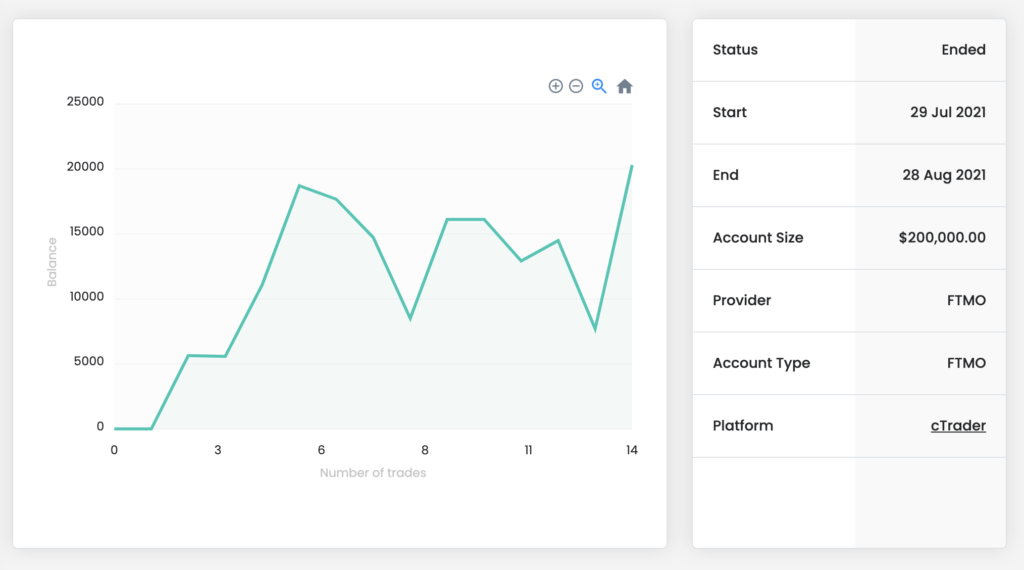

As you can see here on my equity chart, I started off with a number of successful trades and I think that having early wins really helped me carry into a string of losses with far more comfort and confidence than if I had started with only those losses.

With this challenge, because I traded only once a day, I allowed myself a slightly larger risk amount at 3% of my account .

I didn’t feel like trading a 200k account was any different from a 100k account or a $5k account which is what I was coming from.

I’ve trained myself to think in terms of Risk points or percentage points, so the account dollar amounts don’t mean anything to me.

If you haven’t already, I recommend conditioning yourself to think in terms of percentages. It can help take a lot of the emotion out of watching dollar amounts going up and down when you trade.

Remember that money is a placeholder for value and value is relative to the environment it exists in. Think about how you can earn 500 to 1000 points per hole when playing something like Skeeball, but only win one to three points when shooting arcade hoops. The winning skeeball player may need to gain seemingly more points than the winning basketball player, but either way, they both won.

Remember that money is a placeholder for value and value is relative to the environment it exists in. Think about how you can earn 500 to 1000 points per hole when playing something like Skeeball, but only win one to three points when shooting arcade hoops. The winning skeeball player may need to gain seemingly more points than the winning basketball player, but either way, they both won.

If you’re used to risking $100 on a $10,000 account but then get scared when risking $1,000 on a $100,000 account then just remember both of those positions are 1%.

You can handle a 1% risk, it’s no different whether that account is $1,000, $2,000, or $200,000.

Now, normally I would set a standard 2% risk on a trade as adjusted for the weekly balance in my account. But with this FTMO challenge, every time I would get close to the 10% target, I would start cutting down my risk to the amount that would allow for the account to hit 10% with that one win.

I’d also add an extra couple hundred of dollars to the risk as a buffer against slippages and commission.

So that means, as my account increased, I went from trading 3% a trade to 2% or even 1% a trade.

This allowed me to withstand a few losses without getting too far away from that 10% target.

After eleven days, I finally had my winning trade just this last Friday and boy did it feel SO good to see those green “Passed” statuses on my client homepage.

Beating the challenge is incredibly validating for my sense of skills as a trader, as my first few years of day trading involved plenty of disastrous mistakes, and reaching this stage to be able to pass a trading challenge with a solid strategy and trading routine feels like the effort and work put into learning how to trade were not for nothing.

Now, before I get too confident, I do still need to hit the verification challenge, which requires a 5% profit target instead of a 10% one, while maintaining all other restrictions, but I already know that I’m going to risk about 1.5% trade and will also progressively lower my % of account risked as I get closer to that target.

3 Things You Can Do to Pass the $200k FTMO Challenge

So on that note, let’s dive into what I believe to be three important things you can do to set yourself up for success before jumping into a FTMO challenge.

Whether or not this is obvious, the first thing you need to do before you pay for a FTMO challenge is to be fully honest with yourself regarding your profitability.

If I were to come over to your place and sit down at your trading desk, could you pull up some kind of document tracking your trades, or even your trading records on your brokerage account, could you show me evidence that you’ve been able to make a profit month after month?

It’s imperative that you wait until you have had success with trading before trying to get funded.

It’s already difficult to make a profit when trading on your own terms, but when you throw in the restrictions placed by FTMO, the pressure, and challenge that comes with trading increase.

Therefore, the second thing you need in order to ensure success before starting a funded account challenge is a profitable strategy that can meet the profit requirements of the FTMO challenge, whether you were to start trading at the beginning, middle, or end of the month.

Sometimes you don’t need to change your strategy in order to accomplish this, but instead change your method of risk management to hit this amount.

If you haven’t already, be sure to gather some data about your trading strategy by performing a solid backtest from at least the last three months.

Lastly, make sure you have a plan for meeting the requirements of the challenge. This can look different from your typical trading.

Consider the difference between studying a subject for retention versus studying to take a standardized test like the SATs.

There are often little tricks and tips you need to keep in mind to win the test that has nothing to do with actually understanding the content.

There are a couple of things like this that apply to prop trading challenges.

For example, if you hit the 10% target before the minimum ten trading days are up, you need to remember to sell a hundredth of a lot on all other days to meet the trading day requirement.

If you want to be sure to finish your challenge sooner than later, be sure to set these microtrades on days you don’t normally trade, as well.

For me, that means setting microtrades on Sundays, a day on which I normally don’t participate in the market.

So with that said, keep doing your research about the FTMO challenge before actually paying for anything.

Make sure you fully understand the requirements of the challenge, even if it means reading through the faq section multiple times and continuing to find personal anecdotes regarding other trader’s experiences.

It’s absolutely possible to develop yourself as a trader to make a living from your skills.

While it’s not necessarily a fast process, it’s definitely one you can achieve given the right amount of persistence, reflection, willingness to learn, and confidence in yourself.

I hope you all found this informative. Best of luck and strength, traders, and I’ll see you all out in the markets!

- Andrew

Latest posts