Before I dive into the details of this post, I just want to say a very big heartfelt shout out to all Ukrainians around the world – I am so sorry and in so much pain as I see all the suffering, war, and destruction that’s happening in Ukraine right now. This is an unethical move on Putin’s part and I genuinely hope that this war ends soon and that Ukraine can recover and repair the damage.

These are difficult times right now – all around the world, inflation is pretty bad.

Here, in California, gas is just about six dollars a gallon.

Like any market, global economies go through ebbs and flows as they play out boom and bust cycles. Hopefully, we are still in an uptrend overall and in time the world will repair and grow again.

Amidst this volatility, you may be learning how to trade right now – and wanting so badly to get into profitability, or at least make sense of the market.

Or perhaps you’re three years in and you’re in a fumble and you don’t really know what to do as markets are changing. Just when you think you may be gravitating towards clarity, suddenly volatility is all over the place and you’re just kind of stuck in information anxiety.

To help abate some of that anxiety, and clear away the confusion, I want to help you regroup and be able to center in on 7 things you can focus on doing in order to become a profitable trader.

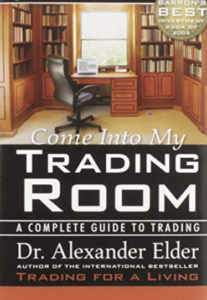

Now, I didn’t just pull these out of thin air. I actually derived these 7 ideas from Alexander Elder’s “The New Trading For a Living”. This is one of the first books I ever read on trading and I continuously go over and over again as I try to remind myself what do I need to be focusing on as I continue to grow as a trader.

<<This is also one of a number of books I personally recommend and have listed in a free guide that I’ve compiled just for you>>

You’re going to find that there aren’t only just trading books on that list but some other personal development and money management books as well. At the end of this article, I’ll touch on why I’ve included those other books.

So let’s dive in and go over 7 things every trader should be doing as they not only learn about markets but also grow into different levels of expertise.

In my notes, I call this list the “Seven Words of Fatherly Advice” from the trading father himself.

7 Things Every Trader Should Be Doing

1) Decide That You’re in This For the Long-Haul

Elder’s first suggestion is to decide that you’re in this for the long haul – for you, trading isn’t some dabbling activity. It’s not like when you go out and you just want to try quizzo for the first time and you know you can have fun with a one-off…no! You’re in this like you’re going to become the next star on Jeopardy.

You want to get into trading with a level of commitment where you know and anticipate that you will still be trading 20 years from now.

The kinds of things you’ll commit to doing in order to gain knowledge and endure the ups and downs that come with the experience will look different when you assume you’ll be in this for a long time versus just browsing with no true commitment.

2) Learn as Much as You Can

The second suggestion is to learn as much as you can, especially in the early stages. It’s really important to get a nice range of information from different sources – you don’t want to just follow one trader. Instead, you’ll probably look up a number of traders on youtube or you’ll probably read a couple of different books.

At the get-go, you want to be expansive and get a little taste of everything you can find in order to collect and later reflect on what to do with this information.

You’ll learn about day trading and scalping and swing trading…and then maybe after watching different videos or trying out different trading styles on your own, you’ll eventually decide on becoming a scalper or a swing trader. But at first, it’s a good idea to learn as much as you can.

The caveat that Elder gives (and that I think is the utmost of importance, too) is that it’s important to keep a healthy level of skepticism.

You can’t necessarily believe in everything you read or see, especially on youtube or other forms of social media.

It’s going to be up to you to filter this information through your own analysis and decide what might be useful what might be unfounded.

Following a bruce lee quote: Take what is useful, discard the rest, and basically come up with something of your own understanding.

3) Don’t Rush the Process

Elder’s third word of advice is to not rush this process. Don’t be greedy – don’t assume you’ll make money during the first couple of months.

You want to take this process slowly, especially if you’re in your first year, don’t start making any plans about quitting your day job.

Assume a slow learning process. Some people will compare day trading to getting a master’s degree – it can take a couple of years. You could try to get all your credits sooner but you tend to frustrate and overwhelm yourself in the process and maybe not do as well in certain courses as if you were to take the process slowly and maybe spend three years on a master’s degree instead of trying to do an accelerated one year.

So using that as an analogy for going into your first year of trading, don’t assume you’ll even make anything at the end of the year.

There’s common project management advice that says however much time you think it will take for you to complete a project, add in at least 30 percent more of a time buffer.

-Because things come up, mistakes happen, and you might not have all the information you need at the get-go.

You’re not a bad trader if you don’t make money your first year and you’re not even a bad trader if you don’t make money your second year.

It can take a lot of time to learn the skills you’re going to need to espouse in order to do well in the markets.

4) Be Able to Use Several Analytical Methods to Confirm Trades

Fourth, we’re getting more into the nuts and bolts, here. You’re going to want to have a way of analyzing the market. This is the aspect that most people pay attention to, as this involves having a strategy and being able to conduct technical or fundamental analysis.

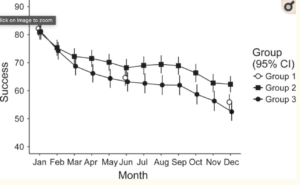

Elder goes on to add that you need to be able to use several analytical methods to confirm trades. He also recommends that you should test everything on historical data and be able to move with markets and know how to approach a bear market versus a bull market. Overall, anticipate that you’re going to need a variety of approaches for different market conditions and it may take some time to learn this, as well.

5) Develop a Money Management Plan

Fifth- and this is huge- Elder recommends that you develop a money management plan. He explains that there should be three main goals with profiting in the markets and they’re ordered in level of importance:

A. Have a long-term plan

B. Aim for steady growth

C. Have high returns

That’s the order you should approach this. For your first couple of years of trading, you are probably just going to focus on making sure you can stay consistently profitable over the year even if you’re not returning a lot.

As you grow as a trader, then you can start looking to hit regular targets for steady growth. This could be profiting every month or every quarter, depending on your style of trading.

Your third goal is to eventually hit a high-profit level. You’ll see this more in experienced traders, maybe going to the fifth sixth year and beyond, where you have a foundation, you’re solid in your discipline, and now you’re looking to increase the amount of profit you make each month. Of course, Elder goes into this more deeply in his book and I do recommend that you check it out to learn more about money management.

6) Remember That the Trader is Always the Weakest Link in a Trading System

I almost want to write it down as a note and put it on my computer to remind myself. He says that it’s important to remember that the trader is always the weakest link in a trading system – not the strategy, not the risk management plan, but the trader. Obviously, the trader is the person who decides the risk management strategy and which strategy to use or whether to enter in impulsive trades or not, because the trader is in command.

Given this information, it is crucial to understand your own weaknesses as you trade and this is something that I don’t think anyone’s going to be able to tell you.

You’re going to have to observe it within yourself.

Elder adds that you need to have a way to examine yourself and be able to cut and end those impulsive trades.

That’s gonna have a lot to do with psychology – you can learn a little bit about this by talking to other traders or learning from the mistakes of other traders, but the most important tool you’ll ever have to understand your psychology and gain control over yourself as a trader is to conduct a trading journal.

Keep track of what you’re thinking and doing as you perform in each trading session and review those entries regularly.

7) Winners Think Differently From Losers

It may be hard to conceptualize now, but how you think in this moment in your current trading sessions will look vastly different from how your mindset will work and the way your thought process will unravel as you’re trading in the future.

Elder specifically writes that you are going to need to change and develop your personality.

This is huge!

This is implying that what it takes to grow as a trader is going to involve work that expands beyond what you think about when you think about trading.

You’re going to have to develop your personal self – you’re going to have to grow into emotional maturity in order to reach that high-level success you’re aiming for.

This is why in the resource guide I list a number of personal development books that have made a huge impact on my life and my own trading, which may make a big impact on yours, as well.

Other actions, like going to therapy or maybe getting on medication if you’re struggling with a mental health illness, are also crucial tools you can use to develop yourself as a trader.

Other actions, like going to therapy or maybe getting on medication if you’re struggling with a mental health illness, are also crucial tools you can use to develop yourself as a trader.

Remember that who you are now and who you will be when you are a profitable professional trader are two different human beings and there will need to be growth and some steps taken to get to that place.

It’s not going to happen overnight, so it is very much in your interest to get into the field of personal development if you want to grow as a trader. I often recommend books for this research because there’s no better way to start thinking like someone else than to hear their thoughts and their words inside your own head.

—

So these are just seven of the most foundational steps you can take to continue on your journey as a trader. There are others out there, but I think this is a very concise list if you’re ever feeling lost and you just want to regroup. I think you could use these seven reminders almost as a checklist to ensure you’re doing the things you need to do in order to profit as a trader.

I hope everyone stays strong and be prepared to deal with a continuation of this volatility in the coming weeks. I wish you nothing but the best of strength and luck in the markets – take care!

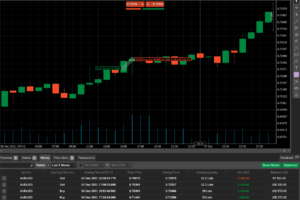

ow, I’m looking at ways to scalp either the end of the New York session or the Asian session.

ow, I’m looking at ways to scalp either the end of the New York session or the Asian session.

Step 2) Know Your Why

Step 2) Know Your Why By understanding why you are doing this thing, you will feel more committed to the challenge. And bringing that emotion to your goals is a big catalyst in helping you stay on track over the long run.

By understanding why you are doing this thing, you will feel more committed to the challenge. And bringing that emotion to your goals is a big catalyst in helping you stay on track over the long run.

So these three books are a great place to start if you’re looking to either begin your day trading career or finally achieve some of your long-standing trading goals. I can’t emphasize enough that reading is a trading edge if you can make it a habit. You’re going to find much more thoughtful and well-structured advice from a book than a mishmash of youtube videos you find online.

So these three books are a great place to start if you’re looking to either begin your day trading career or finally achieve some of your long-standing trading goals. I can’t emphasize enough that reading is a trading edge if you can make it a habit. You’re going to find much more thoughtful and well-structured advice from a book than a mishmash of youtube videos you find online.

This basic information helps you understand the parameters and outcome of the trade.

This basic information helps you understand the parameters and outcome of the trade. Here’s an example from the

Here’s an example from the

However, just showing up and putting in the hours every day isn’t the approach that separates the greats from the common.

However, just showing up and putting in the hours every day isn’t the approach that separates the greats from the common.  Some of the first books on trading that I ever read were Alexander Elder’s Come Into My Trading Room and his other book The New Trading For a Living.

Some of the first books on trading that I ever read were Alexander Elder’s Come Into My Trading Room and his other book The New Trading For a Living.  It comes with incredibly clear instructions for how to use the Effic method to create a system of goals but one of its features I find particular useful for us traders is that there a space to not only plan your day, but also pre-plan your week so you can make sure there’s time for every important task you need to complete.

It comes with incredibly clear instructions for how to use the Effic method to create a system of goals but one of its features I find particular useful for us traders is that there a space to not only plan your day, but also pre-plan your week so you can make sure there’s time for every important task you need to complete.  So to avoid losing money, you’re going to need to mix in some added simulated practice time with your regular trading and I think backtesting a strategy is one way to do this well.

So to avoid losing money, you’re going to need to mix in some added simulated practice time with your regular trading and I think backtesting a strategy is one way to do this well.

Latest posts