When I first taught myself how to day trade, I needed to be very strategic about how much time and effort I put into developing this incredible skill.

I needed to have enough time to also do my course work, write, sleep and take breaks to help my fatigue, as well as perform other daily tasks to keep my life managed.

I expect that you have your own priorities and responsibilities that you need to take care of while also giving enough time and attention to learning what you need to know to make money from the markets.

To make the most of the limited time I had in a day, I created a study routine for myself that follows the 80/20 rule.

What’s the 80/20 rule, you ask?

This is also known as Pareto’s Principle. Pareto was an economist in Italy during the 19th century and through his fieldwork and research, he concluded that 80% of land in the region was owned by 20% of the individuals. Now, the principle itself isn’t actually attributed to Pareto. About a century later, a management consultant developed Pareto’s observation into a theory known as the law of the vital few.

This implies that often in nature, 80% of results are gleaned from only 20% of efforts. It’s a principle that can theoretically be applied to any endeavor.

What this means for us as trading students is that often 80% of information or experience that actually makes us into effective and profitable traders will come from only 20% of the resources and activities we pursue as we learn.

Thus, when I sat down to make my study plan, I wanted to ensure that every moment I used to develop myself as a trader would be effective and worthwhile.

So I’m going to share with you a plan and routine you can keep to make sure you’re making the most of your trading education while also achieving profitability in the markets earlier than you would have if you just haphazardly watched youtube videos and tested the markets with half-baked trading ideas. Let’s get started.

How to Create a Forex Study Plan in 5 Steps

Okay traders, we’re going to create a study routine that can get you trading for profit in just five simple steps.

[If you’d like to download a free pdf of these instructions with an additional list of my most preferred Forex resources and books, click here.]

[If you’d like to download a free pdf of these instructions with an additional list of my most preferred Forex resources and books, click here.]

First, before diving deep into a book or course on trading, you’re going to want to state your trading goals and preferences.

In his book, Talent is overrated, Geoff Colvin distills some of the performance and excellence research conducted by Anders Erikson at Florida State University. It turns out that for many fields, including athletics and music, as well as business and medicine, excellence isn’t a genetic trait but rather a skill that anyone can master given the right kind of effort and mindset.

However, just showing up and putting in the hours every day isn’t the approach that separates the greats from the common.

However, just showing up and putting in the hours every day isn’t the approach that separates the greats from the common.

Erikson and his colleagues discovered that high performers make use of something they call “Deliberate Practice.”

This means that the practice sessions of the people who best excelled in their field were highly intentional – they focused on key movements or skills that were unique to their goal and position.

So when you’re looking to learn more about Forex, maybe at first you’ll want to explore a general survey of what people do when they trade Forex, but you’re going to want to dwindle your focus to a key couple of types of trading and skills in order to perfect your style.

For example:

- Are you looking to day trade, swing trade, or include forex as part of an investment portfolio?

- Do you want to use purely technical analysis or some fundamental analysis in your trading?

- Do you want to learn how to trade a variety of different candlestick patterns or do you want to stick to a mechanical, clear-cut strategy built from indicators?

- Do you have just an hour or two to spend in front of the charts or are you able to spend forty hours a week following every move the market makes?

If you’re not sure as to what you’d like to do, you can start by watching brief tutorials on any of these trading styles and begin with the study material I mention under Trading 101 on the resource list. [Need a copy? Click here]

Step 1: State Your Trading Goals and Preferences

Once you have a clear idea of what you’d like your trading to look like, create a couple of goals that can help guide what kind of content you’ll want to study.

For example, I like short-term trading on the 1-hour or lower time frames. I prefer mechanical strategies that let me trade for an hour or two during the crossover of the London and NYC session.

Therefore, I’m going to want to focus on resources that cover scalping strategies, technical analysis with price action and indicators, as well as non-trading-specific resources that teach me more about discipline and emotional and behavior management so that I can follow my mechanical rules to a T each day.

Step 2: Gather Resources

After you’re able to describe what you’re looking for in a trading practice, you can move on to the second step and begin to gather information on your specific style, as well as reviewing material that covers trading psychology, risk management, and general forex and trading principles.

This is where the 80/20 principle is going to come into play.

You want to focus on resources that teach you key skills that support your style of trading.

It’s also highly beneficial to seek out sources that cover personal development and personal finances, as your discipline and character in these two additional areas will have an effect on your mindset as you trade. Whether consciously or subconsciously, we tend to bring our full selves to the desk when we trade.

If you have trouble controlling your behavior around your family or friends, then you’re going to have issues controlling your behavior in front of the charts.

Profitable traders tend to exhibit a degree of discipline and organization in their lives and wealth management outside of trading, so it’s highly encouraged that you work on these areas as part of your forex education.

If you’re brand new to forex, I recommend starting with free resources like Babypip’s education series and looking up basic tutorials on youtube. I will warn, however, that some of Baby Pip’s material can get really dense and may feel slow when all you want to do is just start by learning an easy strategy and build from there.

You can also look for authors, bloggers, and social media creators who either have what you want or teach in a style that resonates with you. When I first learned how to trade forex, I got through about midway of high school level of baby pips before losing interest.

You can also look for authors, bloggers, and social media creators who either have what you want or teach in a style that resonates with you. When I first learned how to trade forex, I got through about midway of high school level of baby pips before losing interest.

I ended up getting a lot more out of reading books that I could easily reread and mark up or highlight the information I found most beneficial. I encourage you to make reading or listening to audiobooks a part of your study approach, since authors may put more research, reflection, and editing into their published content than you get with a quickly crafted video on youtube or blog.

While I believe Big Publishing companies have their own gatekeeping methods and agendas they like to protect, they also create a more rigorous editorial process so that the information you receive is more accurate, reliable, and responsible in its promises and suggestions.

Wiley is a popular publisher of books on markets, investing, and trading, so you can expect a level of professionalism with books that are published through them.

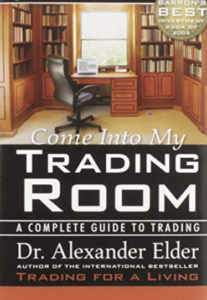

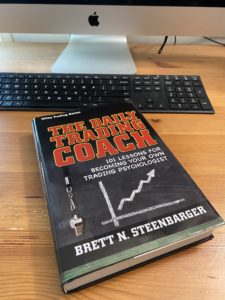

Some of the first books on trading that I ever read were Alexander Elder’s Come Into My Trading Room and his other book The New Trading For a Living.

Some of the first books on trading that I ever read were Alexander Elder’s Come Into My Trading Room and his other book The New Trading For a Living.

When it comes to building up discipline and understanding the psychological forces not only in the markets but also in your mind as you watch your account balance fluctuate, I find reading self-help books incredibly beneficial. Combined with a strategy I created, James Clear’s Atomic Habits is one of the most useful texts I studied to build my own profitable trading system and rules.

If you’d like to see my full list of recommended resources, again, be sure to use the sign-up link in the description box to receive a free pdf of this syllabus.

Step 3: Create a Study System and Schedule

So now that you have your goals, and a list of resources that can help you develop your skills as a trader, your third step is to create a study system and schedule. I’m going to make some recommendations from the world of efficient study methods and hacks.

So when we’re learning something new, it can be really beneficial to engage with content and material about the topic on a daily basis.

Ideally, you’ll want to aim for 30m to 1 hour of time each day devoted to consuming content from your list.

The goal is to make this a regular routine that is consistent and frequent. One of the best ways to develop a study habit is to select a time each day that you feel the most energized and can easily block off for this commitment.

For many people, that can be during the morning before work or school and for others it could be after dinner or your kid’s bedtime when you know you are done with other priorities for the day and can focus without interruption.

One of James Clear’s suggestions for creating a habit that lasts is to stack a new habit on top of a current one.

So if you have a habit of drinking a cup of coffee every morning, you can make reading about day trading part of your coffee routine. Ideally, only tack it on to other habits that let you stay focused on learning and keep your hands free so you can write or type notes.

Furthermore, if you don’t already, it is highly recommended to use a planner to keep your tasks organized and to make sure you have the time you need to invest in your forex education.

When you know what resources you want to study, you can even plan out when you study each item and schedule a deadline so you don’t end up spending five months trying to finish one book. I’m going to guess that you want to develop your skills as a trader as fast as possible, so getting the right information as soon as you can is going to benefit your progress.

For example, when I was learning how to trade, I would include the books and courses I was using as part of my tasks list. I would take the book, look up how many chapters it has, and then decide how many weeks I want to commit to reading this book.

So if the book had twelve chapters, and I wanted to finish it in four weeks, then I would make a weekly goal of reading three chapters of the book. Then, during each weekday, I could read half a chapter or a chapter, depending on how much time I had to commit to studying. Sometimes things don’t go according to plan, so having a weekly goal helped to give me some wiggle room in case I needed to move most of my reading to one particularly free day of the week.

I would do this for each resource. The same thing for baby pips, I would give myself a weekly target for the number of lessons I wanted to finish.

While you may not hit your target exactly, the point is to create a visible plan you can tweak and adjust to make sure you regularly get the information you need to develop yourself as a trader.

Success Hack: Use a Planner

I’ve been using planners for over twelve years and finally found one that is perfect for me.

It’s the Effic planner, named for the productivity method crafted by Dave Ruel and taught in his book, Done by Noon, which aims for that ideal combination of efficiency and efficacy that can be hard to achieve without staying organized.

It comes with incredibly clear instructions for how to use the Effic method to create a system of goals but one of its features I find particular useful for us traders is that there a space to not only plan your day, but also pre-plan your week so you can make sure there’s time for every important task you need to complete.

It comes with incredibly clear instructions for how to use the Effic method to create a system of goals but one of its features I find particular useful for us traders is that there a space to not only plan your day, but also pre-plan your week so you can make sure there’s time for every important task you need to complete.

It also has a convenient notes section that is useful for when you want to create new tasks based on what you learn from your trading or your studying, but don’t want to try to plan out all at once.

For example, today when I was responding to some traders on Instagram, I got an idea for a checklist I wanted to make for myself for when I start my next prop trading challenge. I was able to quickly jot this down in my notes before continuing to write my message.

At the end of the day, there’s a box I check off for the process of reviewing notes and turning them into future tasks. It’s so useful! After reading Dave’s book and using his planners this entire year, I reached out and asked to be an affiliate.

So if you want to learn more about this special style of using a planner, you can use my affiliate link to explore the Effic homepage and get a set for yourself. So actually creating a plan and routine for my day trading studies made the process more efficient and systematized.

(If you’ve been following me for a while, you may know that I am a sucker for systems-building.)

I also made a point of watching youtube videos made by forex traders while I ate meals.

If you ask anyone who is learning a language, they’ll say an important factor in their ability to achieve fluency is exposure. You’re going to want to expose yourself to a wide array of information when you’re first starting out and then incrementally focus on content that is specific to your preferred style.

However, not all content is created equally. if you find yourself falling asleep through a suggested book or questioning its validity by fifty pages, it’s okay to dump that resource for something else.

So this is how Pareto’s principle will work for us.

You’re going to have a process of searching for resources, studying the content, and then when you’re done, you’ll look for a new set of resources that will be influenced by what you found useful from your last list.

This is what’s known as a reiterative process, one that you perform over and over again but make important tweaks along the way that lead to overall improvement.

Step 4: Create a Master Notebook

This brings us to our next step, which is to take notes that you reflect upon to make your own trading system and regularly review these notes so that you can internalize the information.

There are two ways I like to take notes.

One is to first read the material or consume the material without taking any notes, but instead, try to comfortably focus on what the person is talking about.

If I’m reading a book, then I’ll highlight sentences that I want to remember later. After this first round, I’ll go over the material a second time and take notes, or if it’s a book, I’ll go back to my highlighted sentences and take notes from those passages.

The other method is to take notes as you go, taking time to pause the video or put a bookmark in your book so you can focus on writing down the information.

Other note-taking methods include using a recorder for your voice instead of writing something down.

I find notetaking beneficial for avoiding needing to re-read or re-watch the entire resource when I just want to quickly collect that information again in the future.

Remember, we’re looking for a select 20% of resources that will give us 80% of our improvement in our trading skills. So when you find that golden content and information, you’re going to want to regularly review it.

I like to share what I’m reading each week in the disciplined fx newsletter and 70% of the time I share books that I’m re-reading for the fifth sixth or even seventh time. I leave that 30% for new books that may approach a similar topic with some nuance or share a new method. Reflection is key for developing reflexive best practices.

Think about how martial artists will drill the same move over and over and over again.

Your notebook should become your ultimate 80/20 resource.

By reviewing your notes regularly, such as every month or returning to the material that originally helped you become profitable when you’re hitting a slump, you create a pattern of review.

Step 5: Apply What You Learn

Step 5: Apply What You Learn

This leads us to our last step, which is to take what we learn and put it into practice.

When we want to get good at something, it’s often encouraged to try to put in as many repetitions as we can.

That was another feature of the deliberate practice methods Erikson discovered in his study of master performers. They would focus on practice that required many repetitions and could give immediately feedback so as to make adjustments and improvements quickly.

We want to fail fast so we can learn from the process and improve as quickly as possible.

It’s easy to determine such practice activity when you’re a musician or an athlete, as you can focus on playing the same couple of bars of sheet music or throw the same swing over and over again, but It can be difficult to find ways to practice trading without being irresponsible and overtrading.

Demo trading is useful for getting started, but it cannot replicate the added layer of emotional distress that comes when trading with real money. I usually recommend traders start by using a small account of a hundred bucks or less instead of a demo, so that you don’t have to worry about learning with unrealistic simulators.

Demo trading is useful for getting started, but it cannot replicate the added layer of emotional distress that comes when trading with real money. I usually recommend traders start by using a small account of a hundred bucks or less instead of a demo, so that you don’t have to worry about learning with unrealistic simulators.

Again, You want to expose yourself to charts and taking high probability trades and performing diligent risk management without overtrading.

So to avoid losing money, you’re going to need to mix in some added simulated practice time with your regular trading and I think backtesting a strategy is one way to do this well.

So to avoid losing money, you’re going to need to mix in some added simulated practice time with your regular trading and I think backtesting a strategy is one way to do this well.

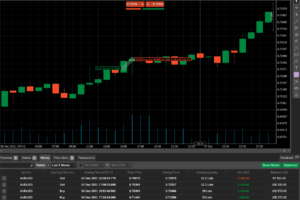

By using your broker’s charts or a tool such as Trading View’s backtest bar replay or even Thinkor Swim’s simulated trading replay, see if you can find ways to put in some practice time each day. If you don’t know what strategy to use, there are many forex education materials that also provide simple strategies.

You can begin with such a strategy and run it through a series of manual backtest sessions.

Remember, this isn’t about getting quick data about your results so much as it’s about getting exposure to the charts for when your strategy does and doesn’t work.

So with these five steps of determining goals, gathering useful educational materials, making a studying schedule and system, as well as taking notes and practicing what you learn, you can create a study routine that’s organized, systematic, and effective. Many traders, myself included, use a mix of self-lead study and courses to achieve profitability with refined day trading skills.

Your journey to profitability will likely take time, effort, education, and lots of reflection on your performance as a trader.

I wish you all the best of strength and luck and I’ll see you in the markets! Take Care!

ow, I’m looking at ways to scalp either the end of the New York session or the Asian session.

ow, I’m looking at ways to scalp either the end of the New York session or the Asian session.

Step 2) Know Your Why

Step 2) Know Your Why By understanding why you are doing this thing, you will feel more committed to the challenge. And bringing that emotion to your goals is a big catalyst in helping you stay on track over the long run.

By understanding why you are doing this thing, you will feel more committed to the challenge. And bringing that emotion to your goals is a big catalyst in helping you stay on track over the long run.

So these three books are a great place to start if you’re looking to either begin your day trading career or finally achieve some of your long-standing trading goals. I can’t emphasize enough that reading is a trading edge if you can make it a habit. You’re going to find much more thoughtful and well-structured advice from a book than a mishmash of youtube videos you find online.

So these three books are a great place to start if you’re looking to either begin your day trading career or finally achieve some of your long-standing trading goals. I can’t emphasize enough that reading is a trading edge if you can make it a habit. You’re going to find much more thoughtful and well-structured advice from a book than a mishmash of youtube videos you find online.

This basic information helps you understand the parameters and outcome of the trade.

This basic information helps you understand the parameters and outcome of the trade. Here’s an example from the

Here’s an example from the

However, just showing up and putting in the hours every day isn’t the approach that separates the greats from the common.

However, just showing up and putting in the hours every day isn’t the approach that separates the greats from the common.  Some of the first books on trading that I ever read were Alexander Elder’s Come Into My Trading Room and his other book The New Trading For a Living.

Some of the first books on trading that I ever read were Alexander Elder’s Come Into My Trading Room and his other book The New Trading For a Living.  It comes with incredibly clear instructions for how to use the Effic method to create a system of goals but one of its features I find particular useful for us traders is that there a space to not only plan your day, but also pre-plan your week so you can make sure there’s time for every important task you need to complete.

It comes with incredibly clear instructions for how to use the Effic method to create a system of goals but one of its features I find particular useful for us traders is that there a space to not only plan your day, but also pre-plan your week so you can make sure there’s time for every important task you need to complete.  So to avoid losing money, you’re going to need to mix in some added simulated practice time with your regular trading and I think backtesting a strategy is one way to do this well.

So to avoid losing money, you’re going to need to mix in some added simulated practice time with your regular trading and I think backtesting a strategy is one way to do this well.

Latest posts