For years, I’ve been struggling with an undiagnosed chronic illness that has robbed me of my energy, ability to sleep well, and peripheral vision. I was knocked off my original career path and decided to learn how to day trade in order to obtain income and a way to afford quality, results-based healthcare. (If you want to learn the longer story, read this two-post series)

Before I became ill and fatigued, I was a highly active person – weight-lifting, biking, jogging, yoga to name a few of my favorite activities. I loved to cook and make healthy and creative meals. I was devastated to lose my progress and joy in these endeavors, but even now, I make a point of lifting, slow jogging, and stretching when I can.

Nonetheless, trading with a chronic illness is incredibly difficult. I routinely miss my early morning trading sessions, the most opportune times to trade for my strategy, in order to catch up on sleep. Unfortunately, this sleep doesn’t ever leave me feeling refreshed, so the cycle continues.

So too, having a foggy brain leaves me slow to act on some trades or taking less trades than what the signals call for. I also have occasions when I completely forget the rules of my strategy and need to take time to review the rules (This is another reason why I keep my strategies as simple and mechanical as possible).

Because of all these issues, I have taken a highly organized and simplified approach to trading. Creating systems that are simple and easy to repeat through routine have made trading for profit possible in such conditions.

So coming from the perspective of someone who has both experienced extensive fitness and then extensive illness, I can say with candor that one of your greatest tools for success in trading is to take care of your body and mind.

Why does your physical and mental health have such an impact on your trading?

Think about what fatigue feels like:

- Your body is sluggish

- Your energy is low

- Your brain is foggy

- You are slower to respond to urgencies

- You will more likely pick creature comforts over somewhat painful, yet effective action

- It’s a vicious downward cycle – the more you feed into the fatigue with comfort (like fast food) or create short-term energy boosts (from sugar, coffee, or sodas) the longer it lasts

- Sometimes lower self-esteem and outright depression/anxiety

In this state, do you think you can make good trading choices – the decisions that will override some of the more emotional impulses that come with trading?

In my experience, it only adds to the challenge of trading for profitability.

When you feel exhausted and have low energy, it can be difficult to want to follow your trading rules, wake up or stay up for your trading session, or be able to effectively evaluate a trade (should you apply discretionary tactics).

When you have natural energy, the opposite happens:

- You have a clear mind

- You can better manage your emotions

- You feel more positive and in control

- You’re quicker to respond to urgencies

- You can better handle any setbacks

An energized trader can better handle the inevitable losses, routinely show up for the trading session, manage impulses and emotions, as well as have the drive and energy to do the extra work that comes with learning about trading (whether that means working through trading books, courses, videos, or spending a handful of hours back-testing)

Now, there’s also something to be said for rest and recovery, I believe taking breaks and enjoying creature comforts can actually boost your health over the long run, but the key is in the dosage – when partaking in any of these activities for the majority of your week, then problems ensue.

Having energy is a physiological phenomenon – that is, there’s a physical, bodily component as well as a psychological one.

Let’s go over how you can improve each one.

How to Improve Your Physical Energy

How to Improve Your Physical Energy

There are two factors that will affect your physical energy more than anything else:

- How you move your body

- What you put into your body

By addressing these two areas many other activities that increase energy become easier to do (such as getting enough restful sleep, as well as working on mental energy practices).

Move Your Body

It’s ironic – creating stress and depleting your energy stores through exercise actually improves your energy over the long run.

Many of us don’t move enough.

From the Industrial Revolution onward, people are spending more hours standing or sitting in one place. We do far less physical work or walking than the humans of the past.

Nowadays, we have to make an effort to include movement in a daily or weekly routine.

Some of the best ways to get a healthy dose of exercise:

- Lift-weights/Resistance Training

- Jog

- Walk

- Run

- Do yoga

- Play sports (softball, racketball, tennis, basketball, etc.)

- Go on solo excursions (hiking, surfing, skiing, etc.)

- Pick up a martial art

Try to get in around 150 minutes per week of movement that increases your heart rate, suggests Dr. Michael Greger. Adding in resistance training, regardless of your body or health goals, is also important for maintaining muscle mass.

What I Do:

- Lift 2-3x/week (Usually 3-4 exercises for up to 3 sets per exercise; Basic comprehensive movements like bench press, split squats, deadlift, shoulder press, pull-ups, etc.)

- Slow-jogging 3-5x/week

- My partner and I have an interesting (and therapeutic!) routine of going on long walks when we want to talk about something that’s difficult in our relationship or personal/individual problems

- I also like to wear a FitBit and use that to help track whether I’m walking enough each day or not

Put Good Things In and Leave Bad Things Out

The second crucial component to improving your physical energy is to be very mindful of what you consume.

Think about the importance of clean food in this way: So few things in this world have such an intimate relationship with us as the food we eat. It’s literally going INSIDE you. It’s important to keep high standards for nourishment.

A lot of folks have a hard time deciding what’s healthy to eat because the information on what’s healthy is outright confusing:

- One day the media says eggs are bad. A few months or years later, the media says eggs are good again

- You see people who cure diseases or experience dramatic weight loss by eating a specific diet (vegan, paleo, keto, carnivore, etc.)

- Thousands of diet books are published each year

- Research papers on nutrition give myopic or contradicting results

- Food packaging misleads with legality-safe terms like ‘natural’, ‘no artificial xyz’, ‘no hormones’ to convey healthy as a marketing trait, but the food item itself contains hidden unsafe, unhealthy ingredients

Given all this, you may not know where to start. Or you’ve started but don’t see any results.

Finding a healthy approach to eating that works for you will be a research project that extends further than what I can write here, but in my own research for using nutrition and diet to help heal a broken body, I’ve found that most successful dieting plans focus on these three things:

- Eat more plants (preferably vegetables)

- Eat whole food items (that is, there is one ingredient and it’s the food itself – think “apples” instead of “apple pie”

- Avoid sugar

Starting with these three easy and basic rules, you can discover a personal diet that leaves your body feeling healthy, able to digest and assimilate the nutrients that fuel your mind and energy.

What I do:

- I eat a vegan, plant-based diet

- The majority of what I eat is whole-food sourced: lots of bananas, spinach, kale, cacao chips, flax seed, apples

- Some of what I eat is processed: brown-rice pasta, sugar-free pasta sauce, plant-based protein powder

- I get the majority of my calories and meals through making smoothies. It’s so easy, just toss everything in and press the button. Does the chewing for you!

- Every now and then I get take out from places like Chipotle, Waba Grill

- I like to drink coffee and green tea, although I probably should quit caffeine at some point given my sleep issues

- I rarely drink and don’t do any recreational drugs

I want to also note that there are a few other things that “go in” that can dramatically affect your energy, such as alcohol, caffeine, supplements, drugs, and even air quality and toiletry products

Keep in mind, if you want to protect and increase your energy:

- Caffeine is best consumed in moderation or not at all

- Your caffeine source should also be a simple ingredient (think black coffee, green tea, not soda or energy drinks)

- Modern agricultural practices have depleted the soil and decreased the nutritional value of even whole food sources, thus taking supplements for possible vitamin and mineral deficiencies can help

- If you work or spend most of your time in one room, getting a quality air filter can help clear some of the air. Overall, be mindful of whether you’re breathing in toxins regularly or not

- Consume alcohol in moderation and never while trading; it’s also advisable to discontinue using recreational drugs, especially marijuana, due to its tendency for causing chronic brain fog. We need to keep you sharp!

How to Improve Your Mental Energy

This second area concerns the thoughts you keep and the mental health care practices you include in your routines. I’ll keep it brief since I wrote about mental health routines here, but it would be incomplete to recommend energy-boosting without also mentioning your mindset.

When it comes to improving your self-confidence and energy through your psychology, more than anything else, staying positive will serve you well. Instead of believing that you can only be happy when good things happen, I encourage you to start believing that good things happen when you’re happy.

Under this philosophy, you take responsibility for choosing your mindset and setting the tone for your daily life.

It took me a long time to realize this, but I firmly believe now that as long as you’re doing at least a little bit of something to help your physical well-being and you’re not experiencing any mental health disorders, a positive attitude is a choice.

Again, I’m telling you this as someone who has lost everything and has had to carve a path out of a deep pit to survive- choosing to stay positive and always trying your best to find the lessons and opportunities in bad experiences will improve your chances of achieving what you desire by 10x.

To help yourself stay positive:

- Think of yourself as a learner and every experience an opportunity to find out more about life, trading, etc.

- Think of life as a game or puzzle and your challenges will help you level up and improve

- Take time to be grateful for the good things you have (if you don’t know where to start, having access to internet is amazing! Think about the thousands of years people went without it – you could have been born back then, but instead, you’re lucky to be here now!)

- Let yourself play – have hobbies and down-time to enjoy activities that make you laugh, smile, and even get silly.

- Pick up a meditation or journaling practice – you will come to better understand your thoughts and better notice their diversity when you take time to reflect

- Create expectations and a schedule for yourself that’s as realistic as possible – taking time to plan 3 big things you need to do each day goes a long way to helping you feel in control of your time and life

What I like to do:

- When problems come my way, I immediately start researching who else has experienced and overcome this problem in order to find out ways to solve it – in this way, I spend less time dwelling and more time doing

- I organize my time and make sure I have plenty of gaps in my schedule for rest or the unexpected. I’ve used a planner for over 12 years to track what I need to do each month, week, and day – I couldn’t imagine life without it

- I meditate regularly and am working on getting back into a daily practice

- I leave evenings open to play games, hang out with partner/friends, watch movies, read

- When I think my problems feel like too much, I think about all the other people who have come and gone, having lived through tragedies and traumas that truly exceed what I’m personally going through – I also see suffering as ubiquitous, something that is a shared human experience and this helps me feels less lonely in my unique situation.

Bonus Tip: Identity what to prioritize. If your diet would make a nutritionist gasp, don’t worry about exercise just yet, instead start there since you’ll feel the greatest relief by improving this one thing.

All in all, if you were to pick even just one action to take from these two major categories, you’ll be sure to see some improvement in your energy levels and happiness. While most of the above may seem trivial to trading, it’s just the opposite.

You bring your whole self to your trading desk.

Not just your trading skills, but also your psychology, your body, and your energy.

What you do when you’re not trading matters too. When you understand and implement this hack that most traders ignore, you significantly increase your chance of making it in the markets.

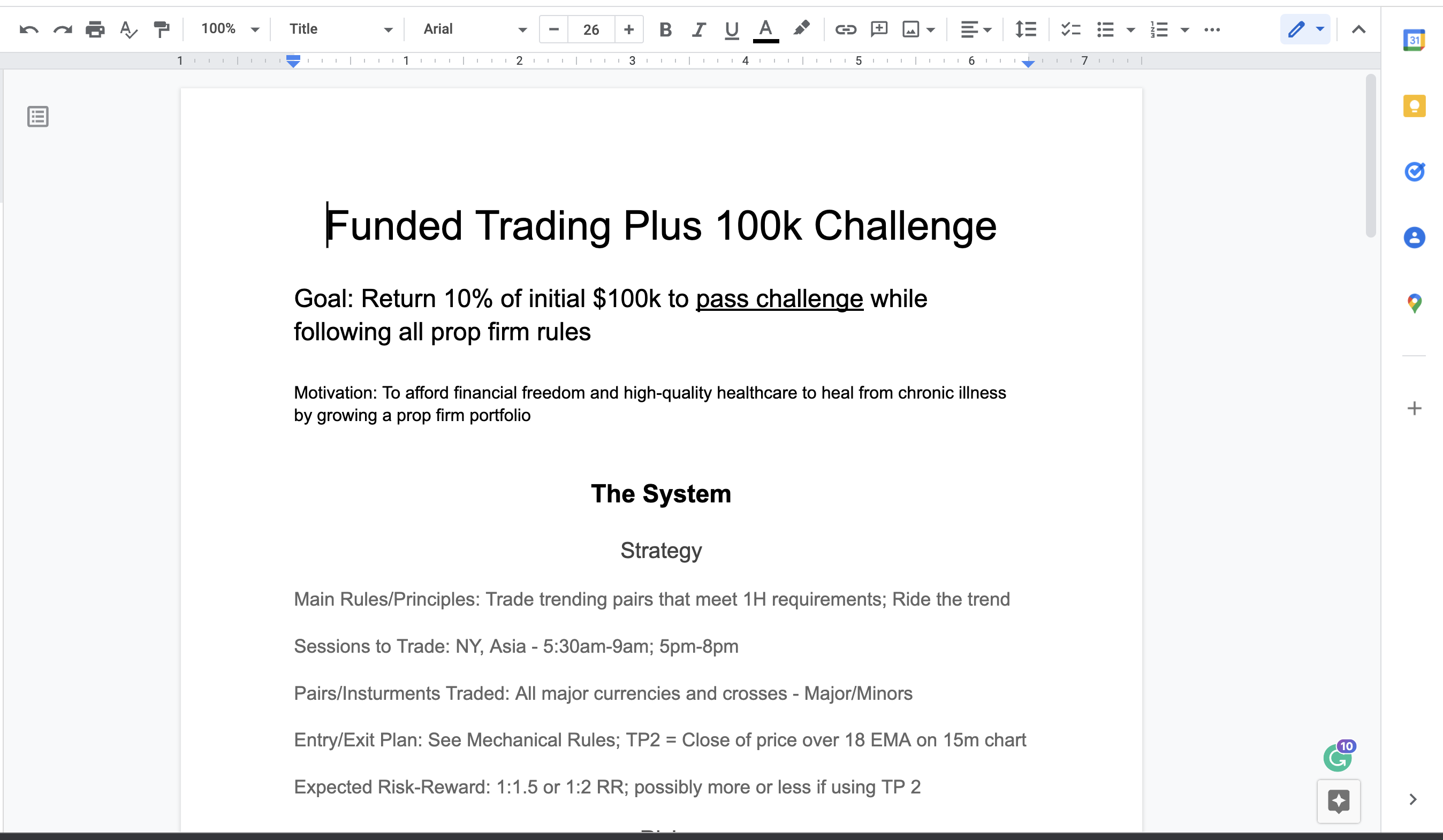

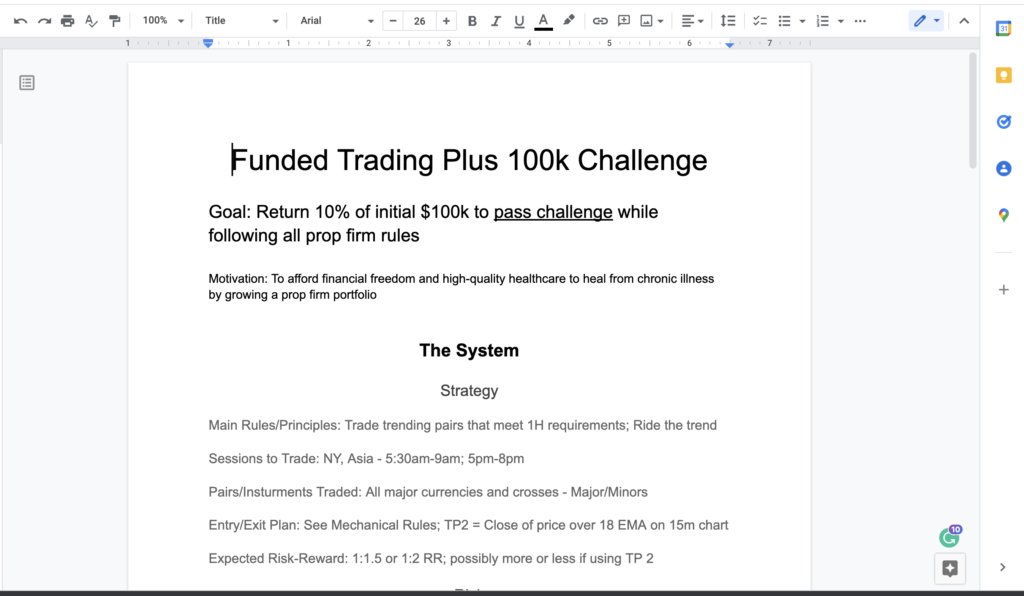

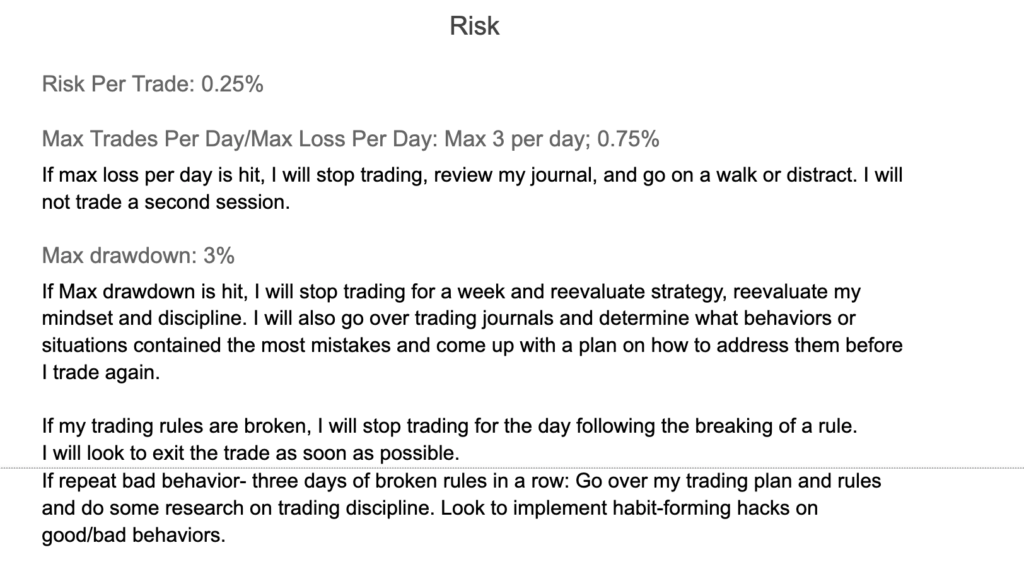

Whether you write a plan for each of your strategies you perform or a plan for each phase of a prop trading challenge, the beginning of every trading pursuit or goal you aim for needs to have a trading plan.

Whether you write a plan for each of your strategies you perform or a plan for each phase of a prop trading challenge, the beginning of every trading pursuit or goal you aim for needs to have a trading plan.  2. Goal

2. Goal

Other actions, like going to therapy or maybe getting on medication if you’re struggling with a mental health illness, are also crucial tools you can use to develop yourself as a trader.

Other actions, like going to therapy or maybe getting on medication if you’re struggling with a mental health illness, are also crucial tools you can use to develop yourself as a trader.

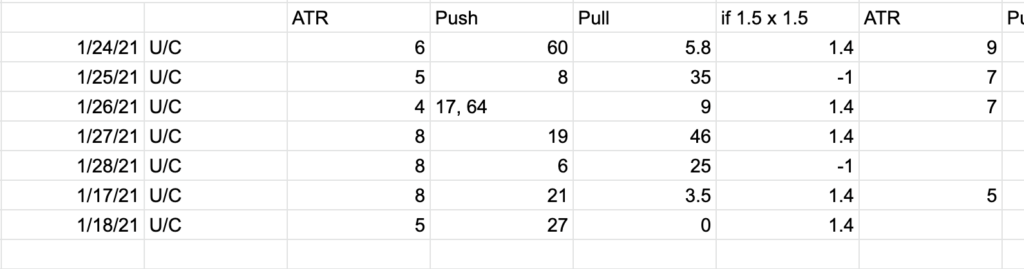

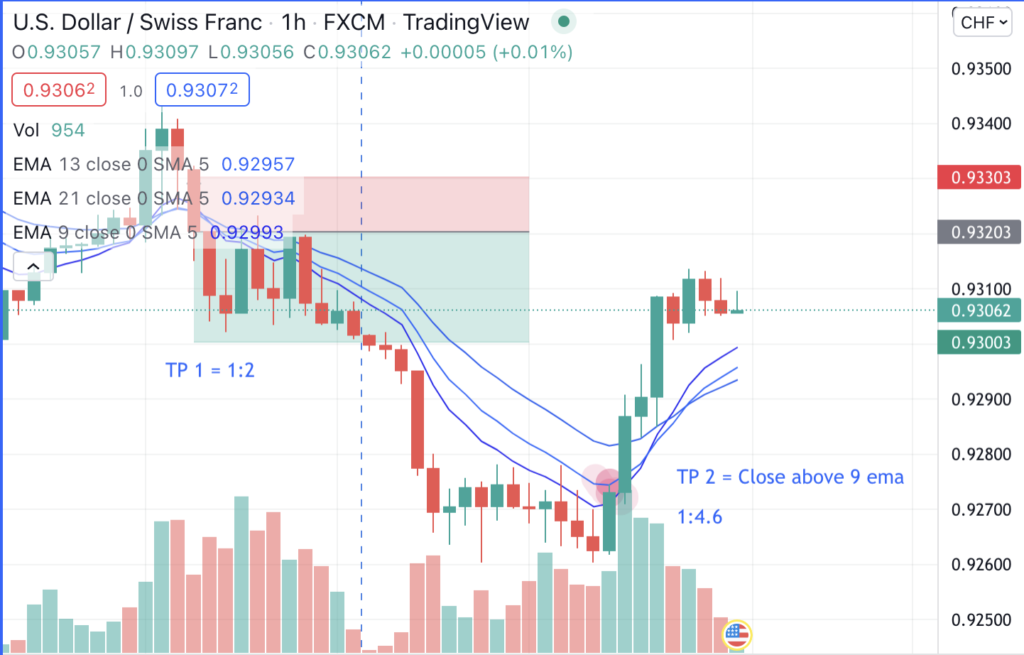

Mechanical strategies can be fairly easy to learn, as long as the conditions for signal, entry, exit, and trade management are clearly described in rules. They’re also easy to program if you want to get into algorithmic trading and have a bot submit trades on your behalf. But every mechanical strategy has periods of drawdowns as they don’t necessarily adapt to new changes to typical market behavior.

Mechanical strategies can be fairly easy to learn, as long as the conditions for signal, entry, exit, and trade management are clearly described in rules. They’re also easy to program if you want to get into algorithmic trading and have a bot submit trades on your behalf. But every mechanical strategy has periods of drawdowns as they don’t necessarily adapt to new changes to typical market behavior.

ow, I’m looking at ways to scalp either the end of the New York session or the Asian session.

ow, I’m looking at ways to scalp either the end of the New York session or the Asian session.

Latest posts