As retail traders and laypersons in the world of finance, many of us first became aware of Forex markets through the function of currency exchange when traveling to another country or watching YouTube videos of other individuals, making what seemed like a quick buck, by using technical analysis. On this personal level, it’s easy to only ever have a superficial understanding of what Forex is – a means to exchange money and make money.

Yet this overly simplified view of Forex markets leads people to think of trading as one would think of hitting the Black Jack table in a Vegas hotel – a service to make or lose money with the hit of a button or the wave of a hand. A gamble, a place of trickery meant to separate you from your money that if you can only figure out its secrets, then you would be able to strategize profit.

In actuality, we traders play only a tiny role in the greater mechanism that is the Forex market. Our orders help provide liquidity and can be a way for bigger players (like banks and investment institutions) to make some (but not all of their) profit off of our ignorance. Yet this market does not solely exist for us to trade it.

There are more fundamental purposes to Forex than to make money off of its fluctuations in price.

Some of you may know that I am currently pursuing a Ph.D. in business.

I’ve been in the world of academia my entire adult life and can attest that while research studies can be overly simplified, highly political, and not always an accurate reflection of a more complex reality, overall the information is still useful and helps with forming models of the way the world works.

Last semester, I took a course in global business practices.

One topic for the course was foreign exchange markets. (Naturally, I chose this as my research topic for my final paper). What I learned from this study and research is that the foreign exchange market is a integral tool for microeconomic and macroeconomic activities in a highly globalized world. There are academic and business models for understanding how Forex works, who it serves, what its purpose is, and how it should be monitored when making international business strategies

The goal of this article is to share with you (as simply as I can) an understanding of how business schools teach and model the Forex market as it is integrated with the world of global finance.

By having a more academic and industry-focused understanding of the Forex markets, you can trade more confidently, choose strategies that profit off of the integral principles of market fluctuations, and develop a professional-level conception of what Forex is.

In this article, we’re going to answer three questions from the perspective of a university-level textbook on global management practices:

- What are the functions of the Forex market?

- What determines exchange rates and can we predict these fluctuations?

- How do international businesses understand and use the Forex market?

At the end, I’ll make a few reflections on what this all means for us traders and which trading strategies I believe best incorporates these theories.

The textbook I am referencing for this piece is Global Business Toady by Charles W. L. Hill (2022).

The Foreign Exchange Market: Textbook Definition

For centuries, business enterprises around the world have engaged in trade. Different societies and countries have issued their own form of currency that allow for economic exchange within their borders. The paper and coin, itself, don’t carry much value – what money can be exchanged for and in what amounts is what gives it its value.

When traders and businesses seek to exchange goods across national borders, often the currency of one country must be exchanged for another in order to conduct transactions in the other country (and reversely, be able to bring back currency that can be used in the home country).

On the most basic level, the foreign exchange market exists so that individuals, businesses, banks, and governments can convert one currency into another in order to conduct international business.

The currency’s exchange rate is the amount it will take to convert the first currency into one unit of currency for the other. This rate changes for a number of reasons, and the changing rate allows us the opportunity to get in and out of the market at different prices in order to make (or lose) money.

As the world has become more globalized, with nations highly interdependent on each other for trade in order to access modern societal resources and services, the forex market is more important to international business than ever before. There is no way we would experience today’s level of globalization without it.

What are the Functions of the Forex Market?

As mentioned in the definition above, the main role of the forex market is to exchange currencies in order to conduct international business transactions. I’ll use the term “business” here, but this also includes the activity of banks and investment firms as well.

Companies will come to the forex market (usually by way of a bank) to convert the currency from exports into the businesses’ preferred currency (usually its home country currency), to exchange the income it receives from foreign investments or from licensing agreements with foreign firms.

So too, international businesses need to use the forex market to exchange their home currency into the currency needed to purchase foreign goods and services. Smaller firms especially prefer to be paid in their home country’s currency.

Businesses will also invest in international money markets for short periods of time and need to convert their home currency into the currency of the bank they wish to invest in – for example, a Canadian firm may exchange Canadian dollars for Koreon Won if they wish to earn a higher interest rate in a South Korean bank than they would in a Canadian one.

Apart from acting as the marketplace to change one currency into another, the forex market allows for a number of other functions that international businesses depend upon in order to increase profit and manage risk.

The next function we’ll discuss is forex’s role in providing an opportunity for businesses to hedge against inherent risks when conducting international transactions.

When a business enters the forex market in order to change currency, like us traders, it risks losing money with fluctuations in the exchange rate between the time it acquires currency and then later seeks to convert it back into its home currency (or vice-versa). Some businesses will hold positions in other currencies or in direction with a negative exchange rate while awaiting a major purchase or sale to a foreign company to avoid losing extra money when it comes time to convert funds back to the home currency.

Businesses, like traders, also partake in currency speculation. They can “park” their cash for a few weeks or months in a forex investment. One kind of investment businesses may undertake is that of the carry trade – which is the act of borrowing in one currency where interest rates are low and then using those funds to invest in another currency with a higher interest rate. This is a popular activity with the Japanese Yen, as it has historically maintained a low interest rate, and can be converted into US dollars where interest rates are higher. Nonetheless, even the carry trade holds risks as exchange rates always run the possibility of going against favor.

Lastly, governments are also a big participant in the forex market – maybe not to the degree that banks are, but when a government decides it wants to intervene and manipulate currency value, it can buy back or sell currency reserves, which can drastically affect the exchange rate. Note that governments keep reserves of international currency, not just their own. Governments may choose to manipulate the currency market in order to protect against inflation, keep its currency stregth strong, or inversely, as is the case with Japan, keep its currency weak so as to maintain a prime economy for international exports. In this way, the forex market can serve as a lever for countries to manage and control national economy.

What Determines Exchange Rates? Can We Predict Their Fluctuations?

In order to address what determines the exchange rates in the forex market, let’s discuss some of its attributes.

Keep in mind – the forex market is not centralized and located in any one place. It is a global network of banks, brokers, and dealers who are all connected by electronic communication systems, which help minimize differences in exchange rates across the globe.

Interest in the forex market has significantly grown over the years. In 1986, the average value of forex trading was about $200 billion per day. By 2019, it was closer to $6.6 trillion per day. The most important trading centers that harbor forex activity include London (accounting for 43%), New York (accounting for 17%), as well as Zurich, Tokyo, Hong Kong, and Singapore (accounting for about 5-6% each). Forex is a market that never sleeps, unlike the stock market.

One other important consideration regarding the nature of the forex market is its reliance on the US dollar to ensure liquidity, even for transactions not involving the dollar. For instance, let’s say you want to trade yen for pesos. There is a greater market of sellers and buyers for people looking to exchange dollars for yen and dollars for pesos than there is a market for directly transferring yen into pesos. This method adds an extra step, but the dollar’s dominance ensures that any currency transaction can be completed. Therefore, the dollar is known as a vehichle currency and is a key currency to watch when navigating the forex market.

One other important consideration regarding the nature of the forex market is its reliance on the US dollar to ensure liquidity, even for transactions not involving the dollar. For instance, let’s say you want to trade yen for pesos. There is a greater market of sellers and buyers for people looking to exchange dollars for yen and dollars for pesos than there is a market for directly transferring yen into pesos. This method adds an extra step, but the dollar’s dominance ensures that any currency transaction can be completed. Therefore, the dollar is known as a vehichle currency and is a key currency to watch when navigating the forex market.

So how might the rate of exchange between currencies be determined and what causes these rates to change?

From an academic standpoint, there are a few theories as to what determines rates in the forex market. However, while each of these theories account for price fluctuations, the market itself is hgighly complex and there is no consensus, even among academics and economists, as to what forces price change. Therefore, it’s important to contemplate the few factors in common that exchange rate theories consider and include them in your comprehensive understanding of forex markets before determining how to strategize your trading approach.

A common starting point for understanding how exchange rates are determined is to use the model of currency value as an indicator for the economic state of a country. When an economy is robust, it logically follows that its currency value should be strong, as investors flock to invest in its currency and underlying economy. This is seen with the strength of the US Dollar, as the United States is historically considered a stable economy, with a nurturing environment for capitalistic pursuits, and an economic value that is one of the most innovative and productive in the world. Thus, it may take more of a different currency with a less robust economy to trade for a single dollar.

Under this theory of exchange rate as an indicator of economic health, one would strategize that any good impact on a country’s economy will help increase its rate of exchange while any negative news would decrease it.

In many ways, fundamental analysis depends on the news and economic reports that indicate such changes in an economy’s health, and thus, its rate of exchange with other currencies. Arguably, news and reports indicating changes to an economy do affect rates of exchange. It’s important to note, though, that fundamental approaches tend to work better with long-term investments than they do for short-term predictions.

However, economic health alone cannot justify all market movements. As explained in an earlier example, Japan’s government intervenes to keep interest rates low and the yen cheap. It benefits them as a country dependent on exports to keep their economy healthy. So too, news events that may seem like a benefit to a country’s economy can often result in no change or reversal of expected fluctuations to its exchange rate. Thus, there must be more to the determination of rates beyond inherent economic health. It’s useful to know the underlying intentions behind each country’s economic policy and goals, and the ways banks may seek to invest accordingly.

Theories on exchange rate changes tend to agree upon three important causes:

- Inflation

- Interest rates

- Market psychology

Inflation

Theoretically, if you can predict what a country’s inflation rate is going to be, you can predict how the value of its currency may change. Inflation occurs when the amount of circulating currency in an economy increases in supply. When there’s an issue of more money in supply, it becomes easier for banks to borrow from the government and for businesses and individuals to then borrow from banks. Often the increase in credit leads to increase business activity and spending. However, if there isn’t enough value generated into useful goods and services from the increase in supply of cash and credit, then inflation follows. Governments may tell their central bank to issue more money in order to finance public needs (like the building of roads, paying for defense, or supporting businesses and citizens during a pandemic) in lieu of asking for more tax revenue (since most folks get upset when they have to pay more in taxes). However, economic inflation also tends to lead to price inflation and a more difficult economy for participants in that economy. Theoretically, a greater supply in currency results in its depreciation against currencies of slower monetary growth on the foreign exchange market.

Therefore, it’s important to consider a country’s policy towards monetary growth when taking positions in the forex market. A government committed to controlling the rate of growth of a currency and keeping future inflation rates low may lead to a stable or stronger currency exchange rate.

Zero inflation isn’t exactly realistic or healthy for a country that needs to experience continuous growth in order to create new solutions and new value for its people. For the United States, a target of 2% inflation over a year is a typical goal, but can change when underlying current events dramatically affect the markets and economy.

Interest Rates

Interest rates are the country’s set base rate for borrowing money. When banks borrow from the government’s central bank, this is the rate at which they borrow funds and this rate is passed down to the loans the banks issue to individuals and businesses, often at a varied, higher rate so that the bank can profit and account for risk of default.

When inflation is high, interest rates are often raised in order to help slow down the borrowing and spending of cash. Inversely, a country can decide to lower interest rates so as to encourage growth in the economy.

When constituents of a central bank are thinking of increasing interest rates, the members are often called “Hawkish” and those who wish to lower rates are considered “Dovish”.

Since we already discussed how inflation affects currency value, it logically follows that if interest rates are changed in order to address the rate of inflation, then interest rates are also a crucial component in predicting currency exchange rates.

Keep in mind that businesses and individuals also seek to make money off of interest rates – they may choose to convert their currency to another country’s currency if the higher rates give a good return and the underlying economy is stable enough to trust that the money will stay safe in its banks. This also helps slow down inflation as there is less money in circulation.

Central banks will make decisions about whether to raise or lower interest rates based upon economic reports and overall market sentiment. This is why investment firms, banks, and fundamental analysts follow and take positions based upon certain economic reports, as the numbers can point to whether a change in interest rates may be necessary. Some of the biggest economic news releases that affect the decision to change interest rates include unemployment and non-farm payrolls, consumer price index, and GDP.

Market Psychology

Classical economists often generated theories on economic motivation and change under the assumption that all market participants are rational and interested in making intelligent decisions. Reality, however, confirms that all humans, even the most rational, are influenced by emotions – the strongest being, when it comes to participating in the markets, greed and fear.

One of the most famous examples of the extent psychology can affect even the most notable of investment firms is seen with the story of how George Soros decided to make a large bet against the British pound in favor of the German Deutsche marks in September of 1992. When Soros made this order, many other traders reacted to herd mentality, since Soros’ reputation was so strong and his opinion highly revered, and a bandwagon effect unfolded. Thus, the pound drastically dropped against the Deutsche marks as more traders entered sell orders and the outcome of a weakened pound became a self-fulfilling prophecy. There were no other major shifts in economic news, the value changed solely because of emotionally-made choices.

While Soros’ story is legendary due to the size of the market value involved, this bandwagon effect occurs daily, especially on shorter time frames. Since even the best of investors are subject to overreacting to news, changes in the market become even harder to predict because the magnitude of the reaction depends on the emotional thinking of the trader or investor and the size of their trades.

Thus, market psychology also plays a role in affecting exchange rate changes. It is difficult to know how every player (or at least the major players) may react to certain news or economic releases and this factor further complicates the ability to accurately predict rate changes.

How Do Businesses Use Forex?

The answer to this question has been sporadically noted throughout this article, but I’ll summarize a list here.

All businesses, including banks and both international and domestic businesses may participate in the foreign exchange market for the following reasons:

- To change currency in order to purchase goods or services from another country

- To change currency in order to receive home currency for goods or services sold in another country

- To make an investment in another country’s bank or market

- To trade based on short-term speculation

- To hedge against major exchange rate fluctuations while undergoing an international transaction

While the activity of businesses in the forex market is far less impactful than that of banks and investment firms, their activity does account for a lot more of the daily liquidity than that of us retail day traders. Thus, it’s important to be mindful of their presence and why they are participating.

Given This Information, What Kinds of Forex Strategies Should Retail Trades Use?

First, I want to emphasize that trading is tough. Investing is tough. There is no one approach to Forex to ensure 100% accuracy for predicting rate change. This is already confirmed by academics and economists. Therefore, the best and most profitable strategies depend upon taking positions due to their probability of predicting where the market will most likely go next.

No matter your strategy, at the end of the day, remember that you are trading an idea of how the market might behave – it’s never certain, and you must always be open to being wrong about your prediction. This is Forex Psychology 101 – be humble, and don’t get frustrated, not every trade is going to be a winner because even the best analysis cannot predict every market player’s intentions and actions.

That said, on a fundamental level, I believe trend trading and using trades that follow market trends or their retracements is at the root of most profitable strategies. It takes into account that the big players who are following fundamental approaches and trading with the most money (i.e. banks and investment firms) will likely move in similar ways. Trends can take into account herd mentality as well.

When big players have a consensus on market analysis, a trend will result. While the details of such a strategy, like the inclusion or exclusion of indicators, price action, or trendlines, and other drawings, will differ, beginning with an intent to discover trends can be a useful approach to building a profitable forex trading strategy.

One other takeaway I perceive from this review of the involvement of businesses in Forex is that their large orders (sometimes sized in millions of dollars) are entered slowly, often near the same exchange rate price, which can further give weight to the reliability of trading Smart Money Concepts, which focus on taking trades as price moves from one area of mass orders to another.

This approach can be difficult to learn, as there are many different ways traders define and manage such an analysis. Some traders do a better job identifying these areas than others. I’m currently working on an approach that is very clear in its rules for market structure and where to enter and exit trades. I hope to launch a course update with this information sometime in late Spring or Summer of 2023.

Conclusion

As retail traders, it’s easy to get so consumed in the private dependency on Forex markets for making an income that we fail to remember that the foreign exchange market is a large beast serving multiple functions. These functions include exchanging currency when traveling from place to place but also provide international businesses and banks a tool to make a global market possible.

Without the technological efficiency of the forex market, the speed of value creation from multi-nationally sourced products would be hindered. Forex is a key component in making possible the food you eat (likely grown in multiple different countries), the technology you use (with major parts developed in various countries of Asia yet assembled and designed in America and other Asian countries), and even the clothes you wear. Take a look around you and you will find many products you own come from companies that have relied upon the Forex market in order to make international business deals possible.

We can take this understanding and recognize that not every move in the market is intended to steal our stop losses – most of the fluctuation occurs because of the entry of large transactions, sometimes due to currency conversion for businesses, but mostly due to banks and investment firms attempting to make a large investment based upon longer-term economic outlook. We can realize that the strategies we hope to profit from should take into account the reality of the market and that at the end of the day, no one approach will predict every change and move.

I hope this university-level research and explanation can benefit you on your own trading journey. If you want to get notified of more DFX content, please be sure to sign up for the newsletter below!

As always, best of strength and luck!

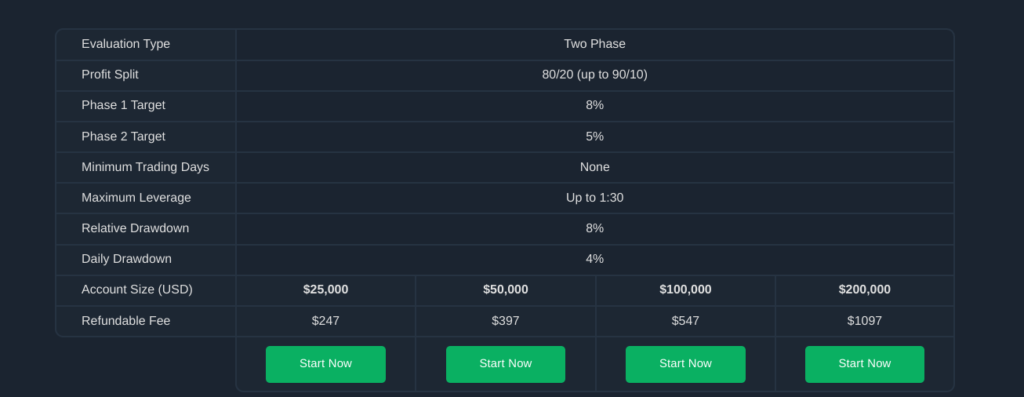

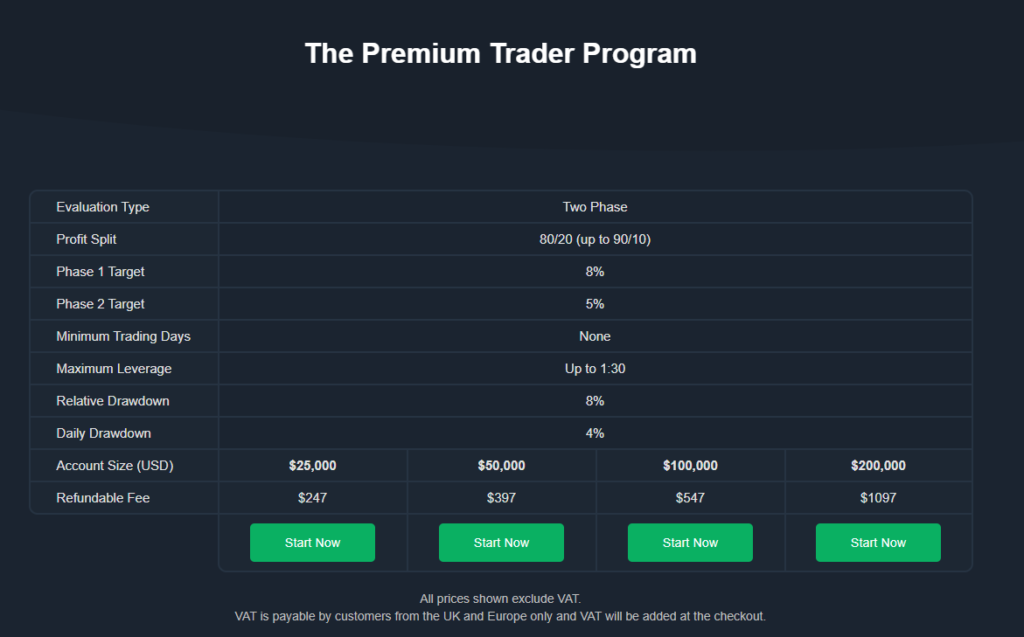

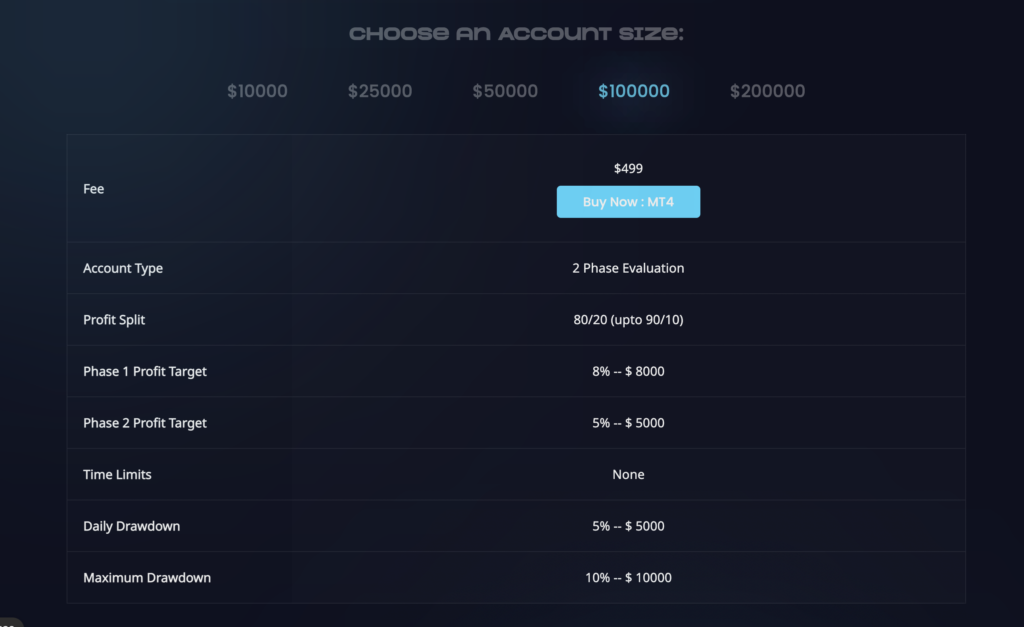

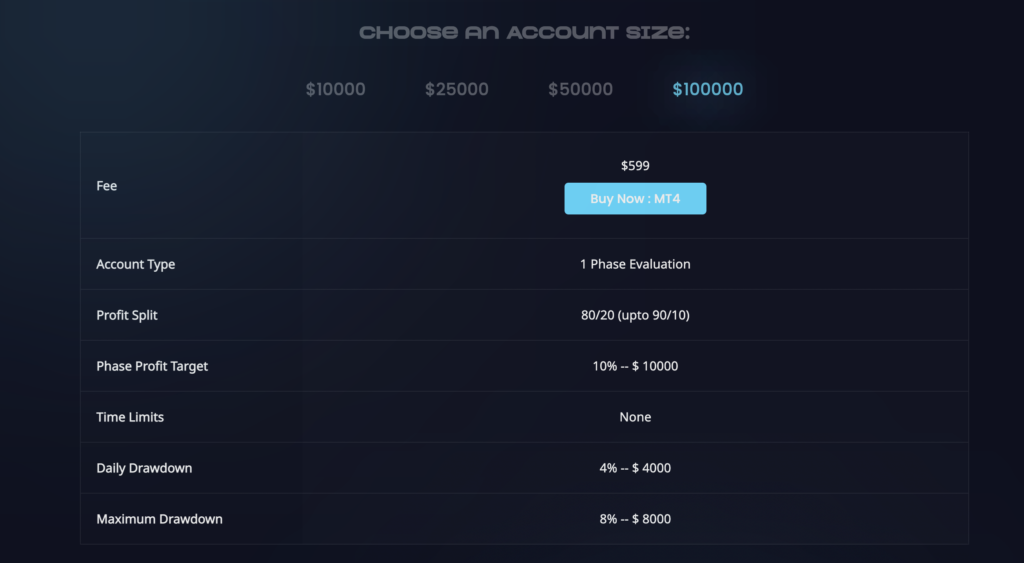

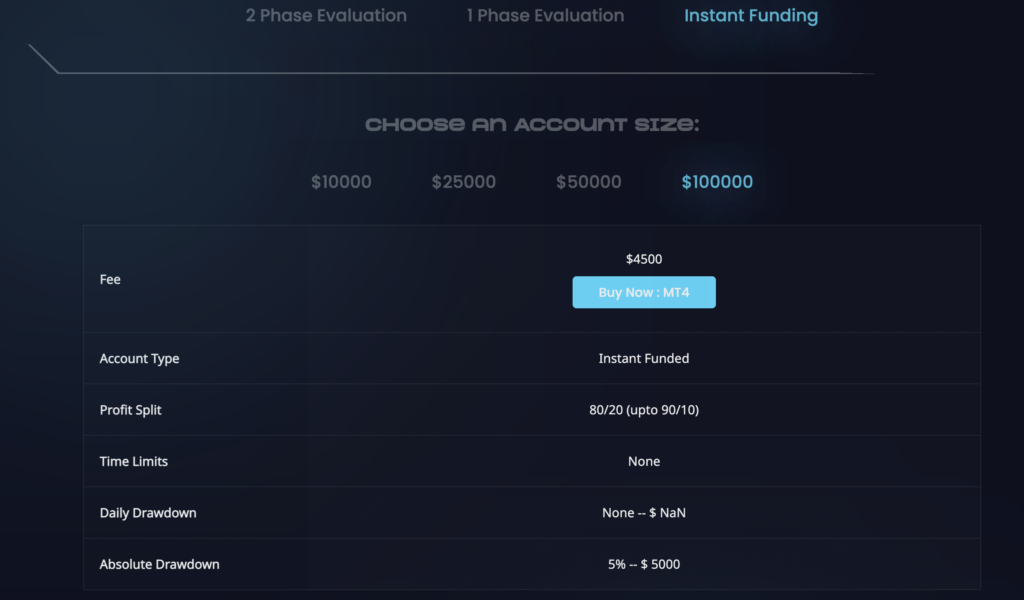

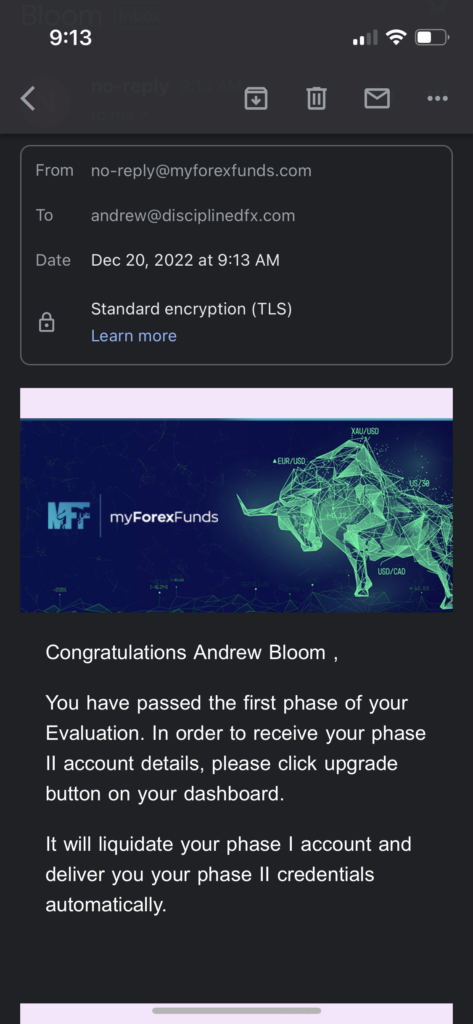

One way new prop firms made themselves more attractive than

One way new prop firms made themselves more attractive than

Well, don’t worry, I’m here to catch those tears when they fall.

Well, don’t worry, I’m here to catch those tears when they fall.

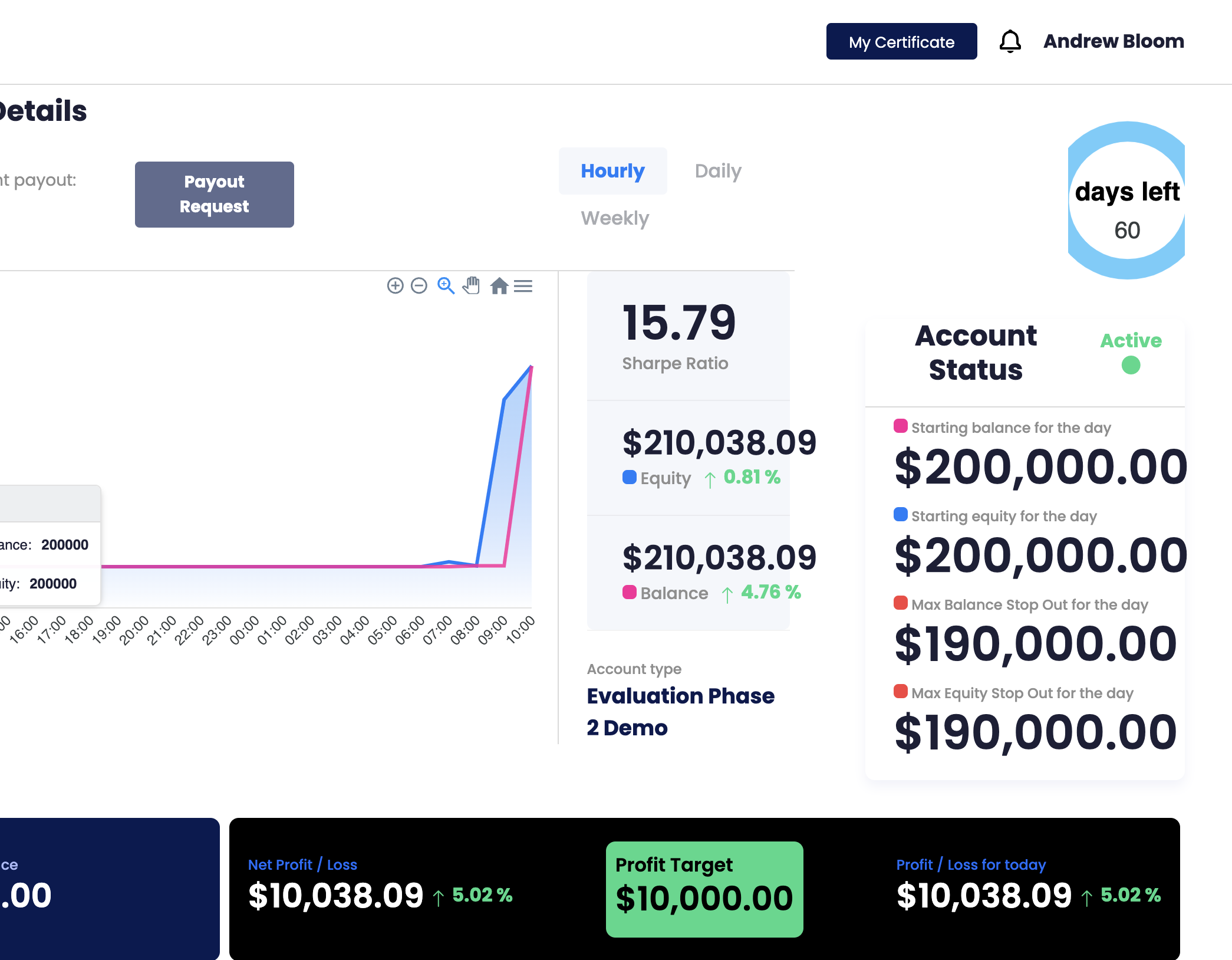

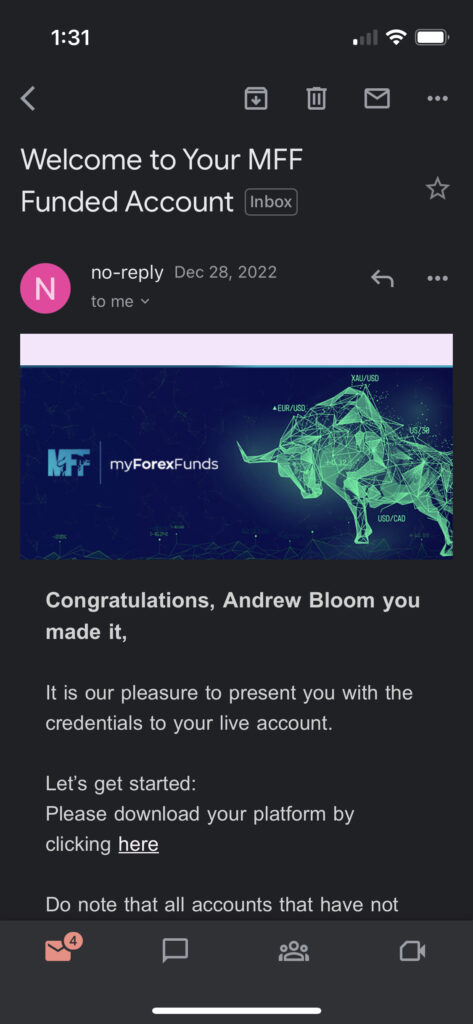

And when you DO get funded…

And when you DO get funded…

One other important consideration regarding the nature of the forex market is its reliance on the US dollar to ensure liquidity, even for transactions not involving the dollar. For instance, let’s say you want to trade yen for pesos. There is a greater market of sellers and buyers for people looking to exchange dollars for yen and dollars for pesos than there is a market for directly transferring yen into pesos. This method adds an extra step, but the dollar’s dominance ensures that any currency transaction can be completed. Therefore, the dollar is known as a vehichle currency and is a key currency to watch when navigating the forex market.

One other important consideration regarding the nature of the forex market is its reliance on the US dollar to ensure liquidity, even for transactions not involving the dollar. For instance, let’s say you want to trade yen for pesos. There is a greater market of sellers and buyers for people looking to exchange dollars for yen and dollars for pesos than there is a market for directly transferring yen into pesos. This method adds an extra step, but the dollar’s dominance ensures that any currency transaction can be completed. Therefore, the dollar is known as a vehichle currency and is a key currency to watch when navigating the forex market.

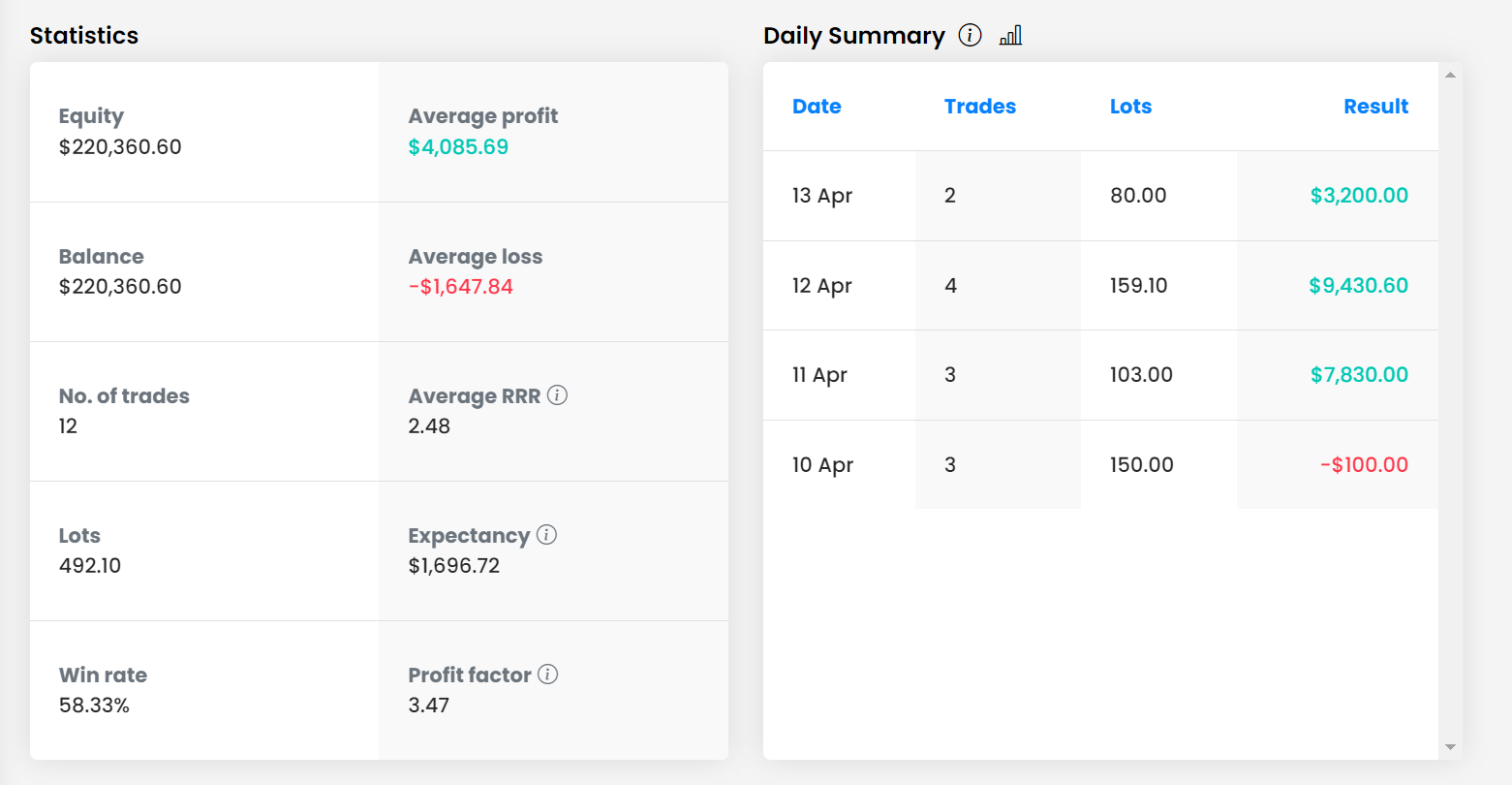

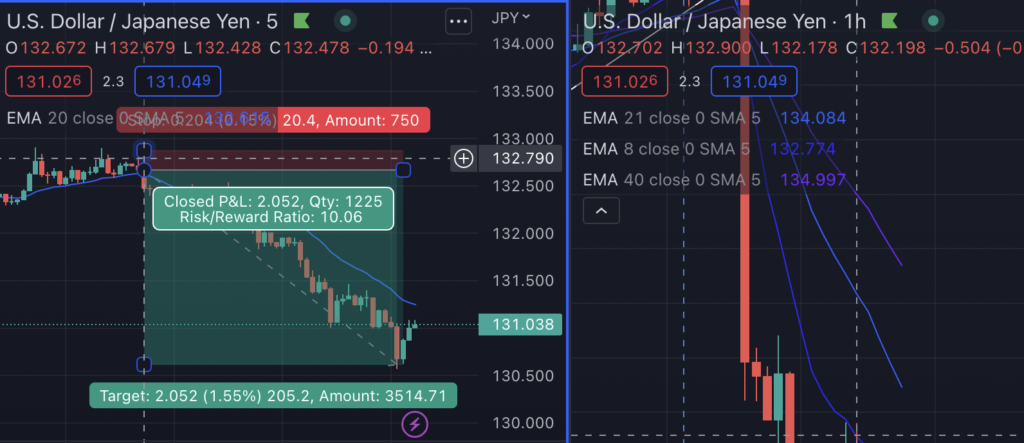

Let’s talk about those two trades that returned 9% and 5%, respectively, while only risking 1% per trade.

Let’s talk about those two trades that returned 9% and 5%, respectively, while only risking 1% per trade.

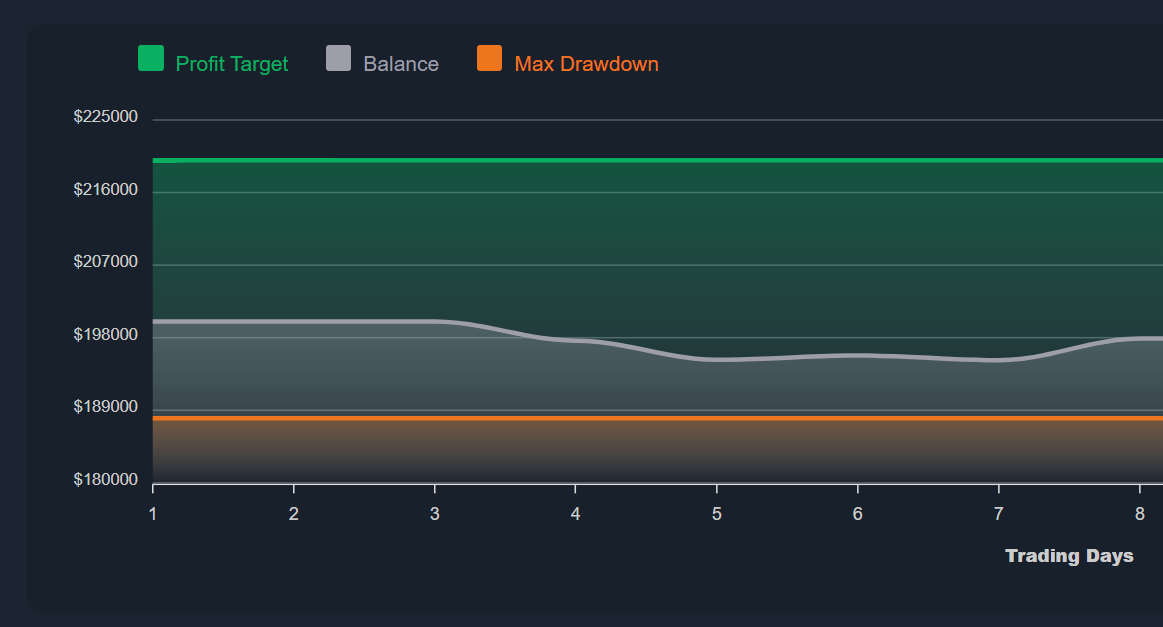

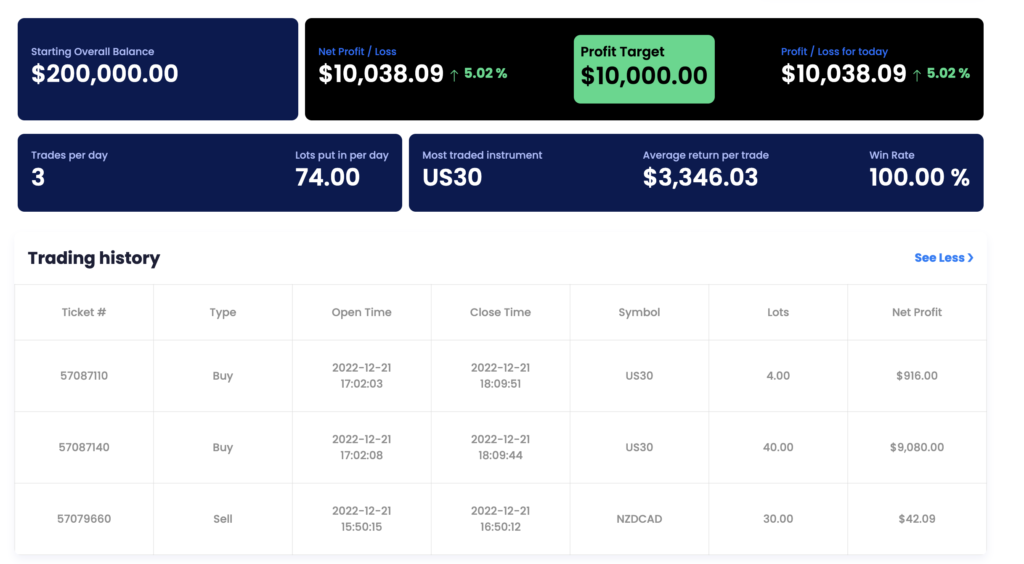

Since I had already hit the 5 minimum trading days for this account, I was immediately granted a verification account and login details. I set this up and the following morning, December 21st, during the New York session. I continued with my 1% risk per trade and focused on the CAD inflation and CPI news that came out at 530PST. The reports showed that the actuals were about the same as expected, so the news was already priced in for this announcement. I initially got in on a NZDCAD trade but I pulled it out at break-even, as per my trading rules.

Since I had already hit the 5 minimum trading days for this account, I was immediately granted a verification account and login details. I set this up and the following morning, December 21st, during the New York session. I continued with my 1% risk per trade and focused on the CAD inflation and CPI news that came out at 530PST. The reports showed that the actuals were about the same as expected, so the news was already priced in for this announcement. I initially got in on a NZDCAD trade but I pulled it out at break-even, as per my trading rules.

Latest posts