Tips for Passing a Funded Trading Plus Challenge

A few weeks ago, I started a prop trading challenge with Funded Trading Plus.

I am an affiliate with this firm, and made the decision to help increase awareness of this prop firm, because I think it’s one of the most realistic prop trading models for both the trader and the firm. The trader is given minimal rules while drawdown rules protect the firm from losing money on funded accounts. It’s a win-win for both parties.

[Use code “DFX10” to get 10% off of your challenge with Funded Trading Plus]

Unlike most prop firms, Funded Trading Plus’ challenges don’t come with a time limit.

This is huge!

A lack of time is one of the reasons why so many traders fail their FTMO or MyForexFunds challenges. When you need to meet a quota (and a large quota at 10%, mind you), suddenly you’re dealing with psychological challenges that exceed the mere feat of trading for profit.

I speak from experience, having both failed and passed 30-day prop trading models. The strategy I used gave signals maybe two or three times a week (which leads to a better win rate, but perhaps not at a speed that will meet the profit requirement in 30 days) – In order to pass I bumped up a more conservative 0.50-1% risked per trade to 2% or more.

I believe many 30-day challenges force traders to trade recklessly or change the way they trade in order to meet a quota that most investment firms would be overjoyed to hit in 6 months.

Thus, many traders fail. Some pass, but most return to more conservative trading styles in order to stay funded.

Now Funded Trading Plus is pummeling the prop trading industry to make challenges more realistic.

With no time limit or minimum time requirement, you can hit the 10% profit target in as much or as little time as you like, so long as you commit to avoiding the (currently) 3% daily drawdown and 6% overall relative drawdown.

Thus, my trading plan for this challenge is to take very small positions at a slow pace. (If you want to trade my strategy with me and be able to chat with me through your journey, join the DFX Scalping Course)

Whether it takes two months or a whole year, I don’t mind waiting to achieve a funded account because instead of letting the prop firm dictate my trading plan, I can trade in a style that I know is responsible, strategic in how much is risked per trade, and lets the market decide when I will profit.

With this model, I don’t need to pray that this month’s market will fit my strategies and preference for trend-following. I can stick around for the better months and survive through the ones that aren’t a fit for my style.

So here I am, three weeks into trading this challenge, and as I evaluate what’s working and not working, I have a few tips to share with you that you’ll want to keep in mind when trading with this particular prop firm’s challenges.

5 Tips to Pass a Funded Trading Plus Challenge

1. Trade according to a strategy that works for you, not what will offer the quickest return

As I mentioned above, Funded Trading Plus offers unlimited time to pass your challenge.

In this way, you don’t need to change your style in order to pass. If you prefer to wait for perfect day trading setups, you don’t need to force yourself to learn how to scalp in order to meet a deadline.

If you like trading the London session more than New York, then focus on that, you don’t need to stretch yourself to do both.

The key is to trade in a way that’s familiar and comfortable for you and doesn’t pull on your heartstrings much when you lose.

From there, use statistics from the strategies that work for you to help you decide what strategy you’ll use for this challenge.

Note: It’s important to remember that this firm offers 1:30 leverage, so if you’re scalping, you may need to risk less than what you’re used to in order to avoid using too much margin or accumulating too many commission costs.

2. Don’t worry about finishing according to a schedule

Let me repeat – let the market decide when your strategy will let you win.

Adding a time limit only frustrates and causes stress. This stress may inspire you to break your trading rules in order to speed up the process.

We don’t want that. It’s a recipe for disaster (again, speaking from experience).

Some of my best trading occurs when I get into a tempo – for me, this means getting one or two signals a day, at least 3 out of 5 days a week. When I try to break this tempo, by adding more strategies or instruments to trade, it throws me off.

You shouldn’t need to change how you trade in order to meet a challenge. Ideally, you want to go into a challenge with your strategy all laid out, with no surprises.

Be prepared to let the market guide you – be okay with passing in one month or five. Your strategy and risk management tactics will help you be able to predict how long you’ll need, but stay flexible in the event it takes longer than planned.

A relaxed trader can make more rational trading decisions than one that is stressed and feels rushed.

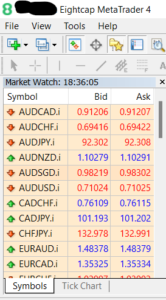

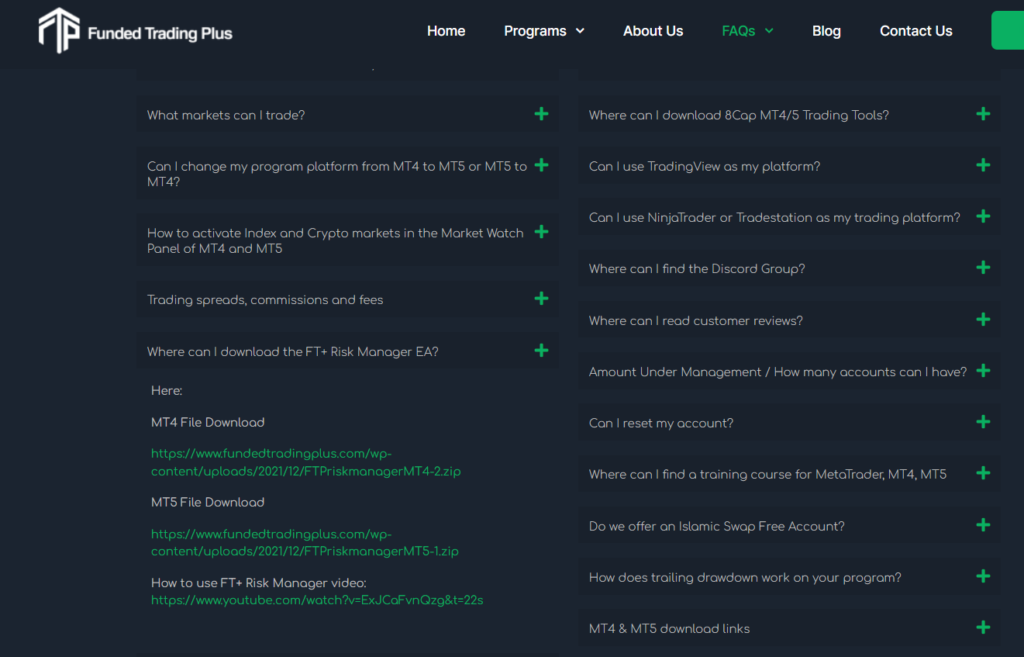

3. Download the MT4/MT5 tools specifically created for the 8-Cap platform

Funded Trading Plus has options in the FAQ section to download a position size calculator that you can use on your demo account.

Even if, like me, you depend on a Trading View chart or some other charting service to make your trading decisions, you’ll want to be able to quickly execute orders on the MT4 or MT5 platform for the challenge.

A position size calculator is a magnificent tool for minimizing the number of inputs you need to type before submitting an order.

A position size calculator is a magnificent tool for minimizing the number of inputs you need to type before submitting an order.

The firm has instructions on how to install and use this and other tools found in their FAQ section.

4. Make sure you completely understand the rules for both the challenge and the funded account that follows.

While we’re on the topic, just go ahead and read the whole FAQ section. Study its contents like a final exam that’s going to pass or fail your senior year of high school. Neither a year of high school nor a prop trading challenge is enjoyable to repeat, you might as well do it right the first time.

If you need to wait to prepare for your challenge, that’s a smart move, too.

Funded Trading Plus has account rules that are slightly different from most of the popular prop firms available. You need to make sure you understand when and how their relative drawdown works.

It may take a few times to understand exactly how their relative drawdown and withdrawal rules play out, but I think I summarized it properly in this article.

If anything seems unclear, reach out to Funded Trading Plus’ support team. They’re friendly and can give you the most accurate answers, better than anything you’ll hear second-hand from myself or other traders.

5. Risk less than you think you should

Assuming you are using a profitable strategy (which you know works because you’re already comfortable trading it live), you probably have an idea of how it performs on a day-to-day basis.

While you’re trading a small account, let’s say $5,000, you may be comfortable risking 2-3% per trade. While professional traders recommend risking less, it’s understandable to risk $150 on a trade. It’s far easier to find a way to make back $150 in the real world than it is $6,000, should you trade the same 3% on a $200k account.

However, while time gives you freedom, Funded Trading Plus doesn’t want you to go nuts – they have a strict 3% daily drawdown rule, which is far tighter than FTMO’s 5% or MFF’s 6%.

My advice: risk up to half of what you think you need.

So if you think you’re comfortable risking up to 2% per day, see if you can get it down to 1% or less. And that’s if you’re taking only one, maybe two trades.

I suggest this because this prop firm is asking you to think long-term. Their rules are set up to filter the profitable traders from the one-hit wonders and irresponsible ones. You’re going to need to prove that your discipline and your strategy are profitable over the long run. If you combine small risk per trade with the bonus suggestion below, you’ll be golden.

If you’re scalping or trading in a way where you can get multiple signals in one day after many days of nothing, you may need to risk 0.75% per trade or less.

In my ideal model of 1-2 trades a day occurring over 3-5 days per week, I would risk no more than 0.75% per trade.

BONUS: Use strategies that let you maximize your profit return.

BONUS: Use strategies that let you maximize your profit return.

This is why I like trend-following strategies – because you can take partial exits at fixed points and then let the rest run with a trailing stop. Or with a rule, like closing the rest of the trade after it pulls back and closes over a moving average.

By maximizing your return per trade, you can risk as little as possible and still hit the profit target in a reasonable amount of time. You won’t be stressed out like traders who are using the small-account rule of 2% per trade.

Final Thoughts

There are prop firms out there that are making bank off of the human desire to make money fast.

You can avoid this trap altogether by not prop trading.

However, prop trading can also be a really great way to make income comparable to a salary without having to amass a ton of equity. It can be a bridge to building up your own large account.

I believe Funded Trading Plus offers one of the most realistic structures for a trading challenge that you can find. If you are responsible, patient, and willing to navigate the expedition with courage, a funded account is waiting for you out there in your future.

Hi, I think your site might be having browser compatibility issues. When I look at your website in Safari, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, fantastic blog!

I was curious if you ever considered changing the page layout of your site? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having 1 or 2 images. Maybe you could space it out better?

Dieses Buch kann einen gro?en Unterschied darin machen, wie wir miteinander, mit uns selbst und mit den gro?en Freuden der Welt umgehen

Great line up. We will be linking to this great article on our site. Keep up the good writing.

I truly appreciate this post. I have been looking all over for this! Thank goodness I found it on Bing. You have made my day! Thanks again

I am often to blogging and i really appreciate your content. The article has really peaks my interest. I am going to bookmark your site and keep checking for new information.

Yeah bookmaking this wasn’t a risky decision great post! .

I’d have to examine with you here. Which is not one thing I usually do! I take pleasure in reading a post that may make folks think. Additionally, thanks for permitting me to comment!

Hello.This post was extremely fascinating, particularly since I was browsing for thoughts on this matter last Monday.

Good info. Lucky me I reach on your website by accident, I bookmarked it.

Keep working ,remarkable job!

This website online is known as a walk-by for all of the information you needed about this and didn’t know who to ask. Glimpse here, and also you’ll definitely uncover it.

Definitely, what a great blog and revealing posts, I definitely will bookmark your site. Best Regards!

My website: групповой анал с худой красоткой

Pingback: Check your social signals count

I’m curious to find out what blog system you are using? I’m having some minor security problems with my latest blog and I’d like to find something more secure. Do you have any recommendations?

Major thanks for the article post. Much thanks again.

My website: русскую ебут в анал

I reckon something truly special in this website.

My website: жестокий секс бдсм

I have been absent for some time, but now I remember why I used to love this website. Thanks , I will try and check back more frequently. How frequently you update your web site?

he blog was how do i say it… relevant, finally something that helped me. Thanks

With havin so much content do you ever run into any problems of plagorism or copyright infringement? My website has a lot of unique content I’ve either created myself or outsourced but it appears a lot of it is popping it up all over the internet without my authorization. Do you know any ways to help prevent content from being stolen? I’d truly appreciate it.

Hello.This post was extremely interesting, especially because I was looking for thoughts on this topic last couple of days.

Great line up. We will be linking to this great article on our site. Keep up the good writing.

And if you don’t have the internet – don’t panic: just call your favourite camgirl! Most ladies love phone sex and are happy to tell you their free online live sex chat rooms. Phone sex with cam girls is hotter because they are real.

Hey there this is kinda of off topic but I was wondering if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding knowledge so I wanted to get advice from someone with experience. Any help would be greatly appreciated!

F*ckin’ tremendous things here. I’m very satisfied to look your post. Thank you a lot and i am looking forward to touch you. Will you please drop me a mail?

Enjoyed studying this, very good stuff, thanks.

There are actually plenty of details like that to take into consideration. That could be a great level to carry up. I offer the ideas above as basic inspiration however clearly there are questions just like the one you bring up where crucial thing might be working in sincere good faith. I don?t know if finest practices have emerged around issues like that, but I’m certain that your job is clearly recognized as a fair game. Each girls and boys really feel the impression of just a moment’s pleasure, for the rest of their lives.

Some really nice and useful information on this web site, also I believe the layout has got good features.

It’s a shame you don’t have a donate button! I’d definitely donate to this brilliant blog! I suppose for now i’ll settle for bookmarking and adding your RSS feed to my Google account. I look forward to brand new updates and will share this website with my Facebook group. Talk soon!

Real informative and good bodily structure of articles, now that’s user friendly (:.

Hello my friend! I wish to say that this article is amazing, nice written and come with approximately all significant infos. I¦d like to peer more posts like this .

There’s noticeably a bundle to find out about this. I assume you made certain nice factors in features also.

Merely wanna remark on few general things, The website pattern is perfect, the written content is really wonderful : D.

I have been absent for a while, but now I remember why I used to love this site. Thank you, I will try and check back more frequently. How frequently you update your website?

My developer is trying to convince me to move to .net from PHP. I have always disliked the idea because of the expenses. But he’s tryiong none the less. I’ve been using Movable-type on numerous websites for about a year and am worried about switching to another platform. I have heard great things about blogengine.net. Is there a way I can import all my wordpress content into it? Any kind of help would be greatly appreciated!

hi!,I like your writing so much! share we communicate more about your post on AOL? I require a specialist on this area to solve my problem. Maybe that’s you! Looking forward to see you.

Your place is valueble for me. Thanks!…

Hi my friend! I wish to say that this article is awesome, great written and include almost all important infos. I would like to look more posts like this.

My brother suggested I might like this web site. He was entirely right. This publish actually made my day. You cann’t consider just how a lot time I had spent for this info! Thanks!

Fantastic website. Plenty of helpful info here. I am sending it to some buddies ans additionally sharing in delicious. And of course, thanks on your effort!

What’s Happening i am new to this, I stumbled upon this I’ve found It positively useful and it has helped me out loads. I hope to contribute & assist other users like its aided me. Great job.

Hello there, just became alert to your blog through Google, and found that it is truly informative. I’m going to watch out for brussels. I will be grateful if you continue this in future. Many people will be benefited from your writing. Cheers!

We are a group of volunteers and starting a new scheme in our community. Your site offered us with valuable info to work on. You have done a formidable job and our whole community will be thankful to you.

I feel that is among the most important info for me. And i’m satisfied studying your article. But wanna remark on few common issues, The website style is ideal, the articles is actually great : D. Just right process, cheers

I was examining some of your articles on this website and I believe this site is real informative ! Keep putting up.

FitSpresso is a natural weight loss supplement crafted from organic ingredients, offering a safe and side effect-free solution for reducing body weight.

Thanks for sharing excellent informations. Your site is so cool. I am impressed by the details that you?¦ve on this website. It reveals how nicely you understand this subject. Bookmarked this web page, will come back for more articles. You, my friend, ROCK! I found simply the info I already searched all over the place and just couldn’t come across. What a great site.

What Is ZenCortex? ZenCortex is an ear health booster that protects ears from potential damage and improves your hearing health.

hello!,I like your writing so much! share we communicate more about your article on AOL? I require a specialist on this area to solve my problem. May be that’s you! Looking forward to see you.

As soon as I observed this site I went on reddit to share some of the love with them.

Pretty nice post. I just stumbled upon your blog and wished to say that I have really enjoyed surfing around your blog posts. After all I will be subscribing to your rss feed and I hope you write again soon!

I think you have noted some very interesting points, appreciate it for the post.

I really like your writing style, excellent information, thanks for putting up :D. “Faith is a continuation of reason.” by William Adams.

I don’t even know the way I stopped up here, however I thought this publish used to be good. I do not realize who you’re but definitely you’re going to a well-known blogger in case you aren’t already 😉 Cheers!

Nice post. I was checking constantly this blog and I am impressed! Extremely useful info particularly the last part 🙂 I care for such information much. I was looking for this certain info for a very long time. Thank you and best of luck.

After study a few of the blog posts on your website now, and I truly like your way of blogging. I bookmarked it to my bookmark website list and will be checking back soon. Pls check out my web site as well and let me know what you think.

One such software that has been generating buzz these days is the Lottery Defeater

I was very pleased to find this web-site.I wanted to thanks for your time for this wonderful read!! I definitely enjoying every little bit of it and I have you bookmarked to check out new stuff you blog post.

You really make it appear so easy along with your presentation however I to find this matter to be actually one thing which I feel I would never understand. It sort of feels too complex and very large for me. I am having a look ahead on your next submit, I?¦ll attempt to get the hang of it!

I was looking at some of your blog posts on this site and I believe this site is rattling informative! Retain posting.

Great write-up, I am regular visitor of one’s web site, maintain up the nice operate, and It is going to be a regular visitor for a lengthy time.

This really answered my problem, thank you!

It’s really a nice and useful piece of info. I am satisfied that you just shared this helpful information with us. Please keep us informed like this. Thank you for sharing.

I’m not that much of a online reader to be honest but your blogs really nice, keep it up! I’ll go ahead and bookmark your site to come back in the future. Many thanks

Outstanding post, I think blog owners should larn a lot from this website its really user pleasant.

Nice post. I learn something more challenging on different blogs everyday. It will always be stimulating to read content from other writers and practice a little something from their store. I’d prefer to use some with the content on my blog whether you don’t mind. Natually I’ll give you a link on your web blog. Thanks for sharing.

Wow! This could be one particular of the most useful blogs We’ve ever arrive across on this subject. Actually Wonderful. I’m also a specialist in this topic therefore I can understand your hard work.

I saw a lot of website but I believe this one has something extra in it in it

Keep working ,terrific job!

What Is Neotonics? Neotonics is a skin and gut supplement made of 500 million units of probiotics and 9 potent natural ingredients to support optimal gut function and provide healthy skin.

Hi there it’s me, I am also visiting this web site daily, this site is in fact nice and the visitors are actually sharing nice thoughts.

I have recently started a blog, the info you offer on this web site has helped me greatly. Thank you for all of your time & work.

What Is ZenCortex? ZenCortex is a natural supplement that promotes healthy hearing and mental tranquility. It’s crafted from premium-quality natural ingredients, each selected for its ability to combat oxidative stress and enhance the function of your auditory system and overall well-being.

Thanks a bunch for sharing this with all of us you really know what you are talking about! Bookmarked. Kindly also visit my web site =). We could have a link exchange agreement between us!

I genuinely enjoy studying on this internet site, it has fantastic posts. “For Brutus is an honourable man So are they all, all honourable men.” by William Shakespeare.

Helpful info. Fortunate me I found your web site unintentionally, and I’m surprised why this coincidence didn’t happened earlier! I bookmarked it.

I was studying some of your content on this internet site and I believe this web site is real informative ! Continue putting up.

Utterly pent articles, Really enjoyed looking at.

You have mentioned very interesting points! ps nice internet site.

I do like the way you have presented this particular problem plus it really does provide us some fodder for thought. Nonetheless, coming from everything that I have experienced, I simply just trust when other comments pack on that men and women continue to be on point and in no way get started upon a soap box involving the news of the day. All the same, thank you for this excellent piece and although I can not really go along with the idea in totality, I respect your point of view.

I’m not sure why but this weblog is loading extremely slow for me. Is anyone else having this problem or is it a issue on my end? I’ll check back later on and see if the problem still exists.

My brother recommended I may like this web site. He was once entirely right. This post actually made my day. You can not believe just how so much time I had spent for this information! Thank you!

I have been exploring for a little bit for any high quality articles or weblog posts on this kind of area . Exploring in Yahoo I finally stumbled upon this web site. Reading this information So i¦m glad to convey that I’ve an incredibly good uncanny feeling I came upon just what I needed. I such a lot unquestionably will make sure to do not omit this site and give it a look on a relentless basis.

you have got an excellent blog right here! would you wish to make some invite posts on my blog?

hi!,I like your writing very so much! share we keep up a correspondence more about your article on AOL? I need an expert on this space to resolve my problem. Maybe that’s you! Taking a look ahead to peer you.

I believe you have noted some very interesting details , thankyou for the post.

Pretty element of content. I simply stumbled upon your site and in accession capital to say that I acquire actually loved account your blog posts. Anyway I’ll be subscribing on your augment or even I success you get admission to persistently fast.

Hey! Do you use Twitter? I’d like to follow you if that would be okay. I’m undoubtedly enjoying your blog and look forward to new posts.

Very great post. I just stumbled upon your blog and wished to say that I have truly enjoyed surfing around your weblog posts. After all I will be subscribing in your feed and I’m hoping you write again soon!

What¦s Taking place i am new to this, I stumbled upon this I’ve discovered It absolutely helpful and it has aided me out loads. I hope to contribute & help different customers like its aided me. Great job.

Thank you ever so for you blog. Really looking forward to read more.

My website: analporno.club

I have read several good stuff here. Definitely price bookmarking for revisiting. I wonder how much attempt you set to make any such magnificent informative website.

Hmm is anyone else having problems with the pictures on this blog loading? I’m trying to find out if its a problem on my end or if it’s the blog. Any feedback would be greatly appreciated.

I loved up to you’ll receive carried out proper here. The cartoon is tasteful, your authored material stylish. nevertheless, you command get got an edginess over that you want be handing over the following. unwell undoubtedly come more beforehand again since precisely the similar nearly very regularly inside case you shield this increase.

I conceive this web site contains very fantastic pent written content articles.

I every time used to study piece of writing in news papers but now as Iam a user of web so from now I am using net for articles, thanks to web

Hey There. I found your blog using msn. This is a very well written article. I will be sure to bookmark it and come back to read more of your useful information. Thanks for the post. I’ll certainly return.

Can I just say what a relief to find someone who actually knows what theyre talking about on the internet. You definitely know how to bring an issue to light and make it important. More people need to read this and understand this side of the story. I cant believe youre not more popular because you definitely have the gift.

Aw, this was a very nice post. In thought I would like to put in writing like this moreover – taking time and precise effort to make an excellent article… however what can I say… I procrastinate alot and in no way appear to get something done.

Undeniably believe that which you stated. Your favorite justification appeared to be on the web the easiest thing to be aware of. I say to you, I definitely get annoyed while people think about worries that they just do not know about. You managed to hit the nail upon the top as well as defined out the whole thing without having side effect , people could take a signal. Will probably be back to get more. Thanks

Hi, just required you to know I he added your site to my Google bookmarks due to your layout. But seriously, I believe your internet site has 1 in the freshest theme I??ve came across. It extremely helps make reading your blog significantly easier.

Valuable information. Lucky me I found your web site by accident, and I’m shocked why this accident did not happened earlier! I bookmarked it.

This site definitely has all of the information I needed about this subject

My website: chastnoeporno

The next time I read a weblog, I hope that it doesnt disappoint me as a lot as this one. I mean, I do know it was my choice to learn, but I truly thought youd have one thing fascinating to say. All I hear is a bunch of whining about something that you would fix in case you werent too busy searching for attention.

Would love to always get updated great web site! .

Regards for this marvellous post, I am glad I found this web site on yahoo.

Hi, I think your site might be having browser compatibility issues. When I look at your website in Safari, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, fantastic blog!

you are really a good webmaster. The web site loading speed is amazing. It seems that you are doing any unique trick. Moreover, The contents are masterwork. you’ve done a fantastic job on this topic!

Thanks for your personal marvelous posting! I quite enjoyed reading it, you are a great author.I will always bookmark your blog and will often come back very soon. I want to encourage one to continue your great job, have a nice weekend!

So what I have found is from 30-70 it’s all green light with the 54 raw Part of me is debating adding a 50 wedge though as I think it gets a bit tough judging the pitch around 85+ I think a 50 would make that pretty easy fill in that spot Generally I reserve my 58 for more flop type shots or a shot around the green where there’s an obstacle or not much green to work with I think a 50,54,58 combo might be gold Especially since I’ve had a 50 in my last few sets

Hi, i believe that i saw you visited my website thus i got here to “return the favor”.I’m attempting to in finding issues to improve my web site!I guess its adequate to use some of your concepts!!

I went over this web site and I think you have a lot of good info , saved to my bookmarks (:.

Hello my friend! I wish to say that this post is awesome, nice written and include almost all important infos. I would like to see more posts like this.

We’re a gaggle of volunteers and starting a new scheme in our community. Your site offered us with valuable information to work on. You’ve done a formidable activity and our entire group shall be thankful to you.

Some really excellent blog posts on this internet site, thanks for contribution.

I am impressed with this website , really I am a fan.

obviously like your website however you need to take a look at the spelling on quite a few of your posts. A number of them are rife with spelling issues and I find it very troublesome to tell the reality however I will certainly come again again.

Hi, Neat post. There’s a problem with your website in internet explorer, would test this… IE still is the market leader and a large portion of people will miss your fantastic writing because of this problem.

Hi there! Do you know if they make any plugins to protect against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any tips?

Hello! I just wanted to ask if you ever have any issues with hackers? My last blog (wordpress) was hacked and I ended up losing several weeks of hard work due to no backup. Do you have any solutions to prevent hackers?

Fantastic beat ! I wish to apprentice while you amend your site, how could i subscribe for a blog website? The account aided me a acceptable deal. I have been a little bit familiar of this your broadcast provided brilliant clear concept

I like this web site because so much useful stuff on here : D.

Great blog! Is your theme custom made or did you download it from somewhere? A theme like yours with a few simple tweeks would really make my blog shine. Please let me know where you got your theme. Thanks

Great blog! Do you have any tips and hints for aspiring writers? I’m hoping to start my own website soon but I’m a little lost on everything. Would you recommend starting with a free platform like WordPress or go for a paid option? There are so many choices out there that I’m completely confused .. Any ideas? Thanks a lot!

After examine just a few of the blog posts on your web site now, and I actually like your approach of blogging. I bookmarked it to my bookmark website listing and will probably be checking again soon. Pls try my site as nicely and let me know what you think.

Very well written story. It will be beneficial to anybody who usess it, as well as me. Keep up the good work – i will definitely read more posts.

I’m very happy to read this. This is the kind of manual that needs to be given and not the accidental misinformation that’s at the other blogs. Appreciate your sharing this best doc.

I conceive this internet site contains some real wonderful information for everyone :D. “Anybody who watches three games of football in a row should be declared brain dead.” by Erma Bombeck.

We are a group of volunteers and opening a brand new scheme in our community. Your web site offered us with useful info to work on. You’ve performed a formidable task and our whole community will probably be grateful to you.

I was examining some of your articles on this website and I think this web site is rattling informative ! Retain putting up.

This is the right blog for anyone who wants to find out about this topic. You realize so much its almost hard to argue with you (not that I actually would want…HaHa). You definitely put a new spin on a topic thats been written about for years. Great stuff, just great!

Some genuinely nice stuff on this internet site, I love it.

Appreciate it for this tremendous post, I am glad I found this website on yahoo.

Heya i’m for the primary time here. I came across this board and I to find It truly helpful & it helped me out much. I’m hoping to present one thing again and aid others such as you aided me.

I didn’t expect such a simple game like Dino Game to be so addictive! I played for hours without realizing!

Please let me know if you’re looking for a writer for your weblog. You have some really good articles and I feel I would be a good asset. If you ever want to take some of the load off, I’d really like to write some material for your blog in exchange for a link back to mine. Please blast me an email if interested. Cheers!

Some genuinely interesting points you have written.Assisted me a lot, just what I was searching for : D.

Thanks a lot for giving everyone an extraordinarily terrific possiblity to read critical reviews from this site. It can be very pleasant and as well , full of a great time for me personally and my office mates to visit your website particularly three times in 7 days to find out the newest issues you have. Not to mention, we are usually amazed with all the eye-popping creative ideas served by you. Selected 4 tips in this article are completely the most beneficial we have all ever had.

You are my aspiration, I have few web logs and sometimes run out from to brand.

B52club là cổng game bài bom tấn – game đổi thưởng hàng đầu với hơn 50 trò chơi đa dạng và công nghệ bảo mật tiên tiến. Hoạt động từ năm 2016 dưới giấy phép PAGCOR, B52 cung cấp trải nghiệm giải trí đẳng cấp với giao diện HD, thanh toán nhanh chóng và dịch vụ khách hàng 24/7. Bài viết sẽ phân tích chi tiết về các khía cạnh của B52club, từ sản phẩm game đến công nghệ và dịch vụ. https://b52.studio/

I have learn a few just right stuff here. Certainly price bookmarking for revisiting. I surprise how so much attempt you place to create this type of magnificent informative web site.

Increase domain rating

“I have recently started a blog, the information you provide on this website has helped me tremendously. Thank you for all of your time & work.”

Unquestionably believe that that you stated. Your favorite reason appeared to be on the web the simplest thing to remember of. I say to you, I certainly get annoyed whilst folks think about worries that they plainly do not realize about. You controlled to hit the nail upon the top as smartly as outlined out the entire thing without having side effect , folks could take a signal. Will likely be again to get more. Thank you

Great write-up, I am regular visitor of one¦s web site, maintain up the nice operate, and It’s going to be a regular visitor for a long time.

I appreciate, cause I found exactly what I was looking for. You have ended my four day long hunt! God Bless you man. Have a nice day. Bye

I?¦ve recently started a site, the info you provide on this website has helped me tremendously. Thanks for all of your time & work.

Very efficiently written article. It will be helpful to everyone who usess it, including me. Keep up the good work – i will definitely read more posts.

I got what you intend,saved to favorites, very nice website .

Hi my friend! I wish to say that this article is awesome, nice written and include approximately all important infos. I’d like to see more posts like this.

I have been browsing online more than 3 hours today, yet I never found any interesting article like yours. It is pretty worth enough for me. Personally, if all webmasters and bloggers made good content as you did, the web will be a lot more useful than ever before.

Great wordpress blog here.. It’s hard to find quality writing like yours these days. I really appreciate people like you! take care

Would love to always get updated outstanding blog! .

Hmm is anyone else encountering problems with the pictures on this blog loading? I’m trying to figure out if its a problem on my end or if it’s the blog. Any responses would be greatly appreciated.

I’ve been absent for some time, but now I remember why I used to love this blog. Thanks, I’ll try and check back more often. How frequently you update your site?

Thank you for sharing with us, I think this website truly stands out : D.

Hello there, You’ve performed an excellent job. I will definitely digg it and in my opinion suggest to my friends. I am confident they’ll be benefited from this website.

Your place is valueble for me. Thanks!…

You have mentioned very interesting points! ps nice website.

I was suggested this web site by my cousin. I’m now not certain whether this publish is written by him as nobody else recognize such certain approximately my difficulty. You are amazing! Thanks!