My Trading Plan for a $200k FTP Retry

I want to share with you my plan for my Funded Trading Plus Retry using a very short-term Swing Trading strategy, what it’s like using their new Trading View platform option, and how my challenge is going so far as I am 3 weeks into the challenge.

After failing my first Funded Trading Plus challenge, I stepped back and took a good hard look at what I needed out of a trading style and routine.

I’ve been a scalper for the majority of my three-plus years trading both Forex and stocks, but I’ve finally come to the conclusion that higher time frames and longer holding periods for trades are far less stressful, much more convenient for my personal schedule, and often more consistently profitable over the long run.

Taking a Funded Trading Plus Retry

So a few weeks ago, after taking some time off to reflect and learn a new approach to swing trading, I decided to sign-up for my next FTP challenge.

A cool benefit about this retry is that it coincided with FTP’s release of their Trading View platform option so I signed up for a 200k account with a 10% discount- (BTW, if you also want a 10% discount off of your FTP challenge, be sure to use “DFX10” at their checkout).

Set up was very easy.

They emailed me the login info, which I could instantly use in my Trading View account. I’ll note that I have a Pro+ account with them so features like multiple partitions, saved layouts, alarms, and other benefits are already available to me. It’s possible to use Trading View’s free service with this challenge, at the very least to access their intuitive and easy-to-calculate order forms, but I personally believe it’s worth the extra cost to access more of trading view’s features and benefits.

Once logged in, the login info was saved, so I can connect without having to type in my password each time I log on. Because this password is saved to my Google Chrome, I can log on to any of my laptops or devices that access TV’s web platform.

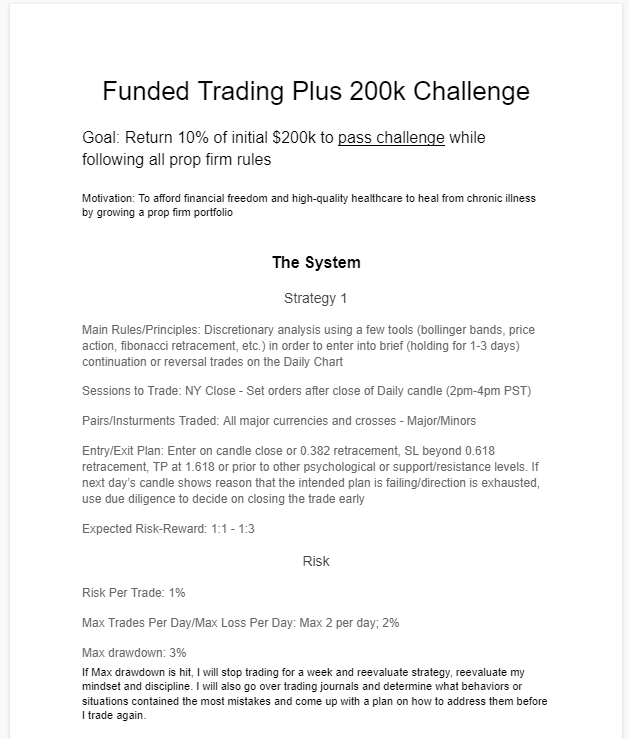

A Daily Chart Strategy + Plan

So with this new challenge, I’ve decided to use a daily chart strategy that I’ve put together. This strategy depends on a couple of tools, like price action, Bollinger bands, fib retracement, support/resistance, among others to help me make a discretionary trading decision after the NY close of the daily candle. Let me tell you more by showing you my trading plan for this challenge:

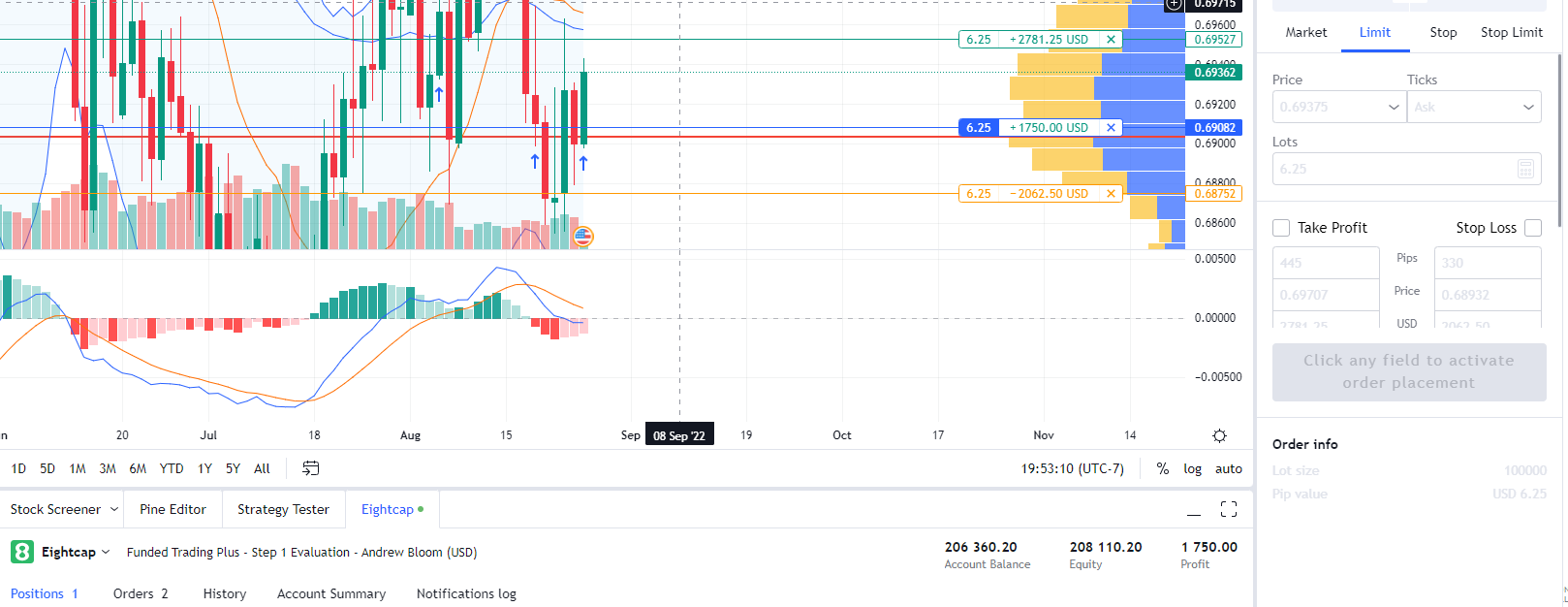

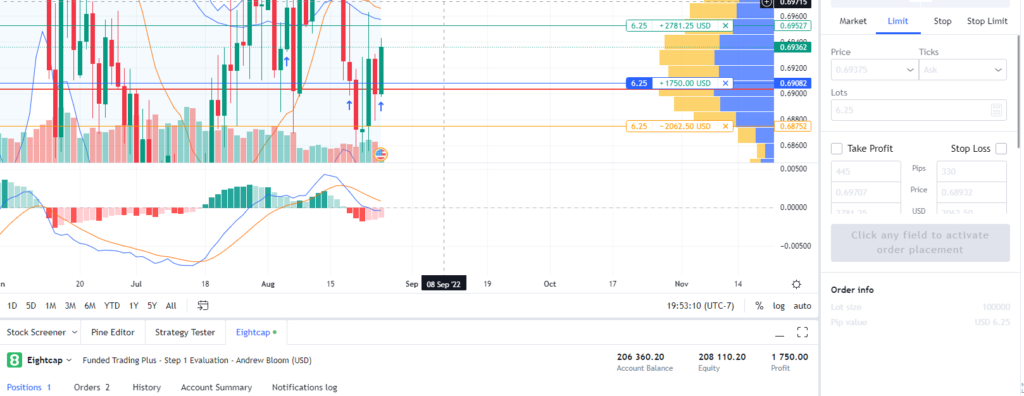

Using Funded Trading Plus’ Trading View Option

Next, let’s talk about Trading View.

I am just in love with being able to directly trade off of the Trading View platform!

Nothing pisses me off about MT4/5 more than how difficult it is to use quick, pips-based order forms and install other tools and indicators.

With Trading View, everything is available in one place. The charts are clean, easy to adjust, or change the appearance of the chart, and overall it’s a pleasant experience.

My saved templates and previous markups on the charts are already there even once I signed on to the 8-cap account.

However, funded trading plus uses 8-cap as its broker, so you need to be sure to select 8-cap’s chart before setting an order on it.

However, funded trading plus uses 8-cap as its broker, so you need to be sure to select 8-cap’s chart before setting an order on it.

Luckily, Trading View will notify you if you attempt to trade on another broker’s charts, so this is more of an annoyance than it is a problem to watch out for.

But, as with any difference in brokers, I’ve noticed that 8-caps charts often look different from Oanda’s, which I still use for my first look at the charts for the day and overall trading decisions.

As someone who is trading at the close of the NY session, I have to wait a bit after the 5 pm EST close before setting a trade, otherwise, my order will be rejected. Its markets open up again usually within 5 minutes later. The spread is sometimes good but can also be nasty, depending on the instrument, so with my strategy, I’m mostly looking to stick to major pairs or popular minor pairs in order to avoid costly spreads in the afternoon.

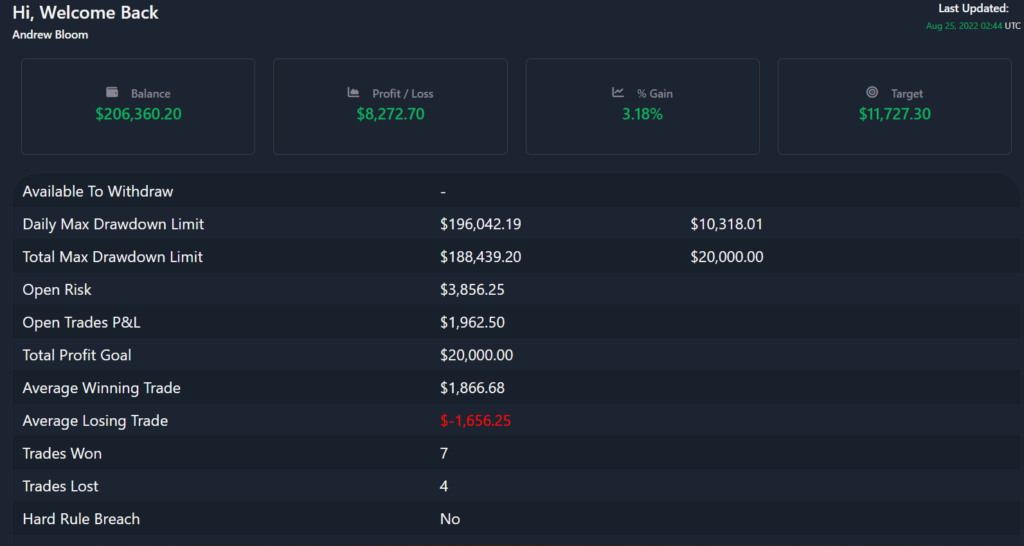

My First 3 Weeks

Lastly, I’m going to show you my current progress going into my fourth week of trading this challenge. I’m happy to report that it’s been a continuous upward drive the whole way through!

I’m currently up 4.22% with 10 trades overall and a 70% win rate (image was taken a day after).

The average win and the average loss are close to one another as I’ve chosen to close a few trades early due to a lack of evidence for continuation on certain trades.

I will say though that I am also a little trigger happy when it comes to closing trades early, and will swiftly close the trade early if there’s even a slight sign of a turnaround, so there’s a possibility that I’d have a higher balance and higher profit to loss ratio should I have held out to profit target on all of my trades. This is something I can go back to test and see if such is the case.

I will say, overall, that emotions play far less of a role in my trading now that I’m taking more relaxed and long-term trades.

The majority of my trades close within 24 hours but some will take two or three days to hit their target.

I’m spending less than 2.5 hours a week trading and it feels amazing to see such profit with very little effort and time.

I’m looking to formulate this strategy and package it up into an informative trading education course, so be on the lookout over the next couple of weeks for further updates!

Overall, I highly recommend considering Funded Trading Plus, particularly if you’re a swing trader, but really for any trading style because having no time limit on your challenge is a wealth of stress relief that could literally save you from making hasty and irresponsible trading decisions!

If you’re looking to take a FTP challenge or are already in one, please let us know how it goes, and I wholeheartedly wish you nothing but the best of strength and luck in your trading.

I’ll see you all in the markets, take care!

I like the helpful information you provide in your articles. I’ll bookmark your weblog and check again here regularly. I’m quite sure I’ll learn lots of new stuff right here! Best of luck for the next!

Great write-up, I am regular visitor of one’s website, maintain up the excellent operate, and It’s going to be a regular visitor for a long time.

Thank you for the sensible critique. Me & my neighbor were just preparing to do some research on this. We got a grab a book from our area library but I think I learned more clear from this post. I am very glad to see such wonderful information being shared freely out there.

I got what you mean , regards for posting.Woh I am glad to find this website through google. “I was walking down the street wearing glasses when the prescription ran out.” by Steven Wright.

Really Appreciate this blog post, can I set it up so I receive an email sent to me whenever you publish a fresh post?

I’ve been absent for some time, but now I remember why I used to love this blog. Thank you, I¦ll try and check back more often. How frequently you update your website?

Thanks for any other wonderful article. The place else may just anybody get that type of info in such a perfect way of writing? I’ve a presentation next week, and I am at the look for such information.

Some truly interesting details you have written.Assisted me a lot, just what I was looking for : D.

What i don’t realize is actually how you are not actually a lot more smartly-favored than you

might be right now. You’re so intelligent.

You realize therefore considerably in relation to this subject, produced me in my view consider

it from a lot of varied angles. Its like men and women aren’t involved unless it’s one thing to accomplish with Girl gaga!

Your individual stuffs nice. Always take care of it up!

I am extremely impressed with your writing skills as well as with

the layout on your blog. Is this a paid theme or did you modify it yourself?

Anyway keep up the excellent quality writing, it is rare to see a great blog like this one these days.

It’s amazing designed for me to have a web site, which is beneficial for my knowledge.

thanks admin

What’s up, I wish for to subscribe for this webpage to obtain newest updates, therefore where can i

do it please help out.

Superb, what a website it is! This website gives helpful facts to us, keep it up.

You really make it appear so easy along with your presentation but I in finding this matter to be

actually one thing which I believe I’d by no means understand.

It kind of feels too complicated and extremely large for me.

I am looking ahead for your subsequent put up, I will try to get the hang of it!

This is a topic that’s close to my heart…

Cheers! Where are your contact details though?

I really like reading an article that can make people think.

Also, many thanks for allowing me to comment!

Hello, its nice post on the topic of media print, we all be familiar

with media is a impressive source of facts.

Howdy! I know this is kinda off topic but I’d figured I’d ask.

Would you be interested in exchanging links or

maybe guest authoring a blog article or vice-versa?

My site covers a lot of the same subjects as yours and

I think we could greatly benefit from each other. If you are interested feel free to send me

an email. I look forward to hearing from you! Great blog by

the way!

What’s Taking place i’m new to this, I stumbled upon this I’ve

found It absolutely helpful and it has helped me out loads.

I’m hoping to contribute & assist other customers like its

helped me. Great job.

Hello! This is kind of off topic but I need some guidance

from an established blog. Is it tough to set up your own blog?

I’m not very techincal but I can figure things out pretty quick.

I’m thinking about setting up my own but I’m not sure where to begin. Do you

have any tips or suggestions? Appreciate it

This excellent website truly has all the information and facts I needed concerning this subject and didn’t know who to ask.

I just like the helpful information you provide on your articles.

I’ll bookmark your weblog and take a look at once more here frequently.

I am quite sure I’ll learn lots of new stuff proper here!

Best of luck for the following!

Valuable info. Lucky me I discovered your web site by accident, and I’m surprised why this coincidence did not took place in advance!

I bookmarked it.

Very quickly this site will be famous amid all blogging people, due to it’s good articles

I’m not that much of a internet reader to be honest but

your blogs really nice, keep it up! I’ll go ahead and bookmark your site to come

back in the future. All the best

Hi there, You’ve done a great job. I’ll definitely digg it and personally recommend to my friends.

I am confident they will be benefited from this web site.

Touche. Solid arguments. Keep up the great spirit.

Paragraph writing is also a fun, if you know then you can write or else it is difficult to write.

With havin so much written content do you ever run into any

problems of plagorism or copyright violation? My website has a

lot of exclusive content I’ve either written myself

or outsourced but it seems a lot of it is popping it up all over the

internet without my authorization. Do you know any ways to help stop content from being ripped

off? I’d definitely appreciate it.

I just like the helpful information you provide for your articles.

I will bookmark your weblog and test again right here frequently.

I’m quite sure I will be informed many new stuff proper

right here! Best of luck for the following!

I think the admin of this web page is truly working hard in favor of his

web site, as here every data is quality based information.

Your method of explaining everything in this paragraph is really pleasant, every one can simply

know it, Thanks a lot.

This is really interesting, You’re a very skilled blogger.

I have joined your feed and look forward to seeking more of

your wonderful post. Also, I have shared your

web site in my social networks!

I every time used to study post in news papers but now as I am a user of net thus from now I am using net for posts, thanks to web.

Woah! I’m really enjoying the template/theme of this blog. It’s simple,

yet effective. A lot of times it’s hard to get that “perfect balance” between superb usability and visual appeal.

I must say you have done a fantastic job with this. In addition, the blog loads super quick for me on Chrome.

Superb Blog!

Greetings! Very useful advice in this particular post!

It is the little changes that will make the most significant changes.

Many thanks for sharing!

Hi there, I want to subscribe for this website to

get hottest updates, therefore where can i do it please help out.

I love what you guys tend to be up too. Such clever work and exposure!

Keep up the awesome works guys I’ve included

you guys to my own blogroll.

I really like it whenever people get together and share thoughts.

Great website, continue the good work!

Actually when someone doesn’t be aware of after that its up

to other viewers that they will help, so here it happens.

Right away I am going to do my breakfast, once having my breakfast coming yet again to read

other news.

Hi friends, its impressive article regarding teachingand entirely explained, keep it up all the time.

Hello very nice blog!! Man .. Beautiful .. Amazing .. I will bookmark your web site and take the feeds additionally?

I’m happy to seek out so many helpful info here in the

submit, we want develop extra techniques on this regard, thanks

for sharing. . . . . .

you’re truly a excellent webmaster. The site loading velocity is amazing.

It seems that you’re doing any unique trick.

Moreover, The contents are masterwork. you’ve performed a magnificent process on this topic!

It is really a great and useful piece of information. I’m happy that you just

shared this helpful info with us. Please stay us up to date like this.

Thanks for sharing.

Thanks very nice blog!

Hi! This is my first visit to your blog! We are a group of volunteers and starting a new initiative in a community in the

same niche. Your blog provided us useful information to work on. You have

done a extraordinary job!

You could definitely see your skills within the work you write.

The sector hopes for more passionate writers like you who aren’t afraid to mention how

they believe. Always go after your heart.

Admiring the persistence you put into your site and in depth information you offer.

It’s awesome to come across a blog every once in a while that isn’t the same unwanted rehashed information. Wonderful read!

I’ve bookmarked your site and I’m including your RSS feeds

to my Google account.

My partner and I stumbled over here coming from a different web address and thought I might check things out.

I like what I see so now i am following you.

Look forward to checking out your web page repeatedly.

I am really grateful to the owner of this website who has shared this great piece of writing at here.

Hi, Neat post. There’s an issue with your site in internet explorer, could check this?

IE still is the marketplace leader and a good section of other people will leave out your wonderful writing because of this problem.

Hi! I just would like to give you a big thumbs up for your excellent info you have got right here on this post.

I will be returning to your site for more soon.

My family members all the time say that I am

killing my time here at web, however I know I am getting experience all

the time by reading such nice content.

I think this is among the so much important information for me.

And i’m glad studying your article. However should remark on some basic things, The site taste is great, the articles is in reality great :

D. Excellent task, cheers

Woah! I’m really enjoying the template/theme of this site.

It’s simple, yet effective. A lot of times it’s very hard to get

that “perfect balance” between superb usability and visual appearance.

I must say that you’ve done a excellent job with this.

Also, the blog loads extremely fast for me on Chrome. Superb Blog!

Hi! I’ve been reading your weblog for a long time now and finally got the courage to go ahead and give you a shout

out from Lubbock Texas! Just wanted to mention keep up the great work!

Hi! I’ve been following your blog for a long time now

and finally got the bravery to go ahead and give you a shout

out from New Caney Tx! Just wanted to mention keep up the fantastic work!

If you wish for to get a great deal from this paragraph then you have to apply such techniques to your won weblog.

This site truly has all the info I wanted concerning

this subject and didn’t know who to ask.

Wow! At last I got a webpage from where I be able to in fact obtain helpful facts regarding my study

and knowledge.

Thanks very interesting blog!

Why users still use to read news papers when in this technological world all is presented on net?

Nice blog! Is your theme custom made or did you download it from somewhere?

A theme like yours with a few simple adjustements would really make my blog stand

out. Please let me know where you got your design. Kudos

Pretty nice post. I just stumbled upon your blog and wanted to say

that I’ve truly loved surfing around your weblog posts.

After all I’ll be subscribing in your rss feed and I hope you write

again soon!

Right away I am going to do my breakfast, once having my breakfast coming over again to read other news.

What a data of un-ambiguity and preserveness of precious know-how about unpredicted feelings.

It’s actually a nice and useful piece of information. I am satisfied that you shared this useful info

with us. Please keep us up to date like this. Thank you for sharing.

I read this piece of writing completely regarding the

difference of most recent and previous technologies, it’s amazing article.

Greetings! Quick question that’s completely off topic.

Do you know how to make your site mobile friendly? My web site

looks weird when viewing from my iphone. I’m trying to find a

theme or plugin that might be able to resolve this issue.

If you have any recommendations, please share. Many thanks!

Greetings! Very useful advice in this particular post!

It is the little changes which will make the greatest changes.

Thanks a lot for sharing!

I’d like to find out more? I’d like to find

out more details.

I know this if off topic but I’m looking into starting my own weblog and

was wondering what all is needed to get setup?

I’m assuming having a blog like yours would cost

a pretty penny? I’m not very web savvy so I’m not 100%

positive. Any suggestions or advice would be greatly appreciated.

Kudos

Highly energetic blog, I loved that a lot. Will there be a part 2?

Good day! Do you know if they make any plugins to help

with Search Engine Optimization? I’m trying to get my blog to rank for

some targeted keywords but I’m not seeing very good results.

If you know of any please share. Thanks!

I’m pretty pleased to discover this great site. I wanted to

thank you for your time for this fantastic read!!

I definitely enjoyed every bit of it and I have you saved as a

favorite to look at new stuff on your blog.

It’s a shame you don’t have a donate button! I’d without a doubt donate to this superb blog!

I suppose for now i’ll settle for book-marking and adding your

RSS feed to my Google account. I look forward to fresh updates and will talk about this blog with my Facebook group.

Chat soon!

This paragraph is genuinely a pleasant one it assists new web users, who are wishing for blogging.

I would like to thank you for the efforts you have put in penning

this blog. I am hoping to check out the same high-grade blog posts

from you in the future as well. In fact, your creative writing

abilities has inspired me to get my own site now 😉

Hello, Neat post. There’s a problem together with your site in web explorer, would check this?

IE nonetheless is the market leader and a good part of other people will

omit your magnificent writing because of this problem.

Way cool! Some very valid points! I appreciate you writing this write-up and the

rest of the site is also very good.

Excellent pieces. Keep posting such kind of information on your page.

Im really impressed by it.

Hi there, You have done a great job. I’ll definitely digg

it and personally suggest to my friends. I’m sure they will be benefited from this web site.

Having read this I thought it was really informative.

I appreciate you finding the time and energy to put this article

together. I once again find myself personally spending a significant amount of time both reading and posting comments.

But so what, it was still worth it!

Greetings I am so delighted I found your weblog, I really found you by accident,

while I was searching on Digg for something else,

Anyways I am here now and would just like to say thanks a lot for a fantastic post and

a all round entertaining blog (I also love the theme/design),

I don’t have time to browse it all at the moment but I

have saved it and also added your RSS feeds, so when I have time I will be back to read a

great deal more, Please do keep up the great work.

Wow! This blog looks exactly like my old one!

It’s on a entirely different subject but it has pretty much the same page layout and design. Great choice of colors!

It’s remarkable to visit this web site and reading the views

of all colleagues about this paragraph, while I am also eager of getting knowledge.

Aw, this was an incredibly good post. Taking the time and actual

effort to produce a really good article… but what can I say… I hesitate a lot and don’t manage to get nearly anything done.

excellent points altogether, you just gained a logo new reader.

What would you suggest about your post that you just made a few days ago?

Any certain?

Wonderful, what a blog it is! This website presents valuable facts to us,

keep it up.

Wonderful blog! I found it while browsing on Yahoo

News. Do you have any suggestions on how to get listed in Yahoo News?

I’ve been trying for a while but I never seem to

get there! Thank you

I’ve been surfing online more than 3 hours today, yet I never found any interesting article like yours.

It is pretty worth enough for me. In my view, if all website owners and bloggers made good content as you did, the net will be a lot more useful than ever before.

I was recommended this website by my cousin. I am not sure whether this post is written by him as no one else know such detailed about my trouble.

You’re amazing! Thanks!

Hello everyone, it’s my first go to see at this website, and paragraph is actually fruitful for me, keep up posting these

articles.

Hi there, everything is going perfectly here and ofcourse every one is sharing information, that’s really fine,

keep up writing.

When some one searches for his essential thing, therefore he/she wishes to be available that in detail, therefore that thing is maintained

over here.

I’m not sure why but this web site is loading very slow for me.

Is anyone else having this problem or is it a issue on my end?

I’ll check back later and see if the problem still exists.

Today, I went to the beachfront with my kids. I found a sea

shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She placed the shell to her ear and screamed.

There was a hermit crab inside and it pinched

her ear. She never wants to go back! LoL I know this is completely off topic but I had to tell someone!

excellent issues altogether, you simply gained a new reader.

What might you recommend about your put up that you simply made a few days in the past?

Any certain?

Why visitors still make use of to read news papers when in this technological world the whole thing is existing on web?

Hello! This is my first visit to your blog! We are a group of

volunteers and starting a new initiative in a community in the

same niche. Your blog provided us beneficial information to

work on. You have done a extraordinary job!

I think this is one of the most significant

info for me. And i am glad reading your article. But wanna remark on few general things, The web site style is perfect, the

articles is really great : D. Good job, cheers

You made some really good points there. I looked on the net to learn more about the issue and found most people will

go along with your views on this web site.

Hey There. I found your blog using msn. This is a really well written article.

I’ll be sure to bookmark it and come back to read more of your useful info.

Thanks for the post. I will definitely comeback.

I’m very happy to discover this website. I wanted to thank

you for ones time just for this wonderful read!! I definitely liked every bit of

it and i also have you book marked to see new stuff on your web site.

Link exchange is nothing else however it is simply placing the other person’s web site link on your page

at suitable place and other person will also do same in favor

of you.

It’s impressive that you are getting thoughts from

this article as well as from our discussion made at this time.

Normally I do not read article on blogs, but I wish to say

that this write-up very pressured me to try and do it!

Your writing taste has been amazed me. Thanks, very nice article.

First off I want to say superb blog! I had a quick question that I’d like to ask if you do

not mind. I was curious to find out how you center yourself and clear your mind

before writing. I have had a hard time clearing my thoughts in getting my thoughts out.

I truly do take pleasure in writing however it just seems like the first 10 to 15 minutes are generally wasted simply just trying to figure out how to

begin. Any ideas or tips? Many thanks!

After I originally commented I seem to have clicked the -Notify me when new comments are

added- checkbox and now whenever a comment is added I recieve 4

emails with the exact same comment. Perhaps there is a means you are able to remove me

from that service? Thanks a lot!

I blog quite often and I truly appreciate your information. Your

article has truly peaked my interest. I’m going to book mark your blog and keep checking for new details about once per week.

I opted in for your RSS feed as well.

Spot on with this write-up, I honestly think this

site needs a lot more attention. I’ll probably be returning to see more, thanks

for the information!

When I initially commented I clicked the “Notify me when new comments are added” checkbox and now each time

a comment is added I get several emails with the same comment.

Is there any way you can remove people from that service?

Thanks a lot!

Good way of telling, and nice post to obtain facts regarding my presentation topic, which

i am going to convey in school.

Spot on with this write-up, I truly believe that this amazing site

needs much more attention. I’ll probably be back again to

read through more, thanks for the information!

I have read so many articles concerning the blogger lovers except this

article is really a fastidious paragraph, keep it up.

Howdy, i read your blog from time to time and i

own a similar one and i was just wondering if you get a lot of spam feedback?

If so how do you protect against it, any plugin or anything

you can advise? I get so much lately it’s driving me crazy

so any support is very much appreciated.

I got this web page from my friend who shared with me concerning this

web page and at the moment this time I am browsing this site and reading very informative posts at this place.

Magnificent items from you, man. I’ve be aware your stuff previous to and you

are just extremely magnificent. I actually like what

you have obtained right here, certainly like what you’re stating

and the way in which in which you are saying it. You’re making it enjoyable and you still take care of to keep

it wise. I cant wait to learn far more from you. That is actually a tremendous site.

Attractive section of content. I just stumbled upon your blog and in accession capital to assert

that I acquire actually enjoyed account your blog posts.

Any way I’ll be subscribing to your feeds and even I achievement you access consistently fast.

I’m not positive the place you’re getting your info, but good topic.

I needs to spend a while learning more or

understanding more. Thanks for wonderful information I used to be searching for this info for

my mission.

I was very pleased to find this web site. I need to to thank you for ones time due to this fantastic read!!

I definitely savored every bit of it and i also have you bookmarked

to look at new information in your blog.

Hello, just wanted to mention, I loved this post. It was helpful.

Keep on posting!

This article will help the internet people for creating new weblog or even a blog from start

to end.

I am regular reader, how are you everybody? This paragraph posted at this website is actually good.

This is a topic that is close to my heart… Cheers! Where are your contact details

though?

I’m impressed, I have to admit. Rarely do I encounter a blog that’s

both equally educative and interesting, and let me tell you, you have hit

the nail on the head. The problem is something that too few men and women are speaking intelligently about.

Now i’m very happy that I found this in my hunt for something regarding this.

Hello my family member! I wish to say that this post is awesome, nice written and come with approximately all significant infos.

I would like to see extra posts like this .

wonderful points altogether, you just gained a brand new reader.

What might you recommend about your post that you just made a few

days in the past? Any certain?

What’s up, I want to subscribe for this weblog to get latest updates, therefore where can i do it please help

out.

Thank you for every other informative website. Where else may just I

am getting that type of info written in such an ideal method?

I have a mission that I’m simply now working on, and I’ve been at the look out for such information.

I am curious to find out what blog system you are utilizing?

I’m experiencing some small security problems with my latest site and I would like to find something

more secure. Do you have any solutions?

I think what you posted was actually very reasonable.

However, consider this, what if you typed a catchier title?

I am not suggesting your content isn’t solid, but what if

you added a headline that grabbed folk’s attention? I mean My Trading Plan for a $200k FTP Retry – Disciplined FX is

a little vanilla. You ought to look at Yahoo’s home page and see

how they create news titles to grab people interested.

You might add a related video or a picture or two to

get people excited about what you’ve got to say. In my opinion, it might bring your website a little livelier.

Every weekend i used to pay a quick visit this web site,

for the reason that i want enjoyment, for the reason that this this

site conations genuinely nice funny data too.

Wow, fantastic blog layout! How long have you

been blogging for? you made blogging look easy.

The overall look of your website is wonderful, as

well as the content!

Hmm is anyone else encountering problems with

the images on this blog loading? I’m trying to figure out if its a problem on my end or if it’s the blog.

Any feedback would be greatly appreciated.

Your style is unique in comparison to other folks I have read stuff from.

Thank you for posting when you’ve got the opportunity, Guess I

will just book mark this blog.

Wow, this post is pleasant, my sister is analyzing these things, therefore I am

going to tell her.

I’m gone to inform my little brother, that he should also

pay a visit this web site on regular basis to get updated from most recent gossip.

Hurrah, that’s what I was exploring for, what a material!

existing here at this blog, thanks admin of this web page.

Wow! After all I got a blog from where I be capable of

genuinely get useful data regarding my study and knowledge.

Good day very nice site!! Man .. Excellent ..

Amazing .. I will bookmark your blog and take the feeds additionally?

I am happy to find a lot of helpful info here in the post, we need develop extra techniques

on this regard, thanks for sharing. . . . . .

Hello There. I found your blog using msn. This is a really well written article.

I will be sure to bookmark it and come back to read more

of your useful info. Thanks for the post. I will definitely return.

Article writing is also a excitement, if you

be familiar with then you can write if not it is difficult

to write.

Great beat ! I wish to apprentice while you amend your site,

how could i subscribe for a blog website? The account helped me a applicable deal.

I had been tiny bit familiar of this your broadcast provided shiny clear idea

I every time spent my half an hour to read this website’s articles all the time along with a

mug of coffee.

Excellent post! We are linking to this particularly great content on our site.

Keep up the great writing.

hey there and thank you for your information – I have certainly picked up anything new from right here.

I did however expertise several technical issues using this site, as I experienced to reload the site

many times previous to I could get it to load correctly.

I had been wondering if your hosting is OK?

Not that I’m complaining, but slow loading instances times will sometimes affect your placement in google and can damage your high-quality score if

ads and marketing with Adwords. Anyway I am adding this RSS to my email

and can look out for a lot more of your respective interesting content.

Ensure that you update this again very soon.

I know this web page presents quality based posts and

other material, is there any other web site which presents these kinds of

things in quality?

Woah! I’m really enjoying the template/theme of this website.

It’s simple, yet effective. A lot of times it’s tough to get

that “perfect balance” between user friendliness and appearance.

I must say you have done a superb job with this.

Also, the blog loads very fast for me on Firefox.

Outstanding Blog!

My brother recommended I would possibly like this website.

He was entirely right. This put up actually made my day. You cann’t imagine

simply how a lot time I had spent for this info! Thank you!

Hey there! Do you use Twitter? I’d like to follow you if

that would be ok. I’m absolutely enjoying your blog and look forward to

new updates.

Truly no matter if someone doesn’t understand then its

up to other users that they will assist, so here it occurs.

of course like your website however you have to check the spelling on several of your posts.

A number of them are rife with spelling problems and I to

find it very bothersome to tell the reality then again I’ll certainly come back

again.

My spouse and I absolutely love your blog and find nearly all

of your post’s to be just what I’m looking for.

can you offer guest writers to write content available for

you? I wouldn’t mind publishing a post or elaborating on a lot of

the subjects you write about here. Again, awesome site!

Good day! I could have sworn I’ve visited this blog before but after looking at many

of the articles I realized it’s new to me. Nonetheless,

I’m definitely delighted I found it and I’ll be book-marking

it and checking back often!

Link exchange is nothing else however it is only placing

the other person’s blog link on your page at

appropriate place and other person will also do same for you.

Good post. I learn something totally new and challenging on blogs I stumbleupon every day.

It’s always useful to read through content from other authors and

use a little something from their sites.

Amazing issues here. I’m very satisfied to see your post.

Thanks a lot and I’m taking a look ahead to touch you. Will you

please drop me a e-mail?

Hi there, i read your blog from time to time and i own a similar one and i was just wondering if you get a lot of spam comments?

If so how do you stop it, any plugin or anything you can advise?

I get so much lately it’s driving me insane

so any help is very much appreciated.

Hello There. I discovered your blog the use of msn. This is

an extremely well written article. I will make sure to bookmark it

and come back to read more of your helpful info. Thanks for the

post. I will certainly return.

I got this web page from my friend who informed me on the topic of this website and at the moment this time I am browsing this web page and

reading very informative posts at this place.

Awesome issues here. I’m very happy to see your article. Thank you so much and I’m having

a look forward to contact you. Will you kindly drop me a e-mail?

Hi there! This post couldn’t be written any better!

Reading through this post reminds me of my old room mate!

He always kept talking about this. I will forward this write-up to him.

Pretty sure he will have a good read. Thanks for sharing!

Pretty nice post. I just stumbled upon your blog and wanted to

say that I’ve truly enjoyed browsing your blog posts. In any case I will

be subscribing to your rss feed and I hope you write again very soon!

Good information. Lucky me I came across your site by chance (stumbleupon).

I have saved as a favorite for later!

whoah this blog is excellent i love studying your articles.

Keep up the good work! You understand, lots of people are looking around for this info, you can help them greatly.

Hey very cool blog!! Guy .. Beautiful ..

Amazing .. I will bookmark your site and take the feeds additionally?

I am satisfied to seek out so many useful information right here within the submit,

we want work out more techniques on this regard, thank you for sharing.

. . . . .

I feel this is among the so much important information for me.

And i am happy reading your article. But wanna commentary on some common issues,

The web site style is great, the articles is in point of fact great : D.

Just right task, cheers

whoah this blog is wonderful i like reading your posts.

Keep up the great work! You understand, lots of people are searching round

for this info, you can aid them greatly.

Hi Dear, are you in fact visiting this site daily, if so afterward

you will without doubt obtain pleasant knowledge.

A person essentially lend a hand to make severely posts I’d state.

That is the first time I frequented your web page and

to this point? I surprised with the research you made to create this actual submit extraordinary.

Fantastic process!

I have been browsing on-line more than three hours these days, yet I by no means found

any fascinating article like yours. It’s pretty price sufficient for me.

In my opinion, if all website owners and bloggers made excellent content material as you did, the web will be

much more useful than ever before.

I have to thank you for the efforts you have put in penning this blog.

I am hoping to see the same high-grade blog posts from you later on as well.

In fact, your creative writing abilities has inspired

me to get my very own website now 😉

Hi, I do believe this is an excellent web site. I stumbledupon it 😉

I will come back yet again since i have book marked it.

Money and freedom is the greatest way to change, may you be rich and continue to guide others.

Hey! Would you mind if I share your blog with my facebook group?

There’s a lot of people that I think would really appreciate your content.

Please let me know. Cheers

Heya excellent blog! Does running a blog like this require a massive amount work?

I have no understanding of coding however

I was hoping to start my own blog in the near future. Anyway, should you have any

recommendations or tips for new blog owners please share.

I know this is off subject however I just had to ask.

Thank you!

Thanks a bunch for sharing this with all of us you actually recognize what you are

speaking about! Bookmarked. Kindly also consult with my web site =).

We could have a hyperlink alternate arrangement among us

Magnificent site. Lots of helpful information here.

I’m sending it to a few buddies ans additionally sharing in delicious.

And certainly, thanks on your sweat!

Hey there just wanted to give you a brief heads up and let

you know a few of the images aren’t loading correctly.

I’m not sure why but I think its a linking issue.

I’ve tried it in two different web browsers and both show the same outcome.

I really love your blog.. Excellent colors & theme.

Did you build this website yourself? Please reply back as I’m looking to create

my own website and would love to find out where you got this

from or exactly what the theme is called. Kudos!

Heya are using WordPress for your site platform? I’m new to the blog

world but I’m trying to get started and create my own. Do

you need any coding expertise to make your own blog? Any help would be

really appreciated!

Paragraph writing is also a fun, if you be familiar with then you can write otherwise it is difficult to write.

wonderful issues altogether, you just won a logo new reader.

What might you suggest in regards to your publish that

you simply made a few days in the past? Any

sure?

hello there and thank you for your info – I have definitely picked up something

new from right here. I did however expertise several

technical points using this website, as I experienced to reload the web site a lot of times previous to I could get it to load

properly. I had been wondering if your web hosting is OK?

Not that I am complaining, but slow loading instances times will often affect your placement

in google and can damage your quality score if advertising and marketing with

Adwords. Anyway I’m adding this RSS to my email and could look out for a lot more

of your respective interesting content. Make sure

you update this again very soon.

Excellent, what a blog it is! This webpage provides helpful information to us, keep it up.

I know this if off topic but I’m looking into starting my own blog and was wondering what all is required to get setup?

I’m assuming having a blog like yours would cost a pretty penny?

I’m not very internet smart so I’m not 100% certain. Any recommendations or advice

would be greatly appreciated. Appreciate it

This post provides clear idea in favor of the new people of blogging, that

truly how to do blogging.

I’ve been surfing online more than 2 hours

today, yet I never found any interesting article like yours.

It is pretty worth enough for me. In my opinion, if all web owners and bloggers made good content as you did, the web will be much more useful than ever

before.

I always spent my half an hour to read this web site’s content daily along with a cup of coffee.

Wonderful beat ! I would like to apprentice while you amend your

website, how can i subscribe for a weblog website?

The account aided me a applicable deal. I

had been tiny bit familiar of this your broadcast offered vivid

clear idea

Heya! I understand this is kind of off-topic however I needed to

ask. Does building a well-established website like yours take a large amount of

work? I am brand new to blogging but I do write in my journal on a daily basis.

I’d like to start a blog so I will be able to share my experience

and thoughts online. Please let me know if you have any ideas or tips for new aspiring

bloggers. Appreciate it!

Hey would you mind stating which blog platform you’re using?

I’m going to start my own blog soon but I’m having a difficult time making a decision between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your design and style seems different then most blogs and

I’m looking for something unique. P.S My

apologies for getting off-topic but I had to ask!

Fantastic beat ! I would like to apprentice while you

amend your website, how can i subscribe for a blog web site?

The account aided me a acceptable deal. I had been a little bit acquainted of this your broadcast provided bright

clear idea

Hello! Do you use Twitter? I’d like to follow

you if that would be okay. I’m absolutely enjoying your blog and look forward to new

updates.

Pretty nice post. I just stumbled upon your weblog and wished to

say that I have truly enjoyed surfing around your weblog posts.

In any case I will be subscribing in your feed and I hope you write again soon!

Thanks designed for sharing such a good thought,

piece of writing is pleasant, thats why i have read

it completely

Hi my family member! I wish to say that this post is awesome, nice written and include approximately all significant infos. I?¦d like to see extra posts like this .

This is a topic that is close to my heart…

Many thanks! Exactly where are your contact details though?

Hi, I think your website might be having browser compatibility issues.

When I look at your blog in Opera, it looks fine but when opening in Internet

Explorer, it has some overlapping. I just wanted to give you a quick heads up!

Other then that, wonderful blog!

fantastic publish, very informative. I ponder why the

opposite experts of this sector don’t notice this. You must proceed your writing.

I’m sure, you’ve a great readers’ base already!

Hello, i read your blog occasionally and i own a similar one

and i was just wondering if you get a lot of spam responses?

If so how do you prevent it, any plugin or anything you can advise?

I get so much lately it’s driving me insane so any assistance is very much appreciated.

Hey very cool site!! Guy .. Excellent .. Wonderful ..

I’ll bookmark your website and take the feeds additionally?

I’m happy to find numerous helpful information here

within the put up, we want develop more techniques on this regard, thank you for sharing.

. . . . .

It’s remarkable in favor of me to have a site, which is good for my experience.

thanks admin

Spot on with this write-up, I actually feel this site needs a great deal more attention. I’ll probably be returning to read more, thanks

for the info!

Hi to every one, it’s truly a good for me to go to see this website, it includes precious Information.

Do you have a spam problem on this blog; I also am a blogger, and I was wanting

to know your situation; many of us have developed some nice

practices and we are looking to swap techniques with other folks, please shoot me an e-mail if interested.

What’s up every one, here every one is sharing

these kinds of knowledge, so it’s good to read this blog, and I used

to visit this blog all the time.

I know this web page gives quality dependent articles and extra stuff, is there

any other web site which provides these things in quality?

I’m not that much of a internet reader to be honest but your blogs really nice, keep it up!

I’ll go ahead and bookmark your site to come back in the future.

Many thanks

What’s Taking place i am new to this, I stumbled upon this

I’ve found It positively helpful and it has helped

me out loads. I am hoping to give a contribution & assist other

customers like its helped me. Good job.

I was recommended this web site by means of my

cousin. I’m now not sure whether or not this post is written via him as nobody else understand

such targeted approximately my difficulty. You’re wonderful!

Thanks!

Thanks very interesting blog!

I am regular visitor, how are you everybody? This post posted at this web page is genuinely nice.

Hello, for all time i used to check blog posts here in the early hours in the morning, for the

reason that i like to find out more and more.

I think this is among the most significant info for me.

And i’m glad reading your article. But want to remark

on few general things, The web site style is wonderful, the articles is really great :

D. Good job, cheers

Heya! I realize this is kind of off-topic but I had

to ask. Does operating a well-established website

such as yours take a large amount of work? I am

brand new to running a blog but I do write in my diary everyday.

I’d like to start a blog so I can easily share my personal experience and feelings online.

Please let me know if you have any recommendations

or tips for brand new aspiring blog owners.

Appreciate it!

My partner and I absolutely love your blog and

find the majority of your post’s to be exactly I’m looking for.

can you offer guest writers to write content in your case?

I wouldn’t mind publishing a post or elaborating on most of the subjects you write

regarding here. Again, awesome weblog!

Thanks on your marvelous posting! I quite enjoyed reading it, you can be a great

author.I will make sure to bookmark your blog and

will often come back very soon. I want to encourage that you continue your great job, have

a nice holiday weekend!

Today, I went to the beach with my kids. I found a sea shell and gave it to

my 4 year old daughter and said “You can hear the ocean if you put this to your ear.”

She placed the shell to her ear and screamed. There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this is totally off topic

but I had to tell someone!

At this time it sounds like BlogEngine is the best blogging platform

available right now. (from what I’ve read) Is that what

you are using on your blog?

This is a topic which is close to my heart…

Take care! Exactly where are your contact details though?

I am really enjoying the theme/design of your web site.

Do you ever run into any internet browser compatibility

issues? A handful of my blog visitors have complained about my website not operating correctly in Explorer but looks great in Chrome.

Do you have any ideas to help fix this problem?

I’m extremely inspired with your writing talents as well as with the format for your blog.

Is that this a paid theme or did you customize it your self?

Either way keep up the excellent high quality writing, it is

rare to look a great blog like this one today..

This article is truly a fastidious one it assists new the web people,

who are wishing for blogging.

Excellent blog here! Additionally your site so much up fast!

What host are you the usage of? Can I am getting your associate hyperlink for your host?

I desire my website loaded up as fast as yours lol

Hi, I do believe this is an excellent web site. I stumbledupon it 😉 I am going to return yet again since i have bookmarked it.

Money and freedom is the best way to change, may you be rich and continue to guide other

people.

It’s remarkable to pay a quick visit this web site and reading the views of all mates concerning this paragraph, while I am also eager of getting know-how.

I’m not sure exactly why but this weblog is loading extremely slow for me.

Is anyone else having this problem or is it a issue on my end?

I’ll check back later and see if the problem still exists.

It’s truly very complex in this active life to listen news on TV, thus

I just use world wide web for that purpose, and take the

most recent information.

Thankfulness to my father who stated to me

on the topic of this blog, this website is genuinely remarkable.

Thanks , I’ve just been searching for information approximately this subject for ages and yours is the greatest I have

came upon so far. However, what about the conclusion? Are

you certain concerning the supply?

Hmm is anyone else encountering problems with the images on this blog loading?

I’m trying to determine if its a problem on my end

or if it’s the blog. Any suggestions would be greatly appreciated.

Hi, i feel that i noticed you visited my web site so i came to return the prefer?.I’m trying to to find issues

to improve my web site!I assume its ok to use some of your concepts!!

Hello there, I discovered your site by means of Google whilst looking for a comparable

matter, your website got here up, it looks great.

I have bookmarked it in my google bookmarks.

Hello there, just turned into aware of your weblog via Google, and found that it is really informative.

I am going to be careful for brussels. I’ll be grateful

if you continue this in future. Lots of other people will likely be

benefited from your writing. Cheers!

Woah! I’m really digging the template/theme of this blog. It’s simple, yet effective. A lot of times it’s difficult to get that “perfect balance” between usability and appearance. I must say you’ve done a awesome job with this. Also, the blog loads very fast for me on Safari. Exceptional Blog!

Hey would you mind letting me know which webhost you’re utilizing?

I’ve loaded your blog in 3 different internet browsers and I must say this blog loads a lot faster then most.

Can you recommend a good hosting provider at a reasonable price?

Thanks, I appreciate it!

Write more, thats all I have to say. Literally, it seems as

though you relied on the video to make your point.

You obviously know what youre talking about, why throw

away your intelligence on just posting videos to your site when you could be giving us something informative to read?

Howdy just wanted to give you a quick heads up.

The words in your content seem to be running off the

screen in Opera. I’m not sure if this is a formatting issue or

something to do with web browser compatibility but I figured I’d post to let you know.

The design and style look great though! Hope you get the issue fixed soon. Kudos

Very descriptive blog, I liked that a lot. Will there be a part 2?

I was wondering if you ever considered changing the structure of

your site? Its very well written; I love what youve got to say.

But maybe you could a little more in the way of content so people could connect with it better.

Youve got an awful lot of text for only having 1 or two pictures.

Maybe you could space it out better?

I like what you guys are up too. Such clever work and reporting!

Keep up the great works guys I’ve included you guys

to blogroll.

Hi just wanted to give you a quick heads up and let you know a few of the pictures aren’t

loading properly. I’m not sure why but I think its a linking issue.

I’ve tried it in two different internet browsers and both show the same results.

I think the admin of this website is really working hard

in support of his web page, because here every material is quality based material.

If some one needs expert view on the topic of blogging afterward i advise

him/her to pay a quick visit this web site, Keep up the pleasant work.

You need to take part in a contest for one of the most

useful blogs online. I’m going to recommend this blog!

It’s actually a great and useful piece of info. I

am happy that you shared this useful information with

us. Please stay us up to date like this. Thank you for sharing.

Wonderful blog! I found it while searching on Yahoo News.

Do you have any suggestions on how to get listed in Yahoo News?

I’ve been trying for a while but I never seem to get there!

Many thanks

Hi there, its good article about media print, we

all be aware of media is a enormous source of

data.

Ahaa, its nice conversation concerning this article at this place at this blog,

I have read all that, so at this time me also commenting here.

Thanks on your marvelous posting! I quite enjoyed reading it, you happen to be a

great author.I will make sure to bookmark your blog and definitely

will come back at some point. I want to encourage you to ultimately continue your great job, have a

nice weekend!

whoah this weblog is excellent i really like studying your articles.

Keep up the great work! You already know, many persons are

searching around for this information, you could aid them greatly.

I all the time used to study article in news papers but now as I am a user of web so from now I am using

net for content, thanks to web.

Peculiar article, just what I was looking for.

This actually answered my downside, thank you!

Good day! I could have sworn I’ve been to this site before but after checking through some of the

post I realized it’s new to me. Anyways, I’m definitely glad I found it and I’ll be bookmarking and checking back often!

continuously i used to read smaller posts which also clear their motive,

and that is also happening with this paragraph which I am reading here.

I was recommended this blog by my cousin. I am now not sure whether this post is written by

him as no one else realize such special about my problem.

You are incredible! Thanks!

Hi, just wanted to say, I liked this article.

It was funny. Keep on posting!

fantastic put up, very informative. I’m wondering why the other experts of this

sector do not notice this. You should proceed your writing.

I’m sure, you have a huge readers’ base already!

My partner and I stumbled over here different website and thought I might

as well check things out. I like what I see so i am just following you.

Look forward to looking at your web page repeatedly.

each time i used to read smaller content which also clear their motive, and that

is also happening with this post which I am reading here.

Excellent article! We are linking to this great post on our website.

Keep up the great writing.

I am truly happy to read this webpage posts which carries plenty of valuable data, thanks for providing such data.

Link exchange is nothing else however it is just placing the other

person’s blog link on your page at appropriate place and

other person will also do same in favor of you.

What’s up friends, its wonderful paragraph about tutoringand

fully explained, keep it up all the time.

Tremendous issues here. I am very glad to look your post. Thanks a lot and I’m taking

a look ahead to touch you. Will you kindly drop me a mail?

hello there and thank you for your info –

I’ve definitely picked up anything new from right here.

I did however expertise several technical points using this site, as

I experienced to reload the website a lot of times previous to I could get it to

load correctly. I had been wondering if your hosting is

OK? Not that I’m complaining, but slow loading instances

times will sometimes affect your placement in google and can damage your quality score if advertising and marketing with

Adwords. Well I am adding this RSS to my email and can look out for a lot more of your respective interesting content.

Ensure that you update this again very soon.

This is really fascinating, You’re a very professional blogger.

I’ve joined your feed and look forward to searching for extra of your excellent post.

Additionally, I have shared your website

in my social networks

Great post! We are linking to this great article on our

site. Keep up the great writing.

I believe that is among the most important info for me.

And i’m happy reading your article. However wanna observation on some common issues,

The website taste is ideal, the articles is truly great

: D. Good activity, cheers

Yes! Finally someone writes about situs bokep.

Have you ever thought about adding a little bit more than just your articles?

I mean, what you say is fundamental and all. However just imagine if

you added some great photos or videos to give your posts more,

“pop”! Your content is excellent but with pics and video clips,

this website could certainly be one of the very best in its niche.

Excellent blog!

I savor, cause I discovered just what I was having a look for.

You’ve ended my 4 day lengthy hunt! God Bless you man. Have a great day.

Bye

Wonderful article! This is the kind of info that should be shared around the net.

Disgrace on Google for no longer positioning

this submit upper! Come on over and seek advice from my site .

Thank you =)

I needed to thank you for this very good read!! I absolutely loved every little

bit of it. I have got you saved as a favorite to look

at new stuff you post…

I like what you guys are up too. Such clever work

and reporting! Keep up the good works guys I’ve included you guys to my own blogroll.

Hello, just wanted to mention, I liked this post. It

was helpful. Keep on posting!

Fantastic beat ! I would like to apprentice whilst you amend your site, how could i subscribe for a blog site?

The account aided me a acceptable deal. I have been a little bit familiar of this your broadcast provided bright

transparent idea

Hmm it appears like your website ate my first comment (it was super

long) so I guess I’ll just sum it up what I had written and say,

I’m thoroughly enjoying your blog. I as well am an aspiring blog blogger but I’m

still new to everything. Do you have any points for beginner blog writers?

I’d certainly appreciate it.

Hey just wanted to give you a quick heads up. The text in your post seem to be running off the screen in Internet explorer.

I’m not sure if this is a format issue or something to

do with internet browser compatibility but I figured I’d post to let you know.

The design look great though! Hope you get the problem resolved soon. Kudos

Aw, this was an extremely nice post. Finding the time and actual effort to

make a very good article… but what can I say… I hesitate

a lot and don’t seem to get nearly anything done.

As the admin of this web site is working, no uncertainty very shortly it will

be well-known, due to its feature contents.

You actually make it seem so easy with your presentation but

I find this topic to be really something which I think I would never understand.

It seems too complex and extremely broad for me. I am looking forward

for your next post, I will try to get the hang of it!

I’m gone to convey my little brother, that he should also pay a visit this web site

on regular basis to take updated from newest reports.

Great web site you have got here.. It’s hard to find good quality

writing like yours these days. I really appreciate people like you!

Take care!!

It’s amazing to visit this web site and reading the views

of all mates regarding this post, while I am also eager of getting

familiarity.

I loved as much as you will receive carried out right here.

The sketch is attractive, your authored material stylish.

nonetheless, you command get got an impatience over that you

wish be delivering the following. unwell unquestionably come

more formerly again as exactly the same nearly a lot often inside case

you shield this increase.

Wonderful article! That is the type of information that are meant to be shared around the internet.

Disgrace on Google for now not positioning this post upper!

Come on over and discuss with my site . Thank you

=)

Yes! Finally something about forum bacol.

You ought to be a part of a contest for one of the highest quality blogs on the net.

I will highly recommend this website!

You really make it appear really easy together with your presentation however I in finding this matter to be actually something

that I think I’d never understand. It kind of feels too

complex and very wide for me. I’m having a look ahead in your

subsequent post, I will try to get the dangle of it!

It’s appropriate time to make some plans for the long run and it’s time to

be happy. I have read this publish and if I may just

I desire to suggest you some fascinating things or advice.

Perhaps you can write next articles regarding this article.

I wish to learn even more things approximately it!

This is a very good tip especially to those fresh to the blogosphere.

Brief but very accurate information… Thank you for sharing this one.

A must read article!

Pretty section of content. I just stumbled upon your weblog and in accession capital to assert

that I acquire in fact enjoyed account your blog posts. Anyway

I’ll be subscribing to your feeds and even I achievement you

access consistently rapidly.

Your means of telling all in this paragraph is truly good, every one can without difficulty know

it, Thanks a lot.

I really love your site.. Very nice colors & theme.

Did you create this website yourself? Please reply back as

I’m hoping to create my own personal site and want to know where you got

this from or just what the theme is called.

Many thanks!

Having read this I thought it was really enlightening.

I appreciate you spending some time and effort

to put this information together. I once again find myself personally spending a significant amount of time both reading and posting

comments. But so what, it was still worth it!

An impressive share! I have just forwarded this onto a co-worker

who had been conducting a little research on this. And he in fact bought me lunch

because I stumbled upon it for him… lol. So allow me to reword this….

Thank YOU for the meal!! But yeah, thanx for spending time to discuss this issue here on your

site.

An outstanding share! I’ve just forwarded this onto a colleague who was doing a little research

on this. And he actually ordered me breakfast due to the fact that I discovered it for him…

lol. So let me reword this…. Thanks for the meal!!

But yeah, thanx for spending the time to talk about this topic here on your website.

Having read this I believed it was really informative. I appreciate you taking the time and

energy to put this information together. I once again find

myself spending a significant amount of time both reading and posting

comments. But so what, it was still worthwhile!

Keep this going please, great job!

Incredible! This blog looks exactly like my old one! It’s

on a totally different topic but it has pretty much the same layout

and design. Excellent choice of colors!

When I initially commented I clicked the “Notify me when new comments are added” checkbox and now each

time a comment is added I get several emails with the

same comment. Is there any way you can remove people from that service?

Bless you!

Good day! I know this is kind of off topic but I was wondering which blog platform are you using

for this website? I’m getting tired of WordPress because I’ve had issues

with hackers and I’m looking at alternatives for another

platform. I would be awesome if you could point me in the direction of a

good platform.

I know this website provides quality based articles and additional data, is there any other website which gives such things

in quality?

I’ve been browsing online more than 2 hours today, yet I never found any interesting article like yours.

It’s pretty worth enough for me. In my opinion, if all

website owners and bloggers made good content as you

did, the web will be much more useful than ever before.

It’s genuinely very difficult in this active life to listen news

on TV, therefore I simply use world wide web

for that purpose, and obtain the newest news.

hello!,I like your writing so much! proportion we keep in touch extra approximately your article on AOL?

I need a specialist on this house to unravel my problem. May be

that is you! Having a look ahead to look you.

Thanks on your marvelous posting! I definitely enjoyed reading

it, you may be a great author.I will always bookmark your blog and may come back later in life.

I want to encourage you to definitely continue your great writing, have

a nice evening!

Hello there! Quick question that’s entirely off topic.

Do you know how to make your site mobile friendly? My website looks weird

when browsing from my iphone4. I’m trying to find a template

or plugin that might be able to resolve this problem. If you have

any recommendations, please share. With thanks!

Fastidious answer back in return of this issue with firm arguments and describing the whole thing regarding that.

Hi there! Do you know if they make any plugins to safeguard against hackers?

I’m kinda paranoid about losing everything I’ve worked hard on. Any tips?

Hello there, You have done an excellent job. I will certainly digg it and personally recommend to my friends.

I am sure they will be benefited from this

website.

Fantastic goods from you, man. I’ve understand your stuff previous to and you are simply too magnificent.

I actually like what you’ve obtained right here, certainly like what you’re stating and the best way through which

you assert it. You’re making it enjoyable and you still

take care of to keep it smart. I can’t wait to read much more from you.

That is actually a great website.

Hello, its fastidious post concerning media print, we all know media is a great source of data.

Simply want to say your article is as astounding.

The clearness in your post is simply excellent and i

could assume you’re an expert on this subject. Well with your permission let me to grab your RSS feed to keep up to

date with forthcoming post. Thanks a million and please keep up the

enjoyable work.

Thanks for any other informative web site.

The place else may just I am getting that kind of info written in such an ideal

way? I’ve a project that I’m just now running on, and I have been at the glance

out for such information.

If you want to improve your experience only keep visiting this web page and be updated with the newest gossip posted here.

What’s Taking place i am new to this, I stumbled upon this I have found

It positively useful and it has helped me out

loads. I’m hoping to contribute & aid other customers like its aided me.

Good job.

May I just say what a comfort to find someone who genuinely knows

what they’re discussing on the internet. You definitely understand how to bring

an issue to light and make it important. More

and more people need to check this out and understand this side of

your story. I was surprised that you aren’t more popular since you

certainly possess the gift.

What’s up to every single one, it’s truly a good for me to pay a visit this web site, it consists of priceless Information.

Very nice post. I just stumbled upon your blog and wanted

to say that I’ve truly enjoyed browsing your blog posts. In any case I will be subscribing to your rss feed and I hope you

write again very soon!

With havin so much written content do you ever run into any issues of plagorism

or copyright violation? My website has a lot of exclusive

content I’ve either created myself or outsourced but

it seems a lot of it is popping it up all over the web without my authorization. Do you know any ways

to help protect against content from being ripped off?

I’d certainly appreciate it.

Undeniably believe that which you said. Your

favorite justification seemed to be on the net the easiest thing to be aware of.

I say to you, I definitely get irked while people think about worries that they just do not know about.

You managed to hit the nail upon the top as well as defined out the

whole thing without having side effect , people can take a

signal. Will probably be back to get more. Thanks

I like the valuable info you provide in your articles.

I’ll bookmark your weblog and check again here regularly.

I am quite sure I’ll learn many new stuff right here!

Good luck for the next!

What a material of un-ambiguity and preserveness

of precious know-how on the topic of unpredicted emotions.

This text is worth everyone’s attention. When can I find out more?

Hello! This post couldn’t be written any better!

Reading this post reminds me of my previous room mate!

He always kept talking about this. I will forward this post to him.

Pretty sure he will have a good read. Thanks for sharing!

We stumbled over here different web address and thought I might

check things out. I like what I see so now i am following

you. Look forward to exploring your web page repeatedly.

It’s in point of fact a great and helpful piece of info.

I’m satisfied that you simply shared this useful information with

us. Please stay us informed like this. Thank you for sharing.

Very good site you have here but I was curious about if you knew of

any message boards that cover the same topics talked about here?

I’d really like to be a part of online community where I can get responses from other experienced

people that share the same interest. If you have any suggestions, please let me know.

Cheers!

Good day! I could have sworn I’ve visited this blog before but after going through some of the posts I realized it’s new to me.

Regardless, I’m certainly pleased I came across

it and I’ll be book-marking it and checking back regularly!

I absolutely love your blog and find almost all of your post’s to be

just what I’m looking for. Does one offer guest writers to

write content to suit your needs? I wouldn’t mind composing a post

or elaborating on a number of the subjects you write concerning here.

Again, awesome blog!

Wow, that’s what I was seeking for, what a stuff!

existing here at this blog, thanks admin of this site.

Hey there! I know this is kind of off topic but I was wondering which

blog platform are you using for this site? I’m getting fed up

of WordPress because I’ve had issues with hackers and I’m looking at options for another platform.

I would be great if you could point me in the direction of a good platform.

Thanks on your marvelous posting! I seriously enjoyed reading it, you’re a great

author.I will ensure that I bookmark your blog and definitely will come back down the road.

I want to encourage one to continue your great posts, have a

nice weekend!

Everything typed made a ton of sense. However,

think about this, what if you added a little information? I ain’t saying

your information isn’t good., however suppose you added something that makes people

desire more? I mean My Trading Plan for a $200k FTP

Retry – Disciplined FX is a little vanilla. You could

glance at Yahoo’s home page and see how they write article headlines

to get people interested. You might add a related video or a related picture or two

to get readers excited about everything’ve got to say.

Just my opinion, it could bring your posts a little livelier.

Thanks for any other informative web site. Where else may just I am getting that type of information written in such a perfect

manner? I’ve a undertaking that I am just now operating on, and I have been at the glance

out for such information.

Thank you for the auspicious writeup. It in fact was a amusement account it.

Look advanced to more added agreeable from you!

By the way, how could we communicate?

Touche. Outstanding arguments. Keep up the great effort.

I go to see everyday a few sites and information sites to read

articles or reviews, but this blog offers feature based

articles.

Hello my loved one! I wish to say that this article

is awesome, great written and come with approximately

all vital infos. I’d like to see more posts like this .