I Failed My Funded Trading Plus Challenge – Lessons Learned

I Failed My FTP Challenge – Here’s What I Learned

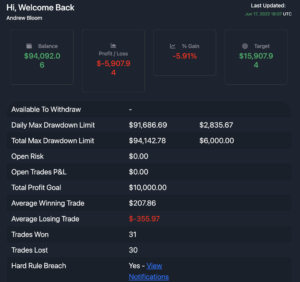

As of last night’s Asia trading session, I failed my Funded Trading Plus challenge.

How do I feel?

Actually, after almost two months of battling a drawdown, I feel pretty relieved.

My challenge was a mess, to put it bluntly. During that time I developed worsening symptoms of my chronic illness and could no longer wake up to trade the NY session (I’m located in Southern California. The NY/London crossover officially starts at 4am here).

So instead, I tried to trade an end-of-NY-session crossover strategy that I had used in the past but hadn’t fully backtested for post-Covid volatility. That was a dud and further drained my account.

I also made a switch to trading during the Asia session. I tried using the trend-following strategies I teach in the Scalping course during this time and the results didn’t quite match the preferred London or NY sessions.

Do you see the pattern in this?

I made far too many changes during a challenge. Shifting too quickly left me feeling a bit chaotic and I failed myself in my own discipline as I made a few trades that broke my rules amidst feelings of anxiety.

The ideal is to run your challenge with a strategy and system already in place with your discipline well intact. You should have evidence that this process is profitable before starting your challenge.

My experience with this Funded Trading Plus challenge ran against that simple formula.

So when I say I’m relieved, I imply that I feel like I received the outcome that my trading choices deserved. I’m at peace with this result. In the truest sense of the word, this was my karma for behaving like a trader going through retrograde. The way I traded over the last few months was not reflective of the practices of a responsible trader.

Given my life circumstances, I did the best with what I had and it wasn’t enough to merit a win.

So now that this first challenge is over, I can take time and space to reflect on the process and decide what to do next.

I intend on taking another Funded Trading Plus challenge, but not necessarily right away. FTP gives you 30 days to “reset” your account. At this time, it seems you get about 20% off of the initial fee for a retry.

Even if I am not ready to trade right away, because there is no time limit to the challenge, I can sign-up again and wait to start the new challenge. I want to be sure I have evidence that I can be profitable with a new approach before attempting to take it live.

For this entire year, I’ve been thinking about taking my trading to another level. For most of my time as a Forex trader, I’ve depended on mechanical strategies and short time frames to execute scalping trades.

While this approach helped me to develop a routine, make money, learn to follow my rules, and be procedural about trading, I’m no longer able to maintain the daily routine of a mechanical scalper. With 3+ years in the market, I feel like this next step is appropriate should I prevail as a successful trader over the long-run.

The Next Step: Learn to Trade Like a Professional

As I do more research on the kinds of trading practices kept by professional traders who have decades of experience behind them, I’ve found that about 90% of these individuals:

- Utilize discretionary trading styles on higher time frames, such as the 1H to Daily charts.

- Utilize both fundamental analysis and technical analysis that accounts for the way big money hunts order flows and responds to news

- Apply a variety of technical analysis tools to understand where to position themselves for high-probability returns: candlestick patterns, trend lines, supply and demand zones, Fibonacci retracements, etc.

- Mostly use indicators to understand the overall market structure, not necessarily to trigger entries or exits

- Use multi-timeframe analysis and top-down approach to understanding directional cycles

- Apply conservative risk management standards (For example, most will risk less than 1% per trade)

- Are buoyant and can apply analysis to any market setup

At this watershed moment, with a failed long-term prop firm challenge in my peripheral view and a vision for more consistent profitability in the future, I think it’s time to take the next step and dive deep into professional-level trading skills.

The Beginner’s Mind

Becoming a “Beginner” again is far different 3 years into trading rather than starting out completely fresh as a new trader. There are many things that I intuitively understand from experience, such as dealing with losses, drawdowns, winning streaks, emotions while trading, etc. I’m also comfortable with trading platforms, submitting orders, reading charts, and have a general understanding of nearly every technical tool and trading approach out there.

When you’re first learning to trade, when every concept you come across is new, information overload is common. You don’t know how to prioritize information. It’s easy to decide not to learn something that feels uncomfortable.

The beauty of “starting over” when you already have experience is that you have more situational awareness and knowledge to help conceptualize difficult topics. You’re not exactly starting over, you’re merely adding more information to mental categories that are shallow in depth.

For example, I may not know how to apply fundamental analysis to my trades just yet, but I am familiar with many economic events that drive markets, such as interest rate decisions, non-farm payroll, retail sales, etc. If I was just starting out and attempting to learn fundamental analysis, these would all be new words and concepts to learn. Instead, at this stage, I am familiar with the terms and their basic meaning – now I want to learn how they all fit together and go deeper on what their numbers entail for market sentiment.

It’s kind of like when you’re learning a new language and you more easily remember vocabulary that sounds similar to words in your own native tongue. It’s far easier to associate already-known concepts than have to drill an entirely new concept into your head.

So this is all to say that learning how to trade like a professional is a process. It’s not one that you can Bootcamp in six months. There’s far too much information to acquire and too many processes to practice. Dealing with your psychology is also something you can only master with experience and time.

It’s not embarrassing for me to say that I’ve failed this challenge because I’m still relatively young in my career as a trader. I share this with you so that you can reflect on your own time in the markets and give yourself some slack if you’re not where you thought you would be by this time. Trading is not easy. If it was, more people would routinely profit. I also hope that some of you will be influenced to join me on this learning adventure, as long as you’re ready to scale your knowledge.

My Trading To-Do List for the Next Few Months (and Even Years)

- Daily read books and take courses offered by professional-level traders who have a solid trading record. Some possibilities include:

- Anna Coulling (“Three-Dimensional Approach to Forex”)

- Kathy Lien (“Day Trading and Swing Trading the Currency Market”)

- Brent Donnelly (“The Art of Currency Trading”)

- Karen Foo (“Fundamentals of Currency Trading”)

- Research other traders who have a solid track record, are professional not only in their trading style but the way they hold themselves and conduct their Forex education business. Academic background in finance is preferred but not necessary.

- Find a trading approach that compliments my lifestyle

- Trade 1H – Daily charts for entries so I can limit my trading session to about an hour a day, in the afternoon when NY closes and I am certain to be awake

- Mixes fundamental analysis with technical analysis – I actually enjoy reading the news. Having a sense of why the markets are moving helps build confidence in a trade idea

- Find a trading mentor who I trust

- Ideally, this is someone who can regularly review my trading decisions and pinpoint flaws and strengths in my thinking process

- Is someone who has a lifestyle and approach that mirrors my own ideals (Calm, genuinely kind, values financial freedom over materialism, enjoys the art of teaching and mentoring – isn’t in it just for the money)

- Be more scrupulous in tracking not only my trades but also what I am doing to develop my education as a Forex trader.

- Sometimes it’s easy to “do more” without really learning from the experience. I want to make sure what I am learning is directly connected to trading improvement and actually has an impact on my trading over the long-run

- Sometimes it’s easy to not do enough or to avoid the difficult work. I want to be sure to go slow with topics that I don’t immediately understand and give myself enough time and patience to work on the tough stuff. I anticipate this being an issue with learning fundamental analysis

- My tracking tools can include: Trading journal (trade stats, overarching trading idea, emotions and thoughts that arise while trading, etc.); Weekly reflection of best/worst trades, what I researched and learned that week; Forex education journal (Jot down a few lines in a log each day as to what I studied, what insights I had, and how I spent my time learning)

This is merely the blueprint of what my game plan will entail as I begin again and learn new Forex strategies that may push beyond what I was comfortable doing in the past. I hope to document this process and share it with you all. I don’t doubt that some of what I come across will also benefit you in your own trading.

Sometimes it’s the big failures that act as kindle for the fire that will light you up and motivate you to reach a new level. Whether it’s blowing up your account, failing a challenge, experiencing a major life change, or facing a long drawdown. Sometimes big problems help us open up to solutions that we might have rejected in the past, out of fear or laziness, or even the belief that we’re not capable of learning.

In the aftermath of a serious problem, one option is to stay caught up in emotions. Another is to use it as a springboard to learn deeply from the experience and make new choices. Don’t forget, you can always get value out of your failures by reflecting upon what happened, taking responsibility for your role in the outcome, and using that knowledge for your improvement.

Saved as a favorite, I like your site!

I used to be able to find good info from your articles.

When I originally left a comment I seem to have clicked the -Notify me when new comments are added- checkbox and from now on whenever a comment is added I receive 4 emails with the exact same comment. Perhaps there is a means you are able to remove me from that service? Thanks!

Good site you’ve got here.. It’s hard to find high-quality writing like yours these days. I honestly appreciate individuals like you! Take care!!

you have an awesome weblog here! would you like to make some invite posts on my blog?

I am typically to blogging and i actually appreciate your content. The article has actually peaks my interest. I am going to bookmark your website and keep checking for new information.

Excellent post. I was checking constantly this blog and I’m impressed! Extremely useful information specially the final phase 🙂 I deal with such information a lot. I was seeking this certain info for a very lengthy time. Thank you and best of luck.

One other thing is that an online business administration training course is designed for college students to be able to without problems proceed to bachelors degree courses. The 90 credit education meets the lower bachelor diploma requirements when you earn the associate of arts in BA online, you will have access to the newest technologies in this field. Several reasons why students would like to get their associate degree in business is because they are interested in the field and want to obtain the general education necessary before jumping in a bachelor diploma program. Thx for the tips you provide with your blog.

It?s actually a nice and useful piece of info. I am glad that you shared this helpful info with us. Please keep us informed like this. Thanks for sharing.

Hello! I’ve been reading your website for some time now and finally got the bravery to go ahead and give you a shout out from Atascocita Texas! Just wanted to tell you keep up the good work!

A motivating discussion is definitely worth comment. I do think that you need to publish more on this issue, it might not be a taboo matter but usually people don’t talk about such issues. To the next! All the best!!

I believe that avoiding ready-made foods is a first step in order to lose weight. They will often taste fine, but ready-made foods have got very little vitamins and minerals, making you take in more simply to have enough vigor to get with the day. Should you be constantly consuming these foods, switching to whole grains and other complex carbohydrates will let you have more electricity while taking in less. Great blog post.

I appreciate, cause I found just what I was looking for. You have ended my four day long hunt! God Bless you man. Have a nice day. Bye

Hi my friend! I want to say that this article is awesome, nice written and include approximately all vital infos. I would like to see more posts like this.

Good blog! I really love how it is easy on my eyes and the data are well written. I’m wondering how I could be notified whenever a new post has been made. I’ve subscribed to your feed which must do the trick! Have a nice day!

Wow! I’m in awe of the author’s writing skills and ability to convey complicated concepts in a concise and precise manner. This article is a real treasure that deserves all the applause it can get. Thank you so much, author, for providing your knowledge and offering us with such a precious treasure. I’m truly grateful!

One more thing is that while searching for a good on the web electronics retail outlet, look for online stores that are constantly updated, always keeping up-to-date with the newest products, the most beneficial deals, and also helpful information on products. This will ensure you are handling a shop that really stays over the competition and give you things to make educated, well-informed electronics buys. Thanks for the important tips I’ve learned through the blog.

Thank you for sharing superb informations. Your web site is very cool. I’m impressed by the details that you?ve on this website. It reveals how nicely you understand this subject. Bookmarked this web page, will come back for extra articles. You, my pal, ROCK! I found simply the info I already searched everywhere and simply couldn’t come across. What a perfect web site.

I was wondering if you ever considered changing the layout of your website? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having 1 or two pictures. Maybe you could space it out better?

Hello my friend! I wish to say that this article is amazing, nice written and include almost all significant infos. I?d like to see more posts like this.

Somebody essentially help to make seriously posts I would state. This is the very first time I frequented your web page and thus far? I amazed with the research you made to create this particular publish extraordinary. Magnificent job!

This site doesn’t show up appropriately on my android – you may wanna try and repair that

Thanks for the points you have provided here. Another thing I would like to convey is that laptop or computer memory needs generally rise along with other advances in the technological innovation. For instance, as soon as new generations of cpus are brought to the market, there’s usually an equivalent increase in the type preferences of all computer memory along with hard drive space. This is because the program operated by simply these cpus will inevitably increase in power to use the new technological innovation.

Thanks for the suggestions you reveal through this site. In addition, quite a few young women exactly who become pregnant usually do not even aim to get medical health insurance because they fear they won’t qualify. Although a lot of states now require that insurers supply coverage regardless of pre-existing conditions. Premiums on these kind of guaranteed plans are usually greater, but when with the high cost of medical treatment it may be a safer route to take to protect your current financial potential.

Hey very cool website!! Man .. Beautiful .. Amazing .. I’ll bookmark your site and take the feeds also?I’m happy to find numerous useful information here in the post, we need work out more strategies in this regard, thanks for sharing. . . . . .

That is very interesting, You are a very skilled blogger. I have joined your feed and look ahead to in search of more of your magnificent post. Also, I have shared your website in my social networks!

Heya are using WordPress for your site platform? I’m new to the blog world but I’m trying to get started and create my own. Do you need any html coding knowledge to make your own blog? Any help would be greatly appreciated!

Hmm it appears like your website ate my first comment (it was extremely long) so I guess I’ll just sum it up what I submitted and say, I’m thoroughly enjoying your blog. I too am an aspiring blog blogger but I’m still new to everything. Do you have any points for rookie blog writers? I’d genuinely appreciate it.

Another thing I’ve noticed is the fact for many people, bad credit is the result of circumstances past their control. One example is they may be actually saddled through an illness so they have excessive bills for collections. It could be due to a work loss or perhaps the inability to do the job. Sometimes divorce process can send the finances in the wrong direction. Many thanks sharing your opinions on this website.

I think this is among the most important information for me. And i am glad studying your article. But want to statement on few basic things, The website taste is perfect, the articles is actually great : D. Just right process, cheers

It?s really a great and helpful piece of information. I?m glad that you shared this useful information with us. Please stay us informed like this. Thank you for sharing.

One thing I’d prefer to discuss is that fat burning plan fast can be performed by the correct diet and exercise. A person’s size not merely affects appearance, but also the complete quality of life. Self-esteem, major depression, health risks, and also physical ability are afflicted in extra weight. It is possible to just make everything right and still gain. Should this happen, a problem may be the perpetrator. While a lot of food and never enough physical exercise are usually at fault, common health conditions and widely used prescriptions can easily greatly add to size. Kudos for your post in this article.

I have seen that car insurance businesses know the autos which are susceptible to accidents and other risks. In addition they know what type of cars are inclined to higher risk and also the higher risk they have got the higher the premium rate. Understanding the very simple basics regarding car insurance will help you choose the right style of insurance policy that will take care of your requirements in case you get involved in an accident. Many thanks sharing the ideas in your blog.

At this time it seems like Drupal is the preferred blogging platform available right now. (from what I’ve read) Is that what you are using on your blog?

Hi there, I discovered your web site by means of Google even as looking for a comparable topic, your site got here up, it appears great. I’ve bookmarked it in my google bookmarks.

I’m truly enjoying the design and layout of your site. It’s a very easy on the eyes which makes it much more pleasant for me to come here and visit more often. Did you hire out a developer to create your theme? Outstanding work!

Hi there, You’ve done a fantastic job. I will certainly digg it and for my part recommend to my friends. I am confident they’ll be benefited from this website.

What i do not realize is in reality how you are now not really much more smartly-preferred than you may be right now. You’re very intelligent. You know therefore significantly in the case of this matter, produced me in my opinion believe it from numerous numerous angles. Its like men and women are not fascinated until it is something to accomplish with Girl gaga! Your individual stuffs outstanding. All the time handle it up!

Thanks for these tips. One thing I additionally believe is that credit cards providing a 0 interest rate often entice consumers in zero monthly interest, instant approval and easy online balance transfers, nonetheless beware of the top factor that may void your current 0 easy street annual percentage rate as well as throw anybody out into the very poor house in no time.

Somebody necessarily assist to make severely articles I would state. That is the first time I frequented your website page and so far? I surprised with the analysis you made to make this actual put up amazing. Magnificent job!

Hello! Someone in my Myspace group shared this website with us so I came to look it over. I’m definitely enjoying the information. I’m book-marking and will be tweeting this to my followers! Outstanding blog and terrific style and design.

cazare cu ponton pescuit

I loved as much as you’ll receive carried out right here. The sketch is tasteful, your authored material stylish. nonetheless, you command get got an shakiness over that you wish be delivering the following. unwell unquestionably come more formerly again since exactly the same nearly a lot often inside case you shield this increase.

I delight in, cause I discovered just what I was taking a look for. You have ended my four day lengthy hunt! God Bless you man. Have a great day. Bye

Thanks for the posting. I have often seen that a majority of people are desperate to lose weight when they wish to show up slim in addition to looking attractive. Even so, they do not always realize that there are many benefits so that you can losing weight as well. Doctors insist that obese people experience a variety of conditions that can be perfectely attributed to the excess weight. The good news is that people who are overweight as well as suffering from several diseases can help to eliminate the severity of their illnesses by way of losing weight. It’s possible to see a slow but noted improvement in health as soon as even a negligible amount of losing weight is accomplished.

Wow! This could be one particular of the most beneficial blogs We’ve ever arrive across on this subject. Actually Wonderful. I am also a specialist in this topic therefore I can understand your effort.

Do you mind if I quote a few of your posts as long as I provide credit and sources back to your blog? My blog is in the exact same niche as yours and my visitors would really benefit from a lot of the information you provide here. Please let me know if this alright with you. Many thanks!

I discovered your blog website on google and examine just a few of your early posts. Proceed to maintain up the superb operate. I just additional up your RSS feed to my MSN News Reader. Searching for ahead to reading extra from you in a while!?

I get pleasure from, lead to I discovered exactly what I used to be having a look for. You’ve ended my four day lengthy hunt! God Bless you man. Have a great day. Bye

Thanks a lot for the helpful article. It is also my opinion that mesothelioma has an very long latency time, which means that signs and symptoms of the disease may well not emerge until 30 to 50 years after the first exposure to mesothelioma. Pleural mesothelioma, that’s the most common variety and has effects on the area around the lungs, may cause shortness of breath, chest muscles pains, and a persistent coughing, which may lead to coughing up our blood.

My brother recommended I might like this web site. He was totally right. This post truly made my day. You cann’t imagine simply how much time I had spent for this information! Thanks!

Thanks for the thoughts you have contributed here. Also, I believe there are a few factors which keep your car insurance policy premium straight down. One is, to think about buying automobiles that are in the good listing of car insurance corporations. Cars which are expensive will be more at risk of being lost. Aside from that insurance policies are also in line with the value of your car, so the higher in price it is, then the higher the particular premium you spend.

I have realized that car insurance corporations know the automobiles which are prone to accidents and other risks. Additionally, these people know what sort of cars are susceptible to higher risk and the higher risk they may have the higher your premium amount. Understanding the simple basics with car insurance will assist you to choose the right form of insurance policy that can take care of your preferences in case you get involved in any accident. Appreciate your sharing the actual ideas on your own blog.

Thanks for the new things you have discovered in your short article. One thing I’d like to discuss is that FSBO associations are built after a while. By bringing out yourself to owners the first weekend their FSBO is actually announced, prior to masses start calling on Thursday, you generate a good link. By mailing them equipment, educational elements, free reviews, and forms, you become a strong ally. By using a personal curiosity about them plus their circumstances, you develop a solid interconnection that, oftentimes, pays off when the owners opt with a realtor they know as well as trust — preferably you.

I?ve read a few good stuff here. Definitely worth bookmarking for revisiting. I wonder how much effort you put to create such a wonderful informative website.

I do not even know the way I ended up here, but I thought this put up used to be good. I don’t recognise who you’re however definitely you’re going to a well-known blogger in case you aren’t already 😉 Cheers!

Ermutigen Sie Ihre Kunden, direkt von Ihrer Online-Bestellseite aus eine Bestellung aufzugeben

Mybudgetart.com.au is Australia’s Trusted Online Wall Art Canvas Prints Store. We are selling art online since 2008. We offer 1000+ artwork designs, up-to 50 OFF store-wide, FREE Delivery Australia & New Zealand, and World-wide shipping.

I can’t express how much I appreciate the effort the author has put into creating this outstanding piece of content. The clarity of the writing, the depth of analysis, and the plethora of information provided are simply astonishing. Her passion for the subject is evident, and it has undoubtedly struck a chord with me. Thank you, author, for sharing your knowledge and enriching our lives with this incredible article!

I will right away take hold of your rss feed as I can not to find your email subscription link or newsletter service. Do you’ve any? Please let me realize so that I may just subscribe. Thanks.

Audio started playing any time I opened up this web page, so annoying!

I have noticed that online education is getting popular because attaining your college degree online has become a popular option for many people. A lot of people have never had an opportunity to attend an established college or university but seek the increased earning possibilities and a better job that a Bachelors Degree affords. Still some others might have a degree in one discipline but wish to pursue another thing they now develop an interest in.

Wow, this article is mind-blowing! The author has done a phenomenal job of presenting the information in an captivating and enlightening manner. I can’t thank her enough for providing such precious insights that have definitely enhanced my understanding in this subject area. Bravo to him for crafting such a gem!

Heya! I’m at work browsing your blog from my new apple iphone! Just wanted to say I love reading your blog and look forward to all your posts! Keep up the excellent work!

Greetings! Quick question that’s completely off topic. Do you know how to make your site mobile friendly? My website looks weird when viewing from my iphone4. I’m trying to find a template or plugin that might be able to resolve this issue. If you have any recommendations, please share. Cheers!

You can definitely see your enthusiasm in the work you write. The world hopes for even more passionate writers like you who aren’t afraid to say how they believe. Always follow your heart.

Holy cow! I’m in awe of the author’s writing skills and ability to convey complex concepts in a clear and precise manner. This article is a real treasure that deserves all the accolades it can get. Thank you so much, author, for providing your expertise and giving us with such a valuable resource. I’m truly grateful!

What’s up friends, its enormous piece of writing concerning

cultureand completely defined, keep it up all the time.

This article resonated with me on a personal level. Your ability to emotionally connect with your audience is truly commendable. Your words are not only informative but also heartwarming. Thank you for sharing your insights.

One thing I’d really like to say is the fact that before purchasing more pc memory, check out the machine in which it will be installed. Should the machine is definitely running Windows XP, for instance, the memory ceiling is 3.25GB. The installation of above this would purely constitute a new waste. Make sure that one’s motherboard can handle your upgrade volume, as well. Thanks for your blog post.

I just like the helpful information you supply to your articles. I will bookmark your weblog and take a look at once more here regularly. I’m moderately certain I?ll learn many new stuff right right here! Best of luck for the next!

Your blog has rapidly become my trusted source of inspiration and knowledge. I genuinely appreciate the effort you invest in crafting each article. Your dedication to delivering high-quality content is apparent, and I eagerly await every new post.

I know this if off topic but I’m looking into starting my own weblog and was wondering what all is needed to get set up? I’m assuming having a blog like yours would cost a pretty penny? I’m not very internet smart so I’m not 100 certain. Any recommendations or advice would be greatly appreciated. Appreciate it

Your positivity and enthusiasm are undeniably contagious! This article brightened my day and left me feeling inspired. Thank you for sharing your uplifting message and spreading positivity among your readers.

I can’t help but be impressed by the way you break down complex concepts into easy-to-digest information. Your writing style is not only informative but also engaging, which makes the learning experience enjoyable and memorable. It’s evident that you have a passion for sharing your knowledge, and I’m grateful for that.

Hiya, I’m really glad I’ve found this info. Today bloggers publish only about gossips and internet and this is really frustrating. A good site with exciting content, this is what I need. Thanks for keeping this web site, I will be visiting it. Do you do newsletters? Can’t find it.

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

Good article. It’s very unfortunate that over the last years, the travel industry has already been able to to deal with terrorism, SARS, tsunamis, influenza, swine flu, plus the first ever true global economic downturn. Through it all the industry has proven to be strong, resilient along with dynamic, obtaining new approaches to deal with trouble. There are often fresh troubles and the possiblility to which the marketplace must again adapt and react.

I’ve discovered a treasure trove of knowledge in your blog. Your unwavering dedication to offering trustworthy information is truly commendable. Each visit leaves me more enlightened, and I deeply appreciate your consistent reliability.

Your blog is a true gem in the vast online world. Your consistent delivery of high-quality content is admirable. Thank you for always going above and beyond in providing valuable insights. Keep up the fantastic work!

You made some first rate points there. I regarded on the internet for the problem and located most people will go along with together with your website.

I?m impressed, I need to say. Really rarely do I encounter a blog that?s each educative and entertaining, and let me inform you, you have got hit the nail on the head. Your concept is excellent; the difficulty is something that not enough individuals are speaking intelligently about. I’m very happy that I stumbled throughout this in my seek for one thing relating to this.

Your blog is a true gem in the vast online world. Your consistent delivery of high-quality content is admirable. Thank you for always going above and beyond in providing valuable insights. Keep up the fantastic work!

Your unique approach to tackling challenging subjects is a breath of fresh air. Your articles stand out with their clarity and grace, making them a joy to read. Your blog is now my go-to for insightful content.

I think other web site proprietors should take this web site as an model, very clean and great user genial style and design, as well as the content. You are an expert in this topic!

Very nice post. I just stumbled upon your weblog and wished to say that I have truly enjoyed surfing around your blog posts. After all I?ll be subscribing to your feed and I hope you write again soon!

I’ve been browsing online greater than 3 hours today, but I by no means discovered any fascinating article like yours. It?s lovely price sufficient for me. In my view, if all web owners and bloggers made just right content as you did, the web might be a lot more useful than ever before.

Your unique approach to tackling challenging subjects is a breath of fresh air. Your articles stand out with their clarity and grace, making them a joy to read. Your blog is now my go-to for insightful content.

I am continually impressed by your ability to delve into subjects with grace and clarity. Your articles are both informative and enjoyable to read, a rare combination. Your blog is a valuable resource, and I am sincerely grateful for it.

I’ve found a treasure trove of knowledge in your blog. Your dedication to providing trustworthy information is something to admire. Each visit leaves me more enlightened, and I appreciate your consistent reliability.

Thanks for your strategies. One thing I’ve noticed is the fact that banks and financial institutions know the dimensions and spending routines of consumers and understand that plenty of people max away their own credit cards around the breaks. They properly take advantage of this kind of fact and begin flooding your own inbox and also snail-mail box together with hundreds of 0 APR credit cards offers shortly when the holiday season concludes. Knowing that in case you are like 98 of all American general public, you’ll soar at the possiblity to consolidate financial debt and transfer balances to 0 interest rate credit cards.

Your unique approach to addressing challenging subjects is like a breath of fresh air. Your articles stand out with their clarity and grace, making them a pure joy to read. Your blog has now become my go-to source for insightful content.

Your dedication to sharing knowledge is unmistakable, and your writing style is captivating. Your articles are a pleasure to read, and I consistently come away feeling enriched. Thank you for being a dependable source of inspiration and information.

I’m truly impressed by the way you effortlessly distill intricate concepts into easily digestible information. Your writing style not only imparts knowledge but also engages the reader, making the learning experience both enjoyable and memorable. Your passion for sharing your expertise is unmistakable, and for that, I am deeply grateful.

http://www.factorytapestry.com is a Trusted Online Wall Hanging Tapestry Store. We are selling online art and decor since 2008, our digital business journey started in Australia. We sell 100 made-to-order quality printed soft fabric tapestry which are just too perfect for decor and gifting. We offer Up-to 50 OFF Storewide Sale across all the Wall Hanging Tapestries. We provide Fast Shipping USA, CAN, UK, EUR, AUS, NZ, ASIA and Worldwide Delivery across 100+ countries.

In a world where trustworthy information is more crucial than ever, your dedication to research and the provision of reliable content is truly commendable. Your commitment to accuracy and transparency shines through in every post. Thank you for being a beacon of reliability in the online realm.

I couldn’t agree more with the insightful points you’ve articulated in this article. Your profound knowledge on the subject is evident, and your unique perspective adds an invaluable dimension to the discourse. This is a must-read for anyone interested in this topic.

Your blog is a true gem in the vast expanse of the online world. Your consistent delivery of high-quality content is truly commendable. Thank you for consistently going above and beyond in providing valuable insights. Keep up the fantastic work!

Your blog has quickly become my trusted source of inspiration and knowledge. I genuinely appreciate the effort you put into crafting each article. Your dedication to delivering high-quality content is evident, and I look forward to every new post.

Your dedication to sharing knowledge is unmistakable, and your writing style is captivating. Your articles are a pleasure to read, and I consistently come away feeling enriched. Thank you for being a dependable source of inspiration and information.

Thanks for your article. It is very unfortunate that over the last several years, the travel industry has had to fight terrorism, SARS, tsunamis, bird flu, swine flu, plus the first ever entire global economic downturn. Through it all the industry has proven to be strong, resilient in addition to dynamic, acquiring new strategies to deal with misfortune. There are constantly fresh issues and the possiblility to which the marketplace must all over again adapt and respond.

Your enthusiasm for the subject matter radiates through every word of this article; it’s contagious! Your commitment to delivering valuable insights is greatly valued, and I eagerly anticipate more of your captivating content. Keep up the exceptional work!

Your dedication to sharing knowledge is unmistakable, and your writing style is captivating. Your articles are a pleasure to read, and I consistently come away feeling enriched. Thank you for being a dependable source of inspiration and information.

I’ve discovered a treasure trove of knowledge in your blog. Your unwavering dedication to offering trustworthy information is truly commendable. Each visit leaves me more enlightened, and I deeply appreciate your consistent reliability.

Thanks for your post on the travel industry. I’d also like to add that if you are a senior considering traveling, it can be absolutely imperative that you buy travel insurance for older persons. When traveling, elderly people are at high risk of getting a health emergency. Obtaining right insurance coverage package for the age group can look after your health and give you peace of mind.

I’m genuinely impressed by how effortlessly you distill intricate concepts into easily digestible information. Your writing style not only imparts knowledge but also engages the reader, making the learning experience both enjoyable and memorable. Your passion for sharing your expertise shines through, and for that, I’m deeply grateful.

Your writing style effortlessly draws me in, and I find it nearly impossible to stop reading until I’ve reached the end of your articles. Your ability to make complex subjects engaging is indeed a rare gift. Thank you for sharing your expertise!

This article resonated with me on a personal level. Your ability to emotionally connect with your audience is truly commendable. Your words are not only informative but also heartwarming. Thank you for sharing your insights.

I just wanted to express how much I’ve learned from this article. Your meticulous research and clear explanations make the information accessible to all readers. It’s evident that you’re dedicated to providing valuable content.

I wanted to take a moment to express my gratitude for the wealth of valuable information you provide in your articles. Your blog has become a go-to resource for me, and I always come away with new knowledge and fresh perspectives. I’m excited to continue learning from your future posts.

I’d like to express my heartfelt appreciation for this insightful article. Your unique perspective and well-researched content bring a fresh depth to the subject matter. It’s evident that you’ve invested considerable thought into this, and your ability to convey complex ideas in such a clear and understandable way is truly commendable. Thank you for sharing your knowledge so generously and making the learning process enjoyable.

What an enlightening post! It opened my eyes to new perspectives.

In a world where trustworthy information is more crucial than ever, your dedication to research and the provision of reliable content is truly commendable. Your commitment to accuracy and transparency shines through in every post. Thank you for being a beacon of reliability in the online realm.

Your unique approach to addressing challenging subjects is like a breath of fresh air. Your articles stand out with their clarity and grace, making them a pure joy to read. Your blog has now become my go-to source for insightful content.

Your blog is a true gem in the vast online world. Your consistent delivery of high-quality content is admirable. Thank you for always going above and beyond in providing valuable insights. Keep up the fantastic work!

Your writing style effortlessly draws me in, and I find it nearly impossible to stop reading until I’ve reached the end of your articles. Your ability to make complex subjects engaging is indeed a rare gift. Thank you for sharing your expertise!

I’m genuinely impressed by how effortlessly you distill intricate concepts into easily digestible information. Your writing style not only imparts knowledge but also engages the reader, making the learning experience both enjoyable and memorable. Your passion for sharing your expertise shines through, and for that, I’m deeply grateful.

I am continually impressed by your ability to delve into subjects with grace and clarity. Your articles are both informative and enjoyable to read, a rare combination. Your blog is a valuable resource, and I am sincerely grateful for it.

I’ve discovered a treasure trove of knowledge in your blog. Your unwavering dedication to offering trustworthy information is truly commendable. Each visit leaves me more enlightened, and I deeply appreciate your consistent reliability.

I couldn’t agree more with the insightful points you’ve made in this article. Your depth of knowledge on the subject is evident, and your unique perspective adds an invaluable layer to the discussion. This is a must-read for anyone interested in this topic.

Thanks alot : ) for your post. I’d like to say that the tariff of car insurance differs from one insurance policy to another, simply because there are so many different facets which play a role in the overall cost. As an example, the make and model of the motor vehicle will have a large bearing on the charge. A reliable aged family automobile will have a more affordable premium compared to a flashy sports vehicle.

I simply wanted to convey how much I’ve gleaned from this article. Your meticulous research and clear explanations make the information accessible to all readers. It’s abundantly clear that you’re committed to providing valuable content.

I simply wanted to convey how much I’ve gleaned from this article. Your meticulous research and clear explanations make the information accessible to all readers. It’s abundantly clear that you’re committed to providing valuable content.

Your dedication to sharing knowledge is unmistakable, and your writing style is captivating. Your articles are a pleasure to read, and I consistently come away feeling enriched. Thank you for being a dependable source of inspiration and information.

Your storytelling prowess is nothing short of extraordinary. Reading this article felt like embarking on an adventure of its own. The vivid descriptions and engaging narrative transported me, and I eagerly await to see where your next story takes us. Thank you for sharing your experiences in such a captivating manner.

Your positivity and enthusiasm are undeniably contagious! This article brightened my day and left me feeling inspired. Thank you for sharing your uplifting message and spreading positivity among your readers.

Your storytelling abilities are nothing short of incredible. Reading this article felt like embarking on an adventure of its own. The vivid descriptions and engaging narrative transported me, and I can’t wait to see where your next story takes us. Thank you for sharing your experiences in such a captivating way.

I am continually impressed by your ability to delve into subjects with grace and clarity. Your articles are both informative and enjoyable to read, a rare combination. Your blog is a valuable resource, and I am sincerely grateful for it.

Your storytelling prowess is nothing short of extraordinary. Reading this article felt like embarking on an adventure of its own. The vivid descriptions and engaging narrative transported me, and I eagerly await to see where your next story takes us. Thank you for sharing your experiences in such a captivating manner.

I simply wanted to convey how much I’ve gleaned from this article. Your meticulous research and clear explanations make the information accessible to all readers. It’s abundantly clear that you’re committed to providing valuable content.

I couldn’t agree more with the insightful points you’ve articulated in this article. Your profound knowledge on the subject is evident, and your unique perspective adds an invaluable dimension to the discourse. This is a must-read for anyone interested in this topic.

Your writing style effortlessly draws me in, and I find it nearly impossible to stop reading until I’ve reached the end of your articles. Your ability to make complex subjects engaging is indeed a rare gift. Thank you for sharing your expertise!

I’m genuinely impressed by how effortlessly you distill intricate concepts into easily digestible information. Your writing style not only imparts knowledge but also engages the reader, making the learning experience both enjoyable and memorable. Your passion for sharing your expertise is unmistakable, and for that, I am deeply appreciative.

Your blog is a true gem in the vast online world. Your consistent delivery of high-quality content is admirable. Thank you for always going above and beyond in providing valuable insights. Keep up the fantastic work!

I figured out more something totally new on this losing weight issue. 1 issue is a good nutrition is extremely vital while dieting. A big reduction in fast foods, sugary ingredients, fried foods, sweet foods, pork, and white colored flour products may be necessary. Holding wastes unwanted organisms, and contaminants may prevent aims for losing belly fat. While specified drugs in the short term solve the situation, the bad side effects will not be worth it, and they also never supply more than a momentary solution. It is just a known indisputable fact that 95 of dietary fads fail. Thanks for sharing your ideas on this blog.

Your writing style effortlessly draws me in, and I find it nearly impossible to stop reading until I’ve reached the end of your articles. Your ability to make complex subjects engaging is indeed a rare gift. Thank you for sharing your expertise!

I have read several good stuff here. Certainly worth bookmarking for revisiting. I wonder how much effort you put to create such a fantastic informative website.

Your blog is a true gem in the vast expanse of the online world. Your consistent delivery of high-quality content is truly commendable. Thank you for consistently going above and beyond in providing valuable insights. Keep up the fantastic work!

Your blog has rapidly become my trusted source of inspiration and knowledge. I genuinely appreciate the effort you invest in crafting each article. Your dedication to delivering high-quality content is apparent, and I eagerly await every new post.

Your blog is a true gem in the vast expanse of the online world. Your consistent delivery of high-quality content is truly commendable. Thank you for consistently going above and beyond in providing valuable insights. Keep up the fantastic work!

I am continually impressed by your ability to delve into subjects with grace and clarity. Your articles are both informative and enjoyable to read, a rare combination. Your blog is a valuable resource, and I am sincerely grateful for it.

This article resonated with me on a personal level. Your ability to emotionally connect with your audience is truly commendable. Your words are not only informative but also heartwarming. Thank you for sharing your insights.

It’s my belief that mesothelioma is usually the most fatal cancer. It contains unusual attributes. The more I really look at it the more I am certain it does not conduct itself like a true solid tissues cancer. In case mesothelioma is usually a rogue virus-like infection, then there is the probability of developing a vaccine plus offering vaccination to asbestos exposed people who are vulnerable to high risk regarding developing long term asbestos relevant malignancies. Thanks for giving your ideas about this important ailment.

Your storytelling abilities are nothing short of incredible. Reading this article felt like embarking on an adventure of its own. The vivid descriptions and engaging narrative transported me, and I can’t wait to see where your next story takes us. Thank you for sharing your experiences in such a captivating way.

I couldn’t agree more with the insightful points you’ve articulated in this article. Your profound knowledge on the subject is evident, and your unique perspective adds an invaluable dimension to the discourse. This is a must-read for anyone interested in this topic.

I couldn’t agree more with the insightful points you’ve articulated in this article. Your profound knowledge on the subject is evident, and your unique perspective adds an invaluable dimension to the discourse. This is a must-read for anyone interested in this topic.

Your writing style effortlessly draws me in, and I find it difficult to stop reading until I reach the end of your articles. Your ability to make complex subjects engaging is a true gift. Thank you for sharing your expertise!

This actually answered my downside, thanks!

Your passion and dedication to your craft radiate through every article. Your positive energy is infectious, and it’s evident that you genuinely care about your readers’ experience. Your blog brightens my day!

Your unique approach to tackling challenging subjects is a breath of fresh air. Your articles stand out with their clarity and grace, making them a joy to read. Your blog is now my go-to for insightful content.

Your enthusiasm for the subject matter shines through every word of this article; it’s contagious! Your commitment to delivering valuable insights is greatly valued, and I eagerly anticipate more of your captivating content. Keep up the exceptional work!

con artist

Almanya’nın en iyi medyumu haluk hoca sayesinde sizlerde güven içerisinde çalışmalar yaptırabilirsiniz, 40 yıllık uzmanlık ve tecrübesi ile sizlere en iyi medyumluk hizmeti sunuyoruz.

Your blog is a true gem in the vast expanse of the online world. Your consistent delivery of high-quality content is truly commendable. Thank you for consistently going above and beyond in providing valuable insights. Keep up the fantastic work!

Your blog is a true gem in the vast expanse of the online world. Your consistent delivery of high-quality content is truly commendable. Thank you for consistently going above and beyond in providing valuable insights. Keep up the fantastic work!

http://www.thebudgetart.com is trusted worldwide canvas wall art prints & handmade canvas paintings online store. Thebudgetart.com offers budget price & high quality artwork, up-to 50 OFF, FREE Shipping USA, AUS, NZ & Worldwide Delivery.

Your blog is a true gem in the vast online world. Your consistent delivery of high-quality content is admirable. Thank you for always going above and beyond in providing valuable insights. Keep up the fantastic work!

hi!,I like your writing very much! share we communicate more about your article on AOL? I need an expert on this area to solve my problem. May be that’s you! Looking forward to see you.

My brother recommended I might like this blog. He was totally right. This post truly made my day. You cann’t consider just how a lot time I had spent for this information! Thanks!

It?s actually a cool and useful piece of info. I am glad that you shared this useful information with us. Please keep us up to date like this. Thanks for sharing.

Thanks for your post on this site. From my own personal experience, there are occassions when softening way up a photograph may possibly provide the digital photographer with a bit of an creative flare. Oftentimes however, this soft blur isn’t exactly what you had as the primary goal and can usually spoil a normally good photo, especially if you consider enlarging that.

I appreciate, cause I found just what I was looking for. You’ve ended my four day long hunt! God Bless you man. Have a nice day. Bye

Its like you learn my mind! You appear to know a lot about this, like you wrote the book in it or something. I feel that you could do with some to drive the message home a little bit, but other than that, this is excellent blog. An excellent read. I will definitely be back.

You could definitely see your enthusiasm in the paintings you write. The arena hopes for even more passionate writers such as you who aren’t afraid to say how they believe. At all times go after your heart.

Hey there, You have done an excellent job. I will certainly digg it and personally suggest to my friends. I am sure they will be benefited from this site.

I’ve been surfing online more than three hours today, yet I never found any interesting article like yours. It?s pretty worth enough for me. Personally, if all web owners and bloggers made good content as you did, the internet will be much more useful than ever before.

https://brooks4uu01.frewwebs.com/23103916/details-fiction-and-chinese-medicine-for-inflammation

Thanks for the suggestions you discuss through this blog. In addition, several young women exactly who become pregnant will not even aim to get health care insurance because they are full of fearfulness they wouldn’t qualify. Although a few states today require that insurers provide coverage irrespective of the pre-existing conditions. Prices on most of these guaranteed plans are usually higher, but when taking into consideration the high cost of medical care bills it may be some sort of a safer approach to take to protect the financial future.

https://garrett3qrpo.tokka-blog.com/23148705/facts-about-massage-korean-spas-revealed

https://cashv2345.develop-blog.com/28467441/indicators-on-chinese-medicine-clinic-you-should-know

https://johnnyrxyy23456.canariblogs.com/not-known-details-about-thailand-massage-37958484

https://social-lyft.com/story5416279/a-simple-key-for-chinese-medicine-cooker-unveiled

https://trackbookmark.com/story16895406/the-basic-principles-of-thailand-massage-and-spa

https://dalton0at99.rimmablog.com/22850590/the-2-minute-rule-for-chinese-medicine-cooker

https://edwint5173.bloggazzo.com/22837714/little-known-facts-about-chinese-medicine-chicago

https://jasper6xzxt.blogsumer.com/22899620/how-korean-massage-beds-ceragem-can-save-you-time-stress-and-money

https://edwin7rn66.tkzblog.com/22903007/5-easy-facts-about-chinese-medicine-for-diabetes-described

https://judah51839.jiliblog.com/80446493/indicators-on-chinese-medicine-clinic-you-should-know

https://brooks7ql94.pointblog.net/5-easy-facts-about-chinese-medicine-for-inflammation-described-63431108

https://hypebookmarking.com/story15633316/fascination-about-healthy-massage-atascocita

https://tallentyrer195zne0.sunderwiki.com/user

https://andersoni912ffe4.fare-blog.com/profile

Valuable information. Lucky me I found your site by accident, and I am stunned why this accident didn’t took place in advance! I bookmarked it.

https://cody07306.izrablog.com/23143895/little-known-facts-about-chinese-medicine-chicago

https://chaplinw234fat8.wikimidpoint.com/user

https://jareds2344.bloggactivo.com/22902111/chinese-medicine-books-no-further-a-mystery

https://masona470qdr0.actoblog.com/profile

https://andy4vc84.glifeblog.com/22838812/top-guidelines-of-chinese-medicine-cooker

https://becketti0616.theobloggers.com/28589096/top-latest-five-chinese-medicine-brain-fog-urban-news

https://marcom8888.getblogs.net/54606360/top-latest-five-chinese-medicine-course-urban-news

https://toplistar.com/story17304941/examine-this-report-on-chinese-medicine-blood-pressure

https://edgarp01yw.59bloggers.com/23022256/not-known-factual-statements-about-korean-massage-scrub

Its like you read my mind! You appear to know so much about this, like you wrote the book in it or something. I think that you could do with some pics to drive the message home a little bit, but instead of that, this is great blog. An excellent read. I will definitely be back.

https://josueh67qo.loginblogin.com/28589437/the-basic-principles-of-korean-massage-atlanta

https://edwine8382.mybloglicious.com/44018385/not-known-facts-about-chinese-medicine-body-map

https://kameronhhxkn.kylieblog.com/23069931/a-review-of-massage-koreatown-nyc

Please let me know if you’re looking for a author for your site. You have some really great articles and I believe I would be a good asset. If you ever want to take some of the load off, I’d absolutely love to write some content for your blog in exchange for a link back to mine. Please send me an email if interested. Many thanks!

https://ignacyo024hgc3.blogacep.com/profile

https://worldsocialindex.com/story1124162/the-definitive-guide-to-korean-massage-for-healthy

https://lorenzow12db.webdesign96.com/23043259/indicators-on-korean-massage-atlanta-you-should-know

https://fredp135opp8.nico-wiki.com/user

https://raymondz7158.blog4youth.com/23165242/fascination-about-chinese-medicine-cooling-foods

https://johna355hcv9.wikijournalist.com/user

I was suggested this website by my cousin. I am not sure whether this post is written by him as nobody else know such detailed about my difficulty. You are incredible! Thanks!

[email protected]

https://devin46d6m.bloggazza.com/22783657/how-much-you-need-to-expect-you-ll-pay-for-a-good-massage-business-tips

https://deanw3568.newbigblog.com/28365245/chinese-medicine-books-no-further-a-mystery

https://louise8247.liberty-blog.com/23036000/the-5-second-trick-for-chinese-medicine-cooling-foods

https://tornadosocial.com/story1191758/5-essential-elements-for-korean-massage-atlanta

https://titusd0852.wikipowell.com/5116429/rumored_buzz_on_chinese_medicine_bloating

https://zaneawsn66655.ja-blog.com/22766340/the-ultimate-guide-to-us-massage-service

An attention-grabbing dialogue is value comment. I believe that it’s best to write more on this subject, it might not be a taboo subject however generally persons are not enough to speak on such topics. To the next. Cheers

https://thesocialvibes.com/story1159122/a-review-of-healthy-massage-elmsford

https://remington28371.blogginaway.com/23130847/not-known-details-about-chinese-medicine-cupping

https://erick0j6lj.arwebo.com/45550351/chinese-massage-oil-an-overview

Today, considering the fast life-style that everyone leads, credit cards have a huge demand throughout the economy. Persons from every discipline are using the credit card and people who aren’t using the credit cards have prepared to apply for one in particular. Thanks for giving your ideas on credit cards.

Hi, i think that i saw you visited my weblog thus i came to ?return the favor?.I’m attempting to find things to improve my website!I suppose its ok to use a few of your ideas!!

Great weblog right here! Additionally your website so much up very fast! What host are you the use of? Can I get your associate hyperlink to your host? I wish my site loaded up as quickly as yours lol

https://troyu12bx.blogadvize.com/28611438/not-known-factual-statements-about-korean-massage-spa-irvine

https://wildbookmarks.com/story15991224/top-latest-five-chinese-medicine-brain-fog-urban-news

https://troym7899.blazingblog.com/22951946/5-easy-facts-about-chinese-medicine-classes-described

Wow, wonderful blog structure! How lengthy have you been blogging for? you made blogging look easy. The overall look of your website is great, as smartly as the content!

https://felixf3420.estate-blog.com/22901728/examine-this-report-on-chinese-medicine-blood-pressure

https://chance7efeb.blogmazing.com/22842898/the-smart-trick-of-korean-massage-near-me-that-nobody-is-discussing

https://rowan79y9u.blogrenanda.com/28370089/detailed-notes-on-chinese-medicine-chart

Right now it looks like BlogEngine is the best blogging platform available right now. (from what I’ve read) Is that what you are using on your blog?

https://conner05937.blog5.net/64165975/chinese-medicine-clinic-options

https://dallasd6036.jaiblogs.com/49177040/facts-about-chinese-medicine-bloating-revealed

https://raymond79yv0.like-blogs.com/22799400/korean-massage-chair-ala-moana-things-to-know-before-you-buy

bookdecorfactory.com is a Global Trusted Online Fake Books Decor Store. We sell high quality budget price fake books decoration, Faux Books Decor. We offer FREE shipping across US, UK, AUS, NZ, Russia, Europe, Asia and deliver 100+ countries. Our delivery takes around 12 to 20 Days. We started our online business journey in Sydney, Australia and have been selling all sorts of home decor and art styles since 2008.

Greetings I am so excited I found your website, I really found you by mistake, while I was researching on Google for something else, Anyhow I am here now and would just like to say kudos for a tremendous post and a all round thrilling blog (I also love the theme/design), I don’t have time to read it all at the moment but I have saved it and also included your RSS feeds, so when I have time I will be back to read much more, Please do keep up the excellent work.

It is appropriate time to make a few plans for the longer term and it’s time to be happy. I have learn this submit and if I may just I desire to counsel you few fascinating issues or suggestions. Perhaps you could write next articles relating to this article. I want to learn even more things about it!

Thanks for these guidelines. One thing I additionally believe is that credit cards giving a 0 apr often appeal to consumers together with zero rate of interest, instant authorization and easy internet balance transfers, but beware of the most recognized factor that may void your 0 easy street annual percentage rate and to throw anybody out into the terrible house rapid.

https://andres2pq89.onzeblog.com/22938339/the-2-minute-rule-for-chinese-medicine-cooker

https://wavesocialmedia.com/story1186295/examine-this-report-on-thailand-massage-bangkok

https://reid7b8af.ourcodeblog.com/22998530/top-latest-five-massage-chinese-foot-urban-news

https://sergioh3208.atualblog.com/28470443/fascination-about-chinese-medicine-cooling-foods

https://lanei788r.estate-blog.com/22821045/an-unbiased-view-of-korean-massage-spa-irvine

https://elizabethg184qwa7.hamachiwiki.com/user

Hello there, simply was alert to your weblog thru Google, and located that it’s really informative. I am gonna watch out for brussels. I?ll appreciate if you proceed this in future. Lots of other folks shall be benefited from your writing. Cheers!

Any good customer support should be able to assist with any standard on-line blackjack

queries.

Thanks for this article. I’d personally also like to talk about the fact that it can be hard if you find yourself in school and just starting out to establish a long credit rating. There are many students who are just simply trying to survive and have a long or good credit history can often be a difficult thing to have.

Hey there would you mind stating which blog platform you’re using? I’m looking to start my own blog soon but I’m having a hard time deciding between BlogEngine/Wordpress/B2evolution and Drupal. The reason I ask is because your design seems different then most blogs and I’m looking for something unique. P.S Sorry for getting off-topic but I had to ask!

Oh my goodness! an amazing article dude. Thanks Nevertheless I’m experiencing issue with ur rss . Don?t know why Unable to subscribe to it. Is there anyone getting equivalent rss drawback? Anyone who knows kindly respond. Thnkx

Good ? I should definitely pronounce, impressed with your web site. I had no trouble navigating through all the tabs as well as related info ended up being truly simple to do to access. I recently found what I hoped for before you know it in the least. Quite unusual. Is likely to appreciate it for those who add forums or something, site theme . a tones way for your client to communicate. Nice task..

https://wikimapia.org/external_link?url=https://backlinkend.co.kr/

Hmm is anyone else encountering problems with the images on this blog loading? I’m trying to determine if its a problem on my end or if it’s the blog. Any suggestions would be greatly appreciated.

Great work! That is the type of info that should be shared around the web. Shame on the search engines for no longer positioning this post upper! Come on over and visit my site . Thanks =)

I am not certain where you are getting your info, however great topic. I needs to spend some time learning more or understanding more. Thanks for magnificent info I used to be looking for this information for my mission.

https://disqus.com/by/browkiss13/about/

Excellent post. I was checking continuously this weblog and I’m impressed! Extremely helpful info particularly the remaining section 🙂 I care for such information much. I was seeking this certain info for a long time. Thank you and best of luck.

https://www.fcc.gov/fcc-bin/bye?https://www.kor-odds.com/EBB2B3EC9794EB939C

obviously like your website but you need to check the spelling on several of your posts. A number of them are rife with spelling problems and I find it very bothersome to tell the truth nevertheless I?ll certainly come back again.

https://olive-pear-gx51vh.mystrikingly.com/blog/4a510144359

I have learned a few important things as a result of your post. I’d also like to mention that there is a situation that you will obtain a loan and do not need a co-signer such as a Fed Student Aid Loan. However, if you are getting that loan through a traditional financier then you need to be ready to have a co-signer ready to help you. The lenders will probably base their decision using a few issues but the largest will be your credit history. There are some loan providers that will furthermore look at your job history and decide based on this but in almost all cases it will depend on your scores.

I?d should test with you here. Which is not one thing I often do! I take pleasure in studying a post that can make individuals think. Additionally, thanks for allowing me to comment!

Excellent goods from you, man. I have understand your stuff previous to and you’re just extremely fantastic. I really like what you’ve acquired here, really like what you’re saying and the way in which you say it. You make it entertaining and you still care for to keep it smart. I can not wait to read far more from you. This is actually a terrific website.

With the whole thing which appears to be developing inside this particular subject material, many of your opinions are fairly refreshing. Even so, I am sorry, because I can not give credence to your entire strategy, all be it exciting none the less. It looks to us that your opinions are generally not entirely validated and in fact you are generally yourself not really completely certain of your argument. In any event I did appreciate looking at it.

https://sendgrid.com/blog/what-is-an-smtp-server/

Thanks for your advice on this blog. One particular thing I want to say is purchasing electronic products items through the Internet is not something new. In reality, in the past ten years alone, the marketplace for online gadgets has grown a great deal. Today, you can find practically virtually any electronic device and other gadgets on the Internet, including cameras along with camcorders to computer parts and gambling consoles.

This article is a breath of fresh air! The author’s unique perspective and thoughtful analysis have made this a truly captivating read. I’m thankful for the effort he has put into creating such an informative and mind-stimulating piece. Thank you, author, for providing your knowledge and igniting meaningful discussions through your outstanding writing!

Thanks for your tips on this blog. One particular thing I wish to say is purchasing electronics items in the Internet is certainly not new. In reality, in the past few years alone, the marketplace for online electronic devices has grown substantially. Today, you can find practically any kind of electronic device and other gadgets on the Internet, which include cameras plus camcorders to computer elements and gambling consoles.

http://www.spotnewstrend.com is a trusted latest USA News and global news provider. Spotnewstrend.com website provides latest insights to new trends and worldwide events. So keep visiting our website for USA News, World News, Financial News, Business News, Entertainment News, Celebrity News, Sport News, NBA News, NFL News, Health News, Nature News, Technology News, Travel News.

There are certainly a whole lot of particulars like that to take into consideration. That may be a great level to carry up. I provide the ideas above as general inspiration but clearly there are questions like the one you carry up the place an important thing will likely be working in sincere good faith. I don?t know if greatest practices have emerged round issues like that, but I’m certain that your job is clearly identified as a fair game. Both girls and boys really feel the influence of just a moment?s pleasure, for the rest of their lives.

My brother suggested I might like this website. He was entirely right. This post truly made my day. You cann’t imagine simply how much time I had spent for this information! Thanks!

https://purwell.com/cbd-roll-on-uses/

I would like to add that if you do not actually have an insurance policy or else you do not participate in any group insurance, you could possibly well take advantage of seeking the assistance of a health agent. Self-employed or people having medical conditions commonly seek the help of any health insurance specialist. Thanks for your blog post.

Excellent read, I just passed this onto a friend who was doing some research on that. And he just bought me lunch because I found it for him smile So let me rephrase that: Thanks for lunch!

Hi, unfortunately, I faced challenges with the slow loading speed of your website, leading to frustration. I recommend a service, linked below, that I’ve used personally to significantly improve my website speed. I really love your website…Optimize now

Your storytelling abilities are nothing short of incredible. Reading this article felt like embarking on an adventure of its own. The vivid descriptions and engaging narrative transported me, and I can’t wait to see where your next story takes us. Thank you for sharing your experiences in such a captivating way.

Your passion and dedication to your craft radiate through every article. Your positive energy is infectious, and it’s evident that you genuinely care about your readers’ experience. Your blog brightens my day!

I wanted to take a moment to express my gratitude for the wealth of invaluable information you consistently provide in your articles. Your blog has become my go-to resource, and I consistently emerge with new knowledge and fresh perspectives. I’m eagerly looking forward to continuing my learning journey through your future posts.

http://www.bestartdeals.com.au is Australia’s Trusted Online Canvas Prints Art Gallery. We offer 100 percent high quality budget wall art prints online since 2009. Get 30-70 percent OFF store wide sale, Prints starts $20, FREE Delivery Australia, NZ, USA. We do Worldwide Shipping across 50+ Countries.

Your enthusiasm for the subject matter shines through in every word of this article. It’s infectious! Your dedication to delivering valuable insights is greatly appreciated, and I’m looking forward to more of your captivating content. Keep up the excellent work!

Your positivity and enthusiasm are undeniably contagious! This article brightened my day and left me feeling inspired. Thank you for sharing your uplifting message and spreading positivity among your readers.

Very nice post. I just stumbled upon your blog and wanted to say that I have truly enjoyed browsing your blog posts. In any case I will be subscribing to your feed and I hope you write again soon!

Your blog has rapidly become my trusted source of inspiration and knowledge. I genuinely appreciate the effort you invest in crafting each article. Your dedication to delivering high-quality content is apparent, and I eagerly await every new post.

04H7N3gLKS1RnTWdblM8psjnHPtxjK

I just wanted to express how much I’ve learned from this article. Your meticulous research and clear explanations make the information accessible to all readers. It’s evident that you’re dedicated to providing valuable content.

Ps2s3HWaeUn6P3u7Nco1vbgRu0HIkW

Your blog is a true gem in the vast online world. Your consistent delivery of high-quality content is admirable. Thank you for always going above and beyond in providing valuable insights. Keep up the fantastic work!

I’m genuinely impressed by how effortlessly you distill intricate concepts into easily digestible information. Your writing style not only imparts knowledge but also engages the reader, making the learning experience both enjoyable and memorable. Your passion for sharing your expertise is unmistakable, and for that, I am deeply appreciative.

Zh3Kj8xKzAXdTDZN94g8wmUHM3LHED

Usually I do not read article on blogs, but I wish to say that this write-up very forced me to try and do it! Your writing style has been amazed me. Thanks, quite nice article.

https://pram.elmercurio.com/Logout.aspx?ApplicationName=EMOL&l=yes&SSOTargetUrl=https://revista-antreprenorului.ro/

I’m continually impressed by your ability to dive deep into subjects with grace and clarity. Your articles are both informative and enjoyable to read, a rare combination. Your blog is a valuable resource, and I’m grateful for it.

Your blog has rapidly become my trusted source of inspiration and knowledge. I genuinely appreciate the effort you invest in crafting each article. Your dedication to delivering high-quality content is apparent, and I eagerly await every new post.

Your unique approach to addressing challenging subjects is like a breath of fresh air. Your articles stand out with their clarity and grace, making them a pure joy to read. Your blog has now become my go-to source for insightful content.

I would like to thnkx for the efforts you have put in writing this site. I am hoping the same high-grade website post from you in the upcoming as well. In fact your creative writing abilities has encouraged me to get my own web site now. Really the blogging is spreading its wings fast. Your write up is a great example of it.

Your writing style effortlessly draws me in, and I find it nearly impossible to stop reading until I’ve reached the end of your articles. Your ability to make complex subjects engaging is indeed a rare gift. Thank you for sharing your expertise!

I can’t help but be impressed by the way you break down complex concepts into easy-to-digest information. Your writing style is not only informative but also engaging, which makes the learning experience enjoyable and memorable. It’s evident that you have a passion for sharing your knowledge, and I’m grateful for that.

Your passion and dedication to your craft radiate through every article. Your positive energy is infectious, and it’s evident that you genuinely care about your readers’ experience. Your blog brightens my day!

Today, I went to the beach with my children. I found a sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She placed the shell to her ear and screamed. There was a hermit crab inside and it pinched her ear. She never wants to go back! LoL I know this is completely off topic but I had to tell someone!

I truly appreciate this post. I have been looking everywhere for this! Thank goodness I found it on Bing. You’ve made my day! Thx again

I wanted to take a moment to express my gratitude for the wealth of invaluable information you consistently provide in your articles. Your blog has become my go-to resource, and I consistently emerge with new knowledge and fresh perspectives. I’m eagerly looking forward to continuing my learning journey through your future posts.