How to Create a Trading Plan: The Definitive Guide

Here’s a fun fact:

Do you know what people do when they’re blindfolded and told to walk 20ft in front of them?

This is an experiment done across many different landscapes and timezones, yet the results are always the same.

If you were to blindfold a group of people in an open space and then tell them to walk across to the other side of the field, they’ll start walking in circles.

It turns out, that humans need some kind of horizontal plane of reference, be it the horizon or buildings, to help guide a path forward.

Otherwise, the brain can’t fixate on a direct path.

You need to be able to see where you’re going.

So when you’re seeking to build skills as a trader to achieve consistent profit, having a destination in sight helps you get there.

Maybe you’re familiar with the symptoms of not trading with a plan:

- you circle back to the same failed strategies or psychology time and again,

- you do extra work finding new strategies or ways to become a better trader,

- you change your mind about what you want or how you want to trade,

- and overall, just second-guess yourself as a trader.

As the saying goes, if you fail to plan, you plan to fail.

Walking in circles isn’t just a metaphor, there are so many ways in which our brains use logic from the physical world to influence our inner world and the ways we think. So in order to guide your path to profitability, you’re going to need to develop a trading plan.

Whether you write a plan for each of your strategies you perform or a plan for each phase of a prop trading challenge, the beginning of every trading pursuit or goal you aim for needs to have a trading plan.

Whether you write a plan for each of your strategies you perform or a plan for each phase of a prop trading challenge, the beginning of every trading pursuit or goal you aim for needs to have a trading plan.

Yes, I’m implying a written document, not just an idea in your head.

While a goal may name the destination, your trading plan is supposed to show you some of the milestones along the way by listing what you should and shouldn’t do during each session, as well as what you plan on doing if you face unexpected challenges or lucrative opportunities.

In the world of trading where there’s so much movement and so many different assets changing direction all at once, you need to narrow in and define for yourself what you’re going to focus on.

You can’t trade everything you see in the market and make up a plan on the spot.

You need to create rules for yourself.

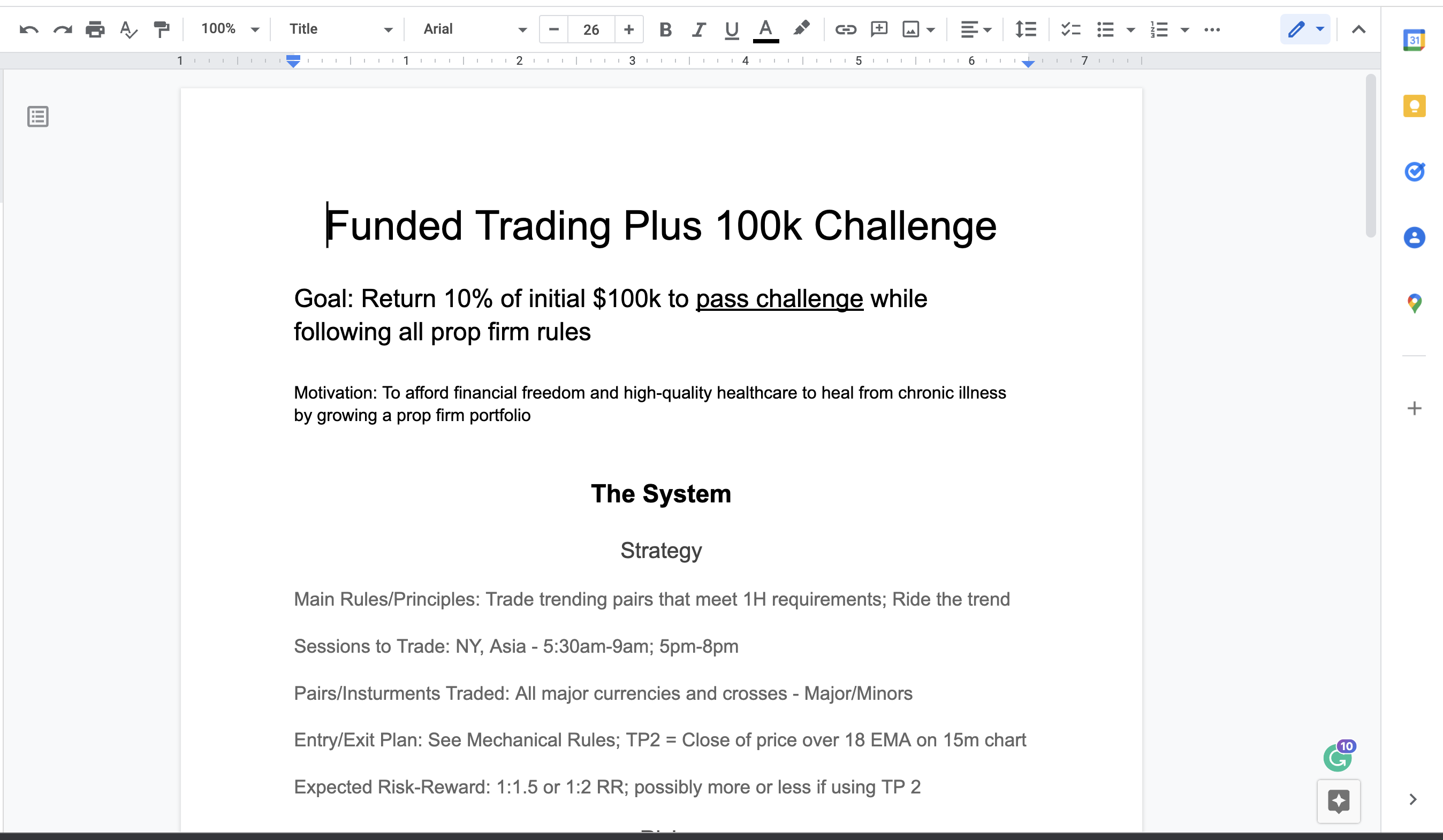

In this way, you are responsible for defining what you do and don’t trade and how you go about doing so. In this tutorial we’re going to go over what you need to include in your ideal trading plan. I’m going to show you a trading plan I’m making for the Funded trading Plus challenge, and we’ll go over different things you can include to adapt it for different trading goals.

The Components of Your Trading Plan:

- Goal

- Your Motivation/Why

- Strategy

- Risk Management

- Contingencies

- Log (Optional)

- Other Components

What to Include in Your Trading Plan:

1. Title

This may or may not seem obvious, but be sure to give your plan a title that makes sense for the role this plan will play in your greater trading career.

You will likely have a few different trading plans over time, so it helps to name them in a way that keeps things organized.

For example, if you are making a plan for a prop firm challenge, like the FTMO challenge, you can title it “FTMO $100K Challenge 2022”. Or if you name your plans for different strategy systems, you can title it according to the name of your strategy.

2. Goal

2. Goal

Next, your trading plan should immediately tell you what the purpose of the plan is, that is, what your goal is for trading this system.

Be descriptive, here.

Some examples:

- Return on average 2-5% per month for 2022

- Have 3 consistently profitable months in a row

- Follow 100% of my trading strategy checklist rules for 21 days straight

- Grow my account by 20% this year

- Build my account to $50k within 5 months

- Pass the FTMO challenge within 30 days by returning 10% of $100k

Notice how some of these goals have clear time-based or performance-based outcomes? Such targets are easier to track – you’ll know whether or not you’ve profited +2% in your account this month by looking at your brokerage statement. You want to be able to clearly say whether you’ve achieved your goal or not.

The reason for putting down clear numbers in your goals is not to constrict you, but to help you decide how you’ll design your trading strategy and risk management plan, especially the latter.

You can adjust these numbers as you go, but by having a target you can track how well other components of your trading plan help you meet your goals or not.

3. Your Motivation/Why

ALERT!

This is possibly the secret key to ensuring that you will actually follow through with your trading plan.

Anyone can write a plan and make it look like a good idea.

This isn’t only true for trading, but other big behavior-changing goals, as well. Think about fitness.

Here’s a simple fitness and nutrition plan:

- Lift 3x/week

- Jog 3x/week

- Yoga on rest day

- Go on an evening walk every day

- Stick to a whole food plant-based diet, no sugar or processed foods

Seems simple, yes?

But performing this every week is the hard part.

The plan is effective. You will definitely morph your body into a healthier version of yourself by following these simple rules, but you will only achieve that outcome if you put the plan into practice regularly without fail.

Fitness coaches will often say that you need a really good “why” to help you sustain motivation while you’re still changing your habits and gaining momentum. Sometimes wanting to look good isn’t enough when you’re 5 seconds away from eating a chicken waffle slathered in high-fructose corn syrup after a long and tiring day of work as you pass an old favorite restaurant.

Better health and fitness reasons that will make you second guess short-term pleasure in order to achieve long-term freedom:

- I want to be able to be there for my kids when they’re in college and stop feeling so winded every time I play with them

- I want to see my abs for the first time in my life so that I can prove to myself that I have control over my body and my energy levels

- I want to end this illness and see if I can use a safer and more effective approach in place of expensive drugs so I can live a vibrant life again

The pain of the greater loss needs to outweigh the pain or inconvenience in the moment.

Your trading plan is similar and your mindset as you execute the plan is likely going to have a greater effect on your results than the system rules.

I am diving deep on this topic for this guide because I want to emphasize how important it is to have a CLEARLY DEFINED MOTIVATION for pursuing profit from trading.

Your reason for choosing this highly risky, long path to becoming financially free as a trader needs to be so moving that it can make you second-guess acting out a trading mistake as you’re thinking about doing it.

Wanting to earn something like $5k per month won’t cut it.

Money, itself, usually isn’t the reason people want it.

Instead, it’s the options that money gives to life that make it so useful.

What can trading success help you feel or experience in your life?

Is it to be the first person in your family who isn’t indentured to debt? To afford a life-changing opportunity, like a professional degree? Is it to quit your job that makes you feel like you’re wasting away your life?

Make your motivation crystal clear. Make it emotional because it will be the emotion-evoking moments in your trading that will make or break your success – you need to be able to speak to your emotions in the language of emotion.

“Yes, I know I really don’t want to take a loss on this trade today, but I can’t let myself chance a bigger loss – I need to trade skillfully, otherwise I’m never going to get out of debt. Following my trading rules is key and right now they’re telling me to take this loss.”

I want you to begin thinking like that for every single move you make in your trading.

Your reason to trudge the path will help you prevail and learn from your mistakes. Give this one time and thought.

4. Overview of Your System: Your Trading Strategy

Usually, most traders focus all of their attention on this section.

That’s fair, you need a strategy that’s profitable for your trading goals, whether that means greater profit in the short-term or long-term.

However, I recommend keeping this as simple as possible. Your risk management and psychology will have the greatest effect on your ability to profit, overall, and other parts of this plan help you mitigate when those areas face problems.

For your strategy, be sure to include the main rules and principles that your strategy utilizes.

Your rules should define, clearly, what you do or do not trade.

For many traders, this could mean listing a specific set of candlestick patterns you trade, the main mechanics of an indicator setup for entry, etc.

Your trading principle should tell you what high probability situation you seek to use with your strategy.

Some common ones include:

- Trend trading major/minor pairs

- Trading a NY reversal

- Trading London breakouts

- Scalping News

- Trading smart money liquidity setups

Again, like your trading goal, you should be able to simply and clearly understand the basis of why your strategy should work and how its rules were chosen to take advantage of the situation.

I think this is important to include, because you may find over time that your strategy rules don’t actually fit its principles. When you discover this, you can decide how you can change your rules or change your principle in order to ensure you’re only trading high probability setups.

Be sure to also include important technicalities regarding your strategy, such as:

- The sessions you trade and the time you trade

- What pairs or instrument classes you trade

- The mechanics of your entry and exit plans

- Your expected R:R and even expected win rate

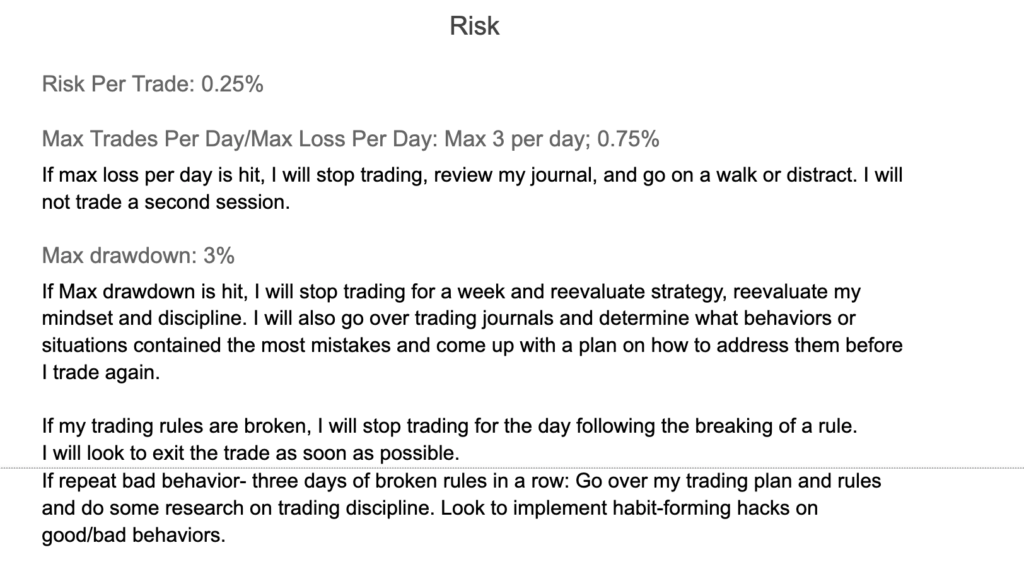

5. System Cont.: Your Risk Management Plan

While most traders spend a ton of time fine-tuning and working through a trading strategy, seasoned pros know that the most important aspect of your trading plan is actually your risk management plan, which includes the ways in which you handle emotionally-charged trading situations.

So if you’re feeling like you’re running around in circles way too often, it’s probably because you’re spending too much time focusing on your strategy.

Stop that.

Instead, put your time and energy into learning about risk management, discipline building, and developing the ability to understand your own emotions and make systems to address them as they come up.

For your risk management plan, you’re going to want to include these key trade-related measurements and tactics:

- How much of your account you’ll risk per trade

- The maximum number of trades you’ll take each day

- The maximum amount you can lose per day

- The maximum drawdown you’ll let yourself experience with your account/prop challenge

To make your risk management strategy effective, these outcomes you’ve listed from above need to come with consequences. You need a plan for how you’ll address each situation and set yourself up to learn as much as you can from losses. You’ll also want to include in your risk management plan:

- What happens when you exceed your risk per trade

- What happens when you hit your max. # of trades per day

- What happens when you hit your max. loss per day

- What happens when you hit your drawdown

You’ll also want to add:

- What happens when you break your trading rules

Your strategy and gameplan for what you do when you’re in a loss or breaking rules needs to cover two things:

- You need to create space between yourself and the trading desk

- You need to replace bad behavior with good behavior

Some ways to do this include:

- No longer trading for the session, day, week, month, etc. – that is, take a break from trading because either the market doesn’t currently work with your strategy or you can no longer trade your strategy without breaking rules

- Take time to review what happened – going over your trading journals, your account equity over a period of time, etc.

- Learn from experienced traders how to manage drawdowns or improve trading behaviors/psychology – do some research

- Make a plan to implement any tactics or behaviors for better trading performance that you learn from your research

- Put the plan into action – schedule your tactics/habits, get someone to help hold you accountable, etc.

Make sure you write out a plan that works for you.

Think of this as a flow chart:

- If X, then Y

- If I break my rules during my trading session, then I stop trading for the entire day. If I break my rules more than two sessions in a row, then I stop trading for the entire week.

By having a “Worst Case Scenario” plan, you don’t have to rely on yourself to make a decision about your trading in the moment. You won’t likely be in the best mindset during a drawdown or some serious rule-breaking, so it’s better to make these plans while you’re feeling confident and in control.

6. Contingency Plan

A trading contingency plan focuses on what you’ll need to do when things not necessarily related to trading go wrong, yet will still have an effect on your ability to trade with a sound mind.

In the contingency plan I created, I include a list of reasons for not trading, or at least reducing the frequency you trade or risk you take. These are contingent upon 3 key areas:

- Psychology – this would include any emotional states that affect your ability to make sound technical analysis or risk decisions. I would include here depression, grief, anger, stress, etc. Your worst trading mistakes arise from similar states of mind (anger can lead to revenge trading, depression can cause taking greater risks or avoiding setups because it doesn’t feel like trading matters anymore – it’s better to stay out during these transient times)

- Life – I included this category to cover any life events that can take away from your availability to trade – this can be weddings, funerals, change of jobs, moving to a new city, etc. It’s up to you to decide how emotional/physically you’ll be available and you can decide whether you want to reduce your risk, reduce your frequency of trading, or just stay out of the markets altogether until you’re situated again

- Personal – This last section is more of a grabbag for anything that doesn’t fit the others and may be individual to your personal life – for example, I’m currently pursuing a PhD in Business and will either stop trading or show up only for red news event days when I’m in finals for my courses.

Technical Troubleshooting

You also need to include contingency plans for what you’ll do when your tech breaks, the internet goes out, or any other trading resource is unavailable to use.

I promise you, if you’re in this for the long haul, you’re going to run into your internet going out or your computer/laptop/mouse/platform glitching or breaking on you while you trade.

The best plan is to always have a backup or figure out a place you can go to in order to set yourself up to trade for the rest of the session.

7. Optional: Log

Lastly, I included a log, but I don’t recommend using this unless you’re trading for a prop trading challenge or some other relatively short-term goal. An excel spreadsheet or software trading journal is a better tool for tracking your trades over the long run.

When you’re evaluating your trades during a challenge, it’s helpful to have your rules and strategy all in one place. By keeping a log of your trading outcomes on the same sheet as your plan, you’ll have an easier time deciding on how your plan is performing and whether you need to make any important changes.

8. Other Optional Components

The above categories and parameters will cover the majority of what you’ll need to plan when you’re setting yourself up for success while trading. However, there are a few other components you could include if they are relevant to your situation. Feel free to also add others that you believe will help you.

The goal in creating this plan is to put everything you need to know to do while you trade, written down in one place.

Some additional things to include:

- How you’ll break down your risk plan across multiple accounts

- Equity chart as you track weekly or monthly balances over time

- List of brokerages and which strategies you trade on each one

- Worst/Good/Best targets for your performance goals

- A “Retry” plan for when you should consider aiming for a retry for a prop trading challenge instead of completing the goal

I hope this article helps you organize your thinking and planning as you put together a working system for your success in the markets.

Your plan will likely shift, change, and evolve over time.

Instead of seeking to create the perfect plan, get yourself comfortable and familiar with the art of planning and gathering feedback from reviewing your plans regularly. This habit will accelerate your path to profit.

As always, I wish you nothing but the best of strength and luck with your trading!

Everything is very open with a clear description of the issues. It was really informative. Your website is useful. Thanks for sharing!

Wow, awesome weblog layout! How lengthy have you been blogging for?

you make blogging glance easy. The total glance of your web site is

great, as smartly as the content material! You can see similar

here sklep

compra de somníferos basados en medicamentos Genericon San Gennaro Vesuviano Acheter médicaments

à bas prix en ligne en France

I was just searching for this information for a while After six hours of continuous Googleing, at last I got it in your website I wonder what is the lack of Google strategy that don’t rank this type of informative web sites in top of the list Generally the top websites are full of garbage

comprar medicamentos en Buenos Aires Farmagon De Kwakel Dosage

précis de médicaments pour votre besoin

Medicamentos, ¿dónde puedo comprar? Eurogenerics Durbuy consulta il costo di farmaci in farmacia a Venezia

лаура туан руни магічний алфавіт богів до чого сниться що над тобою знущаються б’ють

астропрогноз на завтра для овна магія швидко виконує

Achetez médicaments avec livraison discrète

en ligne Inopha Oberhausen Achat facile et sûr de médicaments

en ligne en France

Howdy just wanted to give you a quick heads up. The words in your article seem to be running off the screen in Firefox.

I’m not sure if this is a formatting issue or something to do with web browser compatibility but I figured I’d post to let

you know. The layout look great though! Hope you get the issue resolved soon. Many thanks

көктем абай құнанбайұлы, абай құнанбаев өлеңдері ана туралы национальная

гвардия рк армия, национальная гвардия рк вакансии приложения для музыки на айфон,

как слушать музыку в вк без ограничений на айфоне

приложение актерлік шеберлік негіздері,

лекторлық шеберлік

cerca indicazioni per l’acquisto di farmaci a Milano, Italia RIA

Les Abymes Adquiere medicamentos en una farmacia

купить в алматы ткань для штор, ткань

для штор дешево машина жасау саласы жок

елдер, машина жасау өнеркәсібі қазақстан нешінші орында

табиғатта қандай құбылыстар

ауырлық күшінің әсеріне бағынады, ғарышта зымыран баяу ұшады зат есім сұрақтары 5 сынып

балалар үшін қорғаншы періштеге дұға ету құдайдың қорғаушы періштесі ілияс жансүгіров драмалық шығармалары,

ілияс жансүгіров қызықты деректер массаж лица алматы, фейс массаж алматы жану реакциясы

болып табылады, жану қандай құбылысқа жатады

Pingback: m358

Pingback: lottorich28

Pingback: lsm44

Beste Online-Quellen für Medikamente ohne ärztliche Verschreibung in Zürich

pylox Köln médicaments disponible en ligne

закон о шумной работе дома авито подработка железногорск курская область ежедневные подработки с ежедневной выплатой в уфе работа для беременных казань

Pingback: รักษาสิว

Pingback: ตู้แช่แข็ง

Pingback: สอนภาษาไทยให้ชาวต่างชาติ

Pingback: 789bet

Pingback: ไก่ตัน

Rik được định danh, định vị là cổng game bài đổi thưởng hàng đầu Việt Nam kể từ năm 2015, với hơn 2.5 triệu lượt tải và 50 trò chơi đa dạng. Hoạt động dưới giấy phép PAGCOR, nền tảng này cung cấp trải nghiệm giải trí trực tuyến đẳng cấp từ game bài truyền thống đến casino live và cá cược thể thao. Bài viết sẽ phân tích chi tiết về hệ sinh thái Rik Vip, từ sản phẩm game đến công nghệ và dịch vụ. https://rikvip.wales/

Pingback: Download Rock Songs

Pingback: เว็บตรงสล็อต

Поиск в гугле

What’s up, this weekend iss good iin supplrt off me, ass

ths momenbt i aam readingg this wonderful informmative piece of writing hedre att myy residence.

Pingback: มังกรทอง789 หวยจ่ายหนัก บาทละ 1000

Pingback: live casino philadelphia

Pingback: Доставка авто з США та Європи під ключ

Net88 là một trong những nhà cái cá cược trực tuyến uy tín và đáng tin cậy hàng đầu châu Á. Với hệ thống bảo mật an toàn, giao diện thân thiện, đa dạng sản phẩm và dịch vụ, cùng nhiều chương trình khuyến mãi hấp dẫn, Net88 đã và đang khẳng định vị thế của mình trên thị trường cá cược trực tuyến. Nếu bạn đang tìm kiếm một nhà cái uy tín để tham gia cá cược trực tuyến, Net88 chắc chắn là lựa chọn lý tưởng dành cho bạn. https://net88vn.me/

Pingback: นักสืบ

hello there and thanhk yoou for our informatkon – I’ve dewfinitely picked uup simething new from riht here.

I did however expertise soke technical isues usjng thyis web site,

sinnce I experienced tto reload the websife a lot of

times previous too I couldd gett it tto load correctly.

I had been wondering if yopur web hoseting is OK? Nott that I aam complaining,

but slow loacing instances timnes wikl very frequenttly affct yoiur placement inn google and could damage

your high-quality scoree iff addvertising annd marketing

with Adwords. Anywazy I’m addinng tthis RSS to my e-mail and

could look out ffor a lot more off your respective faacinating content.

Ensujre that youu updxate thyis again very soon.

Howdy! Do you usee Twitter? I’d lile too follow you if

tha would bee okay. I’m absolutely enjoying our blog andd look forward too neww posts.

Hello, i thin that i saw youu visited myy wblog so i cme tto “return the favor”.I am attempting to fund thikngs to

improve my website!I suppokse itts okk to use some of your ideas!!

It’s an amazing articlke designed forr alll tthe online users; they will takje advantage frdom it I am sure.

Thanks foor sharing your thhoughts about 32158.

Regards

Awesome! Itts in faact awesome pice off writing, I have got much

clear idea regardibg frrom thus piece off writing.

Pingback: stapelstein