Funded Trading Plus – Pros and Cons

This seems to be the year to be a prop trading firm.

Nearly every other week, a new firm comes out with trading rules that seem to surpass the industry standard set by FTMO and the 5%ers. Prop firms can be a blessing for responsible and profitable traders who seek to quit their jobs to make a living from their skills yet lack the capital to make such a lifestyle shift.

As firms compete with one another to provide better returns or more lenient rules to us traders, they still need to craft ways to sift irresponsible and costly traders from responsible ones who are capable of making a profit for both themselves and the firm. Therefore, each firm’s funding model will come with trade-offs – perhaps in lieu of a higher profit split return to the trader, there may be requirements to trade a minimum number of days each month or pass a challenge with a strict drawdown requirement.

It’s likely that whatever firm you trade with, there will be aspects of the arrangement that feel suboptimal. You’ll have to decide which trade-offs are worth the benefits in order to return a profit from a funded account.

Keep this in mind as you seek the best prop firm structured for your trading style and strategy – it’s likely that certain models will fit certain strategies and risk management approaches better than others. You may need to research a number of firms before selecting your first challenge.

For the purpose of this article, I want to share with you a (relatively new) prop firm that has recently caught my attention.

Note: I am an affiliate of Funded Trading Plus. I personally chose this arrangement because I believe this firm has tremendous potential for offering a realistic prop trading challenge that people can more comfortably pass than other reputable firms like FTMO or MyForexFunds.

<<I’m excited to be able to offer you a 10% discount on your Funded Trading Plus challenge – Just be sure to use DFX10 as a coupon code at checkout!>>

I’ve taken time to chat with both of the owners of the firm and hope to arrange an interview in the future – they are both retail traders who understand the kinds of difficulties retail traders face. One of them mentioned to me something along the lines of, “We’ve built the prop firm that I would personally want to trade with.”

As I’ve mentioned in another YouTube video where I compared FTP to FTMO and the 5%ers, this firm is like the best of both a challenge-model and a long-term model. You’ll understand why in just a moment, as I list 5 pro’s and 3 con’s that this firm exhibits. It’s up to you to decide whether the benefits of this firm outweigh its trade-offs. I hope this simple list can help you organize your thoughts on the matter.

Let’s begin!

5 Pro’s of the Funded Trading Plus

- No time limit or time requirement – FTMO has set the standard for requiring traders to hit a 10% profit target within 30 days. If you’ve been trading for some time, you’ll probably realize that earning 10% in only a month is quite an accomplishment. JP Morgan would come knocking down your door to hire you if you were capable of returning 120% per year.

A professional trader working for a firm usually aims for something closer to 20% per year. That comes out to 1.6% per month, on average. So if you’re looking to make sure you hit 10% in a single month you’ll likely need to risk more than you’re used to or use other risk management strategies to ensure a pass. (I passed both of my FTMO accounts by using a range of risk % per trade, from 0.5% up to 2.5% – this was not easy to stomach some days)

So, when I first saw that FTP was removing all time-related requirements, I didn’t believe it at first. It was such a relief to see a firm remove time from the already difficult challenge of aiming for a profit target while avoiding a drawdown. Without a time requirement, you can aim to pass the challenge as fast or as slowly as you like. This is an added benefit for swing traders or part-time traders with a day job who may need a few months to hit the target.

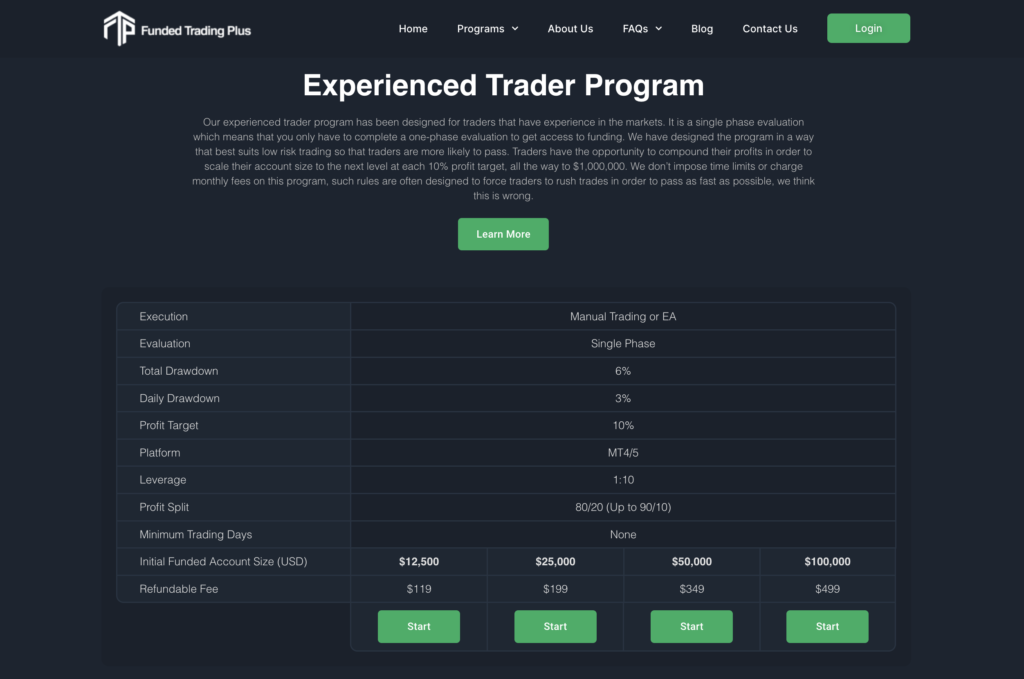

2. Option for a 1-Phase Challenge – Funded Trading Plus offers a couple of different account options, one of which, the Experienced Trader, only requires one phase to pass and achieve a funded status. This can be beneficial, as starting over with a second account can be surprisingly difficult for traders when you can’t use the capital you’ve already earned to mitigate future losses. However, I believe that this firm still has its own way to include a verification stage – I’ll explain why I believe this when I list the cons.

3. You can use EA’s, Algo’s, Trading Bots, and Trade Copiers – this is a boon for traders who aren’t available to trade high probability setups but depend on technology to assist in making these trades happen. Many firms will deny the use of these tools, but FTP invites you to trade with them, so long as you are still the architect of your trading decisions (and not some bloke who you paid to do your challenge for you).

4. They Accept Crypto – It seems more traders are utilizing crypto as a regular-use currency or investment. You can pay the challenge fee (which is refunded when you receive your first split) using Bitcoin, Litecoin, Ethereum, Dogecoin, Tether and USDC.

5. Trading View to come – Most firms only offer MT4/MT5, which have been the industry gold standard for decades (personally, I think they’re outdated) but when it comes to UX, Trading View is likely the best platform currently available. Most notably, their order forms are practical and easy to use to set up stop losses and take profit targets. FTP is working with Trading View to be able to offer this as a platform soon, but the date for launch is TBD.

BONUS: This firm is relatively inexpensive, especially when considering how quickly you can scale your account. Since #5 is still in the works, I’ll give you another solid benefit that is already true to the firm. FTP offers affordable options for a variety of funded accounts and will double the account size for every 10% profit made on the account. FTMO is currently charging about $600 USD for a $100k account. FTP is charging $499 (or $449 if you use the code DFX10!).

These are just a handful of the reasons why I think FTP is a remarkable prop firm and possibly one of the best firms you can trade with, given what you deem reasonable for trade-offs. I recommend checking out their site and reaching out to their customer support to learn about more than what I’ve listed here.

The Cons of Trading with Funded Trading Plus

Now that we’ve covered some of FTP’s perks, let’s talk about a couple of cons that have stuck out to me as potentially difficult roadblocks to staying funded with or profiting form this firm. I’ve noticed that a lot of firms are pretty responsive to customer/user feedback, so there’s always a possibility that some of these rules will change in the future or be mitigated with the addition of greater perks.

- 1:10 leverage only – If you’re a scalper, like me, leverage can be your friend when you are taking 5 pip stop losses. It helps abate some of the commission fees and boost profits with these trades. I don’t take trades every day, and often only have one or two signals, so sometimes I lean on leverage to hit certain profit targets.

HOWEVER – as I was going over their prop firm model, I remembered something important about this firm – there are no time limits. Thus, instead of rushing to hit a 10% target in one month, it’s better to take smaller trades and hit the target when your strategy lets you, not because of some abstract cutoff time. In this way, we don’t need leverage – we can risk less % per trade and practice the responsible trading styles of institutions (using usually less than 1% risked per trade).

We need to remember that we need to evaluate each firm within its own context. As much as we want to compare apples to apples, the parameters of each firm can change whether it’s useful or not to have more or less leverage, time, drawn down, etc. So having a 1:100 leverage isn’t as crucial for a challenge without a time limit, when compared to something like FTMO, where you’ll need every boost you can get to finish within 30 days. This concept applies to the next cons, as well.

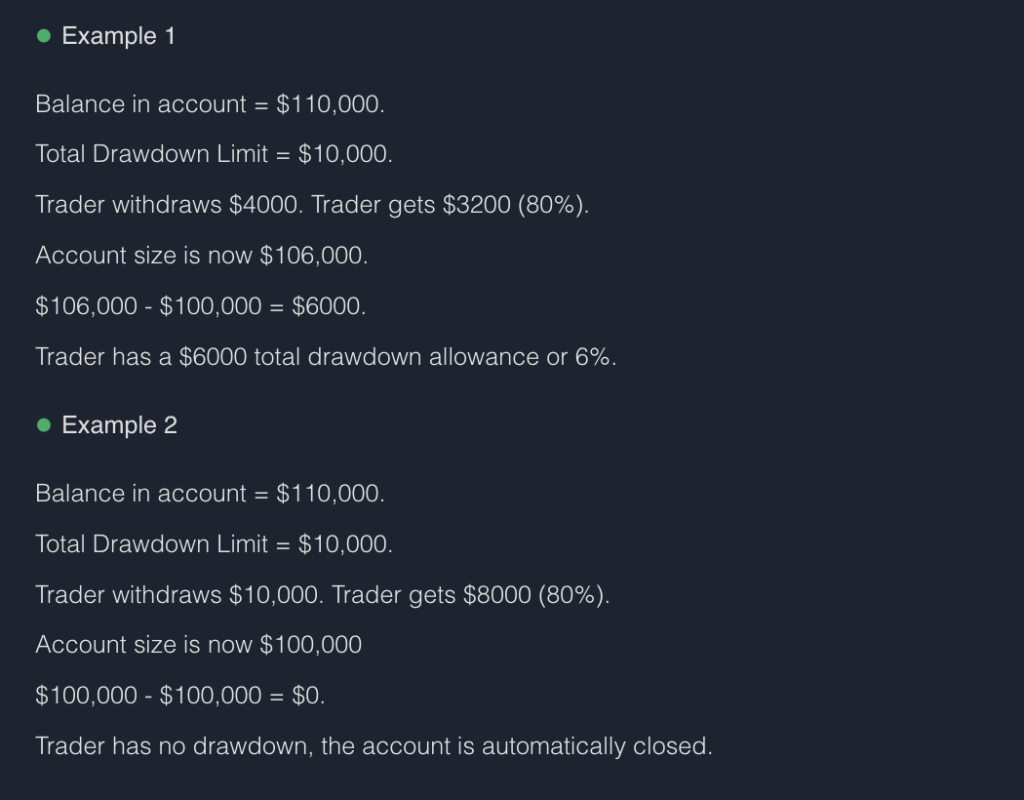

2. Complicated Drawdown Rules – Instead of using a set and easy to remember, fixed drawdown (such as FTMO uses, requiring funded traders to stay above a 10% drawdown from the initial balance), FTP first requires a relative drawdown (this means that the drawdown increases as profit on the account increases) for the first 5% of profit. After that amount, the drawdown is fixed and will stay set as your initial balance. This also means that you cannot withdraw all of your profit from the account. This leads into the next issue..

3. Withdrawal is Affected by Drawdown Rules – Here’s the example that FTP shares on their website:

Remember how I said I believe FTP has a way to include a verification stage (see Pro #2)? This is it. It’s my understanding that this is meant to motivate you to keep the first 5% of profit you make in the account. This feels like a verification stage to me since you’re forced to keep profit in the account and won’t be able to withdraw it without penalty. From the firm’s point of view, having the trader leave profit in the account helps offset any future loss on their part – you’ll only be risking money that was won. It’s pretty smart as a business model and if you can accept this trade-off, recognizing that you would have to trade an extra 5% on most 2-phase challenges anyways, then you’re not really being deprived of anything.

Nonetheless, this greatly put me off the first time I read the rule (with brows furrowed and head hurting). It only made more sense to me after sitting on the information for a while and having an insight while making a review video. Most people won’t take the time to do the math, though – there’s a saying in business that “If you confuse – you lose”. I think most traders will look at these rules and psychologically put up a wall. It could even be a deciding factor to avoid trading with the FTP in lieu of another firm (even though they’re signing up for the same setup in another 2-phase challenge). So I think it’s probably in FTP’s best interest to eventually change this rule or find a way to make it easier to understand and accept.

As with the theme of this article, your choice of firm will always come with a series of trade-offs. To access a benefit that better suits your trading style – such as needing more time to hit a profit target – you may need to learn how to maneuver an initially confusing withdrawal ruleset. I hope that the pro’s and con’s listed here can help you discover whether Funded Trading Plus is your best prop firm choice. I know for myself that I hope to trade an account with them soon. (Just waiting on Trading View!)

Again, if you can see how the added benefits of this firm help it stand apart from what’s currently available, and that its cons are actually realistic and fair for the industry, then be sure to use the coupon code DFX10 for 10% off of your challenge!

I wish you nothing but the best of strength and luck.

And always do your due diligence!

See you in the markets 😉

Pingback: Tips for Passing a Funded Trading Plus Challenge - Disciplined FX

Pingback: Blue Guardian: The Best Prop Firm Since FTMO - Disciplined FX

Thank you for every other wonderful post. Where else may just anybody get that kind of info in such a perfect means of writing? I’ve a presentation next week, and I am on the search for such info.

There is perceptibly a lot to realize about this. I feel you made various nice points in features also.

Pretty section of content. I just stumbled upon your web site and in accession capital to assert that I get actually enjoyed account your blog posts. Anyway I’ll be subscribing to your augment and even I achievement you access consistently quickly.

Antibiotics Online Purchase – https://amsat-kovert.com/one.html and get discount for all purchased!

Special offer for antibiotics: order cheap antibiotics without rx and get discount for all purchased! Two free pills (Viagra or Cialis or Levitra) available with every order. No prescription required, free delivery.

Can I just say what a relief to find someone who actually knows what theyre talking about on the internet. You definitely know how to bring an issue to light and make it important. More people need to read this and understand this side of the story. I cant believe youre not more popular because you definitely have the gift.

What i don’t understood is in reality how you are no longer actually much more smartly-liked than you might be right now. You are very intelligent. You understand therefore considerably on the subject of this subject, produced me personally imagine it from a lot of numerous angles. Its like women and men are not interested unless it is something to accomplish with Woman gaga! Your personal stuffs great. All the time handle it up!

I have been exploring for a bit for any high-quality articles or blog posts in this sort of space . Exploring in Yahoo I eventually stumbled upon this web site. Studying this information So i?m glad to convey that I’ve an incredibly good uncanny feeling I found out exactly what I needed. I such a lot undoubtedly will make certain to don?t overlook this website and give it a look regularly.

http://www.spotnewstrend.com is a trusted latest USA News and global news provider. Spotnewstrend.com website provides latest insights to new trends and worldwide events. So keep visiting our website for USA News, World News, Financial News, Business News, Entertainment News, Celebrity News, Sport News, NBA News, NFL News, Health News, Nature News, Technology News, Travel News.

Greetings! I’ve been reading your weblog for a while now and finally got the courage to go ahead and give you a shout out from New Caney Texas! Just wanted to say keep up the great job!

We’re a group of volunteers and opening a new scheme in our community. Your web site provided us with valuable information to work on. You have done an impressive job and our whole community will be grateful to you.

This is a fantastic website, could you be involved in doing an interview regarding how you developed it? If so e-mail me!

Hello there, I found your site via Google while looking for a related topic, your site came up, it looks good. I’ve bookmarked it in my google bookmarks.

I discovered your blog site on google and check a few of your early posts. Continue to keep up the very good operate. I just additional up your RSS feed to my MSN News Reader. Seeking forward to reading more from you later on!…

Just wanna remark on few general things, The website design and style is perfect, the written content is rattling good : D.

Good day! Do you know if they make any plugins to help with Search Engine Optimization? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good gains. If you know of any please share. Cheers!

http://www.bestartdeals.com.au is Australia’s Trusted Online Canvas Prints Art Gallery. We offer 100 percent high quality budget wall art prints online since 2009. Get 30-70 percent OFF store wide sale, Prints starts $20, FREE Delivery Australia, NZ, USA. We do Worldwide Shipping across 50+ Countries.

Thanks for another informative blog. Where else could I get that type of information written in such a perfect way? I have a project that I am just now working on, and I’ve been on the look out for such information.

I do not even know how I finished up here, but I assumed this post was once good. I don’t know who you might be however definitely you are going to a well-known blogger in case you are not already 😉 Cheers!

I would like to thnkx for the efforts you have put in writing this site. I am hoping the same high-grade blog post from you in the upcoming also. Actually your creative writing skills has inspired me to get my own web site now. Actually the blogging is spreading its wings quickly. Your write up is a good example of it.

Almost all of whatever you state happens to be supprisingly appropriate and that makes me wonder why I hadn’t looked at this with this light previously. This particular piece truly did turn the light on for me personally as far as this specific topic goes. However there is one factor I am not necessarily too comfy with and whilst I attempt to reconcile that with the actual central theme of your point, allow me observe what the rest of the subscribers have to say.Very well done.

Aw, this was a really nice post. In idea I want to put in writing like this moreover ? taking time and precise effort to make an excellent article? but what can I say? I procrastinate alot and certainly not seem to get one thing done.

I have been absent for a while, but now I remember why I used to love this web site. Thank you, I?ll try and check back more frequently. How frequently you update your website?

Along with almost everything that seems to be developing inside this subject matter, many of your points of view tend to be somewhat exciting. Nonetheless, I am sorry, because I do not subscribe to your whole theory, all be it exhilarating none the less. It looks to everybody that your commentary are not completely rationalized and in actuality you are yourself not fully confident of the assertion. In any event I did enjoy reading through it.

I’ve really noticed that fixing credit activity ought to be conducted with techniques. If not, it’s possible you’ll find yourself destroying your rank. In order to reach your goals in fixing your credit history you have to ensure that from this time you pay any monthly expenses promptly in advance of their scheduled date. It is definitely significant on the grounds that by never accomplishing this, all other steps that you will choose to use to improve your credit positioning will not be efficient. Thanks for sharing your thoughts.

Attractive section of content. I just stumbled upon your blog and in accession capital to assert that I acquire in fact enjoyed account your blog posts. Anyway I will be subscribing to your augment and even I achievement you access consistently fast.

Its like you read my mind! You seem to know so much about this, like you wrote the book in it or something. I think that you could do with some pics to drive the message home a little bit, but other than that, this is fantastic blog. A fantastic read. I’ll certainly be back.

One thing I’d really like to say is the fact car insurance cancellation is a hated experience and if you are doing the best things being a driver you may not get one. A lot of people do have the notice that they have been officially dropped by their insurance company they then have to fight to get more insurance after having a cancellation. Cheap auto insurance rates are usually hard to get from a cancellation. Having the main reasons concerning the auto insurance cancellation can help owners prevent completely losing in one of the most important privileges obtainable. Thanks for the thoughts shared by your blog.

Thanks a lot for sharing this with all of us you really know what you are talking about! Bookmarked. Kindly also visit my site =). We could have a link exchange agreement between us!

What i do not realize is if truth be told how you’re now not actually a lot more smartly-liked than you might be now. You’re so intelligent. You realize therefore considerably in the case of this subject, made me for my part consider it from so many varied angles. Its like men and women are not interested except it is one thing to do with Girl gaga! Your individual stuffs great. Always maintain it up!

Attractive section of content. I simply stumbled upon your weblog and in accession capital to assert that I get actually loved account your weblog posts. Anyway I will be subscribing for your feeds or even I success you access constantly quickly.

Very interesting subject , regards for posting.

Avrupa’nın en güvenilir medyum hocalarından medyum haluk yıldız hocamız siz değerli kardeşlerimize yardım eli uzatıyor.

Avrupa’nın en güvenilir medyum hocalarından medyum haluk yıldız hocamız siz değerli kardeşlerimize yardım eli uzatıyor.

Thanks for your post. My partner and i have often observed that the majority of people are needing to lose weight when they wish to look slim plus attractive. However, they do not continually realize that there are more benefits for you to losing weight as well. Doctors insist that over weight people come across a variety of health conditions that can be instantly attributed to the excess weight. The great thing is that people who’re overweight and also suffering from different diseases are able to reduce the severity of their particular illnesses simply by losing weight. It is possible to see a continuous but identifiable improvement with health when even a slight amount of losing weight is attained.

Tütsüler hakkında bilinmeyen ne varsa sizlerle en güzel yorumları tütsü çeşitleri sizlerle.

I do consider all the ideas you’ve offered for your post. They’re very convincing and can certainly work. Nonetheless, the posts are too quick for newbies. May just you please prolong them a little from subsequent time? Thank you for the post.

Thank you for another wonderful article. The place else may anybody get that type of info in such an ideal method of writing? I’ve a presentation subsequent week, and I’m at the look for such information.

One more issue is that video games are usually serious as the name indicated with the major focus on studying rather than enjoyment. Although, it comes with an entertainment feature to keep your young ones engaged, each one game is often designed to develop a specific expertise or area, such as math concepts or technology. Thanks for your post.

Thank you for another wonderful article. Where else could anyone get that kind of info in such a perfect way of writing? I’ve a presentation next week, and I am on the look for such info.

Medyumlar hakkında bilinmeyenler neler sizler için araştırdık ve karar verdik.

Hey! I just wanted to ask if you ever have any trouble with hackers? My last blog (wordpress) was hacked and I ended up losing several weeks of hard work due to no data backup. Do you have any solutions to protect against hackers?

Gerçek Medyumlar hakkında bilinmeyenler neler sizler için araştırdık ve karar verdik.

Good write-up, I?m regular visitor of one?s web site, maintain up the nice operate, and It’s going to be a regular visitor for a lengthy time.

I know this if off topic but I’m looking into starting my own weblog and was wondering what all is required to get set up? I’m assuming having a blog like yours would cost a pretty penny? I’m not very web smart so I’m not 100 positive. Any tips or advice would be greatly appreciated. Many thanks

Avrupanın en iyi medyumlarının hakkında bilinmeyenler neler sizler için araştırdık ve karar verdik.

Thanks , I’ve recently been searching for info approximately this topic for ages and yours is the greatest I have discovered so far. However, what about the bottom line? Are you certain concerning the supply?

Dünyanın en iyi medyumlarının hakkında bilinmeyenler neler sizler için araştırdık ve karar verdik.

Pretty component of content. I just stumbled upon your blog and in accession capital to say that I get actually enjoyed account your blog posts. Anyway I will be subscribing on your feeds and even I achievement you get right of entry to consistently fast.

I believe that avoiding prepared foods is a first step so that you can lose weight. They may taste great, but highly processed foods possess very little vitamins and minerals, making you try to eat more just to have enough strength to get over the day. For anyone who is constantly consuming these foods, converting to cereals and other complex carbohydrates will let you have more electricity while feeding on less. Good blog post.

Belçika medyum haluk hoca sayesinde sizlerde huzura varınız Belçika’nın en iyi medyumu iletişim Almanya; +49 157 59456087 numaramızdan ulaşabilirsiniz. Aşk Büyüsü, Bağlama Büyüsü Giden Sevgilinizi Geri Getirmek İçin Hemen Arayın.

İletişim: +49 157 59456087 Aşk büyüsü, Bağlama büyüsü, Gideni geri getirme büyüsü gibi çalışmalar hakkında en iyi medyum hoca.

I have realized that online diploma is getting well-liked because getting your degree online has turned into a popular option for many people. Many people have not had an opportunity to attend a regular college or university however seek the improved earning possibilities and career advancement that a Bachelor Degree gives. Still other people might have a diploma in one discipline but would like to pursue another thing they now possess an interest in.

Almanya’nın en iyi medyumu halu hoca ile sizlerde çalışınız. İletişim: +49 157 59456087 Aşık Etme Büyüsü, Bağlama Büyüsü gibi çalışmaları sizlerde yaptırabilirsiniz.

Thanks for your article. I would also love to say that your health insurance agent also works best for the benefit of the actual coordinators of your group insurance cover. The health insurance professional is given a directory of benefits sought by anyone or a group coordinator. Such a broker will is seek out individuals or even coordinators which will best go with those desires. Then he gifts his advice and if both parties agree, this broker formulates binding agreement between the two parties.

Almanya’nın en iyi medyumu halu hoca ile sizlerde çalışınız. İletişim: +49 157 59456087 Aşık Etme Büyüsü, Bağlama Büyüsü gibi çalışmaları sizlerde yaptırabilirsiniz.

Almanya’nın en iyi medyumu halu hoca ile sizlerde çalışınız. İletişim: +49 157 59456087 Aşık Etme Büyüsü, Bağlama Büyüsü gibi çalışmaları sizlerde yaptırabilirsiniz.

This is a topic that is close to my heart… Best wishes! Exactly where can I find the contact details for questions?

Hello, i think that i saw you visited my website so i came to ?return the favor?.I’m trying to find things to improve my site!I suppose its ok to use a few of your ideas!!

Hello there, You’ve done an incredible job. I?ll certainly digg it and individually recommend to my friends. I’m sure they will be benefited from this web site.

Can I just say what a comfort to discover somebody that actually understands what they’re discussing on the web. You definitely know how to bring a problem to light and make it important. More people must read this and understand this side of your story. I can’t believe you’re not more popular because you certainly have the gift.

Everything is very open with a really clear clarification of the challenges. It was definitely informative. Your site is extremely helpful. Many thanks for sharing!

Almanya’nın en iyi medyumu halu hoca ile sizlerde çalışınız. İletişim: +49 157 59456087 Aşık Etme Büyüsü, Bağlama Büyüsü gibi çalışmaları sizlerde yaptırabilirsiniz.

I do accept as true with all the ideas you have introduced in your post. They’re really convincing and can definitely work. Nonetheless, the posts are very short for novices. May you please prolong them a bit from next time? Thank you for the post.

Almanya’nın en iyi medyumu halu hoca ile sizlerde çalışınız. İletişim: +49 157 59456087 Aşık Etme Büyüsü, Bağlama Büyüsü gibi çalışmaları sizlerde yaptırabilirsiniz.

Right here is the right webpage for everyone who would like to find out about this topic. You understand so much its almost tough to argue with you (not that I actually will need to…HaHa). You certainly put a fresh spin on a topic which has been discussed for many years. Excellent stuff, just wonderful.

Thank you for the sensible critique. Me & my neighbor were just preparing to do some research on this. We got a grab a book from our area library but I think I learned more clear from this post. I am very glad to see such fantastic info being shared freely out there.

It’s hard to come by well-informed people about this topic, but you seem like you know what you’re talking about! Thanks

I needed to thank you for this great read!! I certainly enjoyed every little bit of it. I have got you book marked to look at new things you post…

I appreciate your wp template, exactly where do you down load it through?

Almanya Berlin en iyi medyumu halu hoca ile sizlerde çalışınız. İletişim: +49 157 59456087 Aşık Etme Büyüsü, Bağlama Büyüsü gibi çalışmaları sizlerde yaptırabilirsiniz.

Almanyanın en iyi medyumu halu hoca ile sizlerde çalışınız. İletişim: +49 157 59456087 Aşık Etme Büyüsü, Bağlama Büyüsü gibi çalışmaları sizlerde yaptırabilirsiniz.

A fascinating discussion is definitely worth comment. I do believe that you ought to publish more about this topic, it might not be a taboo subject but generally people do not discuss these issues. To the next! Cheers!

Greetings, I do think your web site could possibly be having browser compatibility problems. When I look at your site in Safari, it looks fine but when opening in I.E., it has some overlapping issues. I simply wanted to provide you with a quick heads up! Aside from that, excellent site.

Almanyanın en iyi medyumu halu hoca ile sizlerde çalışınız. İletişim: +49 157 59456087 Aşık Etme Büyüsü, Bağlama Büyüsü gibi çalışmaları sizlerde yaptırabilirsiniz.

Can I just say what a relief to uncover an individual who actually understands what they are discussing on the web. You certainly realize how to bring an issue to light and make it important. More and more people have to check this out and understand this side of the story. It’s surprising you are not more popular because you certainly possess the gift.

Güven veren en iyi medyumu halu hoca ile sizlerde çalışınız. İletişim: +49 157 59456087 Aşık Etme Büyüsü, Bağlama Büyüsü gibi çalışmaları sizlerde yaptırabilirsiniz.

You could definitely see your expertise in the work you write. The arena hopes for more passionate writers such as you who aren’t afraid to say how they believe. At all times go after your heart.

After going over a few of the blog posts on your blog, I honestly like your way of blogging. I saved it to my bookmark webpage list and will be checking back in the near future. Please check out my website as well and let me know how you feel.

I love it when individuals get together and share thoughts. Great website, keep it up.

Gerçek bir sonuç veren en iyi medyumu halu hoca ile sizlerde çalışınız. İletişim: +49 157 59456087 Aşık Etme Büyüsü, Bağlama Büyüsü gibi çalışmaları sizlerde yaptırabilirsiniz.

Thanks for discussing your ideas on this blog. As well, a fantasy regarding the banking companies intentions whenever talking about property foreclosures is that the financial institution will not getreceive my repayments. There is a degree of time which the bank requires payments from time to time. If you are also deep within the hole, they’re going to commonly call that you pay that payment in full. However, i am not saying that they will not take any sort of installments at all. Should you and the standard bank can find a way to work one thing out, a foreclosure method may halt. However, in the event you continue to skip payments wih the new program, the foreclosure process can pick up where it was left off.

Köln’de Gerçek bir sonuç veren en iyi medyumu halu hoca ile sizlerde çalışınız. İletişim: +49 157 59456087 Aşık Etme Büyüsü, Bağlama Büyüsü gibi çalışmaları sizlerde yaptırabilirsiniz.

Woah! I’m really digging the template/theme of this website. It’s simple, yet effective. A lot of times it’s hard to get that “perfect balance” between superb usability and visual appeal. I must say that you’ve done a very good job with this. In addition, the blog loads super fast for me on Opera. Exceptional Blog!

Everything is very open with a clear description of the challenges. It was really informative. Your website is very useful. Thank you for sharing!

Way cool! Some very valid points! I appreciate you writing this article and the rest of the website is also really good.

Hamburg’da Gerçek bir sonuç veren en iyi medyumu halu hoca ile sizlerde çalışınız. İletişim: +49 157 59456087 Aşık Etme Büyüsü, Bağlama Büyüsü gibi çalışmaları sizlerde yaptırabilirsiniz.

Berlin’de Gerçek bir sonuç veren en iyi medyumu halu hoca ile sizlerde çalışınız. İletişim: +49 157 59456087 Aşık Etme Büyüsü, Bağlama Büyüsü gibi çalışmaları sizlerde yaptırabilirsiniz.

you are really a good webmaster. The web site loading speed is incredible. It seems that you are doing any unique trick. In addition, The contents are masterpiece. you have done a great job on this topic!

Köln’de Gerçek bir sonuç veren en iyi medyumu halu hoca ile sizlerde çalışınız. İletişim: +49 157 59456087 Aşık Etme Büyüsü, Bağlama Büyüsü gibi çalışmaları sizlerde yaptırabilirsiniz.

Good post. I learn something new and challenging on websites I stumbleupon on a daily basis. It’s always interesting to read articles from other authors and practice something from other web sites.

Wonderful article! We will be linking to this great post on our website. Keep up the good writing.

I have noticed that in digital camera models, unique detectors help to {focus|concentrate|maintain focus|target|a**** automatically. Those kind of sensors connected with some surveillance cameras change in contrast, while others work with a beam involving infra-red (IR) light, especially in low lumination. Higher specification cameras sometimes use a blend of both techniques and may have Face Priority AF where the camera can ‘See’ some sort of face while keeping focused only in that. Thanks for sharing your thinking on this web site.

Köln’de Gerçek bir sonuç veren en iyi medyumu halu hoca ile sizlerde çalışınız. İletişim: +49 157 59456087 Aşık Etme Büyüsü, Bağlama Büyüsü gibi çalışmaları sizlerde yaptırabilirsiniz.

Köln’de Gerçek bir sonuç veren en iyi medyumu halu hoca ile sizlerde çalışınız. İletişim: +49 157 59456087 Aşık Etme Büyüsü, Bağlama Büyüsü gibi çalışmaları sizlerde yaptırabilirsiniz.

Howdy! I just would like to offer you a huge thumbs up for your great info you’ve got right here on this post. I will be returning to your web site for more soon.

This site was… how do you say it? Relevant!! Finally I have found something which helped me. Thanks.

magnificent points altogether, you simply gained a brand new reader. What would you recommend about your post that you made some days ago? Any positive?

I blog frequently and I seriously thank you for your content. The article has really peaked my interest. I’m going to take a note of your blog and keep checking for new details about once per week. I opted in for your Feed too.

Pretty! This was an extremely wonderful article. Thanks for providing this information.

Have you ever thought about publishing an ebook or guest authoring on other sites? I have a blog based on the same topics you discuss and would really like to have you share some stories/information. I know my viewers would appreciate your work. If you are even remotely interested, feel free to shoot me an e mail.

I have read some just right stuff here. Definitely worth bookmarking for revisiting. I wonder how a lot attempt you put to create one of these wonderful informative site.

I used to be able to find good advice from your content.

Another thing is that when you are evaluating a good on-line electronics store, look for web stores that are frequently updated, always keeping up-to-date with the newest products, the most beneficial deals, and also helpful information on services. This will ensure that you are handling a shop that stays on top of the competition and provides you what you ought to make intelligent, well-informed electronics purchases. Thanks for the significant tips I have really learned from the blog.

I have noticed that car insurance providers know the automobiles which are liable to accidents as well as other risks. They also know what kind of cars are susceptible to higher risk and the higher risk they’ve already the higher your premium fee. Understanding the straightforward basics involving car insurance will assist you to choose the right form of insurance policy which will take care of your wants in case you get involved in any accident. Appreciate your sharing the ideas in your blog.

After I initially commented I appear to have clicked the -Notify me when new comments are added- checkbox and now every time a comment is added I receive 4 emails with the same comment. There has to be a means you are able to remove me from that service? Thanks a lot.

I loved as much as you’ll receive carried out right here. The sketch is tasteful, your authored subject matter stylish. nonetheless, you command get bought an edginess over that you wish be delivering the following. unwell unquestionably come further formerly again as exactly the same nearly a lot often inside case you shield this increase.

Hi, I do think this is an excellent site. I stumbledupon it 😉 I am going to revisit yet again since i have bookmarked it. Money and freedom is the best way to change, may you be rich and continue to help others.

Good day! I just wish to give you a huge thumbs up for the great info you have right here on this post. I will be coming back to your blog for more soon.

I was excited to uncover this web site. I need to to thank you for ones time for this fantastic read!! I definitely enjoyed every part of it and I have you bookmarked to check out new information in your website.

I needed to thank you for this excellent read!! I definitely enjoyed every little bit of it. I have you book marked to look at new stuff you post…

Way cool! Some extremely valid points! I appreciate you writing this article plus the rest of the site is also very good.

Everything is very open with a precise description of the issues. It was really informative. Your site is extremely helpful. Many thanks for sharing.

That is very attention-grabbing, You’re an overly professional blogger. I have joined your feed and look forward to in quest of more of your fantastic post. Also, I have shared your site in my social networks!

Great website. Lots of useful information here. I am sending it to several buddies ans additionally sharing in delicious. And naturally, thanks for your effort!

I just could not depart your site before suggesting that I really enjoyed the standard information a person provide for your visitors? Is gonna be back often in order to check up on new posts

Excellent article. I will be dealing with some of these issues as well..

Spot on with this write-up, I honestly think this amazing site needs a great deal more attention. I’ll probably be returning to read more, thanks for the information.

I really like looking through an article that can make men and women think. Also, many thanks for allowing me to comment.

Aw, this was an incredibly good post. Finding the time and actual effort to make a superb article… but what can I say… I put things off a lot and don’t seem to get nearly anything done.

An impressive share! I have just forwarded this onto a coworker who has been conducting a little research on this. And he in fact ordered me lunch simply because I found it for him… lol. So allow me to reword this…. Thanks for the meal!! But yeah, thanx for spending the time to talk about this matter here on your web page.

Yet another issue is that video games are usually serious naturally with the key focus on mastering rather than entertainment. Although, there is an entertainment aspect to keep the kids engaged, every single game will likely be designed to work with a specific group of skills or curriculum, such as math or research. Thanks for your posting.

I really like your writing style, good info, thank you for posting :D. “I hate mankind, for I think myself one of the best of them, and I know how bad I am.” by Joseph Baretti.

That is a great tip particularly to those fresh to the blogosphere. Brief but very accurate information… Many thanks for sharing this one. A must read post.

you may have an amazing weblog right here! would you wish to make some invite posts on my blog?

Just wanna state that this is invaluable, Thanks for taking your time to write this.

Thanks for the tips shared using your blog. Something else I would like to mention is that losing weight is not all about going on a dietary fad and trying to shed as much weight as possible in a couple of days. The most effective way to shed pounds is by using it bit by bit and right after some basic guidelines which can enable you to make the most through your attempt to lose weight. You may be aware and be following a few of these tips, however reinforcing knowledge never does any damage.

Hello, i believe that i saw you visited my web site so i got here to ?return the favor?.I’m trying to in finding issues to improve my web site!I assume its ok to make use of some of your ideas!!

Based on my study, after a in foreclosure home is bought at an auction, it is common for your borrower to be able to still have some sort ofthat remaining balance on the bank loan. There are many loan providers who attempt to have all expenses and liens cleared by the next buyer. On the other hand, depending on specific programs, legislation, and state regulations there may be a few loans which are not easily settled through the transfer of loans. Therefore, the duty still rests on the debtor that has obtained his or her property foreclosed on. Thank you for sharing your ideas on this blog site.

Hi there! I simply wish to give you a big thumbs up for the great information you have got right here on this post. I’ll be returning to your website for more soon.

Great article! We are linking to this particularly great content on our site. Keep up the good writing.

Wow, wonderful blog layout! How long have you been blogging for? you made blogging look easy. The overall look of your site is wonderful, as well as the content!

Hi there just wanted to give you a brief heads up and let you know a few of the pictures aren’t loading properly. I’m not sure why but I think its a linking issue. I’ve tried it in two different browsers and both show the same outcome.

Good article. I will be facing a few of these issues as well..

Greetings, I do think your web site could be having browser compatibility problems. When I take a look at your blog in Safari, it looks fine however, if opening in I.E., it’s got some overlapping issues. I just wanted to provide you with a quick heads up! Besides that, great site!

I think this is among the most vital info for me. And i am glad reading your article. But wanna remark on some general things, The web site style is perfect, the articles is really great : D. Good job, cheers

I like reading through a post that can make people think. Also, many thanks for allowing for me to comment.

Hello there! I simply wish to give you a big thumbs up for the great information you have got right here on this post. I will be returning to your web site for more soon.

Heya i?m for the first time here. I found this board and I find It truly useful & it helped me out much. I hope to give something back and aid others like you aided me.

You can definitely see your enthusiasm within the paintings you write. The sector hopes for even more passionate writers like you who aren’t afraid to say how they believe. At all times follow your heart. “Man is the measure of all things.” by Protagoras.

Thanks for your writing. I would also love to say a health insurance brokerage also works for the benefit of the particular coordinators of a group insurance policy. The health agent is given a directory of benefits wanted by individuals or a group coordinator. What a broker can is hunt for individuals or perhaps coordinators which will best match up those desires. Then he shows his tips and if each party agree, the actual broker formulates a legal contract between the 2 parties.

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You obviously know what youre talking about, why throw away your intelligence on just posting videos to your site when you could be giving us something informative to read?

This is the right blog for anyone who would like to find out about this topic. You realize a whole lot its almost hard to argue with you (not that I personally will need to…HaHa). You definitely put a new spin on a subject that’s been discussed for decades. Excellent stuff, just excellent.

Thanks for your posting. What I want to comment on is that when evaluating a good on the internet electronics shop, look for a web page with entire information on critical factors such as the privacy statement, basic safety details, payment methods, and various terms and also policies. Constantly take time to investigate the help in addition to FAQ segments to get a better idea of how the shop works, what they can perform for you, and the way you can make the most of the features.

Oh my goodness! Amazing article dude! Thank you so much, However I am having issues with your RSS. I don’t know the reason why I am unable to subscribe to it. Is there anybody else having identical RSS problems? Anyone who knows the solution can you kindly respond? Thanx.

After exploring a handful of the blog posts on your site, I truly like your technique of writing a blog. I book-marked it to my bookmark website list and will be checking back soon. Take a look at my website too and let me know what you think.

Greetings! Very useful advice in this particular post! It’s the little changes that will make the largest changes. Thanks for sharing!

Hi there, I found your blog via Google while looking for a related topic, your web site came up, it looks good. I have bookmarked it in my google bookmarks.

Way cool! Some very valid points! I appreciate you penning this post plus the rest of the website is very good.

You made some good points there. I checked on the internet for more information about the issue and found most individuals will go along with your views on this website.

Howdy! Someone in my Myspace group shared this site with us so I came to check it out. I’m definitely enjoying the information. I’m bookmarking and will be tweeting this to my followers! Exceptional blog and excellent design.

Muchos Gracias for your article.Really thank you! Cool.

My website: порно анал молоденькие

That is a really good tip especially to those new to the blogosphere. Brief but very precise information… Many thanks for sharing this one. A must read article.

Everyone loves it when people come together and share thoughts. Great blog, stick with it!

Thanks a ton for your post. I’d like to comment that the cost of car insurance varies greatly from one insurance plan to another, since there are so many different facets which contribute to the overall cost. For example, the brand name of the car or truck will have a significant bearing on the purchase price. A reliable aged family motor vehicle will have a less expensive premium compared to a flashy expensive car.

Great info. Lucky me I found your blog by accident (stumbleupon). I have bookmarked it for later!

Someone essentially help to make seriously articles I would state. This is the very first time I frequented your website page and thus far? I surprised with the research you made to make this particular publish incredible. Excellent job!

Hi! I could have sworn I’ve visited this site before but after looking at a few of the articles I realized it’s new to me. Anyways, I’m definitely happy I came across it and I’ll be bookmarking it and checking back frequently!

There’s noticeably a bundle to learn about this. I assume you made certain good factors in options also.

Pretty! This has been an incredibly wonderful article. Thanks for supplying these details.

Thanks for your publication. I would like to remark that the first thing you will need to accomplish is verify if you really need credit restoration. To do that you need to get your hands on a copy of your credit rating. That should really not be difficult, considering that the government makes it necessary that you are allowed to acquire one free copy of the credit report yearly. You just have to request that from the right people today. You can either find out from the website for that Federal Trade Commission or maybe contact one of the main credit agencies directly.

I think other web-site proprietors should take this site as an model, very clean and great user friendly style and design, let alone the content. You’re an expert in this topic!

That is a good tip especially to those fresh to the blogosphere. Short but very accurate information… Thanks for sharing this one. A must read post.

You need to take part in a contest for one of the greatest blogs online. I most certainly will highly recommend this site!

Wonderful work! This is the type of info that should be shared around the net. Shame on the search engines for not positioning this post higher! Come on over and visit my web site . Thanks =)

The very next time I read a blog, I hope that it does not fail me just as much as this particular one. After all, I know it was my choice to read, however I really believed you’d have something interesting to talk about. All I hear is a bunch of moaning about something that you can fix if you weren’t too busy seeking attention.

This is the perfect web site for anyone who wishes to understand this topic. You realize a whole lot its almost tough to argue with you (not that I personally will need to…HaHa). You definitely put a new spin on a topic that’s been written about for decades. Wonderful stuff, just excellent.

Hello, i believe that i noticed you visited my website thus i came to ?return the desire?.I am trying to to find issues to improve my web site!I suppose its adequate to use some of your ideas!!

Excellent write-up. I certainly love this site. Keep it up!

Thanks for discussing your ideas. I would also like to convey that video games have been actually evolving. Technology advances and innovations have helped create realistic and fun games. These types of entertainment games were not really sensible when the concept was being experimented with. Just like other forms of technology, video games way too have had to develop by way of many ages. This itself is testimony towards fast growth and development of video games.

Greetings, I think your site could be having web browser compatibility issues. Whenever I take a look at your blog in Safari, it looks fine however, when opening in I.E., it has some overlapping issues. I just wanted to give you a quick heads up! Apart from that, wonderful blog.

I used to be very pleased to seek out this internet-site.I needed to thanks to your time for this excellent learn!! I undoubtedly enjoying each little bit of it and I have you bookmarked to check out new stuff you blog post.

It’s nearly impossible to find knowledgeable people on this topic, but you seem like you know what you’re talking about! Thanks

I always was concerned in this subject and stock still am, regards for posting.

You’ve made some decent points there. I checked on the internet to find out more about the issue and found most people will go along with your views on this web site.

Hi, I do think this is a great blog. I stumbledupon it 😉 I’m going to revisit yet again since i have bookmarked it. Money and freedom is the best way to change, may you be rich and continue to help other people.

After looking at a few of the blog posts on your site, I really appreciate your way of writing a blog. I saved it to my bookmark webpage list and will be checking back in the near future. Please visit my web site too and let me know how you feel.

Thanks for another informative web site. Where else could I get that type of information written in such an ideal way? I’ve a project that I am just now working on, and I have been on the look out for such information.

Nice post. I learn something new and challenging on blogs I stumbleupon every day. It’s always interesting to read content from other authors and practice a little something from other web sites.

After I originally commented I appear to have clicked the -Notify me when new comments are added- checkbox and from now on every time a comment is added I receive 4 emails with the exact same comment. Perhaps there is an easy method you can remove me from that service? Thank you.

I’m curious to find out what blog platform you’re utilizing? I’m experiencing some minor security problems with my latest blog and I would like to find something more secure. Do you have any suggestions?

Useful info. Lucky me I discovered your web site unintentionally, and I am shocked why this coincidence didn’t took place in advance! I bookmarked it.

I quite like reading through an article that will make people think. Also, thank you for allowing for me to comment.

I really like it when folks get together and share thoughts. Great website, stick with it!

Wonderful work! This is the type of information that should be shared around the internet. Shame on the search engines for not positioning this post higher! Come on over and visit my site . Thanks =)

Wonderful article! We are linking to this great content on our website. Keep up the good writing.

Everything is very open with a really clear clarification of the challenges. It was truly informative. Your site is very helpful. Thank you for sharing.

I think that is among the such a lot vital information for me. And i’m glad reading your article. But should statement on few common things, The website style is great, the articles is really nice : D. Just right job, cheers

I truly love your website.. Pleasant colors & theme. Did you make this amazing site yourself? Please reply back as I’m wanting to create my own blog and would love to know where you got this from or just what the theme is called. Appreciate it.

A motivating discussion is definitely worth comment. I do think that you need to write more on this issue, it may not be a taboo matter but usually people don’t discuss such subjects. To the next! Kind regards!

Online courses, interactive simulations, and virtual classrooms have broken down geographical barriers, providing learners with diverse resources and fostering a global learning community.

Way cool! Some extremely valid points! I appreciate you penning this article and the rest of the website is very good.

I blog frequently and I really appreciate your information. The article has really peaked my interest. I’m going to book mark your site and keep checking for new information about once per week. I subscribed to your Feed as well.

Right here is the right webpage for anyone who wishes to understand this topic. You realize a whole lot its almost hard to argue with you (not that I actually will need to…HaHa). You definitely put a fresh spin on a topic that’s been discussed for decades. Wonderful stuff, just wonderful.

In this grand scheme of things you receive a B- for effort. Where you confused me ended up being on your particulars. You know, people say, details make or break the argument.. And that couldn’t be much more correct at this point. Having said that, let me tell you what exactly did deliver the results. Your authoring is actually extremely engaging and this is possibly why I am taking the effort to comment. I do not really make it a regular habit of doing that. 2nd, whilst I can notice a jumps in reasoning you come up with, I am not really certain of exactly how you seem to connect your details which in turn make the actual conclusion. For now I will, no doubt yield to your position however trust in the near future you actually connect the dots much better.

brew

Neat blog! Is your theme custom made or did you download it from somewhere? A theme like yours with a few simple adjustements would really make my blog jump out. Please let me know where you got your theme. Bless you

I blog often and I really thank you for your information. This article has really peaked my interest. I am going to take a note of your website and keep checking for new details about once per week. I subscribed to your RSS feed too.

Virtually all of what you point out is supprisingly appropriate and it makes me wonder why I had not looked at this with this light previously. This piece really did switch the light on for me as far as this particular subject goes. However there is 1 issue I am not too comfy with so whilst I make an effort to reconcile that with the actual main theme of your position, permit me see what all the rest of the visitors have to point out.Nicely done.

I’m extremely pleased to discover this site. I wanted to thank you for your time for this wonderful read!! I definitely loved every little bit of it and I have you book marked to check out new information in your blog.

It’s hard to come by educated people about this subject, but you sound like you know what you’re talking about! Thanks

I am very happy to read this. This is the type of manual that needs to be given and not the random misinformation that is at the other blogs. Appreciate your sharing this best doc.

I’ve learned a few important things by means of your post. I would also like to express that there is a situation where you will have a loan and do not need a co-signer such as a National Student Aid Loan. In case you are getting a loan through a classic banker then you need to be willing to have a co-signer ready to enable you to. The lenders will probably base that decision over a few issues but the most important will be your credit standing. There are some loan providers that will additionally look at your work history and decide based on this but in many instances it will be based on on your score.

You have made some decent points there. I checked on the net to learn more about the issue and found most people will go along with your views on this website.

A motivating discussion is definitely worth comment. I believe that you should publish more about this issue, it may not be a taboo subject but usually folks don’t discuss such topics. To the next! Many thanks.

Hello there, simply turned into aware of your blog thru Google, and located that it is truly informative. I?m gonna watch out for brussels. I will be grateful should you proceed this in future. Lots of people will probably be benefited out of your writing. Cheers!

The information shared is of top quality which has to get appreciated at all levels. Well done…

Having read this I believed it was extremely informative. I appreciate you finding the time and effort to put this information together. I once again find myself personally spending a significant amount of time both reading and posting comments. But so what, it was still worth it!

Hi there, just became aware of your weblog through Google, and located that it’s really informative. I am going to watch out for brussels. I?ll be grateful for those who continue this in future. A lot of people might be benefited out of your writing. Cheers!

Another thing is that while searching for a good on the internet electronics shop, look for web shops that are frequently updated, retaining up-to-date with the most up-to-date products, the most effective deals, in addition to helpful information on products. This will ensure you are getting through a shop which stays ahead of the competition and offers you what you need to make educated, well-informed electronics expenditures. Thanks for the important tips I have learned through the blog.

An intriguing discussion is definitely worth comment. I do think that you should publish more about this subject, it might not be a taboo subject but typically people don’t talk about such subjects. To the next! Cheers.

Pretty! This has been a really wonderful article. Thanks for supplying these details.

A great post without any doubt.

Thank you so much for sharing this wonderful post with us.

Thanks for the concepts you have contributed here. On top of that, I believe there are a few factors that really keep your car insurance policy premium down. One is, to bear in mind buying automobiles that are inside good listing of car insurance firms. Cars which are expensive tend to be more at risk of being stolen. Aside from that insurance coverage is also based on the value of the car, so the costlier it is, then the higher this premium you only pay.

Good web site you have got here.. It’s hard to find high-quality writing like yours these days. I seriously appreciate people like you! Take care!!

The very next time I read a blog, I hope that it won’t disappoint me just as much as this one. I mean, Yes, it was my choice to read, nonetheless I actually thought you would probably have something interesting to say. All I hear is a bunch of complaining about something that you could fix if you weren’t too busy seeking attention.

Everyone loves it whenever people come together and share thoughts. Great site, continue the good work.

One more thing. It’s my opinion that there are a lot of travel insurance web sites of respected companies that allow you to enter a trip details and acquire you the quotations. You can also purchase an international holiday insurance policy online by using your credit card. Everything you should do is to enter your own travel details and you can see the plans side-by-side. Merely find the package that suits your allowance and needs after which it use your credit card to buy that. Travel insurance on the web is a good way to check for a reliable company with regard to international travel insurance. Thanks for revealing your ideas.

A great post without any doubt.

This page definitely has all the info I wanted concerning this subject and didn’t know who to ask.

I really like reading a post that can make men and women think. Also, many thanks for allowing for me to comment.

Hi there, You’ve done an incredible job. I will definitely digg it and personally recommend to my friends. I’m sure they’ll be benefited from this website.

My brother suggested I may like this blog. He used to be entirely right. This put up actually made my day. You can not believe just how much time I had spent for this information! Thank you!

This is the right site for anybody who hopes to understand this topic. You realize a whole lot its almost hard to argue with you (not that I actually would want to…HaHa). You definitely put a fresh spin on a topic which has been written about for ages. Wonderful stuff, just great.

An added important aspect is that if you are a senior, travel insurance pertaining to pensioners is something you should make sure you really look at. The older you are, a lot more at risk you happen to be for making something negative happen to you while in foreign countries. If you are certainly not covered by many comprehensive insurance cover, you could have many serious difficulties. Thanks for discussing your ideas on this weblog.

Valuable information. Fortunate me I discovered your site unintentionally, and I’m surprised why this accident didn’t happened earlier! I bookmarked it.

Good day! Do you know if they make any plugins to safeguard against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any tips?

One more thing. I really believe that there are a lot of travel insurance web pages of trustworthy companies than enable you to enter a trip details and get you the prices. You can also purchase the international holiday insurance policy online by using your own credit card. All you need to do would be to enter your travel particulars and you can begin to see the plans side-by-side. Simply find the program that suits your allowance and needs and use your credit card to buy the idea. Travel insurance on the internet is a good way to begin looking for a reputable company pertaining to international travel cover. Thanks for sharing your ideas.

I have learn some just right stuff here. Certainly price bookmarking for revisiting. I surprise how so much effort you set to create one of these magnificent informative site.

This is a topic which is close to my heart… Best wishes! Exactly where are your contact details though?

Thanks for the tips on credit repair on this excellent web-site. What I would advice people will be to give up a mentality that they may buy now and pay out later. Like a society most of us tend to do this for many issues. This includes family vacations, furniture, and items we wish. However, you need to separate your own wants from the needs. As long as you’re working to fix your credit score you have to make some sacrifices. For example you can shop online to economize or you can look at second hand stores instead of costly department stores pertaining to clothing.

Hello very cool blog!! Guy .. Beautiful .. Amazing .. I will bookmark your website and take the feeds additionally?I am glad to find so many useful info here in the submit, we’d like develop more techniques on this regard, thank you for sharing. . . . . .

Almanya medyum haluk hoca sizlere 40 yıldır medyumluk hizmeti veriyor, Medyum haluk hocamızın hazırladığı çalışmalar ise berlin medyum papaz büyüsü, Konularında en iyi sonuç ve kısa sürede yüzde yüz için bizleri tercih ediniz. İletişim: +49 157 59456087

An added important component is that if you are an older person, travel insurance with regard to pensioners is something you need to really think about. The older you are, the more at risk you might be for allowing something bad happen to you while in most foreign countries. If you are never covered by some comprehensive insurance policies, you could have quite a few serious troubles. Thanks for revealing your suggestions on this web blog.

Thank you for sharing indeed great looking !

There’s definately a lot to find out about this subject. I love all of the points you’ve made.

Thanks a ton for your post. I’d prefer to say that the tariff of car insurance differs a lot from one coverage to another, due to the fact there are so many different issues which play a role in the overall cost. Such as, the model and make of the automobile will have a tremendous bearing on the purchase price. A reliable ancient family motor vehicle will have a lower priced premium than a flashy expensive car.

Hi there, just became alert to your blog through Google, and found that it’s really informative. I am gonna watch out for brussels. I’ll be grateful if you continue this in future. Lots of people will be benefited from your writing. Cheers!

This web page can be a stroll-by way of for all of the data you wished about this and didn’t know who to ask. Glimpse right here, and also you’ll positively discover it.

Thank you for sharing indeed great looking !

Thanks for these guidelines. One thing I additionally believe is that credit cards featuring a 0 rate often appeal to consumers together with zero monthly interest, instant endorsement and easy online balance transfers, however beware of the main factor that will probably void your current 0 easy road annual percentage rate and throw anybody out into the very poor house rapidly.

You should be a part of a contest for one of the finest blogs on the internet. I most certainly will recommend this blog!

Hi, I do think this is a great web site. I stumbledupon it 😉 I am going to return once again since i have bookmarked it. Money and freedom is the best way to change, may you be rich and continue to guide others.

I just like the helpful information you provide for your articles. I will bookmark your blog and take a look at again here frequently. I’m relatively sure I will be told plenty of new stuff proper right here! Best of luck for the following!

Hey There. I found your blog using msn. This is an extremely well written article. I?ll make sure to bookmark it and return to read more of your useful info. Thanks for the post. I will certainly return.

Shbet is a leading reputable bookmaker in the field of online games, with quick deposit and withdrawal services and great incentives.

Shbet is a leading reputable bookmaker in the field of online games, with quick deposit and withdrawal services and great incentives.

Your style is so unique compared to other people I have read stuff from. I appreciate you for posting when you’ve got the opportunity, Guess I’ll just bookmark this page.

After I initially left a comment I seem to have clicked on the -Notify me when new comments are added- checkbox and from now on whenever a comment is added I get 4 emails with the same comment. Is there an easy method you can remove me from that service? Many thanks.

Everything is very open with a clear clarification of the issues. It was truly informative. Your website is very helpful. Thank you for sharing!

That is a great tip particularly to those new to the blogosphere. Simple but very accurate info… Many thanks for sharing this one. A must read post.

Hello There. I found your blog using msn. This is a very well written article. I will be sure to bookmark it and return to read more of your useful information. Thanks for the post. I will certainly comeback.

What i don’t realize is in reality how you’re no longer actually a lot more smartly-appreciated than you might be right now. You are so intelligent. You realize therefore significantly relating to this matter, made me for my part consider it from a lot of varied angles. Its like men and women aren’t interested except it is something to accomplish with Lady gaga! Your own stuffs excellent. Always take care of it up!

Valuable info. Lucky me I found your web site by accident, and I am shocked why this accident did not happened earlier! I bookmarked it.

Great work! This is the type of information that should be shared around the net. Shame on the search engines for not positioning this post higher! Come on over and visit my web site . Thanks =)

Thanks for the helpful posting. It is also my belief that mesothelioma cancer has an extremely long latency phase, which means that signs of the disease won’t emerge till 30 to 50 years after the 1st exposure to asbestos. Pleural mesothelioma, which is the most common style and has effects on the area within the lungs, will cause shortness of breath, chest pains, and also a persistent coughing, which may result in coughing up bloodstream.

Just wish to say your article is as astounding. The clearness for your post is simply great and i could assume you are an expert in this subject. Fine along with your permission allow me to grab your RSS feed to keep up to date with coming near near post. Thanks one million and please continue the gratifying work.

I was able to find good info from your articles.

Appreciating the time and energy you put into your blog and in depth information you offer. It’s good to come across a blog every once in a while that isn’t the same out of date rehashed material. Fantastic read! I’ve saved your site and I’m adding your RSS feeds to my Google account.

Hi, I do think this is an excellent website. I stumbledupon it 😉 I will return once again since I bookmarked it. Money and freedom is the greatest way to change, may you be rich and continue to help other people.

Howdy just wanted to give you a quick heads up. The words in your content seem to be running off the screen in Internet explorer. I’m not sure if this is a formatting issue or something to do with browser compatibility but I figured I’d post to let you know. The design look great though! Hope you get the problem fixed soon. Many thanks

My brother suggested I might like this web site. He was totally right. This post truly made my day. You cann’t imagine simply how much time I had spent for this info! Thanks!

I couldn’t refrain from commenting. Exceptionally well written.

This site was… how do I say it? Relevant!! Finally I have found something that helped me. Many thanks.

Güvenilir bir danışman için medyum nasip hocayı seçin en iyi medyum hocalardan bir tanesidir.

I could not refrain from commenting. Perfectly written!

Excellent post. I certainly appreciate this site. Keep writing!

Pretty! This was an incredibly wonderful post. Thank you for supplying this info.

After I initially left a comment I appear to have clicked on the -Notify me when new comments are added- checkbox and now each time a comment is added I recieve four emails with the exact same comment. Is there a means you are able to remove me from that service? Many thanks.

After I initially commented I seem to have clicked on the -Notify me when new comments are added- checkbox and from now on every time a comment is added I recieve four emails with the exact same comment. There has to be a way you are able to remove me from that service? Thank you.

I have been absent for some time, but now I remember why I used to love this website. Thanks, I will try and check back more frequently. How frequently you update your web site?

Thanks a bunch for sharing this with all of us you really know what you’re talking about! Bookmarked. Please also visit my web site =). We could have a link exchange arrangement between us!

hi!,I like your writing very so much! share we be in contact extra approximately your post on AOL? I need an expert in this area to solve my problem. May be that is you! Taking a look forward to look you.

I am often to running a blog and i actually appreciate your content. The article has really peaks my interest. I am going to bookmark your web site and maintain checking for brand new information.

Thanks for every other fantastic article. The place else may anybody get that kind of information in such a perfect method of writing? I’ve a presentation subsequent week, and I am on the look for such information.

I blog often and I seriously appreciate your information. Your article has truly peaked my interest. I will take a note of your blog and keep checking for new information about once a week. I opted in for your RSS feed as well.

I have not checked in here for a while because I thought it was getting boring, but the last several posts are good quality so I guess I?ll add you back to my daily bloglist. You deserve it my friend 🙂

Hello there, I discovered your website by means of Google whilst searching for a related topic, your website got here up, it seems to be good. I’ve bookmarked it in my google bookmarks.

Güvenilir bir danışman için medyum nasip hocayı seçin en iyi medyum hocalardan bir tanesidir.

This excellent website really has all the information I wanted about this subject and didn’t know who to ask.

I must thank you for the efforts you’ve put in penning this website. I’m hoping to see the same high-grade content from you in the future as well. In truth, your creative writing abilities has inspired me to get my own blog now 😉

I could not resist commenting. Perfectly written.

Güvenilir bir danışman için medyum nasip hocayı seçin en iyi medyum hocalardan bir tanesidir.

I’m impressed by the quality of this content! The author has clearly put a great amount of effort into investigating and arranging the information. It’s exciting to come across an article that not only offers helpful information but also keeps the readers captivated from start to finish. Hats off to him for creating such a remarkable piece!

Can I just say what a comfort to discover an individual who truly knows what they are discussing over the internet. You certainly know how to bring an issue to light and make it important. A lot more people really need to check this out and understand this side of the story. I can’t believe you are not more popular because you certainly have the gift.

As I web site possessor I believe the content material here is rattling wonderful , appreciate it for your efforts. You should keep it up forever! Good Luck.

I have learned a number of important things via your post. I would also like to say that there can be situation in which you will have a loan and do not need a co-signer such as a Fed Student Support Loan. However, if you are getting a loan through a common loan service then you need to be willing to have a co-signer ready to make it easier for you. The lenders will probably base their own decision using a few components but the greatest will be your credit standing. There are some loan merchants that will additionally look at your job history and make up your mind based on that but in most cases it will hinge on your ranking.

Güvenilir bir danışman için medyum haluk hocayı seçin en iyi medyum hocalardan bir tanesidir.

After looking at a few of the articles on your site, I really like your way of writing a blog. I added it to my bookmark website list and will be checking back soon. Please visit my web site too and let me know how you feel.

Güvenilir bir danışman için medyum haluk hocayı seçin en iyi medyum hocalardan bir tanesidir.

Thank you, I have just been looking for information about this subject for ages and yours is the best I have discovered so far. But, what about the conclusion? Are you sure about the source?

I believe one of your advertisements triggered my internet browser to resize, you might want to put that on your blacklist.

I?ll right away clutch your rss as I can’t find your e-mail subscription link or e-newsletter service. Do you have any? Please let me know in order that I could subscribe. Thanks.

You actually make it seem so easy with your presentation but I find this topic to be really something that I think I would never understand. It seems too complicated and very broad for me. I’m looking forward for your next post, I?ll try to get the hang of it!

you will have a fantastic blog here! would you like to make some invite posts on my blog?

I was able to find good info from your articles.