Best Forex Prop Firms for the Rest of 2023

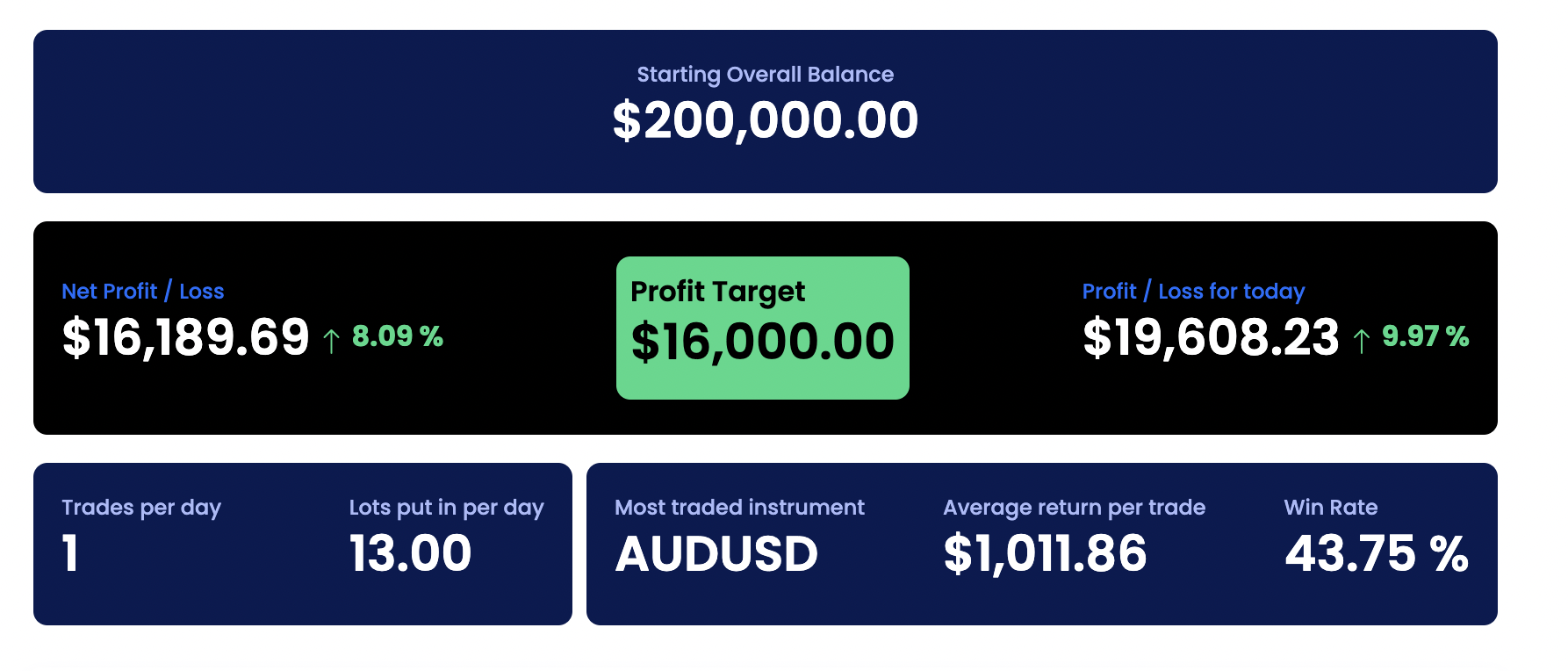

Last month, one of the biggest and most popular prop firms, MyForexFunds (MFF), was shut down by US regulatory agencies. [Above is a screenshot of the $200k challenge I passed, and have (sadly) lost through the shutdown.]

MFF is not the first firm to meet its demise due to regulatory or financial troubles. Other firms like The Prop Trading in Australia and Traders Central in Canada are examples of other short-lived prop trading enterprises that faced such difficulties (although The Prop Trading was able to survive its inquisition and launch its website again after a few months of shutdown).

More than ever before, it’s becoming increasingly important for prop firm traders in 2023 and beyond to do a thorough research of a prop firm before deciding to take a challenge.

And it’s not only important to research the rules of a challenge, whether it fits your trading style or not, and whether its rules are meant to prevent fair funding or not, but also whether the firm shows signs of being sustainable for the long-term.

When you’re looking for prop firms that are responsible with their business activity and have a likelihood of staying unaffected by regulatory or financial issues, consider choosing one that has these features:

- Publicly displays who the owners and operators are (as seen on an “About Us” page or similar featurette)

- Ensure that the owners and operators have experience in finance or with running a medium-to-large business. (A popular YouTube channel is not valid evidence of experience in finance)

- Ensure that the owners and operators are NOT in their young-20’s or at least have members on the team who are older and more experienced

- Ideally operates outside of the United States and Canada – these two countries tend to have more strict laws regarding the operation of small financial institutions

- Exhibits proof of payout

- Has a reputation of being a popular and reliable firm

The Best Prop Firms for 2023 and Beyond

Given these recommendations, I believe the following are some of the best prop firms you can choose from as 2023 comes to a close and 2024 begins:

Location: Czechoslovakia

FTMO is one of the most popular and long-standing prop trading firms around. This year, the firm removed its time limit requirements on its challenges and continues to offer one of the most reliable 2-phase challenge on the market.

As an example, here are the Key Features of its sole offering:

- Two Phase, Challenge Phase 10% target, Verification Phase 5% target

- 4 minimum trading days

- Daily loss up to 5%

- Total loss up to 10%

- Refundable fee with first payout

- Can scale account by 25% every 4 months if meet target

- Swing and regular accounts available

- Restrictions around trading during news and weekends, depending on account type

Location: UK

FTP is one of the most respected prop firms in the industry, with an experienced and reliable team that are available for email and chat whenever you need. They were the first firm to offer no-time-limit challenges and they continue to offer the best scaling program you can find. Their accounts are also appropriate for traders who wish to hold over weekends and news events.

[Use affiliate coupon code “DFX10” to receive 10% off of your challenge]

As an example, here is their Experienced Trader Program:

Its Key Features are:

- Single Phase, 10% target, no verification phase required

- Daily drawdown: 3%

- Maximum Relative Drawdown: 6%

- 10% Profit Target for scaling-up the funded account

- No stop-loss required

- Able to hold trades overnight and over weekend

- Additional $12.5k option

Now here is the Advanced Trader Program:

Key Features:

- Two-phase: Assessment #1 (10% target) and Assessment #2 (5% target)

- Daily Drawdown: 5%

- Maximum Relative Drawdown: 10%

- 20% Profit Target for scaling-up the funded account

- Stop-loss required for each trade

- Do not hold trades over weekend

Both programs cost the same for their individual account sizes. Both offer MT4/MT5 accounts, they each offer an 80/20 profit split, allow for maximum 1:30 account leverage, and allow EA bots.

Location: UK, Israel

The 5%ers have also been around for a considerable amount of time. They offer a multitude of challenge types and products, placing emphasis on rewarding traders for their long-term growth rather than the ability to scalp quick profits. They often offer low-cost small accounts that are meant to be scaled over time as the trader builds equity.

While the 5%ers offers many different challenges, here is an example of their Hyper-Growth program:

- $10,000 account for $260

- 10% evaluation target

- 6% stop-out level

- 3% daily pause level

- Unlimited time

- Double your funded account on every target

As always, I highly encourage you to do your due diligence and review these prop firms, their products, their FAQs, their rules, and never fail to ask questions of the staff, no matter how trivial!

Prop Trading is not dead, it’s going through a shake-out process.

I believe it’s best to have accounts from multiple firms as to avoid losing all of one’s access to trading capital in case of shutdowns or bankruptcy. Use the above suggestions to make the best possible decisions.

Best of strength and luck with your trading!

Pingback: Funded Trading Plus Is No Longer a Prop Firm - Disciplined FX

Pingback: Top 3 Forex Trading Strategies and Courses for 2024 - Disciplined FX

Pingback: ABL Mobility Online Shop

Pingback: บริษัทรับทำเว็บไซต์

Pingback: Buy Beretta M9A1

Pingback: lucabet88

Pingback: https://stealthex.io

Pingback: ทำความรู้จัก ประวัติ Pragmatic Play

Pingback: โคมไฟ

Pingback: pg333

Pingback: Las Vegas SEO company

Pingback: หัวมาโบ

Pingback: ..

Pingback: cat888

Pingback: phuket diving

Pingback: jaxx download

Pingback: เน็ต AIS

Pingback: Slot Online ฝากถอนAUTO

Pingback: ทัวร์ธุรกิจจีน

Pingback: PHUKET VILLA

Pingback: pgslot

Pingback: Telegram中文版

Pingback: รับจัดงานศพ

Pingback: สล็อต888 วอเลท

Pingback: คลินิกเสริมความงาม

Pingback: โอลี่แฟน

Pingback: ฟรีสปินสล็อต คืออะไร?

Pingback: essentials fear of god

Pingback: สีกันไฟ

Pingback: เติมเกม

Pingback: 82 pg สล็อตไม่ผ่านเอเย่น มีระบบเล่นฟรี

Pingback: pgslot168

Pingback: pin up скачать

Pingback: ipl betting sites

Pingback: aviator website