3 Ways To Get More Profit From Your Trades

I’ve been doing a bit of research lately on the different ways professional retail traders select profit targets.

One of the most frequently touted adages for staying profitable in trading is: “Let profits run!”

There will come a point in your trading when you will no longer want to just be profitable, but also get the most out of your trades. Looking for more trades or trying to be available for more sessions aren’t always feasible. One can lead to over-trading and the other is both mentally draining and time-consuming. Instead, another way to build up one’s returns is to seek to increase your risk-to-reward ratio.

However, like many easy-to-repeat phrases of advice in the trading world (among others like “buy the rumor, sell the fact” or “buy low, sell high”), it’s hard to apply this wisdom without considering the context of your strategy.

If you’re a scalper or you trade during the Asia session, “Let profits run!” can sometimes be poor advice. Or expectations for “Let profits run” could mean capturing 100 pips over a week versus 10 pips for a Tokyo scalp.

In order to make the most of your take-profit targets, you’ll need to think deeply about your trading style, your trading goals, and then find a take-profit approach that works best for you.

While there are many other ways to seek more pips out of the market, here are three unique methods that you can apply to your trading.

3 Ways to Get More Profit From Your Trades

1) Backtest Your Strategy To Determine Appropriate R:R

Who is this best for: Algorithmic traders, mechanical strategies, scalping strategies

While past performance does not guarantee future outcomes, often history repeats itself. Since market moves are motivated by human emotions, players in the markets tend to behave similarly over time.

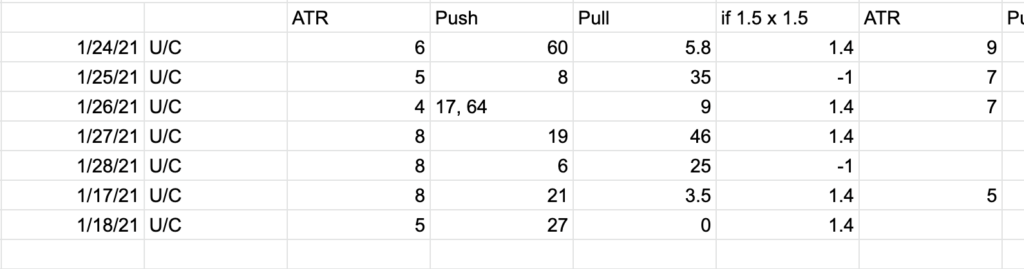

Especially if your strategy has clear-cut rules, you can readily backtest its performance and measure how far price tends to move before going against your trade. I like to do this with the mechanical strategies I use to trade. To compile data for this analysis, I’ll track the most pips moved towards and against my trade in a spreadsheet, as seen below.

Push implies the farthest distance the trade would go in my favor and the pull represents the movement that would go against the trade before turning towards profit again. “1.5 x 1.5” ended up being “1.5 ATR as a stop-loss and 1.4 multiplied by the stop loss for take profit.

Such data can be revealing. You can apply different risk-to-reward variables to see which results in the highest return over a period of time. Perhaps, even contrary to the advice to “Let profits run,” you may find that it pays to have a tighter take-profit target, with a R:R like 1:1 to 1:1.5. I find this to be particularly true for algorithmic trades or trades that occur on shorter time frames (5m, 1m, etc.), when trades are taken with any given setup, without higher time-frame analysis.

The more data, the better. Test it against different R:R possibilities, such as 1:2, 1:2.2, 1:4, or even 1:1.4. However, as with any backtesting activity, the results need to be taken with a grain of salt. Slippages, slow entry orders, and other small tweaks or mistakes can affect these outcomes. Therefore, I like to aim for a little less of a target than what my results tell me.

2) Using Multiple Targets: Using Both a Fixed and a Dynamic Profit Target

Who is this best for: Trend traders, price action traders

Many traders will split their take-profit targets over multiple different exits. This is probably one of the most widely used methods to let profits run while taking some profit along the way. While you want to get as much as you can out of a trade, the farther price moves, the increase in likelihood it will eventually turn around. Even with the best of analysis, picking tops and bottoms of trends can be excruciatingly difficult. Instead, it’s better to use an exit strategy that is malleable to a variety of outcomes.

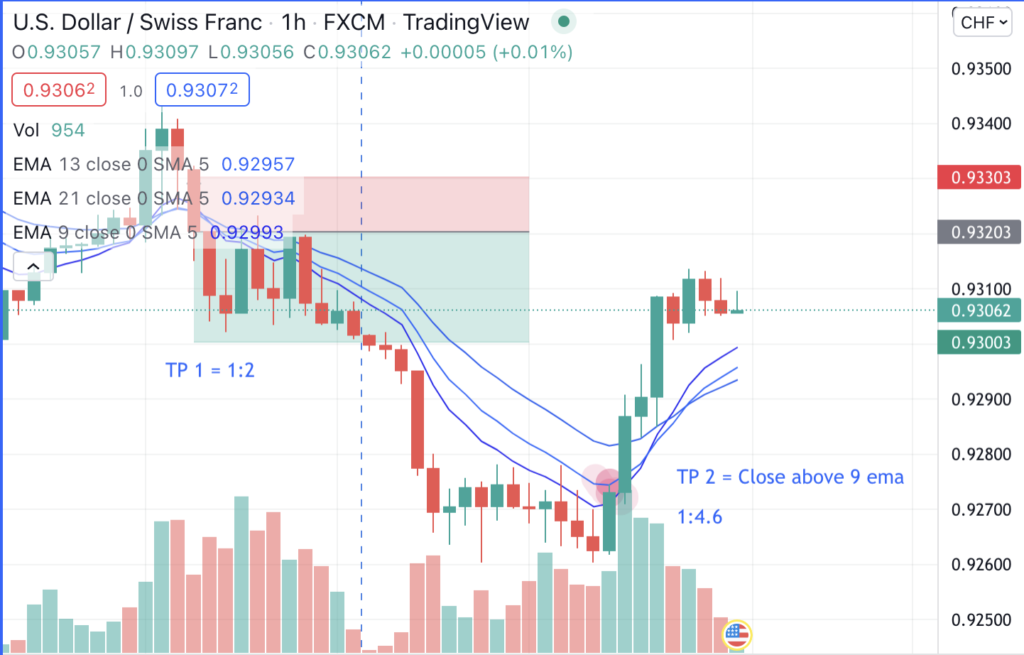

An example of using both a fixed and dynamic profit target can look like this:

Instead of one target, use two take-profit targets.

The first can be a hard risk-to-reward ratio, such as 1:2, where you are profiting twice as much as you risk. At this price point you can decide to exit half of your position.

The second take-profit target can be an indicator or price action pattern that signals a reversal. One example of this is to let price continue until it pulls back and crosses a 21-ema. Another example is to exit when you see a bearish/bullish pinbar going against you on a higher time frame, like the 4h if you took your trade on a 1H. You can research different ways to spot signs that a trend is about to end if you’re using this to get as much as you can out of a trend strategy.

3) Apply a Trailing Stop

Who is this best for: Trend Traders, day traders, swing traders

There are traders out there who only use trailing stops for a take-profit target, they won’t put a defined target on the chart, but instead let the market’s momentum decide where the appropriate profit lies. This approach can help with minimizing losses and drawdowns but sometimes at the cost of a higher return. The benefit in using this approach is that it’s agile and sets a target that more closely matches what the market is willing to give.

There are a few ways you can use trailing stops.

One way is to set it as an automatic stop-loss that follows the movement in ticks. If price goes down after a pre-defined level (such as with every 10 pips moved), the stop loss follows as well. This works better with wider stops, as often used in swing trading, and less volatile markets, as too close of a stop can take out a trade early.

Another way is to move your stop below the low/high of every 3 bars – this works best with trend trading.

Again, you can research trailing stops more deeply, as there are many methods out there.

Conclusion

No one exit strategy will work for all trading plans, time frames, or trading sessions. Backtesting, demo trading, and small positions can all be used to test the efficacy of a profit target as it relates to your strategy. Be sure to put the time and work in to experiment with your trading, as you’ll learn and build your skills by performing these exercises!

Wishing you the best of strength and luck in the markets!

Appreciating the dedication you put into your site

and detailed information you provide. It’s awesome to come across a blog every

once in a while that isn’t the same old rehashed material.

Great read! I’ve bookmarked your site and

I’m including your RSS feeds to my Google account.

Wonderful work! This is the kind of information that should be shared around the internet.

Shame on the search engines for not positioning this post higher!

Come on over and seek advice from my web site .

Thanks =)

Hello just wanted to give you a quick heads up. The words

in your article seem to be running off the screen in Chrome.

I’m not sure if this is a formatting issue or something to do

with internet browser compatibility but I figured I’d post to let you know.

The design and style look great though! Hope you get the issue resolved soon. Thanks

Heya i am for the first time here. I came across this board and I to find It really useful & it

helped me out a lot. I am hoping to offer one thing again and help others such as you helped

me.

First of all I want to say excellent blog! I had a quick question that I’d like to ask if you don’t mind.

I was interested to find out how you center yourself and

clear your mind before writing. I have had a hard time clearing my mind in getting

my thoughts out there. I truly do enjoy writing however

it just seems like the first 10 to 15 minutes are usually lost just trying to figure out how

to begin. Any suggestions or tips? Kudos!

Good post. I learn something new and challenging on blogs I stumbleupon every day.

It’s always exciting to read through content from other authors and practice something

from their websites.

Aw, this was an exceptionally good post. Finding the time and actual effort to generate a very good article… but what can I say… I procrastinate a

lot and never manage to get nearly anything done.

Very good blog! Do you have any tips for aspiring writers?

I’m planning to start my own blog soon but I’m a little lost on everything.

Would you suggest starting with a free platform like WordPress or go for

a paid option? There are so many options out there that

I’m totally confused .. Any tips? Cheers!

obviously like your website but you need to check the spelling on several

of your posts. Many of them are rife with spelling problems and I find it very

bothersome to inform the truth then again I will definitely come again again.

What’s up friends, how is all, and what you would like to

say concerning this post, in my view its truly amazing

in support of me.

I pay a visit daily a few web pages and blogs to read content,

but this webpage gives quality based posts.

Great work! That is the kind of info that are supposed to be shared

around the web. Shame on Google for now not positioning this submit higher!

Come on over and seek advice from my web site .

Thanks =)

What’s up every one, here every one is sharing

such familiarity, so it’s fastidious to read this blog, and I used to pay a visit this webpage everyday.

I was recommended this web site by my cousin. I’m not

sure whether this post is written by him as nobody else know

such detailed about my difficulty. You are wonderful!

Thanks!

Thank you for the good writeup. It in fact used to be a leisure account it.

Look advanced to more delivered agreeable from

you! However, how could we be in contact?

After I initially left a comment I seem to have clicked the -Notify me

when new comments are added- checkbox and now each time a comment

is added I recieve four emails with the same

comment. Perhaps there is a means you can remove me from that

service? Many thanks!

I quite like reading an article that can make men and women think.

Also, many thanks for allowing me to comment!

Hello! This post couldn’t be written any better! Reading this post reminds me of my

good old room mate! He always kept chatting about this.

I will forward this article to him. Fairly certain he will have a good read.

Many thanks for sharing!

Hello! I just wanted to ask if you ever have any

trouble with hackers? My last blog (wordpress) was hacked and I ended up losing

several weeks of hard work due to no data backup.

Do you have any methods to prevent hackers?

Hello Dear, are you actually visiting this web site regularly,

if so then you will without doubt get pleasant experience.

Its like you read my mind! You seem to know so

much about this, like you wrote the book in it or something.

I think that you can do with a few pics to drive the message home a bit, but instead

of that, this is wonderful blog. An excellent read. I’ll certainly

be back.

Heya i’m for the first time here. I found this board

and I find It really useful & it helped me out much.

I am hoping to offer something again and aid others like you aided

me.

Definitely believe that that you stated. Your favorite justification appeared to be on the net the easiest thing to consider of.

I say to you, I certainly get irked at the same time as other

folks consider issues that they just do not understand about.

You managed to hit the nail upon the highest and also outlined out the entire

thing with no need side effect , other folks can take a signal.

Will likely be back to get more. Thank you

It’s impressive that you are getting thoughts from this post

as well as from our discussion made at this place.

I couldn’t refrain from commenting. Perfectly written!

You should take part in a contest for one of the finest blogs on the net.

I’m going to highly recommend this site!

Asking questions are truly nice thing if you are not understanding something totally, however this article offers

pleasant understanding even.

You have made some decent points there. I checked on the net to find out more about the issue and

found most individuals will go along with your views on this website.

Hello! Do you use Twitter? I’d like to follow you if that would be okay.

I’m definitely enjoying your blog and look forward to

new posts.

I have been surfing online more than three hours today, yet I never found any

interesting article like yours. It’s pretty worth enough

for me. In my opinion, if all site owners and bloggers made good content as you did,

the internet will be a lot more useful than ever before.

I go to see day-to-day some web sites and websites to read

articles, however this website presents quality based posts.

When some one searches for his essential thing, thus he/she wishes to be available that in detail, so that thing is maintained over here.

It is in point of fact a nice and useful piece of information. I am happy that you

just shared this helpful info with us. Please stay

us up to date like this. Thanks for sharing.

Hi there i am kavin, its my first occasion to commenting anywhere, when i read

this article i thought i could also create comment

due to this brilliant post.

I like it when folks come together and share opinions. Great site, stick

with it!

Wow, awesome weblog format! How lengthy have you been running a blog for?

you make running a blog glance easy. The entire glance of

your web site is great, as neatly as the content!

This paragraph is really a pleasant one it helps new net visitors, who are wishing for blogging.

Hey I am so grateful I found your site, I really found

you by mistake, while I was looking on Google for something else,

Anyhow I am here now and would just like to say cheers

for a remarkable post and a all round interesting blog (I also love the theme/design), I don’t have time to look over it all

at the minute but I have saved it and also added your RSS feeds,

so when I have time I will be back to read a great deal more, Please do keep up the awesome job.

Hello to every one, the contents present at this web site are really amazing for people knowledge, well,

keep up the nice work fellows.

I am regular reader, how are you everybody? This paragraph posted at this site is in fact

nice.

Do you mind if I quote a few of your posts as long as I provide credit

and sources back to your weblog? My blog site is in the exact same niche

as yours and my users would really benefit from some of the information you provide here.

Please let me know if this alright with you. Many thanks!

I think this is among the most vital information for me.

And i am glad reading your article. But should remark on some general things, The website

style is wonderful, the articles is really nice : D.

Good job, cheers

I believe this is one of the so much important information for me.

And i’m glad reading your article. But should statement on few basic issues, The

website style is perfect, the articles is really excellent :

D. Good process, cheers

I blog frequently and I truly appreciate your information. The article has really peaked my

interest. I will book mark your website and keep checking

for new details about once a week. I subscribed

to your RSS feed too.

This is the right blog for everyone who would like to find out about this topic.

You know a whole lot its almost tough to argue with you (not that I personally would want to…HaHa).

You certainly put a fresh spin on a topic which has been written about for ages.

Wonderful stuff, just great!

That is a good tip especially to those new to the

blogosphere. Simple but very accurate information… Thanks for sharing this one.

A must read post!

I like reading a post that will make men and women think.

Also, thanks for allowing for me to comment!

This excellent website really has all of the info I needed about this subject

and didn’t know who to ask.

I am regular reader, how are you everybody? This paragraph posted at this web page is really pleasant.

I want to to thank you for this very good read!!

I absolutely enjoyed every bit of it. I’ve got you bookmarked

to check out new things you post…

Hi there, just wanted to say, I loved this article.

It was helpful. Keep on posting!

Hurrah! At last I got a webpage from where I know how to in fact

take valuable facts concerning my study and knowledge.

You need to take part in a contest for one of the best sites on the web.

I will recommend this blog!

I’m curious to find out what blog system you happen to be using?

I’m experiencing some small security problems with my latest blog

and I would like to find something more safeguarded. Do you have any suggestions?

Yesterday, while I was at work, my sister stole my iPad and tested to see if it can survive a 40 foot drop, just so

she can be a youtube sensation. My iPad is now broken and she has 83 views.

I know this is entirely off topic but I had to share it with someone!

Do you have a spam problem on this blog; I also am a blogger, and I was wanting to know

your situation; we have developed some nice methods and we are looking to swap techniques with

other folks, why not shoot me an email if interested.

It’s an awesome article for all the online people; they will obtain advantage from

it I am sure.

Fastidious response in return of this difficulty with solid arguments and explaining all concerning that.

Admiring the dedication you put into your website and in depth information you offer.

It’s good to come across a blog every once in a

while that isn’t the same outdated rehashed information. Excellent read!

I’ve saved your site and I’m including your RSS feeds to my Google account.

I’m not that much of a online reader to be honest but your blogs

really nice, keep it up! I’ll go ahead and bookmark your site

to come back later on. All the best

Good article. I will be dealing with many of

these issues as well..

It’s hard to come by knowledgeable people for this subject, however, you seem like

you know what you’re talking about! Thanks

I enjoy, lead to I discovered just what I was having a look for.

You’ve ended my four day long hunt! God Bless you man. Have a great day.

Bye

I am sure this article has touched all the internet visitors,

its really really nice piece of writing on building up new weblog.

Pretty section of content. I just stumbled upon your

site and in accession capital to assert that I get actually enjoyed account your

blog posts. Anyway I’ll be subscribing to your augment and

even I achievement you access consistently fast.

Fastidious answer back in return of this issue with real arguments and telling

the whole thing regarding that.

Hey there this is kinda of off topic but I was wondering if blogs use WYSIWYG editors or if

you have to manually code with HTML. I’m starting a blog soon but have no coding skills so I wanted to get advice from someone with experience.

Any help would be greatly appreciated!

For the reason that the admin of this web site is working, no uncertainty very shortly it will be well-known, due to

its feature contents.

What’s up, after reading this awesome piece of writing

i am also glad to share my experience here with mates.

I simply could not leave your site prior to suggesting that

I extremely loved the usual info an individual supply for your

visitors? Is gonna be again regularly to inspect new posts

Thankfulness to my father who stated to me about this webpage, this webpage

is actually amazing.

My brother recommended I would possibly like this blog.

He used to be entirely right. This put up actually made my

day. You can not imagine just how much time I had spent for this information! Thanks!

Please let me know if you’re looking for a writer for your site.

You have some really good articles and I think I would be

a good asset. If you ever want to take some of the load off,

I’d absolutely love to write some articles for your blog in exchange for a link back to mine.

Please blast me an e-mail if interested. Thanks!

I like the helpful information you provide in your articles.

I will bookmark your blog and check again here regularly.

I’m quite sure I will learn many new stuff right here!

Good luck for the next!

Nice post. I was checking continuously this blog and I’m impressed!

Very useful info particularly the last part 🙂 I care

for such info a lot. I was seeking this particular info for a

long time. Thank you and good luck.

Hi there, its nice article about media print, we all know

media is a great source of information.

Awesome! Its truly amazing post, I have got much clear idea on the topic of from this piece of writing.

Fastidious replies in return of this matter with genuine arguments and describing all

regarding that.

Woah! I’m really loving the template/theme of this blog.

It’s simple, yet effective. A lot of times it’s hard to get that “perfect balance” between user friendliness

and visual appeal. I must say you have done a very good job with this.

Additionally, the blog loads very quick for me on Internet explorer.

Excellent Blog!

Thanks , I have just been looking for information approximately this topic for ages and yours

is the greatest I’ve came upon till now. But,

what about the bottom line? Are you positive in regards to the supply?

Keep on working, great job!

I believe that is one of the most vital information for me.

And i am satisfied studying your article. However should commentary

on some common issues, The website style is great, the articles is truly nice :

D. Just right job, cheers

Ahaa, its good conversation regarding this paragraph at this place at this

weblog, I have read all that, so now me also commenting at this place.

I was wondering if you ever thought of changing the layout of your site?

Its very well written; I love what youve got to say. But

maybe you could a little more in the way of content so people could connect

with it better. Youve got an awful lot of text for only having one or 2 pictures.

Maybe you could space it out better?

Somebody essentially lend a hand to make seriously posts I would state.

This is the very first time I frequented your website page and

up to now? I amazed with the analysis you made to make this actual post

extraordinary. Magnificent process!

Valuable info. Fortunate me I discovered your web site by accident, and I

am shocked why this coincidence didn’t came about in advance!

I bookmarked it.

I simply couldn’t leave your website before suggesting that I actually enjoyed the standard information a person supply in your guests?

Is gonna be again often to check up on new posts

As the admin of this website is working, no hesitation very shortly it will be well-known, due to its quality contents.

Why users still make use of to read news papers when in this

technological world all is available on net?

Pretty component of content. I simply stumbled upon your website

and in accession capital to assert that I acquire actually

loved account your weblog posts. Any way I’ll be subscribing

on your augment or even I fulfillment you get right of entry

to persistently fast.

Hi, i feel that i noticed you visited my weblog so i came to return the favor?.I am attempting to

in finding things to improve my site!I guess its adequate to make use of a few of

your ideas!!

Very soon this web page will be famous amid all blog people, due to it’s good posts

What’s up, its good paragraph concerning media

print, we all know media is a fantastic source of data.

Generally I don’t learn post on blogs, but I would like

to say that this write-up very forced me to take a look at and do so!

Your writing taste has been surprised me. Thank you, very great article.

Incredible points. Sound arguments. Keep up the good work.

Is noce to have this kind of sites that are extincted nowdays

Have a peek here

I enjoy what you guys tend to be up too. This type of clever work and exposure!

Keep up the good works guys I’ve included you guys to my blogroll.

Hi there, yes this paragraph is in fact fastidious and

I have learned lot of things from it concerning blogging.

thanks.

Link exchange is nothing else however it is just placing the other person’s webpage link on your page at proper place and other person will also do similar for you.

Hey There. I found your blog using msn. This is a very well

written article. I’ll be sure to bookmark it and come

back to read more of your useful info. Thanks for the post.

I’ll certainly return.

Greetings from Los angeles! I’m bored at work so I decided to browse your site on my iphone during lunch break.

I love the info you provide here and can’t wait to take a look when I get home.

I’m shocked at how quick your blog loaded on my cell phone ..

I’m not even using WIFI, just 3G .. Anyways, great site!

I’m excited to uncover this site. I need to to thank you for ones time for this fantastic read!!

I definitely enjoyed every little bit of it and I have you saved

to fav to see new information on your web site.

It’s remarkable designed for me to have a site, which is valuable in support of my know-how.

thanks admin

Hello colleagues, fastidious article and pleasant urging commented here, I am actually

enjoying by these.

Hi there would you mind letting me know which webhost you’re using?

I’ve loaded your blog in 3 completely different web browsers and

I must say this blog loads a lot quicker then most.

Can you suggest a good hosting provider at a

honest price? Thanks, I appreciate it!

Hello colleagues, its impressive paragraph about cultureand entirely defined, keep it up all

the time.

Ridiculous quest there. What happened after? Thanks!

Hello! This is kind of off topic but I need some guidance from an established blog.

Is it difficult to set up your own blog? I’m not very techincal but I can figure things out pretty fast.

I’m thinking about creating my own but I’m not sure where to begin. Do you have any points or suggestions?

Thanks

Great Click here!

It’s an awesome post in support of all the online users; they will get benefit from it I am sure.

If you want to get a great deal from this post then you have

to apply these strategies to your won web site.

Howdy! I could have sworn I’ve been to this site before but after reading through some of the post I realized it’s new to me.

Nonetheless, I’m definitely glad I found it and I’ll be bookmarking

and checking back often!

I’m not that much of a internet reader to be honest but your sites really nice, keep it up!

I’ll go ahead and bookmark your website to come back later on. Cheers

No matter if some one searches for his necessary

thing, so he/she wants to be available that in detail, thus that thing is maintained over here.

If some one desires to be updated with most up-to-date technologies therefore he must be pay a quick visit this web

site and be up to date everyday.

Great article! This is the type of info that are meant to be shared around the internet.

Shame on the search engines for no longer positioning this post upper!

Come on over and talk over with my website .

Thank you =)

excellent publish, very informative. I wonder why the other experts of this sector do not understand

this. You should proceed your writing. I’m sure, you’ve a great readers’ base already!

Wonderful beat ! I would like to apprentice

while you amend your web site, how can i subscribe for a blog web site?

The account helped me a acceptable deal. I had been tiny bit acquainted of this

your broadcast provided bright clear idea

Great Click for more

I’m now not sure where you are getting your information, however

great topic. I needs to spend some time finding out more or understanding more.

Thanks for magnificent information I was looking for this information for my

mission.

Asking questions are in fact nice thing if you are not understanding anything fully, but

this piece of writing presents pleasant understanding even.

We are a group of volunteers and opening a new scheme in our community.

Your site provided us with valuable info to work on.

You have done an impressive job and our whole community will be thankful to you.

Awesome blog! Do you have any recommendations for aspiring

writers? I’m planning to start my own website soon but I’m a little lost on everything.

Would you propose starting with a free platform like WordPress or

go for a paid option? There are so many choices out there

that I’m completely overwhelmed .. Any ideas?

Cheers!

It’s a shame you don’t have a donate button! I’d certainly donate to this

fantastic blog! I guess for now i’ll settle for

book-marking and adding your RSS feed to my Google account.

I look forward to brand new updates and will talk about this website with my Facebook group.

Chat soon!

This is highly informative. Check out home renovation ideas for more

This was a great article. Check out Sugarplay for more

Appreciate the comprehensive insights. For more, visit seo autopilot neo

Hi there just wanted to give you a brief heads up and let you know a

few of the pictures aren’t loading correctly.

I’m not sure why but I think its a linking issue. I’ve tried it in two different web browsers

and both show the same results.

Душа (2020): Замечательный анимационный фильм о жизни и музыке https://telegra.ph/Novye-filmy-2023-spisok-luchshih-premer-goda-12-19

Avage AI: Transforme Sua Estratégia de Trading no Brasil

Avage AI é uma aplicação de trading avançada, projetada especialmente para o mercado brasileiro avageai-br.com

Hi there! This post couldn’t be written any better! Looking at

this post reminds me of my previous roommate! He always kept talking about this.

I’ll forward this post to him. Fairly certain he’s going to have a great read.

I appreciate you for sharing!

This was very beneficial. For more, visit what is cryptocurrency

¿Qué opinas del mejor concurso SEO: https://www.desdesoria.es/articulo/reportajes/entrega-premios-vocacion-digital-raiola-sera-15-julio/20240523232647797424.html ? ¿Estás particip

Hey There. I found your blog using msn. This is an extremely well written article.

I’ll make sure to bookmark it and return to read more of your useful info.

Thanks for the post. I’ll certainly return.

This was nicely structured. Discover more at home renovation Toronto

Nicely done! Discover more at Αισώπου Μύθοι εστειατόρια ψυρρή

Appreciate the comprehensive insights. For more, visit Have a peek at this website

Great insights! Discover more at home renovation in Toronto

This was highly informative. Check out traditional greek tavern athens for more

Thanks for the thorough analysis. More info at home renovation in Toronto

This was very enlightening. More at μεζεδοπωλεία ψυρρή Αισώπου Μύθοι

poor top quality general performance<br bad quality performance

Very nice site it would be nice if you check Have a peek at this website

Tại Tâm Beauty Clinic, chúng tôi xuất bản các nội dung đánh giá, bảng xếp hạng liên quan đến ngành làm đẹp, bao gồm các spa trị mụn, spa làm đẹp, spa dưỡng da,… Mỗi thương hiệu được đưa vào bảng xếp hạng đều trải qua quá trình sàng lọc kỹ lưỡng https://tambeautyclinic.vn

Thanks for the useful suggestions. Discover more at μεζεδοπωλεια ψυρρή Αισώπου Μύθοι

Thanks for the thorough analysis. More info at Baji Bagh

poor high-quality performance<br poor quality service

Thanks for the valuable insights. More at restaurants near me

I appreciated this article. For more, visit παραδοσιακη ελληνικη κουζινα ψυρρή

Excellent weblog right here! Also your web site a lot up

very fast! What host are you the usage of? Can I am getting your

affiliate hyperlink to your host? I want my web site

loaded up as fast as yours lol

negative quality material<br piss and vinegar

Well done! Discover more at https://nixanailsmo.com/

This was quite informative. For more, visit μεζεδοπωλεια στου ψυρρη

This was beautifully organized. Discover more at https://thenailstop.net/

lousy high-quality functionality<br poor quality

Very helpful read. For similar content, visit https://victoriannailsandspa.com/

Bu makaleyi beğendim. Daha fazla bilgi için santral servisi ‘a göz atın

Nicely done! Find more at traditional greek tavern athens Aesopou Fables

Your content reflects a genuine passion for promoting a balanced lifestyle, always encouraging readers to prioritize self-care and mental well-being Bennie

Your site has become my go-to for meal planning ideas that align with my healthy lifestyle goals Beni

Your budgeting advice has been a game-changer for me when it comes to managing my finances and living a more fulfilling lifestyle Bennie

Your blog posts on mental health have been incredibly helpful in navigating challenging times and prioritizing self-care within my lifestyle Beni

This was a great article. Check out Get more info for more

Your blog posts on mental health have been incredibly helpful in navigating challenging times and prioritizing self-care within my lifestyle Beni

Your site is an endless source of inspiration for incorporating sustainable fashion into one’s lifestyle, promoting conscious consumption Bennie

Your site is a treasure trove of inspiration for incorporating fitness into a busy lifestyle, proving that staying active is always possible Beniamin

Dont purchase just about anything from below f*** yeah

Wow! After all I got a weblog from where I can truly obtain useful facts

concerning my study and knowledge.

phoenix bail phoenix bail bonds

terrible excellent content<br poor quality

phoenix bail phoenix bail bonds

phoenix bail phoenix bail bonds

phoenix bail phoenix bail bonds

phoenix bail phoenix bail bonds

phoenix bail phoenix bail bonds

phoenix bail phoenix bail bonds

Yararlı tavsiyeler! Daha fazlası için https://www.karelsantralservisi.net/ adresini ziyaret edin

Jeśli szukasz tanich i wysokiej jakości produktów do swojego e-papieroska solo 2

ayrıntılı bilgiler takdir edin. Daha fazlası için https://www.karelsantralservisi.net/ adresini ziyaret edin

Dziękuję za świetne doświadczenie zakupów w sklepie https://hackerone.com/rostafwiyq29 ! Obsługa klienta była bardzo pomocna i zamówienie dotarło szybko i bez problemów

Dziękuję za szybką dostawę mojego zamówienia z https://list.ly/quinussedj ! Wspaniale jest mieć takiego partnera w zakupach vape online

This was very enlightening. More at hardwood flooring maintenance

Well explained. Discover more at laying hardwood planks

Estoy muy contento con el servicio de lavado en seco en Cartagena de limpieza de muebles . Siempre entregan puntualmente y mi ropa luce como nueva

Reliable mobile patrol security guard services like mobile patrol security guard service offer a proactive technique to securing your premises, guaranteeing day-and-night security versus possible hazards

Para un lavado en seco impecable en Cartagena, no puedo recomendar otro lugar que no sea https://escatter11.fullerton.edu/nfs/show_user.php?userid=6350887 . Siempre hacen un trabajo excepcional

Desde que descubrí el lavado en seco en Cartagena de https://www.spreaker.com/podcast/lavanderiaencartagenayxwy–6193888 , nunca más he tenido que preocuparme por la limpieza de mis prendas. Son los mejores

When it concerns safeguarding your residential or commercial property, compromising on security is never ever an option. Pick the trusted and expert mobile patrol security personnel service– mobile patrol security guard service — for unmatched protection

When it pertains to protecting your home, jeopardizing on security is never ever a choice. Choose the trusted and expert mobile patrol guard service– mobile patrol security guard service — for unmatched defense

Helpful suggestions! For more, visit best hardwood flooring

This was a fantastic resource. Check out MyPrepaidCenter redeem code for more

No podría estar más satisfecho con el servicio de lavado en seco en Cartagena que ofrece lavado en seco . Siempre superan mis expectativas

Nicely done! Find more at porn

Very helpful read. For similar content, visit Cwin Vietnam Company

Appreciate the insightful article. Find more at types of wood floors

No puedo expresar lo satisfecho que estoy con el servicio de lavado en seco en Cartagena de lavado en seco en Cartagena . Siempre superan mis expectativas

This was a great article. Check out hardwood flooring installation for more

Recomiendo encarecidamente limpieza de tapicerias en Cartagena para el lavado en seco en Cartagena. Su atención al cliente y resultados impecables los hacen sobresalir

This was a great article. Check out pron for more

Appreciate the great suggestions. For more, visit pron

Appreciate the thorough information. For more, visit Cwin Company

Estoy encantado con el servicio de lavado en seco en Cartagena que ofrece https://www.divephotoguide.com/user/oceansscartagenakxpf/ . Mi ropa siempre vuelve perfectamente limpia y sin arrugas

Wonderful beat ! I would like to apprentice at the same time as you amend your website, how can i subscribe for a blog site?

The account aided me a acceptable deal. I were a little bit

acquainted of this your broadcast provided brilliant clear concept

Well done! Discover more at Myprepaidcenter Card

I appreciated this post. Check out Myprepaidcenter.com for more

This was very well put together. Discover more at togelon

Thanks for the insightful write-up. More like this at affordable hardwood flooring

Thanks for the clear advice. More at home renovation Toronto

Nicely done! Discover more at Rich11

Appreciate the useful tips. For more, visit togelon login

This was a great article. Check out togelon for more

Appreciate the great suggestions. For more, visit types of hardwood flooring

Gracias a limpieza de muebles , puedo disfrutar de un servicio de lavado en seco confiable y conveniente en Cartagena

Estoy muy contento con el servicio de lavado en seco en Cartagena de https://www.metal-archives.com/users/lavanderiaencartagenackcj . Siempre entregan puntualmente y mi ropa luce como nueva

Thanks for the useful suggestions. Discover more at comprehensive home renovation

Thanks for the informative post. More at home renovation website

Thanks for the clear breakdown. More info at sexmoi

Well explained. Discover more at Myprepaidcenter Card

Appreciate the helpful advice. For more, visit Rich11

Thanks for the clear breakdown. More info at Rich11

This was a great help. Check out installing wood floors for more

Very helpful read. For similar content, visit home renovation Newmarket

This is highly informative. Check out laying hardwood planks for more

Nicely detailed. Discover more at https://giphy.com/channel/ossidyxvpc

No puedo expresar lo satisfecho que estoy con el servicio de lavado en seco en Cartagena de https://hackerone.com/oceansscartagenacqyu34 . Siempre superan mis expectativas

Thanks for the thorough analysis. Find more at MyPrepaidCenter redeem code

Thanks for the clear advice. More at home renovation Brampton

Estoy muy satisfecho con el servicio de lavado en seco en Cartagena que ofrece https://speakerdeck.com/oceanssxaei . Siempre obtengo resultados impecables y a tiempo

I liked this article. For additional info, visit home renovation in Toronto

Well explained. Discover more at My Prepaid Center

Estoy muy contento con el servicio de lavado en seco en Cartagena de limpieza de coches en Cartagena . Siempre entregan puntualmente y mi ropa luce como nueva

Thanks for the comprehensive read. Find more at togelon login alternatif

This was highly educational. For more, visit togelon login

This was highly educational. For more, visit Rich11

Nicely done! Discover more at home renovation Thornhill

Estoy impresionada con la rapidez y eficacia del servicio de lavado en seco en Cartagena de https://hub.docker.com/u/oceanolavanderiadzla . Siempre superan mis expectativas

Nicely done! Find more at hardwood flooring maintenance

This was highly educational. More at Rich11

This was very beneficial. For more, visit togelon

This was a wonderful post. Check out MyPrepaidCenter for more

This was highly educational. More at Rich11

Recomiendo ampliamente el servicio de lavado en seco en Cartagena de https://thegadgetflow.com/user/oceanssklrl/ . Siempre cumplen con mis expectativas y más

I appreciated this post. Check out basement renovation Toronto for more

This was highly educational. For more, visit affordable hardwood flooring

This was highly educational. More at hardwood flooring maintenance

Confío plenamente en https://unsplash.com/@tapiceriacartagenajhpy para el lavado en seco en Cartagena. Sus años de experiencia y atención al detalle los hacen los mejores del sector

El lavado en seco en Cartagena de https://www.calameo.com/accounts/7695920 es mi opción número uno. Son profesionales, confiables y siempre obtengo resultados perfectos

This is quite enlightening. Check out Rich11 for more

Appreciate the comprehensive advice. For more, visit togelon

Appreciate the great suggestions. For more, visit types of hardwood flooring

I enjoyed this post. For additional info, visit virusbola

Desde que descubrí el lavado en seco en Cartagena de https://hub.docker.com/u/lavanderiaencartagenamqeg , nunca más he tenido que preocuparme por la limpieza de mis prendas. Son los mejores

Your water slides are the highlight of our summer parties! They keep everyone entertained and provide hours of refreshing fun in the sun birthday parties

I enjoyed this read. For more, visit togelon

Thanks for the useful suggestions. Discover more at togelon login alternatif

El lavado en seco en Cartagena de https://www.spreaker.com/podcast/oceanoiain–6193961 es mi opción preferida. Su atención al detalle y resultados impecables me mantienen como cliente fiel

Gracias a https://issuu.com/oceansscjsk , puedo disfrutar de un servicio de lavado en seco confiable y conveniente en Cartagena

Ta strona to raj dla wszystkich miłośników e-papierosków! Serdecznie https://unsplash.com/@ephardwtey

This was a great article. Check out https://campsite.bio/thoinspojg for more

Nicely done! Discover more at virusbola

Estoy encantada con el servicio de lavado en seco en Cartagena de https://issuu.com/oceansscjsk . Mis prendas siempre vuelven perfectamente limpias y sin arrugas

Your water slides are so impressive! The variety of sizes and designs ensures there’s something for everyone to enjoy during summer parties inflatable water slide for parties

The bounce houses I rented from you were a huge hit at my school’s carnival https://numberfields.asu.edu/NumberFields/show_user.php?userid=3795067

Thanks for the great information. More at https://www.demilked.com/author/kanyonudmw/

Estoy impresionado con la rapidez y eficiencia del servicio de lavado en seco en Cartagena de https://www.sbnation.com/users/lavanderiacartagenaduat . Siempre entregan a tiempo y con calidad

Dziękuję za świetne doświadczenie zakupów w sklepie Przejdź na tę stronę ! Obsługa klienta była bardzo pomocna i zamówienie dotarło szybko i bez problemów

Great job! Discover more at rtp togelon

Appreciate the comprehensive advice. For more, visit virusbola

This was beautifully organized. Discover more at rtp togelon

Jeśli chcesz znaleźć najlepsze ceny na akcesoria do e-papieroska https://guides.co/a/josie-papucci

Gracias a https://www.cheaperseeker.com/u/oceanoxequ , puedo disfrutar de un servicio de lavado en seco confiable y conveniente en Cartagena

Recomiendo ampliamente el servicio de lavado en seco en Cartagena de limpieza de coches en Cartagena . Siempre cumplen con mis expectativas y más

Wow, your water slides are massive! They’re perfect for those hot summer days when everyone wants to cool off. Thanks for offering such amazing inflatable rentals inflatable rentals

Thanks for the useful post. More like this at virusbola

Helpful suggestions! For more, visit lgo4d

Thanks for the detailed guidance. More at virusbola

This was quite enlightening. Check out https://qtnailbarhouston.com/ for more

Valuable information! Discover more at https://luxurynailbardallas.com/

This was a great help. Check out https://www.blogtalkradio.com/comyazhpug for more

Confío plenamente en limpieza de tapicerias en Cartagena para el lavado en seco en Cartagena. Su atención al detalle y experiencia los convierten en los mejores

As a homeowner in Castle Pines, CO, I not too long ago experienced the chance to perform having a roofing contractor for many much-essential repairs https://www.google.com/maps?cid=14359286450617917338

Estoy muy contento con el servicio de lavado en seco en Cartagena de https://escatter11.fullerton.edu/nfs/show_user.php?userid=6351993 . Siempre entregan puntualmente y mi ropa luce como nueva

This was quite useful. For more, visit virusbola

This was very beneficial. For more, visit lgo4d link

Well explained. Discover more at lgo4d link

Estoy impresionada con la calidad del servicio de lavado en seco en Cartagena que ofrece limpieza de muebles en Cartagena . Mi ropa siempre vuelve impecable y fresca

Awesome article! Discover more at togelon

Valuable information! Discover more at https://qtnailbarhouston.com/

This was a wonderful post. Check out nail salon Dallas for more

Estoy impresionada con la calidad del servicio de lavado en seco en Cartagena que ofrece https://giphy.com/channel/lavanderiacartagenaanks . Mi ropa siempre vuelve impecable y fresca

This was very insightful. Check out virusbola for more

Recomiendo encarecidamente https://hackerone.com/lavanderiaencartagenaohij45 para el lavado en seco en Cartagena. Su atención al cliente y resultados impecables los hacen sobresalir

Thanks for the insightful write-up. More like this at https://www.cheaperseeker.com/u/sorduskirh

This was a wonderful guide. Check out https://list.ly/ismerdpenw for more

Thanks for the detailed post. Find more at lgo4d

Recomiendo ampliamente el servicio de lavado en seco en Cartagena de lavado en seco . Siempre cumplen con mis expectativas y más

El lavado en seco en Cartagena de limpieza de muebles en Cartagena es mi opción número uno. Son profesionales, confiables y siempre obtengo resultados perfectos

Thanks for the clear breakdown. More info at virusbola

Thanks for the clear breakdown. More info at virusbola

Great insights! Find more at lgo4d link alternatif

Thanks for the helpful advice. Discover more at lgo4d

Like a homeowner in Castle Pines, CO, I just lately had the chance to function with a roofing contractor for a few Considerably-required repairs. Soon after conducting in depth study, I stumbled on Roofing contractor in Castle Pines CO and chose to give them a contact

As being a homeowner in Castle Pines, CO, I not long ago had the chance to perform that has a roofing contractor for many much-needed repairs. Soon after conducting extensive exploration, I stumbled on https://www.google.com/maps?cid=14359286450617917338 and decided to give them a call

Wah, desain situs main slot di visa288 live chat sungguh eye-catching! Aku jadi semakin tertarik untuk bergabung

This was quite useful. For more, visit togelon

Para un lavado en seco de calidad en Cartagena, no hay mejor opción que https://pixabay.com/users/oceansslfbt-44183205/ . Siempre cuidan mi ropa como si fuera suya propia

Polecam tę stronę jako źródło wysokiej jakości grzałek, wkładów i płynów do e-papierosów https://www.pexels.com/@bettie-mathis-1337681190/

This site write-up couldn’t have appear at a much better time! I am presently setting up a shift to Tupelo and was seeking respected movers in the region google.com

Thanks for the clear breakdown. More info at https://qtnailbarhouston.com/

Thanks for the thorough analysis. More info at https://luxurynailbardallas.com/

Thanks for the thorough analysis. More info at https://list.ly/gundanferj

Main slot di visa288 slot memberikan peluang menang yang adil dan transparan

Slot online di visa288 slot memberikan bonus loyalitas yang besar kepada para pemain setia

El lavado en seco en Cartagena de https://www.pexels.com/@clara-francalanci-1340592301/ es mi opción preferida. Su atención al detalle y resultados impecables me mantienen como cliente fiel

Thanks for the thorough analysis. More info at https://letterboxd.com/galimeezrc/

Nicely done! Discover more at virusbola

Confío plenamente en https://www.pexels.com/@clara-francalanci-1340592301/ para el lavado en seco en Cartagena. Su atención al detalle y experiencia los convierten en los mejores

Thanks for the thorough article. Find more at togelon login alternatif

This was highly educational. More at ATLANTICO CHAISE BY NARDI OMEGA

Estoy encantado con el servicio de lavado en seco en Cartagena que ofrece https://www.hometalk.com/member/108266464/rosa1364931 . Mi ropa siempre vuelve perfectamente limpia y sin arrugas

Thanks for the valuable insights. More at https://luxurynailbardallas.com/

Great job! Find more at virusbola

This is very insightful. Check out lgo4d slot for more

¡Qué interesante es el tema del espejo emocional! A veces no nos damos cuenta de la importancia de cuidar de nuestra imagen propia y estado de ánimo para tener una buena calidad de vida. Gracias por compartir este conocimiento tan valioso y relevante Navegar por este sitio

Me encanta cómo abordas el tema del espejo emocional y su influencia en nuestra imagen propia y estado de ánimo. Es algo con lo que todos debemos lidiar en algún momento de nuestras vidas Descubre más aquí

Thanks for the helpful article. More like this at virusbola

This was very beneficial. For more, visit https://qtnailbarhouston.com/

Terima kasih telah memperkenalkan saya ke situs slot online visa288 live chat

This was quite informative. For more, visit togelon

Thanks for the helpful article. More like this at GAR FURNITURE

Thanks for the clear advice. More at COSTCO RESTAURANT FURNITURE NARDI

Appreciate the detailed information. For more, visit klik disini

Slot online di visa288 memberikan bonus selamat datang yang sangat menguntungkan bagi para pemain baru

Appreciate the useful tips. For more, visit virusbola

This was very enlightening. For more, visit lgo4d link

This was very well put together. Discover more at https://www.divephotoguide.com/user/daronetwii/

Valuable information! Find more at https://luxurynailbardallas.com/

Appreciate the thorough write-up. Find more at togelon login alternatif

Confío plenamente en https://pixabay.com/users/tapiceriacartagenaasko-44183671/ para el lavado en seco en Cartagena. Sus años de experiencia y atención al detalle los hacen los mejores del sector

El servicio de lavado en seco en Cartagena de limpieza de muebles en Cartagena es excepcional. Confío plenamente en ellos para cuidar mi ropa más preciada

¡Qué interesante es el tema del espejo emocional! A veces no nos damos cuenta de la importancia de cuidar de nuestra imagen propia y estado de ánimo para tener una buena calidad de vida https://www.hola.com/estar-bien/20210907195580/influencia-estetica-bienestar-emocional/

I appreciated this post. Check out visa288 live chat for more

This is quite enlightening. Check out https://www.gamespot.com/profile/fastofwbue/ for more

This was a great article. Check out https://unsplash.com/@sordusufce for more

Thanks for the detailed guidance. More at togelon 176

Estoy muy satisfecho con el servicio de lavado en seco en Cartagena que ofrece https://www.demilked.com/author/oceanolavanderiapsxf/ . Siempre obtengo resultados impecables y a tiempo

Estoy totalmente de acuerdo en que el espejo emocional juega un papel importante en nuestra vida diaria. Debemos aprender a valorarnos y cuidar de nuestra salud emocional para mantener un estado de ánimo positivo Más detalles aquí

Nicely done! Find more at lgo4d live chat

Aku selalu mencari situs main slot dengan bonus yang menggiurkan seperti yang ditawarkan oleh visa288 slot

Me encanta cómo abordas el tema del espejo emocional y su influencia en nuestra forma de sentirnos y relacionarnos con los demás Ir a este sitio

Para un lavado en seco de calidad en Cartagena, no hay mejor opción que limpieza de coches en Cartagena . Siempre cuidan mi ropa como si fuera suya propia

El lavado en seco en Cartagena de limpieza de tapicerias en Cartagena es insuperable. Siempre cuidan de mis prendas delicadas y las devuelven impecables

This was quite informative. More at virusbola

Thanks for the informative post. More at https://pixabay.com/users/soltoszkdl-44188616/

If you’re searching for trusted and professional security services in Tucson, look no further than Tucson Security Guard Service– they constantly deliver exceptional outcomes Security guard agency

This was very enlightening. More at lgo4d slot login

Ingin mencoba peruntungan di dunia main slot? Saya sarankan untuk mencoba bermain di situs visa288 login

Dengan bermain slot online di visa288 live chat , saya mendapatkan hiburan tanpa harus meninggalkan rumah

Gracias por compartir este contenido tan valioso sobre el espejo emocional y cómo nos afecta en diferentes aspectos de nuestra vida. Me ha hecho reflexionar sobre mi propia imagen y estado de ánimo Ver más

El lavado en seco en Cartagena de https://list.ly/oceanoeirz es insuperable. Siempre cuidan de mis prendas delicadas y las devuelven impecables

Tucson Security Personnel Service has a well-deserved credibility for being the leading provider of security services in Tucson Construction site security

Thanks for the detailed guidance. More at togelon

When it comes to security services, Tucson Security Guard Service is the name you can trust for unrivaled reliability, remarkable service, and comfort Mobile security patrol

I liked this article. For additional info, visit lgo4d live chat

Estoy impresionada con la calidad del servicio de lavado en seco en Cartagena que ofrece https://hackerone.com/lavanderiacartagenaevdr31 . Mi ropa siempre vuelve impecable y fresca

Trusting Tucson Security Guard Service with my property’s security was one of the best choices I made– they are really the professionals in their field Security guard agency

Useful advice! For more, visit togelon

Very helpful read. For similar content, visit virusbola

Great tips! For more, visit togelon login alternatif

Aku sangat puas dengan layanan pelanggan yang responsif di situs main slot visa288 login

The guards from Tucson Guard Service are trained in conflict resolution, ensuring that any prospective concerns are handled calmly and effectively Security guard companies near me

¡Qué interesante es el tema del espejo emocional! No siempre nos damos cuenta de cómo nuestra imagen propia puede afectar nuestro estado de ánimo. Gracias por compartir este artículo Consejos para una autoimagen saludable

Tucson Guard Service is committed to providing superior security services that prioritize the security of their clients and their properties Construction site security

Excellent tips about discovering the right garage builder! Living in Boulder, CO, It really is critical to operate with professionals who understand the neighborhood creating codes and rules. Luckily for us, Garage contractors Boulder CO seems to tick each of the bins

Wonderful write-up! As being a resident of Boulder, CO, I’ve been searching for a trustworthy garage builder for my forthcoming venture https://maps.app.goo.gl/49t1X7uW77M4fbxZ9

Estoy muy satisfecho con el servicio de lavado en seco en Cartagena que ofrece https://www.polygon.com/users/oceanoigio . Siempre obtengo resultados impecables y a tiempo

Thanks for the helpful advice. Discover more at virusbola

Tucson Security Guard Service provides extensive security options that are customized to fulfill the unique requirements of each client Security guard companies near me

Appreciate the helpful advice. For more, visit https://www.gamespot.com/profile/saemoncfqj/

Great insights! Find more at virusbola

Valuable information! Find more at https://www.indiegogo.com/individuals/37881424

Wonderful tips! Find more at https://www.demilked.com/author/maldorugbr/

This was very beneficial. For more, visit https://www.linkedin.com/in/t%C3%A2m-beauty-clinic-28aa67267/

Nuestra cara es el reflejo de nuestras emociones y experiencias de vida. Es fascinante cómo puede influir en nuestra actitud y confianza personal https://www.instagram.com/anna.brow.madrid/?hl=es

Thanks for the practical tips. More at visa288 live chat

This was highly informative. Check out virusbola for more

I found this very interesting. For more, visit lgo4d

This was very enlightening. For more, visit lgo4d live chat

Estoy impresionado con la calidad del servicio de lavado en seco en Cartagena que ofrece https://www.longisland.com/profile/tapiceriacartagenakuzc/ . Mi ropa siempre luce como nueva después de cada visita

Thanks for the useful suggestions. Discover more at rtp togelon

Recomiendo ampliamente https://www.mixcloud.com/oceanolavanderiayesb/ para el lavado en seco en Cartagena. Su atención al cliente y resultados impecables los convierten en los mejores

Me encanta cómo abordas la relación entre el espejo emocional, nuestra imagen propia y nuestro estado de ánimo. Es un tema tan relevante en nuestra sociedad actual Impacto de la belleza en la salud mental

Me encanta cómo explicas la importancia del espejo emocional en nuestra vida diaria y cómo nos afecta en todos los aspectos. Nos ayuda a entender cómo nos percibimos a nosotros mismos y cómo eso influye en nuestro estado de ánimo y relaciones personales mantener una imagen positiva

Appreciate the comprehensive advice. For more, visit acoustic-glazer-68a.notion.site

Thanks for the great explanation. More info at εξαρτηματα κουφωματων αλουμινιου θεσσαλονικη

To be a homeowner in Castle Pines, CO, I recently experienced the opportunity to work with a roofing contractor for a few Substantially-essential repairs https://maps.app.goo.gl/eg3P69T2g5TktxAh8

This was quite helpful. For more, visit visa288 login

I enjoyed this read. For more, visit https://www.linkedin.com/in/t%C3%A2m-beauty-clinic-28aa67267/

Gracias a https://www.blogtalkradio.com/tapiceriacartagenacosn , puedo confiar en un excelente servicio de lavado en seco en Cartagena. Mis prendas siempre están impecables y bien cuidadas

I appreciated this post. Check out https://www.linkedin.com/in/t%C3%A2m-beauty-clinic-28aa67267/ for more

This was a great article. Check out http://brooksjjyi178.tearosediner.net/door-remodeling-ideas-transforming-old-doors-into-spectacular-features for more

This was quite informative. For more, visit virusbola

This was quite enlightening. Check out https://zanewnei478.e-monsite.com/pages/the-effect-of-aluminum-frames-on-energy-cost-savings-in-your-home.html for more

Moja strona zawiera wiele interesujących artykułów na temat https://wellbeingmatters.mn.co/posts/52587119 . Zapraszam do zapoznania się z nimi i podzielenia się swoją opinią

This is quite enlightening. Check out dknation.draftkings.com for more

Nuestra cara es el reflejo de nuestras emociones y experiencias de vida. Es fascinante cómo puede influir en nuestra actitud y confianza personal Salud y belleza

Very informative article. For similar content, visit togelon login alternatif

Nuestra cara es el reflejo de nuestras experiencias y emociones. Es fascinante cómo la estética facial puede comunicar mucho más de lo que imaginamos Percepciones estéticas

This was very beneficial. For more, visit https://www.metal-archives.com/users/audianwbuo

El lavado en seco en Cartagena de https://unsplash.com/@oceanodpen es mi opción preferida. Su atención al detalle y resultados impecables me mantienen como cliente fiel

Nicely detailed. Discover more at lgo4d link

Saya suka bermain slot online di visa288 slot karena mereka memiliki koleksi permainan yang sangat lengkap

Great insights! Discover more at https://caidenlytv883.weebly.com/blog/door-remodeling-ideas-changing-old-doors-into-sensational-features

Appreciate the detailed information. For more, visit virusbola

This was highly educational. For more, visit virusbola

Great job! Find more at momolan595.bloggersdelight.dk

Appreciate the detailed post. Find more at αλουμινια κουφωματα προσφορεσ

Recomiendo encarecidamente https://www.mixcloud.com/oceanozysx/ para el lavado en seco en Cartagena. Su atención al cliente y resultados impecables los hacen sobresalir

El lavado en seco en Cartagena de https://www.metal-archives.com/users/oceanokxgb es mi opción preferida. Su atención al detalle y resultados impecables me mantienen como cliente fiel

Nicely detailed. Discover more at lgo4d slot login

Appreciate the thorough analysis. For more, visit https://anotepad.com/notes/8th628by

This was quite helpful. For more, visit lgo4d

Planujesz budowę domu? Sprawdź moją stronę, na której znajdziesz wiele artykułów na temat https://zenwriting.net/xocahej904/budowa-domow-crafting-dreams-brick-by-brick

Appreciate the insightful article. Find more at togelon

Appreciate the great suggestions. For more, visit https://www.linkedin.com/in/t%C3%A2m-beauty-clinic-28aa67267/

This was highly educational. More at ενεργειακα κουφωματα αλουμινιου

Awesome article! Discover more at visa288

El espejo emocional y su relación con nuestra imagen propia y estado de ánimo es un tema que no se discute lo suficiente en nuestra sociedad actual. Gracias por abordarlo en este artículo tan informativo y relevante para nuestro bienestar emocional Accede a tratamientos psicológicos

Gracias a limpieza de muebles , puedo disfrutar de un servicio de lavado en seco confiable y conveniente en Cartagena

excellent points altogether, you simply gained a new reader.

What would you recommend about your put up

that you made some days ago? Any certain?

Appreciate the insightful article. Find more at https://s3.us-west-004.backblazeb2.com/aluframesgr/aluframesgr/uncategorized/the-appeal-of-black-framed-windows-in-modern-interior.html

I enjoyed this article. Check out https://www.gamespot.com/profile/saemoncfqj/ for more

Thanks for the helpful advice. Discover more at writeupcafe.com

I found this very interesting. For more, visit https://www.gamespot.com/profile/godiedkkbx/

Thanks for the clear breakdown. More info at virusbola

Recomiendo ampliamente el servicio de lavado en seco en Cartagena de https://www.demilked.com/author/oceanocartagenazyet/ . Siempre cumplen con mis expectativas y más

Appreciate the detailed post. Find more at https://www.gamespot.com/profile/godiedkkbx/

Hello Dear, are you genuinely visiting this site on a

regular basis, if so afterward you will definitely obtain good knowledge.

This was very insightful. Check out https://www.linkedin.com/in/t%C3%A2m-beauty-clinic-28aa67267/ for more

Nuestra cara es el reflejo de nuestras emociones y experiencias de vida. Es fascinante cómo puede influir en nuestra actitud y confianza personal Más ayuda

Terima kasih atas informasi menarik! Aku akan segera mendaftar dan bermain slot online di visa288 login

Appreciate the detailed post. Find more at https://ewr1.vultrobjects.com/alugramesgr/aluframesgr/uncategorized/aluminum-frames-vs.html

Appreciate the detailed insights. For more, visit κουφωματα αλουμινιου ρεθυμνο

Saya senang menemukan situs visa288 slot sebagai tempat bermain judi slot terpercaya

Very informative article. For similar content, visit https://www.linkedin.com/in/t%C3%A2m-beauty-clinic-28aa67267/

Estoy totalmente de acuerdo en que el espejo emocional juega un papel importante en nuestra vida diaria y bienestar mental cómo la belleza afecta la mente

This was very enlightening. More at virusbola

This was very beneficial. For more, visit lgo4d

Gracias a https://list.ly/oceanssxjlx , puedo disfrutar de un servicio de lavado en seco confiable y conveniente en Cartagena

This was very enlightening. More at https://www.gamespot.com/profile/ruvornmnfk/

This was quite informative. For more, visit togelon login

Estoy totalmente de acuerdo en que el espejo emocional es fundamental para entender cómo nos vemos a nosotros mismos y cómo nos sentimos. Gracias por compartir este valioso contenido Accede a tratamientos psicológicos

Appreciate the insightful article. Find more at κουφωματα αλουμινιου λαρισα

Wah link daftar

La estética facial es algo que nos preocupa a muchos, ya que puede tener un impacto significativo en nuestra confianza personal. Gracias por compartir este contenido Cuidado emocional

Estoy encantado con el servicio de lavado en seco en Cartagena que ofrece https://www.hometalk.com/member/108254716/donald1824945 . Mi ropa siempre vuelve perfectamente limpia y sin arrugas

This was a fantastic read. Check out κουφωματα αλουμινιου αγια παρασκευη for more

Appreciate the thorough analysis. For more, visit https://www.linkedin.com/in/t%C3%A2m-beauty-clinic-28aa67267/

Thanks for the insightful write-up. More like this at κουφωματα αλουμινιου μεταχειρισμενα θεσσαλονικη

Nuestra cara es el reflejo de nuestras emociones y experiencias de vida. Es fascinante cómo puede influir en nuestra actitud y confianza personal Estética y bienestar

This was nicely structured. Discover more at lgo4d

Thanks for the great tips. Discover more at virusbola

Appreciate the helpful advice. For more, visit lgo4d

This was very well put together. Discover more at nail salon 03079

This was a great article. Check out togelon for more

Thanks for the thorough article. Find more at https://ganailsspa.com/

El lavado en seco en Cartagena de https://list.ly/oceanocartagenawuqv es mi opción preferida. Su atención al detalle y resultados impecables me mantienen como cliente fiel

No puedo creer lo conveniente que es el lavado en seco en Cartagena gracias a https://www.animenewsnetwork.com/bbs/phpBB2/profile.php?mode=viewprofile&u=986431 . Ahorro tiempo y mis prendas se ven impecables

Very informative article. For similar content, visit https://storage.googleapis.com/aluframesgr/aluframesgr/uncategorized/the-versatility-of-aluminum-frames-checking-out-design.html

Situs https://www.longisland.com/profile/corrilalxn/ memiliki tampilan yang menarik dan mudah digunakan oleh pemain

Me encanta cómo abordas el tema del espejo emocional y su relación con nuestra imagen propia y estado de ánimo. Es algo con lo que todos podemos relacionarnos en algún momento de nuestras vidas Encuentra más información

I appreciated this post. Check out ασφαλειεσ συρομενων κουφωματων αλουμινιου for more

Nicely done! Discover more at virusbola

Fantastic post! Discover more at togelon login alternatif

Nicely done! Find more at togelon login alternatif

El lavado en seco en Cartagena de https://www.pexels.com/@frederick-testi-1340591276/ es simplemente excepcional. Nunca he tenido un problema y siempre obtengo resultados impecables

Nuestra cara es el reflejo de nuestras emociones y experiencias de vida. Es fascinante cómo puede influir en nuestra actitud y confianza personal https://www.instagram.com/anna.brow.madrid/?hl=es

I appreciated this post. Check out link login for more

Appreciate the useful tips. For more, visit lgo4d slot login

Dengan tampilan yang menarik dan interface yang user-friendly, visa288 live chat adalah pilihan yang tepat untuk bermain main slot

This was quite enlightening. Check out https://www.slideserve.com/cwrictwrzx/say-goodbye-to-drafts-how-thermal-proof-aluminum-frames-help for more

Thanks for the clear advice. More at https://files.fm/u/g7vs9uhwec

Appreciate the detailed information. For more, visit https://rosamondnailsandspa.com/

An intriguing discussion is worth comment.

I think that you ought to publish more about this issue, it might not be a

taboo matter but usually people do not speak about such subjects.

To the next! All the best!!

El lavado en seco en Cartagena de https://www.pexels.com/@frederick-testi-1340591276/ es mi opción preferida. Su atención al detalle y resultados impecables me mantienen como cliente fiel

I found this very helpful. For additional info, visit nail salon 03079

Thanks for the valuable article. More at nail salon near me

This was a fantastic resource. Check out https://tennaturalnailspa.com/ for more

El servicio de lavado en seco en Cartagena de limpieza de coches en Cartagena es excepcional. Confío plenamente en ellos para cuidar mi ropa más preciada

Secure your financial future with the stability of gold and silver bullion. Trust gold bullion for all your precious metals needs

Thanks for the detailed guidance. More at https://ganailsspa.com/

Thanks for the thorough article. Find more at https://ganailsspa.com/

This was very enlightening. More at virusbola

I found this very interesting. Check out virusbola for more

The Radha Krishna Murtis on your site are so lifelike, it’s as if they come alive with their divine presence https://penzu.com/p/c4e5de6bbab21fb3

Valuable information! Discover more at lgo4d

Thanks for the thorough article. Find more at https://files.fm/u/g7vs9uhwec

Thanks for the clear breakdown. More info at lgo4d

Gracias a https://www.demilked.com/author/oceansscartagenajviv/ , puedo disfrutar de un servicio de lavado en seco confiable y conveniente en Cartagena

This blog site post could not have come at a much better time! I have been exploring garage builders in Boulder, CO, and stumbled upon your site. The testimonies and top quality of work showcased on North Denver Garage Doors Boulder are excellent

Nunca había reflexionado tanto sobre el impacto del espejo emocional en nuestra vida diaria. Gracias por compartir tus conocimientos y experiencias en este tema tan importante Haga clic aquí para obtener más

Helpful suggestions! For more, visit togelon login alternatif

I cannot emphasize more than enough how critical it is to choose trustworthy movers when relocating. Your blog site submit has highlighted the Extraordinary companies provided by https://maps.app.goo.gl/heCxZMd3My4GYhXo6 in Tupelo MS

If you’re tired of the ups and downs of the stock market, it might be time to consider investing in gold and silver bullion through gold market analysis reports

Invest in tangible assets that stand the test of time. Choose gold and silver bullion from gold bullion for peace of mind

This was very well put together. Discover more at αεροστοπ για κουφωματα αλουμινιου

Dengan hadiah besar dan variasi permainan yang menarik, tidak heran banyak orang memilih main slot di visa288 live chat

Thanks for the helpful advice. Discover more at βαφονται τα κουφωματα αλουμινιου

Your blog put up lose light-weight on the significance of choosing a certified and insured roofing contractor in Katy, TX https://maps.app.goo.gl/at2qMBB9Qu6ftXY47

El notario desempeña una labor fundamental en la gestión de documentos, brindando seguridad y confianza a todas las partes involucradas https://www.conceptosjuridicos.com/notario/

Para un lavado en seco de calidad en Cartagena, no hay mejor opción que https://www.mapleprimes.com/users/oceansscartagenaywbq . Siempre cuidan mi ropa como si fuera suya propia

Thanks , I’ve just been searching for information approximately

this topic for ages and yours is the best I’ve came upon so far.

But, what concerning the bottom line? Are you certain concerning the source?

This was very enlightening. For more, visit lgo4d live chat

Nuestra cara es el reflejo de nuestras emociones y experiencias de vida. Es fascinante cómo puede influir en nuestra actitud y confianza personal Ir a este sitio web

This was quite informative. For more, visit togelon

This was a wonderful guide. Check out ενεργειακα κουφωματα αλουμινιου for more

Dengan fitur demo gratis, saya bisa mencoba permainan slot di visa288 sebelum bermain dengan uang sungguhan

This was quite useful. For more, visit virusbola

Appreciate the thorough information. For more, visit togelon

Wah cek promo

This is very insightful. Check out nail salon W Rosamond Blvd for more

This was a fantastic read. Check out https://rosamondnailsandspa.com/ for more

Bullion is not just an investment – it’s a symbol of wealth and prosperity. Choose gold to help you build a legacy for generations to come

Appreciate the detailed insights. For more, visit https://serenitynailsbossier.com/

Well explained. Discover more at https://serenitynailsbossier.com/

This was a great help. Check out https://confirmed-airboat-d40.notion.site/Add-a-backsplash-to-your-kitchen-to-protect-walls-from-stains-while-adding-a-stylish-design-element-0fb84a522f88455e87aa477ef52059d3?pvs=4 for more

El lavado en seco en Cartagena de https://www.hometalk.com/member/108262111/eva1237333 es mi opción preferida. Su atención al detalle y resultados impecables me mantienen como cliente fiel

This was quite helpful. For more, visit virusbola

Useful advice! For more, visit lgo4d

As the saying goes, “All that glitters is not gold.” But when it comes to investing in bullion, it certainly is! Check out silver bullion for the best deals on gold and silver

Appreciate the useful tips. For more, visit instapaper.com

This was a fantastic read. Check out https://tennaturalnailspa.com/ for more

Nicely done! Find more at virusbola

Dengan adanya fitur demo play, kita bisa mencoba berbagai jenis permainan main slot di visa288 slot tanpa harus mengeluarkan uang

I appreciated this article. For more, visit togelon login alternatif

Appreciate the thorough write-up. Find more at praktiker κουφωματα αλουμινιου

Great job! Discover more at https://papaly.com/b/pLBc

This was quite informative. For more, visit https://ganailsspa.com/

Thanks for the insightful write-up. More like this at sco.lt

Thanks for the insightful write-up. More like this at spreaker.com

Estoy muy satisfecho con el servicio de lavado en seco en Cartagena que ofrece limpieza de muebles en Cartagena . Siempre obtengo resultados impecables y a tiempo

La relación entre el espejo emocional, nuestra imagen propia y nuestro estado de ánimo es fascinante, como bien explicas en este artículo Encuentra más información

Estoy totalmente de acuerdo en que el espejo emocional tiene un impacto directo en nuestra forma de sentirnos y cómo nos relacionamos con los demás Compruebe aquí

Slot online di visa288 memberikan layanan pelanggan yang responsif dan membantu dengan cepat menyelesaikan masalah

Thanks for the detailed post. Find more at https://giphy.com/channel/coenwinocz

Very useful post. For similar content, visit lgo4d

Thanks for the useful suggestions. Discover more at lgo4d slot

La figura del notario es esencial para garantizar la legalidad y autenticidad de los documentos. Gran artículo sobre su papel en la gestión Recursos útiles

Nicely done! Find more at https://padlet.com/avishaked601rtznp/my-remarkable-padlet-ct8ylmwdn502qkjv/wish/3017648638

Me encanta cómo resaltas la importancia del notario en la gestión de documentos legales. Un tema que todos deberíamos conocer Fe pública notarial

This was very well put together. Discover more at togelon login

Thanks for the thorough analysis. Find more at nail salon 03079

Estoy impresionado con la calidad del servicio de lavado en seco en Cartagena que ofrece https://www.creativelive.com/student/ray-cognome?via=accounts-freeform_2 . Mi ropa siempre luce como nueva después de cada visita

This was beautifully organized. Discover more at επιδοτηση κουφωματα αλουμινιου

This was very well put together. Discover more at blurb.com

Gracias por abordar este tema tan relevante y necesario. Es importante recordar que la verdadera belleza radica en nuestra autenticidad y confianza interior Continuar leyendo

Appreciate the comprehensive advice. For more, visit https://ganailsspa.com/

Para un lavado en seco de calidad en Cartagena, no hay mejor opción que https://www.mixcloud.com/oceansscartagenakfjc/ . Siempre cuidan mi ropa como si fuera suya propia