Why You Should Use cTrader For Your FTMO Challenge

Welcome back to the Disciplined FX blog – my name is Andrew Bloom and if you haven’t met me before, I am a Ph.D. student in the field of business with a concentration in entrepreneurship and I’ve been a day trader for about four to five years and a day trader of forex markets for about 2-3 years. I also started Disciplined FX last year to help teach traders from all walks of life how to become profitable in forex markets while focusing on building habits that support discipline and using mechanical trading in order to develop that routine mindset when you’re actually in front of the charts.

[This post contains FTMO affiliate links]

So I’m going to make a guess as to why you’re here today – I’m going to wager that you’re looking for a good reason for either cTrader or mt4 mt5 and you’re hanging out on the fence there. You’re not really sure which one to go for as you’re submitting your FTMO application.

Personally, I believe there’s one very good reason why you should pick cTrader (See my post on their best features, here) instead of mt4 mt5 , the typical gold standard platforms for day trading any market, but the reason why isn’t gonna be why you think it should be.

Hear me out on this.

What Traders Look for in a Platform

Let’s quickly talk about what people are looking for in a platform.

So you might be looking for things like the ability to program your own strategies using expert advisors, or the ability to set alarms to use a variety of indicators. Now, these are all worthwhile elements of a good platform but something that I think really takes the cake is the ability to easily and intuitively place a trade at any given moment and ensure that your order will be submitted the way you want it to.

Ultimately, we want to make quick orders, especially if you’re a scalper like me or a day trader who is waiting for a very fine and precise moment to enter the trade.

Regardless of what platform you use you’re going to want to have an order form that you are comfortable with and able to use on the spot to put in your stop loss, take profit targets, as well, and you can trust that that order will be placed correctly.

Why Do You Need a Great Order Form?

So why am I focusing on orders?

The reason is that I don’t think you actually need to be deciding on a platform for your FTMO challenge because I don’t think you should be using FTMO‘s platforms.

Instead, I think it’s really useful – and this is true also in professional day trading – to use either your own broker’s charts or a charting software that you trust, such as Trading View, where you’ve done proficient backtesting.

You’re going to want to use another chart for making your decisions for your prop trading orders.

For me, I use Oanda‘s trading charts.

It means I’m also using their prices which are relatively close enough to the kinds you’ll find on the FTMO platforms but what’s important for me is that I’ve backtested my mechanical strategy on these charts many, many times and I’m using that data to inform the kinds of risk percent per trade as well as statistical components to help me make decisions as to when, for example, I should maybe stop trading on a challenge and look for a retry if something unusual occurs.

I want to use Oanda‘s charts to figure this out because that’s going to be where that information is consistent.

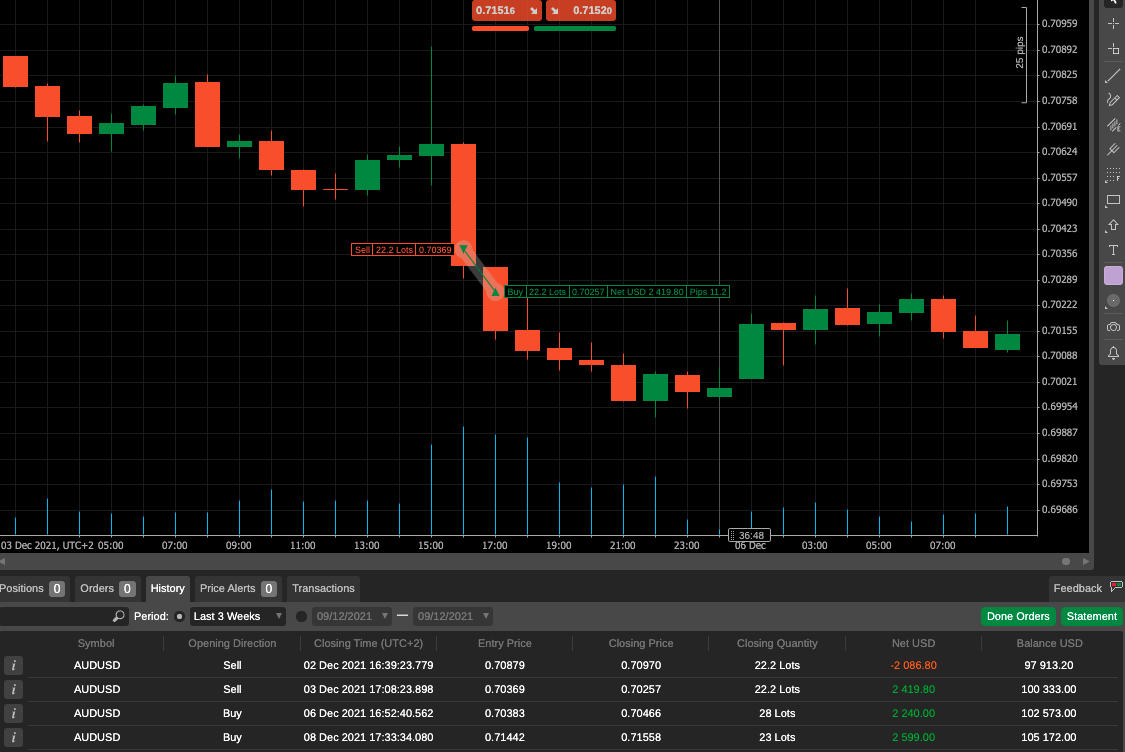

What I do when I trade with FTMO or any other prop firm is just use their platforms as order forms.

I just want to set up the stop loss, take profit, put in the position size, and set it, forget it. Let it unravel on its own.

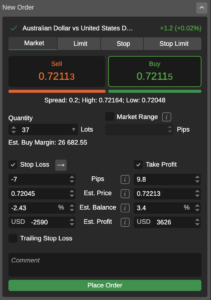

This is the reason why I think cTrader is the better option than mt4 mt5 – it’s because their order forms are so intuitive. They let you calculate how much you want to risk on your trade based on your account size. They do the math for you and most importantly they let you select your take profit and your stop loss based on pips – you don’t have to know the price ahead of time.

It takes out that step of having to measure your trade and figure out the price levels, which is such a boon when you’re a scalper like me and you’re thinking in pips.

Some Downsides to Selecting cTrader

Now, the one downside though to using cTrader is that you can’t use their mobile app for your challenge.

If you want to do more mobile trading you’re going to have to use mt4 mt5. However, mt4 and mt5’s mobile order form is like a risk management nightmare in and of itself. I do use it for my own trading because I’ve grown accustomed to it but I don’t recommend starting out on mobile trading with mt4 or mt5 if you’re just getting started with them for the first time.

As you take your challenge, however, let’s assume you’re able to sit in front of a computer. You’re able to use multiple charts. You can easily set your brokerage’s chart as your analysis chart, if you will, on one screen and use cTrader on the other where you can easily submit orders. The one thing i will recommend though is to be careful of jumping across different currency pairs as those orders will switch – they will go back to some kind of default order such as the last trade you took.

There might be settings to change this, but so far my experience has been to be sure you know what your orders are so that in case you’re jumping around, looking for a pair to trade with, you can change that order form again if it gets clicked out.

The Ideal Set-Up

So here’s the ideal outcome: you signed up for your prop trading challenge you clicked cTrader as your platform of choice. You’re using your brokerage’s charts on one screen and you have c Trader on another. You make your decisions on your own broker’s charts – those were the ones you use to backtest – and you just submit your position size you use your stop loss and take profit to calculate how much you want to risk for this trade. Lastly, you fill out your position size accordingly. They do the math for you right there and when you see the signal to go on your broker’s charts, you submit the order on cTrader and that’s it.

You don’t touch anything else. You don’t use their charts to trade with and it’s a very simple, quick process.

So that’s the number one reason why I suggest cTrader over mt4/mt5 is that you’re not actually going to use them as a platform. Instead, you’re just using them as ordering services where you can set up your trade position very quickly, easily, with the math calculated out for you and get on with your trading day or your day in general.

Overall, I like cTrader. (See my post on their best features, here) They have nice charts. But for the purpose of trading like a professional, I believe it’s best to use prop firm’s platforms only as places where you enter your orders – not where you analyze charts.

I do accept as true with all of the ideas you have introduced on your post. They are really convincing and can definitely work. Still, the posts are very brief for newbies. May just you please extend them a bit from next time? Thank you for the post.

We’re a group of volunteers and opening a new scheme in our community.

Your web site provided us with valuable information to work on. You’ve done a

formidable job and our entire community will be grateful to you.

Piece of writing writing is also a fun, if you be familiar

with after that you can write if not it is complicated to write.

Hey there! I know this is kinda off topic however I’d figured I’d ask.

Would you be interested in exchanging links or maybe guest authoring a blog post or vice-versa?

My website covers a lot of the same topics as yours and I believe we could greatly benefit from each other.

If you happen to be interested feel free to send me an e-mail.

I look forward to hearing from you! Terrific blog by the way!

I think the admin of this web page is really working

hard in support of his site, as here every stuff is quality based

stuff.

Amazing! Its really awesome article, I have got much clear idea on the topic of from

this piece of writing.

Really when someone doesn’t understand after that

its up to other users that they will assist, so here it occurs.

Hello, i think that i saw you visited my website

thus i came to “return the favor”.I am attempting to find things to enhance my web site!I suppose its ok to

use a few of your ideas!!

It’s actually very difficult in this active life to listen news on TV, therefore I simply use internet for that reason, and obtain the most up-to-date information.

Hi would you mind sharing which blog platform you’re working

with? I’m planning to start my own blog soon but I’m having a hard time choosing

between BlogEngine/Wordpress/B2evolution and Drupal. The reason I ask is because your design and

style seems different then most blogs and I’m looking for something completely unique.

P.S Sorry for being off-topic but I had to ask!

This post is truly a good one it helps new the web people,

who are wishing in favor of blogging.

Have you ever considered publishing an ebook or guest authoring on other sites?

I have a blog based on the same topics you discuss and would love to have you share some stories/information. I know my readers would enjoy your work.

If you are even remotely interested, feel free to shoot me

an e-mail.

hello!,I like your writing so a lot! percentage

we be in contact more about your article on AOL?

I need an expert in this space to solve my problem. Maybe that’s you!

Having a look ahead to look you.

Hello there, You’ve done a fantastic job.

I will definitely digg it and personally recommend to my friends.

I am confident they’ll be benefited from this website.

Please let me know if you’re looking for a author for your weblog.

You have some really great posts and I feel I would be a good

asset. If you ever want to take some of the load off, I’d really like to

write some material for your blog in exchange for a link back to

mine. Please shoot me an email if interested. Thanks!

you’re in reality a good webmaster. The website

loading pace is amazing. It seems that you are doing any unique trick.

Furthermore, The contents are masterwork. you’ve

performed a fantastic task in this matter!

Thank you for another informative blog. The place else may I get that type

of info written in such an ideal way? I have a challenge that

I am just now running on, and I have been on the glance out for

such information.

Simply want to say your article is as amazing. The clearness in your post is just excellent and

i could assume you are an expert on this subject.

Well with your permission let me to grab your

RSS feed to keep updated with forthcoming post. Thanks a million and please carry on the gratifying work.

What’s up mates, how is all, and what you want to say regarding this post,

in my view its in fact remarkable designed for me.

Ahaa, its good conversation about this piece of writing at this place at this

weblog, I have read all that, so now me also

commenting here.

What’s up, this weekend is good for me, because this time i am

reading this impressive educational article here at my residence.

I go to see day-to-day a few web sites and blogs

to read articles, but this weblog presents feature based articles.

At this time I am ready to do my breakfast, when having

my breakfast coming yet again to read further news.

I pay a visit everyday a few web pages and

blogs to read content, except this weblog presents quality based articles.

It’s in fact very complicated in this full of activity life to listen news on Television, therefore I simply

use web for that reason, and get the latest

information.

Hello! This post could not be written any better!

Reading through this post reminds me of my old

room mate! He always kept talking about this.

I will forward this article to him. Fairly certain he will

have a good read. Thank you for sharing!

Very good article. I am experiencing a few of these

issues as well..

Good day! I just wish to give you a huge thumbs up for the excellent info you have got here on this post.

I will be coming back to your site for more soon.

It’s a pity you don’t have a donate button! I’d without a

doubt donate to this superb blog! I guess for now i’ll

settle for book-marking and adding your RSS feed to my Google account.

I look forward to new updates and will share this site with my Facebook group.

Chat soon!

I loved as much as you will receive carried out right

here. The sketch is attractive, your authored material

stylish. nonetheless, you command get got an impatience over that

you wish be delivering the following. unwell unquestionably come

further formerly again as exactly the same nearly very often inside case you shield this hike.

I am truly grateful to the holder of this website who has shared this enormous paragraph at at this time.

Hello there, just became aware of your blog through Google, and found that it’s truly informative.

I am going to watch out for brussels. I’ll appreciate if you

continue this in future. Numerous people will be benefited from your writing.

Cheers!

I’m not that much of a internet reader

to be honest but your sites really nice, keep it up! I’ll go ahead and bookmark your site to come back later.

Cheers

Hi, Neat post. There’s an issue along with your site in internet

explorer, might check this? IE still is the market leader and a good component to

other folks will miss your great writing because of this problem.

Thanks , I’ve recently been looking for info approximately this subject for ages and yours

is the best I’ve discovered till now. However, what about

the conclusion? Are you sure about the supply?

certainly like your website but you need to take a look at the spelling on several

of your posts. Many of them are rife with spelling

issues and I in finding it very troublesome to tell the truth nevertheless I will

certainly come again again.

This is really interesting, You’re a very skilled blogger.

I have joined your rss feed and look forward to seeking more

of your excellent post. Also, I have shared your site in my social networks!

Fantastic post however I was wanting to know if you could write

a litte more on this topic? I’d be very grateful if you could elaborate a little bit more.

Appreciate it!

I could not refrain from commenting. Very well written!

Oh my goodness! Impressive article dude! Thanks, However I am having issues

with your RSS. I don’t understand the reason why I can’t join it.

Is there anyone else getting identical RSS issues?

Anybody who knows the answer can you kindly respond? Thanks!!

Hi this is kinda of off topic but I was wondering if blogs

use WYSIWYG editors or if you have to manually code

with HTML. I’m starting a blog soon but have no coding know-how so I wanted to get advice from someone with experience.

Any help would be enormously appreciated!

Hi everyone, it’s my first visit at this web site, and post is

really fruitful in favor of me, keep up posting these articles.

Hi everyone, it’s my first go to see at this web page, and piece of writing is really fruitful in favor of me, keep

up posting these articles.

Nice blog here! Also your website loads up fast!

What host are you using? Can I get your affiliate link to your host?

I wish my website loaded up as fast as yours lol

Hi to all, how is everything, I think every one is getting more from this site, and your views are pleasant designed for new people.

I have learn some excellent stuff here. Certainly value bookmarking for revisiting.

I surprise how a lot effort you place to create the sort of fantastic informative web site.

This design is steller! You obviously know how to

keep a reader amused. Between your wit and your videos, I was almost

moved to start my own blog (well, almost…HaHa!) Excellent job.

I really enjoyed what you had to say, and more than that, how you presented it.

Too cool!

Tremendous issues here. I am very happy to look your post.

Thanks a lot and I am having a look ahead

to contact you. Will you please drop me a e-mail?

It’s going to be ending of mine day, but before ending I am

reading this wonderful article to improve my know-how.

Asking questions are genuinely pleasant thing if you are not understanding something fully,

but this piece of writing offers nice understanding yet.

I know this website offers quality depending articles and other information, is there any other web site which gives these

kinds of stuff in quality?

I absolutely love your website.. Excellent colors & theme.

Did you develop this web site yourself? Please reply back as I’m trying to create my own site and would like to learn where you got this

from or exactly what the theme is named. Many thanks!

Asking questions are actually pleasant thing

if you are not understanding something totally, but this piece of

writing presents nice understanding even.

Hello, i think that i noticed you visited my blog so

i got here to return the choose?.I am attempting to to find issues to enhance

my website!I assume its ok to use some of your ideas!!

I visited multiple web sites but the audio quality for audio

songs present at this web site is really excellent.

Good post. I learn something new and challenging on blogs I stumbleupon every day.

It will always be interesting to read content from other writers and use a little something from their

web sites.

Fine way of explaining, and nice piece of writing to take information about my presentation subject, which i

am going to deliver in institution of higher education.

I appreciate, result in I found exactly what I used to be looking for.

You have ended my 4 day lengthy hunt! God Bless you man. Have a

great day. Bye

Hmm is anyone else encountering problems

with the pictures on this blog loading?

I’m trying to determine if its a problem on my end or if it’s the blog.

Any responses would be greatly appreciated.

I will immediately clutch your rss feed as I can not in finding your email subscription hyperlink

or e-newsletter service. Do you’ve any? Kindly allow me recognize so that I may subscribe.

Thanks.

Hello there! I know this is kinda off topic but I was wondering which blog platform are you using for this site?

I’m getting tired of WordPress because I’ve had problems

with hackers and I’m looking at alternatives for another platform.

I would be great if you could point me in the direction of a good

platform.

I know this if off topic but I’m looking into starting my own blog and was

wondering what all is needed to get setup? I’m assuming having a blog like yours would cost a pretty penny?

I’m not very internet savvy so I’m not 100% sure.

Any suggestions or advice would be greatly appreciated.

Appreciate it

Piece of writing writing is also a excitement, if you be familiar with then you can write or else it is

complicated to write.

Hi there! I could have sworn I’ve been to this site before but

after reading through some of the post I realized it’s new to me.

Nonetheless, I’m definitely glad I found it and I’ll be book-marking and checking back often!

Peculiar article, exactly what I needed.

It’s in reality a great and useful piece of information.

I’m glad that you simply shared this useful info with us.

Please keep us up to date like this. Thank you for sharing.

Good post. I learn something totally new and challenging on sites I stumbleupon every day.

It’s always interesting to read through articles

from other authors and use a little something from their websites.

If you are going for most excellent contents like me, just go to see

this web page every day because it presents

feature contents, thanks

hello there and thank you for your information – I’ve definitely picked up something new

from right here. I did however expertise a few technical

issues using this web site, since I experienced to reload the site lots of times previous to I could get it to load properly.

I had been wondering if your web hosting is OK? Not that I am complaining,

but slow loading instances times will often affect

your placement in google and can damage your high quality score if ads and

marketing with Adwords. Anyway I’m adding this RSS to my e-mail and

could look out for much more of your respective fascinating content.

Ensure that you update this again very soon.

Great goods from you, man. I’ve be mindful your stuff previous to

and you are simply too magnificent. I actually like what you have acquired right here, certainly like what

you are stating and the way during which you say it. You make it entertaining and

you still care for to keep it wise. I cant wait to learn much more from you.

That is really a terrific site.

Hello There. I found your blog using msn. This is a very well

written article. I will make sure to bookmark it and come back to read more

of your useful information. Thanks for the post.

I will certainly return.

Nice blog here! Also your site loads up very fast! What host are you using?

Can I get your affiliate link to your host? I wish my site

loaded up as quickly as yours lol

Way cool! Some extremely valid points! I appreciate you penning this post and

also the rest of the website is also very good.

magnificent post, very informative. I’m wondering why the other experts of

this sector do not realize this. You should continue

your writing. I am sure, you’ve a great readers’ base already!

Good day! I know this is kinda off topic but I was wondering if you knew where

I could find a captcha plugin for my comment form? I’m using the same blog platform as yours and

I’m having difficulty finding one? Thanks a lot!

Hi would you mind letting me know which web host you’re utilizing?

I’ve loaded your blog in 3 different browsers and I must say this blog loads a lot quicker then most.

Can you suggest a good internet hosting provider

at a fair price? Cheers, I appreciate it!

I have fun with, result in I discovered just what I was taking a look for.

You have ended my four day long hunt! God Bless you man. Have a great

day. Bye

Hey There. I found your blog using msn. This is a really

well written article. I’ll make sure to bookmark it and return to read

more of your useful information. Thanks for the post. I’ll certainly comeback.

If some one needs to be updated with most recent technologies afterward

he must be visit this web site and be up to date all the

time.

I blog frequently and I really thank you for your information. This great article has truly peaked my

interest. I will book mark your site and keep checking for new information about once a week.

I subscribed to your RSS feed too.

I visited various web pages however the audio quality for audio songs existing at this

website is actually excellent.

I need to to thank you for this great read!! I definitely

enjoyed every bit of it. I’ve got you bookmarked to check out new stuff you post…

Great article, exactly what I needed.

Hello friends, how is all, and what you want to say regarding this piece

of writing, in my view its in fact awesome in support of me.

Appreciation to my father who stated to me regarding this blog, this webpage is truly

amazing.

I’d like to find out more? I’d want to find out more details.

My brother recommended I would possibly like this web

site. He used to be entirely right. This post truly made my day.

You cann’t imagine simply how so much time I had spent for this information! Thanks!

I don’t know whether it’s just me or if everyone else experiencing issues with your website.

It looks like some of the text on your content are running off the screen. Can somebody else please comment and let me

know if this is happening to them as well? This might be a issue

with my web browser because I’ve had this happen before.

Many thanks

It’s very trouble-free to find out any topic on net as compared to textbooks,

as I found this piece of writing at this site.

My programmer is trying to persuade me to move to .net from PHP.

I have always disliked the idea because of the costs.

But he’s tryiong none the less. I’ve been using WordPress on numerous websites for about a year and am anxious

about switching to another platform. I have

heard excellent things about blogengine.net. Is there a way I

can transfer all my wordpress posts into it? Any kind

of help would be really appreciated!

This design is spectacular! You obviously know how to keep a reader entertained.

Between your wit and your videos, I was almost moved to

start my own blog (well, almost…HaHa!) Excellent job.

I really loved what you had to say, and more than that,

how you presented it. Too cool!

My programmer is trying to persuade me to move to .net from

PHP. I have always disliked the idea because of the expenses.

But he’s tryiong none the less. I’ve been using Movable-type on numerous websites for about a year and am nervous about switching to another platform.

I have heard very good things about blogengine.net. Is there a way I can transfer all

my wordpress posts into it? Any help would be greatly appreciated!

Heya i’m for the first time here. I came across this

board and I to find It really helpful & it helped

me out a lot. I’m hoping to offer one thing again and help others like you helped me.

I think this is among the most vital info for me. And i am glad reading your article.

But should remark on some general things, The web site style is wonderful, the articles is really nice : D.

Good job, cheers

An outstanding share! I have just forwarded this onto a

co-worker who was conducting a little homework on this.

And he actually ordered me dinner because I found it for him…

lol. So allow me to reword this…. Thank YOU for the meal!!

But yeah, thanx for spending the time to discuss

this topic here on your site.

Genuinely when someone doesn’t know then its up to other users that they

will assist, so here it takes place.

I simply couldn’t leave your site prior to suggesting that

I really enjoyed the standard information an individual

supply to your visitors? Is going to be back often in order to investigate cross-check new posts

This text is worth everyone’s attention. When can I

find out more?

Hi there everyone, it’s my first go to see at this web page, and piece

of writing is in fact fruitful in favor of me,

keep up posting these articles.

Its not my first time to pay a quick visit this website,

i am visiting this web site dailly and get pleasant data from here all the time.

Hello there, I found your website via Google at the same time as searching for a comparable matter, your web site got here

up, it seems to be good. I have bookmarked it in my google bookmarks.

Hi there, simply turned into alert to your weblog thru Google, and located that it’s really informative.

I’m going to watch out for brussels. I’ll appreciate if you happen to continue this in future.

Numerous other folks shall be benefited out of your writing.

Cheers!

Great site you have got here.. It’s hard to find excellent writing like yours these days.

I truly appreciate people like you! Take care!!

Hey there! Do you know if they make any plugins to assist with Search Engine Optimization? I’m

trying to get my blog to rank for some targeted keywords but I’m not seeing very good success.

If you know of any please share. Appreciate it!

Hello to all, how is all, I think every one is getting more

from this website, and your views are pleasant designed for new users.

Hey There. I found your blog using msn. This is a really well written article.

I will make sure to bookmark it and come back to read

more of your useful info. Thanks for the post. I’ll certainly

return.

I am regular visitor, how are you everybody? This post

posted at this web page is in fact good.

I love what you guys are usually up too. Such clever work and exposure!

Keep up the very good works guys I’ve you guys to my own blogroll.

These are actually wonderful ideas in about blogging.

You have touched some fastidious points here.

Any way keep up wrinting.

Really no matter if someone doesn’t be aware of afterward its up

to other visitors that they will help, so here it occurs.

If you wish for to get much from this post then you have to apply such techniques to your won web site.

It’s very straightforward to find out any topic on net

as compared to books, as I found this article

at this site.

We stumbled over here coming from a different web page and thought I may as well check things

out. I like what I see so i am just following you.

Look forward to checking out your web page yet again.

Magnificent goods from you, man. I’ve understand your stuff previous to and you are just too

wonderful. I really like what you’ve acquired here, really like what you’re stating

and the way in which you say it. You make

it enjoyable and you still take care of to keep it wise.

I cant wait to read much more from you. This is actually a tremendous web site.

Greetings! I know this is kind of off topic but

I was wondering which blog platform are you using for this site?

I’m getting sick and tired of WordPress because I’ve had

problems with hackers and I’m looking at options for another platform.

I would be awesome if you could point me in the direction of a good platform.

If you are going for best contents like me, just visit this site

all the time because it offers quality contents,

thanks

It is appropriate time to make some plans for the

longer term and it is time to be happy. I have learn this submit and if I may I

desire to counsel you some interesting things or tips.

Maybe you could write subsequent articles relating to

this article. I want to learn even more issues about it!

I constantly emailed this weblog post page to all my contacts, since if like to

read it afterward my friends will too.

Hey I am so glad I found your website, I really found you by accident,

while I was looking on Google for something else, Anyhow I am here now

and would just like to say thanks for a fantastic post

and a all round interesting blog (I also love the theme/design), I don’t have time to browse it all at the moment but I have saved it and also

included your RSS feeds, so when I have time I will

be back to read much more, Please do keep up the

awesome b.

Hello There. I found your blog using msn. This is

a really well written article. I’ll make sure to bookmark it and return to read more

of your useful information. Thanks for the post.

I’ll certainly comeback.

Really no matter if someone doesn’t be aware of after

that its up to other visitors that they will assist, so here it takes place.

It’s the best time to make a few plans for the future and it is time to be happy.

I have learn this submit and if I may I desire to counsel you few fascinating things or advice.

Perhaps you could write subsequent articles referring to this article.

I wish to learn more things about it!

I’ve read some excellent stuff here. Certainly price bookmarking for revisiting.

I wonder how a lot attempt you put to make this type of excellent informative site.

You have made some good points there. I looked on the internet to learn more about

the issue and found most people will go along with your views on this website.

I every time spent my half an hour to read this

webpage’s articles every day along with a mug of coffee.

Very rapidly this website will be famous amid all blogging viewers, due to it’s fastidious posts

Its like you read my mind! You appear to know so

much about this, like you wrote the book in it or something.

I think that you could do with some pics to drive the message home a bit, but instead of that, this is magnificent blog.

An excellent read. I will definitely be back.

Nice post. I was checking continuously this weblog and I am impressed!

Extremely useful information specially the closing

section 🙂 I maintain such information a lot.

I used to be looking for this certain information for a long time.

Thank you and good luck.

Wow! Finally I got a webpage from where I know how

to actually obtain helpful data concerning my study and knowledge.

Hi there to all, how is the whole thing, I think

every one is getting more from this website, and your views

are fastidious designed for new people.

This is a topic that is near to my heart… Cheers! Exactly where are your contact details though?

Howdy, i read your blog occasionally and i own a similar

one and i was just curious if you get a lot of spam responses?

If so how do you stop it, any plugin or anything you can advise?

I get so much lately it’s driving me mad so any help is very much appreciated.

I’m amazed, I must say. Seldom do I come across a blog that’s both

equally educative and entertaining, and without a doubt, you’ve hit the nail on the head.

The problem is an issue that not enough men and women are speaking

intelligently about. Now i’m very happy that I stumbled across this during my search for something concerning this.

Hey there! I realize this is sort of off-topic but I had to ask.

Does managing a well-established website like yours require a massive amount work?

I am completely new to blogging but I do write in my journal daily.

I’d like to start a blog so I can easily share my own experience and

views online. Please let me know if you have any

ideas or tips for brand new aspiring bloggers.

Appreciate it!

I like it when people get together and share opinions.

Great blog, keep it up!

Awesome things here. I’m very glad to look your post. Thanks a lot and I am taking a look ahead to contact you.

Will you kindly drop me a e-mail?

I constantly emailed this webpage post page to all my contacts, since

if like to read it then my friends will too.

I have to thank you for the efforts you have put in writing this site.

I am hoping to view the same high-grade blog posts

by you later on as well. In truth, your creative writing abilities has motivated me

to get my own, personal website now 😉

fantastic points altogether, you simply received a emblem new reader.

What may you recommend in regards to your publish that you made a

few days in the past? Any positive?

hello!,I like your writing very so much!

proportion we keep up a correspondence more about your post on AOL?

I need an expert in this house to solve my problem.

May be that’s you! Looking forward to look you.

What’s Taking place i am new to this, I stumbled upon this I’ve found

It positively helpful and it has aided me out loads.

I am hoping to give a contribution & help different users like its aided me.

Great job.

It’s awesome for me to have a web site, which is helpful designed for

my know-how. thanks admin

I just couldn’t go away your web site prior to suggesting that

I extremely enjoyed the standard information an individual provide in your guests?

Is gonna be again ceaselessly to inspect

new posts

Greetings! Very useful advice within this post! It is the little changes that make the greatest changes.

Thanks for sharing!

What a information of un-ambiguity and preserveness

of precious familiarity on the topic of unexpected feelings.

For most recent news you have to go to see web and on world-wide-web

I found this web site as a finest website for hottest

updates.

It’s very straightforward to find out any matter on net as

compared to textbooks, as I found this paragraph at this web page.

bookmarked!!, I love your blog!

I don’t know whether it’s just me or if everyone else experiencing problems with your blog.

It appears as though some of the written text within your content are running off the screen. Can somebody else please

provide feedback and let me know if this is happening to them too?

This might be a problem with my web browser

because I’ve had this happen previously.

Thanks

I’m really impressed together with your writing abilities and also with the format in your blog.

Is that this a paid subject or did you modify it your self?

Anyway stay up the excellent quality writing, it’s rare to peer

a nice weblog like this one nowadays..

My brother recommended I may like this web site. He was once entirely right.

This submit actually made my day. You cann’t believe just how much time I had

spent for this information! Thanks!

Hello! I just would like to offer you a big thumbs up for the excellent info you

have got here on this post. I will be coming back to your

blog for more soon.

It’s an awesome post designed for all the web users; they will get benefit from it I am sure.

Hi! Do you use Twitter? I’d like to follow you if that would be okay.

I’m absolutely enjoying your blog and look forward to new updates.

What’s up, just wanted to mention, I loved this

post. It was inspiring. Keep on posting!

Excellent article. Keep posting such kind of info

on your page. Im really impressed by your site.

Hi there, You have done an excellent job. I’ll definitely digg it and personally recommend to my

friends. I am confident they will be benefited from this

web site.

Thanks for sharing your info. I truly appreciate your efforts and I am waiting for your next post

thanks once again.

Hi! I could have sworn I’ve been to this site before but

after looking at many of the articles I realized it’s new to me.

Anyways, I’m definitely happy I found it and I’ll be book-marking it and checking back frequently!

It’s genuinely very difficult in this full of activity life to listen news on TV, thus I just use internet for that reason, and get the

newest information.

I just couldn’t leave your web site prior to suggesting that I extremely enjoyed the standard information a person supply for your guests?

Is gonna be back regularly to inspect new

posts

With havin so much content and articles do you ever run into any problems of

plagorism or copyright infringement? My blog has a lot

of exclusive content I’ve either written myself or outsourced but it

seems a lot of it is popping it up all over the internet without my permission. Do you know any techniques to help stop content

from being stolen? I’d truly appreciate it.

Thanks on your marvelous posting! I certainly enjoyed reading

it, you happen to be a great author.I will remember to bookmark your blog and definitely will come back later on.

I want to encourage one to continue your great

writing, have a nice afternoon!

Howdy! Do you use Twitter? I’d like to follow you if that would be okay.

I’m absolutely enjoying your blog and look forward to new updates.

For latest news you have to pay a quick visit the web and on the web I found

this site as a most excellent web page for newest updates.

Heya! I just wanted to ask if you ever have any problems with hackers?

My last blog (wordpress) was hacked and I ended up

losing a few months of hard work due to no data backup.

Do you have any solutions to stop hackers?

I am genuinely grateful to the holder of this web page who has shared this enormous paragraph at at this time.

I like the valuable information you supply for your articles.

I’ll bookmark your weblog and check again here frequently.

I am rather sure I will be told a lot of new stuff right here!

Good luck for the next!

Hi, I do think this is a great website. I stumbledupon it 😉 I may come back

once again since I book-marked it. Money and freedom is the best way to change, may you be rich and continue to help other people.

Somebody necessarily assist to make critically posts I’d state.

That is the first time I frequented your website page and thus far?

I amazed with the analysis you made to make this particular

publish extraordinary. Great activity!

I was wondering if you ever thought of changing the page layout of your

website? Its very well written; I love what youve got to say.

But maybe you could a little more in the way of content so people could connect

with it better. Youve got an awful lot of text for only having one or two images.

Maybe you could space it out better?

Way cool! Some very valid points! I appreciate you penning

this article and also the rest of the website is very good.

Hmm it looks like your site ate my first comment (it was super long) so I guess

I’ll just sum it up what I wrote and say, I’m thoroughly enjoying your blog.

I too am an aspiring blog blogger but I’m still new to everything.

Do you have any suggestions for first-time blog writers? I’d certainly appreciate it.

If some one needs to be updated with latest technologies therefore he must be pay a visit this website and be up to date daily.

wonderful post, very informative. I wonder why the other specialists

of this sector don’t realize this. You should proceed your writing.

I am confident, you’ve a huge readers’ base already!

I am sure this article has touched all the internet

viewers, its really really good paragraph on building up new webpage.

Your mode of explaining everything in this article is genuinely

good, all be able to without difficulty know it,

Thanks a lot.

I read this article fully on the topic of the resemblance of newest

and earlier technologies, it’s remarkable

article.

I believe that is among the such a lot important information for me.

And i’m satisfied studying your article. But should observation on few basic

issues, The web site taste is great, the articles is in reality excellent : D.

Good job, cheers

Hi there, I do think your blog may be having web browser

compatibility problems. Whenever I take a look at your blog in Safari, it looks fine however when opening in IE, it’s got some overlapping issues.

I merely wanted to provide you with a quick heads up!

Besides that, fantastic website!

Hey I know this is off topic but I was wondering if you knew of any

widgets I could add to my blog that automatically tweet my newest twitter updates.

I’ve been looking for a plug-in like this for quite some time and

was hoping maybe you would have some experience with something

like this. Please let me know if you run into anything.

I truly enjoy reading your blog and I look forward to your new updates.

An interesting discussion is worth comment. I do believe that you ought to write more on this

issue, it may not be a taboo matter but generally

people do not speak about these issues. To the next!

Many thanks!!

I am regular reader, how are you everybody?

This piece of writing posted at this web site is genuinely good.

This is the right blog for anybody who hopes to find out

about this topic. You know so much its almost tough to argue with you (not that I actually would want to…HaHa).

You certainly put a fresh spin on a topic that’s been discussed for years.

Excellent stuff, just great!

If you are going for best contents like myself, simply go to

see this web page every day since it offers quality

contents, thanks

Nice post. I learn something totally new and challenging on blogs I stumbleupon every day.

It will always be exciting to read content from other writers and use a little

something from their sites.

Today, I went to the beach with my children. I found a

sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She

put the shell to her ear and screamed. There was a hermit crab inside and

it pinched her ear. She never wants to go back! LoL I know this

is completely off topic but I had to tell someone!

Incredible! This blog looks just like my old one!

It’s on a totally different topic but it has pretty much the same page

layout and design. Outstanding choice of colors!

I loved as much as you’ll receive carried out right here.

The sketch is attractive, your authored material stylish.

nonetheless, you command get bought an edginess over that you

wish be delivering the following. unwell unquestionably come more formerly

again as exactly the same nearly very often inside case you shield this increase.

Hi there! Someone in my Myspace group shared this site with

us so I came to check it out. I’m definitely enjoying the information. I’m bookmarking and will be tweeting this to my followers!

Exceptional blog and fantastic design.

This piece of writing is genuinely a good one it assists new the web visitors, who are

wishing for blogging.

Hmm is anyone else experiencing problems with the images on this blog loading?

I’m trying to find out if its a problem on my end or if it’s the blog.

Any responses would be greatly appreciated.

Very nice post. I simply stumbled upon your weblog and wanted to say that

I’ve truly loved surfing around your weblog posts.

After all I will be subscribing on your rss feed and I am hoping you

write again soon!

I like the helpful information you provide in your articles.

I’ll bookmark your weblog and check again here

regularly. I’m quite certain I will learn a lot of new stuff right here!

Good luck for the next!

I don’t even know how I ended up here, but I thought this post

was great. I don’t know who you are but definitely you’re going to a famous

blogger if you are not already 😉 Cheers!

Greetings from Los angeles! I’m bored to tears at work so I decided to check out your

site on my iphone during lunch break. I enjoy the information you provide here and

can’t wait to take a look when I get home. I’m amazed at how fast your blog loaded

on my cell phone .. I’m not even using WIFI, just 3G ..

Anyhow, great blog!

Great article. I’m dealing with some of these issues as well..

I love what you guys are up too. Such clever work and coverage!

Keep up the very good works guys I’ve you guys to blogroll.

WOW just what I was searching for. Came here by searching for forum lendir

gambar igo

You actually make it seem so easy with your presentation but I find this topic to be really something that I think

I would never understand. It seems too complicated

and extremely broad for me. I am looking forward for

your next post, I will try to get the hang of it!

Thanks on your marvelous posting! I really enjoyed reading it, you

are a great author.I will ensure that I bookmark your blog and definitely will

come back very soon. I want to encourage you to definitely continue your great work, have a nice day!

Please let me know if you’re looking for a writer for your blog.

You have some really good articles and I believe I would be a good

asset. If you ever want to take some of the load off,

I’d absolutely love to write some articles for your blog in exchange for a link

back to mine. Please blast me an e-mail if interested. Many thanks!

I’m curious to find out what blog platform you’re utilizing?

I’m experiencing some minor security issues with my latest blog

and I would like to find something more safeguarded.

Do you have any solutions?

Hi there would you mind letting me know which webhost you’re working

with? I’ve loaded your blog in 3 different browsers and I must say this blog loads a

lot faster then most. Can you suggest a good hosting provider at a

fair price? Kudos, I appreciate it!

I’m gone to tell my little brother, that he should also visit this blog on regular basis to take updated from hottest information.

Great beat ! I wish to apprentice while you amend your web site, how

could i subscribe for a blog site? The account helped me a acceptable deal.

I had been tiny bit acquainted of this your broadcast provided bright

clear idea

Hello there, just became aware of your blog through Google,

and found that it’s really informative. I am going to watch out

for brussels. I’ll appreciate if you continue this in future.

Many people will be benefited from your writing. Cheers!

This website was… how do you say it? Relevant!! Finally I’ve found something that helped me.

Kudos!

Hey I know this is off topic but I was wondering if you knew

of any widgets I could add to my blog that automatically tweet my

newest twitter updates. I’ve been looking for a plug-in like

this for quite some time and was hoping maybe you

would have some experience with something like this.

Please let me know if you run into anything. I truly enjoy reading your

blog and I look forward to your new updates.

I am sure this piece of writing has touched

all the internet users, its really really nice paragraph on building up new web site.

Hello Dear, are you truly visiting this website on a regular basis, if so

after that you will definitely take nice experience.

Hello, of course this piece of writing is genuinely fastidious

and I have learned lot of things from it concerning blogging.

thanks.

Hi there, its good paragraph concerning media print,

we all know media is a enormous source of information.

Link exchange is nothing else except it is

simply placing the other person’s weblog link on your page at

appropriate place and other person will also do same in support of you.

Have you ever considered publishing an e-book or guest authoring on other websites?

I have a blog based on the same subjects you discuss and would really like

to have you share some stories/information. I know my visitors would appreciate your work.

If you’re even remotely interested, feel free to shoot me an e-mail.

Pretty nice post. I simply stumbled upon your weblog and wished to mention that I’ve really enjoyed

browsing your weblog posts. In any case I’ll be subscribing for your rss feed and I am hoping you write again soon!

Normally I do not read post on blogs, however I wish to say

that this write-up very forced me to try and do it! Your writing taste has been surprised me.

Thank you, quite great article.

First off I would like to say excellent blog! I had a quick question that I’d like to ask if you don’t mind.

I was interested to find out how you center yourself and clear your thoughts prior to writing.

I have had difficulty clearing my mind in getting my ideas out.

I do take pleasure in writing however it just seems like the first 10 to 15 minutes are usually wasted just trying to figure out how to begin. Any suggestions or tips?

Many thanks!

Hey There. I found your weblog using msn. This is

a very smartly written article. I’ll make sure to bookmark it and come back to learn extra of your

helpful info. Thank you for the post. I will definitely comeback.

Yes! Finally someone writes about lendir abg.

I think this is among the most significant information for

me. And i’m glad reading your article. But wanna remark on some general things, The website

style is great, the articles is really nice : D. Good job,

cheers

I’ve been browsing online greater than three hours nowadays,

yet I never discovered any fascinating article like yours. It is lovely value sufficient for me.

Personally, if all website owners and bloggers made excellent content material as you did, the internet

will likely be a lot more helpful than ever before.

Good info. Lucky me I found your site by chance (stumbleupon).

I have bookmarked it for later!

Good day! I could have sworn I’ve been to this blog before but after checking through some of the post I realized

it’s new to me. Nonetheless, I’m definitely happy I found it and I’ll be book-marking and checking

back often!

Greetings! Quick question that’s totally off topic. Do you know how to make your site mobile

friendly? My weblog looks weird when viewing from my iphone4.

I’m trying to find a template or plugin that might be able

to resolve this issue. If you have any recommendations, please share.

Many thanks!

This is really interesting, You are a very skilled blogger.

I have joined your rss feed and look forward to seeking more of

your great post. Also, I’ve shared your web site in my social networks!

Hi! Do you know if they make any plugins to

protect against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any recommendations?

Definitely believe that that you said. Your favorite reason appeared

to be on the net the easiest thing to take into accout of.

I say to you, I definitely get annoyed even as other people think about worries that they plainly

do not recognise about. You managed to hit the nail

upon the top and outlined out the entire thing

without having side-effects , other people can take a signal.

Will likely be back to get more. Thanks

Thanks a lot for sharing this with all folks you really realize what you’re speaking about!

Bookmarked. Please also visit my website =). We will

have a link exchange agreement among us

Hey just wanted to give you a quick heads up. The text

in your post seem to be running off the screen in Firefox.

I’m not sure if this is a format issue or something to do with web browser compatibility but I figured I’d post to let you know.

The style and design look great though! Hope you get the problem

resolved soon. Many thanks

Everyone loves it when individuals get together and share ideas.

Great blog, keep it up!

With havin so much content and articles do you ever

run into any issues of plagorism or copyright infringement?

My site has a lot of exclusive content I’ve either

authored myself or outsourced but it seems a lot of it is popping it up all

over the internet without my agreement. Do you know any ways

to help protect against content from being stolen? I’d truly appreciate it.

I’m really enjoying the design and layout of your website.

It’s a very easy on the eyes which makes it much more pleasant for

me to come here and visit more often. Did you hire out a designer

to create your theme? Excellent work!

Pretty! This was an extremely wonderful post. Thanks for providing these details.

Thanks for a marvelous posting! I quite enjoyed reading it, you are a great author.I will be sure to bookmark your

blog and definitely will come back sometime soon. I want to encourage you

to ultimately continue your great work, have a nice evening!

Hello, i believe that i noticed you visited my weblog so i got here to go back the desire?.I’m trying to find issues to

enhance my site!I assume its adequate to make use of some of your ideas!!

Nice post. I was checking constantly this weblog and I am impressed!

Very helpful info specially the closing part 🙂

I deal with such info a lot. I was looking for this particular information for a long time.

Thank you and good luck.

Thank you ever so for you blog. Really looking forward to read more.

My website: выебал свою сестру

Thank you ever so for you blog. Really looking forward to read more.

My website: красивый анал бесплатно

A lot of blog writers nowadays yet just a few have blog posts worth spending time on reviewing.

My website: смотреть порно нарезки

Wow, marvelous weblog structure! How lengthy have you ever been blogging for?

you made running a blog look easy. The total look of your web site

is great, let alone the content material! You can see similar: sklep internetowy and

here najlepszy sklep

Hi to every body, it’s my first pay a visit of this web site; this web

site consists of awesome and actually excellent information for readers.

That is the suitable blog for anybody who wants to seek out out about this topic. You realize so much its nearly laborious to argue with you (not that I really would need匟aHa). You undoubtedly put a new spin on a topic thats been written about for years. Nice stuff, simply nice!

I’m not sure exactly why but this website is loading very slow for me.

Is anyone else having this problem or is it a issue on my end?

I’ll check back later and see if the problem still exists.

Wow, superb weblog format! How lengthy have you ever

been running a blog for? you make blogging look easy. The overall look

of your website is wonderful, let alone the content material!

You can see similar: najlepszy sklep and here dobry sklep

It’s very interesting! If you need help, look here: hitman agency

I just could not depart your site prior to suggesting that I extremely enjoyed the standard information a person provide for your visitors? Is going to be back often to check up on new posts

Hello there! I could have sworn I’ve been to your blog before but after

looking at a few of the posts I realized it’s

new to me. Nonetheless, I’m certainly happy I came

across it and I’ll be bookmarking it and checking back

often! I saw similar here: sklep internetowy and also here: sklep internetowy

I came here to explore the world of desire and seduction free adult live chat!

You could definitely see your expertise within the article you write.

The arena hopes for even more passionate writers

such as you who are not afraid to mention how they believe.

At all times go after your heart.

You actually make it seem so easy together with your presentation but

I find this matter to be really one thing which I feel I would never understand.

It seems too complicated and extremely huge for me.

I am looking forward on your subsequent publish, I’ll attempt to get the hold of it!

You made some decent points there. I looked on the web to

find out more about the issue and found most people will go along

with your views on this site.

It’s actually very complicated in this busy life to listen news on Television, so I

just use web for that purpose, and get the hottest news.

Hey there, I think your site might be having browser compatibility issues.

When I look at your blog site in Opera, it looks fine but when opening

in Internet Explorer, it has some overlapping. I just wanted to

give you a quick heads up! Other then that, fantastic

blog! I saw similar here: Sklep internetowy

Hey! Do you use Twitter? I’d like to follow you

if that would be okay. I’m definitely enjoying

your blog and look forward to new updates.

Excellent post however I was wondering if you could write a litte more on this subject?

I’d be very thankful if you could elaborate a little bit further.

Thanks! I saw similar here: Sklep online

Keep on writing, great job! I saw similar here: E-commerce

Hello! Do you know if they make any plugins to help

with Search Engine Optimization? I’m trying to get my blog

to rank for some targeted keywords but I’m not seeing very

good gains. If you know of any please share. Thanks! You can read similar blog here:

Sklep internetowy

Thanks for your publication. I also think laptop computers have gotten more and more popular currently, and now will often be the only kind of computer found in a household. The reason is that at the same time they are becoming more and more very affordable, their computing power is growing to the point where these are as robust as pc’s coming from just a few in years past.

F*ckin’ awesome things here. I’m very happy to look your post. Thank you a lot and i’m taking a look forward to contact you. Will you please drop me a mail?

Hi there! Do you know if they make any plugins to

assist with SEO? I’m trying to get my blog to rank for some targeted keywords but

I’m not seeing very good success. If you know of any please share.

Many thanks! You can read similar text here: Sklep internetowy

Thank you, I have recently been searching for information about this topic for a long time and yours is the best I’ve discovered till now. But, what in regards to the bottom line? Are you positive concerning the source?

Hello! Do you know if they make any plugins to assist with Search Engine Optimization? I’m

trying to get my blog to rank for some targeted keywords

but I’m not seeing very good success. If you know of any please share.

Cheers! You can read similar art here: Najlepszy sklep

Hi! Do you know if they make any plugins to help

with SEO? I’m trying to get my blog to rank for some

targeted keywords but I’m not seeing very good gains.

If you know of any please share. Cheers! You can read similar article here: Sklep internetowy

I visited a lot of website but I conceive this one has got something extra in it in it

Very interesting subject, appreciate it for posting.

What Is Aizen Power? Aizen Power is presented as a distinctive dietary supplement with a singular focus on addressing the root cause of smaller phalluses

Wow, incredible blog structure! How long have you been running a blog for?

you made blogging glance easy. The overall glance of your site

is wonderful, let alone the content material!

I’m gone to inform my little brother, that he should also go to see this weblog on regular basis to take updated from newest information.

Good answer back in return of this issue with firm

arguments and explaining the whole thing about that.

Its like you read my mind! You seem to know so much about this,

like you wrote the book in it or something.

I think that you could do with a few pics to drive

the message home a bit, but other than that, this is fantastic blog.

A great read. I’ll certainly be back.

Thanks for sharing excellent informations. Your website is very cool. I’m impressed by the details that you?¦ve on this website. It reveals how nicely you understand this subject. Bookmarked this website page, will come back for extra articles. You, my friend, ROCK! I found just the info I already searched all over the place and just couldn’t come across. What a great web site.

Heya i’m for the first time here. I found this board and I find It really useful & it helped me out a lot. I hope to give something back and help others like you aided me.

Touche. Solid arguments. Keep up the good spirit.

Thanks for ones marvelous posting! I genuinely enjoyed reading it, you’re a great author.I will remember to bookmark your blog and will eventually come back later in life. I want to encourage you to ultimately continue your great writing, have a nice day!

Hi, Neat post. There is an issue with your site in web explorer, may check this?

IE still is the marketplace leader and a huge portion of other people will omit

your excellent writing due to this problem.

What Is Exactly ZenCortex? ZenCortex is an optimal hearing function support

Wow, marvelous blog format! How lengthy have you been blogging for?

you made blogging look easy. The entire glance of your website is magnificent, as neatly as the content material!

You can see similar here prev next and it’s was wrote by Donnie62.

Wow, wonderful weblog structure! How lengthy have you ever been blogging for?

you make running a blog look easy. The full glance of

your website is magnificent, let alone the content!

You can see similar here prev next and that was wrote by Skye07.

Wow, superb blog structure! How lengthy have

you been running a blog for? you made running a blog look easy.

The whole look of your web site is wonderful, as well as the content!

I read similar here prev next and it’s was wrote by Marth91.

Wow, fantastic weblog layout! How lengthy have you been blogging for?

you make blogging look easy. The total glance of your site is fantastic,

as smartly as the content material! I saw similar here prev next and those was wrote by Dinorah09.

Wow, superb weblog layout! How long have you been running a

blog for? you made running a blog look easy. The entire look of your

web site is fantastic, as smartly as the content! You can see similar here prev next and those was wrote by Cheryl99.

As I website owner I think the subject matter here is real wonderful, thanks for your efforts.

Wow, amazing blog format! How lengthy have you been blogging for?

you made blogging look easy. The full look of your web site is great, as neatly as the content!

I read similar here Rico Fyj8. 2024/04/23

I simply couldn’t go away your website before suggesting that I really loved the standard information an individual provide in your visitors? Is gonna be again often to check up on new posts

Hi there! Someone in my Myspace group shared this website with us so I came to give it a look. I’m definitely enjoying the information. I’m book-marking and will be tweeting this to my followers! Wonderful blog and outstanding design and style.

Thanks a bunch for sharing this with all of us you really know what you’re talking about! Bookmarked. Please also visit my site =). We could have a link exchange arrangement between us!

I am continuously invstigating online for tips that can benefit me. Thx!

Only wanna input that you have a very decent web site, I like the style and design it really stands out.

I read this piece of writing completely about the resemblance of most up-to-date

and previous technologies, it’s amazing article.

You have remarked very interesting details ! ps decent web site.

I conceive this site holds some very good information for everyone :D. “Morality, like art, means a drawing a line someplace.” by Oscar Wilde.

FitSpresso is a weight loss supplement designed for individuals dealing with stubborn body fat.

Hey there outstanding blog! Does running a blog like this require

a lot of work? I have no expertise in coding but I was hoping to start my own blog soon. Anyway, should you have any suggestions or techniques

for new blog owners please share. I know this is off topic but I simply wanted to ask.

Cheers!

Write more, thats all I have to say. Literally, it seems

as though you relied on the video to make your point.

You definitely know what youre talking about,

why waste your intelligence on just posting videos to your blog when you could be

giving us something informative to read?

If you wish for to take a great deal from this paragraph then you have to apply such methods to your won website.

This article will help the internet users for setting

up new web site or even a weblog from start to end.

When I initially left a comment I appear to have clicked the

-Notify me when new comments are added- checkbox and from now on each time a comment

is added I recieve four emails with the exact same comment.

Perhaps there is an easy method you can remove me from that service?

Thank you!

At this time it looks like WordPress is the top blogging platform

out there right now. (from what I’ve read) Is that what you are using on your blog?

I will immediately seize your rss as I can not to find your e-mail subscription link or newsletter service. Do you have any? Please let me understand in order that I may subscribe. Thanks.

I was wondering if you ever thought of changing

the layout of your site? Its very well written; I love what youve got to say.

But maybe you could a little more in the way of

content so people could connect with it better. Youve got an awful lot of text for only

having 1 or 2 images. Maybe you could space it out better?

Having read this I thought it was really informative. I appreciate you spending

some time and effort to put this content together.

I once again find myself spending a lot of time both reading and commenting.

But so what, it was still worth it!

Hello mates, its enormous article regarding cultureand completely explained, keep it up all the time.

Woah! I’m really digging the template/theme of this site. It’s simple, yet effective. A lot of times it’s very hard to get that “perfect balance” between superb usability and appearance. I must say you’ve done a fantastic job with this. In addition, the blog loads super quick for me on Internet explorer. Excellent Blog!

Wow, marvelous blog layout! How long have you

been blogging for? you make blogging look easy. The overall look of your site is excellent, let alone the content!

Why viewers still use to read news papers when in this technological globe everything is existing on net?

Hi! I’ve been following your web site for a while now and finally got the courage to go ahead and give you a shout out from Porter

Texas! Just wanted to mention keep up the great job!

Hello! Do you know if they make any plugins to protect against hackers?

I’m kinda paranoid about losing everything I’ve worked hard on. Any suggestions?

Greetings from Los angeles! I’m bored to tears at work so

I decided to browse your site on my iphone during lunch break.

I really like the info you present here and can’t wait to take a

look when I get home. I’m shocked at how fast your blog

loaded on my mobile .. I’m not even using WIFI,

just 3G .. Anyhow, very good site!

Very good post! We are linking to this particularly great article on our

site. Keep up the good writing.

Can you tell us more about this? I’d like to find out some additional information.

I’m not sure exactly why but this blog is loading incredibly slow for me. Is anyone else having this issue or is it a issue on my end? I’ll check back later on and see if the problem still exists.

Awesome things here. I’m very happy to peer your article.

Thanks a lot and I am taking a look ahead to touch you.

Will you kindly drop me a e-mail?

There’s certainly a great deal to learn about this topic.

I love all of the points you’ve made.

If you would like to take a great deal from this piece of writing then you have to

apply such methods to your won weblog.

What Is Sugar Defender Supplement? Sugar Defender is a plant-based supplement and it helps to regulate the blood sugar levels in the body.

What is Java Burn? Java Burn, an innovative weight loss supplement, is poised to transform our perception of fat loss.

Wow, amazing blog layout! How long have you been blogging for?

you made blogging look easy. The overall look of your website is great, as well

as the content!

What is Java Burn? Java Burn, an innovative weight loss supplement, is poised to transform our perception of fat loss.

Fantastic goods from you, man. I’ve understand your stuff

previous to and you are just extremely wonderful.

I really like what you’ve acquired here, really like what you are saying and the way in which you say it.

You make it enjoyable and you still care for to keep it wise.

I can not wait to read much more from you. This is actually a wonderful website.

What a stuff of un-ambiguity and preserveness of valuable knowledge

regarding unpredicted emotions.

I am truly grateful to the owner of this site who has shared this fantastic piece of writing at here.

I love the efforts you have put in this, regards for all the great blog posts.

A motivating discussion is worth comment. I believe that

you ought to write more on this issue, it may not be a taboo subject

but usually people don’t speak about these subjects.

To the next! Best wishes!!

This design is incredible! You most certainly know how to keep a reader entertained.

Between your wit and your videos, I was almost moved to start my own blog (well,

almost…HaHa!) Great job. I really enjoyed what you had

to say, and more than that, how you presented it. Too cool!

Your blog is a wealth of information. I always learn something new from your posts. This one was particularly enlightening. Great job!blogpulse

It’s an amazing paragraph in favor of all the web people;

they will get advantage from it I am sure.

An fascinating discussion is worth comment. I believe that you need to write read more about this topic, may possibly not be described as a taboo subject but generally everyone is too few to chat on such topics. An additional. Cheers

Can I just say such a relief to find someone who in fact knows what theyre referring to online. You actually know how to bring a concern to light to make it important. More people need to check this out and understand this side in the story. I cant believe youre less popular since you certainly develop the gift.

When visiting blogs, i always look for a very nice content like yours ,

Hi. your blog is full of comments and it is very active,

you’re actually a good webmaster. The website loading speed is amazing. It sort of feels that you’re doing any unique trick. Also, The contents are masterpiece. you’ve performed a excellent process on this subject!

Thanks for having the time to write about this issue. I truly appreciate it. I’ll post a link of this entry in my site.

Hey i’m for the first time here. I came across this board and I find It seriously helpful & it helped me out much. I hope to give something back and aid others as you aided me.

There are several posts to choose from near this, I do think taking there reference could experience made this spot or article really informative. That’s not me expression this information is negative. Simply I’ve got to pronounce how the info provided here was unique, merely to make it more in close proximity to complete, supporting with former information get been actually good. The points you will enjoy touched allow me to share really important, thus I will spot some of the information here to produce this actually good for entirely the newbie’s here. Many thanks for this information. Actually helpful!

I am really enjoying the theme/design of your website. Do you ever run into any internet browser compatibility problems? A small number of my blog visitors have complained about my blog not working correctly in Explorer but looks great in Firefox. Do you have any recommendations to help fix this problem?

I am glad to be a visitant of this double dyed website! , thankyou for this rare info ! .

Truly the following information is definitely impressive it really helped me along with my children, appreciate it!

i am looking for furniture stores that offer great discount when you buy in bulk quantitites,

My husband and i were now excited that John could complete his studies with the ideas he made in your web site. It is now and again perplexing just to always be giving away instructions that many some people may have been making money from. We really discover we’ve got the blog owner to thank for this. The main illustrations you made, the simple website menu, the relationships you aid to instill – it’s got everything sensational, and it’s helping our son and our family consider that that topic is amusing, which is certainly really essential. Thanks for the whole thing!

Lovely just what I was searching for. Thanks to the author for taking his time on this one.

The the next time I read a weblog, Lets hope so it doesnt disappoint me as much as that one. What i’m saying is, I know it was my replacement for read, but When i thought youd have some thing interesting to say. All I hear is often a few whining about something that you could fix in case you werent too busy searching for attention.

This is actually intriguing, You’re an incredibly experienced author. I have joined with your feed and also anticipate finding your really great write-ups. Aside from that, We have shared the blog within our internet sites.

An intriguing discussion might be priced at comment. I think that you simply write much more about this topic, it might certainly be a taboo subject but typically folks are there are not enough to communicate in on such topics. An additional. Cheers

I truly admire everything you website in right here, highly informative and sensible. One issue, I am running Opera on Linux and some of the content are just a little wonky. I understand it’s not a popular, but it’s nonetheless something to watch out for. Just giving you a manages.

you are in reality a good webmaster. The website loading pace is incredible. It sort of feels that you’re doing any distinctive trick. Furthermore, The contents are masterwork. you’ve performed a wonderful activity on this subject!