The New Era of No-Time-Limit Prop Challenges

Mark it on your calendars – July of 2023 is the beginning of a new era of prop trading experiences.

From now on, everything we’ve known about trading challenges is about to change.

This past week, FTMO finally let go of their time limit requirements on prop challenges. (The 30-day time limit for Phase 1 and the 60-day time limit for Phase 2 are both gone)

Within a day, MyForexFunds announced that they are dropping the time limits on their challenges, as well.

[However, with relaxed rules often comes new fine print on existing rules. We’ll talk about this soon..]

Since FTMO became popular in 2020, more prop firms established themselves and used tweaks in challenge rules, pricing, and funded status perks to help compete against the FTMO reign.

My Forex Funds

FTMO

One way new prop firms made themselves more attractive than FTMO was by abolishing the time-limit requirement, a rule which can make for stressed-out and excessive risk-taking trading. Firms like Funded Trading Plus capitalized on this “no time limit” feature.

One way new prop firms made themselves more attractive than FTMO was by abolishing the time-limit requirement, a rule which can make for stressed-out and excessive risk-taking trading. Firms like Funded Trading Plus capitalized on this “no time limit” feature.

But now that FTMO has finally offered a new benefit that out-competes the smaller firms, it’s up to firms like FTP to come up with creative ways to make their prop challenges and funded accounts more attractive.

This all leads me to believe that we’re about to see a new wave of prop trading perks – perhaps in a way that genuinely funds responsible traders without setting them up with extra obstacles you wouldn’t normally see with a personal account.

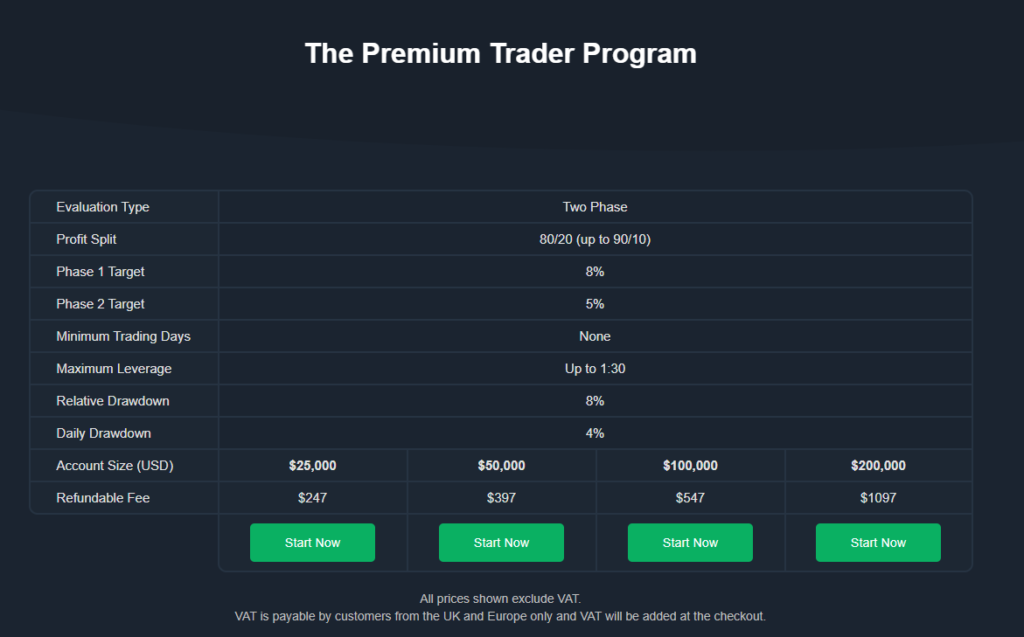

For instance, just today, Funded Trading Plus announced the release of a new trading program, the Premium Trader Program.

It’s a 2-Phase, no-time-limit challenge,

with a 8% phase-1 profit target,

a 5% phase-2 profit target,

and a bumped-up drawdown allowance of 8% overall

and 4% for the day.

The program is described as being designed with Smart Money Concepts traders in mind

[If you want a prop-firm passing, rules-based SMC strategy, check out my Scalping Course!]

They also offer one of the quickest scaling plans you can find.

Now, it may seem like this is just another MyForexFunds format, but with the introduction of no time limits, other aspects of MFF and FTMO have changed as well..

NEW FTMO AND MFF RULES

As a rule, whenever you see the announcement of relaxed prop firm rules or new perks, ALWAYS check the fine print for the addition of hurdles. The firms don’t want to make it TOO easy for you to pass..

After the announcement of the dropped time limits, I did a scan of each firm’s website to look for any new roadblocks.

It looks like MyForexFunds now has a new rule requiring at least 3 days of trading per week. This may not be a big hurdle for most day traders and scalpers, but it can be an added and unnecessary pressure for swing traders (who benefit the most from no time limits). It looks like they’re reducing the leverage on CFD’s as well (from 1:100 to 1:50).

As for FTMO, it doesn’t look like they’ve changed much, but they still have the highest profit target at 10% for Phase-1 and 5% for Phase-2. They also have strict funded account rules regarding trading around news, needing to close your position to avoid holding it over night or holding over the weekend. You can avoid these rules by switching to a “Swing Account” but you’ll need to use 1:30 leverage and the fees and missed order fills for scalping can get pretty costly.

WHICH PROP FIRM IS RIGHT FOR YOU?

Given the recent changes, here’s how I think you can strategize your best prop firm fit.

If you are a scalper: MyForexFunds or FTP (in that order)

Why?

Each has rules that can work well with scalping – you shouldn’t have to worry about meeting MFF’s 3 trading day requirement and both of these firms fill orders without hassle. I’ve had scalping trades that were loss on FTMO and MFF but hit for FTP.

If you’re a day trader: FTP or MyForex Funds (in that order)

Why?

Day trading in Forex is not like day trading in stocks. It’s a lot slower-paced and sometimes you may not even get 3 trades in a week. Also, FTMO is not on this list because many day trades can turn into overnight trades, or get triggered around a news event, so we don’t want to get caught in missing opportunities on FTMO.

If you’re a swing trader: FTMO

Why?

Now that the time limit is gone, FTMO actually offers a really great model for swing trading, as long as you use the swing trading account type.

If you’re looking to scale: FTP

Why?

MyForexFunds and FTMO both require a wait time over a period of months before you can scale. With FTP, this can be done in a day if you hit their 10% target. They have the best model for efficient scaling.

If you’re sick of challenges and want to just buy an account: FTP

Why?

They are one of the few prop firms that offers this type of account and combined with their scaling program, it can be a quick way to immediately grow and make funds off of your trading.

CONCLUSION

It will be really interesting to see how the entire prop trading industry will change now that the biggest names in the field are going without time limits. I’m looking forward to building my account portfolio with new “slow and controlled” challenges. If you’re on the same journey, I invite you to be sure to do your due diligence and I wish you the best of strength and luck with your challenges!

Pingback: Project Mancave

Pingback: ติดเน็ตบ้าน AIS

Pingback: Saphir Thailand

Pingback: ตกแต่งภายในหาดใหญ่

Pingback: เค้กดึงเงิน

Pingback: https://shbet.tours

Pingback: dultogel com

Pingback: dayz cheat

Pingback: หัวพอต Marbo

Pingback: รับทำบัญชี ภูเก็ต

Pingback: pk789

Pingback: fenix168

Pingback: free Stripchat tokens

Pingback: สล็อตออนไลน์ เว็บตรงไม่ผ่านเอเย่นต์

Pingback: เกมส์อีเว้นท์

Pingback: บาคาร่าเกาหลี

Pingback: tga168

Pingback: PGSLOT ใจดีให้ยืมเครดิตฟรี 100%

Pingback: เครื่องทำน้ำอุ่นพลังงานแสงอาทิตย์

Pingback: ชุดยูนิฟอร์ม

Pingback: slot99

Pingback: kc9

Pingback: kc9