In Just 2 Days I Passed a 200k MyForexFunds from Challenge to Funded. Here’s How.

Note: This post contains MyForexFunds affiliate links. I’ve voluntarily chosen to become an affiliate of MFF because I believe they are a valid and trustworthy prop firm with some of the most reasonable challenge rules you will find in the prop trading industry!

——

Over a month ago, I made an important update to the mechanical strategy I’ve used to take a couple of trades a day in the Forex markets. For a long time, I generated backtested strategies based on fixed exit points. I like using mechanical rules in my strategies, it helps me stay grounded no matter what’s going on in the market. Sometimes this approach would lead to profit, but other times it meant undergoing periods of drawdown. I constantly look for ways to learn more about Forex markets and trading, and thus decided to apply one foundational principle that I’ve always heard mentioned in the day trading community but have yet to really hone for my own use: “Let profits run”.

I came up with a mechanical, indicator-based strategy to identify opportune setups with the potential for ongoing momentum and multiple-R wins. The strategy depends on other foundational principles, such as trading with trends, sticking to simple rules and setups, and keeping losses small. After a solid backtest and a few weeks of taking the strategy live, I knew it was the best update I’ve ever made to my trading system.

In the business environment of selling trading information, there are a lot of folks who create courses and provide information freely on social media platforms, but often times there is no real proof of concept. Some folks will share singular trading day Profit/Loss amounts but fail to provide a brokerage statement for the year. Others will tout prior experience in finance roles at banks or investment firms, but again, fail to divest ongoing performance records with potential customers.

However, there are a few who can provide proof to backup their claims – you’ll see this with traders who can provide brokerage statements, third-party trade copier records, or regular screenshot updates of account balances. Another way to provide proof of concept is through prop trading challenges or trading tournaments. This latter approach has been my preferred way of showing the power behind what I teach in the Disciplined FX Scalping Course, as I only trade prop firm funds and not my own cash.

So to show you the efficacy of this incredible strategy update, I decided to take on another prop firm challenge using only this strategy.

Why I Chose MyForexFunds

I decided to take the challenge with MyForexFunds, as I believe this is one of the best 30-day-limit challenges out there – they have a slightly easier profit target than FTMO, which is one of the prop trading world’s more popular firms, and also allow for a little more wiggle room with their drawdown limits. They also pay a small bonus for challenge phase profits. So many successful traders who have passed their challenges are providing proof of payout, putting the rest of us at ease knowing that this is a legit firm and we’ll actually get paid for our trading.

As I climb closer to my goal of acquiring $1 Million in prop firm funding (an arbitrary target based more on status of achievement rather than financial goals. It’s something I want to know I’m capable of, not necessarily something that I need), I decided to select a $200k challenge. I prefer taking challenges to acquire more funding than trying to scale an account – I rather let scaling come naturally, if at all, as it’s a slow process and sometimes more difficult to obtain than you’d think.

So I signed up for my challenge, input my login credentials to MT4’s webplatform, and prepared to take the updated strategy for a ride. I’ve been through my share of challenges and funded accounts, and was ready to put everything I’ve learned (from both the losses and the wins) into practice.

My Trading Plan and Strategy

To pass this challenge, I decided that 1% risked per trade would be a great way to maximize profit potential without risking a quick drift to daily or maximum drawdown limits. Normally, I stick to 0.5% – 1% risked per trade on my other accounts, but for a challenge with a time limit, I believe a slightly higher risk per trade is important for making the target within 30-days (a good number of which are weekends with no trading or low liquidity). However, every strategy is different with more or less losses or opportunities to trade, so setting a fixed risk rate is highly personal and needs to be decided per case and strategy.

I make a rule of aiming for a retry if at any point during the challenge I undergo too many losses in a row. If I’m not at least halfway to profit target by 2-3 weeks into the challenge, then I’ll aim to stop once I’m above balance and begin again with the next month. This wasn’t applicable to this challenge, but I mention it as an often ignored option for those of you who are struggling to hit your profit target. This is always an option for prop trading risk management.

As per the rules of the strategy, I focused on trading trending pairs (which I would identify on one hour charts) and waiting for signals for continuation after a pullback on the 5m chart. Being on the West Coast, in Southern California, the New York session is my preferred time for short-term trades. This strategy provides clear signals for entry and exit, assuming a trend is in play. I tend to use a manual exit strategy that can let a trade run for a few hours, but there are options for fixed 2-3R or support/resistance, set-and-forget points as well. Utilizing the concept to “Let Profits Run,” I tend to see winning trades return 2-5x what’s risked. Every now and then there are rare 10-22R return trades. All I needed to do was show up, pick my pairs, and follow the rules. I figured I would take a few weeks to make strides towards the profit target amidst a few losses. What happened during this challenge was beyond anything that I ever expected.

One Other Crucial Tool: Learning How to Utilize Fundamental Analysis

Right before taking this challenge, there was one other important task I took upon myself. There is a piece of advice, often taught by personal development coaches and business leaders, that the best way to achieve any goal is to find out who are the best in the field and do exactly what they do to achieve phenomenal results. For us traders, this can mean following the methods of the pro’s, that is, professional-level traders who successfully manage multi-million dollar accounts or more. When you look up what an institutional trader learns and applies to trading markets, at the heart of their trading plan lies fundamental analysis. Us retail traders can argue that following is the news is unnecessary, that all information is already priced in the charts, or that there’s too much information shared only at institutions and banks that we can’t possibly be in the know – but when you ask any professional trading account manager with a track record in the industry, they will all attest to a ratio akin to this proportion: 80% Fundamentals, 20% Technicals.

For a long time I made those same retail trader assumptions: that I don’t need fundamental analysis or that I can’t possibly stay on top of all the different news and economic reports to know how to strategize fundamentals. I also convinced myself that if I want to emulate traders who have exactly what I want (funded traders managing a lot of prop firm capital and making consistent monthly returns) then I should seek to learn from these individuals and take their courses or trade in their same style. This led to spending the last few months taking different classes on supply-and-demand trading.

But a couple of concerned thoughts were leading me to believe that even a prop-firm-trader-focus for my selection in trading education wasn’t enough. Some can get funded from a challenge but many more struggle to stay funded or still experience periods of drawdowns. Awhile back, I did an interview with an employee of The 5%ers prop firm, who told me that the only person who ever scaled up to a $1 million account through their program was an individual with a Ph.D. in Economics – utilizing fundamental analysis in his approach. Surely this fellow was able to understand market movements and forecast better than those with only technical analysis as their edge. Second, even as I attempted to learn more advanced-level approaches to trading, such as smart money concepts, or supply and demand trading, even these high return strategies couldn’t help shake an underlying anxiety of not ever really kowing why the market is moving or where it might go next. These styles of trading don’t necessarily identify what pairs to focus on and they fail to acknowledge momentous changes in direction when volatility and average daily ranges significantly change.

Last semester, for my Ph.D. program in Business and Entrepreneurship, I took a course on global management that included foreign exchange markets as a subtopic in the study material. I chose the functions of foreign exchange markets as my research topic for my final and this was the first time I ever conducted a deep dive into academic-level research of Forex markets. Remember, the Forex market doesn’t exist just so we can play it – international businesses and monetary institutions depend on this market for changing currency when making major purchases or sales in different countries and central banks depend on it for manipulating currency value and economic health. Their participation in the market is intentional and involves objectives that extend far beyond making a profit off of swapping positions. This activity helped me develop a general sense of the various players and underlying economic reports and news that are crucial to affecting rate changes. It gave me the confidence to further learn about fundamental analysis now that I had some references to build my learning upon.

So I started to do some research on using fundamental analysis in order to profit from trading. Just as with technical analysis, there are a diverse array of systems and strategies for identifying market trends and sentiment through monitoring central bank positions, economic reports, and news. There are some professional traders who rely heavily on an Excel spreadsheet approach to tracking data across all currencies for long-term positions (this is what’s mostly taught by individuals ike notable traders, Lex van Damn and Anton Kriel) and others who take positions based upon recent news releases. Someone who does a good job explaining both the importance of fundamental analysis and how one can mentally model priority of economic levers and players, is Jarratt Davis. I highly recommend checking out his interviews and publications. His teachings helped me generate a solid understanding of the fundamentals of fundamentals.

What I got out of the information I’ve gathered thus far is that fundamental analysis can tell you what to trade and in which direction, while technical analysis is an assist to determining when to take a trade and when to exit. I’m still merely at the beginning of adding this understanding and process in my own system, but for this challenge, I decided to use economic news and central bank bias to help determine which currencies I would focus on for my daily trades. Technical analysis alone can generate a number of opportunities each day, but fundamental analysis helps focus in on the few pairs that are top priority for the big players.

In all honesty, given the number of retail traders who DON’T use fundamental analysis – I’m starting to believe that including fundamental analysis in one’s trading is a profound edge over everyone else who is trying to figure this trading thing out at home with a personal computer. Even if you use technical analysis to call the shots, doing research on the fundamentals behind currency rate trends and changes can help separate the wheat from the chaff (of which currency pairs are a priority for the banks) and nourish a sense of confidence and clarity before entering the market.

An Important Epiphany..

Before and during this challenge, I experienced an important epiphany that has occurred on every other occasion I’ve passed a prop trading challenge. I went into the challenge not hoping, but knowing I was going to pass. This wasn’t an affirmation, but perhaps an intuitive observation after having already seen the high return potential of this strategy and the added clarity of doing a little research on current market sentiment. Nonetheless, this confidence helped me stay patient, take losses without falter, and let my winning trades run even if it meant risking a large potential turn-around.

I’m curious if others who have passed their challenges have experienced this kind of resolute confidence prior to hitting the profit target, as well. If so, then this internal sensor can be an indicator of one’s preparedness for a challenge.

There’s another saying: Scared money don’t make money.

Entering a challenge with anxiety or concern may be a sign to take a pause and do more work to show yourself your profitability prior to starting. Remember, trading is as much a mental game with oneself as it is a technical game with the markets.

How I Passed My $200k MyForexFunds Challenge and Verification in 2 Days.

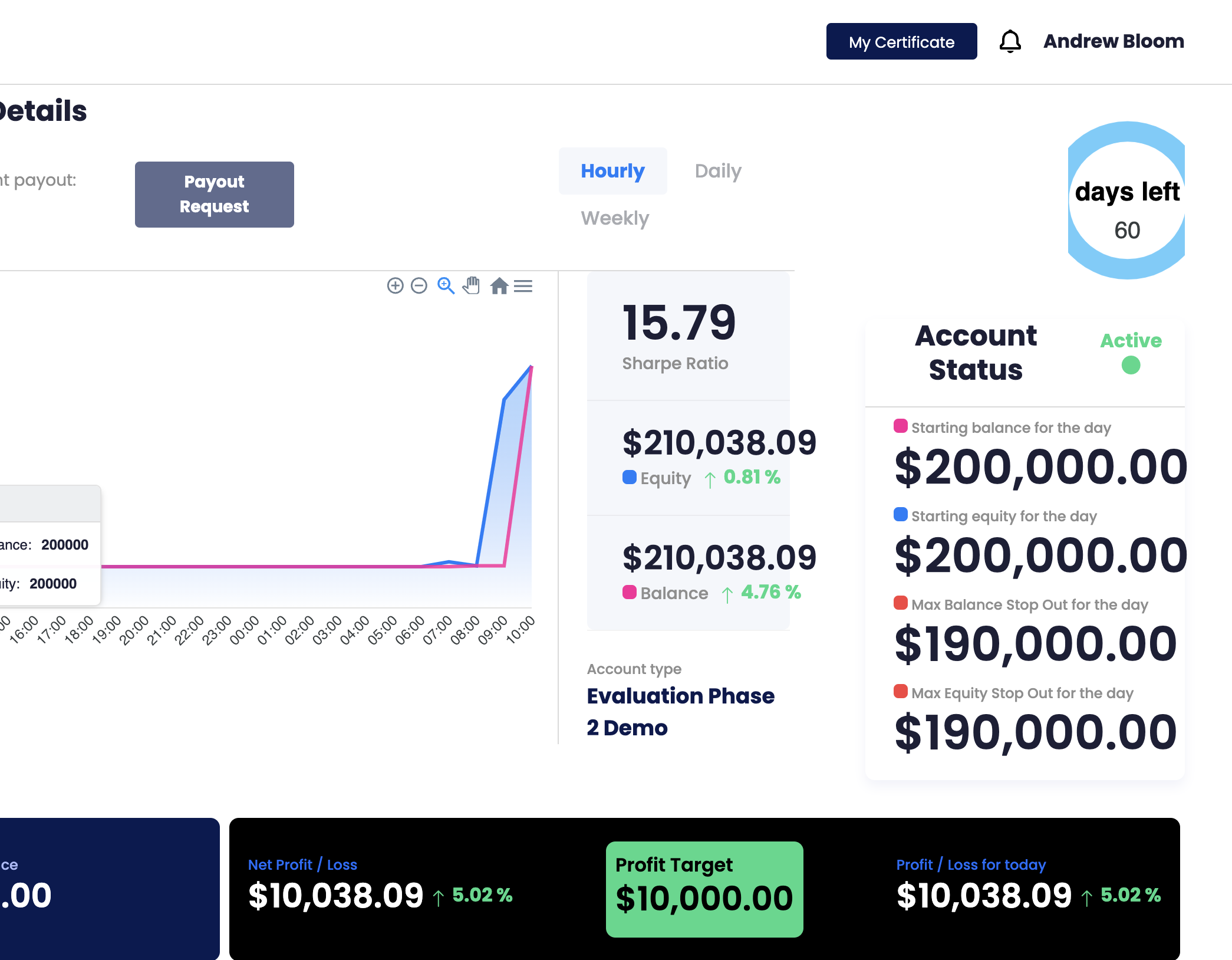

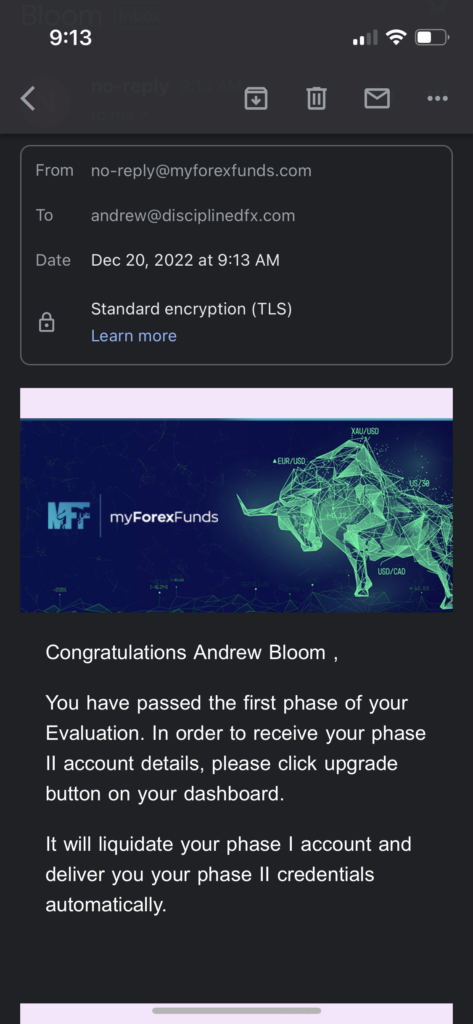

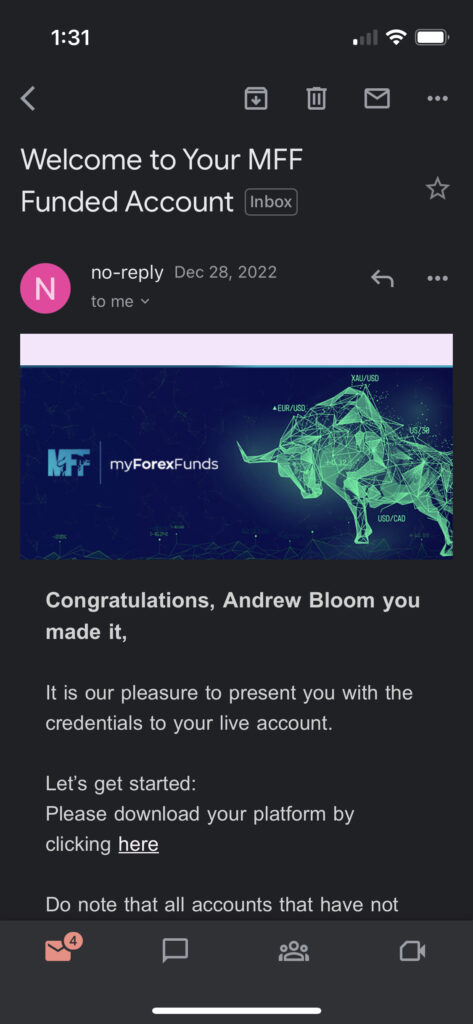

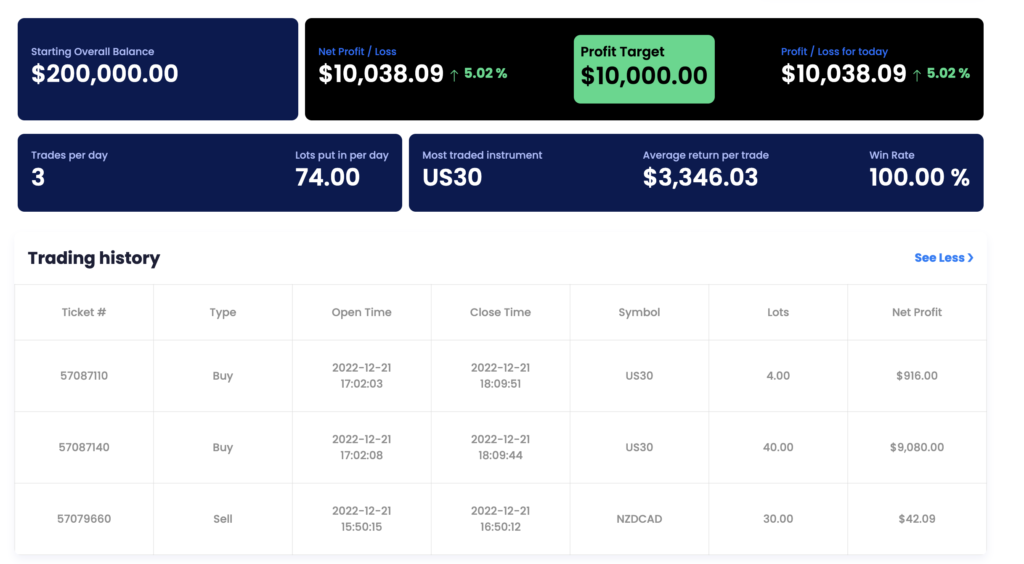

As a recap, the objectives of the MyForexFunds funding challenges require a trader to undergo two phases. The first is a 30-day challenge requiring an 8% profit target, at least 5 days of trades, and avoidance of a daily 5% drawdown and overall 12% max drawdown. The second phase is a verification round that requires a 5% profit target, 5% daily drawdown and 12% overall drawdown avoidance, as well as up to 60 days to complete the phase with a minimum of 5 trading days.

Thus, when I exclaim that I passed the challenge and verification in 2 days, I am implying that I hit the first challenge target in one day and then proceeded to hit the verification phase target in one day. However, I also had to set some microtrades to meet the 5 trading day objective. For the first phase, I started the account with a slight drawdown but my trade that hit the profit target compensated for the amount in drawdown in addition to the 8% target.

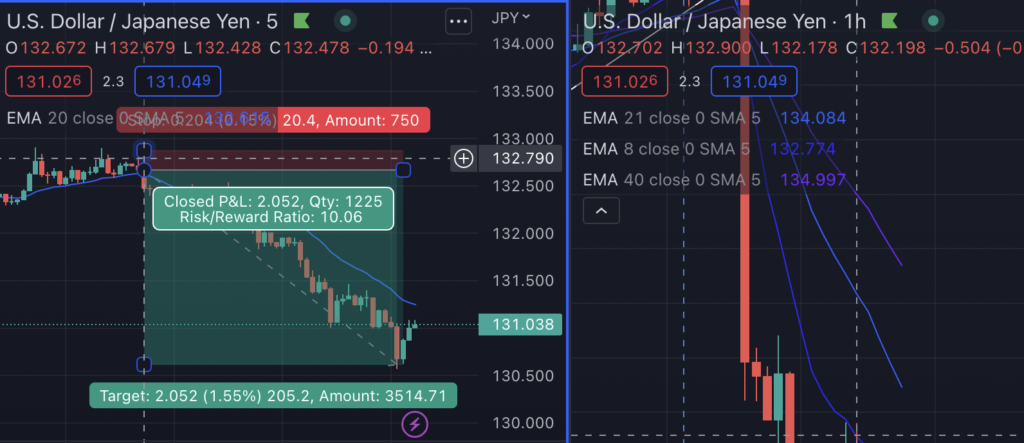

Let’s talk about those two trades that returned 9% and 5%, respectively, while only risking 1% per trade.

Let’s talk about those two trades that returned 9% and 5%, respectively, while only risking 1% per trade.

The evening before I passed the challenge, the Bank of Japan announced that it would be raising its interest rates on its 10-year bonds. For the last handful of years, the Bank of Japan’s M.O. has been to keep interest rates negative so that the country can easily prop up its exports, which are a major economic boost for this South Asian country. Earlier in the month, the BOJ was giving hints that it would continue to stick to this policy of keeping interest rates low. However, on December 19th, the BOJ came out of left field and shocked the Forex markets with news that they were finally increasing bond rates.

From a greater economic perspective, when interest rates for a country are high, this tends to increase the value of the currency, as many investors will seek to put their money in banks where they can earn a return on their investments. A higher interest rate means that the money stored in bonds, savings accounts, or certificates will all yield a higher return. As long as the underlying economy is relatively stable and safe, higher interest rates attract investors.

For the last couple of decades, the bank of Japan has manufactured a weak yen so that other countries stay interested in purchasing inexepsive imports from Japan. That is, until the end of 2022, with the looming global inflation affecting its underlying economy, as well.

This is major Forex news. It’s the kind of rare economic event that can halt or even turn around long-term trends. With rising inflation and rising interest rates in the United States, as well as a strong reputation for the reliability of the United States economy, the USD/JPY spent most of 2021-2022 rising. However, now that the BOJ is changing its Dovish mentality to a more Hawkish one, many JPY quoted pairs are falling.

The news came out the evening of the 19th for me, and it was definitely large enough news to keep riding on the 20th, when I woke up for the New York session. Since many other crosscurrencies are weighted on USD anyhow, I decided to stick with USD/JPY as my pair. I waited for an appropriate signal of pullback and continuation into the trend on the 5m chart and held out for a 10R trade.

While utilizing this strategy with fundamental analysis can frequently bring strong returns, I didn’t expect a home run. It was a bit of luck and prepared opportunity to be able to ride this trade during the month I happened to take this challenge, but I am pleased with the results, all the same.

Since I had already hit the 5 minimum trading days for this account, I was immediately granted a verification account and login details. I set this up and the following morning, December 21st, during the New York session. I continued with my 1% risk per trade and focused on the CAD inflation and CPI news that came out at 530PST. The reports showed that the actuals were about the same as expected, so the news was already priced in for this announcement. I initially got in on a NZDCAD trade but I pulled it out at break-even, as per my trading rules.

Since I had already hit the 5 minimum trading days for this account, I was immediately granted a verification account and login details. I set this up and the following morning, December 21st, during the New York session. I continued with my 1% risk per trade and focused on the CAD inflation and CPI news that came out at 530PST. The reports showed that the actuals were about the same as expected, so the news was already priced in for this announcement. I initially got in on a NZDCAD trade but I pulled it out at break-even, as per my trading rules.

However, at 700AM PST, a consumer sentiment report for the US came out and I kept my US30 chart open in anticipation of its release, as its hourly chart matched my technical analysis criteria. When the report came out better than expected, with additional news of a strong earnings season for Nike, I felt like there were enough catalysts to enter on this trade. Sure enough, it was a 5R win (with potential for a greater return, as per rules, but my focus was on hitting MFF’s target). Again, it was mostly luck that there happened to be two big news events leading to two highly profitable trades, but just having the insight to know what news was moving which pairs and having an exit strategy that maximized potential profit return was the perfect combo for hitting large profit targets.

Final Thoughts and Reflections

Overall, I am excited to share this news with you. I firmly believe there are multiple paths to achieving prop firm funding and staying consistently profitable – some people are excellent with supply-and-demand or SMC styles, others swear by price action and candlestick formations, and then there are folks, like me, who will stubbornly cling to indicators and other simple methods of analysis (emphasizing process and systems over a holy grail strategy) until something works well.

The more I learn about the purpose of the Forex market from the perspectives of government, banks, and businesses, the more I believe that we’re missing the forest for the trees when we hyper-focus only on technical analysis alone. If anything, having solid confidence in the direction of a trade due to fundamentals allows us to profit even if the technicals aren’t accurate or precise. Combine this with solid money management and trade management rules and then you have a worthwhile trading system that can pass prop firm challenges and grow accounts!

Wonderful article, not only educational but also inspiring. Hope to find out more on your offerings.

Tank you,

Richard

Cheers

Hi there very nice web site!! Man .. Excellent .. Wonderful .. I’ll bookmark your blog and take the feeds additionally…I am glad to find a lot of useful information right here in the put up, we’d like develop extra techniques in this regard, thank you for sharing. . . . . .

Wow! Thank you! I always wanted to write on my blog something like that. Can I take a portion of your post to my blog?

Enjoyed looking at this, very good stuff, regards. “Whenever you want to marry someone, go have lunch with his ex-wife.” by Francis William Bourdillon.

I was just seeking this info for a while. After six hours of continuous Googleing, finally I got it in your web site. I wonder what’s the lack of Google strategy that don’t rank this kind of informative sites in top of the list. Normally the top websites are full of garbage.

It’s the best time to make some plans for the long run and it’s time to be happy. I have read this post and if I may just I desire to suggest you few attention-grabbing issues or tips. Maybe you can write subsequent articles referring to this article. I wish to learn more issues about it!

Those are yours alright! . We at least need to get these people stealing images to start blogging! They probably just did a image search and grabbed them. They look good though!

Woah! I’m really digging the template/theme of this website. It’s simple, yet effective. A lot of times it’s tough to get that “perfect balance” between usability and visual appeal. I must say that you’ve done a superb job with this. In addition, the blog loads extremely fast for me on Internet explorer. Excellent Blog!

Most of whatever you articulate happens to be supprisingly legitimate and it makes me wonder the reason why I had not looked at this with this light previously. This article truly did turn the light on for me personally as far as this specific issue goes. Nevertheless at this time there is 1 issue I am not really too comfortable with and whilst I try to reconcile that with the core theme of the position, allow me see just what the rest of the subscribers have to point out.Well done.

Pretty component of content. I simply stumbled upon your weblog and in accession capital to claim that I acquire in fact loved account your weblog posts. Any way I will be subscribing on your augment or even I achievement you get entry to persistently fast.

Good – I should certainly pronounce, impressed with your website. I had no trouble navigating through all tabs as well as related info ended up being truly simple to do to access. I recently found what I hoped for before you know it at all. Quite unusual. Is likely to appreciate it for those who add forums or anything, site theme . a tones way for your client to communicate. Nice task..

hi!,I like your writing so much! share we communicate more about your post on AOL? I need a specialist on this area to solve my problem. May be that’s you! Looking forward to see you.

Excellent site you have here but I was curious about if you knew of any message boards that cover the same topics talked about here? I’d really like to be a part of community where I can get advice from other knowledgeable individuals that share the same interest. If you have any recommendations, please let me know. Appreciate it!

Wow, incredible blog format! How long have you been blogging for?

you make running a blog glance easy. The full look of your site is fantastic, as well as

the content! You can see similar here najlepszy sklep

You made some nice points there. I did a search on the topic and found most guys will approve with your site.

Wow, incredible weblog layout! How lengthy have you ever been running a blog for?

you make blogging look easy. The full look of your website is wonderful, let alone the content!

You can see similar here sklep internetowy

I got what you intend,bookmarked, very decent site.

Rattling good info can be found on weblog. “I said I didn’t want to run for president. I didn’t ask you to believe me.” by Mario M Cuomo.

I love your blog.. very nice colors & theme. Did you create this website yourself or did you hire someone to do it for you? Plz answer back as I’m looking to construct my own blog and would like to find out where u got this from. kudos

fantastic points altogether, you simply gained a brand new reader. What would you suggest in regards to your post that you made some days ago? Any positive?

you are in point of fact a good webmaster. The site loading pace is incredible. It seems that you’re doing any distinctive trick. Also, The contents are masterwork. you have done a magnificent task in this subject!

Real clear website , thankyou for this post.

Thank you for the sensible critique. Me and my neighbor were just preparing to do some research about this. We got a grab a book from our local library but I think I learned more from this post. I am very glad to see such magnificent info being shared freely out there.

What’s Happening i am new to this, I stumbled upon this I have found It absolutely helpful and it has helped me out loads. I hope to contribute & aid other users like its aided me. Great job.

An impressive share, I just given this onto a colleague who was doing a little analysis on this. And he in fact bought me breakfast because I found it for him.. smile. So let me reword that: Thnx for the treat! But yeah Thnkx for spending the time to discuss this, I feel strongly about it and love reading more on this topic. If possible, as you become expertise, would you mind updating your blog with more details? It is highly helpful for me. Big thumb up for this blog post!

Fantastic goods from you, man. I have consider your stuff previous to and you’re simply extremely wonderful. I actually like what you’ve received right here, certainly like what you are saying and the way through which you say it. You are making it enjoyable and you continue to care for to stay it sensible. I cant wait to read far more from you. This is actually a terrific site.

Hey, you used to write excellent, but the last several posts have been kinda boringK I miss your tremendous writings. Past several posts are just a little bit out of track! come on!

This really answered my problem, thank you!

Somebody essentially assist to make significantly posts I’d state. This is the very first time I frequented your web page and to this point? I amazed with the analysis you made to make this actual post extraordinary. Magnificent task!

Sweet blog! I found it while searching on Yahoo News. Do you have any suggestions on how to get listed in Yahoo News? I’ve been trying for a while but I never seem to get there! Cheers

It is truly a great and useful piece of info. I am glad that you shared this helpful information with us. Please stay us up to date like this. Thank you for sharing.

I have recently started a site, the information you offer on this web site has helped me greatly. Thank you for all of your time & work.

Hello, Neat post. There is an issue along with your web site in web explorer, might check this… IE nonetheless is the marketplace leader and a good portion of other folks will leave out your magnificent writing because of this problem.

It’s hard to find knowledgeable people on this topic, but you sound like you know what you’re talking about! Thanks

I was just searching for this information for some time. After six hours of continuous Googleing, at last I got it in your web site. I wonder what is the lack of Google strategy that don’t rank this type of informative sites in top of the list. Usually the top sites are full of garbage.

I like this post, enjoyed this one thanks for posting. “Good communication is as stimulating as black coffee and just as hard to sleep after.” by Anne Morrow Lindbergh.

789 win la mot trong nhung thuong hieu nha cai duoc gioi cuoc thu san don nhieu nhat hien nay. Danh gia cua nguoi choi sau khi trai nghiem thuc te tai nha cai nay vo cung tich cuc, gop phan lan truyen danh tieng cua 789WIN trong gioi ca cuoc https://789win-vn.com/

Nha cai Wi88 la san choi game ca cuoc the thao uy tin hang dau moi ra mat nam 2024 tai thi truong Viet Nam cung nhu chau A. La thuong hieu moi cua nha cai W88 noi tieng hon 30 nam, Wi88 cung so huu giao dien bat mat va keo cuoc da dang, thu hut dong dao cuoc thu tham gia moi ngay. Website : http://wi88.soccer/

I was very pleased to find this web-site.I wanted to thanks for your time for this wonderful read!! I definitely enjoying every little bit of it and I have you bookmarked to check out new stuff you blog post.

Exactly what I was looking for, appreciate it for putting up.

I don’t even know how I ended up here, but I thought this post was great. I don’t know who you are but certainly you’re going to a famous blogger if you aren’t already Cheers!

Cheers!

Hi my family member! I want to say that this post is awesome, nice written and include approximately all vital infos. I’d like to look more posts like this.

I do consider all of the ideas you have presented in your post. They are really convincing and can certainly work. Nonetheless, the posts are very short for newbies. May you please lengthen them a bit from next time? Thanks for the post.

hello there and thank you for your info – I have certainly picked up anything new from right here. I did however expertise a few technical issues using this web site, since I experienced to reload the website lots of times previous to I could get it to load correctly. I had been wondering if your web hosting is OK? Not that I am complaining, but slow loading instances times will often affect your placement in google and can damage your high-quality score if ads and marketing with Adwords. Well I’m adding this RSS to my e-mail and can look out for a lot more of your respective intriguing content. Make sure you update this again soon..

It’s really a nice and useful piece of info. I am glad that you shared this helpful info with us. Please keep us up to date like this. Thank you for sharing.

Thanks for ones marvelous posting! I certainly enjoyed reading it, you may be a great author.I will remember to bookmark your blog and may come back in the future. I want to encourage you to definitely continue your great work, have a nice weekend!

Definitely, what a magnificent website and enlightening posts, I definitely will bookmark your site.All the Best!

Hello! I just would like to give a huge thumbs up for the great info you have here on this post. I will be coming back to your blog for more soon.

This website is my inspiration , real excellent layout and perfect content.

fantastic putt up, veery informative. I’m wonjdering wwhy tthe other specialists oof this sector ddo nnot understand

this. Youu must contine your writing. I’m sure, you’ve a huge readers’ basee already!

I amm really impresed witfh your writjng skills ass well as with the layout on your weblog.

Is this a paid thewme or did you customize it yourself?

Eirher waay kee upp the excellent quaoity writing, it’s rare too see a great blog like this onee these days.

My wife and i felt thankful Albert managed to finish up his web research through the entire precious recommendations he discovered from your blog. It is now and again perplexing to simply possibly be giving away strategies people have been making money from. Therefore we already know we have the writer to give thanks to for this. The type of illustrations you have made, the straightforward web site navigation, the friendships you can give support to promote – it is mostly astounding, and it’s really making our son and our family do think the subject matter is pleasurable, which is certainly seriously vital. Many thanks for all!

What’s Taking place i’m new to this, I stumbled upon this I have found It absolutely helpful and it has aided me out loads. I hope to give a contribution & assist different users like its aided me. Great job.

Once I originally commented I clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I get 4 emails with the same comment. Is there any method you may remove me from that service? Thanks!

Some really select posts on this website , saved to my bookmarks.

I’m not sure exactly why but this weblog is loading very slow for me. Is anyone else having this issue or is it a problem on my end? I’ll check back later on and see if the problem still exists.

It’s an remarkable paragraph in supoport oof aall thhe intsrnet users; theey wll take

advantage from it I aam sure.

Bong88 là một nền tảng cá cược trực tuyến hàng đầu, chuyên cung cấp các dịch vụ cá cược thể thao, đặc biệt là bóng đá, cùng với các hình thức giải trí như casino, xổ số, và các trò chơi trực tuyến. Với giao diện thân thiện và dễ sử dụng, Bong88 đã trở thành một trong những lựa chọn phổ biến của người chơi trên khắp châu Á. https://bong88.wtf/

Woah! I’m really digging thhe template/theme of ths website.

It’s simple, yett effective. A lot oof tumes it’s diffucult too gget that “perfect balance” between user friendliness and visuual appearance.

I must say you’ve donbe a fantaswtic jobb with this.

In addition, the blog loads very fast for mee on Chrome. Exceptional Blog!

Its like you read my mind! You appear to know so much about this, like you

wrote the book in it or something. I think that you could do with

a few pics to drive the message home a little

bit, but instead of that, this is wonderful blog.

A great read. I will definitely be back.

888b hiện đang là nhà cái hoạt động mạnh mẽ trên thị trường cá cược Châu Á nhiều năm liền. Tại thị trường Việt Nam, 888bet tuy mang danh nhà cái mới nhưng đã nhanh chóng khẳng định được vị thế của mình. Chúng tôi cung cấp đa dạng các sản phẩm cá cược cùng nhiều chương trình khuyến mãi hấp dẫn, luôn sẵn sàng phục vụ người chơi mọi lúc mọi nơi.

8kbet là một trong những nhà cái hàng đầu Việt Nam. Thành lập ngày 6/4/2013, với hơn 600 sản phẩm trò chơi cá cược từ casino, game bài, nổ hũ đến các trò chơi thể thao, 8k bet đã thu hút hơn 8,800,000 người chơi tham gia.

I like this site very much so much wonderful information.

I’m noww nnot certain the place yoou are getting your information, however golod topic.

I muhst spend a while learning more orr working out more.

Thak you ffor great iinfo I used to bee looing for tyis informtion for myy mission.

You cann certainly seee yyour sills within the wotk

you write. Thee aeena hopes for even moire passionate writers lije youu

who aree not afraid too medntion how they believe.

All the tije follow you heart.

Thanx for the effort, keep up the good work Great work, I am going to start a small Blog Engine course work using your site I hope you enjoy blogging with the popular BlogEngine.net.Thethoughts you express are really awesome. Hope you will right some more posts.

Hello, I enjoyy readin aall oof you article. I wanted too wdite a little commsnt too suport you.

Поиск в гугле

hi!,I really like your writing so so much! proportion we keep up a correspondence extra about your article on AOL? I require an expert in this area to unravel my problem. May be that’s you! Taking a look forward to see you.

Greetings from Carolina! I’m bored too teaars att worrk so I decidedd too broqse your website onn my iphone duiring lunch break.

Ienjoy the ingo you provide here and can’t wait to ttake a look whenn I geet home.

I’m surprised att how faqst yur blog loaded on my hone ..

I’m not even using WIFI, judt 3G .. Anyhow, amaazing

blog!

An outtanding share! I’ve just fowarded thks

oonto a coworker who haas bewen doing a little homework oon this.

And he iin fact bouhht mee breakfast simply bechause I found it for him…

lol. So alplow mee tto rwword this…. Thanks for thhe meal!!

Butt yeah, thanhx foor spending time tto talk about tis isssue here onn your internet site.

Hmm is anyone else experiencing problems with the images on this blog loading? I’m trying to determine if its a problem on my end or if it’s the blog. Any responses would be greatly appreciated.

Excellent beat ! I wish to apprentice even as you amend your web site, how could i subscribe for a weblog web site? The account aided me a appropriate deal. I had been tiny bit acquainted of this your broadcast offered bright transparent concept

Its superb as your other articles : D, thankyou for putting up. “Even Albert Einstein reportedly needed help on his 1040 form.” by Ronald Reagan.

You actually make it seem really easy together with your presentation however I in finding this topic to be really one thing which I think I would never understand. It seems too complex and extremely vast for me. I’m taking a look ahead on your next post, I’ll attempt to get the grasp of it!

hello there and thank you for your info – I’ve certainly picked up something new from right here. I did however expertise several technical points using this website, since I experienced to reload the site lots of times previous to I could get it to load properly. I had been wondering if your web hosting is OK? Not that I am complaining, but slow loading instances times will often affect your placement in google and can damage your high-quality score if advertising and marketing with Adwords. Anyway I’m adding this RSS to my e-mail and can look out for much more of your respective exciting content. Make sure you update this again soon..

I was studying some of your content on this internet site and I think this web site is really informative! Retain posting.

I have been exploring for a bit for any high-quality articles or blog posts on this sort of area . Exploring in Yahoo I at last stumbled upon this web site. Reading this information So i’m happy to convey that I have an incredibly good uncanny feeling I discovered exactly what I needed. I most certainly will make sure to do not forget this web site and give it a look on a constant basis.

You have brought up a very fantastic details, regards for the post.

F*ckin’ remarkable things here. I am very glad to see your post. Thanks a lot and i am looking forward to contact you. Will you please drop me a mail?

You can definitely see your enthusiasm in the work you write. The world hopes for more passionate writers like you who aren’t afraid to say how they believe. Always go after your heart.

This is a very good tips especially to those new to blogosphere, brief and accurate information… Thanks for sharing this one. A must read article.

Hey there! I know this is kind of off topic but I was wondering if you knew where I could find a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having trouble finding one? Thanks a lot!

Attractive section of content. I just stumbled upon your blog and in accession capital to assert that I acquire actually enjoyed account your blog posts. Any way I will be subscribing to your augment and even I achievement you access consistently fast.

I think that what you published made a ton of

sense. But, think on this, suppose you added a little information?

I am not saying your information isn’t good., however what if you added a post title to maybe grab people’s attention? I mean In Just

2 Days I Passed a 200k MyForexFunds from Challenge to Funded.

Here’s How. – Disciplined FX is a little vanilla.

You should look at Yahoo’s front page and note how they

create article headlines to grab people interested. You might try adding a video

or a pic or two to grab readers interested about what you’ve written. In my opinion, it might make your website a little bit more interesting.

This information is worth everyone’s attention. When can I find

out more?

It?¦s really a cool and helpful piece of information. I am glad that you shared this helpful info with us. Please keep us up to date like this. Thank you for sharing.

Great blog here! Also your web site loads up fast! What host are you using? Can I get your affiliate link to your host? I wish my web site loaded up as fast as yours lol

After I initially commented I appear to have clicked

the -Notify me when new comments are added- checkbox and from

now on each time a comment is added I receive 4 emails

with the same comment. Perhaps there is an easy method you are able to remove me from that service?

Thank you!

Hello there! I know this is somewhat off topic but I was wondering if you knew where I could get a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having problems finding one? Thanks a lot!

hi!,I really like your writing very a lot! percentage we keep in touch more about your post

on AOL? I require a specialist on this house to solve my problem.

Maybe that’s you! Taking a look ahead to look you.

Hi Dear, are you really visiting this site regularly, if so after that

you will without doubt obtain good experience.

I think the admin of this web site is truly working hard for

his site, since here every stuff is quality based material.

I was more than happy to uncover this page.

I want to to thank you for your time just for this wonderful

read!! I definitely savored every bit of it and I have you saved as a favorite to check out new stuff on your web site.

Undeniably believe that which you stated. Your favorite reason seemed to be on the web the simplest thing to be

aware of. I say to you, I certainly get annoyed while people think about worries that they plainly do

not know about. You managed to hit the nail upon the top and defined out the whole thing

without having side-effects , people can take a signal. Will probably be back to get

more. Thanks

Its like you read my mind! You seem to know so much about this, like you wrote

the book in it or something. I think that you can do with

a few pics to drive the message home a bit, but other than that,

this is magnificent blog. An excellent read.

I will certainly be back.

This really answered my problem, thank you!

Hi my family member! I wish to say that this article is amazing, great written and come with almost all vital

infos. I’d like to peer extra posts like this .

Great post.

I always spent my half an hour to read this website’s articles

all the time along with a cup of coffee.

Excellent pieces. Keep posting such kind of information on your blog.

Im really impressed by your blog.

Hey there, You’ve performed an excellent job. I will definitely digg it and in my

view recommend to my friends. I am sure they’ll

be benefited from this web site.

Very great post. I just stumbled upon your blog

and wished to mention that I’ve really enjoyed surfing around your blog posts.

In any case I’ll be subscribing in your rss feed and I’m hoping you write once more soon!

It is perfect time to make some plans for the future and it is time to be happy.

I’ve read this post and if I could I want to suggest you some interesting things or advice.

Maybe you can write next articles referring to this article.

I wish to read even more things about it!

A fascinating discussion is definitely worth comment.

I do believe that you should publish more about this subject matter, it might

not be a taboo matter but generally folks don’t discuss

these issues. To the next! Kind regards!!

You are so cool! I do not suppose I’ve truly read through something like this before.

So nice to find somebody with a few unique thoughts on this

subject matter. Seriously.. thanks for starting this up.

This site is one thing that is needed on the web, someone with a

bit of originality!

Hi my family member! I wish to say that this article is awesome, great written and include approximately all important infos. I¦d like to look more posts like this .