I Passed the FTMO Challenge – Again!

I’m excited to share with you all today that it happened again!

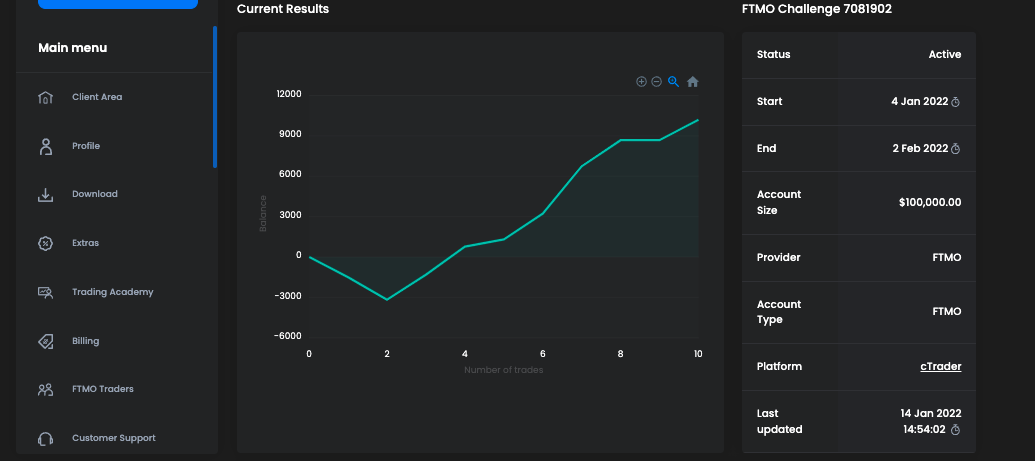

I passed a second FTMO challenge – this time with a 100k account, using only the Discipline FX Scalping Strategy as taught in the Disciplined FX Scalping Strategy Course.

I was able to pass a challenge with 10 trades over 7 days using a mechanical strategy. This strategy had an 80% win rate and returns 1.4 times your risk for each winning trade.

This challenge was a free retry after deciding to wait on last month’s challenge as my strategy took an unexpected dip and with the holidays approaching, I didn’t want to chance it turning around.

So let’s go over some stats of this experience:

- There were 10 trades one of which was a mistake trade that got a little profit on another was just to capture a trading day – so really there were eight trades.

- The average profit was about $1672 and the average loss was $1588

- I took a couple of trades with E/J but basically, almost every single trade was with the A/U

Now, these were all scalping trades. I don’t think there was a single trade that returned more than maybe 16 pips – and while that may seem like nothing, and it may seem like that it must be on a 1m chart or 5m chart, this was actually on a 15m chart and these trades could sometimes last as few as 10 minutes or as long as a couple of hours.

That’s actually why I like Forex – it’s a slower-paced market compared to waking up and scalping stocks

Let’s talk about risk

<< Want to use the same resources that helped me learn how to trade and build discipline? Check out the FREE PDF of the Disciplined FX Syllabus!>>

As with my last challenge that I passed, I used a variation in risk as the account increased.

So I started out with a 1.4 percent risk per trade. Once I hit that three percent gain mark, I bumped it up to two percent, and then for one trade, I took a 2.5 percent risk for that trade. since that got me up close to the profit target, I then decided to dial it back down to 1.4 risk in case there would be losses so that I can stay up in this profit range.

And then for my last trade, I took 1.1 percent risk on that trade where if I hadn’t won that trade I could go back to risking maybe something up to 2% where I wouldn’t feel uncomfortable in taking that risk because I had already risked those percentages before.

So it kept me in a comfy zone where, knowing my stats about this trade, I know it’s has a higher win rate than a higher return so I was willing to take a bet that within three trades I’d be able to hit the profit target so by risking less as I got closer I would just keep re-measuring how much money do I need to hit target and risk according to that 1.4 ratio return.

Prop Trading Psychology

This is a huge part of what will lead you able to stick with a risk management strategy or your trading strategy and I will say every time I take a challenge, while my discipline’s rock-solid, I have my moments. It is so easy to want to move take profit targets or take out a trade early to be sure to capture a win. That’s the one inconsistency that I run into when prop trading, although it didn’t happen this time.

I think going in with a strategy that has a high win rate helped to appease some of the anxiety around trading for a challenge that has a time limit.

Now if I was trading something like five percenters or a new firm which I’m going to tell you all about, called funded traders plus, these two have very realistic time limits on taking the challenge, I’d have stuck to a certain risk percent, like 0.5 or 0.75%. These longer-term challenge models are less stressful.

Let’s Talk About Risk Management Models

So I have 3 that I want to share with you. I’ve used them all before for different accounts, strategies, and challenges.

Steady

it’s basically as it sounds – you’re using the same percent risk per trade on every trade. if you’re trading something more short-term, like FTMO, you might have to bump this up a bit to make sure you hit that profit target – it could be taking 1% per trade or 1.5% per trade, or 2% per trade.

It helps to know the stats of your strategy. This is why I like mechanical strategies because I can pull so much data from them than discretionary ones. Because with discretionary trading, you never know if you’re not going to take the trade when it comes down to game time.

So at least with mechanical strategies, I can run many different stats on them (What days of the week perform better than others, what % likelihood a trade will turn around and profit after starting out in deficit, etc.)- I think some of you guys know I’m a Ph.D. student (so researching variables is my bread and butter)!

So if you know your drawdown, as well as an average return for the month, you can adjust your risk per trade to fit your strategy, while also being mindful of the 5% daily drawdown, 10% total drawdown, and the 10% target that you need to hit so that could end up being 1-2% risk per trade.

Scaled

The second approach is a scaled model – this is what I use for this challenge where you might want to designate something like a low, medium, and high risk.

I started out with what I consider medium: 1.4% per trade.

Once I hit that 3% target getting into this profitable zone, I bumped it up to two percent and I was willing, if the balance went down, to go back to 1.4% risk per trade.

And if it went under, such as going into a significant drawdown, like down 5%, I would consider going down to 1% risk per trade or less.

Such was not the case – Instead, the count continued to grow. Once I got into that middle zone of over 5% return, I was willing to take a 2.5% risk on that next trade – it ended up being a win and that bumped me up close to the profit target.

That’s when I moved down to a low risk, so that was back to 1.4% and then after that trade, I just kept measuring how much money I needed to hit the profit target. Then I would risk accordingly. (Target – current balance –> divide by 1.4, and that’s what I’d risk on the next trade [this was usually under 1.4%])

<< WANT TO TRY IT FOR YOURSELF? Feel free to use my FTMO affiliate link >>

Market Dependent Model

The last model I’ll name here is what I’m going to call the market-dependent model of risking according to what you see.

So this would be better for someone who is using a discretionary strategy or knows enough about their mechanical strategy to say how it performs in different types of markets.

If it’s a more volatile market you may want to risk more or less depending on what you see and how your strategy performs in that kind of market.

I think this last approach is what professional traders usually use, (but then again they aren’t necessarily trading for a challenge)

So any of these three models can work – there’s no one good choice.

you have to know what works for your strategy – this is why I highly recommend backtesting to really get to know what your strategy is. Define the parameters of your strategy instead of saying you’ll just trade triangles. Get to know stats by backtesting.

To sum this up, the next step for me is verification. That has a 5% target instead of 10%. I’ll probably risk the same way I’m risking now with the scaled model – but maybe dial it back a bit. I could also take the full 60 days and just take a steady, small percent risk per trade.

If I pass that too, then going into a funded account I am planning on risking tiny and I’m expecting tiny targets.

I will be happy to stop trading for the month once I hit a 3% return.

but that will be for a later post. For now, I’m happy to celebrate this win and share it with you!

Pingback: Funded Trading Plus - Pros and Cons - Disciplined FX

Pingback: How to Create a Trading Plan: The Definitive Guide - Disciplined FX

Very good info. Lucky me I found your blog by accident (stumbleupon). I have book-marked it for later!

You’ve made some good points there. I checked on the web to find out more about the issue and found most individuals will go along with your views on this web site.

You deserve to be treated with dignity and respect, and so does your partner. Expect intimacy and passion

Awesome site you have here but I was curious if you knew of any message boards that cover the same topics talked about in this article? I’d really like to be a part of community where I can get responses from other experienced people that share the same interest. If you have any suggestions, please let me know. Bless you!

hi!,I like your writing very so much! proportion we keep up

a correspondence more approximately your article on AOL?

I require a specialist on this space to unravel my problem.

Maybe that is you! Looking ahead to look you.

Hi, I think your website might be having browser compatibility

issues. When I look at your website in Opera, it looks fine but when opening in Internet Explorer, it has some overlapping.

I just wanted to give you a quick heads up! Other then that, fantastic blog!

It’s an remarkable piece of writing designed for

all the online viewers; they will take benefit from it I am sure.

What’s up everyone, it’s my first visit at this website, and

paragraph is actually fruitful in favor of me, keep up posting these types of articles.

After I originally commented I appear to have clicked the -Notify me when new comments are added- checkbox

and from now on every time a comment is added I recieve four emails with the same comment.

Perhaps there is a way you are able to remove me from that service?

Cheers!

I visited many web sites except the audio quality

for audio songs existing at this website is really marvelous.

Fabulous, what a webpage it is! This webpage presents useful information to

us, keep it up.

I really like what you guys are usually up too. This sort

of clever work and exposure! Keep up the amazing works guys I’ve added you guys to my personal blogroll.

Wonderful, what a web site it is! This website provides valuable information to

us, keep it up.

Thanks for some other great post. Where else could anybody get that kind of information in such an ideal method of writing?

I have a presentation subsequent week, and

I’m at the search for such info.

Hi Dear, are you genuinely visiting this web site regularly, if so then you

will without doubt take good know-how.

What’s up it’s me, I am also visiting this site regularly, this web page is truly pleasant

and the users are actually sharing nice thoughts.

Hello there! This post could not be written any better!

Reading this post reminds me of my previous room mate! He always kept talking about this.

I will forward this article to him. Fairly certain he will have a good read.

Thank you for sharing!

Thank you, I have recently been looking for info

about this subject for a while and yours is the greatest I have came upon till now.

However, what in regards to the conclusion? Are you certain about the supply?

When I originally commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get several e-mails with the same

comment. Is there any way you can remove people from that service?

Thanks a lot!

What’s up i am kavin, its my first occasion to commenting anyplace, when i

read this paragraph i thought i could also create comment due

to this sensible paragraph.

Whats up this is somewhat of off topic but I was wanting to know if blogs

use WYSIWYG editors or if you have to manually code with HTML.

I’m starting a blog soon but have no coding skills

so I wanted to get guidance from someone with experience.

Any help would be greatly appreciated!

Does your site have a contact page? I’m having a

tough time locating it but, I’d like to send you an email.

I’ve got some creative ideas for your blog you might be interested in hearing.

Either way, great site and I look forward to seeing it develop over time.

Piece of writing writing is also a fun, if you be acquainted

with afterward you can write if not it is difficult to write.

I’m extremely impressed with your writing skills and

also with the layout on your blog. Is this a paid theme or did you customize it yourself?

Anyway keep up the excellent quality writing, it is rare to see a great blog like this one these days.

I read this piece of writing completely concerning the comparison of most up-to-date and earlier

technologies, it’s awesome article.

Pretty! This was an extremely wonderful post. Many thanks for providing this information.

Valuable info. Lucky me I found your site accidentally, and

I am shocked why this accident did not happened

in advance! I bookmarked it.

Thanks for the good writeup. It in truth used to be a entertainment account

it. Glance complex to more delivered agreeable from you!

However, how can we communicate?

Hello just wanted to give you a quick heads up.

The words in your article seem to be running off the screen in Chrome.

I’m not sure if this is a format issue or something to do with internet

browser compatibility but I thought I’d post to let you know.

The design and style look great though! Hope you get the issue resolved soon. Thanks

I’m gone to convey my little brother, that he should also pay a visit this web site on regular basis to get updated from newest gossip.

hello!,I love your writing so so much! share we keep in touch extra approximately your post

on AOL? I need an expert in this space to resolve my problem.

Maybe that’s you! Having a look ahead to peer you.

It’s difficult to find well-informed people in this particular

subject, however, you sound like you know what you’re talking about!

Thanks

I was able to find good information from your articles.

First of all I would like to say awesome blog!

I had a quick question in which I’d like to ask if you don’t mind.

I was interested to find out how you center yourself and clear your

head prior to writing. I’ve had a hard time clearing my thoughts in getting my thoughts out there.

I truly do take pleasure in writing but it just seems like the first 10 to 15

minutes are generally wasted simply just trying to figure out how to begin. Any recommendations or tips?

Kudos!

It is perfect time to make some plans for the future and it is

time to be happy. I’ve read this post and if I could I desire to suggest

you some interesting things or advice. Perhaps you can write next articles

referring to this article. I desire to read more things about it!

I couldn’t refrain from commenting. Very well written!

The other day, while I was at work, my cousin stole my iPad and tested to see if it can survive a

forty foot drop, just so she can be a youtube sensation. My apple ipad is now broken and she has 83 views.

I know this is entirely off topic but I had to share it with someone!

Very nice article, totally what I was looking for.

always i used to read smaller articles or reviews which also clear their motive, and that is also

happening with this paragraph which I am reading at this

time.

I constantly spent my half an hour to read this blog’s posts all the

time along with a mug of coffee.

Do you have a spam problem on this website; I also am a blogger,

and I was wanting to know your situation; many of us have created some nice

methods and we are looking to swap solutions with others,

be sure to shoot me an email if interested.

I go to see every day a few blogs and blogs to

read articles, except this web site presents quality based writing.

Thanks for a marvelous posting! I genuinely enjoyed reading it, you happen to be a great author.I will make certain to bookmark your blog

and may come back in the foreseeable future. I want to encourage continue your great writing, have

a nice afternoon!

My family members always say that I am wasting

my time here at net, however I know I am getting know-how all

the time by reading such pleasant articles.

I really like your blog.. very nice colors & theme. Did you create this website

yourself or did you hire someone to do it for you?

Plz answer back as I’m looking to construct my own blog and would like to find

out where u got this from. thanks a lot

Oh my goodness! Amazing article dude! Thank you, However I am encountering difficulties with your RSS.

I don’t understand the reason why I am unable to subscribe to it.

Is there anybody else getting identical RSS problems?

Anyone that knows the solution will you kindly respond?

Thanx!!

Greetings! Very helpful advice in this particular post!

It is the little changes that produce the greatest changes.

Thanks a lot for sharing!

Fantastic post however , I was wondering if you

could write a litte more on this topic? I’d be

very grateful if you could elaborate a little bit further.

Appreciate it!

Pretty nice post. I just stumbled upon your weblog and wished to say

that I have really enjoyed browsing your blog posts.

In any case I will be subscribing to your feed and I hope you

write again soon!

What’s up to all, how is the whole thing, I think every one is getting

more from this web site, and your views are fastidious designed for

new people.

I every time used to read piece of writing in news papers but now as I am a user of internet

so from now I am using net for articles or reviews,

thanks to web.

Link exchange is nothing else however it is just placing

the other person’s blog link on your page at proper place and other person will also do similar for you.

It’s a pity you don’t have a donate button! I’d definitely donate to this fantastic blog!

I guess for now i’ll settle for book-marking and adding your RSS feed to my Google account.

I look forward to fresh updates and will talk about this blog with my Facebook group.

Talk soon!

Wow that was odd. I just wrote an very long comment but after I clicked submit my comment didn’t appear.

Grrrr… well I’m not writing all that over again. Anyway,

just wanted to say superb blog!

Hello to all, how is the whole thing, I think every one is getting more from this web page, and your views are fastidious in support of new

visitors.

This information is invaluable. Where can I find out more?

My spouse and I stumbled over here coming from a different web

page and thought I should check things out. I like what I see so now

i am following you. Look forward to looking at

your web page repeatedly.

Fantastic goods from you, man. I have understand your stuff previous to and you

are just too fantastic. I actually like what you’ve acquired here, really

like what you are saying and the way in which you

say it. You make it enjoyable and you still care for to

keep it smart. I can’t wait to read far more from you.

This is really a tremendous web site.

Appreciate the recommendation. Let me try it out.

Asking questions are really good thing if you are not understanding anything completely,

but this piece of writing provides fastidious understanding yet.

Its like you learn my thoughts! You appear to understand so much about this, such as you wrote the guide in it or something.

I believe that you simply can do with some p.c.

to drive the message house a little bit, but

instead of that, that is great blog. A great read. I will definitely be back.

Its like you read my mind! You seem to grasp so much approximately

this, like you wrote the guide in it or something. I believe that you simply could do with a

few p.c. to pressure the message house a little bit, however instead of

that, that is great blog. A great read. I’ll certainly be back.

This paragraph will help the internet visitors for building up new weblog or even a blog from start

to end.

Everyone loves it when individuals come together

and share opinions. Great site, keep it up!

I pay a visit everyday some sites and information sites to read

posts, but this webpage gives feature based writing.

This is my first time pay a visit at here and i am truly impressed to read everthing at alone place.

I’ve been exploring for a little for any high quality articles or blog posts in this sort of area .

Exploring in Yahoo I eventually stumbled upon this site.

Reading this info So i am satisfied to exhibit that I’ve a very just right uncanny feeling I found out exactly what I needed.

I most unquestionably will make certain to do not fail to remember this web site and

provides it a look regularly.

wonderful points altogether, you simply won a new reader.

What might you suggest about your post that you simply made some days

ago? Any certain?

Thanks for ones marvelous posting! I truly enjoyed reading it, you

will be a great author. I will always bookmark your blog and will often come back down the road.

I want to encourage that you continue your great posts, have

a nice morning!

I like the valuable information you provide in your articles.

I’ll bookmark your weblog and check again here regularly.

I am quite certain I will learn lots of new stuff right here!

Good luck for the next!

Hello just wanted to give you a quick heads up. The text in your article seem to be running off the screen in Internet explorer.

I’m not sure if this is a formatting issue or something to do with browser compatibility but I thought I’d post to

let you know. The design look great though!

Hope you get the issue solved soon. Many thanks

I am regular reader, how are you everybody? This article posted at this website is genuinely fastidious.

each time i used to read smaller content that also clear their

motive, and that is also happening with this post which I am reading now.

I like the helpful information you provide in your articles.

I’ll bookmark your weblog and check again here regularly. I am quite sure I’ll learn many new

stuff right here! Best of luck for the next!

If you are going for finest contents like me, just pay a

visit this site every day as it offers quality contents, thanks

Hello are using WordPress for your site platform? I’m new to the blog world but I’m trying to get started and create my own. Do you require any html coding knowledge to make your own blog?

Any help would be greatly appreciated!

We absolutely love your blog and find most of your post’s to be what precisely

I’m looking for. Does one offer guest writers to write content for you personally?

I wouldn’t mind writing a post or elaborating on most of the subjects you write

concerning here. Again, awesome web site!

Asking questions are truly pleasant thing if you are not understanding anything totally, but this paragraph offers good understanding even.

Someone necessarily lend a hand to make critically

posts I would state. This is the first time I frequented your web page and

up to now? I amazed with the analysis you made to create this actual put up amazing.

Great activity!

Awesome post.

Good day! I know this is kind of off topic but I was

wondering if you knew where I could find a captcha plugin for my comment form?

I’m using the same blog platform as yours and I’m having trouble

finding one? Thanks a lot!

We stumbled over here coming from a different web address and

thought I may as well check things out. I like what I see so now i’m following you.

Look forward to going over your web page for a second time.

Good day! This is my 1st comment here so I just wanted to give a quick shout out and say I

genuinely enjoy reading your blog posts. Can you

recommend any other blogs/websites/forums that go over the same topics?

Thanks!

fantastic put up, very informative. I ponder why the opposite experts

of this sector don’t realize this. You should proceed

your writing. I am confident, you have a great readers’ base

already!

Howdy! This post could not be written any better! Reading through this post reminds me of my old

room mate! He always kept talking about this. I will forward this

article to him. Pretty sure he will have a good

read. Many thanks for sharing!

This site truly has all of the info I needed concerning

this subject and didn’t know who to ask.

I don’t know whether it’s just me or if perhaps everybody

else encountering problems with your blog. It seems like some of the text in your content are

running off the screen. Can somebody else please provide feedback and let me know if this is happening to them as

well? This could be a problem with my internet browser because

I’ve had this happen before. Cheers

I was suggested this web site via my cousin. I am not positive whether or not this

put up is written through him as no one else know such specified about my difficulty.

You are wonderful! Thank you!

Write more, thats all I have to say. Literally, it seems as though you relied

on the video to make your point. You definitely know what youre talking about, why throw away your intelligence on just posting videos to your blog when you could be giving

us something enlightening to read?

I’m gone to inform my little brother, that he should also visit this web site on regular basis to take updated from newest news update.

Wow, marvelous weblog format! How long have you been running

a blog for? you made running a blog glance

easy. The entire glance of your web site is wonderful, let alone the content material!

I’m truly enjoying the design and layout of your blog.

It’s a very easy on the eyes which makes it much

more pleasant for me to come here and visit more often. Did

you hire out a designer to create your theme? Excellent

work!

I do consider all the ideas you have presented on your post.

They’re really convincing and will certainly work. Still,

the posts are very brief for starters. Could you please extend them a bit from next time?

Thank you for the post.

It is appropriate time to make a few plans for the longer term and it’s time to be happy.

I have learn this submit and if I may just I want to counsel you

some attention-grabbing things or tips. Perhaps you could write next articles referring to this article.

I want to learn more issues about it!

Hi everyone, it’s my first visit at this website, and post is

truly fruitful designed for me, keep up posting

these articles or reviews.

This blog was… how do I say it? Relevant!!

Finally I have found something which helped me. Kudos!

Hmm is anyone else encountering problems with the pictures on this blog loading?

I’m trying to determine if its a problem on my end

or if it’s the blog. Any suggestions would be greatly appreciated.

Thank you for the good writeup. It in fact

was a amusement account it. Glance complicated

to more added agreeable from you! By the way, how can we keep up a correspondence?

Spot on with this write-up, I actually believe this web site needs much more attention.

I’ll probably be back again to read more, thanks for the advice!

This information is invaluable. When can I find out more?

Nice post. I was checking constantly this blog and I am impressed!

Extremely helpful info specially the last part 🙂 I care for

such info much. I was looking for this certain info for a very long time.

Thank you and good luck.

I really like what you guys are up too. This type of clever work and exposure!

Keep up the terrific works guys I’ve you guys to my blogroll.

It’s actually a nice and useful piece of info. I am

happy that you shared this helpful information with us.

Please stay us up to date like this. Thank you for sharing.

Hi, i read your blog from time to time and

i own a similar one and i was just wondering if you get a lot of spam feedback?

If so how do you reduce it, any plugin or anything you can recommend?

I get so much lately it’s driving me mad so any support is very

much appreciated.

hey there and thank you for your information – I have definitely picked up something new from right here.

I did however expertise some technical issues using this site, since I

experienced to reload the web site lots of times previous

to I could get it to load correctly. I had been wondering if your hosting is OK?

Not that I’m complaining, but sluggish loading instances times will sometimes affect your placement in google and can damage your high quality score if advertising and marketing with Adwords.

Anyway I am adding this RSS to my email and can look out for

much more of your respective interesting content. Ensure that you update this again soon.

I really appreciate this post. I have been looking everywhere for this! Thank goodness I found it on Bing. You have made my day! Thank you again

Thanks for the auspicious writeup. It if truth be told was a leisure account it.

Glance complex to far added agreeable from you!

However, how can we communicate?

Aw, this was a very good post. Taking a few minutes and actual effort to generate a

good article… but what can I say… I procrastinate a whole lot and never seem

to get nearly anything done.

Thanks very interesting blog!

Hi my family member! I wish to say that this post is awesome, nice written and come

with almost all vital infos. I’d like to see

extra posts like this .

Appreciate this post. Let me try it out.

It’s awesome designed for me to have a site, which is good for my knowledge.

thanks admin

I know this if off topic but I’m looking into starting my

own blog and was curious what all is needed to get set up?

I’m assuming having a blog like yours would cost a pretty penny?

I’m not very internet savvy so I’m not 100% positive. Any suggestions or advice would be greatly

appreciated. Cheers

Ahaa, its good dialogue about this paragraph here

at this blog, I have read all that, so at this time me also commenting here.

Pretty! This was a really wonderful article. Thank you for

providing these details.

This is really interesting, You’re a very skilled blogger.

I have joined your rss feed and look forward to seeking

more of your great post. Also, I have shared your web

site in my social networks!

Howdy I am so happy I found your site, I really found you by mistake,

while I was browsing on Google for something else, Nonetheless I am here

now and would just like to say thanks a lot for a remarkable

post and a all round enjoyable blog (I also love the theme/design), I don’t have time

to go through it all at the moment but I have book-marked it

and also included your RSS feeds, so when I have time I

will be back to read more, Please do keep up the fantastic work.

It’s fantastic that you are getting thoughts from this paragraph as well

as from our argument made at this time.

Hi there just wanted to give you a brief heads up and let you know a few of the

pictures aren’t loading properly. I’m not sure why but I think its a linking issue.

I’ve tried it in two different web browsers and both show the same results.

It’s really very difficult in this busy life to listen news on TV, thus I just use world wide web for

that purpose, and take the most up-to-date information.

continuously i used to read smaller content which as well clear their

motive, and that is also happening with this piece

of writing which I am reading now.

This paragraph will help the internet users for creating new

webpage or even a weblog from start to end.

I loved as much as you will receive carried out

right here. The sketch is tasteful, your authored subject matter stylish.

nonetheless, you command get got an edginess over that you wish be delivering the following.

unwell unquestionably come more formerly again as exactly the same nearly a lot often inside case you shield this hike.

Hey there! Do you know if they make any plugins to protect against hackers?

I’m kinda paranoid about losing everything I’ve worked hard on. Any suggestions?

My coder is trying to persuade me to move to .net from PHP.

I have always disliked the idea because of the costs.

But he’s tryiong none the less. I’ve been using WordPress on numerous

websites for about a year and am worried

about switching to another platform. I have heard very good things about blogengine.net.

Is there a way I can import all my wordpress content into it?

Any kind of help would be greatly appreciated!

Hi to every one, the contents present at this web site

are in fact amazing for people knowledge, well, keep

up the nice work fellows.

Good day! I just would like to give you a big thumbs up for the

excellent information you have got right here on this post.

I will be coming back to your web site for more soon.

Good info. Lucky me I discovered your website by accident (stumbleupon).

I have book-marked it for later!

Woah! I’m really digging the template/theme of this website.

It’s simple, yet effective. A lot of times it’s challenging to

get that “perfect balance” between superb usability and visual appeal.

I must say you have done a excellent job with this. Also, the blog loads super fast for me on Safari.

Excellent Blog!

Hello there! This is my first visit to your blog!

We are a team of volunteers and starting a new initiative in a community in the

same niche. Your blog provided us useful information to work on. You have done a marvellous job!

Appreciate this post. Will try it out.

What’s Going down i am new to this, I stumbled upon this I have found It positively helpful and it has helped

me out loads. I hope to contribute & assist other customers like its helped me.

Good job.

At this time I am going away to do my breakfast, after having my breakfast coming again to read other news.

Hello! Do you use Twitter? I’d like to follow you if that would be ok.

I’m definitely enjoying your blog and look forward to new

posts.

After looking at a handful of the blog articles on your site, I really appreciate

your technique of blogging. I saved it to my bookmark site list and

will be checking back in the near future. Please visit my web site too

and tell me how you feel.

Hello There. I found your blog the use of msn. This is a very

well written article. I will make sure to bookmark it and come back to learn extra of

your useful information. Thanks for the post.

I’ll definitely return.

Hello there! I could have sworn I’ve visited this blog before but after looking at

many of the articles I realized it’s new to me.

Regardless, I’m definitely pleased I discovered it and I’ll be bookmarking it and checking

back often!

This is my first time pay a visit at here and i am in fact pleassant to read everthing at alone place.

I’m curious to find out what blog system you have been utilizing?

I’m experiencing some minor security issues with my latest

blog and I’d like to find something more safeguarded.

Do you have any recommendations?

Saved as a favorite, I like your website!

If you wish for to get much from this piece of writing then you have to apply these techniques to your won blog.

Hey there! This is my first visit to your blog! We are a collection of volunteers

and starting a new project in a community in the same niche.

Your blog provided us useful information to work

on. You have done a marvellous job!

Good site you have got here.. It’s difficult to find excellent writing like yours nowadays.

I really appreciate people like you! Take care!!

Excellent beat ! I wish to apprentice while you amend your web site, how can i subscribe for

a blog website? The account aided me a acceptable deal.

I had been a little bit acquainted of this your broadcast offered bright clear concept

I was wondering if you ever considered changing the

layout of your site? Its very well written; I love what youve got to say.

But maybe you could a little more in the way of content so

people could connect with it better. Youve got an awful lot of text for only having one or two pictures.

Maybe you could space it out better?

Hey! Do you use Twitter? I’d like to follow you if that would

be okay. I’m undoubtedly enjoying your blog and look forward

to new posts.

This article is truly a pleasant one it helps new net viewers, who are wishing for blogging.

Appreciate this post. Will try it out.

Highly descriptive blog, I loved that bit. Will there be a part 2?

Hurrah, that’s what I was seeking for, what a information! present

here at this website, thanks admin of this web page.

Thank you, I have recently been looking for information approximately this subject for ages and yours

is the greatest I have found out till now. But, what in regards to the bottom line?

Are you sure in regards to the source?

Howdy! This article couldn’t be written any better!

Going through this post reminds me of my previous roommate!

He continually kept preaching about this. I most certainly will send this

article to him. Fairly certain he’s going to have a very

good read. I appreciate you for sharing!

Great beat ! I would like to apprentice at the same time as you amend

your web site, how can i subscribe for a weblog web site?

The account aided me a acceptable deal. I had been tiny bit acquainted of this your broadcast

provided vivid transparent idea

Have you ever thought about adding a little bit more than just your articles?

I mean, what you say is important and everything. Nevertheless

think about if you added some great photos or videos to give your posts more, “pop”!

Your content is excellent but with pics and clips, this

blog could definitely be one of the very best in its field.

Great blog!

Hello there I am so grateful I found your blog, I really found you by

error, while I was researching on Askjeeve for something else, Anyhow I am here now

and would just like to say cheers for a tremendous post

and a all round exciting blog (I also love the theme/design), I don’t have time to read through it all at the moment but I have saved it and also included your RSS feeds, so when I have time I will

be back to read much more, Please do keep up the excellent job.

Thanks to my father who told me about this web site, this web site is

really amazing.

Awesome post.

Heya! I know this is kind of off-topic but I had to ask.

Does managing a well-established website such as yours require a

lot of work? I am completely new to operating a blog however I do write in my

diary every day. I’d like to start a blog so I will be able

to share my experience and feelings online. Please let me know if you have any kind of

suggestions or tips for brand new aspiring bloggers.

Appreciate it!

I am sure this article has touched all the internet visitors, its really really

good piece of writing on building up new webpage.

I have learn a few good stuff here. Certainly value bookmarking for revisiting.

I wonder how a lot attempt you set to create this sort of wonderful informative site.

Hello everyone, it’s my first pay a quick visit at

this website, and article is genuinely fruitful in favor of me,

keep up posting these articles.

you’re truly a good webmaster. The website loading speed is incredible.

It sort of feels that you are doing any distinctive trick.

Moreover, The contents are masterpiece. you’ve performed a excellent activity in this subject!

you are really a excellent webmaster. The site loading pace

is incredible. It sort of feels that you’re doing any

distinctive trick. Also, The contents are masterwork.

you’ve performed a great activity in this topic!

Hello! I could have sworn I’ve visited this web site before but after going through a few of the articles I realized it’s

new to me. Regardless, I’m certainly happy I stumbled upon it and

I’ll be book-marking it and checking back frequently!

I know this web site gives quality based articles

and extra material, is there any other web page which offers such stuff in quality?

I all the time emailed this blog post page to all my contacts, as if like to

read it afterward my links will too.

I enjoy what you guys are up too. This sort of clever work and reporting!

Keep up the terrific works guys I’ve you guys to my own blogroll.

Hi there would you mind sharing which blog platform you’re working with?

I’m looking to start my own blog soon but I’m having a tough time deciding between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your design seems different then most blogs and I’m looking for

something completely unique. P.S Sorry for getting off-topic but I had to ask!

Hello there! Do you use Twitter? I’d like to follow you if that would be okay.

I’m definitely enjoying your blog and look forward to new

updates.

Appreciation to my father who stated to me on the topic of this

weblog, this weblog is really amazing.

I do accept as true with all of the concepts you’ve presented in your post.

They are really convincing and will definitely work.

Nonetheless, the posts are too brief for novices. Could

you please lengthen them a little from next time?

Thanks for the post.

You really make it seem so easy with your presentation but I find

this topic to be actually something that I think I would never understand.

It seems too complex and very broad for me. I am looking forward for

your next post, I’ll try to get the hang of it!

Hi! I just wish to give you a big thumbs up for the great information you have here on this post.

I will be coming back to your site for more soon.

Hi there, its good paragraph concerning media print, we all be aware of media is a enormous

source of facts.

We absolutely love your blog and find the majority of

your post’s to be exactly I’m looking for. Do you offer guest writers to

write content for yourself? I wouldn’t mind composing a post or elaborating on some of the subjects you write regarding here.

Again, awesome website!

I’m really enjoying the design and layout of your blog.

It’s a very easy on the eyes which makes it much more enjoyable for me to come here and visit more often.

Did you hire out a developer to create your theme? Outstanding

work!

It’s actually a nice and helpful piece of info. I am satisfied that you just shared this useful info with us.

Please stay us up to date like this. Thank you for sharing.

I every time used to study article in news papers but now as I am a user of web so from now I am using net for posts, thanks to web.

Wonderful post! We will be linking to this particularly great content on our site.

Keep up the great writing.

Hi there would you mind letting me know which webhost you’re working with?

I’ve loaded your blog in 3 different web browsers and I must

say this blog loads a lot faster then most. Can you suggest a

good internet hosting provider at a reasonable price?

Kudos, I appreciate it!

Hi there! Do you know if they make any plugins to assist with Search Engine Optimization? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good

success. If you know of any please share. Kudos!

Excellent post. I was checking constantly this blog and I’m impressed!

Very helpful information specially the remaining phase 🙂 I take care

of such info much. I was looking for this certain info for a very

long time. Thank you and best of luck.

Wonderful beat ! I wish to apprentice while you amend your

site, how can i subscribe for a blog website?

The account helped me a acceptable deal. I had been a little bit acquainted of this your broadcast provided bright clear concept

I am regular visitor, how are you everybody? This piece of

writing posted at this web site is genuinely fastidious.

Great blog here! Also your website loads up very fast! What web host

are you using? Can I am getting your associate hyperlink to your host?

I wish my website loaded up as fast as yours lol

What a stuff of un-ambiguity and preserveness of precious familiarity regarding unpredicted emotions.

Simply desire to say your article is as astonishing.

The clarity in your post is simply spectacular and i can assume

you are an expert on this subject. Fine with your permission allow me

to grab your feed to keep up to date with forthcoming post.

Thanks a million and please continue the enjoyable work.

Since the admin of this site is working, no hesitation very soon it will be renowned, due

to its quality contents.

Thank you for the good writeup. It in reality was a entertainment account it.

Glance complicated to more added agreeable from you!

By the way, how could we keep in touch?

It’s going to be finish of mine day, except before finish I am reading this

fantastic paragraph to improve my knowledge.

I am extremely impressed with your writing skills as

well as with the layout on your blog. Is this a paid theme or did you modify it yourself?

Either way keep up the nice quality writing, it’s rare to see a

nice blog like this one today.

When someone writes an piece of writing he/she keeps the thought of a user in his/her mind that how

a user can understand it. So that’s why this paragraph is great.

Thanks!

Greetings! I know this is somewhat off topic but I was wondering which blog platform are you using for this website?

I’m getting tired of WordPress because I’ve had problems with hackers and I’m looking at options

for another platform. I would be awesome if you could

point me in the direction of a good platform.

Hi there would you mind letting me know which web host you’re working with?

I’ve loaded your blog in 3 different internet browsers and I must say this blog loads a

lot quicker then most. Can you suggest a good hosting provider at

a honest price? Thanks a lot, I appreciate it!

Fantastic web site. Plenty of useful information here.

I’m sending it to several friends ans additionally sharing in delicious.

And of course, thank you to your effort!

Sweet blog! I found it while surfing around on Yahoo News.

Do you have any suggestions on how to get listed in Yahoo News?

I’ve been trying for a while but I never seem to get there!

Appreciate it

Hi, I think your site might be having browser compatibility issues.

When I look at your blog in Safari, it looks fine but when opening in Internet Explorer, it has some overlapping.

I just wanted to give you a quick heads up! Other then that, excellent blog!

Nice post. I used to be checking continuously this weblog and I’m impressed!

Extremely useful information specially the final section 🙂 I handle such info a lot.

I used to be seeking this particular info for a long time.

Thank you and good luck.

When someone writes an piece of writing he/she retains the thought of a user

in his/her brain that how a user can understand it. Thus that’s why

this article is perfect. Thanks!

I’m not sure exactly why but this site is loading incredibly slow for me.

Is anyone else having this problem or is it a problem on my end?

I’ll check back later on and see if the problem still exists.

Hello there! This article could not be written any better!

Reading through this post reminds me of my previous roommate!

He constantly kept talking about this. I’ll forward this information to him.

Fairly certain he’s going to have a good read. Thank you for sharing!

whoah this weblog is great i like reading your posts.

Keep up the good work! You recognize, lots of individuals are hunting round for this information, you could help

them greatly.

What’s up i am kavin, its my first time to commenting anyplace, when i read this paragraph i thought i could also make comment due

to this brilliant paragraph.

Link exchange is nothing else except it is simply placing the

other person’s website link on your page at appropriate place and other person will also do

similar in favor of you.

Thanks for sharing, this is a fantastic blog post.Really thank you! Much obliged.

My website: порно по категориям на русском

An impressive share! I’ve just forwarded this onto a colleague who has been doing a little homework on this.

And he actually ordered me dinner simply because I found it for him…

lol. So allow me to reword this…. Thank YOU for the meal!!

But yeah, thanx for spending time to talk

about this issue here on your site.

When I initially left a comment I appear to have

clicked the -Notify me when new comments are added- checkbox

and from now on whenever a comment is added I receive 4 emails with the exact same comment.

There has to be a way you are able to remove me from that service?

Thanks!

Thank you, I have recently been searching for info about this subject for a long time and yours is

the greatest I’ve came upon so far. But, what in regards to the bottom line?

Are you certain in regards to the supply?

This post will assist the internet viewers for setting up new weblog or even a weblog from start to end.

It’s going to be end of mine day, except before end I am reading

this enormous post to increase my know-how.

This design is steller! You most certainly know how to

keep a reader entertained. Between your wit and your videos, I

was almost moved to start my own blog (well, almost…HaHa!) Great job.

I really loved what you had to say, and more than that, how

you presented it. Too cool!

I seriously love your website.. Excellent colors & theme.

Did you create this website yourself? Please reply back as I’m attempting to

create my very own blog and want to find out where you got this from or just

what the theme is named. Thank you!

My website: красивое порно подростков

Very nice post. I just stumbled upon your blog and wanted to say that

I’ve truly enjoyed browsing your blog posts. After

all I will be subscribing to your feed and I hope you write again very soon!

Hello everyone, it’s my first pay a visit at this site, and piece of writing is actually fruitful for me, keep up posting these articles or

reviews.

Major thanks for the article post. Much thanks again.

My website: брат трахает сестру в анал

As a Newbie, I am continuously exploring online for articles that can be of assistance to me.

My website: секс с худенькими

Wow, fantastic weblog layout! How long have you ever been running a

blog for? you made running a blog glance easy.

The total look of your site is great, let alone the content!

You can see similar: najlepszy sklep and here e-commerce

It is perfect time to make some plans for the future and it is time to be happy.

I’ve read this post and if I could I wish to suggest you

some interesting things or advice. Perhaps you can write next

articles referring to this article. I want to read even more

things about it!

im looking for a slave who can obey me! i have live cams blonde for you

It’s very interesting! If you need help, look here: hitman agency

Way cool! Some extremely valid points! I appreciate you penning this article and

also the rest of the site is really good.

What i do not realize is in truth how you’re not really much more

smartly-appreciated than you may be now. You are so intelligent.

You already know thus significantly with regards to this matter,

produced me for my part believe it from so many varied angles.

Its like men and women aren’t involved except it’s one

thing to do with Girl gaga! Your individual stuffs excellent.

Always take care of it up!

Heya just wanted to give you a quick heads up and let you know a few of the pictures

aren’t loading correctly. I’m not sure why but I think

its a linking issue. I’ve tried it in two different web

browsers and both show the same outcome. I saw similar here: najlepszy sklep

and also here: e-commerce

We stumbled over here by a different web page and thought I might as well check things out.

I like what I see so now i’m following you. Look forward

to finding out about your web page for a second time.

Hey, you used to write wonderful, but the last few posts have been kinda boringK I miss your great writings. Past few posts are just a bit out of track! come on!

I think that what you posted made a ton of

sense. But, consider this, what if you were to create a awesome headline?

I ain’t saying your information is not good, however suppose you added something to possibly grab folk’s attention? I mean I Passed the FTMO Challenge – Again! – Disciplined FX is a little

vanilla. You could look at Yahoo’s home page and watch how they create news titles to get viewers interested.

You might try adding a video or a picture or two to grab people interested about everything’ve written. In my opinion, it

could bring your posts a little livelier.

My developer is trying to convince me to move to .net from PHP.

I have always disliked the idea because of the costs.

But he’s tryiong none the less. I’ve been using Movable-type on various websites for about a year and am nervous about switching to another

platform. I have heard good things about blogengine.net.

Is there a way I can transfer all my wordpress posts into it?

Any help would be greatly appreciated! I saw similar here:

Dobry sklep

Hi sweetie, give me a call. The thought of my huge blonde cam girls is guaranteed to put a lot of pressure on you.

Remarkable issues here. I am very satisfied to look your

post. Thanks a lot and I am having a look forward to touch you.

Will you please drop me a mail? I saw similar here: Sklep online

Fantastic beat ! I would like to apprentice while you amend your

web site, how could i subscribe for a blog site? The account helped me

a acceptable deal. I had been a little bit acquainted of this your

broadcast provided bright clear idea

Hello there! Do you know if they make any plugins to help with Search Engine Optimization? I’m trying to get my blog to rank

for some targeted keywords but I’m not seeing very good results.

If you know of any please share. Thank you! You can read similar art here:

Dobry sklep

Howdy! Do you know if they make any plugins

to assist with SEO? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good

gains. If you know of any please share. Cheers! You can read similar text here: Dobry sklep

It’s very interesting! If you need help, look here: ARA Agency

It’s very interesting! If you need help, look here: ARA Agency

I just couldn’t go away your website before suggesting that I actually loved the standard info an individual supply on your visitors? Is gonna be again steadily in order to check up on new posts

Hello there! Do you know if they make any plugins to help with Search Engine Optimization? I’m trying to get my blog to rank

for some targeted keywords but I’m not seeing very good gains.

If you know of any please share. Appreciate it!

You can read similar article here: Sklep

Very interesting subject, appreciate it for putting up. “What passes for optimism is most often the effect of an intellectual error.” by Raymond Claud Ferdinan Aron.

I’ve been surfing online more than 3 hours today, yet I

never found any interesting article like yours.

It is pretty worth enough for me. In my view, if all site owners and bloggers made good content as you did,

the internet will be much more useful than ever before.

What is Alpha Tonic? Alpha Tonic stands as a natural health supplement designed to comprehensively address men’s overall well-being.

Hello to all, as I am really eager of reading this website’s post to be updated regularly.

It contains pleasant information.

My brother suggested I might like this website. He was totally right. This post truly made my day. You can not imagine simply how much time I had spent for this info! Thanks!

F*ckin’ tremendous things here. I am very happy to look your article. Thank you so much and i’m taking a look forward to touch you. Will you kindly drop me a e-mail?

hey there and thank you for your info – I have certainly picked up anything new from right here. I did however expertise several technical points using this website, since I experienced to reload the site many times previous to I could get it to load correctly. I had been wondering if your web host is OK? Not that I am complaining, but slow loading instances times will often affect your placement in google and could damage your quality score if ads and marketing with Adwords. Well I am adding this RSS to my e-mail and could look out for much more of your respective intriguing content. Make sure you update this again soon..

Wow, awesome blog format! How lengthy have you ever

been blogging for? you make blogging glance easy.

The total glance of your website is fantastic, let alone the content!

You can see similar here najlepszy sklep

Valuable info. Lucky me I found your website by chance, and I am stunned why this twist of fate didn’t happened earlier! I bookmarked it.

Helpful information. Lucky me I discovered your web site by chance, and I’m stunned why this accident did not happened earlier! I bookmarked it.

Wow, incredible blog format! How long have you been blogging for?

you made running a blog glance easy. The entire

glance of your web site is fantastic, let

alone the content material! I read similar here prev next and those was

wrote by Carlos04.

Wow, incredible weblog format! How long have you been running a blog for?

you made running a blog look easy. The total glance of your web site is great, as well as the content

material! I saw similar here prev next and that was wrote by Indira03.

Wow, marvelous weblog structure! How long have you ever been blogging

for? you make running a blog glance easy.

The total glance of your website is magnificent, as smartly as

the content material! You can read similar here prev

next and it’s was wrote by Dan02.

Wow, fantastic blog format! How lengthy have

you been running a blog for? you make blogging glance easy.

The overall glance of your website is great, let alone the content material!

You can see similar here prev next and that was wrote by Charlie99.

Wow, awesome weblog structure! How long have you ever been running a blog for?

you made running a blog look easy. The total

glance of your web site is magnificent, let alone the content material!

You can see similar here prev next and those was wrote by Renato70.

I think this website has some real superb information for everyone. “He who has not looked on Sorrow will never see Joy.” by Kahlil Gibran.

Wow, wonderful blog layout! How lengthy have you ever

been running a blog for? you make running a blog glance easy.

The whole glance of your website is wonderful, let alone the content!

You can see similar here Sandy Nil8. 2024/04/23

I’m impressed, I must say. Actually not often do I encounter a blog that’s both educative and entertaining, and let me tell you, you’ve got hit the nail on the head. Your concept is excellent; the difficulty is something that not sufficient people are talking intelligently about. I am very completely happy that I stumbled across this in my seek for one thing relating to this.

It¦s in reality a great and helpful piece of info. I¦m satisfied that you just shared this helpful information with us. Please stay us up to date like this. Thank you for sharing.

Tonic Greens, a natural health supplement, is designed to enhance immune function.

I’m not that much of a internet reader to be honest but your sites really nice, keep it up! I’ll go ahead and bookmark your website to come back later on. Cheers

Puravive is a natural weight loss supplement and is said to be quite effective in supporting healthy weight loss.

What i don’t realize is in reality how you are not actually much more well-favored than you may be right

now. You are very intelligent. You realize thus considerably when it comes to

this matter, produced me personally imagine it from so many varied angles.

Its like men and women aren’t fascinated except it’s one thing to accomplish with

Woman gaga! Your individual stuffs great. Always deal with

it up!

What is Leanbiome? LeanBiome is a dietary supplement that is formulated with nine critically-researched lean bacteria species.

Real fantastic information can be found on web site. “The only thing you take with you when you’re gone is what you leave behind.” by John Allston.

Admiring the hard work you put into your blog and detailed information you present. It’s awesome to come across a blog every once in a while that isn’t the same out of date rehashed material. Wonderful read! I’ve saved your site and I’m adding your RSS feeds to my Google account.

You made some first rate factors there. I regarded on the internet for the issue and found most people will associate with along with your website.

This is the right blog for anyone who wants to find out about this topic. You realize so much its almost hard to argue with you (not that I actually would want…HaHa). You definitely put a new spin on a topic thats been written about for years. Great stuff, just great!

Do you mind if I quote a couple of your articles as long as I provide credit and sources back to your weblog?

My blog is in the very same area of interest

as yours and my users would really benefit from some of the information you present here.

Please let me know if this alright with you. Appreciate it!

I love how you present information in such a clear and engaging way. This post was very informative and well-written. Thank you!peakpulsesite

Today, I went to the beach front with my kids. I found a sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She put the shell to her ear and screamed. There was a hermit crab inside and it pinched her ear. She never wants to go back! LoL I know this is totally off topic but I had to tell someone!

It’s going to be finish of mine day, however before end I am reading this great article to

improve my knowledge.

Hey very nice website!! Man .. Beautiful .. Amazing .. I’ll bookmark your blog and take the feeds also…I am happy to find a lot of useful information here in the post, we need work out more strategies in this regard, thanks for sharing. . . . . .

You consistently produce high-quality content that is both informative and enjoyable to read. This post was no exception. Keep it up!pulsepeak

aggressive as men when they are driving. They are much less likely to be the instigator in a road rage incident, for example. It is also

To have a look at was at regular a couple of, a the mother consideration which should genuinely undergo Native english speakers known as, like a result your lady allow me to undergo while using type in mentor Ye in Vibrant Development in Beijing. About the style As i did begin to find out in regards to the refreshing new Practice Native english speakers and in many cases dealt with that sentence structure made for to start with.

Following analyze several of the website content on your own internet site now, and I in fact like your way of running a blog. I book marked that to be able to my save web site listing and can be examining back again shortly. Please attempt my own website as effectively as well as let me know what you believe.

There are a few fascinating points soon enough here but I don’t determine if I see every one of them center to heart. There is certainly some validity but I am going to take hold opinion until I take a look at it further. Good write-up , thanks therefore we want much more! Included with FeedBurner also

After research a number of of the blog posts on your web site now, and I truly like your means of blogging. I bookmarked it to my bookmark website checklist and will be checking again soon. Pls check out my web page as nicely and let me know what you think.

My spouse and i got delighted Raymond could deal with his studies out of the precious recommendations he got out of the blog. It is now and again perplexing to just possibly be offering tactics that many some other people may have been making money from. And we see we have got the blog owner to be grateful to for this. All of the explanations you made, the simple site navigation, the friendships you can aid to instill – it’s all impressive, and it is aiding our son and the family reason why that issue is satisfying, which is certainly pretty indispensable. Many thanks for the whole lot!

We still cannot quite believe that I really could often be some checking important points on your webblog. His dad and i also are sincerely thankful for generosity for giving me possibility pursue our chosen profession path. Basically material I managed to get out of your web-site.

I believe one of your advertisements caused my web browser to resize, you might want to put that on your blacklist.

The when I just read a weblog, I am hoping who’s doesnt disappoint me up to brussels. I am talking about, I know it was my substitute for read, but I just thought youd have some thing interesting to express. All I hear is really a handful of whining about something that you could fix when you werent too busy searching for attention.

Your current positions constantly have got alot of really up to date info. Where do you come up with this? Just stating you are very innovative. Thanks again

Its like you learn my thoughts! You seem to understand so much approximately this, such as you wrote the e-book in it or something. I believe that you could do with some to power the message home a bit, but other than that, that is fantastic blog. A fantastic read. I’ll certainly be back.

This is exactly what I was looking for.. really simple to install, totally free just had to register to download, thanks

Hi, I had been studying the net and I ran into your own blog. Maintain up the excellent function.

I¡¦ve read several good stuff here. Certainly value bookmarking for revisiting. I surprise how much effort you put to create one of these excellent informative site.

You made some decent points there. I looked on the internet for your issue and located most people may go together with together with your web site.

Hi there, I discovered your website by way of Google even as looking for a related subject, your site got here up, it appears great. I have bookmarked it in my google bookmarks.

I don’t normally comment but I gotta say thankyou for the post on this amazing one : D.

Pretty nice post. I recently stumbled upon your blog and wished to state that I’ve actually appreciated searching your blog content. After all I will be registering to your own nourish and i also we imagine you compose once more quickly!

Loving the information on this internet site , you have done great job on the blog posts.

What your declaring is completely real. I know that everybody have to say the exact same point, but I just assume that you set it in a way that everyone can fully grasp. I also really like the images you set in here. They fit so effectively with what youre hoping to say. Im guaranteed youll attain so numerous folks with what youve obtained to say.

Some truly nice and useful info on this site, likewise I conceive the style holds excellent features.

I admire the time and effort you put into your blog. I wish I had the same drive.

Have you ever thought about adding a little bit more than just your articles? I mean, what you say is valuable and everything. But think about if you added some great photos or video clips to give your posts more, “pop”! Your content is excellent but with images and video clips, this blog could definitely be one of the most beneficial in its niche. Excellent blog! Miss Gaming

After study a few of the blog posts on your website now, and I truly like your way of blogging. I bookmarked it to my bookmark website list and will be checking back soon. Pls check out my web site as well and let me know what you think.

We still cannot quite assume that Really should have refused often be those types of checking important points on your blog post. Our family and that i are sincerely thankful for your personal generosity enchanting giving me possibility pursue our chosen profession path. Delighted important info I bought with the web-site.

Spot on with this write-up, I truly suppose this web site wants way more consideration. I’ll in all probability be once more to read far more, thanks for that info.

I am impressed with this site, real I am a big fan.

There couple of intriguing points in time in the following paragraphs but I don’t know if these center to heart. There’s some validity but I’ll take hold opinion until I look into it further. Great write-up , thanks and we want a lot more! Added onto FeedBurner also

Hello there! Do you know if they make any plugins to help with SEO?

I’m trying to get my website to rank for some targeted keywords but I’m not seeing very

good results. If you know of any please share. Many

thanks! You can read similar article here: Escape room list

Hi , I do believe this is an excellent blog. I stumbled upon it on Yahoo , i will come back once again. Money and freedom is the best way to change, may you be rich and help other people.

There are many fascinating time limits on this page however I don’t determine if these people center to heart. You can find some validity however I am going to take hold opinion until I consider it further. Good article , thanks and that we want extra! Included in FeedBurner as properly

I’m curious to find out what blog platform you are using? I’m experiencing some minor security issues with my latest site and I’d like to find something more secure. Do you have any solutions?

Really clear web site , thanks for this post.

“Thanks so much for this! I have not been this moved by a blog for a long time!”

Any INTERNAL REVENUE SERVICE will never give attention with any specific extreme taxation expenses, in order that you are really taking that with the dirt bike pants by simply not necessarily altering your own tax burden monthly payments.

Bloghopping is really my forte and i like to visit blogs,

I am constantly looking online for articles that can facilitate me. Thx!

One of the best manufacturers of stair carpet exclusive invites you to a special occasion.

Nice blog here! Also your web site quite a bit up very fast! What host are you the usage of? Can I am getting your associate link to your host? I want my website loaded up as quickly as yours lol.

To take a look the status of the income tax give you back, visit the IRS . GOV web site from attempting to find the application inside google.

I beloved as much as you’ll obtain performed proper here. The comic strip is attractive, your authored subject matter stylish. however, you command get got an nervousness over that you want be handing over the following. in poor health indisputably come further previously again since exactly the same nearly a lot often inside case you defend this hike.

I just love to read new topics from you blog..~`.-

Everyone loves it whenever people come together and share thoughts. Great site, continue the good work!

Woah this is just an insane amount of information, must of taken ages to compile so thank you so much for just sharing it with all of us. If your ever in any need of related info, perhaps a bit of coaching, seduction techniques or just general tips, just check out my own site!

This website may be a walk-through its the details it suited you with this and didn’t know who to inquire about. Glimpse here, and you’ll undoubtedly discover it.

Thanks for all your efforts that you have put in this. very interesting info .

very good post, i actually love this web site, carry on it

well, i bought some digital pedometer on the local walmart and it is great for monitoring your performance when walking”

Good day! Do you know if they make any plugins to assist with Search Engine Optimization? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good gains. If you know of any please share. Thanks!

I have been surfing online more than three hours lately, yet I by no means found any interesting article like yours. It is beautiful price enough for me. In my opinion, if all webmasters and bloggers made excellent content material as you did, the web will probably be much more useful than ever before!

Excellent! I appreciate your input to this matter. It has been insightful. my blog: half marathon training schedule

we are always looking for alternative or green energy because we want to stop polluting the environment,

Wonderful blog! I found it while browsing on Yahoo News. Do you have any tips on how to get listed in Yahoo News? I’ve been trying for a while but I never seem to get there! Cheers

Wow, you seem to be very knowledgable about this kind of topics.”-”;’

That is a sensible blog site. What i’m saying is them. You’ve a lot of comprehending with this trouble, in so doing much eagerness. In addition , you know how you can also make most people rally associated with the item, clearly from your side effects. You have have some design right here thats not necessarily overly nice, although is really a proclamation the size of what exactly youre declaring. Brilliant employment, in fact.

I’ve recently started a site, the information you offer on this site has helped me tremendously. Thanks for all of your time & work.

Nice one for taking a few minutes to talk about this amazing, I think highly concerning it as well as absolutely love browsing regarding the issue. Any time prospects, because you gain skill, what views posting to the journal by having added data? This is very helpful for everyone.

My friend first found your blog on Google and she referred your blog to me.*,:,-

I merely seen your blog site the other day and i also are generally browsing doing it continually. There’s a a lot of tips suitable here so i fancy your thing of a rrnternet site far too. Preserve good occupation!

Hi there, just became alert to your blog through Google, and found that it’s truly informative. I am going to watch out for brussels. I will be grateful if you continue this in future. Many people will be benefited from your writing. Cheers!

Thank you for sharing with us, I think this website really stands out : D.

You really make it seem so uncomplicated with your presentation but I find that topic to be really something that I think I would never understand. It seems too complicated and incredibly broad for me. I am looking forward for your next post, I can try to get the hang up of it!

Hi my family member! I want to say that this post is awesome, great written and include almost all significant infos. I’d like to peer more posts like this .

I do love the manner in which you have framed this particular difficulty and it really does supply us a lot of fodder for consideration. However, through everything that I have seen, I only trust when the feed-back pack on that people today keep on point and not start upon a soap box regarding some other news of the day. Still, thank you for this outstanding point and even though I can not go along with this in totality, I regard the standpoint.

Carbon Dioxide Cylinders – Best Tricks All Consumers Must Know

Impressive web site, Distinguished feedback that I can tackle. Im moving forward and may apply to my current job as a pet sitter, which is very enjoyable, but I need to additional expand. Regards

You should take part in a contest for probably the greatest blogs on the web. I’ll recommend this web site!

I am glad this it turned out so well and I hope it will continue in the future because it is so interesting and meaningful to the community.

Researchers have prepared an animal model of major depressive disorder that is based on an unusual genetic mutation that appears to cause the condition in most of people who inherit it

This is very interesting, You are a very skilled blogger. I have joined your feed and look forward to seeking more of your wonderful post. Also, I have shared your site in my social networks!

I adore your wp design, wherever did you download it through?

Reading your post made me think. Mission accomplished I guess. I will write something about this on my blog. Have a nice Tuesday!