How to Actually Pass Your FTMO Challenge in 2023

Who here has lost a prop challenge before?

No really, raise hands – that’s right, we want full class participation here.

Okay, so it’s your first year of trading, you’ve learned a few strategies, likely ones with indicators, likely from some 20-something college dropout on Youtube. And I know what you’re thinking – wait, isn’t this guy some YouTuber who’s in his 20-somethings, who also taught indicator strategies? Well you’re wrong, I’m actually in my early 30’s. And please don’t “yuck my yum” – indicators have actually served me really well.

Anyways, we were talking about you.

So you’re mostly losing money month to month, and you’re remembering so fondly the days of joy and ecstasy when you do actually make a little money, and you conveniently forget about all those other days when you pulled your hair, cried tears of sorrow and anguish, and you told yourself, “I’m never trading a prop challenge again”.

But you still cling to hope.

And you still keep showing up

And despite allllllll the evidence saying otherwise, you say to yourself, after only trading for five months, “Yeah, I think I’m ready for a prop firm challenge.”

You know where this is going.

You’re going to fail that challenge and the 4 others you’ll take after it.

And I’m not actually not here to talk about that experience.

Trading for a prop firm, before you’re actually profitable or ready, is the duh answer to the question of why people fail their prop challenges.

Lack of trading experience is the “duh” answer and it’s not what this post is about.

Instead, today we’re going to talk about 3 reasons why you with your years of trading and your experience and your hard work, are going to fail not one, not two, but multiple challenges.

And likely lose your funded account as well.

By the end of this post you’re going to become enlightened of the crux of what is preventing you from reaching this prop firm trader status and with each one I’ll share with you a few remedies, so that you can overcome and finally stop this vicious cycle.

And if you stick around long enough, you might just find a piece of treasure hidden in this post.

So, I often speak with a positive and mostly academic way of presenting information on this blog, but today is going to be a little bit different. I want to tell it to you straight and with a healthy dose of humor to boot.

If You’re Going to Prop Trade, You Must Understand This ONE THING

Okay, enough intro, let’s dive in.

I think before anything else, we need to cover a ground rule.

There’s something you need to understand before we talk about why most people fail challenges.

Here, let’s sit down, I need to make sure you’re not standing for this in case you faint.

So, make yourself ready to receive what I’m about to give. (That sounds weird)

So, make yourself receptive to what I’m about to say.

Ready?

Prop firms are designed to fail traders.

(That kind of hurt your hope a bit, didn’t it?)

Well, don’t worry, I’m here to catch those tears when they fall.

Well, don’t worry, I’m here to catch those tears when they fall.

But before we move forward, it’s time to accept that trying to achieve an idea of being a“good enough” trader is not what it’s going to take to actually become funded.

And if you get fed up with prop trading and decide to trade with your own account instead, you have not failed as a trader, you’re just making a choice that fits your preferred style.

So please, please, please, please, please, everyone just take a deep breath, stop being so hard on yourself.

Trading is hard, it comes with a ton of a failure, so if you’re failing, you’re just having a normal trading experience.

When it comes to prop trading, it’s not about being some kind of professional-level trader, it’s about being a savvy prop firm trader who can play the game and play it well.

Prop trading is a game and by the end of this video, you’re going to be well-equipped to play that game and get around its rules.

WHY TRADERS FAIL FTMO CHALLENGES

Okay, now that we’re back to earth and grounded, let’s get started with the 3 reasons why most traders will fail their ftmo challenge and how to remedy these problems so that we can overcome them.

Reason #1: Trading With Strategies Not Designed for Prop Challenges

Reason #1 that most people will fail prop firms is that they believe professional strategies will get them funded.

So many people, logically and rightfully assume that using a professional-level strategy will get them to profit, right?

WRONG!

I want you to remember this advice instead: learn from people who have exactly what you want and we are placing emphasis on the adverb in that sentence..

Don’t know what an adverb is? Well, good thing you’re becoming a prop trader and not becoming an English teacher.

If you want to pass a prop firm challenge, then you need to learn from people who have also passed prop firm challenges.

So a reason that a lot of people may fail is that they’re using these professional-level strategies that are not actually capable of hitting the FTMO target of 10% in one month. Or they just have a lot of months that are low-income, break-even, or lose.

So one way you could remedy this issue is to avoid FTMO altogether and instead take a no-time-limit prop firm challenge, kind of like Funded Trading Plus (plus there’s a nifty 10% off coupon to go with it – Use “DFX10” at checkout for 10% off).

If you decide to go that route, then you don’t even need to read the rest of this blog. Here’s your solution to stop failing with FTMO, you’re welcome.

But even if you search the ends of the earth for a prop firm with as few rules as possible, you’re still going to run into either a rule, or an ambitious profit target, that’s going to make it difficult to just walk right in and pass a challenge.

Therefore, it’s likely that the highly professional strategy you learned from some seasoned former investment firm trader will not be durable enough to pass your FTMO challenge.

You may need to learn a completely different strategy, use a different risk management tactic, or learn a whole other trading style that you have never tried before.

Speaking of new strategies..

What’s that.. Oh, look, a 50% off coupon for my own FTMO-passing strategy.

[USE “FULLPRICESUCKS for 50% OFF the DFX Scalping Course]

A plug for my own course, how completely unexpected!

I’ll just leave that right here, do with it as you will.

Reason #2: Not Using a Manipulative Risk Strategy

The second reason why most traders fail their FTMO challenge even if they have a profitable strategy is that they’re not using a risk management strategy that will take them to the 10% profit target .

This usually means that traders will either over-leverage on their risk or they’re not using a savvy enough of a risk management approach that can help them manipulate their wins.

So FTMO asks the trader to hit 10% profit within 30 days.

If you take out the Saturdays and Sundays that you can’t trade, then you are left with 23 to 25 actual trading days.

Some of those days you might not even get a signal for your strategy.

So overall this is not a lot of time to work through a strategy.

If you wind up in a losing streak, it’s highly unlikely that you’re going to get out of it by the end of the challenge.

Most people can’t get by and do this by risking only 1% per trade unless they have a really high win rate and a really risk-to-reward ratio.

So the logical next step, may be to bump up the risk per trade.

Some people will risk 2 or even 3 or 4% per trade.

And this can be really exciting when this works but it’s hella depressive when it doesn’t.

If you’re more of a swing trader, you may be able to get away with risking 2% per trade so long as you have a high win rate or high return.

But the more trades you take each week the likelier that bumping up your risk will just hurt you over the long run.

Believe me, I’ve been here too. I have passed a challenge using 2% per trade, taking 2 trades a day most days of the week, only to get into the verification stage and then completely be blindsided by a losing streak and lose that verification.

It is completely natural that strategies have losing streaks.

Instead, there’s another way you can approach tackling this big 10% target.

Try risking more when you win and less when you lose.

The most common tactic for this I see around the world of forex prop traders is to make sure your strategy can achieve a 1:3 risk to reward and has a higher than 50% win rate and then when you win, you take that 3% you won and apply it to the next trade, where you’ll be risking 3 or 4%. If that trade wins, then you’ll have passed your challenge. If it loses, then you just return to risking 1% per trade.

So all you need to do is focus on showing up and then just get two wins in a row.

Bam! Challenge won.

Another tactic that I see that I also like to use for myself, is to have a variable risk percent for each level of the challenge.

So for instance, starting out the gate I might risk 1% on a trade when I’m at that break-even balance. If I win and go higher, like hit 3% return, then maybe I’ll bump up my risk per trade to something like 2%. And inversely if I were to lose and have a 3% drawdown on the account, then maybe I’ll risk something like 0.5% per trade until I can get back up to that break-even status.

This fluctuation is really useful when there are a lot of winning streaks or losing streaks and it can help you keep a more strong psychological mindset and not be too dissuaded by any gargantuan loss.

And when you DO get funded…

And when you DO get funded…

Now there’s another important point we need to touch on while we’re talking about risk- You need to know that the slimy tricks that you’re going to play while you’re trying to pass your challenge are not actually sustainable when you are funded.

Not in this dumpster fire.

The biggest reason why most people fail to keep their funded account is that they continue to trade the same way as they did when they were trying to get 10% in profit in one month.

Granted, this doesn’t mean that you’re not capable of having these really big winning months I’m just saying for your sanity when you start prop trading as a fully funded prop trader, just aim for a realistic 2% in the month.

Hit that win, get your refund fee for your challenge and keep that around just in case you lose your funded account so that you’re never paying for more than one challenge account. If you have to start over. Again.

My biggest tip that your greedy mind will likely scoff at and probably ignore is to just aim for 2% a month and be done with it.

Go for consistency in profit, not massive gain, at least when you’re navigating the first few months of being a prop firm trader.

Hope for the best, expect the worst, and maybe wind up somewhere in the middle.

Reason #3 Trading With Fear

And the last reason why traders will fail their FTMO challenge is that from the first trade of the challenge they are stuck in fear.

I have never won a prop challenge while feeling scared.

Inversely, every time I’ve won a prop challenge or have received a funded account or got a payout, I felt confident that month and I trusted my strategy.

When you’re feeling confident, you’re less likely to break a rule or seek to revenge trade or play around and overmanage your trade.

Confidence comes from having trust in your strategy, not from doing cocaine while you trade, that’s just straight-up toxic behavior!

(I don’t know why so many people find Wolf of Wall Street inspiring, he loses in the end! It’s not going to work out for you, it didn’t work out for him. )

Anyways, you build confidence when you actually understand that your strategy works.

You need to have evidence that it’s profitable. This ain’t some whoo whoo magic, I’m not asking you to perform trust falls with your strategy.

And the best way to gain that evidence is to:

1) Backtest

2) Demo trade

3) Trade it on a very small live account.

Basically, have some experience making money on your strategy before you take it to a prop challenge.

And maybe keep a meditation practice so you stop being such a reactive person. Capisce?

Conclusion

Okay, you read the title of this video, and you knew it wasn’t going to be an easy answer to swallow. I don’t doubt that at least twice while reading this that you probably thought to yourself, “I’m not going to do that!” But seriously, if you’re losing challenge after challenge after challenge, then just stop. Stop! Go back, find something that resonated with you in this post, and do it, do it today.

Try something different as suggested by someone who has actually passed prop firm challenges.

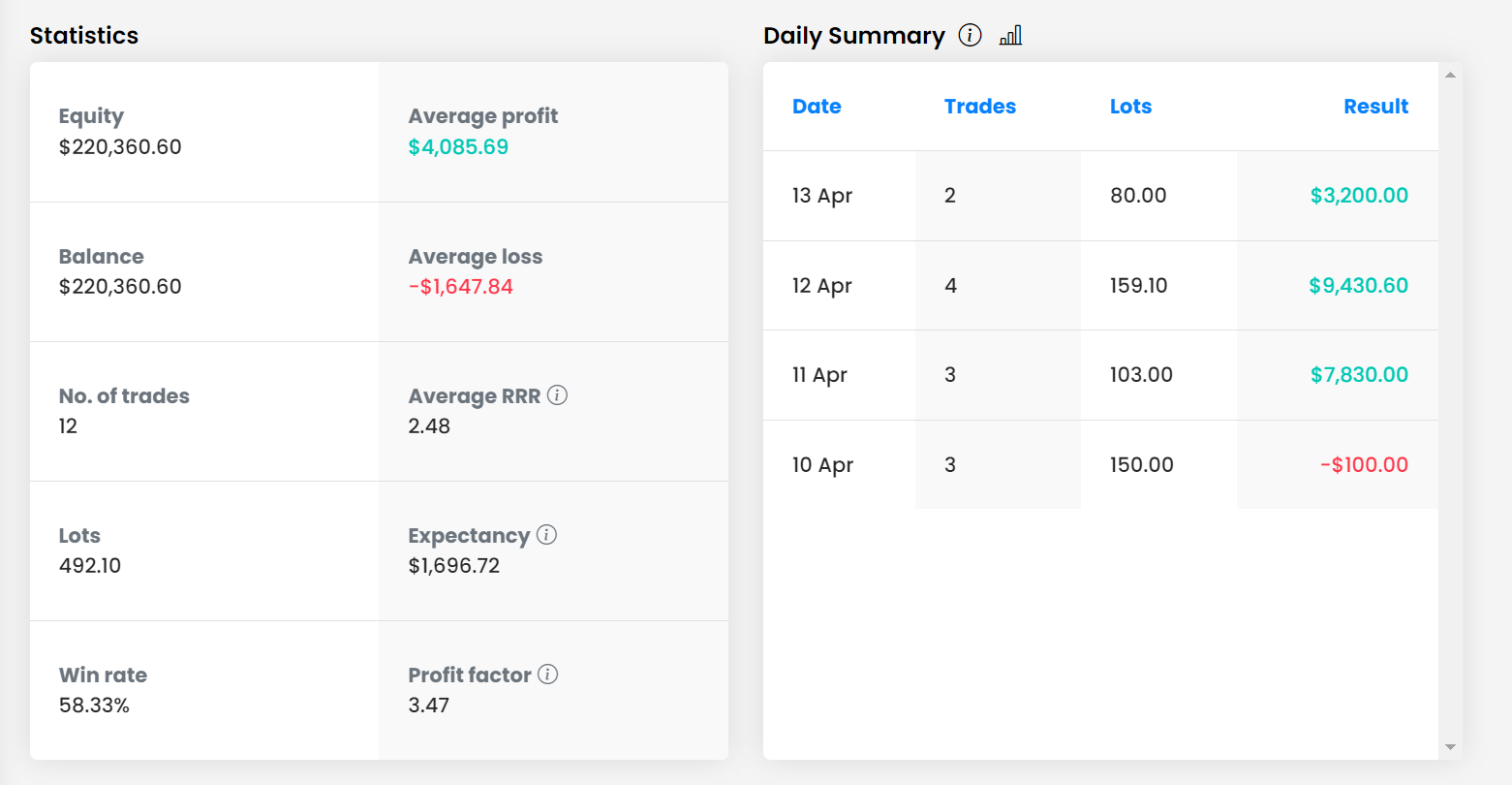

[Oh look, here’s one of my certificates from passing FTMOchallenges]

Maybe now you’ll take me seriously when I say, please, review, go back, and find one thing to do today you can use to make yourself a better trader.

You really don’t need to lose three more challenges in order to finally take this seriously.

Your bank account will thank you.

Alright, I’m done here for today, thank you for reading, subscribe if you want more insights into prop trading, and I wish you all nothing but the best of strength and luck with your own trading.

I’ll see you in the markets.

Take care!

Pingback: LSM99DAY เว็บพนันออนไลน์อันดับ 1 ให้บริการตรงไม่มีตัวแทน

Pingback: ส่งพัสดุ

Pingback: EndoliftX

Pingback: hit789

Pingback: videos

Pingback: rca77

Pingback: fenix168

Pingback: สล็อตวอเลท เติมเงินเว็บตรง AUTO ไม่มีขั้นต่ำ

Pingback: ทางเข้าpg

Pingback: ทัวร์ธุรกิจจีน

Pingback: บริการส่ง SMS

Pingback: SHOPEE สล็อต

Pingback: best disposable vape

Pingback: chat sites

Pingback: Forex trading

Pingback: คาสิโนออนไลน์ sagame

Pingback: Angthong National Marine Park

Pingback: ชุดกระชับสัดส่วน

Pingback: Mostbet casino

Pingback: สมัครเล่นหวย ปิงปองออนไลน์

Pingback: review

Pingback: เช็คสลิปโอนเงิน

Pingback: เครื่องเป่าแอลกอฮอล์

Pingback: assistencia informatica lisboa

Pingback: EV Charger