Glow-Node: The Definitive Prop Firm Review

This post contains affiliate links. I have voluntarily chosen to become an affiliate of this prop firm after doing thorough research and asking questions to a representative of Glow Node. I believe this is a quality experience for prop traders looking for a new set of challenge rules.

Finding the Diamond in the Rough

As someone who has been solely trading prop firm funds for over two years, I am a trader who is always keeping an eye out for firms that offer more realistic challenge rules and better benefits. For the most part, when I see new firms pop up, I immediately avoid all marketing material and go straight to their challenge rules and FAQ pages. If any of the rules mostly mimic FTMO, MyForexFunds (MFF), or Funded Trading Plus (FTP), I pass on the opportunity. I’m picky – I don’t want to try or recommend anything that will take advantage of traders – we both deserve better than hype and scams. FTMO, MFF, and FTP have plenty of third-party validity and exhibition of proof of payout. I only want to share and promote firms that reward traders for responsible and (realistic) profitable trading while minimizing the number of hurdles a trader needs to jump through in order to see any kind of payout.

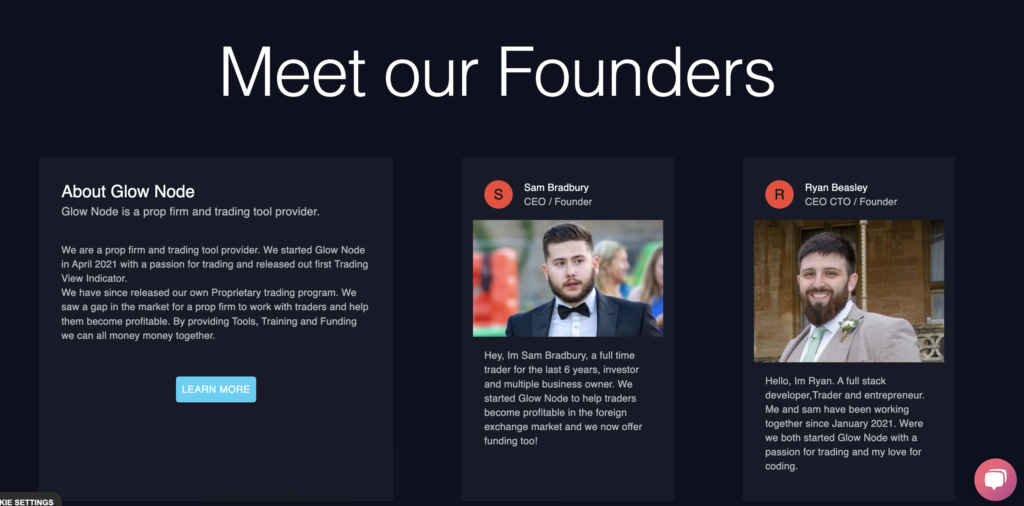

However, when there are new offerings and features that promise a slightly easier challenge and greater payout benefits, then I dig in to learn more. I want to make sure the firm is run by professionals, has a solid business plan and team, and shows promise of continually seeking ways to offer more to the trading community.

Today, I’m here to share with you a new diamond in the rough – Glow Node.

Luckily, I don’t always need to search for new firms. Some of the best ones (Funded Trading Plus, for example) find me. Recently, a member of Glow Node, Isiah, e-mailed me to share information about their firm and affiliate opportunities. Originally established in 2022 as a trading education and indicator provider, they are now offering prop firm challenges to responsible traders.

I’ve turned down plenty of prop firms in the past because they don’t meet my criteria for offering something easier/better than FTMO, MFF, or FTP.

Glow Node is the first, in a while, that has impressed me from the start because it does so much more than just beat the industry gold standard! In this review, I’m going to tell you why.

Okay, Andrew, enough context, now tell us – What’s so AWESOME about Glow Node?

Alright, let’s dive in – to start, we’re going to cover Glow Node’s main account offerings and rules. Remember, I am writing a review of this firm and am expressing my own analysis and opinions. Please do your own research and inquiry by visiting www.glow-node.com and using their chatbot or contact information to get accurate and verified details. Rules and criteria frequently change in this industry, so there may come a time when what’s presented here is outdated.

ALWAYS READ THROUGH THE FAQ OF ANY PROP FIRM BEFORE SIGNING UP!

Glow Node currently offers a 2-Phase Evaluation, 1-Phase Evaluation, and Instant Funding through the brokerage firm 8-cap.

As of 2.15.2023:

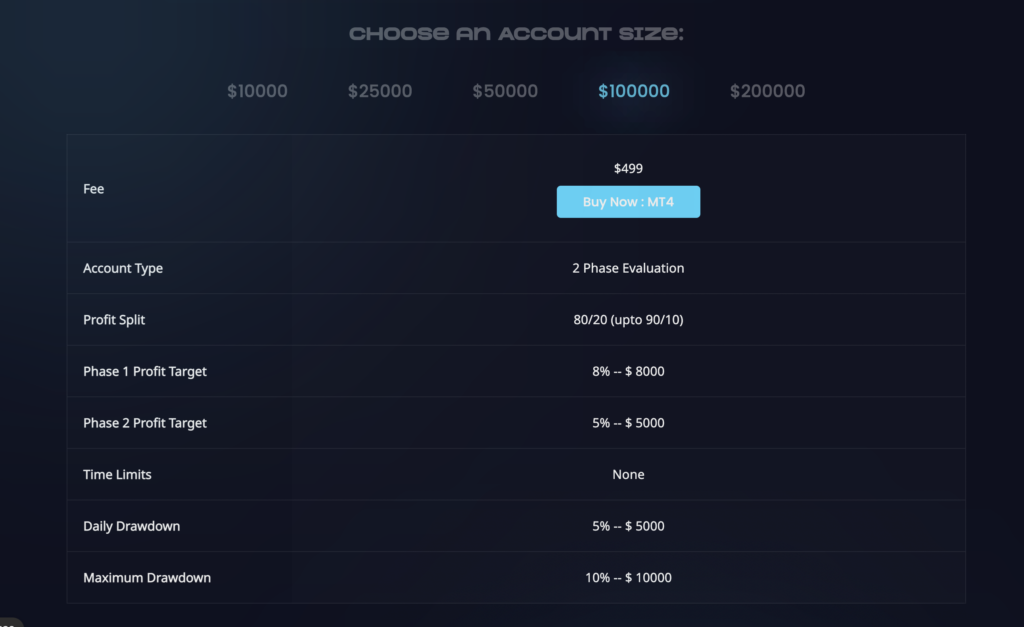

2-Phase Evaluation

Account Sizes: $10,000 – $200,000

Cost of $100k account: $499

Profit Split: 80/20 (up to 90/10)

Phase 1 Target: 8%

Phase 2 Target: 5%

Time limit: NONE

Daily Drawdown: 5% (Relative)

Max Drawdown: 10% (Trailing)

Trading Time: Okay to trade News, Overnight, Weekends

Live Account: Same daily/max drawdown rules and no restrictions on trading time

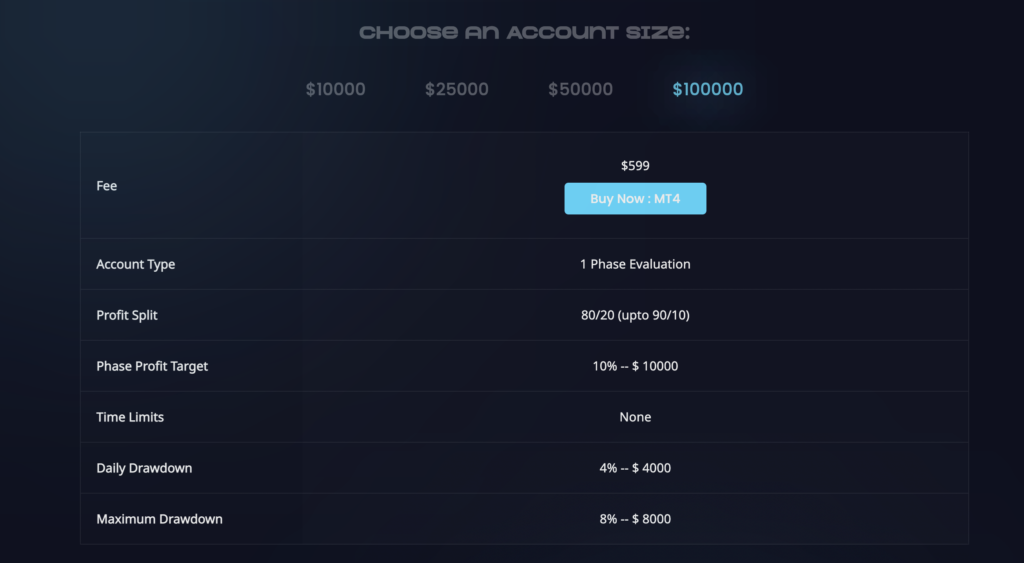

1-Phase Evaluation

Account Sizes: $10,000 – $100,000

Cost of $100k account: $599

Profit Split: 80/20 (up to 90/10)

Phase 1 Target: 10%

Time limit: NONE

Daily Drawdown: 4% (Relative)

Max Drawdown: 8% (Trailing)

Trading Time: Okay to trade News, Overnight, Weekends

Live Account: Same daily/max drawdown rules and no restrictions on trading time

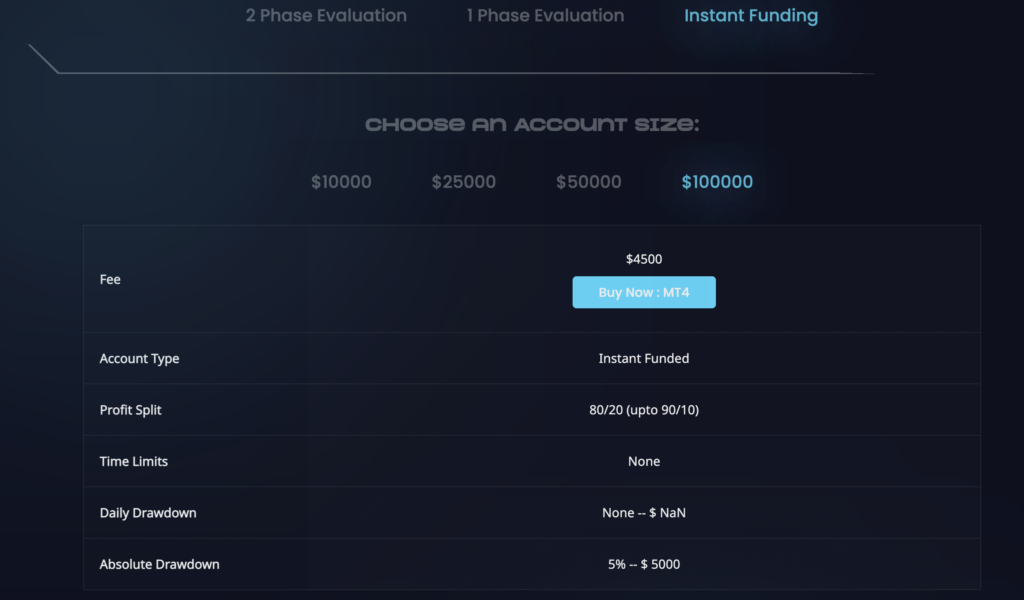

Instant Funding

Account Sizes: $10,000 – $100,000

Cost of $100k account: $4500

Profit Split: 80/20 (up to 90/10)

Daily Drawdown: none

Max Drawdown: 5% (Absolute)

Trading Time: Okay to trade News, Overnight, Weekends

Other Things to Keep in Mind:

- You can request withdrawals from the account every 14 days by contacting support

- Be careful of news trading – if there are abnormal price movements after a news release the firm can reset your trade. Learn more under “CAN I TRADE NEWS” in Frequently Asked Questions.

- They charge $3.50 commission per lot for Forex pairs

- Max Leverage: 1:30 for Forex, 1:10 for indices, 1:3 for cryptocurrencies

- You cannot hold over 30% margin during the weekend with your funded account (volatility protection)

- You can maintain a maximum of 3 accounts with a total of $300,000 starting balance

- EA copy traders and bots are allowed

- The firm offers a scaling plan, that more or less bumps up the account 30% when, over 3 months, there are 10% profits withdrawn from the challenge accounts or 15% achieved through instant funding

- Refund of challenge fee only after achieving 15% profit

The Pros of Trading with Glow Node

Just by observing the above rules, you can already tell that there are two MAJOR features that this firm offers:

- No time-limit challenges

- Easier profit targets (compared to FTMO and Funded Trading Plus)

- Short-term swing-trading-friendly

I’m a huge fan of prop firms that don’t have a time limit. Responsible trading often involves placing small lot sizes and risking closer to 1% or less per trade. It’s really tough to hit 10% profit when you’re given only 20 or less days to trade (After factoring weekends and holidays). So too, anyone who relies upon higher time frames with trades held longer than a few hours often struggle to hit time-limit challenges without risking more per trade. Unless you are a scalper or have a high-return-per-trade/high win-rate, 30 day challenges are designed to psychologically trap you and lead you to failure by over-risking.

Thus, Glow Node is a fantastic option for traders who want a lot of wiggle room and freedom to hit the target when the markets (rather than the prop firm) decide. Furthermore, this is a great resource for swing traders who like the easier target of 8% profit but need more time to complete the challenge than what MyForexFunds or other time-based firms offer.

Additional Offerings – How This Firm is Positioning Itself to Grow as a Company

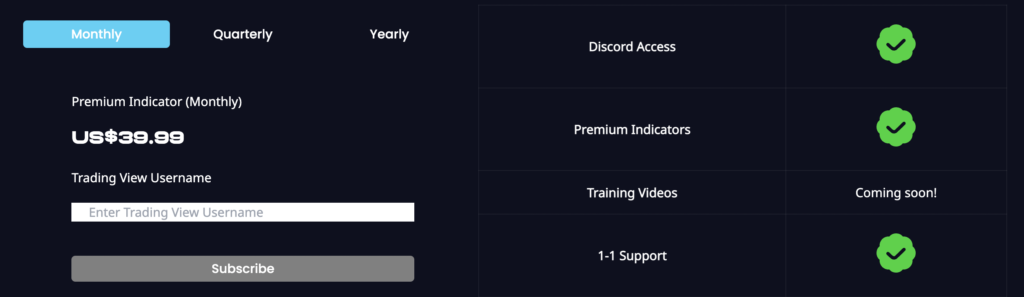

There are a couple of other things that make Glow Node a reliable and reputable firm beyond offering a more realistic and easier challenge. They are also preparing to launch FREE trading education for traders. Currently, the firm runs an active Discord group and offers a subscription to indicator-based signals. After a brief review of the indicator’s sales page, I am not entirely clear what the philosophy or features of this indicator entail, but the upcoming launch of their free education may explain more.

Now for the Cons

As I’ve explained in other prop firm reviews, while we traders may groan and moan over the variety of rules set by prop firms, at some point every prop firm needs to make a trade-off or two in order to stay profitable as a business and ensure that only consistently profitable and responsible traders make the cut. This is why you’ll see firms requiring 2-phase challenges, high profit targets, rules for lot sizes or stop losses, etc.

However, we also want to make sure that the firms we trade with is offering ethically-sound rules and requirements. This means that responsible traders who can show consistent profit should be able to receive a payout for their work and application of solid trading skills without hassle. And when a firm promises to pay its traders, it should do so! We want to avoid challenges that require the trader to take greater risks than what’s advisable by professional trading philosophy.

Sometimes it can be tricky to determine whether rules are set for the protection of the firm or to make money off of unrealistic trading conditions.

For Glow Node, I believe their rules are reasonable.

The greatest con’s I see here are just standard trade-offs:

- The firm withholds a refund for the challenge fee until 15% profit is withdrawn

- The chance of resetting a trade during a news event is a problem for scalpers who trade based upon news events

- No more than 30% of margin can be held over the weekend – this can make trading difficult for long-term swing traders (Although it’s actually a good protection in disguise)

**Also, being a new firm, they may lack the proof of payout by individual traders that other long-standing firms do. But this is something that will change as more individuals become funded and paid.

Why these trade-offs are not a concern:

- The majority of prop firm income is generated from challenge fees.

In a world where 95% of traders fail, you don’t need to guess why these challenge fees are pricey. Thus, one way a firm can make a trade off between offering relaxed rules and ensuring they still profit is to do what it can to keep the challenge fee. While the firm is making it easier to beat their challenge, staying profitable once funded is a whole other beast. Only those who are truly consistent in profiting can hold through. Again, this is a reward for responsible traders over the long run, so I’m not too worried. You’ll just have to wait for that nice little bonus in your payout for a few weeks or months.

However, this is a trade-off – there are other firms who will return your fee to you with your first payout. But those same firms will ask that you achieve unreasonable profit within 30 days. You can pick which one works best for your style of trading.

- The news rule may only apply to rare occasions.

I’m not entirely sure what the range of instances for resetting a trade include, whether it’s a highly abnormal release or just extra volatility from major economic data, like the NFP. I imagine this isn’t a concern for most traders, especially when using higher time frames. Nonetheless, be sure to contact the firm and ask more questions if news scalping is part of your main trading system. You can also stick to other firms that allow for more wiggle room around news trading.

- We probably shouldn’t be holding over the weekend, anyways. There’s a ton of volatility after weekend news is digested. It’s like turning your phone on after a 14-hour flight and being bombarded with text messages. The market deals with all of the changes to orders at once.

Personally, when I swing trade for prop firm accounts, I’m looking to hold a trade no longer than 1-4 days, tops, and never on the weekends. My impression of other short-term swing traders who have funded accounts is that this is their approach, too.

However, if you are swing trading for a longer period of time, your stop loss is a lot larger than intraday traders and your position size far smaller. It’s likely that if you’re risking less than 1% per trade and you don’t hold a lot of positions, then you should be fine and this rule won’t affect you. However, be sure to contact the firm and ask more questions before deciding to sign up for a challenge. Better safe than sorry.

One last thing – I should also note that, while this isn’t necessarily a con, it can be a bit of an adjustment to go from trading with absolute drawdowns to having a trailing drawdown. If you’re used to FTMO or MyForexFunds, then you can’t go into Glow Node blindly trading with the same lot sizes and risk percentages per trade. You need to keep an eye on where your trailing drawdown is before each trading session.

I recommend dialing down your risk a notch to something like 1% or less – time is on your side and a smaller risk per trade helps take the stress out of trading when you do lose or experience losing streaks. However, if your strategy has a low win-rate but high return, then you may want to seek out a different firm as it’s likely that the trailing drawdown may catch up with you at some point.

Who Benefits The Most From Taking a Glow Node Challenge?

Okay, so now that we’ve covered the basics, pros, and cons, let’s determine who may benefit the most from trading with this firm.

Given that this is a no-time-limit challenge with a reasonable profit target, and a few rules regarding news and weekend trading with the live accounts, I think these trading styles will have the best probability of regularly receiving payouts from Glow Node:

- Short-term swing traders – holds trades for 1-4 days

- Day traders who trade around news events

- Scalpers who avoid news

- Individuals who know they can achieve 1-5% profitability per month but can’t fathom hitting 8% or 10% within 30 days

- Folks who have failed MyForexFunds challenges due to hitting the time limit

- Traders who are looking for educational support from their prop firm

Overall, this relatively new firm offers a unique set of rules and features that help responsible and patient traders make a solid living off of well-honed trading skills. I’m looking forward to trading with them in the future and seeing what their upcoming education launch has in store!

Um interested

As soon as I noticed this internet site I went on reddit to share some of the love with them.

Very interesting topic, regards for putting up.

Very interesting subject , thankyou for posting.

Thank you for another informative web site. The place else may just I get that type of

info written in such a perfect way? I’ve a undertaking that I’m just now working on,

and I have been on the glance out for such info. You can see similar: sklep internetowy and here dobry sklep

Hello, I enjoy reading all of your article. I wanted

to write a little comment to support you. I saw similar here:

najlepszy sklep and also here: dobry sklep

Way cool! Some very valid points! I appreciate you writing this post and also the rest of the

site is extremely good.!

Wow, incredible weblog format! How lengthy have you been running a blog for?

you make running a blog glance easy. The full look of your website is excellent, as smartly as the content material!

You can see similar: dobry sklep and here e-commerce

It’s very interesting! If you need help, look here: hitman agency

These comments often reflect an individual’s beliefs, preferences, or judgments about the significance, importance, or quality of a particular subject. Value comments can be found in various contexts, such as discussions about art, literature, music, ethics, politics, and more.

Attractive section of content. I just stumbled upon your site and in accession capital to assert that I

get actually enjoyed account your blog posts. Any way I’ll be subscribing

to your augment and even I achievement you access consistently fast.

I saw similar here: e-commerce and also here: e-commerce

Hi there friends, its wonderful paragraph regarding educationand completely explained, keep it up all the time.

I saw similar here: Najlepszy sklep

It’s very interesting! If you need help, look here: ARA Agency

I’m not positive the place you’re getting your info, however great topic. I needs to spend some time finding out more or understanding more. Thank you for great info I used to be in search of this information for my mission.

Hello! Do you know if they make any plugins to help with SEO?

I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good success.

If you know of any please share. Kudos! You can read similar text here: E-commerce

bookmarked!!, I like your site!

Wow, this post is pleasant, my younger sister is analyzing such things, thus I am going

to tell her.

I all the time emailed this website post page to

all my contacts, since if like to read it next my friends will too.

Hi! I know this is somewhat off topic but I was wondering which blog platform are you using

for this website? I’m getting tired of WordPress because I’ve had issues with hackers and

I’m looking at alternatives for another platform.

I would be awesome if you could point me in the direction of a good platform.

After I initially commented I appear to have clicked the -Notify me when new comments are added- checkbox and from now on whenever a

comment is added I recieve 4 emails with the exact same comment.

There has to be an easy method you are able to remove me from that

service? Thank you!

My spouse and I stumbled over here different web address and thought I might as well check

things out. I like what I see so now i am following you. Look forward to looking

at your web page again.

Hi, Neat post. There is a problem with your site in internet explorer, would check this… IE still is the market leader and a big portion of people will miss your excellent writing because of this problem.

I haven?¦t checked in here for some time because I thought it was getting boring, but the last few posts are great quality so I guess I will add you back to my everyday bloglist. You deserve it my friend 🙂

This website is known as a walk-via for all the info you wished about this and didn’t know who to ask. Glimpse right here, and also you’ll undoubtedly uncover it.

Wow, wonderful weblog structure! How lengthy have you been blogging for?

you made running a blog look easy. The whole look of your site is fantastic, as neatly

as the content! You can see similar here najlepszy sklep

You have brought up a very fantastic points, thankyou for the post.

I?¦ve been exploring for a little for any high quality articles or blog posts in this kind of house . Exploring in Yahoo I at last stumbled upon this web site. Studying this information So i?¦m satisfied to exhibit that I’ve an incredibly excellent uncanny feeling I came upon exactly what I needed. I most unquestionably will make sure to don?¦t put out of your mind this website and provides it a glance regularly.

Someone essentially help to make seriously articles I would state. This is the very first time I frequented your website page and thus far? I surprised with the research you made to create this particular publish extraordinary. Magnificent job!

Thanx for the effort, keep up the good work Great work, I am going to start a small Blog Engine course work using your site I hope you enjoy blogging with the popular BlogEngine.net.Thethoughts you express are really awesome. Hope you will right some more posts.

Wow, wonderful blog structure! How lengthy have you ever been blogging for?

you made blogging look easy. The full look of

your site is excellent, as well as the content! You can see similar here prev next and it’s was wrote by Lyle73.

Wow, awesome weblog format! How lengthy have you been running a blog for?

you make blogging look easy. The total glance of your

web site is great, let alone the content material!

You can read similar here prev next and it’s was wrote by

Frances69.

Greetings! I know this is kinda off topic but I’d figured I’d ask. Would you be interested in exchanging links or maybe guest writing a blog article or vice-versa? My site covers a lot of the same subjects as yours and I think we could greatly benefit from each other. If you might be interested feel free to shoot me an e-mail. I look forward to hearing from you! Excellent blog by the way!

Wow, fantastic weblog format! How long have you been blogging for?

you made blogging look easy. The full look of your web

site is magnificent, as well as the content!

I read similar here prev next and those was wrote by Dewayne92.

Wow, incredible weblog format! How lengthy

have you ever been running a blog for? you made

blogging glance easy. The overall glance of your web site is wonderful,

let alone the content! You can see similar here prev next and that was wrote by Aisha71.

Wow, wonderful blog format! How lengthy have you been running a blog for?

you make blogging glance easy. The whole look of your web site

is wonderful, as neatly as the content! You can read similar here prev next and those was wrote by Cordell93.

Wow, superb weblog layout! How long have you been running a blog for?

you made running a blog look easy. The overall look

of your website is excellent, let alone the content material!

I saw similar here Linwood Zef4. 2024/04/23

I am sure this post has touched all the internet visitors, its really really fastidious

piece of writing on building up new web site.

Your style is very unique in comparison to other people I have read stuff from.

Thank you for posting when you have the opportunity,

Guess I’ll just bookmark this blog.

Right away I am ready to do my breakfast, later than having my breakfast coming again to read further

news.

I enjoy, result in I discovered just what I used to be taking a look for.

You have ended my 4 day lengthy hunt! God Bless you man. Have a

nice day. Bye

This article will help the internet users for creating new webpage or even a weblog

from start to end.

Hi there, I log on to your blogs daily. Your humoristic style

is witty, keep doing what you’re doing!

naturally like your web-site but you need to test the spelling on quite a few of your posts.

Many of them are rife with spelling issues

and I find it very bothersome to tell the reality then again I’ll surely come back again.

I’m not certain where you are getting your info, but good topic.

I must spend some time learning much more or understanding more.

Thank you for magnificent info I was on the lookout for this information for my mission.

Great delivery. Great arguments. Keep up the amazing work.

Thanks for sharing your thoughts about website. Regards

I’ve been surfing online more than three hours nowadays,

but I by no means found any attention-grabbing article like yours.

It’s pretty worth sufficient for me. In my view, if all webmasters and bloggers

made excellent content as you probably did, the web can be much more useful than ever before.

Stunning quest there. What occurred after?

Thanks!

Aw, this was a very nice post. Finding the time and

actual effort to generate a really good article… but what can I say…

I hesitate a lot and don’t manage to get anything done.

I enjoy, result in I discovered exactly what I used to

be taking a look for. You have ended my four day lengthy hunt!

God Bless you man. Have a great day. Bye

There’s definately a lot to know about this issue.

I really like all of the points you’ve made.

Thanks for the good writeup. It in fact was a

amusement account it. Glance complex to more added agreeable from you!

However, how can we keep in touch?

Hi! I could have sworn I’ve been to this site before but after browsing through

a few of the posts I realized it’s new to me.

Anyways, I’m certainly pleased I came across it and I’ll be book-marking it and checking back often!

Wow, this piece of writing is pleasant, my younger sister is analyzing these things, so I am

going to inform her.

This is very interesting, You’re a very skilled

blogger. I have joined your rss feed and look forward to seeking more of your excellent post.

Also, I’ve shared your site in my social networks!

It’s very trouble-free to find out any topic on web as compared to books, as I found this

piece of writing at this website.

Hey there! I’m at work browsing your blog from my new

apple iphone! Just wanted to say I love reading through your blog and look forward to all your posts!

Keep up the excellent work!

When someone writes an post he/she maintains the thought of a user in his/her mind that how a user can understand it.

Thus that’s why this post is outstdanding. Thanks!

Everything is very open with a clear explanation of the challenges.

It was truly informative. Your site is useful. Thanks for sharing!

It’s actually a nice and useful piece of

information. I’m happy that you shared this helpful information with us.

Please keep us up to date like this. Thank you for sharing.

What’s up, after reading this amazing piece

of writing i am too delighted to share my knowledge here with colleagues.

My relatives always say that I am killing my time here at net, except

I know I am getting familiarity all the time by reading thes fastidious posts.

Heya! I understand this is sort of off-topic but I needed to ask.

Does running a well-established blog such as yours require a massive amount work?

I’m completely new to writing a blog however I do write in my journal everyday.

I’d like to start a blog so I can easily share my own experience and feelings online.

Please let me know if you have any suggestions or tips for brand new aspiring bloggers.

Thankyou!

Thanks for sharing your thoughts on joker123 deposit pulsa.

Regards

Pretty component of content. I just stumbled upon your website and

in accession capital to say that I acquire actually loved account your blog posts.

Anyway I’ll be subscribing to your augment or even I

fulfillment you access constantly fast.

Have you ever considered about including a little bit more than just your articles?

I mean, what you say is fundamental and all. However

think of if you added some great photos or video clips to give your posts more,

“pop”! Your content is excellent but with pics and video clips, this

blog could undeniably be one of the greatest in its niche.

Excellent blog!

Great post. I will be experiencing many of these issues as well..

There’s definately a great deal to find out about this

issue. I really like all the points you have made.

Today, I went to the beachfront with my kids. I found a sea shell

and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She placed the shell to her ear and screamed.

There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this is entirely off topic but I had to tell someone!

Terrific work! This is the kind of information that are supposed to be shared around

the internet. Disgrace on the search engines

for no longer positioning this post higher!

Come on over and talk over with my web site .

Thanks =)

Thanks for a marvelous posting! I really enjoyed reading it, you could be a great author.I will make

certain to bookmark your blog and definitely will come back at some point.

I want to encourage you continue your great writing,

have a nice evening!

I know this if off topic but I’m looking into starting my own blog and was curious what all is required to get

set up? I’m assuming having a blog like yours would cost a pretty penny?

I’m not very internet smart so I’m not 100% sure.

Any tips or advice would be greatly appreciated. Many thanks

Hi! Would you mind if I share your blog with my myspace group?

There’s a lot of people that I think would really enjoy your content.

Please let me know. Many thanks

I’m no longer certain where you are getting your information, however

good topic. I must spend a while finding out more or understanding

more. Thank you for magnificent info I was searching for this info for my mission.

I love it when people come together and share

ideas. Great blog, stick with it!

After looking at a handful of the articles on your web site, I truly

appreciate your way of blogging. I added it to my bookmark site

list and will be checking back in the near future.

Please check out my web site too and let me know how you feel.

It’s hard to come by well-informed people in this

particular subject, but you seem like you know what you’re talking about!

Thanks

Do you have a spam problem on this website; I

also am a blogger, and I was wanting to know your situation; we have created some nice methods and we are looking

to swap techniques with others, please shoot me an email if interested.

A motivating discussion is definitely worth comment.

I believe that you ought to publish more about this issue, it may not be a taboo subject but generally people do not

discuss these subjects. To the next! All the best!!

Hello to all, the contents existing at this web page are really remarkable for people experience,

well, keep up the good work fellows.

Hey There. I found your weblog the usage of msn. This is a really smartly written article.

I’ll make sure to bookmark it and return to read more of your helpful info.

Thank you for the post. I’ll certainly comeback.

Great blog! Do you have any recommendations for aspiring

writers? I’m planning to start my own website soon but I’m a

little lost on everything. Would you advise

starting with a free platform like WordPress or go for a paid option? There are so many options out there that

I’m totally confused .. Any suggestions? Kudos!

Tonic Greens, a natural health supplement, is designed to enhance immune function.

This article gives clear idea for the new people

of blogging, that genuinely how to do running a blog.

Good blog you’ve got here.. It’s hard to find quality

writing like yours nowadays. I seriously appreciate people like you!

Take care!!

Hey there! I’ve been following your web site for a long

time now and finally got the courage to go

ahead and give you a shout out from Lubbock Texas!

Just wanted to mention keep up the fantastic work!

This is really interesting, You are a very skilled blogger.

I have joined your feed and look forward to seeking more of your great post.

Also, I have shared your web site in my social networks!

This blog was… how do I say it? Relevant!! Finally I have found something that helped me.

Thanks a lot!

Hi to every one, the contents present at this web site are in fact amazing for people knowledge,

well, keep up the nice work fellows.

I am really loving the theme/design of your weblog. Do you ever run into any

browser compatibility problems? A few of my blog readers have complained about my blog

not operating correctly in Explorer but looks great in Safari.

Do you have any recommendations to help fix this issue?

It’s in point of fact a great and useful piece of information. I am satisfied that you shared this helpful info with us. Please keep us informed like this. Thanks for sharing.

Terrific work! That is the kind of information that

are supposed to be shared around the net. Shame on the seek engines for not positioning this submit upper!

Come on over and consult with my site . Thanks =)

I absolutely love your site.. Excellent colors & theme.

Did you develop this web site yourself? Please reply

back as I’m attempting to create my very own website and would like to find out where you got this from or just what the theme is called.

Appreciate it!

hello there and thank you for your info – I’ve definitely picked up anything new from right here.

I did however expertise several technical points using this site, since I experienced to

reload the site lots of times previous to I could

get it to load properly. I had been wondering if your hosting is OK?

Not that I’m complaining, but sluggish loading instances times will sometimes affect

your placement in google and could damage your quality score if advertising and marketing with Adwords.

Well I’m adding this RSS to my email and could look out for much more of your respective interesting content.

Make sure you update this again soon.

Awsome article and right to the point. I don’t know if this is really the best place to ask but do you people have any ideea where to hire some professional writers? Thanks in advance 🙂

I am not sure where you are getting your information, but

good topic. I needs to spend some time learning more or understanding more.

Thanks for excellent info I was looking for this info for my mission.

I used to be able to find good advice from your articles.

Informative Site… Hello guys here are some links that contains information that you may find useful yourselves. It’s Worth Checking out 급전

Absolutely pent subject matter, appreciate it for selective information .대출

It’s fantastic that you are getting ideas from this post as well as from our

discussion made at this place.

After looking over a handful of the blog posts on your site, I truly appreciate your way of writing a blog.

I book marked it to my bookmark site list and will

be checking back in the near future. Please visit my web site too and let me know

how you feel.

I really like your blog.. very nice colors & theme.

Did you design this website yourself or did you hire someone to

do it for you? Plz answer back as I’m looking to design my own blog and would like to find out

where u got this from. thanks

Hello there! This post could not be written much better!

Reading through this post reminds me of my previous roommate!

He constantly kept preaching about this. I will forward this post to

him. Pretty sure he will have a very good read.

Thank you for sharing!

Your article is a valuable contribution to the conversation.급전

Wonderful work! This is the type of info that are meant to be shared across the internet.

Disgrace on the seek engines for now not positioning this submit upper!

Come on over and visit my web site . Thank you =)

I appreciate the time and effort you’ve put into this article.급전

Can you tell us more about this? I’d love to find

out more details.

Undeniably believe that which you stated. Your favorite reason seemed to be on the

web the simplest thing to be aware of. I say to you, I

certainly get irked while people think about worries that they just don’t know

about. You managed to hit the nail upon the top as well as defined out the whole thing without having side effect , people could take a signal.

Will likely be back to get more. Thanks

Thanks for one’s marvelous posting! I seriously enjoyed reading it,

you’re a great author.I will be sure to bookmark your blog and may

come back in the future. I want to encourage one to continue

your great posts, have a nice morning!

Puravive is a natural weight loss supplement and is said to be quite effective in supporting healthy weight loss.

Your passion for this topic is evident in every word.대출

It is perfect time to make a few plans for the future and it is time to be happy.

I’ve read this put up and if I may I wish to suggest you some attention-grabbing issues or advice.

Maybe you can write subsequent articles relating to this article.

I desire to learn more things approximately it!

Renew: An OverviewRenew is a dietary supplement that is formulated to help in the weight loss process.

Article writing is also a excitement, if you know then you can write or else it is complicated to write.

Your article is a valuable contribution to the conversation.대출

Inspiring story there. What happened after?

Take care!

What’s up to all, the contents present at this website are

in fact amazing for people experience, well, keep up the nice

work fellows.

Your article has challenged my assumptions in the best possible way.급전

Hey there, You have done an excellent job. I’ll

definitely digg it and personally suggest to my friends.

I am sure they will be benefited from this website.

It’s very interesting! If you need help, look here: link building

I resonate deeply with what you’ve written.급전

Right here is the perfect webpage for everyone who wishes to understand this topic.

You know so much its almost tough to argue with you (not that I really would want to…HaHa).

You definitely put a new spin on a subject that has been discussed for many years.

Great stuff, just great!

always i used to read smaller articles which

also clear their motive, and that is also happening with this paragraph which I

am reading at this place.

I simply couldn’t leave your website before suggesting that I extremely enjoyed the usual info a person provide for your guests? Is going to be back often in order to investigate cross-check new posts

Wow! At last I got a weblog from where I be

capable of genuinely take helpful information concerning my

study and knowledge.

Your article has opened my eyes.급전

Hi my loved one! I want to say that this post is awesome, nice written and include approximately all significant infos. I would like to peer extra posts like this .

I visited various sites except the audio quality for audio songs existing at this website is truly superb.

Exactly what I was searching for, appreciate it for posting.

If you wish for to improve your knowledge just keep visiting this web page and be updated with the latest gossip posted here.

Awesome article.

Howdy very nice site!! Man .. Excellent .. Amazing ..

I’ll bookmark your web site and take the feeds additionally?

I’m happy to seek out numerous useful information right here

in the submit, we want develop extra techniques in this regard, thank you for sharing.

. . . . .

I do enjoy the manner in which you have framed this difficulty plus it does present us a lot of fodder for thought. Nonetheless, from what precisely I have seen, I simply hope when the feed-back stack on that people keep on issue and not start on a soap box regarding some other news of the day. All the same, thank you for this fantastic piece and although I do not really go along with this in totality, I respect the standpoint.

Hey I am so excited I found your webpage, I really found you by error,

while I was looking on Askjeeve for something else, Anyhow I

am here now and would just like to say thanks a lot for a

tremendous post and a all round interesting blog (I also love the theme/design), I don’t have time to browse

it all at the moment but I have saved it and also included your RSS feeds, so

when I have time I will be back to read a great deal more, Please do keep up

the fantastic work.

This article was exactly what I was looking for. Excellent work!coinsslot

I loved as much as you will receive carried out right here.

The sketch is tasteful, your authored material stylish.

nonetheless, you command get got an shakiness over that you wish be delivering the following.

unwell unquestionably come further formerly again since exactly the same

nearly a lot often inside case you shield this increase.

I really appreciate the thorough analysis you’ve provided here.swiftnook

I know this if off topic but I’m looking into starting my own weblog and was curious what all is needed to get setup?

I’m assuming having a blog like yours would cost a pretty

penny? I’m not very internet smart so I’m not 100%

sure. Any tips or advice would be greatly appreciated.

Thank you

Pretty portion of content. I just stumbled upon your web site and in accession capital to assert that I

acquire actually enjoyed account your weblog

posts. Any way I’ll be subscribing in your feeds or even I success you get right of

entry to consistently rapidly.

What’s up, its nice post on the topic of media print, we all be aware of media is

a fantastic source of data.

Thank you, I’ve just been searching for information approximately

this subject for a long time and yours is the best I have discovered till now.

However, what in regards to the conclusion? Are you certain in regards to the source?

Neat blog! Is your theme custom made or did you download it

from somewhere? A design like yours with a few simple tweeks

would really make my blog jump out. Please let me

know where you got your design. With thanks

Great items from you, man. I’ve be aware your stuff previous to and

you’re just extremely magnificent. I really like what you’ve received right here,

certainly like what you’re stating and the way in which in which you

say it. You are making it entertaining and you still care for to stay it smart.

I can’t wait to read far more from you. That is actually

a tremendous web site.

I do not even know the way I finished up right

here, however I assumed this submit was once good. I don’t recognise who

you might be but certainly you’re going to a well-known blogger should you are not already.

Cheers!

You can definitely see your enthusiasm within the work

you write. The world hopes for more passionate writers like you who

aren’t afraid to mention how they believe. At all times go after

your heart.

Woah! I’m really loving the template/theme of this blog.

It’s simple, yet effective. A lot of times it’s hard to get

that “perfect balance” between usability and appearance.

I must say you have done a great job with this. Additionally, the blog loads extremely fast for me on Firefox.

Excellent Blog!

This was an enlightening post. I look forward to reading more from you.peakpulsesite

Superb blog! Do you have any suggestions for aspiring writers? I’m hoping to start my own blog soon but I’m a little lost on everything. Would you recommend starting with a free platform like WordPress or go for a paid option? There are so many options out there that I’m totally overwhelmed .. Any recommendations? Many thanks!

Excellent blog here! Also your web site loads up fast!

What web host are you using? Can I get your affiliate link to your host?

I wish my website loaded up as fast as yours lol

Excellent blog here! Also your web site loads up fast!

What web host are you using? Can I get your affiliate link to

your host? I wish my site loaded up as quickly as yours lol

Good article. I’m going through a few of these issues

as well..

Great site. Lots of useful information here.

I am sending it to a few buddies ans also sharing in delicious.

And of course, thanks for your sweat!

Have you ever thought about including a little bit more than just your articles?

I mean, what you say is valuable and everything. Nevertheless just imagine if you added some great photos or videos to give your posts more, “pop”!

Your content is excellent but with pics and video clips,

this website could definitely be one of the most beneficial in its niche.

Amazing blog!

Your blog is a wealth of information. I always learn something new from your posts. This one was particularly enlightening. Great job!blogpulse

It’s genuinely very complex in this active life to listen news on TV, thus I simply use internet for that

purpose, and take the hottest information.

What i do not realize is in reality how you’re no longer really a lot more smartly-liked than you

may be now. You are very intelligent. You realize thus considerably with regards to

this topic, produced me individually imagine it from so many

various angles. Its like women and men aren’t interested except it is something to do with

Girl gaga! Your personal stuffs outstanding. All the time care for it

up!

Precisely what I was looking for, thankyou for putting up.

https://143.198.92.123/ | mainaja

Is noce to have this kind of sites that are extincted nowdays

More helpful hints

You consistently produce high-quality content that is both informative and enjoyable to read. This post was no exception. Keep it up!pulsepeak

If you wish for to increase your knowledge just

keep visiting this web page and be updated with the

most recent news posted here.

I enjoy what you guys are usually up too. Such clever work and reporting!

Keep up the good works guys I’ve added you guys to our blogroll.

I simply could not depart your web site prior to suggesting that I really

loved the usual info an individual supply for your guests?

Is gonna be back steadily in order to check out new posts

I am extremely impressed together with your writing abilities and also with the format

in your blog. Is that this a paid theme or did you customize it yourself?

Either way stay up the excellent quality writing, it’s uncommon to

see a nice weblog like this one nowadays..

Hi it’s me, I am also visiting this web site daily, this web page is genuinely nice and the visitors are actually sharing

good thoughts.

You’ve made some really good points there. I looked on the internet to

learn more about the issue and found most people will go along with your

views on this website.

This is very interesting, You’re a very skilled blogger.

I’ve joined your feed and look forward to seeking more of your wonderful post.

Also, I have shared your website in my social networks!

Hey there would you mind letting me know which webhost you’re utilizing?

I’ve loaded your blog in 3 different web browsers and I must say

this blog loads a lot faster then most. Can you suggest

a good web hosting provider at a reasonable price?

Thanks, I appreciate it!

I’m truly enjoying the design and layout of your site. It’s a very easy on the eyes

which makes it much more pleasant for me to come here and visit more often. Did you

hire out a developer to create your theme? Excellent work!

Regards for helping out, great information. “I have witnessed the softening of the hardest of hearts by a simple smile.” by Goldie Hawn.

I am genuinely happy to read this website posts which contains plenty of helpful

facts, thanks for providing these data.

Tremendous things here. I am very satisfied to see

your post. Thank you so much and I’m taking a look ahead to touch you.

Will you please drop me a mail?

I really appreciate the thoroughness of your research and the clarity of your writing. This was a very insightful post. Great job!slotcoin

hi, thanks!:

Very good article! We are linking to this great content on our website.

Keep up the great writing.

hi, thanks!: Peranox

hi, thanks!: zone porn

hi, thanks!: zone porn

You have a real gift for writing. Your posts are always so engaging and full of valuable information. Keep up the great work!nexusnook

Great check here

l free to adjust these comments as needed to better fit the specific blog posts you’re responding to!dashdome

I enjoyed this article. Check out modern home renovations for more

I have been exploring for a little for any high quality articles or weblog posts on this sort of

area . Exploring in Yahoo I ultimately stumbled upon this website.

Reading this information So i’m glad to exhibit that I’ve a very good uncanny feeling I came upon exactly what I needed.

I most no doubt will make certain to don?t fail to remember

this site and give it a look regularly.

Appreciate the helpful advice. For more, visit Sugarplay

Достать ножи (2019): Интересная история о загадочном убийстве и его расследовании https://muse.io/keenanicvw

Nicely done! Find more at seo autopilot neo

Great write-up, I am regular visitor of one’s web site, maintain up the excellent operate, and It’s going to be a regular visitor for a long time.

Avage AI: Transforme Sua Estratégia de Trading no Brasil

Avage AI é uma aplicação de trading avançada, projetada especialmente para o mercado brasileiro Site

Wow that was odd. I just wrote an incredibly long comment but after I clicked submit my comment didn’t appear. Grrrr… well I’m not writing all that over again. Anyhow, just wanted to say excellent blog!

l free to adjust these comments as needed to better fit the specific blog posts you’re responding to!dashdome

¿Qué opinas del mejor concurso SEO: https://www.desdesoria.es/articulo/reportajes/entrega-premios-vocacion-digital-raiola-sera-15-julio/20240523232647797424.html ? ¿Estás particip

Nicely detailed. Discover more at home renovation in Toronto

This is quite enlightening. Check out παραδοσιακη ελληνικη κουζινα ψυρρή for more

Thanks for the helpful article. More like this at home renovation Toronto

Wonderful tips! Discover more at Αισώπου Μύθοι τα καλυτερα μεζεδοπωλεια ψυρρη

Appreciate the comprehensive insights. For more, visit μεζεδοπωλεία ψυρρή Αισώπου Μύθοι

Thanks for the useful suggestions. Discover more at home renovation in Toronto

Very nice site it would be nice if you check More help

Dont invest in something from right here bad quality service

Thanks for the great explanation. Find more at Baji Bagh

This was quite helpful. For more, visit restaurants near me

Very useful post. For similar content, visit Click here

This was a fantastic read. Check out Aesopou Fables traditional greek tavern near me for more

lousy high-quality performance<br bitchy attitude

Appreciate the thorough analysis. For more, visit nail salon 27707

I am regular visitor, how are you everybody? This post

posted at this website is in fact nice.

Thanks for the thorough analysis. More info at Find more info

Well explained. Discover more at nail salon Jackson Ave

Great insights! Discover more at Continue reading

This was a fantastic resource. Check out traditional greek tavern athens Aesopou Fables for more

bad high-quality company<br bad quality

Dont purchase everything from below worst quality

Замечательный сайт о стоматологии в Ташкенте! Очень понравилась информация и разделы со советами https://orcid.org/0009-0002-6955-1233

BYD Han обладает передовыми системами безопасности и высокой https://www.gamespot.com/profile/caburgwvnt/

Hi my family member! I wish to say that this post is amazing, great written and come with approximately all significant infos. I’d like to peer more posts like this.

Подмена локации: изменяйте местоположение вашего устройства, чтобы получить доступ к контенту, недоступному в вашем регионе https://open.substack.com/pub/edwinrnik883/p/114?r=3fh532&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true

hey there and thank you for your information – I have definitely picked up anything new from right here. I did however expertise several technical issues using this web site, as I experienced to reload the web site many times previous to I could get it to load correctly. I had been wondering if your web hosting is OK? Not that I’m complaining, but slow loading instances times will very frequently affect your placement in google and could damage your high quality score if advertising and marketing with Adwords. Well I am adding this RSS to my e-mail and could look out for much more of your respective intriguing content. Ensure that you update this again very soon..

An impressive share, I just given this onto a colleague who was doing a little analysis on this. And he in fact bought me breakfast because I found it for him.. smile. So let me reword that: Thnx for the treat! But yeah Thnkx for spending the time to discuss this, I feel strongly about it and love reading more on this topic. If possible, as you become expertise, would you mind updating your blog with more details? It is highly helpful for me. Big thumb up for this blog post!

This unique comment appears to get quite a few web page visitors. How should you market it? It also provides beneficial completely unique turn in tips. Man making a process huge perhaps comprehensive to specifics of is the central process.

My brother suggested I might like this web site. He was once totally right. This put up truly made my day. You cann’t consider just how much time I had spent for this info! Thanks!

Spot on with this write-up, I really believe this amazing site requirements far more consideration. I’ll more likely once again you just read a great deal more, many thanks that info.

We still cannot quite assume that I made it worse often be kind of staring at the important points seen on your blog post. Our grandkids and i also are sincerely thankful with regards to your generosity plus giving me possibility pursue our chosen profession path. Document information and facts I became of the web-site.

Aw, this has been an exceptionally good post. In concept I would like to place in writing similar to this moreover – spending time and actual effort to have a really good article… but what can I say… I procrastinate alot and by no means seem to get something completed.

I admit, I have not been on this blog in a long time, however it was joy to find it again. It is such an important topic and ignored by so many, even professionals! I thanx for helping to make people more aware of these issues. Just great stuff as per usual!

Thanks for this advice I has been exploring all Yahoo to discover it!

I’d should consult you here. Which is not some thing I usually do! I spend time reading an article that should get people to feel. Also, thanks for allowing me to comment!

Keep up the fantastic piece of work, I read few posts on this internet site and I think that your web blog is really interesting and contains lots of superb information.

This internet site is my breathing in, rattling superb style and design and perfect written content.

Wonderful website. A lot of useful information here. I’m sending it to a few friends ans additionally sharing in delicious. And naturally, thank you on your sweat!

Thank you, I have just been looking for info about this subject for ages and yours is the best I’ve discovered till now. But, what about the conclusion? Are you sure about the source?

I’m really loving the theme/design of your blog. Do you ever run into any web browser compatibility problems? A few of my blog audience have complained about my site not operating correctly in Explorer but looks great in Opera. Do you have any recommendations to help fix this issue?

I like the valuable info you provide in your articles. I’ll bookmark your blog and check again here regularly. I’m quite certain I’ll learn many new stuff right here! Good luck for the next!

There is noticeably a bundle to comprehend this. I assume you’ve made particular nice points in functions also.

Many thanks for sharing this great write-up. Very inspiring! (as always, btw)

parties are of course very enjoyable, i would never miss a good party specially if it has some great program“

You have remarked very interesting points ! ps nice site.

I precisely had to thank you very much all over again. I’m not certain what I could possibly have undertaken without the entire tactics discussed by you about this situation. Entirely was a very difficult problem for me, however , seeing a specialized strategy you handled that took me to cry for joy. Now i’m grateful for the service and as well , wish you realize what an amazing job you happen to be carrying out instructing the rest with the aid of your blog. I’m certain you haven’t got to know all of us.

Hey There. I discovered your blog using msn. That is a very smartly written article. I will make sure to bookmark it and come back to read more of your useful information. Thanks for the post. I will certainly return.

All I can say is, I don’t know what to really say! Except certainly, for the amazing tips which are shared on this blog. I’m able to think of a zillion fun methods to read the content articles on this site. There’s no doubt that I will eventually take action utilizing your tips on that matter I could not have been able to take care of alone. You are so careful to let me be one of those to learn from your useful information. Please see how considerably I appreciate it.

I will immediately take hold of your rss as I can’t to find your email subscription hyperlink or newsletter service. Do you have any? Kindly permit me understand so that I may just subscribe. Thanks.

Great post. The tips and the ideas given in the post seems to be very much informative and useful

You should take part in a contest personally of the highest quality blogs on the internet. I’ll recommend this great site!

Nice post. I discover some thing much harder on various blogs everyday. Most commonly it is stimulating to read content off their writers and rehearse something at their store. I’d opt to use some using the content in my small weblog no matter whether you don’t mind. Natually I’ll offer you a link with your internet weblog. Thank you sharing.

Thanks for the tips on credit repair on this amazing web-site. What I would offer as advice to people will be to give up this mentality that they may buy at this point and shell out later. As a society all of us tend to do this for many things. This includes trips, furniture, and items we’d like. However, you have to separate a person’s wants from all the needs. While you are working to raise your credit score make some trade-offs. For example you possibly can shop online to economize or you can look at second hand suppliers instead of high priced department stores regarding clothing.

Come across back yard garden unusual periods of one’s Are generally Weight reduction and every one one may be important. One way state could possibly be substantial squandering through the diet. lose weight

Oh i truly envy the method that you post topics, generate an income wish i could create that way..

Heya i am for the primary time here. I found this board and I in finding It truly useful & it helped me out a lot. I am hoping to give something back and help others such as you helped me.

A lot of thanks for all of your work on this site. Betty really loves setting aside time for internet research and it is simple to grasp why. Most people learn all concerning the dynamic manner you convey rewarding tips on the website and as well encourage participation from visitors about this point plus my princess is undoubtedly being taught a great deal. Enjoy the rest of the new year. You have been conducting a fabulous job.

You could certainly see your enthusiasm in the paintings you write. The world hopes for even more passionate writers such as you who aren’t afraid to mention how they believe. Always go after your heart.

cheers for such a great blog. Where else could anyone get that kind of info written in such a perfect way? I have a presentation that I am presently working on, and I have been on the look out for such information.

Greetings! I simply want to offer a huge thumbs up for the great stuff you have got here on this post. I’ll be coming back again to the blog for more very soon.

Hi! I understand this is kind of off-topic but I had to ask. Does managing a well-established blog like yours require a lot of work? I am completely new to operating a blog however I do write in my diary daily. I’d like to start a blog so I can share my personal experience and views online. Please let me know if you have any kind of suggestions or tips for new aspiring blog owners. Thankyou!

Hi there! I simply want to give a huge thumbs up for the good data you could have right here on this post. I will likely be coming again to your weblog for more soon.

You got a very wonderful website, Gladiola I noticed it through yahoo.

I was just seeking this info for a while. After six hours of continuous Googleing, finally I got it in your site. I wonder what’s Google’s issue is! Thank you for the help!

Consumers has to be deeper schooled to spot the importance inside the fears, to utilize fashionable procedures of birth control, to conserve a few of our all all-natural alternatives collectively with promoting several of our items and expert services. Our firm is sure you can easliy include a extra powerful collectively with clearer put from now on.

Took me time to read all the comments, but I really enjoyed the article. It proved to be Pretty helpful to me and I am positive to all the commenters here It is always nice when you can not only be informed, but also entertained Im positive you had fun writing this post.

Fantastic job here. I really enjoyed what you had to say. Keep heading because you surely bring a new voice to this subject. Not many people would say what youve said and still make it interesting. Well, at least Im interested. Cant wait to see more of this from you.

Thanks for your write-up. What I want to point out is that while looking for a good internet electronics shop, look for a website with comprehensive information on critical indicators such as the personal privacy statement, security details, any payment procedures, and other terms in addition to policies. Constantly take time to look into the help along with FAQ areas to get a far better idea of how a shop functions, what they are capable of doing for you, and just how you can make use of the features.

Great post, thanks for the awesome blog post. I’m having troubles subscribing to your blogs feed. Thought I’d let you know

Just want to say your article is as amazing. The clearness in your post is just great and i could assume you’re an expert on this subject. Well with your permission allow me to grab your RSS feed to keep updated with forthcoming post. Thanks a million and please keep up the enjoyable work.

I visited a lot of website but I believe this one contains something extra in it in it

Generally I don’t learn post on blogs, but I would like to say that this write-up very compelled me to take a look at and do so! Your writing taste has been surprised me. Thanks, quite great article.

I love your writing style truly enjoying this web site .

I am only commenting to let you know of the remarkable experience our girl encountered reading the blog. She noticed many pieces, which included how it is like to possess an amazing giving nature to get certain people really easily learn certain multifaceted things. You undoubtedly exceeded visitors’ desires. I appreciate you for rendering the important, healthy, informative as well as easy tips about the topic to Kate.

Many thanks I ought say, impressed with your site. I will post this to my facebook wall.

This website is usually a walk-through it really is the information it suited you concerning this and didn’t know who need to. Glimpse here, and you’ll absolutely discover it.

Wholesale Cheap Handbags Will you be ok merely repost this on my site? I’ve to allow credit where it can be due. Have got a great day!

I’d have to consult with you here. Which isn’t something I usually do! I like reading an article that can make people feel. Also, many thanks for allowing me to comment!

dance schools that also offers free yoga classes would be very very nice.,

Im using a tiny problem I cant subscribe your feed, Im using google reader fyi.

When a blind man bears the standard pity those who follow…. Where ignorance is bliss ‘tis folly to be wise….

I am curious to find out what blog platform you happen to be using? I’m having some minor security issues with my latest blog and I would like to find something more risk-free. Do you have any suggestions?

our bedding collections consists of beddings that come from new york and this are great bedding collections’

Howdy! Do you know if they make any plugins to help with SEO?

I’m trying to get my website to rank for some

targeted keywords but I’m not seeing very good results.

If you know of any please share. Cheers! You can read similar

article here: Escape rooms

Strong blog. I acquired various nice information. I?ve been keeping an eye fixed on this technology for some time. It?utes attention-grabbing the way it retains completely different, however a number of of the primary parts stay constant. have you ever observed plenty amendment since Search engines created their own latest purchase within the field?

I’m impressed, I must say. Really rarely can i encounter a weblog that’s both educative and entertaining, and let me tell you, you have hit the nail for the head. Your idea is outstanding; the problem is something which there are not enough persons are speaking intelligently about. My business is very happy i found this around my search for something concerning this.

I’m curious to find out what blog system you happen to be working with? I’m having some minor security problems with my latest site and I would like to find something more risk-free. Do you have any solutions?

general blogging is great because you can cover a lot of topics in just a single blog**

This web page is known as a walk-by for all of the data you needed about this and didn’t know who to ask. Glimpse right here, and you’ll positively discover it.

Have you tried twitterfeed on your blog, i think it would be cool.~,-’;

pretty helpful material, overall I feel this is really worth a bookmark, thanks

Sweet internet site , super style and design , really clean and utilise friendly .

Hey There. I found your blog using msn. This is an extremely well written article. I’ll be sure to bookmark it and return to read more of your useful information. Thanks for the post. I’ll definitely comeback.

Some truly nice stuff on this website , I like it.

After study many of the blogs on the website now, and i genuinely as if your strategy for blogging. I bookmarked it to my bookmark site list and you will be checking back soon. Pls take a look at my internet site as well and tell me if you agree.

Good day I am so glad I found your web site, I really found you by mistake, while I was looking on Aol for something else, Regardless I am here now and would just like to say thank you for a fantastic post and a all round enjoyable blog (I also love the theme/design), I don’t have time to browse it all at the moment but I have book-marked it and also added your RSS feeds, so when I have time I will be back to read a great deal more, Please do keep up the awesome work.

I appreciate the right to discuss the idea, I am extremely in it and even absolutely adore figuring out more to do with it topic. Any time prospects, due to the fact enjoy knowledge, will you thinking replacing your own weblog using farther info? This can be very used in all of us.

I do not even know the way I stopped up here, however I assumed this post used to be great. I do not know who you are however certainly you are going to a well-known blogger when you aren’t already Cheers!

Hi there, I recently found your web web site by way of bing. Your own post is actually pertinent to be able to my entire life at present, and also Ia’m really happy I discovered your internet site.

purify blackbird athens dilip detering skinny moderations obi kenobi moondog

My brother suggested I would possibly like this website. He used to be entirely right. This post actually made my day. You can not imagine just how much time I had spent for this info! Thanks!

I’ve been browsing on-line more than 3 hours today, yet I never discovered any interesting article like yours. It is pretty value sufficient for me. In my view, if all webmasters and bloggers made just right content as you did, the net might be much more helpful than ever before!

I am typically to blogging i really appreciate your posts. Your content has really peaks my interest. My goal is to bookmark your blog and maintain checking for first time information.

Superb work! This really is the type of info that should be shared around the web. Shame on the search engines for not positioning this post higher! Come on over and visit my internet site . Thanks =)

Hey! I could have sworn I’ve been to this site before but after reading through some of the post I realized it’s new to me. Anyways, I’m definitely delighted I found it and I’ll be book-marking and checking back frequently!

Sorry for the large evaluation, but I’m really loving the new Zune, as well as hope this particular, as well as the superb reviews some other individuals have written, will help you determine if it’s the right choice for you.

You made some decent points there. I looked on the net to the issue and found most people may go as well as using your site.

there is great money involve when we talk about personal injury, attorneys make great money out of them too,,

You ought to join in a contest for starters of the highest quality blogs online. I will recommend this page!

An impressive share, I simply given this onto a colleague who was doing a bit of analysis on this. And he the truth is purchased me breakfast as a result of I found it for him.. smile. So let me reword that: Thnx for the treat! But yeah Thnkx for spending the time to discuss this, I feel strongly about it and love reading extra on this topic. If possible, as you change into experience, would you mind updating your weblog with more details? It is extremely useful for me. Large thumb up for this blog post!

The crucial point to recognize is this fact applies not just in , but additionally to.

Hi there, Could I export that photo and use that on my own blog?

This is really interesting, You’re a very skilled blogger. I have joined your feed and look forward to seeking more of your excellent post. Also, I have shared your site in my social networks!

You created some decent points there. I looked online for your issue and located most people go along with together with your web site.

Youre so cool! I dont suppose Ive read anything in this way before. So nice to discover somebody with a few original thoughts on this subject. realy appreciation for beginning this up. this web site is something that is required over the internet, a person with a little originality. useful job for bringing something new to the web!

Very nice design and wonderful content material , nothing else we want : D.

polo shirts are very casual and stylish indeed, most of the time i use polo shirts*

Excellent read, I just passed this onto a colleague who was doing some research on that. And he actually bought me lunch since I found it for him smile Therefore let me rephrase that: Thanks for lunch! “Dreams are real while they last. Can we say more of life” by Henry Havelock Ellis.

Wow, amazing weblog structure! How long have you been running a blog for? you made running a blog look easy. The whole look of your site is magnificent, neatly as the content material!

David Bowie is a classic, i like all his songs during the old days.~

What i don’t understood is if truth be told how you’re no longer really a lot more neatly-liked than you might be now. You’re so intelligent. You understand thus considerably when it comes to this topic, made me in my view consider it from so many numerous angles. Its like women and men don’t seem to be fascinated unless it’s something to accomplish with Woman gaga! Your own stuffs great. Always take care of it up!

You have made some decent points there. I checked on the web for more information about the issue and found most individuals will go along with your views on this site.

What Is Puravive? Puravive is an herbal weight loss supplement that supports healthy weight loss in individuals.

Thanks so much for giving everyone a very wonderful possiblity to read in detail from this website. It is often so good and as well , jam-packed with amusement for me and my office mates to visit your site at the least thrice per week to read the newest items you have got. Of course, I’m certainly fascinated considering the splendid tricks served by you. Certain two ideas in this article are undoubtedly the most suitable we have all had.

well of course, everyone loves to get rich but not everyone would love to do hard work”

Bless you for this specific info I was basically looking around all Yahoo to be able to find it!

I’m really enjoying the design and layout of your blog. It’s a very easy on the eyes which makes it much more enjoyable for me to come here and visit more often. Did you hire out a designer to create your theme? Great work!

I’m truly enjoying the design and layout of your site. It’s a very easy on the eyes which makes it much more enjoyable for me to come here and visit more often. Did you hire out a designer to create your theme? Superb work!

I am forever thought about this, thank you for posting.

Pretty nice post. I just stumbled upon your weblog and wanted to say that I’ve really enjoyed surfing around your blog posts. After all I’ll be subscribing to your feed and I hope you write again soon!

very good post, i definitely love this website, keep on it

satellite tv has got to be one of the best inventions that we humans enjoy,.

Spot up for this write-up, I really believe this web site requirements a great deal more consideration. I’ll likely to end up again to read a lot more, many thanks for that information.

Hey are using WordPress for your blog platform? I’m new to the blog world but I’m trying to get started and create my own. Do you require any html coding expertise to make your own blog? Any help would be greatly appreciated!

i always make fire pits specially when we are out in the woods making some camp fire“

Spot on with this write-up, I genuinely feel this website wants far more consideration. I’ll possibly be once more to read much more, thanks for that information.

It’s not the case that reader must be completely agreed with author’s views about posts. So this is what happened with me, anyways it’s a good effort, I appreciate it. Thanks

Both Will Ferrell and Mark Wahlberg play off of each other much better than you might expect as the titular characters, and Michael Keaton – once again, this summer – steals just about every scene that he’s in as the Guys’ more-calm-than-he-probably-should-be captain.

Do you mind generally if I refer to one or two of your articles and reviews for as long as I provide credit as well as sources back to your web page? My website page is within the similar market as your site and my web-site visitors will make use of most of the ideas you actually offer on this site. Please let me know if this is okay for you. Many thanks!

This is tough. I’m not saying you are responsible, really I think its everyone else that is responsible.

Hi I found your site by mistake when i was searching Google for this issue, I have to say your site is really helpful I also love the theme, its amazing!. I dont have that much time to read all your post at the moment but I have bookmarked it and also add your RSS feeds. I will be back in a day or two. thanks for a great site.

Oh my goodness! a great write-up dude. Thanks a ton Nevertheless We are experiencing problem with ur rss . Do not know why Not able to join it. Could there be everyone obtaining identical rss difficulty? Anyone who knows kindly respond. Thnkx

This really is a very amazing powerful resource that you’re offering and you just provide it away cost-free!! I that can match discovering websites which often are aware of the particular worth of providing you a excellent learning resource for zero cost. We truly dearly loved examining this article. Regards!

I must express my gratitude for your kindness supporting men who must have help on your concern. Your special commitment to passing the solution across ended up being wonderfully advantageous and have continually helped many people much like me to get to their aims. Your personal helpful help implies a great deal a person like me and much more to my office workers. Best wishes; from all of us.

Most people have overlooked this main principle. I was baffled and this post cut through the common solutions that only present lacking substance. Don’t stop publishing at this quality.

I also recommend HubPages itself, and Squidoo, which is similar.

The subsequent time I learn a blog, I hope that it doesnt disappoint me as much as this one. I mean, I do know it was my option to read, but I really thought youd have something attention-grabbing to say. All I hear is a bunch of whining about something that you could possibly repair should you werent too busy on the lookout for attention.

Attractive element of content. I just stumbled upon your weblog and in accession capital to say that I get in fact enjoyed account your blog posts. Anyway I will be subscribing on your augment or even I fulfillment you access persistently rapidly.

Thanks for creating this. I really feel as though I know so much more about the topic than I did before. You should continue this, Im sure most people would agree youve got a gift.

hello anyone, I used to be just checkin out this internet site and I really admire the foundation of your article, and have absolutely nothing to do, so if anyone wants to have an engaging convo about this, make sure you get in touch with me on myspace, my name is kim smith

Hello there! Do you know if they make any plugins to help with Search Engine Optimization? I’m trying to get my site to rank for some targeted

keywords but I’m not seeing very good gains. If you know of any please share.

Cheers! You can read similar article here: blogexpander.com

Amazing the following tutorial is certainly astonishing it genuinely aided me and even our kids, cheers!

That song sucks i think, my younger brother is listening that, and its so boring song !

Pretty section of content. I just stumbled upon your website and in accession capital to assert that I get in fact enjoyed account your blog posts. Any way I will be subscribing to your augment and even I achievement you access consistently quickly.

Thank you for sharing with us, I think this website really stands out .

I am not sure why however this web site will be launching very gradual for me. Is someone else having this difficulty or possibly that any issue in my end? I will check back down the road if ever the issue nonetheless is out there.

Not a unhealthy post, did it take you numerous of time to consider it?