FTP Drawdown EXPLAINED in Less Than 5 Minutes

Funded Trading Plus is, in my humble opinion, hand’s down the best no-time-limit prop firm. I also believe, in my humble opinion, that this style of prop trading challenge is the most realistic for keeping your emotions calm and surviving losing streaks.

Their Experienced Trader program is a 1-phase challenge. Unlike 2-phase time-limit challenges like FTMO, with a strict 5% daily drawdown and 10% daily drawdown of the initial account balance. However, FTP’s Experienced Trader program has a 3% daily drawdown and a 6% relative drawdown. Once you are funded the total drawdown rules change a little – you have a max drawdown of 6% of the initial account until you hit at least 6% profit, after which your max drawdown stays at the initial account balance, even if you lose or withdraw money.

Does this sound confusing to you? If so, by the end of this article you will completely understand how this works and why it’s so simple.

And if you still don’t, then be sure to use this link to read more about FTP’s rules on their website. (If you decide to purchase a challenge, be sure to use the code “DFX10” for 10% off at checkout!)

So let’s break this down with plenty of real-life examples.

Daily Drawdown

So you are required to maintain a balance above a 3% daily drawdown and a 6% relative drawdown for the Experienced trader challenge.

This means that for the daily drawdown, it starts at 3% of your initial account size, and then once you start trading, it’s computed from the prior day’s balance when the server clock hits 23:59.

So if today you scalp with a $100,000 account, you start with a $3,000 daily drawdown limit. If you lose 1% of the account during your trading day between losses and commission, then the next day (as indicated by the server) your account balance is 99,000 and your daily drawdown limit is $2,970. If the day after that, you win 2% ($1980), your following day daily drawdown would be $3,029.40 for your $100,980 account balance.

I fleshed out a whole scenario here because I want you to get a realistic picture of what this looks like in practice.

The daily drawdown is easy to understand, it’s pretty straightforward.

It’s of 3% of yesterday’s account balance.

Total/Relative Drawdown

As for the relative drawdown, your drawdown limit will change as your account grows. This drawdown amount is calculated from a high-water mark, that is, the highest amount you have achieved with your account balance (i.e. your balance plus closed trades).

The relative drawdown amount is 6%.

So if you start with an account that is $100,000, your initial drawdown amount is $6,000. However, let’s say you have a spectacular trading day and gain 6% in profit. Or even better, your first trade returns 6%. Your relative drawdown limit is now at the $100,000 mark and it will not go down from there.

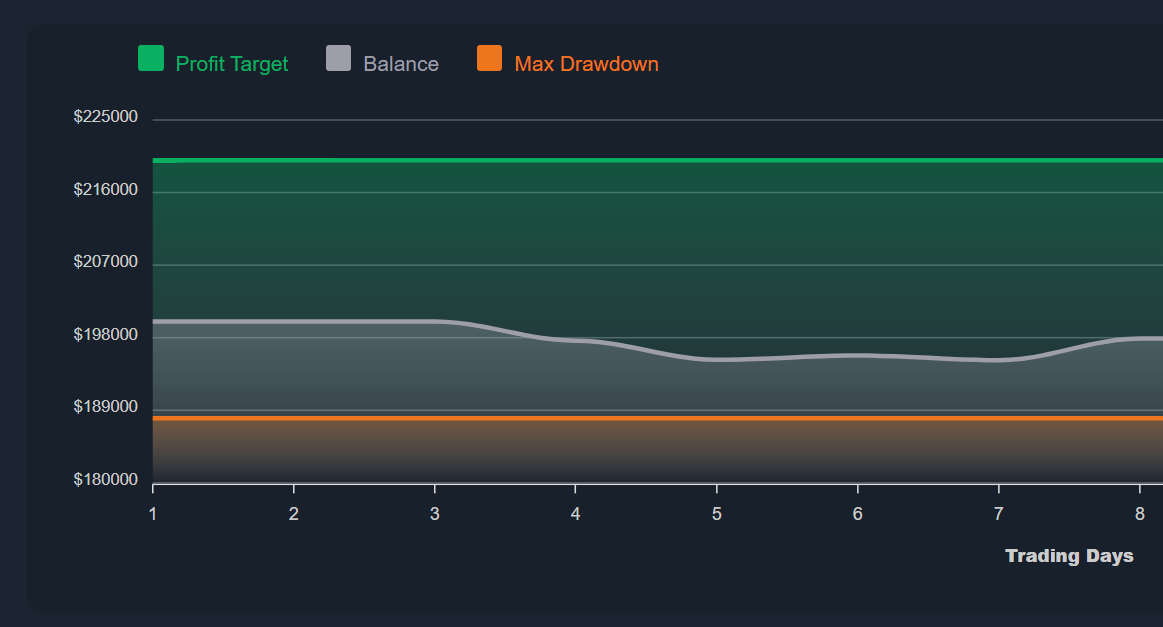

Funded Total Drawdown

Once you are funded with Funded Trading Plus, you have the same relative drawdown rules as your challenge account.

However, once you hit 6% in profit the drawdown locks at the initial account balance.

So for our example of a $100,000 account, you could make $6,000 through funded trading and your drawdown locks in at $100,000. BUT you must keep your funded account above drawdown, so once your $100,000 drawdown limit locks in, you can’t let your account fall back to that amount, even if it’s through taking a withdrawal of profit.

So if your account is at $106,000 and you take out a $3,000 profit, then you only have 3% or $3,000 left for your drawdown!

This is highly risky.

Funded Profit Withdraw

Therefore, you have two choices when it comes to locking in your first profit withdrawal.

You can either wait until you’ve accumulated the amount you want to withdraw as long as it allows you to keep the $106,000 in your account.

So if you want to withdraw $4,000 you will need to get your account up to $110,000. I like this amount because once you hit 10% return on your account you can also receive a full refund for your challenge fee.

However, I think there’s one other easier target you could try to hit – if you aim for a $107,000 target, then you can take out $1000, use some of it to cover your initial challenge fee and the rest as a reward.

Then you can aim for the 10% return and get your challenge refund and a bigger profit.

It is helpful to get paid and this can be a protection should you end up losing your account and need to start over, yet not have to dish out more money.

So what do you think, do you have a better understanding of how Funded Trading Plus’ drawdown model works?

Personally, I think it’s not that hard to understand, it’s something you get used to, and it’s worth the extra time and discipline with sticking to small risk on each trade. If you want to learn more, please check out the Funded Trading Plus’ homepage. I wish you all nothing but the best of strength and luck with your trading. Take care!

Pingback: My Plan for Swing Trading Funded Trading Plus' $50k Challenge - Disciplined FX

Pingback: site

Pingback: בלוג אחסון אתרים

Pingback: เว็บปั้มวิว

Pingback: amandaghost.com

Pingback: ลวดสลิง

Pingback: เว็บสล็อตหมีแพนด้า เว็บตรง ของแทร่ 100% ดีอย่างไร?

Pingback: บริการจัดหาแรงงาน

Pingback: บาคาร่าเกาหลี

Pingback: Ford Everest

Pingback: cat8888

Pingback: dayz hack free

Pingback: รับทำเว็บไซต์

Pingback: my page

Pingback: บาคาร่าเกาหลี

Pingback: 789bet

Pingback: โอลี่แฟน

Pingback: SEO Affiliate Domination

Pingback: pgslot

Pingback: pgslot

Pingback: SP2

Pingback: tga168

Pingback: Latest Music Free Download

Pingback: ทางเข้า lucabet

Pingback: BAU Diyala

Pingback: 789BET

Pingback: ออกแบบเสื้อยืด

Pingback: lloydbakerinjuryattorneys.com

Pingback: ทดลองเล่นสล็อต PG SLOT

Pingback: กรอบแว่นสายตา

Pingback: สล็อตออนไลน์เกาหลี

Pingback: altogel

Pingback: pool construction near me

Pingback: พิมพ์การ์ดงานแต่ง

Pingback: pakong188

Pingback: cannabis crete

Pingback: pilates instructor woodland hills

Pingback: Nonameauto

Pingback: betflix wallet