Experienced Trader vs. Advanced Trader Program – Which FTP Challenge Should You Take?

Funded Trading Plus came onto the prop firm scene with one of the biggest benefits to taking a successful prop trading challenge: they removed the challenge time limit.

This post contains affiliate links. I have personally chosen to promote Funded Trading Plus because I firmly believe they are a professional, realistic, and helpful prop firm with reasonable challenge rules. I am not asked to post these reviews but do so out of my own choice.

Many firms, like FTMO or MyForexFunds, offer challenges with 30-day time limits – including full days when trading isn’t possible.

Frankly, this is an unnecessary pressure – you’re not necessarily a better trader because you can capture profit quickly. It’s a challenge rule that typically benefits the prop firm (rather than the prop trader) because most people buckle under the pressure of needing to perform fast.

So Funded Trading Plus offered the kind of challenges they would also want as traders, themselves – challenges without a time limit.

Under this model, you can take as much time as you need to profit. For many traders, this means being able to risk a responsible amount per trade (closer to 1% or less, rather than the 2% standard encouraged to traders who are risking their own money). It also means that you won’t necessarily have to fail a challenge and retake it again in order to get through a less-than-stellar month for your strategy. An (unnecessary) added pressure is removed from a challenge that is already difficult, as it is.

[Want 10% off of your Funded Trading Plus challenge? Use DFX10 at checkout!]

Funded Trading Plus’ Challenge Offers

Now that you want to take on a prop firm challenge with FTP, you have a couple of options. The firm offers three programs: Experienced Trader, Advanced Trader, and Master Trader program.

This article is focused on the first two options, as they are very similar yet come with different rules that may be more or less appropriate depending on your style of trading – we’ll talk about these distinctions soon.

The third option, the Master Trader program, was recently updated as a program that offers instant funding with a 70/30%, trader/firm, profit split. This is a more expensive program than the others and does not come with any initial challenge phase. The major rule is to keep above the 5% trailing drawdown in order to maintain the account.They allow for weekly withdrawals above $50. It’s a fantastic arrangement for anyone with considerable trading experience, evidence of consistent profitability, and enough expendable income to float the initial fee.

For those who do not wish to spend more than $999 (Or $909, with a DFX discount – you can use DFX10 at checkout!), there are two other challenge options to choose from. While they may appear vastly similar, each has its own benefits for different stylese of traders. Let’s explore!

Experienced Trader Program vs. Advanced Trader Program

Seeing is believing – to start, let’s look at each program’s features, as they are displayed on FTP’s program pages, to get an idea of their similarities and differences.

Below is the Experienced Trader Program:

Key Features:

- Single Phase, no verification phase required

- Daily drawdown: 3%

- Maximum Relative Drawdown: 6%

- 10% Profit Target for scaling-up the funded account

- No stop-loss required

- Able to hold trades overnight and overweekend

- Additional $12.5k option

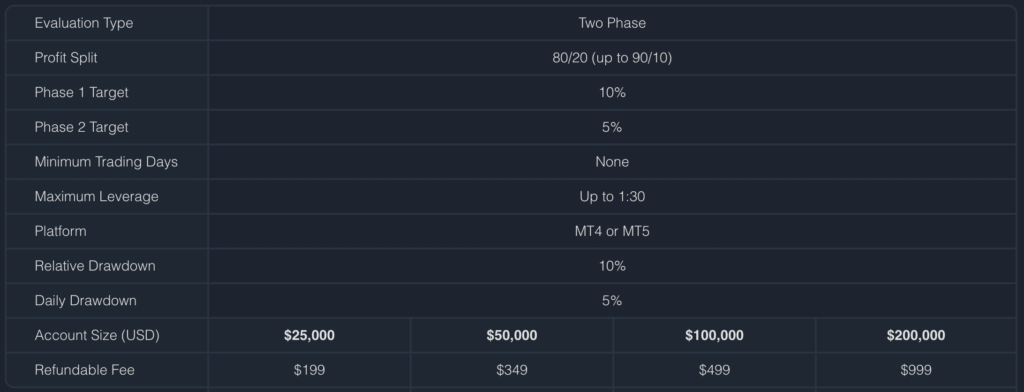

Below is the Advanced Trader Program:

Key Features:

- Two-phase: Assessment #1 (10% target) and Assessment #2 (5% target)

- Daily Drawdown: 5%

- Maximum Relative Drawdown: 10%

- 20% Profit Target for scaling-up the funded account

- Stop-loss required for each trade

- Do not hold trades over weekend

Both programs cost the same for their individual account sizes. Both offer MT4/MT5 accounts, offer an 80/20 profit split, allow for maximum 1:30 account leverage, and allow EA bots.

However, there are some distinct differences as well. With only one phase to complete, only a 10% profit target for scaling, and the option for over weekend trades, Experienced Trader Program seems to offer the better deal. And if that’s what you’re thinking – you’re probably right!

Let’s face it – challenges are overwhelming. Undergoing two phases, even when one has a smaller profit target, is still more challenging than undergoing only one. There are a significant number of traders who fail their second challenge with firms like MyForexFunds and FTMO. Granted, those are time-limit-based challenges, but the risk is all the same. On a psychological level, sometimes trading a prop challenge feels more stressful than trading a funded account. Perhaps it’s better to deal with only one phase.

But before we completely write off the Advanced Trader Program, let’s consider its one key benefit: The maximum and daily drawdowns are 1.66x the size of those offered by the Experienced Trader Program.

That means for every 1% you can risk with the Experienced Trader, you could be risking up to 1.66% for Advanced Trader.

If you’re risking 0.5% per trade, this allows you 3x the number of trades or opportunities.

So with this understanding, we can now see who might benefit from the Advanced Trader program – either individuals who are comfortable risking more per trade in order to capture bigger wins (this works best when your take profit targets vary in size with unlimited potential) or for traders who scalp multiple trades a day and would like the extra wiggle room for safety.

The Verdict: Experienced or Advanced?

Now that you understand that the one key difference between these two programs is the drawdown allowance, you should be able to discern whether this added benefit is worth the trade-off of missing out on a single-phase challenge, over-weekend trades, and half the target for scaling.

For most people, I believe the Experienced Trader Program is the better option of the two.

There are too many additional benefits that outweigh the allowances of the Advanced Trader Program.

[Want 10% off of your Funded Trading Plus challenge? Use DFX10 at checkout!]

Remember, you don’t need to rush the challenge by taking bigger risks on your trades or over-leveraging your account. If you want to be able to have more opportunities to scalp or trade each day, you can always cut down on your risk per trade. Risking 1% or less per trade for this challenge option is optimal. If you take more than 2 trades per day, cut that down to 0.75% or less.

Overall, Funded Trading Plus is a professional and reliable prop firm for achieving realistic results with funded account trading. They are the only firm I go out of my way to promote, not because they sponsor my posts (they don’t), but because I firmly believe this is one of the most professional, trustworthy, and reasonable firms out there.

I was very pleased to find this page. I wanted to thank you for your time for this fantastic read!! I definitely appreciated every little bit of it and i also have you bookmarked to check out new information in your website.

I would like to thank you for the efforts you have put in writing this blog. I really hope to check out the same high-grade blog posts from you in the future as well. In truth, your creative writing abilities has inspired me to get my very own blog now 😉

You made some nice points there. I looked on the internet for the topic and found most persons will approve with your site.

I’ve read a few just right stuff here. Definitely value bookmarking for revisiting. I wonder how so much effort you put to make any such great informative web site.

My brother suggested I might like this website. He was entirely right.

This post truly made my day. You cann’t imagine just how much time I had spent for this info!

Thanks!

My developer is trying to convince me to move to .net from PHP.

I have always disliked the idea because of the costs.

But he’s tryiong none the less. I’ve been using WordPress on numerous websites for

about a year and am anxious about switching to another platform.

I have heard very good things about blogengine.net.

Is there a way I can import all my wordpress content into it?

Any help would be really appreciated!

I do agree with all of the ideas you have presented in your post. They’re really convincing and will certainly work. Still, the posts are too short for starters. Could you please extend them a little from next time? Thanks for the post.

F*ckin¦ tremendous issues here. I¦m very happy to see your post. Thanks so much and i am looking ahead to contact you. Will you please drop me a mail?

I’d have to examine with you here. Which is not one thing I usually do! I take pleasure in reading a post that may make folks think. Additionally, thanks for permitting me to comment!

Heya! I’m at work surfing around your blog from my new apple iphone! Just wanted to say I love reading your blog and look forward to all your posts! Carry on the excellent work!

I like this post, enjoyed this one thank you for posting. “We are punished by our sins, not for them.” by Elbert Hubbard.

Yesterday, while I was at work, my sister stole my iphone and tested

to see if it can survive a twenty five foot drop, just so she can be a youtube sensation. My iPad is now broken and she has 83 views.

I know this is totally off topic but I had to share it with someone!

Now I am going to do my breakfast, once having my breakfast coming yet

again to read further news.

Appreciating the commitment you put into your site and in depth

information you provide. It’s awesome to come across a blog every once in a while that isn’t the same outdated

rehashed material. Great read! I’ve saved your site and I’m adding your RSS feeds to my Google

account.

Very nice post. I absolutely love this site. Thanks!

Hey there, You’ve done a fantastic job. I will certainly digg it

and personally suggest to my friends. I am sure they’ll be benefited from this web site.

Hey there, You have done an incredible job. I’ll definitely digg it and personally

recommend to my friends. I am sure they’ll be benefited from

this website.

It is appropriate time to make some plans for the longer

term and it’s time to be happy. I’ve learn this publish and if I may

just I want to suggest you some fascinating issues or

suggestions. Maybe you can write subsequent articles relating

to this article. I wish to read even more things about it!

Hello to every one, it’s genuinely a nice for

me to go to see this website, it includes useful Information.

Wow, wonderful weblog format! How long have you ever been running a blog

for? you make running a blog look easy. The overall look of your

site is great, as smartly as the content material!

When someone writes an piece of writing he/she keeps the

image of a user in his/her mind that how a user can be aware of it.

So that’s why this article is great. Thanks!

Aw, this was a really nice post. Taking the time and actual effort to produce a

top notch article… but what can I say… I put things off a lot and don’t manage

to get anything done.

Hi there, I found your website by the use

of Google at the same time as looking for a related subject,

your web site came up, it looks great. I have bookmarked it in my google bookmarks.

Hello there, just changed into aware of your weblog through Google, and found that

it is truly informative. I’m gonna be careful for brussels.

I will appreciate in the event you proceed this in future.

Lots of other people can be benefited from your writing.

Cheers!

It’s truly very complicated in this active life to

listen news on TV, therefore I simply use web for that purpose,

and obtain the most recent news.

It’s actually very complicated in this active life to listen news on Television, therefore I just use web

for that purpose, and take the hottest news.

What’s up, after reading this remarkable piece of writing i am also glad

to share my knowledge here with mates.

Good day I am so thrilled I found your weblog, I really found you by error,

while I was looking on Aol for something

else, Nonetheless I am here now and would just like to say kudos for a

marvelous post and a all round enjoyable blog (I also love the theme/design), I don’t

have time to go through it all at the moment but I have saved it and

also added in your RSS feeds, so when I have time I will be back to read a great deal more, Please do keep up the excellent job.

Hey there this is kinda of off topic but I was wanting to know if blogs use

WYSIWYG editors or if you have to manually code with HTML.

I’m starting a blog soon but have no coding experience so I

wanted to get guidance from someone with experience.

Any help would be enormously appreciated!

Somebody essentially lend a hand to make

critically articles I might state. That is the first time I frequented your website page and

up to now? I surprised with the analysis you made to create

this actual put up incredible. Wonderful job!

I’m not that much of a internet reader to be

honest but your sites really nice, keep it up! I’ll go ahead and bookmark your website to come back

later. Many thanks

It’s not my first time to visit this web site, i am browsing this site dailly and take

fastidious data from here daily.

That is very fascinating, You are an overly skilled blogger.

I have joined your rss feed and stay up for in the hunt for more of your great post.

Also, I’ve shared your site in my social networks

You really make it seem so easy with your presentation but I find this topic to be

actually something which I think I would never understand.

It seems too complex and extremely broad for me. I am looking forward for your next post, I’ll try to get the hang of it!

What’s up to all, the contents existing at this site are in fact remarkable for people

experience, well, keep up the nice work fellows.

Howdy, I do believe your blog could possibly

be having internet browser compatibility issues.

When I look at your website in Safari, it looks fine however, when opening in Internet Explorer,

it’s got some overlapping issues. I simply wanted

to provide you with a quick heads up! Besides that, great

website!

Hi my friend! I want to say that this article is awesome,

nice written and come with almost all vital infos.

I would like to look more posts like this .

We are a group of volunteers and opening a new scheme in our community.

Your web site offered us with valuable information to work

on. You have done a formidable job and our whole community

will be grateful to you.

fantastic put up, very informative. I ponder why the other experts of this

sector don’t notice this. You should continue your writing.

I am confident, you have a great readers’ base already!

I’m amazed, I have to admit. Rarely do I encounter a blog that’s equally educative and engaging, and without a doubt, you have hit the nail

on the head. The problem is something that too few men and women are speaking intelligently about.

Now i’m very happy I came across this during my hunt for

something concerning this.

Ahaa, its good dialogue concerning this article

at this place at this website, I have read all that,

so at this time me also commenting here.

Asking questions are in fact nice thing if you are not understanding

anything entirely, except this article provides nice understanding

yet.

Wow, this article is nice, my younger sister is analyzing

these things, therefore I am going to inform her.

This blog was… how do I say it? Relevant!! Finally I have found something that helped me.

Thanks a lot!

Thanks for the auspicious writeup. It in fact

was once a leisure account it. Look complicated

to more added agreeable from you! However, how could we communicate?

Excellent pieces. Keep writing such kind of information on your page.

Im really impressed by your blog.

Hey there, You’ve done a fantastic job. I will definitely digg it and in my view suggest to my friends.

I am confident they will be benefited from this website.

Howdy just wanted to give you a quick heads up and let you know a few of the images aren’t loading properly. I’m not sure why but I think its a linking issue. I’ve tried it in two different browsers and both show the same results.

Hey there! Do you use Twitter? I’d like to follow you if that

would be okay. I’m definitely enjoying your blog and look forward to

new posts.

Hi there great blog! Does running a blog such as this take a massive amount work?

I’ve no understanding of programming however I was hoping to start my own blog soon. Anyhow, should you have

any recommendations or techniques for new blog owners please share.

I know this is off topic but I simply had to ask. Thanks!

Hello there! This is kind of off topic but I need some advice from an established blog.

Is it tough to set up your own blog? I’m not very techincal

but I can figure things out pretty quick.

I’m thinking about creating my own but I’m not sure where to begin. Do

you have any tips or suggestions? With thanks

I am regular reader, how are you everybody? This paragraph posted at this website is actually fastidious.

Superb blog! Do you have any tips for aspiring writers?

I’m hoping to start my own blog soon but I’m a little lost on everything.

Would you advise starting with a free platform like WordPress or go for a paid option? There are so many options out there that I’m completely confused ..

Any suggestions? Many thanks!

Greetings! Very useful advice within this article! It’s the little changes that make the most

important changes. Many thanks for sharing!

Hi there, i read your blog from time to time and i own a similar one and

i was just wondering if you get a lot of spam feedback?

If so how do you prevent it, any plugin or anything you can suggest?

I get so much lately it’s driving me crazy so any

assistance is very much appreciated.

Hi, I do think this is an excellent web site.

I stumbledupon it 😉 I may revisit once again since I saved as a favorite

it. Money and freedom is the best way to change, may you be rich and continue to guide others.

Saved as a favorite, I really like your web

site!

What a information of un-ambiguity and preserveness of

precious know-how concerning unpredicted feelings.

Having read this I believed it was rather informative.

I appreciate you finding the time and energy to put this informative article

together. I once again find myself spending a lot of time both reading

and leaving comments. But so what, it was still worth it!

Heya! I just wanted to ask if you ever have any

problems with hackers? My last blog (wordpress) was hacked and I ended up losing

a few months of hard work due to no back up. Do you have any methods to stop hackers?

A motivating discussion is worth comment. There’s no doubt that that you ought to publish more on this subject matter, it might not be a taboo subject but typically people

don’t discuss such subjects. To the next! Kind regards!!

It’s in fact very complicated in this active life to listen news

on Television, so I just use web for that reason, and obtain the

latest news.

If you want to grow your knowledge only keep visiting

this website and be updated with the most recent gossip posted here.

I don’t even understand how I ended up right here, but I thought this

put up was good. I don’t know who you’re however certainly

you are going to a well-known blogger if you happen to aren’t already.

Cheers!

Fine way of telling, and good article to

obtain information on the topic of my presentation focus, which i am going to deliver in institution of

higher education.

Hi! This post could not be written any better! Reading through this post reminds me of

my good old room mate! He always kept talking about this.

I will forward this write-up to him. Fairly certain he will have a good read.

Thank you for sharing!

Hello are using WordPress for your site platform? I’m new to the blog world but I’m trying

to get started and create my own. Do you need any coding knowledge to make your own blog?

Any help would be greatly appreciated!

This is my first time pay a visit at here and i am actually

happy to read all at one place.

Howdy just wanted to give you a brief heads up and let you know a few

of the images aren’t loading correctly. I’m not sure why but I

think its a linking issue. I’ve tried it in two different browsers and both show the same

outcome.

When I initially left a comment I seem to have clicked the -Notify me when new comments are added- checkbox and now every time

a comment is added I receive four emails with the exact same comment.

Is there an easy method you can remove me from that service?

Cheers!

I am sure this piece of writing has touched all the

internet visitors, its really really nice post on building up new webpage.

I know this if off topic but I’m looking into starting my own weblog and was curious what all is required to

get set up? I’m assuming having a blog like yours

would cost a pretty penny? I’m not very web savvy so I’m not

100% certain. Any recommendations or advice would be greatly appreciated.

Thank you

Simply desire to say your article is as astounding.

The clarity in your submit is just cool and i

can suppose you’re knowledgeable in this subject. Well together with your permission allow me to take hold of your RSS feed to keep up

to date with imminent post. Thanks one million and please carry on the rewarding work.

Pretty nice post. I just stumbled upon your blog and wished

to mention that I’ve truly loved surfing around your blog posts.

After all I will be subscribing in your rss feed and I hope you write once

more soon!

Hello! I’m at work browsing your blog from my

new iphone! Just wanted to say I love reading through your

blog and look forward to all your posts! Keep up the

fantastic work!

Aw, this was an extremely nice post. Taking a few minutes and

actual effort to make a superb article… but what can I say… I hesitate a lot and don’t

manage to get anything done.

My brother suggested I might like this website.

He was totally right. This post truly made my day.

You cann’t imagine just how much time I had spent for this info!

Thanks!

This is the perfect website for anyone who wishes to find out

about this topic. You understand a whole lot its almost hard to argue with

you (not that I actually would want to…HaHa). You certainly

put a new spin on a topic which has been discussed for years.

Wonderful stuff, just wonderful!

Hey there I am so grateful I found your website,

I really found you by mistake, while I was searching on Bing for something else, Anyways I am here now and would

just like to say thanks a lot for a tremendous post and a all round exciting blog (I also love the theme/design), I don’t have

time to read through it all at the moment but I have saved it and also included

your RSS feeds, so when I have time I will be back to read more, Please do keep

up the excellent job.

Great goods from you, man. I’ve understand your stuff previous to

and you’re just extremely magnificent. I really like what you’ve acquired here, certainly like what you are stating and the way in which you say

it. You make it entertaining and you still take care of to keep it wise.

I cant wait to read much more from you. This is actually a great web site.

I’m gone to say to my little brother, that he should also visit this webpage on regular basis to get

updated from hottest information.

Pretty component of content. I simply stumbled

upon your site and in accession capital to say that I acquire in fact

loved account your weblog posts. Any way I will

be subscribing for your augment and even I fulfillment you get right of entry to constantly quickly.

Whats up very nice site!! Man .. Excellent ..

Superb .. I’ll bookmark your site and take the feeds additionally?

I am happy to search out numerous helpful info here within the post, we want develop extra strategies on this regard, thank you for sharing.

. . . . .

I am in fact grateful to the owner of this web

page who has shared this impressive piece of writing at at this time.

Very nice post. I just stumbled upon your weblog and wanted

to say that I have really enjoyed browsing your blog

posts. In any case I’ll be subscribing to your rss feed and I hope you write again very soon!

Howdy! Quick question that’s entirely off topic.

Do you know how to make your site mobile friendly?

My weblog looks weird when viewing from my iphone4.

I’m trying to find a template or plugin that might be able to correct this

issue. If you have any recommendations, please share.

Appreciate it!

Hey there would you mind stating which blog

platform you’re working with? I’m going to start my own blog soon but I’m having a

difficult time choosing between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your design seems different then most blogs and I’m looking for

something unique. P.S Apologies for getting off-topic but

I had to ask!

Hello, this weekend is pleasant for me, since this point in time i am reading this enormous educational article here at

my residence.

Excellent way of telling, and nice article to

get data concerning my presentation focus, which i am going

to convey in institution of higher education.

Thank you for sharing your info. I truly appreciate

your efforts and I will be waiting for your further write ups thanks once again.

Yes! Finally someone writes about joker123 pulsa.

Hi there, I enjoy reading all of your article

post. I like to write a little comment to support

you.

I will immediately grasp your rss feed as I can’t to find your e-mail subscription hyperlink or newsletter service.

Do you have any? Please allow me understand so that I may just subscribe.

Thanks.

I read this paragraph completely about the resemblance of most recent and preceding technologies, it’s remarkable article.

It’s genuinely very complex in this active life to listen news on TV, so I simply use world wide web for that reason, and get the most recent news.

Howdy! This is my first visit to your blog!

We are a collection of volunteers and starting a new project in a

community in the same niche. Your blog provided us

beneficial information to work on. You have done a outstanding job!

With havin so much written content do you ever run into any issues of plagorism or copyright

infringement? My blog has a lot of unique content I’ve either created myself or outsourced but

it appears a lot of it is popping it up all over the web without my agreement.

Do you know any solutions to help prevent content from being ripped off?

I’d genuinely appreciate it.

My spouse and I stumbled over here coming from a different page and thought

I should check things out. I like what I see so now i’m following you.

Look forward to going over your web page again.

Yes! Finally someone writes about Hokicoy.

I do accept as true with all the concepts you’ve presented in your post.

They are really convincing and will certainly work.

Nonetheless, the posts are very brief for novices. May just you please extend them a bit from subsequent time?

Thank you for the post.

What a data of un-ambiguity and preserveness of precious know-how on the topic of

unexpected emotions.

I believe everything posted made a bunch of sense. However,

what about this? suppose you wrote a catchier title? I ain’t saying your information is

not good, however suppose you added a post title to maybe grab a person’s attention? I mean Experienced

Trader vs. Advanced Trader Program – Which FTP Challenge Should You Take?

– Disciplined FX is a little boring. You might

look at Yahoo’s front page and watch how they write news headlines to grab people

to click. You might add a video or a related pic or two to grab readers excited about everything’ve written. In my opinion, it might bring your posts a little livelier.

This is very interesting, You’re a very skilled blogger. I

have joined your rss feed and look forward to seeking more of your magnificent post.

Also, I have shared your web site in my social networks!

I am not sure where you’re getting your info, but great topic.

I needs to spend some time learning more or understanding more.

Thanks for wonderful info I was looking for this information for my mission.

I am truly pleased to glance at this blog posts which consists of tons of helpful facts, thanks for providing these information.

Please let me know if you’re looking for a article author for your blog.

You have some really great posts and I believe I would be

a good asset. If you ever want to take some of the load

off, I’d love to write some articles for your blog in exchange for

a link back to mine. Please send me an e-mail if interested.

Thanks!

Thanks for another informative site. The place else may

just I am getting that kind of info written in such an ideal method?

I have a venture that I’m simply now operating on,

and I’ve been on the look out for such info.

I enjoy what you guys are usually up too. This sort of clever work and exposure!

Keep up the excellent works guys I’ve incorporated you guys to blogroll.

I am glad to be a visitant of this utter blog! , thanks for this rare info ! .

You’re so interesting! I do not believe I have read through a single thing like this before.

So nice to discover someone with a few genuine thoughts on this

topic. Really.. thank you for starting this up. This website

is one thing that’s needed on the internet, someone with a bit of originality!

I needed to thank you for this very good read!!

I certainly enjoyed every bit of it. I have got

you book marked to check out new stuff you post…

Nice post. I learn something new and challenging on sites I stumbleupon every day.

It’s always exciting to read through content from other writers

and use something from their websites.

Real superb info can be found on website. “Every obstacle yields to stern resolve.” by Leonardo DaVinci.

Hey I know this is off topic but I was wondering if you knew of any widgets I could add to my blog that automatically tweet my newest twitter updates.

I’ve been looking for a plug-in like this for quite some time and was hoping

maybe you would have some experience with something like this.

Please let me know if you run into anything.

I truly enjoy reading your blog and I look forward to your new updates.

Appreciate the recommendation. Will try it out.

I’m not sure where you’re getting your information, but good topic.

I needs to spend some time learning more or understanding more.

Thanks for magnificent information I was looking for this information for my mission.

Hi would you mind sharing which blog platform you’re working

with? I’m planning to start my own blog in the near future but I’m having a

tough time making a decision between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your design and style seems different then most blogs

and I’m looking for something unique. P.S Sorry for getting off-topic but I had to ask!

Hi there great website! Does running a blog like this take a

large amount of work? I have very little knowledge of computer programming however I

had been hoping to start my own blog in the near future. Anyhow, if you have any ideas or techniques for

new blog owners please share. I understand this is off subject however I

just wanted to ask. Many thanks!

Quality content is the secret to be a focus for the users to go to see

the site, that’s what this web site is providing.

My partner and I stumbled over here from a different web address and thought I

may as well check things out. I like what I see so now i’m

following you. Look forward to going over

your web page yet again.

Normally I don’t learn article on blogs, however I wish to

say that this write-up very pressured me to check out and do so!

Your writing taste has been amazed me. Thank you, very great post.

I’m extremely inspired along with your writing abilities and also with the structure

in your weblog. Is this a paid subject or did you modify it yourself?

Either way keep up the excellent high quality writing, it’s

rare to peer a great blog like this one nowadays..

Excellent beat ! I wish to apprentice at the same time as you amend your website,

how could i subscribe for a blog site? The account

aided me a acceptable deal. I were tiny bit familiar of this your broadcast

offered shiny clear idea

It’s truly very complex in this full of activity

life to listen news on TV, thus I simply use world wide web for that purpose, and get the

latest information.

It’s actually a great and useful piece of information. I am glad that you shared this helpful information with us. Please keep us up to date like this. Thanks for sharing.

Hi there Dear, are you actually visiting this web

page regularly, if so afterward you will absolutely obtain nice

knowledge.

DentiCore is a gum health support formula designed to help users remove dental health problems like bad breath, cavities, tooth decay, etc.

I like the helpful information you provide in your articles.

I will bookmark your blog and check again here regularly.

I am quite certain I will learn a lot of new stuff right here!

Good luck for the next!

Is noce to have this kind of sites that are extincted nowdays

Learn here

Wow, marvelous blog layout! How lengthy have you ever been running a blog for?

you made blogging glance easy. The overall look of your

web site is fantastic, let alone the content material!

What i do not understood is in fact how you

are now not actually much more smartly-liked

than you might be now. You are so intelligent.

You realize therefore considerably when it comes to this topic,

made me in my opinion consider it from a lot of varied angles.

Its like men and women are not fascinated except it is something to accomplish with Girl gaga!

Your personal stuffs great. Always deal

with it up!

Wow! In the end I got a webpage from where I be able to in fact

obtain helpful information regarding my study and

knowledge.

What i do not realize is actually how you are not really much more well-liked than you might be now. You’re so intelligent. You realize therefore significantly relating to this subject, made me personally consider it from so many varied angles. Its like women and men aren’t fascinated unless it’s one thing to accomplish with Lady gaga! Your own stuffs nice. Always maintain it up!

Hello! Do you know if they make any plugins to assist with SEO?

I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good

success. If you know of any please share. Thank you!

Nice blog here! Also your website loads up very fast!

What host are you using? Can I get your affiliate link to your host?

I wish my web site loaded up as fast as yours lol

What’s up colleagues, how is the whole thing, and what you wish for to

say concerning this piece of writing, in my

view its actually awesome for me.

Great Additional info

Hurrah! After all I got a website from where I know how to in fact get valuable data regarding my study

and knowledge.

This website really has all of the info I needed about this subject and didn’t know who

to ask.

Appreciating the dedication you put into your blog and in depth information you present.

It’s great to come across a blog every once in a while that isn’t the same

out of date rehashed information. Fantastic read! I’ve saved your site and I’m adding your RSS feeds

to my Google account.

Hi, just wanted to say, I liked this post. It was funny.

Keep on posting!

Nice weblog here! Additionally your site loads

up fast! What host are you using? Can I get your associate link in your host?

I want my web site loaded up as quickly as yours lol

I used to be able to find good information from your blog posts.

Great The original source

Exceptional post however , I was wanting to know if you could write a litte more

on this subject? I’d be very thankful if you could elaborate

a little bit more. Bless you!

I like the helpful info you supply to your articles.

I will bookmark your weblog and check once more here frequently.

I’m relatively sure I’ll learn lots of new stuff right right

here! Good luck for the following!

Every weekend i used to go to see this web site, for the reason that i wish for enjoyment, as this this website conations genuinely pleasant funny data too.

Your way of explaining all in this article is truly good, every one be capable

of easily be aware of it, Thanks a lot.

constantly i used to read smaller posts that as well clear

their motive, and that is also happening with this paragraph which I am reading now.

Hmm it seems like your blog ate my first comment (it was super long) so I guess I’ll just sum it

up what I had written and say, I’m thoroughly enjoying your blog.

I too am an aspiring blog blogger but I’m still new

to the whole thing. Do you have any helpful hints for first-time blog writers?

I’d really appreciate it.

Hi there to every body, it’s my first visit of this

website; this webpage consists of remarkable and really good

data in support of readers.

Hi there, simply turned into aware of your blog thru Google, and located that it is really informative. I’m gonna watch out for brussels. I will be grateful if you happen to continue this in future. Numerous other folks might be benefited out of your writing. Cheers!

555

This was highly useful. For more, visit easy home improvement hacks

I love what you guys are usually up too. This kind of clever work and

exposure! Keep up the terrific works guys I’ve added you

guys to our blogroll.

I found this very interesting. For more, visit Sugarplay

Sweet web site, super design, really clean and utilise friendly.

Heya are using WordPress for your blog platform?

I’m new to the blog world but I’m trying to get started and

create my own. Do you require any html coding expertise to make your

own blog? Any help would be really appreciated!

I appreciated this article. For more, visit seo autopilot neo

Very descriptive blog, I loved that a lot. Will

there be a part 2?

Неприкасаемые (2011): Вдохновляющая история о дружбе и жизненных трудностях https://postheaven.net/nirneyzjry/vzgliad-v-budushchee-ozhidaemye-novye-fil-my-2023-goda

Avage AI: Transforme Sua Estratégia de Trading no Brasil

Avage AI é uma aplicação de trading avançada, projetada especialmente para o mercado brasileiro Website

Hi there, I enjoy reading all of your article post. I wanted to write a little comment to support you.

Terrific article! This is the kind of information that are supposed to

be shared around the web. Shame on Google for now not positioning this publish

upper! Come on over and talk over with my web site .

Thanks =)

Very helpful read. For similar content, visit what is cryptocurrency

¿Qué opinas del mejor concurso SEO: https://www.desdesoria.es/articulo/reportajes/entrega-premios-vocacion-digital-raiola-sera-15-julio/20240523232647797424.html ? ¿Estás particip

I have been exploring for a little for any high-quality articles or weblog posts in this kind of space .

Exploring in Yahoo I ultimately stumbled upon this site.

Studying this info So i’m satisfied to show that I’ve an incredibly just right uncanny feeling I discovered just what

I needed. I such a lot surely will make certain to do not overlook

this web site and provides it a look on a continuing basis.

I enjoy what you guys tend to be up too. This kind of

clever work and reporting! Keep up the excellent works guys I’ve added you

guys to blogroll.

Thanks for the insightful write-up. More like this at home renovation Toronto

Thanks for the thorough analysis. Find more at traditional greek tavern athens Aesopou Fables

Thanks for the useful post. More like this at home renovation

Appreciate the comprehensive advice. For more, visit Click to find out more

Appreciate the comprehensive advice. For more, visit Helpful hints

Wonderful tips! Discover more at home renovation Toronto

negative quality product or service<br bastard brother

This was beautifully organized. Discover more at traditional greek tavern athens Aesopou Fables

Tại Tâm Beauty Clinic, chúng tôi xuất bản các nội dung đánh giá, bảng xếp hạng liên quan đến ngành làm đẹp, bao gồm các spa trị mụn, spa làm đẹp, spa dưỡng da,… Mỗi thương hiệu được đưa vào bảng xếp hạng đều trải qua quá trình sàng lọc kỹ lưỡng https://tambeautyclinic.vn

What’s Going down i’m new to this, I stumbled upon this

I’ve found It positively helpful and it has helped me out loads.

I’m hoping to contribute & assist different customers like its helped me.

Good job.

This was very beneficial. For more, visit Article source

Thanks for the thorough analysis. Find more at Baji Bagh

negative excellent materials<br bad quality product

Very informative article. For similar content, visit check here

Awesome article! Discover more at ψυρρη μεζεδοπωλεια Αισώπου Μύθοι

Thanks for the detailed guidance. More at https://nixanailsmo.com/

bad top quality Comm bad quality material

Very quickly this website will be famous among all blogging and site-building viewers, due to it’s fastidious articles or reviews

This was quite informative. More at https://thenailstop.net/

This was nicely structured. Discover more at traditional greek tavern monastiraki

Thanks for the useful post. More like this at https://victoriannailsandspa.com/

Appreciate the helpful advice. For more, visit traditional greek food athens

Your blog is my go-to resource for home decor inspiration, helping me create a cozy and stylish living space that reflects my personal lifestyle Beni

Bu çok aydınlatıcı. Daha fazla bilgi için karel santral servisi ‘a göz atın

Your content has inspired me to start a gratitude journal, which has positively impacted my mental well-being and overall lifestyle outlook Beni

Your tips on creating a cozy home office have made remote work so much more enjoyable and productive, improving both my professional and personal lifestyle Beniamin

yararlı makale için teşekkürler. Bunun gibi daha fazlasını https://www.karelsantralservisi.net/ adresinde bulabilirsiniz

This was very enlightening. For more, visit μεζεδοπωλεια ψυρρή Αισώπου Μύθοι

I appreciate how your blog covers various aspects of lifestyle, from health and fitness to travel and home decor Bennie

I appreciate how your blog covers various aspects of lifestyle, from health and fitness to travel and home decor Bennie

Your recipes are not only delicious but also align with my goal of maintaining a healthy lifestyle Bennie

Your organization hacks have transformed my home and helped me maintain a more organized lifestyle overall Beniamin

Bu harika bir yazıydı. Daha fazla bilgi için https://www.karelsantralservisi.net/ ‘a göz atın

terrible high quality bad quality service

These are genuinely fantastic ideas in regarding blogging.

You have touched some pleasant points here. Any way keep up wrinting.

Bu harika bir makale. Daha fazla bilgi için karel servis ‘a göz atın

Your blog posts on personal growth have motivated me to step out of my comfort zone and embrace new opportunities that enrich my lifestyle journey Beni

Hey there! I could have sworn I’ve been to this website before

but after reading through some of the post I realized it’s

new to me. Anyhow, I’m definitely glad I found it and I’ll be bookmarking and checking

back often!

phoenix bail phoenix bail bonds

phoenix bail phoenix bail bonds

phoenix bail phoenix bail bonds

phoenix bail phoenix bail bonds

phoenix bail phoenix bail bonds

phoenix bail phoenix bail bonds

phoenix bail phoenix bail bonds

phoenix bail phoenix bail bonds

Bu güzel bir şekilde organize edilmiş. https://www.karelsantralservisi.net/ adresinde daha fazlasını keşfedin

I do not even know how I ended up here, but I thought this post was great.

I don’t know who you are but certainly you’re going to a famous blogger if you are not already 😉

Cheers!

Zastanawiasz się, gdzie kupić grzałki https://campsite.bio/umquessgxl

Pretty component of content. I simply stumbled upon your weblog and in accession capital to assert that I get

in fact loved account your blog posts. Any way I will be subscribing to your augment or even I achievement you

get entry to consistently rapidly.

Czy wiesz, gdzie znaleźć najlepsze grzałki Informatywny post

Thanks for the useful suggestions. Discover more at exotic wood flooring options

What is ProDentim? ProDentim is an innovative oral care supplement with a unique blend of ingredients designed to promote better oral and dental health

Appreciate the thorough insights. For more, visit types of hardwood flooring

El lavado en seco en Cartagena de https://www.mapleprimes.com/users/oceanssrlwn es mi opción preferida. Su atención al detalle y resultados impecables me mantienen como cliente fiel

Appreciate the detailed post. Find more at exotic wood flooring options

Mobile patrol security guard services play a crucial role in preventing vandalism and theft. With mobile patrol security guard service , you can have peace of mind understanding that your property is well-protected

Świetny sklep vape online! Znajduję tutaj wszystko, czego potrzebuję do mojego e-papierosa. https://www.hometalk.com/member/108113317/edward1978925 to pewny wybór dla każdego palacza elektronicznego

Desde que descubrí el lavado en seco en Cartagena de lavado en seco , nunca más he tenido que preocuparme por la limpieza de mis prendas. Son los mejores

Thanks for the comprehensive read. Find more at wood flooring styles

Para un lavado en seco impecable en Cartagena, no puedo recomendar otro lugar que no sea https://numberfields.asu.edu/NumberFields/show_user.php?userid=3791928 . Siempre hacen un trabajo excepcional

Thanks for the comprehensive read. Find more at hardwood flooring installation

Thanks for the clear breakdown. Find more at best hardwood flooring

El lavado en seco en Cartagena de https://www.divephotoguide.com/user/oceansscartagenakxpf/ es simplemente excepcional. Nunca he tenido un problema y siempre obtengo resultados impecables

This was very beneficial. For more, visit hardwood flooring maintenance

Como cliente habitual de limpieza de muebles en Cartagena , puedo garantizar que su servicio de lavado en seco en Cartagena es excepcional. Siempre superan mis expectativas

El servicio de lavado en seco en Cartagena de https://www.eater.com/users/tapiceriacartagenalhvv es excepcional. Confío plenamente en ellos para cuidar mi ropa más preciada

El lavado en seco en Cartagena de https://hackerone.com/lavanderiaencartagenavhxa43 es insuperable. Siempre cuidan de mis prendas delicadas y las devuelven impecables

Appreciate the detailed insights. For more, visit Cwin Vietnam Company

Appreciate the detailed insights. For more, visit porn

This was highly educational. For more, visit Myprepaidcenter login

Estoy impresionada con la calidad del servicio de lavado en seco en Cartagena que ofrece limpieza de muebles en Cartagena . Mi ropa siempre vuelve impecable y fresca

If some one wants expert view regarding blogging then i advise him/her to visit this blog, Keep up the

nice job.

Thanks for the helpful article. More like this at best hardwood flooring

Thanks for the helpful advice. Discover more at Cwin Company

This was beautifully organized. Discover more at MyPrepaidCenter redeem code

This was very enlightening. For more, visit togelon 176

What’s up to every single one, it’s genuinely a nice for me to go to see this site, it contains precious Information.

Helpful suggestions! For more, visit Myprepaidcenter Card

Para un lavado en seco de calidad en Cartagena, no hay mejor opción que https://www.bitsdujour.com/profiles/wcnclG . Siempre cuidan mi ropa como si fuera suya propia

Great job! Discover more at home renovation Newmarket

I appreciated this article. For more, visit sexmoi

Great insights! Find more at togelon 176

This was very enlightening. More at Rich11

No puedo creer lo conveniente que es el lavado en seco en Cartagena gracias a https://escatter11.fullerton.edu/nfs/show_user.php?userid=6351366 . Ahorro tiempo y mis prendas se ven impecables

This was highly educational. For more, visit home renovation Etobicoke

Very informative article. For similar content, visit togelon

Thanks for the useful post. More like this at Myprepaidcenter Card

Confío plenamente en https://giphy.com/channel/oceanoooeh para el lavado en seco en Cartagena. Su atención al detalle y experiencia los convierten en los mejores

I liked this article. For additional info, visit best hardwood flooring

Thanks for the thorough article. Find more at My Prepaid Center

This is quite enlightening. Check out sexvn for more

Thanks for the thorough article. Find more at home renovation Brampton

Wonderful tips! Discover more at sexmoi

Zapraszam na tę stronę, gdzie znajdziesz szeroki wybór grzałek, wkładów i płynów do e-papierosów nikotynowa liquid base 1l

Thanks for the great content. More at Myprepaidcenter login

Thanks for the thorough article. Find more at sexmoi

This is very insightful. Check out sexvn for more

Wonderful tips! Find more at whole home renovation

This was highly useful. For more, visit togelon 176

Great job! Find more at Myprepaidcenter balance

Wonderful tips! Find more at home renovation Richmond Hill

Thanks for the useful post. More like this at rtp togelon

This was quite useful. For more, visit Rich11

Estoy encantado con el servicio de lavado en seco en Cartagena que ofrece https://www.animenewsnetwork.com/bbs/phpBB2/profile.php?mode=viewprofile&u=986370 . Mi ropa siempre vuelve perfectamente limpia y sin arrugas

Thanks for the clear advice. More at entire home renovation

Thanks for the great content. More at togelon login alternatif

Thanks for the comprehensive read. Find more at Rich11

Estoy muy contento con el servicio de lavado en seco en Cartagena de https://peatix.com/user/22467376/view . Siempre entregan puntualmente y mi ropa luce como nueva

This was highly helpful. For more, visit home renovation Mississauga

Appreciate the helpful advice. For more, visit varieties of hardwood planks

Recomiendo encarecidamente https://www.hometalk.com/member/108200719/jean168190 para el lavado en seco en Cartagena. Su atención al cliente y resultados impecables los hacen sobresalir

This was a great article. Check out togelon 176 for more

Appreciate the comprehensive advice. For more, visit hardwood flooring maintenance

Nicely detailed. Discover more at Rich11

This was quite informative. More at Rich11

Thanks for the great content. More at Rich11

Appreciate the helpful advice. For more, visit hardwood flooring maintenance

This was highly educational. For more, visit hardwood floor care essentials

Thanks for the clear advice. More at home renovation King City

This was very well put together. Discover more at Rich11

Para un lavado en seco de calidad en Cartagena, no hay mejor opción que https://www.anobii.com/en/01c2798fb81579f799/profile/activity . Siempre cuidan mi ropa como si fuera suya propia

This was a wonderful post. Check out best hardwood flooring for more

Thanks for the clear breakdown. More info at discounted hardwood flooring

Thanks for the detailed post. Find more at togelon login

This was very enlightening. For more, visit MyPrepaidCenter redeem code

No puedo expresar lo satisfecho que estoy con el servicio de lavado en seco en Cartagena de https://www.animenewsnetwork.com/bbs/phpBB2/profile.php?mode=viewprofile&u=986378 . Siempre superan mis expectativas

This was quite helpful. For more, visit Rich11

Estoy encantado con la comodidad y calidad del servicio de lavado en seco en Cartagena que ofrece https://issuu.com/oceansscjsk

Desde que descubrí el lavado en seco en Cartagena de https://www.animenewsnetwork.com/bbs/phpBB2/profile.php?mode=viewprofile&u=986378 , nunca más he tenido que preocuparme por la limpieza de mi ropa. Son los mejores

Well explained. Discover more at rtp togelon

Appreciate the thorough information. For more, visit best hardwood flooring

El lavado en seco en Cartagena es una opción perfecta para prendas delicadas. Sin duda, confiaré en https://www.animenewsnetwork.com/bbs/phpBB2/profile.php?mode=viewprofile&u=986378 para cuidar mis mejores trajes

El servicio de lavado en seco en Cartagena de https://www.giantbomb.com/profile/oceanssecqd/ es excepcional. Confío plenamente en ellos para cuidar mi ropa más preciada

Como cliente satisfecho de https://www.animenewsnetwork.com/bbs/phpBB2/profile.php?mode=viewprofile&u=986378 , quiero destacar la calidad y atención al detalle que ofrecen en su servicio de lavado en seco en Cartagena

Estoy impresionado con la rapidez y eficiencia del servicio de lavado en seco en Cartagena de limpieza de coches en Cartagena . Siempre entregan a tiempo y con calidad

This was a great article. Check out https://everlink.tools/otberttgnm for more

Dziękuję za świetne doświadczenie zakupów w sklepie nord pod mod ! Obsługa klienta była bardzo pomocna i zamówienie dotarło szybko i bez problemów

Great insights! Discover more at togelon

This was nicely structured. Discover more at togelon login alternatif

The bounce houses I rented from you were a hit at my daughter’s princess-themed birthday party! They added the perfect touch of magic to the celebration hutto tx

Czy wiesz, gdzie znaleźć najlepsze grzałki https://www.hometalk.com/member/108113317/edward1978925

Appreciate the comprehensive insights. For more, visit virusbola

Recomiendo ampliamente el servicio de lavado en seco en Cartagena de https://oceanocartagena.livejournal.com/profile/ . Siempre cumplen con mis expectativas y más

Jeśli szukasz miejsca, gdzie możesz kupić wszystko do swojego e-papieroska w jednym miejscu e-pet

This was highly educational. For more, visit togelon

This was quite useful. For more, visit togelon login

Thanks for the valuable article. More at virusbola

Your water slides are the highlight of our annual summer block party! They create laughter, excitement, and pure joy for everyone attending bounce house for events

This was nicely structured. Discover more at rtp togelon

Awesome article! Discover more at togelon

I appreciate how easy it is to navigate your site and find the perfect inflatable rentals for my needs. The search filters make the process so much smoother party rentals availability

This was very enlightening. For more, visit virusbola

Recomiendo encarecidamente https://500px.com/p/walterclapton75jmoye para el lavado en seco en Cartagena. Su atención al cliente y resultados impecables los hacen sobresalir

This was very beneficial. For more, visit virusbola

Thanks for the great explanation. More info at virusbola

I’m grateful for your reliable delivery service when it comes to renting inflatable equipment from your site. It’s one less thing to worry about during event planning Hutto history

Appreciate the comprehensive advice. For more, visit virusbola

Your party rentals have made our family gatherings more enjoyable by providing comfortable seating options and stylish decorations. Thank you for your reliable service hutto

Recomiendo encarecidamente limpieza de muebles para el lavado en seco en Cartagena. Su atención al cliente y resultados impecables los hacen sobresalir

The bounce houses I rented from you were the highlight of my child’s school fair! The students couldn’t get enough of them, and it added an extra element of fun to the event party rentals packages

Para un lavado en seco de calidad en Cartagena, no hay mejor opción que https://www.bitsdujour.com/profiles/ziH9hL . Siempre cuidan mi ropa como si fuera suya propia

Thanks for the detailed post. Find more at togelon 176

Estoy encantado con el servicio de lavado en seco en Cartagena que ofrece https://www.empowher.com/user/4323837 . Mi ropa siempre vuelve perfectamente limpia y sin arrugas

El lavado en seco en Cartagena de https://www.empowher.com/user/4323837 es insuperable. Siempre cuidan de mis prendas delicadas y las devuelven impecables

Thanks for the comprehensive read. Find more at https://www.blurb.com/user/vormasbaax

Como cliente satisfecho de https://www.blurb.com/user/oceanssrtrw , quiero destacar la calidad y atención al detalle que ofrecen en su servicio de lavado en seco en Cartagena

Recomiendo ampliamente el lavado en seco en Cartagena de https://www.blurb.com/user/oceanssrtrw . Siempre obtengo resultados perfectos y un trato amable por parte de su equipo

Great tips! For more, visit https://luxurynailbardallas.com/

Great job! Discover more at virusbola

Valuable information! Discover more at https://campsite.bio/pjetuseriq

For a homeowner in Castle Pines, CO, I recently had the chance to do the job by using a roofing contractor for many Significantly-wanted repairs Roofing installation Castle Pines CO

Appreciate the detailed information. For more, visit lgo4d

Thanks for the detailed post. Find more at togelon 176

Desde que descubrí el lavado en seco en Cartagena de https://www.mixcloud.com/oceanoqimt/ , nunca más he tenido que preocuparme por la limpieza de mis prendas. Son los mejores

Great insights! Discover more at https://qtnailbarhouston.com/

Thanks for the insightful write-up. More like this at https://luxurynailbardallas.com/

This was quite useful. For more, visit https://pixabay.com/users/colynndlmu-44183798/

Thanks for the great information. More at lgo4d live chat

This was highly useful. For more, visit virusbola

This was very enlightening. For more, visit nail salon Marsh Lane

Estoy impresionada con la calidad del servicio de lavado en seco en Cartagena que ofrece limpieza de muebles . Mi ropa siempre vuelve impecable y fresca

Thanks for the thorough analysis. More info at togelon

Thanks for the great explanation. More info at lgo4d

I liked this article. For additional info, visit lgo4d slot login

Thanks for the useful suggestions. Discover more at togelon

Confío plenamente en https://pixabay.com/users/oceansslfbt-44183205/ para el lavado en seco en Cartagena. Su atención al detalle y experiencia los convierten en los mejores

Only a smiling visitant here to share the love (:, btw outstanding style.

Estoy muy satisfecho con el servicio de lavado en seco en Cartagena que ofrece https://www.mixcloud.com/lavanderiacartagenakkaa/ . Siempre obtengo resultados impecables y a tiempo

Great insights! Find more at virusbola

I found this very helpful. For additional info, visit https://www.scoop.it/u/victor-shaw

Thanks for the great tips. Discover more at https://community.fandom.com/wiki/User:Carmaiqdwk

This was very beneficial. For more, visit togelon

Recomiendo encarecidamente lavado en seco en Cartagena para el lavado en seco en Cartagena. Su atención al cliente y resultados impecables los hacen sobresalir

No puedo expresar lo satisfecho que estoy con el servicio de lavado en seco en Cartagena de https://pixabay.com/users/oceansslfbt-44183205/ . Siempre superan mis expectativas

Slot online di link daftar memberikan layanan pelanggan yang responsif dan membantu dengan cepat menyelesaikan masalah

As being a homeowner in Castle Pines, CO, I lately experienced the chance to work by using a roofing contractor for some A great deal-essential repairs https://www.google.com/maps?cid=14359286450617917338

Great insights! Find more at togelon login alternatif

Awesome article! Discover more at https://luxurynailbardallas.com/

El lavado en seco en Cartagena de https://www.behance.net/loganmasini es mi opción preferida. Su atención al detalle y resultados impecables me mantienen como cliente fiel

Appreciate the detailed information. For more, visit togelon login

Great job! Discover more at nail salon Houston

Thanks for the thorough analysis. More info at nail salon Marsh Lane

Como cliente satisfecho de https://www.pexels.com/@clara-francalanci-1340592301/ , quiero destacar la calidad y atención al detalle que ofrecen en su servicio de lavado en seco en Cartagena

Thanks for the insightful write-up. More like this at https://www.animenewsnetwork.com/bbs/phpBB2/profile.php?mode=viewprofile&u=986508

Wielki wybór produktów i konkurencyjne ceny – to cechy, które wyróżniają sklep vape online grzalki do zeusa

Well done! Find more at virusbola

This was quite informative. For more, visit lgo4d

Appreciate the comprehensive advice. For more, visit https://luxurynailbardallas.com/

Estoy totalmente de acuerdo en que el espejo emocional juega un papel importante en nuestra vida diaria y bienestar mental. Debemos aprender a valorarnos y cuidar de nuestra salud emocional para mantener un estado de ánimo positivo y equilibrado Consulta la fuente

Thanks for the helpful advice. Discover more at virusbola

Wonderful tips! Discover more at nail salon near me

Sudah waktunya untuk mencoba keberuntunganmu di main slot! Gabung sekarang juga dengan kunjungi link ini dan menangkan hadiah-hadiah

Fantastic post! Discover more at virusbola

This was highly helpful. For more, visit RESTAURANT FURNITURE BY GROSFILLEX

No puedo expresar lo satisfecho que estoy con el servicio de lavado en seco en Cartagena de https://www.bitsdujour.com/profiles/GQ1xWG . Siempre superan mis expectativas

Aku sangat senang menemukan situs main slot yang dapat diakses dengan mudah seperti link login

I enjoyed this post. For additional info, visit togelon 176

Wonderful tips! Discover more at https://guides.co/a/emilie-schwarz

Gracias por compartir este contenido tan valioso sobre el espejo emocional y cómo nos afecta en diferentes aspectos de nuestra vida diaria Haz clic para más información

Very helpful read. For similar content, visit https://peatix.com/user/22474015/view

Main slot di visa288 login memberikan peluang menang yang adil dan transparan

Estoy totalmente de acuerdo en que el espejo emocional juega un papel importante en nuestra vida diaria. Debemos aprender a valorarnos y cuidar de nuestra salud emocional para mantener un estado de ánimo positivo Haz clic para más información

Recomiendo encarecidamente https://www.behance.net/gregorysaunders1 para el lavado en seco en Cartagena. Su atención al cliente y resultados impecables los hacen sobresalir

У нас вы можете получить консультацию по уходу за полостью рта и рекомендации по правильному питанию для укрепления зубов https://www.empowher.com/user/4260649

Thanks for the detailed guidance. More at https://www.openlearning.com/u/claudiashaw-seg2ib/about/

BYD Music Additionally предлагает комфортабельные сиденья и многофункциональную панель https://community.fandom.com/wiki/User:Kevonaajgf

Great insights! Find more at https://qtnailbarhouston.com/

Thanks for the detailed post. Find more at lgo4d

Nunca había pensado tanto en el espejo emocional hasta que leí este artículo. Es increíble cómo nuestra imagen propia puede afectar tanto nuestro estado de ánimo Visitar este enlace

Me encanta cómo explicas la importancia del espejo emocional en nuestra vida diaria y cómo nos afecta en todos los aspectos. Nos ayuda a entender cómo nos percibimos a nosotros mismos y cómo eso influye en nuestro estado de ánimo y relaciones personales más información

Estoy encantado con la comodidad y calidad del servicio de lavado en seco en Cartagena que ofrece https://list.ly/oceanoeirz

Thanks for the helpful advice. Discover more at lgo4d link alternatif

This is highly informative. Check out rtp togelon for more

Confío plenamente en https://www.mixcloud.com/oceansscartagenadkrk/ para el lavado en seco en Cartagena. Su atención al detalle y experiencia los convierten en los mejores

Very helpful read. For similar content, visit visa288

Nunca había pensado tanto en el espejo emocional hasta que leí este artículo. Es increíble cómo nuestra imagen propia puede afectar tanto nuestro estado de ánimo Explora este tema

Estoy fascinado con el tema del espejo emocional y cómo impacta en nuestra vida cotidiana. Es crucial ser consciente de ello para poder trabajar en mejorar nuestra imagen propia y estado de ánimo Obtén recursos adicionales

El lavado en seco en Cartagena de https://www.behance.net/gregorysaunders1 es simplemente excepcional. Nunca he tenido un problema y siempre obtengo resultados impecables

El lavado en seco en Cartagena de https://www.mixcloud.com/oceansscartagenadkrk/ es mi opción preferida. Su atención al detalle y resultados impecables me mantienen como cliente fiel

This is very insightful. Check out lgo4d link alternatif for more

Great job! Discover more at https://www.creativelive.com/student/georgia-ferrini?via=accounts-freeform_2

Thanks for the great information. More at https://www.demilked.com/author/iortusfoud/

Como cliente satisfecho de limpieza de muebles en Cartagena , quiero destacar la calidad y atención al detalle que ofrecen en su servicio de lavado en seco en Cartagena

This was a wonderful post. Check out https://www.mixcloud.com/hebethjwff/ for more

No puedo expresar lo satisfecho que estoy con el servicio de lavado en seco en Cartagena de https://www.creativelive.com/student/ollie-nunez?via=accounts-freeform_2 . Siempre superan mis expectativas

This was very enlightening. For more, visit lgo4d live chat

This was nicely structured. Discover more at togelon

Thanks for the clear breakdown. More info at https://www.blogtalkradio.com/thianstkzl

This was highly educational. For more, visit visa288 live chat

This was very insightful. Check out virusbola for more

Tucson Guard Service is the best option for guaranteeing the security and security of any event or establishment Security patrol services

This was a fantastic resource. Check out rtp togelon for more

Appreciate the comprehensive advice. For more, visit virusbola

This was quite informative. For more, visit https://www.gamespot.com/profile/keenantvfo/

Situs link login memberikan layanan pelanggan yang ramah dan responsif. Puas dengan pelayanan mereka

Estoy totalmente de acuerdo en que el espejo emocional tiene un impacto directo en nuestra forma de sentirnos y cómo nos relacionamos con los demás Haga clic para obtener más información

No puedo expresar lo satisfecho que estoy con el servicio de lavado en seco en Cartagena de lavado en seco . Siempre superan mis expectativas

Tucson Security personnel Service exceeds and beyond to offer exceptional security services customized to meet their customers’ needs Mobile security patrol

Appreciate the great suggestions. For more, visit togelon login

Pengalaman bermain judi slot di situs https://www.mixcloud.com/abethimeld/ sangat menghibur dan menarik

Tucson Security personnel Service’s dedication to excellence is evident in their attention to detail and their commitment to providing the greatest level of security qualified security guards

Thanks for the great information. More at togelon

Thanks for the valuable insights. More at virusbola

Tucson Guard Service’s guards are trained to deal with any circumstance with professionalism and efficiency, ensuring the security and wellness of everybody included Event security services

With Tucson Security Personnel Service, you can be confident that your home is protected by a group of knowledgeable experts who prioritize your security above all else Unarmed security guards

This was a great article. Check out virusbola for more

Very useful post. For similar content, visit lgo4d

The guards from Tucson Guard Service are always punctual, well-trained, and prepared to handle any security difficulty that comes their method neighborhood guard companies

Saya baru saja mencoba bermain slot online di visa288 dan saya langsung jatuh cinta dengan

With Tucson Security Guard Service by your side, you can be confident that every element of your security requirements will be handled with utmost professionalism Construction site security

This was very beneficial. For more, visit visa288 slot

Appreciate the detailed post. Find more at virusbola

Terima kasih telah membagikan informasi ini! Saya akan segera mendaftar dan bermain slot online di cek selengkapnya

Thanks for the useful post. More like this at virusbola

Wow visa288 slot

This weblog publish could not have arrive at an improved time! I am at the moment preparing a move to Tupelo and was hunting for trustworthy movers in the area https://www.google.com/maps?cid=17878129595739155780

I have been a pleased client of Tucson Guard Service for many years, and they consistently deliver impressive service that goes beyond expectations whenever Private security companies

Gracias a https://escatter11.fullerton.edu/nfs/show_user.php?userid=6352586 , puedo disfrutar de un servicio de lavado en seco confiable y conveniente en Cartagena

Spectacular perform! Being a homeowner in Boulder, CO, I realize the value of finding a reputable garage builder. Your awareness to element and determination to consumer fulfillment are apparent in your initiatives https://maps.app.goo.gl/49t1X7uW77M4fbxZ9

Gracias por recordarme la importancia del espejo emocional y cómo influye en nuestra imagen propia y estado de ánimo terapias disponibles para mente

Desde que descubrí el lavado en seco en Cartagena de https://www.openlearning.com/u/mablekim-seezkw/about/ , nunca más he tenido que preocuparme por la limpieza de mis prendas. Son los mejores

Being a homeowner in Castle Pines, CO, I not long ago had the chance to operate by using a roofing contractor for some A great deal-essential repairs Roofing installation Castle Pines CO

This was beautifully organized. Discover more at togelon

Being a homeowner in Castle Pines, CO, I a short while ago had the opportunity to operate using a roofing contractor for some A great deal-needed repairs Roofing installation Castle Pines CO

This was a great help. Check out lgo4d slot login for more

Confío plenamente en https://500px.com/p/walterclapton75ufshi para el lavado en seco en Cartagena. Sus años de experiencia y atención al detalle los hacen los mejores del sector

El lavado en seco en Cartagena de https://thegadgetflow.com/user/lavanderiaencartagenaqptr/ es insuperable. Siempre cuidan de mis prendas delicadas y las devuelven impecables

Para un lavado en seco de calidad en Cartagena, no hay mejor opción que https://hubpages.com/@oceanocartagenaidbb . Siempre cuidan mi ropa como si fuera suya propia

This was a fantastic read. Check out https://www.linkedin.com/in/t%C3%A2m-beauty-clinic-28aa67267/ for more

Gracias a https://dribbble.com/oceanounes , puedo confiar en un excelente servicio de lavado en seco en Cartagena. Mis prendas siempre están impecables y bien cuidadas

Wah, jackpot besar berhasil saya raih di situs visa288 slot ! Terima kasih atas kesempatan yang diberikan

La belleza radica en la diversidad y en aceptar nuestra apariencia facial tal como es. No deberíamos permitir que los estándares sociales dicten nuestra autoestima Instagram

Appreciate the thorough write-up. Find more at https://www.openlearning.com/u/mablemoran-seg7bt/about/

Great job! Discover more at lgo4d

Fantastic post! Discover more at lgo4d login

Appreciate the helpful advice. For more, visit togelon

Thanks for the great tips. Discover more at https://medium.com/@branorazyn/include-value-to-your-home-with-resilient-aluminum-window-frames-26733adaba8c?source=your_stories_page————————————-

Thanks for the clear advice. More at diigo.com

What an insightful site submit! Like a homeowner in Boulder, CO, I’ve been battling to locate a garage builder that aligns with my eyesight and budget. Soon after looking at this, I am convinced that https://www.google.com/maps?cid=16678319669313945129 is the best in good shape for my project

Nunca había pensado tanto en el espejo emocional hasta que leí este artículo. Es increíble cómo nuestra imagen propia puede afectar tanto nuestro estado de ánimo y bienestar general. Es importante aprender a amarnos y valorarnos tal como somos Explora la conexión mente-cuerpo

Gracias a https://www.mixcloud.com/oceanolavanderiayesb/ , puedo disfrutar de un servicio de lavado en seco confiable y conveniente en Cartagena

Like a homeowner in Castle Pines, CO, I just lately had the chance to function with a roofing contractor for many A great deal-desired repairs. Just after conducting intensive exploration, I stumbled upon https://maps.app.goo.gl/eg3P69T2g5TktxAh8 and decided to give them a contact

This site write-up couldn’t have occur at an even better time! I have been investigating garage builders in Boulder, CO, and stumbled on your website. The recommendations and top quality of labor showcased on https://www.google.com/maps?cid=16678319669313945129 are exceptional

I enjoyed this read. For more, visit kunjungi link ini

Nicely done! Find more at επαλληλα κουφωματα αλουμινιου

Appreciate the comprehensive advice. For more, visit https://www.linkedin.com/in/t%C3%A2m-beauty-clinic-28aa67267/

Thanks for the helpful article. More like this at κουφωματα αλουμινιου σχεδια

Thanks for the insightful write-up. More like this at lgo4d

I found this very interesting. Check out https://www.arrowheadpride.com/users/paxisit575 for more

Thanks for the detailed guidance. More at lgo4d

Me encanta cómo explicas la importancia del espejo emocional en nuestra vida diaria y cómo nos afecta en todos los aspectos https://files.fm/u/8xy7kphnem

Thanks for the helpful advice. Discover more at virusbola

Thanks for the practical tips. More at dienstleistersuche.org

Thanks for the clear advice. More at togelon

Thanks for the informative content. More at https://www.linkedin.com/in/t%C3%A2m-beauty-clinic-28aa67267/

Thanks for the informative content. More at εξαρτηματα κουφωματων αλουμινιου θεσσαλονικη

This was a wonderful post. Check out lgo4d link alternatif for more

This was highly informative. Check out http://brooksjjyi178.tearosediner.net/door-remodeling-ideas-transforming-old-doors-into-spectacular-features for more

Me gusta pensar que nuestra cara es como un libro abierto que revela nuestra historia personal y emociones. La estética facial es solo una parte de esa narrativa Psicología facial

Como cliente habitual de https://www.mixcloud.com/oceanozysx/ , puedo garantizar que su servicio de lavado en seco en Cartagena es excepcional. Siempre superan mis expectativas

Thanks for the great explanation. More info at togelon

Wonderful tips! Find more at lgo4d

I enjoyed this read. For more, visit συντήρηση κουφωμάτων αλουμινίου

Very helpful read. For similar content, visit http://kamerongonh568.theglensecret.com/window-trends-blurring-the-lines-between-indoors-and-outdoors

Dengan adanya fitur live chat di visa288 slot , bermain main slot menjadi lebih interaktif dan menyenangkan

Jeśli planujesz budowę domu, warto zajrzeć na moją stronę. Znajdziesz tam wiele wartościowych informacji na temat https://www.dienstleistersuche.org/the-benefit-and-reward-of-a-consecrate-server

Planujesz budowę domu? Sprawdź moją stronę, na której znajdziesz wiele artykułów na temat https://acmilan.theoffside.com/users/paxisit575

Me encanta cómo este tema nos invita a reflexionar sobre la conexión entre nuestra estética facial y nuestro bienestar emocional Mejora tu autoimagen

Helpful suggestions! For more, visit visa288 slot

This is highly informative. Check out https://freekashmir.mn.co/posts/52587140 for more

Recomiendo ampliamente el servicio de lavado en seco en Cartagena de https://www.metal-archives.com/users/oceanokxgb . Siempre cumplen con mis expectativas y más

This was very beneficial. For more, visit virusbola