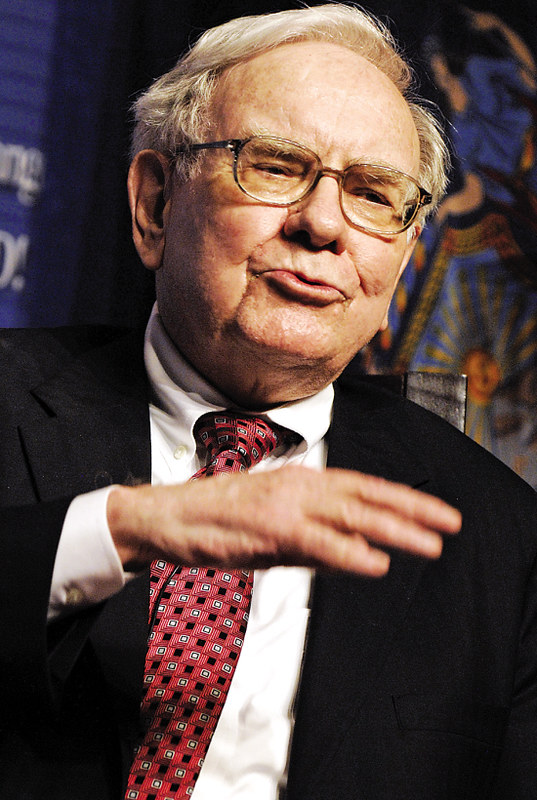

Why Warren Buffett Should Be Your #1 Role Model

Since the dawn of the first personal computer, the contemporary financial world has been dominated by tech entrepreneurs.

Think of successful billionaires and you’ll come up with Bill Gates, Steve Jobs, Sergey Brin, Meg Whitman, and Elon Musk (think PayPal, not Twitter), to name a few.

These billionaires emulate the popular entrepreneurial notions of gaining power through disruption, betting on high-risk/high-reward, moving fast and breaking things, and putting in 18-hour work days, among other “faster, better, stronger” ways of thinking and doing.

But before the rise of Silicon Valley giants, the household name for the richest person in the world belonged to an introverted, soft-spoken, patient, kind-hearted, and jovial man.

Warren Buffett

And for good reason: Buffett went from millionaire to billionaire through his 1985 takeover of Berkshire Hathaway (which was a former textile manufacturing company turned business conglomerate, housing Buffett’s various investments). Long before a personal computer could be found in every home and long before every man/woman/child could be stalkbooked.. I mean, Facebook’d.. the richest man in the world preached financial success by way of two means:

- Living on less than what’s earned

- Investing for the long run

(And continuing to do the first even when becoming exponentially successful through the second)

Granted, Buffett was lucky in that he lived through the longest Bull market run in the world’s best country for pursuing capitalistic gain, but there are many aspects of his investing and business behaviors that led him to more profound financial success than most will ever see.

Buffett has a knack for being a value investor and sticking to the areas of industry he understands best (what he calls his “circle of competency”), spending hours each day just quietly reading, researching, and staying abreast of the news, and waiting for opportune moments to enter and exit investment positions. These are some of the ways he has outshone other investors over the years.

Buffett’s fortune is why you know his name.

But there’s something special about Buffett for which you should join me in placing him as your number one role model as you learn and earn from trading the markets.

You see, unlike more ruthless billionaires (such as Musk, for instance) and the many personalities you’ll meet as you seek trading knowledge around the web, Buffett has a profound reputation as someone who is honest, trustworthy, and morally sound.

Overall, Buffett is a person of integrity.

He exercises patience, modesty, and wisdom over quick gains or displays of status and wealth.

While he could afford a Bugatti, he drives a Buick that’s more than a few years old.

While he could afford multiple mansions, he instead lives in the same single-family suburban home he bought in Omaha, NE back in 1958.

While he could afford a live-in chef, he often gets McDonald’s (through the drive-through, like us commoners) for breakfast.

While he could make millions each year, like his tech counterparts, his salary at Berkshire Hathaway is capped at $100,000.

If you can’t already tell, Buffett isn’t seeking status, and it’s hard to say he’s even seeking wealth (for himself, at least). Much of Buffett’s earnings go back into further investing in worthwhile businesses or to one of many charitable programs. After his death, his plan for his money is to give it all away to philanthropic endeavors.

Ultimately, Buffett is a symbol of the virtue of Capitalism and what Capitalism should be – the art of creating value for the sake of shared value. Buffett is competing against himself, he is seeking to maximize his score on his own scorecard each day, and he sticks to his values and morals above all else.

Buffett is one of the best role-models you can have.

Not just for investing or trading, but for being an all-around upright citizen and compassionate human being.

Imagine if you could take Buffett’s ways of thinking and doing and implement them into your own trading. You would:

- Care more about following your plan and rules than your profit/loss each day

- Be patient with your progress and stick to the trading strategies and styles you’re good at (your circle of competence) rather than chasing the market

- Get joy out of seeing yourself improve as a trader rather than showing off how much money you’re making

- Pursue wisdom and integrity, rather than objects and attention

- Learn humility and thoroughly examine your trading psychology and performance rather than blame the market, your strategy, or other traders

The moral of this article is to be selective about the people you choose to be your trading role models. Ignore the bling slingers and the arrogant folks with lots of followers on YouTube and stick to traders and money makers like Buffett who are not only successful but also exercise ethical integrity and a commitment to something bigger than themselves.

If you’d like to learn more about Buffett, I recommend checking out these sources:

The Snowball by Alice Schroeder

Buffett: The Making of an American Capitalist by Roger Lowenstein

Becoming Warren Buffett – HBO documentary

Something fun – Buffett made a kid’s animation show over ten years ago and all the episodes can be found here on YouTube

Pingback: ประวัติ ความเป็นมา sexy gaming

Pingback: ต่อผมแท้

Pingback: fenix168

Pingback: จอ led ขนาดใหญ่

Pingback: slot wallet ลุ้นรับเครดิตฟรี

Pingback: llucabet

Pingback: omg

Pingback: David

Pingback: รับจํานํารถ

Pingback: Rent warehouse Pathum Thani

Pingback: ตู้เชื่อม

Pingback: Compre pastillas Ativan Lorazepam

Pingback: marbo 9000 puff

Pingback: jaxx download

Pingback: Nexus Market Exit Scam

Pingback: have a peek here

Pingback: Onion Hosting

Pingback: กระเบื้องปูพื้น ภายนอก

Pingback: masato788

Pingback: タイ不動産会社おすすめ

Pingback: rich89bet

Pingback: จดทะเบียนบริษัท

Pingback: Infographics

Pingback: พิมพ์การ์ดแต่งงาน

Pingback: เว็บปั้มไลค์

Pingback: kc9

Pingback: slot99

Pingback: ผู้ผลิต โบลเวอร์

Pingback: pgslot168

Pingback: ricky casino

Pingback: amblotto VS lsm99 เว็บไหนน่าเล่น